The global metal aerosol packaging market is anticipated to grow from USD 8.2 billion in 2025 to USD 13.3 billion by 2035, at a CAGR of 5.0%. Over 65% of demand is concentrated in personal care and home care, while capacity additions are accelerating in OTC health and auto-detailing sprays.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 8.2 billion |

| Forecast Value (2035) | USD 13.3 billion |

| CAGR (2025 to 2035) | 5.0% |

High utilization rates above 85% have been reported in Vietnam and Mexico. European suppliers continue to dominate actuator component production, feeding contract fillers in Asia. Private-label growth has led to increased multi-format filling investments. North American brands are shifting toward shrink-sleeve finishes, while tinplate volatility is prompting longer procurement lock-ins.

June 30, 2025, Crown Holdings Inc. released its 2024 Sustainability Report titled “Built to Last”, highlighting progress toward its Twenty by 30™ goals. Commenting on the milestone, Timothy Donahue, Chairman, President, and CEO, stated: “Worldwide, our team's unwavering pledge to create a more sustainable future allows us to continue making significant strides in our initiatives focusing on innovation, responsibility, and community engagement.”

The metal aerosol packaging market accounts for approximately 25-30% of the global metal packaging market, reflecting strong use in both consumer and industrial applications. Within the broader aerosol packaging and sprayers segment, metal formats dominate with an estimated 60-65% share, primarily due to their pressurization strength and compatibility with volatile compounds.

In the packaging machinery and filling equipment market, metal aerosol-specific systems contribute around 4-6%, tied to niche filling lines. For personal care and household product packaging, metal aerosols hold a 12-15% share, especially in deodorants, hairsprays, and air fresheners. Within industrial and automotive chemical packaging, their share stands at about 10-12%, driven by lubricants, paints, and protective sprays requiring sealed, high-pressure dispensing formats

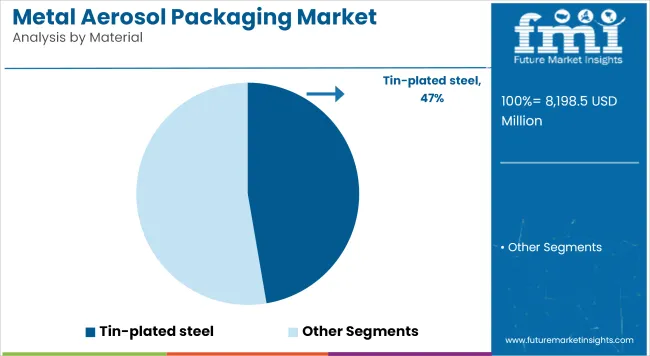

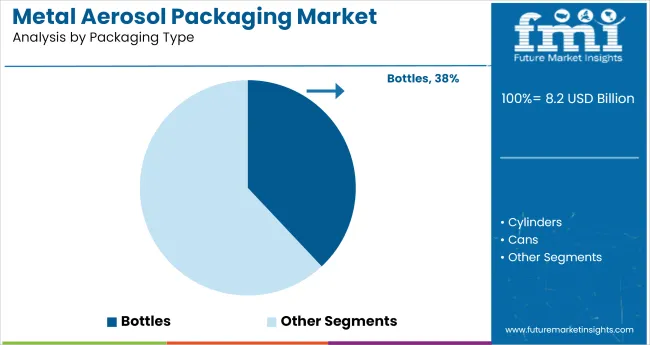

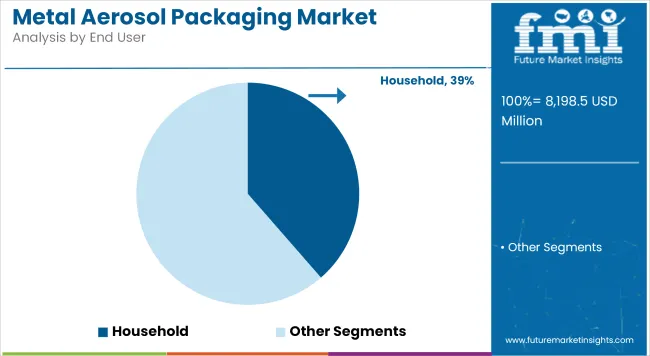

The metal aerosol packaging industry is segmented by material, with tin-plated steel holding a 47% share in 2025. In terms of packaging type, bottles dominate, contributing 38% to the market. By end-user, the household segment is expected to represent 39% industry share. These segments are shaped by shifting consumer preferences, regulatory measures, and technological advancements in packaging materials and designs.

Tin-plated steel is expected to account for 47% of the market share in 2025. The material is widely used due to its high strength, corrosion resistance, and versatility. In the aerosol market, tin-plated steel is preferred for packaging products that require protection from moisture and air, such as personal care products, household cleaners, and automotive sprays.

The rise in demand for environmentally-friendly packaging has also prompted innovation in tin-plated steel, with manufacturers increasing recyclability rates and introducing lighter materials.

In 2024, bottles are projected to capture 38% of the market share. Bottles are favored in the personal care and home care sectors, where products such as deodorants, perfumes, and cleaning agents dominate. The convenience and controlled dispensing features of bottles are central to their popularity. Additionally, companies are innovating with airless pump technology and other features that improve usability and extend the shelf life of the product.

The household segment is expected to hold 39% of the market share by 2025. The demand for aerosol packaging in products like cleaning sprays, air fresheners, and pest control solutions is rising due to consumer preference for convenience.

In 2024, the household segment is projected to generate USD 1.8 billion in revenue, with cleaning products seeing a 10% YoY increase in demand. As more consumers shift to online shopping, direct-to-consumer shipments of household aerosol products are expected to continue driving the growth of this sector.

The metal aerosol packaging industry is influenced by demand across personal care, household, automotive, and industrial sectors. While demand remains steady, the industry faces pressure from regulatory compliance, price fluctuations in metals, and shifting consumer preferences in packaging aesthetics and function.

Consumer-Centric Demand in Home and Personal Care

Demand for metal aerosol packaging is being driven by its increasing use in personal care, household, and automotive products. Brands favor these formats for their durability, leak-proof dispensing, and compatibility with volatile compounds. E-commerce growth and consumer preference for compact, pressurized packaging are further supporting volume expansion across multiple end-use sectors.

Raw Material Volatility and Compliance Pressures

Volatility in raw material prices and regulatory compliance pressures are reshaping the metal aerosol packaging industry. Manufacturers are contending with higher input costs and stricter mandates around recyclability and material transparency, especially in Europe and North America.

| Countries | CAGR(2025 to 2035) |

|---|---|

| United States | 5.2% |

| European Union | 5.1% |

| Japan | 5.1% |

| South Korea | 5.0% |

| United Kingdom | 4.9% |

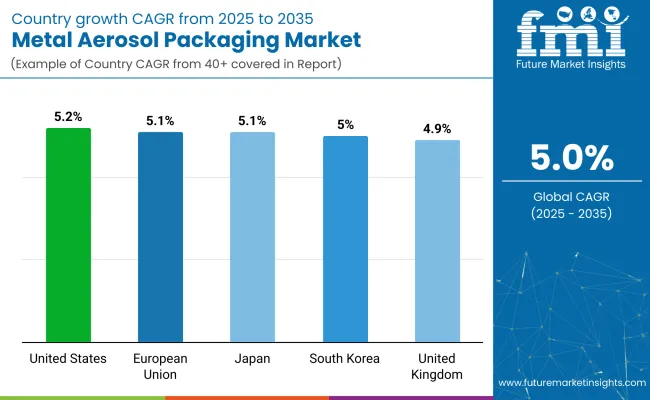

The global metal aerosol packaging industry is projected to expand at a 5.0% CAGR between 2025 and 2035. Among the profiled regions, the United States leads with 5.2%, closely followed by the European Union and Japan at 5.1%, while South Korea aligns with the global rate at 5.0%, and the United Kingdom trails slightly at 4.9%. These figures highlight minimal variance across top manufacturing hubs, indicating mature infrastructure with steady upgrade cycles.

In the United States, investment is being directed toward high-speed filling lines and integrated valve production. EU-based converters are prioritizing mono-material innovations, particularly in Germany, Italy, and the Netherlands.

Japan is scaling hybrid can production for cosmetics and medical sprays, with output focused on premium precision formats. South Korea’s steady pace is underpinned by aerosol use in electronics cooling and automotive detailing. The UK shows slower momentum, with brands consolidating SKUs due to rising per-unit costs and packaging tax compliance.

The United States metal aerosol packaging market CAGR is estimated to have increased from around 4.2% during 2020 to 2024 to 5.2% between 2025 to 2035. Growth has been led by higher consumption in personal care, food, and household applications, especially within large retail hubs like New York and Los Angeles.

Expanded e-commerce penetration and brand investments in aesthetically strong packaging formats have boosted volume requirements. Shifting preferences toward cost-efficient, durable formats have aligned with growing use across hygiene sprays and air care products. Broader SKU proliferation in both national and private labels has further elevated demand for metal aerosol systems.

The European Union’s metal aerosol packaging market CAGR is estimated to have risen from approximately 4.1% in 2020 to 2024 to 5.1% over 2025 to 2035. Germany, France, and Italy have remained central to growth, supported by a robust personal care export base and expansion in convenience-led home care packaging.

High-quality aerosol formats have gained traction across cross-border retail and specialty segments. Packaging requirements for ready-to-use consumer goods have grown with increased e-commerce logistics. Multinational suppliers are also investing in printing and can design upgrades to meet consumer demand for functional yet premium-feel packaging formats.

Sales of metal aerosol packaging in Japan have experienced a CAGR shift from approximately 4.0% during 2020 to 2024 to 5.1% in the 2025 to 2035 period. The transition reflects continued industrial demand from electronics, auto care, and personal grooming products. Tokyo and Osaka have led volume expansion, with mail-order and direct-to-store models boosting packaging complexity.

A preference for compact, durable formats that suit space-constrained supply chains has accelerated product development. Companies are responding with mono-material solutions and easy-to-recycle can formats, addressing regulatory pressures and evolving consumer preferences for cleaner dispensing systems across household categories.

Demand for metal aerosol packaging in South Korea has seen its CAGR increase from an estimated 4.1% during 2020 to 2024 to 5.0% over the 2025 to 2035 period. Key demand stems from hair care, room sprays, and deodorants, driven by brand innovation in high-density dispensing formats.

Seoul and Busan have accounted for a majority of retail demand, with rising consumer acceptance of travel-size packaging contributing to product format diversification. Suppliers are integrating tamper-proof features and smart labeling to cater to e-commerce standards and hygiene compliance. This shift has created more complexity in packaging design while pushing up unit demand in small-batch production.

The United Kingdom’s metal aerosol packaging market CAGR has increased from 4.0% in 2020 to 2024 to 4.9% over the 2025 to 2035 period. Demand remains strong across personal grooming, household sprays, and cleaning agents, supported by concentrated retail activity in London, Manchester, and Birmingham.

Private-label expansion and the rollout of refill-compatible aerosol dispensers have helped reposition metal packaging in competitive pricing tiers. Enhanced consumer interest in premium finishes, branding, and recyclability has driven innovation in pressurized dispensing systems. Greater product turnover in e-commerce has further elevated needs for protective, shelf-ready packaging across aerosol categories.

In the metal aerosol packaging market, leading players are expanding scale and versatility by investing in light weighting, advanced printing, and eco-compatible propellant compatibility. Ball Corporation remains a front-runner with global production capacity supporting personal care and household segments.

Crown Holdings Inc. and Ardagh Packaging are advancing aluminum and steel formats for deodorants, paints, and industrial chemicals, often co-developing specifications with multinational brands. CCL Industries and Bway Corporation focus on visual differentiation, offering shaped cans and high-resolution graphics for consumer appeal.

Alucon and Colep Portugal provide competitive solutions for regional markets in Asia and Europe, while DS Containers and Exal Corporation serve OTC and cosmetics manufacturers with monobloc and hybrid aerosol designs engineered for shelf stability and transport durability.

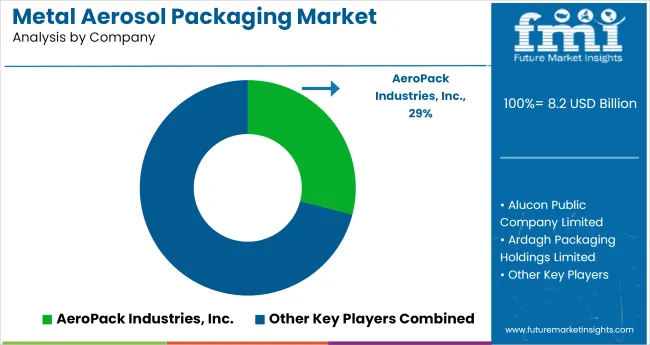

Leading Company - AeroPack Industries, Inc.

Industry Share -29%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 8.2 billion |

| Projected Industry Size (2035) | USD 13.3 billion |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Materials Analyzed (Segment 1) | Tin-Plated Steel, Aluminum, Stainless Steel |

| End Users Analyzed (Segment 2) | Household, Automotive, Agriculture, Healthcare, Industrial |

| Packaging Types Analyzed (Segment 3) | Bottles, Cylinders, Cans, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | AeroPack Industries, Inc., Alucon Public Company Limited, Ardagh Packaging Holdings Limited, Ball Corporation, Bway Corporation, CCL Industries, Inc., Colep Portugal S.A., Crown Holdings Inc., DS Containers, Inc., Exal Corporation, Other Emerging Players |

| Additional Attributes | Dollar sales, share by material and end user, growing use in healthcare sprays and automotive lubricants, rise in aluminum packaging adoption, demand in personal care and household aerosol cans, regional supply chain capacity shifts |

The industry includes tin-plated steel, aluminum, and stainless steel.

The industry is segmented into household, automotive, agriculture, healthcare, and industrial sectors.

The industry includes bottles, cylinders, cans, and other packaging formats.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East and Africa.

The industry is projected to reach USD 13.3 billion by 2035.

The industry is expected to grow at a CAGR of 5.0% from 2025 to 2035.

Tin-plated steel is expected to dominate with 47% share in 2025.

The industry is estimated to reach USD 8.2 billion in 2025.

North America, particularly the United States, is expected to be the key growth region with a projected growth rate of 5.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA