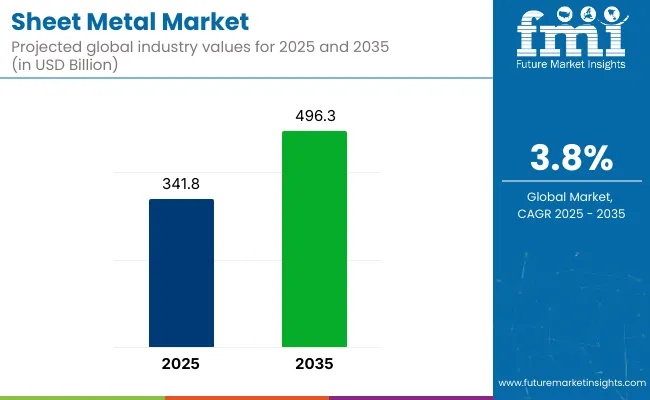

The sheet metal market is valued at USD 341.8 billion in 2025 and is slated to reach USD 496.3 billion by 2035, growing at a CAGR of 3.8%. Its growth is driven by rising demand in construction, automotive, aerospace, and electronics industries worldwide.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 341.8 Billion |

| Projected Market Size (2035) | USD 496.3 Billion |

| CAGR (2025 to 2035) | 3.8% |

Lightweight properties, durability, and versatility of sheet metal make it a preferred material for various structural, manufacturing, and precision applications. Increasing adoption in EV production, infrastructure projects, and renewable energy installations is further fueling market expansion.

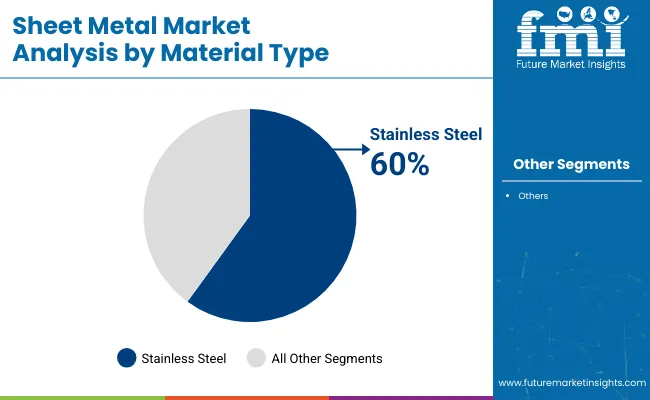

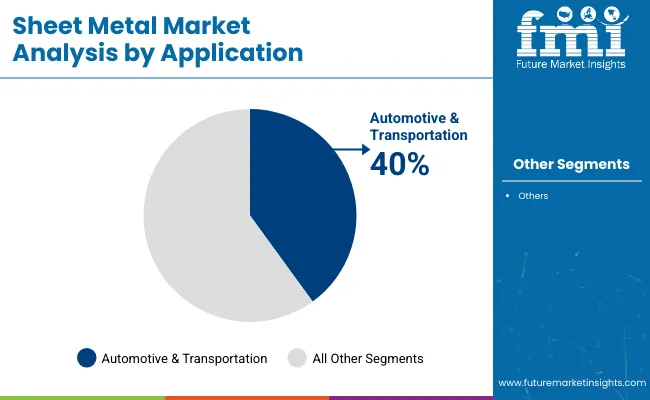

In 2025, stainless steel is expected to hold the highest market share within material types, accounting for over 60% due to its corrosion resistance and structural strength in industrial, automotive, and construction applications. The automotive & transportation segment is projected to dominate applications with approximately 40% market share, driven by demand for high-strength, lightweight components in vehicle structures and EV battery enclosures. USA is forecasted to register the fastest growth with a CAGR of 3.9% due to rapid industrialization and semiconductor manufacturing advancements.

The sheet metal market is experiencing technological advancements focused on enhancing production efficiency and material performance. Innovations such as AI-driven sheet metal processing, precision laser cutting, and nano-coated high-strength alloys are enabling better quality control, predictive maintenance, and energy efficiency across fabrication processes. Companies are adopting these solutions to streamline manufacturing workflows and maintain competitive standards.

The sheet metal market holds a substantial share across its parent industries. Within the metalworking industry, it accounts for approximately 35-40%, given its widespread use in fabrication and forming processes. In the construction materials market, it holds around 20-25%, primarily in roofing, cladding, and structural components.

The automotive components market sees a 25-30% share due to high usage in body panels and chassis parts. In the aerospace materials market, the share is lower at 10-12% due to stringent material requirements. Overall, sheet metal plays a pivotal role in sectors demanding precision, durability, and scalability in structural and functional applications.

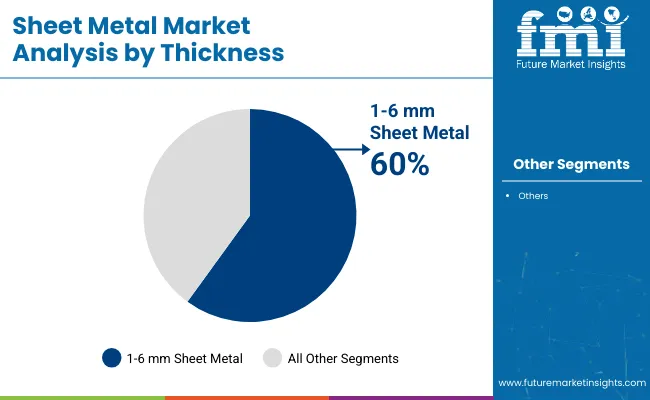

The market is segmented into material type, thickness, application, and region. By material type, the market is divided into stainless steel, aluminum, brass, tin, titanium, and zinc. Based on thickness, it is categorized into <1 mm, 1-6 mm, and >6 mm. In terms of application, the market is segmented into automotive & transportation, building & construction, industrial machinery, oil & gas, and commercial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Stainless steel is projected to lead the material type segment, accounting for over 60% of the global market share by 2025. Its superior corrosion resistance, strength, and durability make it an essential material for diverse applications in automotive, construction, and industrial machinery.

The 1-6 mm thickness segment is expected to dominate, holding more than 60% of the market share in 2025. This thickness range offers optimal strength and formability for structural, automotive, and industrial components.

The automotive & transportation sector is projected to lead the application segment, capturing approximately 40% market share in 2025. Sheet metals are critical in vehicle manufacturing for structural, safety, and lightweight design considerations.

The sheet metal market has been experiencing steady growth, driven by increasing demand for lightweight automotive components, infrastructure development, and renewable energy installations.

Recent Trends in the Sheet Metal Market

Challenges in the Sheet Metal Market

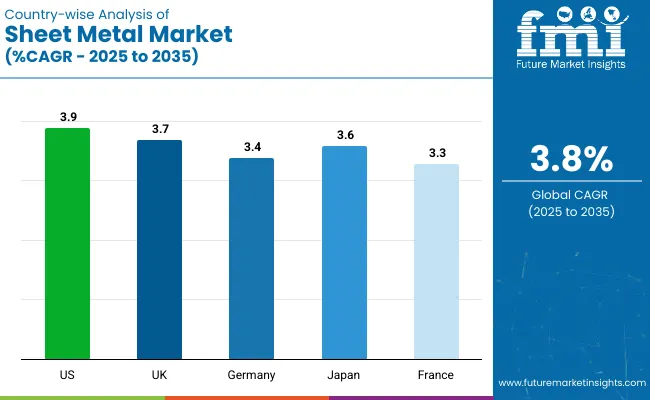

The USA leads the sheet metal market with the highest projected CAGR of 3.9%, driven by strong demand from the automotive, aerospace, and construction sectors. The UK follows with a 3.7% CAGR, supported by EV production and renewable energy infrastructure. Japan registers a 3.6% CAGR, fueled by demand in automotive and electronics manufacturing.

Germany shows a moderate growth rate of 3.4%, led by industrial machinery and automotive applications. France trails slightly at 3.3%, with growth centered on construction and sustainable manufacturing. Overall, mature industrial economies are experiencing steady demand, with the USA and UK at the forefront of technology-led growth.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The sheet metal demand in the USA is projected to grow at a CAGR of 3.9% from 2025 to 2035. Growth has been supported by rising demand in automotive manufacturing, aerospace production, and building construction.

The UK sheet metal revenue is forecast to expand at a CAGR of 3.7% over the forecast period. Demand has been driven by renewable energy projects, automotive manufacturing, and infrastructure development.

Sheet metal demand in Germany is projected to grow at a CAGR of 3.4% between 2025 and 2035. The nation’s strong automotive and industrial machinery sectors have been boosting demand for sheet metal products.

France’s sheet metal market is expected to grow at a CAGR of 3.3% from 2025 to 2035. Growth has been supported by rising demand in construction, automotive manufacturing, and industrial equipment production.

Sheet metal sales in Japan are forecast to grow at a CAGR of 3.6% through 2035. Growth has been driven by automotive manufacturing, electronics production, and smart infrastructure development.

The sheet metal market is moderately consolidated, with global leaders and regional manufacturers shaping competitive dynamics through advanced fabrication technologies, recycled metal solutions, and AI-integrated production systems.

Tier-one firms, such as ArcelorMittal S.A., Nippon Steel Corporation, Moulds Pvt. Ltd., SSR Metals Private Limited, Fabrinox, United States Steel Corporation, Nucor Corporation, General Works Inc, and Bud Industries Inc have been focusing on high-quality metal production, technological R&D for low-carbon alloys, and expanding applications in automotive, construction, and industrial sectors.

Recent Sheet Metal Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 341.8 billion |

| Projected Market Size (2035) | USD 496.3 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion / Volume in metric tons |

| By Material Type | Stainless Steel, Aluminum, Brass, Tin, Titanium, Zinc |

| By Thickness | <1 mm, 1-6 mm, >6 mm |

| By Application | Automotive & Transportation, Building & Construction, Industrial Machinery, Oil & Gas, Commercial |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Brazil, India, Italy |

| Key Players | Moulds Pvt. Ltd., SSR Metals Private Limited, Fabrinox, United States Steel Corporation, Nucor Corporation, General Works Inc, Bud Industries Inc, BlueScope Steel Limited, ATAS International Inc, A&E Manufacturing Company. |

| Additional Attributes | Market share analysis by material type and application, country-wise CAGR analysis, and brand positioning insights |

The market is expected to reach USD 496.3 billion by 2035.

The global market is projected to grow at a CAGR of 3.8% during this period.

Stainless steel is expected to lead with over 60% market share in 2025.

Automotive & transportation is expected to hold approximately 40% of the market share in 2025.

USA is anticipated to be the fastest-growing market with a CAGR of 3.9% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Porous Metal Sheet Market Analysis Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheet Pan Racks Market

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Balance Sheet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Bonding Sheet Market Forecast and Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Tarpaulin Sheets Market Share & Provider Insights

Greaseproof Sheets Market Size and Share Forecast Outlook 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Insights for Greaseproof Sheets Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA