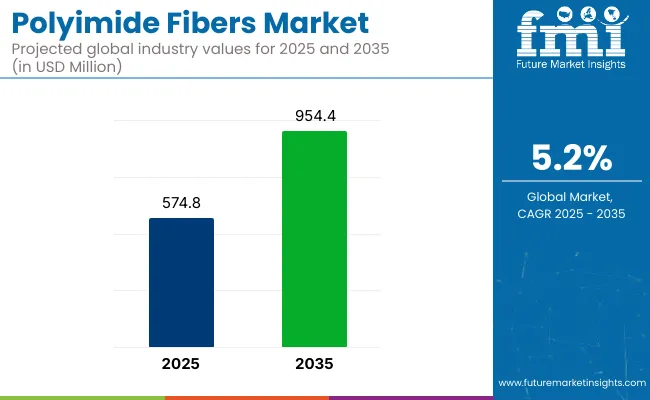

The global polyimide fibers market is valued at USD 574.8 million in 2025 and is slated to be worth USD 954.4 million by 2035, reflecting a CAGR of 5.2%. Market expansion is being driven by increased demand for high-performance, heat-resistant, and chemically stable fibers in sectors such as aerospace, automotive, and industrial filtration.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 574.8 million |

| Market Size (2035) | USD 954.4 million |

| CAGR (2025 to 2035) | 5.2% |

Rising investments in protective clothing for defense and firefighting applications, along with growing needs for sustainable and recyclable materials, are expected to further fuel this demand. Additionally, innovations in smart textiles and nanofiber-based filtration technologies are being prioritized by manufacturers to remain competitive.

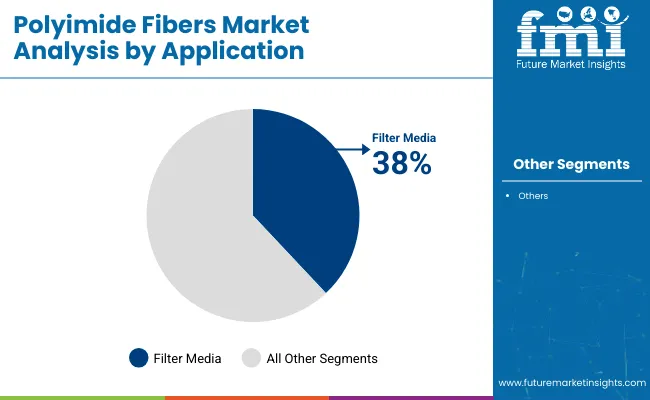

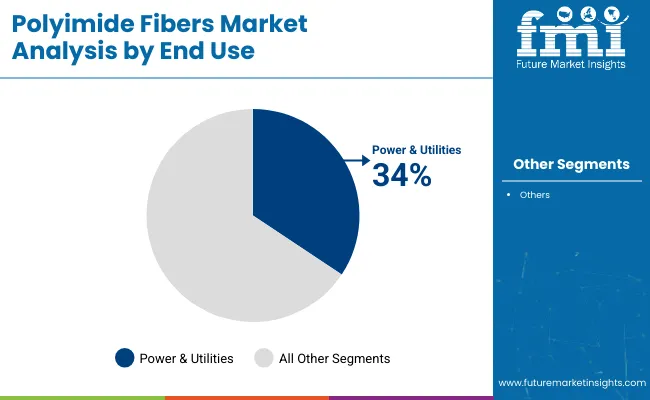

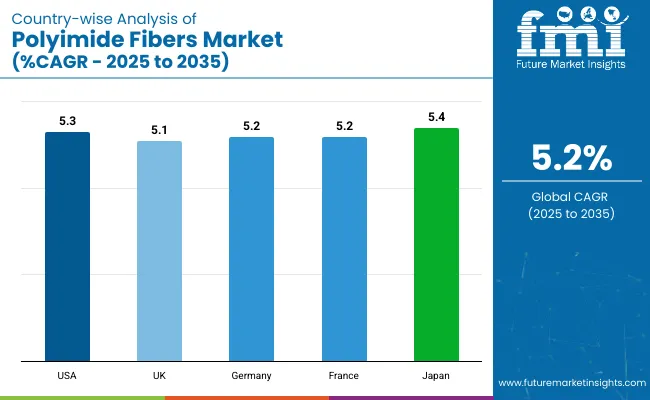

The USA is expected to hold the largest share of the polyimide fibers market, driven by significant usage in aerospace and industrial safety sectors. Japan is anticipated to register the highest CAGR of 5.4% during the study period, supported by rising investments in semiconductors, electric vehicles, and protective textiles. In 2025, filter media is projected to hold approximately 38% of the application share, while power & utilities is estimated to lead the end use segment with around 34% market share.

Significant innovations have been introduced in the polyimide fibers market through the integration of nanotechnology and AI-assisted manufacturing. Smart fibers with self-healing capabilities and enhanced conductivity have been developed to meet the rising demands of the aerospace and wearable electronics sectors.

Bio-based polyimide fibers are being engineered to reduce environmental impact while maintaining high performance. Additionally, advanced coating techniques and hybrid composite technologies have been implemented to extend fiber durability and versatility.

Stringent environmental and industrial safety regulations have been enforced across key markets to ensure compliance with sustainable production standards. In the European Union, carbon-neutral manufacturing mandates and restrictions on hazardous emissions have driven the adoption of eco-friendly polyimide fibers. In the USA and Japan, government grants have been provided to encourage R&D in advanced material technologies, including fire-resistant and recyclable fibers.

The polyimide fibers market is segmented based on application, end use, and region. By application, the segments include filter media, protective clothing, insulation material, and others (including fiber-reinforced composites, electrical wrapping, and structural laminates).

Under end use, segmentation includes construction, power & utilities, chemical & processing, mining, and others (such as aerospace, defense, and transportation sectors). Regionally, the market is divided into North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and Middle East & Africa.

Filter media is projected to lead the application segment with a 38% share in 2025, driven by high-temperature industrial needs and stricter emission norms. Protective clothing and insulation material have followed, supported by fire safety standards and aerospace demand.

Power & utilities has been projected to be the most lucrative end use segment, holding an estimated 34% market share in 2025.

The polyimide fibers market is experiencing steady growth, fueled by rising demand for high-performance materials, sustainability-driven innovation, and advancements in fiber processing and automation technologies.

Recent Trends in the Polyimide Fibers Market

Key Challenges

Sales of polyimide fibers in the USA have been projected to grow at a CAGR of 5.3% from 2025 to 2035. Growth has been fueled by advanced applications in aerospace, defense, and industrial sectors. Strong government investment in material R&D, along with increasing demand for durable, heat-resistant fibers, has positioned the USA as a market leader.

The polyimide fiber demand in the UK is estimated to grow at a 5.1% CAGR between 2025 and 2035. Strong demand has been observed in aerospace, defense, and fire safety sectors. Research funding and regulatory enforcement around environmental safety have enhanced fiber adoption and innovation in high-durability and flame-retardant textile solutions.

Germany’s polyimide fibers market is expected to grow at a CAGR of 5.2% during the forecast period. Industrial innovation, particularly in filtration and automotive exhaust control, has driven consistent demand. Germany’s engineering capabilities and environmental compliance policies have enabled the rapid integration of polyimide fibers across infrastructure and electronic applications.

The France polyimide fibers market is poised to witness a 5.2% CAGR from 2025 to 2035. The country has maintained a balanced demand across construction, chemical processing, and defense sectors. Innovation in thermal insulation and industrial protective clothing has been supported by government funding and EU-aligned regulations.

Japan’s polyimide fibers industry is projected to register a CAGR of 5.4% through 2035, driven by electronics manufacturing, miniaturization of semiconductors, and automotive innovations. Fiber optimization using automation and smart production lines has been implemented to improve material resilience, making Japan a technology leader in the segment.

The global polyimide fibers market is characterized by a moderately consolidated structure, with leading players such as Jiangsu Shino New Materials Technology Co., Ltd., Changchun Hipolyking Co., Ltd., and Jiangsu Aoshen Hi-Tech Materials Co., Ltd. holding significant market shares. These companies are actively investing in research and development to enhance product performance and expand their application areas. Strategic collaborations and expansions are also being pursued to strengthen their market positions.

Jiangsu Shino New Materials Technology Co., Ltd. has focused on developing high-performance polyimide fibers with superior thermal stability and chemical resistance. Changchun Hipolyking Co., Ltd. has emphasized the production of polyimide raw materials and nano-products, catering to various industrial needs. Jiangsu Aoshen Hi-Tech Materials Co., Ltd. has made significant strides in producing polyimide fibers using dry spinning methods, achieving large-scale production capabilities.

Recent Polyimide Fibers Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 574.8 million |

| Projected Market Size (2035) | USD 954.4 million |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in kilotons |

| By Application | Filter Media, Protective Clothing, Insulation Material, Others |

| By End Use | Construction, Power & Utilities, Chemical & Processing, Mining, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Jiangsu Shino New Materials Technology Co., Ltd., Jiangsu Aoshen Hi Material Co., Changchun Hipolyking Co., Ltd., Shandong Xingye Environmental Technology Corp., Changchun Hipolyking, and Baoding Sanyuan Textile Technology Co., Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is valued at USD 574.8 million in 2025.

By 2035, the market is projected to reach USD 954.4 million.

The market is expected to grow at a CAGR of 5.2% from 2025 to 2035.

Japan is expected to grow the fastest, with a CAGR of 5.4%.

Filter media leads with an estimated 38% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyimide Film and Tape Market Forecast Outlook 2025 to 2035

Polyimide and Imide Polymers Market

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Blended Fibers Market Size and Share Forecast Outlook 2025 to 2035

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Colourless Polyimide Films Market

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Food Dietary Fibers Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA