The global citrus fibers market is estimated to account for USD 517.3 Million in 2025. It is anticipated to grow at a CAGR of 5.7% during the assessment period and reach a value of USD 890.4 Million by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Citrus Fibers Market Size (2025E) | USD 517.3 Million |

| Projected Global Citrus Fibers Market Value (2035F) | USD 890.4 Million |

| Value-based CAGR (2025 to 2035) | 5.7% |

Citrus fibers are a type of dietary fiber extracted from citrus fruits like oranges, lemons, and grapefruits. These fibers are usually extracted from the peel, pulp, or membranes of the fruit. They are often applied as food ingredients for assisting in texture and moisture retention to improve the overall fiber content of products like baked goods, beverages, and snack foods.

The prime driver behind the market is rising awareness of the health benefits that are associated with citrus fibers. An increase in consumers' desire for natural, plant-based fibers is observed to support digestive health and enhance general well-being. Citrus fibers have been found to be rich in pectin and have multiple benefits, including aiding digestion, regulating cholesterol levels, and enhancing gut health.

This trend is even stronger in health-conscious individuals and clean-label dieters, who believe in consuming products that contain mostly natural, unprocessed ingredients. As the population of the globe becomes increasingly health-conscious, functional food and ingredient sales, including citrus fibers, keep growing.

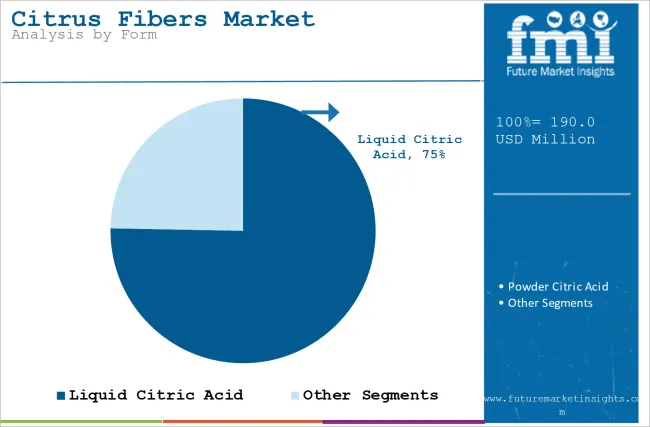

In terms of form, the market is bifurcated into powder citric acid and liquid citric acid. Liquid citric acid is easily dissolved in solutions. This makes liquid citric acid perfect for liquid products such as soft drinks, syrups, and others. It is sometimes easier to handle and add during a process in which a definite concentration is desired.

Moreover, it is typically cheaper to produce and transport in large quantities as compared to its powdered counterpart. It requires fewer steps of processing as compared to producing the powder. Transportation in liquid bulk is more economical than transportation of powder in bulk.

| Attributes | Details |

|---|---|

| Top Product | Natural |

| Market Share in 2025 | 34% |

With respect to product type, the market is segregated into artificial and natural. The natural segment is poised to register a 34% share in 2025. Natural citrus fibers are a rich source of both soluble and insoluble fiber, which can support digestive health, improve gut function, and possibly lower cholesterol levels.

Soluble fiber, in particular, helps regulate blood sugar levels and provides a feeling of fullness, which can assist with weight management. These health benefits can be much more readily accepted by consumers looking for naturally derived, functional ingredients.

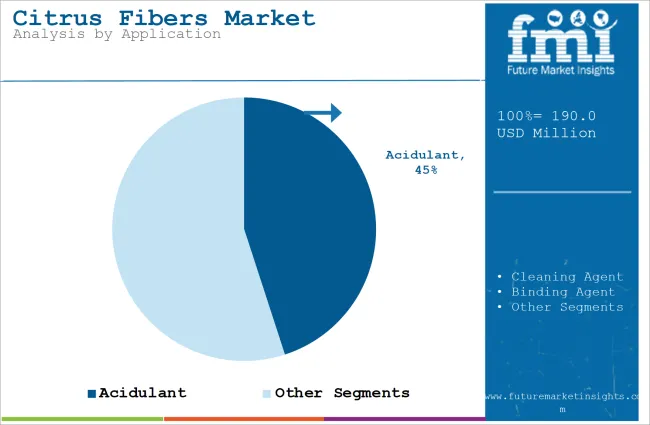

On the basis of application, the market is segmented into cleaning agent, preservative, binding agent, acidulant, and others. One of the significant applications of citrus fibers is as a binder. Citrus fibers have excellent water-binding and gelling properties, making them highly effective in food products such as baked goods, snacks, and plant-based meat alternatives.

They improve the texture, structure, and consistency of these products. In processed foods, citrus fibers can replace fats or other binding agents, ensuring a desirable mouthfeel and moisture content, an important feature of healthier food formulations.

| Attributes | Details |

|---|---|

| Top End Use | Citric Acid for Food & Beverages |

| Market Share in 2025 | 45% |

In terms of end use, the market is classified into citric acid for food & beverages, citric acid for pharmaceuticals, citric acid for animal feed, citric acid for personal care, citric acid for metal finishing & cleaning, and others. The citric acid for food & beverages segment is slated to witness a 45% share in 2025. Citrus fibers provide functional benefits that enhance food and beverage texture, mouthfeel, and moisture retention.

They are most valuable in gluten-free and reduced-fat applications where they replicate both structure and texture typically developed by gluten or fat. Additionally, these fibers retain moisture in baked goods, snacks, and beverages and can provide a fresher appearance and longer shelf life without the addition of unnatural preservatives.

Versatile Nature of Citrus Fibers to Propel their Demand

Citrus fibers have found a role in the food industry as they can be used as a fat replacer in various applications. These fibers can replace the fat content in food, allowing for less fat and desirable texture and mouthfeel, and can be implemented into low-fat or reduced-calorie products, for example, bakery goods, creams, and sauces to simulate the oral coating of fat with much less overall fat. They can also be used as a functional ingredient in may food items.

Surging Plant-based Diet Trend to Foster Sales

With plant-based and vegan diets on the rise, one ingredient that finds increased demand is citrus fiber. As an essential component of dietary fiber in one's diet, these fibers are often introduced as a more comforting texture element to plant-based meat alternatives, dairy-free products, and other foods considered friendly to the vegan way. The rise in per capita income has also bolstered the sales of plant-based diets.

Growing Product Usage in Functional Food

One of the trends that have become prevalent in the citrus fibers market is the rising utilization of citrus fibers in plant-based and functional foods. More consumers are adopting plant-based diets due to health, environmental, and ethical reasons. Thus, demand for plant-based products with a high fiber content is on the rise.

Citrus fibers are a natural fit for these products, offering not only health benefits such as improved digestion and heart health but also functional properties such as texture enhancement and moisture retention. This trend reflects the broader shift toward more nutritious, sustainable, and plant-derived ingredients in food formulations.

Surging Demand for Clean-label Food

A mega consumer trend that drives the citrus fibers market is the growing demand for clean-label, minimally processed foods. Consumers are increasingly looking for transparency in the ingredients used in the products they consume, opting for natural, recognizable components rather than artificial additives. Citrus fibers, derived from whole fruits such as oranges and lemons, meet these criteria perfectly, offering a clean-label alternative to synthetic or highly processed fibers. This shift toward natural, wholesome ingredients is influencing food manufacturers to incorporate citrus fibers into their products to meet consumer expectations for healthier, simpler, and more transparent food options.

Finite Raw Material Availability May Hinder Sales

One of the biggest restraining factors in the citrus fibers market is the limited availability of raw materials. Citrus fibers are basically extracted from the by-product of citrus fruit processing. In other words, their supply closely depends on citrus fruits' supply. Seasonal fluctuations and potentially poor harvest due to climatic conditions or infestation issues may adversely affect consistent fiber supply. Variability in the availability of raw material leads to breaks in the supply chain and increases costs of production in citrus fibers and might hamper the growth prospects of the citrus fibers market.

The Indian market is set to expand at 6.7% CAGR during the study period. In particular, it possesses a significant agro-base from which citrons, lemons, limes, and oranges are largely procured to constitute sources for citrus fibers.

The thrust in agriculture-based industries by the government of India through the development and promotion of value-added products manufactured from domestically sourced produce is also accelerating this industry. The market for citrus fibers in India is expanding due to the encouragement of the use of agricultural byproducts such as citrus peels, which opens up new revenue streams for farmers and manufacturers.

Global trends are shifting to clean label products that contain simple, natural ingredients. Citrus fibers, because they are obtained from citrus peel, are a natural and sustainable ingredient that fits perfectly into the fast-rising demand for artificial additive-free and preservative-free products. Thus, citrus fibers are gaining ground in food applications such as snack food, beverages, and baked goods with more consumers now requiring transparent and healthy food choices.

The USA is expected to witness 4.3% CAGR during the assessment period. The country has experienced a rapid growth of gluten-free, grain-free, and plant-based diets. Consumers are now more inclined to avoid wheat or search for alternative flour and ingredients.

Citrus fibers are gaining popularity in gluten-free and grain-free applications, such as breads, cookies, and snacks, and hence are attractive to manufacturers who cater to these markets. Their ability to improve the texture and quality of gluten-free products has made citrus fibers a popular ingredient in the formulation of gluten-free baked goods catering to a wider audience of people with dietary restrictions or preferences.

Canadian consumers are growing more conscious regarding sustainability in purchasing choices. Increasing interest is being driven by the demand for sustainably sourced ingredients that contribute to sustainable food systems.

Citrus fibers are derived from citrus peels, which are common wastes in the juice industry. They are generally considered a sustainable and eco-friendly ingredient. Their use reduces food waste and contributes to more circular food systems. Citrus fibers are in rising demand in Canada, as sustainability becomes a more important factor in consumer choices.

The UK food processing industry is changing toward innovative and functional foods that address the changing requirements of consumers. Citrus fibers are increasingly applied to improve the texture, shelf life, and nutritional profile of various food products.

Their natural thickening and binding capability is contributing to their popularity in processed foods, such as bakery items, snacks, beverages, and dairy alternatives. With the constant growth and development of the food processing sector, the demand for citrus fibers would increase.

Germany houses one of the most innovative food industries in the world, with an ongoing strive to meet the emerging needs of consumers. Citrus fibers are added to a host of products, from gluten-free baked goods to plant-based foods and functional beverages, to help meet that demand.

Apart from acting as a binder, citrus fibers aid in moisture retention and increase shelf life. With food manufacturers focusing on the development of new and improved products, citrus fibers have become an increasingly valuable ingredient in achieving such objectives.

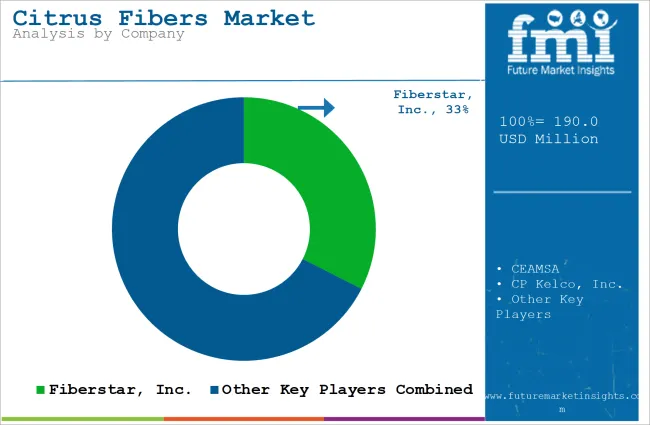

The competitive landscape depicts a mix of established food ingredient firms and specialized firms working on natural fiber solutions. Cargill, Tate & Lyle, and DuPont are some of the key players engaged in the production and supply of citrus fibers and are well-based in the global food and beverage sector due to their strong presence.

These companies take advantage of their large distribution networks and expertise in food science to incorporate citrus fibers into a broad span of applications including functional foods, beverages, and dietary supplements. They invest further into research and development to widen the versatility of citrus fibers and develop newer product formulations catering to consumer demand for healthier and more sustainable alternatives.

Besides the biggest companies, newer and niche companies like Fiberstar, CitroBio, and Herbochem are becoming very important players. They emphasize the natural, clean-label appeal of citrus fibers more and compete based on sustainability and innovation.

Their growth strategies include food manufacturing tie-ups that provide them with tailored solutions for customers and multiplying a portfolio in plant-based and gluten-free spaces while also investing in best-in-class sustainable sourcing practices.

In terms of form, the market is bifurcated into powder citric acid and liquid citric acid.

With respect to product type, the market is segregated into artificial and natural.

On the basis of application, the market is segmented into cleaning agent, preservative, binding agent, acidulant, and others.

In terms of end use, the market is classified into citric acid for food & beverages, citric acid for pharmaceuticals, citric acid for animal feed, citric acid for personal care, citric acid for metal finishing & cleaning, and others.

From the regional standpoint, the market is segregated into Latin America, Asia Pacific, the Middle East & Africa, North America, and Europe.

The market is anticipated to reach USD 517.3 Million in 2025.

The market is predicted to reach a size of USD 890.4 Million by 2035.

Some of the key companies supplying the product include Fiberstar, Inc., CP Kelco, Inc., and others.

India is a prominent hub for product.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Pectin Market Size, Growth, and Forecast for 2025 to 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Citrus Alcohol Market Trends - Flavor Innovations & Demand 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Citrus Aurantium Extract Market – Growth, Applications & Industry Trends

Citrus bioflavonoid Market

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Blended Fibers Market Size and Share Forecast Outlook 2025 to 2035

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Polyimide Fibers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA