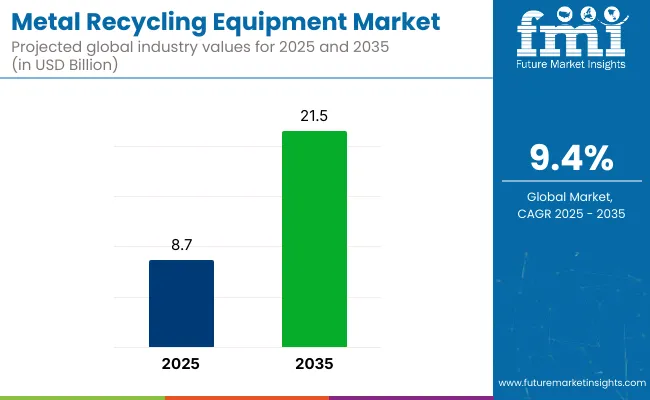

The global metal recycling equipment market is projected to grow from USD 8.7 billion in 2025 to USD 21.5 billion by 2035, registering a CAGR of 9.4%. This robust growth is fueled by the increasing emphasis on sustainable manufacturing and the circular economy across industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.7 billion |

| Industry Value (2035F) | USD 21.5 billion |

| CAGR (2025 to 2035) | 9.4% |

Rising concerns over metal waste, coupled with stringent environmental regulations, are driving the adoption of advanced recycling technologies. Innovations in shredders, shears, and balers with higher efficiency, automation, and energy-saving features are accelerating market penetration.

Innovations in metal recycling equipment include the integration of AI-powered sorting systems, sensor-based separation technologies, and fully automated shredders and balers that enhance operational efficiency. Modern machines feature energy-efficient motors, IoT connectivity for real-time monitoring, and modular designs for easier maintenance.

Advanced eddy current separators and induction sorting systems allow precise recovery of non-ferrous and precious metals. These technological advancements not only improve metal recovery rates but also reduce environmental impact and labor costs, making recycling operations more sustainable and profitable.

The metal recycling equipment market holds approximately 35% to 40% share in the scrap processing equipment market, driven by high demand for shredders, balers, and shears. Within the broader metal recycling market, equipment accounts for 20% to 25%, reflecting its role in enabling collection, sorting, and processing. In the recycling equipment market, metal recycling equipment contributes around 18% to 22%, supported by rising industrial scrap and e-waste volumes. It holds roughly 10% to 12% share in the waste management equipment market, and about 8% to 10% in both the environmental technology and resource recovery markets, as sustainability efforts grow.

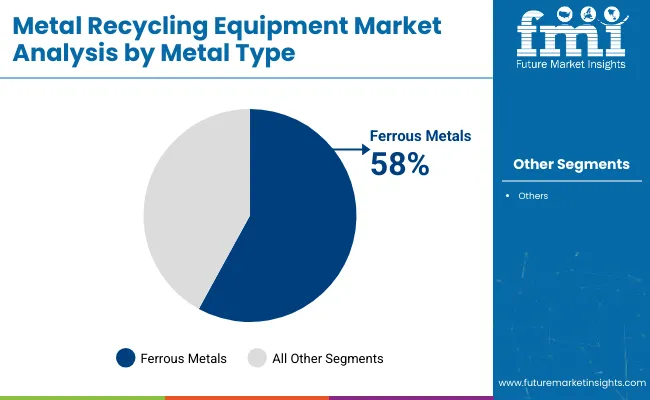

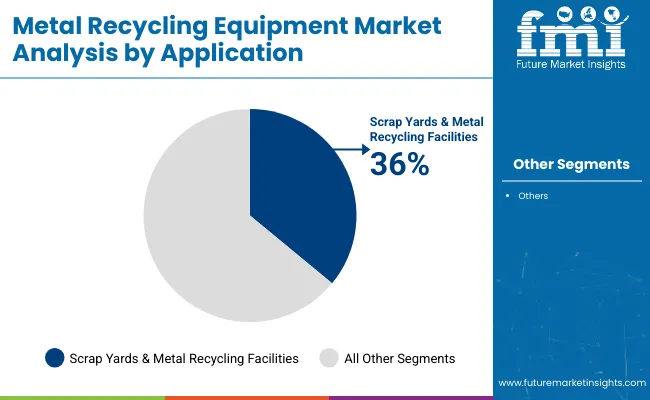

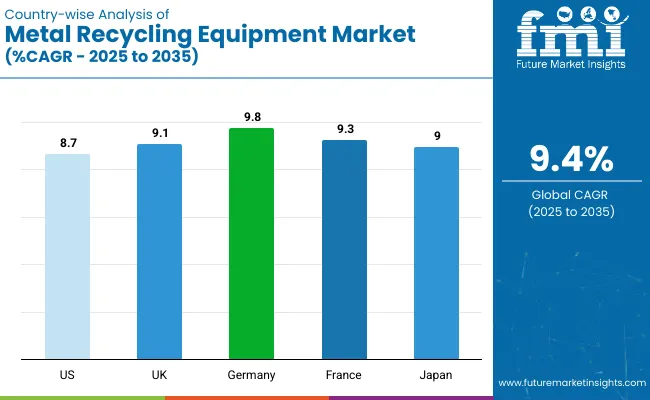

Germany is projected to be the fastest-growing metal recycling equipment market, expanding at a CAGR of 9.8% from 2025 to 2035. Ferrous metals will dominate the metal type segment with a 58% share, while scrap yards and metal recycling facilities will lead applications with 36%. The USA and UK markets are also expected to grow steadily at CAGRs of 8.7% and 9.1%, respectively.

The metal recycling equipment market is segmented into equipment type, metal type, application, end use, and region. By equipment type, the market is divided into shredders, shears, briquetting machines, granulators, balers, and separators. In terms of metal type, the market is bifurcated into ferrous metals (iron, steel) and non-ferrous metals (aluminum, copper, lead, zinc, others).

Based on application, the market is segmented into scrap yard & metal recycling facilities, automotive recycling, construction & demolition, electronics recycling, and industrial manufacturing. By end use, the market is segmented into automotive, building & construction, electrical & electronics, aerospace & defense, and industrial machinery. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

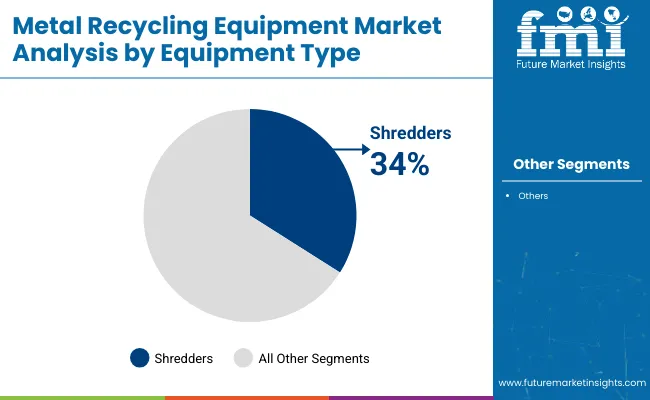

Shredders are projected to dominate the equipment type segment, accounting for 34% of the global market share by 2025. These machines are essential in reducing the size of scrap metal for easier handling, processing, and transportation.

Ferrous metals are expected to lead the metal type segment, capturing 58% of the global market share by 2025. Demand is driven by the widespread use of steel and iron in automotive, construction, and industrial applications.

Scrap yards and metal recycling facilities are set to dominate the application segment, holding 36% of the global market share by 2025. These sites serve as primary hubs for collecting, sorting, and processing various metal scraps.

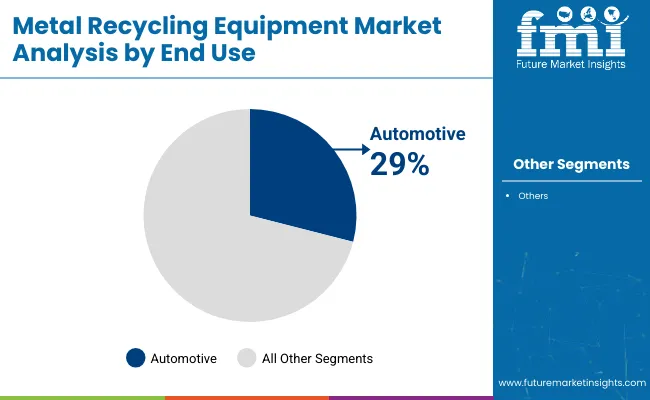

The automotive industry is projected to lead the end use segment, accounting for 29% of the global market share by 2025. This is attributed to increasing vehicle scrappage rates and the shift toward recycling aluminum and steel parts from end-of-life vehicles.

The global metal recycling equipment market is witnessing robust growth, fueled by the rising emphasis on sustainable resource utilization and environmental compliance across industries. The equipment plays a pivotal role in processing and repurposing scrap metal, supporting circular economy initiatives. Industries such as automotive, construction, and electronics increasingly rely on advanced recycling systems to manage waste efficiently, reduce costs, and meet regulatory requirements.

Recent Trends in the Metal Recycling Equipment Market

Challenges in the Metal Recycling Equipment Market

The USA metal recycling equipment market is projected to grow at a CAGR of 8.7% (2025 to 2035), driven by regulatory backing and rising demand in automotive and construction. The UK market, growing at 9.1%, benefits from strict environmental rules and electronics recycling. Germany leads with a 9.8% CAGR, supported by industrial scrap generation and strong OEM presence.

France follows at 9.3%, fueled by sustainability mandates and modular recycling tech. Japan, with a 9% CAGR, leverages advanced automation and zero-waste initiatives. Across these countries, government support, green policies, and high demand from construction, automotive, and electronics sectors are boosting equipment adoption.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The sales of metal recycling equipment in the USA are expected to grow at a CAGR of 8.7% from 2025 to 2035. This growth is driven by the country’s robust recycling infrastructure and regulatory support for sustainable waste management practices.

The UK metal recycling equipment revenue is projected to grow at a CAGR of 9.1% from 2025 to 2035, supported by stringent environmental regulations and a strong focus on metal recovery from end-of-life products.

Germany’s metal recycling equipment demand is projected to grow at a CAGR of 9.8% from 2025 to 2035, driven by the country’s strong industrial manufacturing and automotive base.

The French metal recycling equipment market is expected to grow at a CAGR of 9.3% from 2025 to 2035, owing to growing pressure to reduce metal waste and meet sustainability targets.

Japan’s metal recycling equipment revenue is expected to grow at a CAGR of 9% from 2025 to 2035, driven by the country's mature recycling systems and technological leadership.

The metal recycling equipment market is moderately consolidated, with leading players such as Liebherr Group, Metso Corporation, CP Manufacturing, Danieli Centro Recycling, and ZatoSrl. These companies dominate by offering innovative and efficient recycling systems tailored to industries like automotive, construction, and industrial manufacturing.

For instance, Liebherr Group delivers high-performance shredders and shears designed for heavy-duty scrap processing, while Metso Corporation is known for its advanced metal separation and crushing solutions, widely used in steel and aluminum recycling.

CP Manufacturing, Inc. specializes in sensor-based sorting and automated systems for high-precision metal recovery. Danieli Centro Recycling provides cutting-edge balers and shredders for processing ferrous and non-ferrous scrap. Meanwhile, ZatoSrl is recognized for its mobile recycling equipment and eco-friendly systems suited for compact and decentralized operations.

Recent Metal Recycling Equipment Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 8.7 billion |

| Projected Market Size (2035) | USD 21.5 billion |

| CAGR (2025 to 2035) | 9.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in thousand units |

| Equipment Type Analyzed | Shredders, Shears, Briquetting Machines, Granulators, Balers, and Separators |

| Metal Type Analyzed | Ferrous Metals (Iron, Steel) and Non-Ferrous Metals (Aluminum, Copper, Lead, Zinc, Others) |

| Application Analyzed | Scrap Yard & Metal Recycling Facilities, Automotive Recycling, Construction & Demolition, Electronics Recycling, and Industrial Manufacturing |

| End Use Analyzed | Automotive, Building & Construction, Electrical & Electronics, Aerospace & Defense, and Industrial Machinery |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Liebherr Group, Metso Corporation, CP Manufacturing, Danieli Centro Recycling, Zato Srl , BHS Sonthofen GmbH, Wendt Corporation, American Pulverizer Company, JMC Recycling Systems Ltd., SSI Shredding Systems, Inc. |

| Additional Attributes | Dollar sales by equipment type, share by metal segment, regional demand growth, policy influence, automation trends, competitive benchmarking |

The market is segmented into Shredders, Shears, Briquetting Machines, Granulators, Balers, and Separators.

The industry is divided into Ferrous Metals (Iron, Steel) and Non-Ferrous Metals (Aluminum, Copper, Lead, Zinc, Others).

The market caters to Scrap Yard & Metal Recycling Facilities, Automotive Recycling, Construction & Demolition, Electronics Recycling, and Industrial Manufacturing.

The report covers key sectors, including Automotive, Building & Construction, Electrical & Electronics, Aerospace & Defense, and Industrial Machinery.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The market is valued at USD 8.7 billion in 2025.

The market is forecasted to reach USD 21.5 billion by 2035, reflecting a CAGR of 9.4%.

Shredders will lead the market by equipment type, accounting for 34% of the global market share in 2025.

Scrap yards & metal recycling facilities will dominate the market with a 36% share in 2025.

Germany is projected to grow at the fastest rate, with a CAGR of 9.8% from 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA