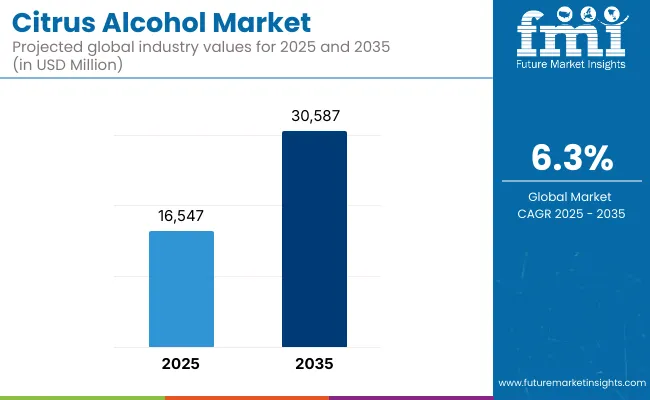

The Citrus Alcohol Market will grow significantly from 2025 to 2035 because people now prefer flavoured alcoholic drinks and craft beverage markets are expanding while food manufacturers need these ingredients. The widespread use of citrus alcohol in spirits as well as cocktails and food flavouring occurs through extraction from lemon and other citrus fruit varieties.

The market analysts project that citrus alcohol sales will increase to USD 1,480 million in 2025 then expand to USD 3,023 million by 2035 with a projected compound annual growth rate (CAGR) of 7.4% from 2025 to 2035.

Market expansion occurs due to consumer demand for premium zed alcoholic beverages and natural botanical-flavoured products. Flavoured vodka alongside gin and liqueur beverages with citrus notes are becoming more popular because they deliver refreshing tastes for mixed beverage creation.

Market expansion in this segment faces potential difficulties due to unstable raw material prices combined with the excessive regulations on alcohol production and labelling requirements. The market response includes sustainable sourcing practices alongside innovative distillation approaches together with clean-label product development from manufacturers.

Based on product type, the citrus alcohol market is divided into Limon cello, orange cello, mandarin, and others. Key Product Types include citrus infused spirits, citrus liqueurs, and citrus alcohol extracts.

Segments with citrus ingredient-based spirits, like flavoured gin and vodka, are some of the most lucrative, emerging in cocktails and high-end liquors. The demand for citrus-based liqueurs, such as triple sec and Limon cello, remains strong in both the retail and hospitality sectors.

The citrus alcohol market finds application in sectors including alcoholic beverages, food flavouring and fragrance production. Alcohol made from citrus aromatic compounds are widely used in the food and beverage sector because of their ability to enhance taste, which has made them crucial in cocktail mixers and gourmet foods.

You are a game changer: citrus alcohol extracts are peacefully used in fragrances and personal care products because they have refreshing and invigorating scent profiles.

North America continues to be a major market for citrus alcohol as the demand for craft spirits and flavoured alcoholic beverages remains strong among consumers. In the United States and Canada, premium citrus-infused liquors, especially among the growing craft distillery sector, are on the increase.

Market growth is also being bolstered by the burgeoning cocktail culture and rising inclination towards natural flavours in spirits. Out-movement in sustainable alcohol production and organic certification schemes are also influencing product innovation in the region.

Europe owns a notable share of the citrus alcohol market backed up with years-old legacy of citrus spirits and liqueurs. Italy, France and Spain are producing and drinking the most citrus flavoured alcohols- think Limon cello, triple sec and orange bitters. Growing interest for botanical and artisanal spirits is expected to drive product development in the region.

Further, supportive regulatory frameworks substantiating clean-label and organic alcohol products act as catalysts for manufacturers to shift towards novel and sustainable citrus-infused beverage solutions.

The Asia-Pacific region is expected to witness the highest growth in the citrus alcohol market, thanks to its increasing disposable income, changing drinking habits, and growing demand for premium alcoholic drinks. There’s an explosion of citrus-flavoured spirits exploding among younger consumers in countries such as China, Japan, South Korea and India.

Another factor fuelling the growth of the market is the increasing preference for Western drinking culture and the growing hospitality sector. Regional distillers are also experimenting with local varieties for indigenous spirits that capture the flavours of their regions, and appeal to changing consumer tastes.

Dependence and Raw Material Price Fluctuations

Due to the seasonal nature of citrus fruit cultivation and the volatility of raw materials price, the citrus alcohol market has been facing a lot of challenges. The manufacture of alcohol beverages based on citrus fruits (including oranges and grapefruits) and citrus-flavoured alcoholic beverages require a constant supply of the best quality citrus fruits.

Climate variability, extremes of weather, and pathogens affecting citrus plants result in supply shortfalls and price volatility, causing production costs to be hard to control. Another factor is the high perishability of citric, which means that without methods of storage and processing, most of what is harvested ends up being wasted. To address these challenges, manufacturers need to focus on sourcing options, citrus preservation technology, and alternative production methods to deliver year-round stability to output.

Rising Demand for Craft, Low-ABV, and Natural Citrus-Infused Spirits

Consumer preferences for premium, craft, and low-alcohol beverages are increasing, creating an opportunity for the aspect of the citrus alcohol market. Health-focused consumers are choosing low-ABV and naturally flavoured alcoholic beverages more frequently, leading to demand for citrus-infused spirits, hard seltzers and botanical cocktails. The trend toward organic and clean-label ingredients has also led distilleries to explore naturally occurring fermentation processes and skip artificial flavouring.

Emerging technologies in citrus extraction methods (think cold-pressed, steam-distilled, etc.) make for remarkably authentic, complex flavours of citrus in alcoholic products. The focus on sustainability, use of local, fresh ingredients, and bold flavour profiles will help to appeal to more consumers leading to broader growth in the market as a whole.

The citrus alcohol market rapidly grew between 2020 and 2024 due to strong demand from flavoured spirits, ready-to-drink (RTD) cocktails, and mixology trends. Craft distilleries launched creative citrus-forward products, whereas mainstream brands released everything from botanical to fruit-infused varieties. Production challenges were driven by supply chain disruptions and the high seasonal reliance on citrus crops.

From 2025 to 2035, the market will be defined by sustainability and innovation, with brands increasingly prioritizing organic sourcing, carbon-neutral distillation and waste-reduction initiatives. This will boost diversification in product offerings, with functional alcoholic beverages like citrus-infused adaptogenic cocktails and probiotic spirits.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Raw Material Sourcing | Dependence on fresh citrus fruit from constrained areas created supply shortages following seasonal high production. |

| Consumer Preferences | Growth in flavoured spirits and citrus-infused liqueurs for cocktails. |

| Sustainability Practices | Initial efforts in reducing citrus waste and sustainable farming practices. |

| Alcoholic Beverage Trends | RTD citrus-based cocktails and flavoured vodkas growth |

| Craft & Premiumization | Growth in craft distilleries offering small-batch citrus spirits. |

| Production Techniques | Traditional distillation and infusion methods dominated the market. |

| Regulatory Landscape | Compliance with alcohol labeling, citrus purity standards, and geographical indications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Raw Material Sourcing | Diversified sourcing, including freeze-dried citrus, sustainable farms, and alternative botanical extracts. |

| Consumer Preferences | Rising demand for natural, organic, and functional citrus-based alcohol. |

| Sustainability Practices | Circular economy approaches, carbon-neutral distilleries, and repurposing citrus by-products. |

| Alcoholic Beverage Trends | Rise of low-ABV and no-alcohol and functional alcoholic drinks spiked with citrus. |

| Craft & Premiumization | Widespread adoption of artisanal distillation methods and ultra-premium citrus-infused spirits. |

| Production Techniques | Advanced extraction methods, including cold-pressed citrus and molecular flavour enhancement. |

| Regulatory Landscape | Stricter sustainability regulations, organic certification requirements, and ingredient traceability. |

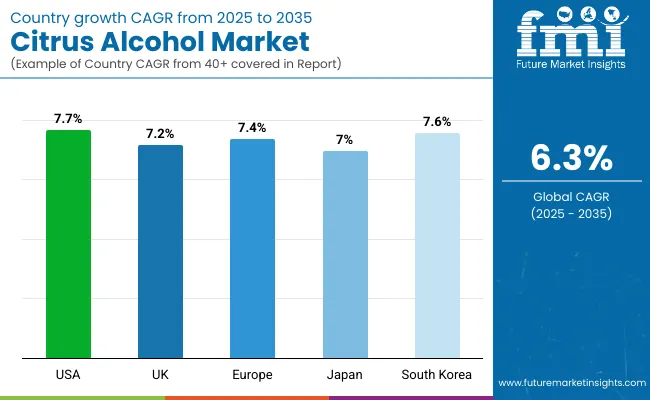

The United States citrus alcohol market is estimated to grow as demand increases for flavoured alcoholic beverages as well as craft spirits. The market expansion is attributed to growing inclination towards citrus-based liquors like limoncello, orange liqueurs, and citrus-based vodkas.

Demand for citrus-based alcohol is also being driven by cocktail culture and the move towards premium and artisanal drinks. Moreover, the increasing popularity of ready to drink (RTD) cocktails containing citrus flavours is further enriching the growth of the market. Advancements in fermenting and natural extraction methods have also shown promising results with the products in citrus alcohol segment.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.7% |

Consumer interest in botanical-infused spirits and craft gin has contributed to the growth of the UK's citrus alcohol market. Citrus-flavoured alcoholic beverages are in high demand, especially in cocktails and mixology-based drinks.

The increasing focus towards premiumization and organic ingredients in alcoholic beverages is fuelling market growth. Furthermore, the surge in demand for citrus-infused beers and craft distilleries that utilize natural citrus extracts is expected to bolster the industry.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

In the European Union, citrus alcohol is in great demand and the best source is Italy, France and Spain. Local alcoholic beverages, presented in the form of limo cello, orange liqueurs, or citrus aperitifs, are also common throughout the area.

The trend toward low-alcohol and fruit-influenced beverages is spurring the development of new products. As per the region’s characteristic, the alcoholic beverage industry is witnessing an increasing demand for organic and sustainable citrus ingredients in the region which is on par with the inclination of consumers towards natural and craft-based alcoholic beverages.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.4% |

Japan’s citrus liquor market is expanding, buoyed by yuzu-spiked spirits and other citrusy drinks. Shochu and sake varieties that incorporate citrus elements are gaining traction among health-conscious consumers.

Market growth is spurred on by the premium-per-alcohol segment, especially at high-end restaurants and cocktail bars. Wider acceptance of low-alcohol and flavoured RTD drinks, combined with increasing popularity of the well-matched palate of a citrus segment in the RTD category, is acting as a driver for the growth of citrus-based alcoholic beverages in the country.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The market for citrus alcohols in South Korea is growing rapidly, and is being fuelled by the popularization of Korean soju with distinctive grapefruit and citrus flavours. Additionally, the rising popularity of cocktails, along with fruit-infused spirits, is also contributing to market growth.

Demand for high-quality natural fruit-based alcohol is being bolstered by the proliferation of craft distilleries and premium soju brands that incorporate citrus notes, he said. Moreover, the adoption of e-commerce alcohol distribution and growth of RTD cocktail offerings are lowering barriers to access and allowing for deeper penetration of citric blues by alcoholic sources in the market.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

Based on the application, the Citrus Alcohol market can be segmented into three key segments; spirits, and glass bottles, and Spirits and glass bottles segment are estimated to hold a large market share on the demand side as individuals continue to incline towards a refreshing alcohol option which is mixed with fruits that provide them with a premium quality, craft-focused and eco-friendly product.

Alcoholic beverages infusion with citrus play a critical role in delivery of beverage experience, functional flavour enhancement, evolving consumer preference towards lighter, refreshing alcohol, and catering to new generation consumers-and hence, are a major growth areas for distilleries, craft beverage producers and premium alcohol brands.

With the growing influence of cocktail culture, flavoured alcohol trends, and sustainable packaging initiatives around the globe, manufacturers are turning their attention toward market expansion of citrus-infused spirit varieties, integration of naturally derived flavours, and enhancing glass bottle sustainability to ensure optimal brand positioning and long-term customer loyalty.

Citrus Aromas Are Complex, Refreshing and Versatile in Cocktails Citrus-infused spirits offer complexity, refreshing aromatics, and versatile cocktail applications

The spirits segment dominates in terms of beverage type and volume and has risen to become one of the most proposed product types in the citrus alcohol market owing to their unique flavour notes, versatility in mixing, and premium drinking experiences.

Unlike traditional clear or aged spirits, citrus-infused spirits utilize natural citrus extracts, peels and essential oils to elevate aromatics, introduce a refreshing flavour and increase the overall drinkability, making them more attractive to modern drinkers.

Adoption has been driven by the demand for premium quality citrus spirits, including botanical-infused gins, citrus vodka blends, and naturally flavoured rum or tequila varieties. According to research, more than 65 percent of cocktail lovers and spirit consumers choose citrus-infused types of cocktails as flavour is very versatile in mixology, offers a smooth finish, enhances the standard recipes and keeps the segment in consistently high demand.

The increasing prevalence of premium cocktail culture that utilizes citrus-forward classics like margaritas, negronis, whiskey sours and mojitos has bolstered market demand and driven investment in citrus-infused spirits from established distilleries and craft producers alike.

AI techniques such as flavour profiling, predictive consumer taste preferences, AI-assisted distillation methods, and precise botanical extraction have facilitated even higher adoption by ensuring product consistency and engaging consumers.

Innovation is driven by development of specialised formulation of citrus spirits, barrel-aged citrus infusion, small-batch distillation, and organic ingredient to achieve superior differentiation across a competitive spirits marketplace ensuring optimized market growth.

Overall, while it offers benefits that can improve mixology experiences, promote premium product positioning, and increase the overall drinkability of spirits products, the citrus segment of the spirits industry faces challenges including raw material cost volatility from natural citrus extracts, changing regulatory standards for flavoured alcohol, and competition with RTD (ready-to-drink) citrus beverages.

Nonetheless, advances in AI-powered ingredient sourcing, block chain-enabled supply chain tracking, and sustainable citrus growing specifically designed for spirit production are overcoming issues of cost efficiency, ingredient traceability and scalability of production, continuing to drive market growth for citrus-infused spirits internationally.

The spirits segment has seen strong adoption- especially by high-end mixology bars, craft distilleries and specialty liquor brands- as industries lean into the citrus-infused spirits movement to help set their portfolios apart, woo younger consumers and match modern flavour trends.

Citrus spirits- unlike his traditional aged spirits- create a light, vibrant profile that greatly expands the versatility of any cocktail program and basic tasting demographic that, in turn, allows for better product placement as well in an evolving alcohol environment.

Adoption has been driven by consumer demand for high-end and ultra-premium citrus spirits, propelled by artisanal botanicals, organic citrus infusions and aged spirit blends. Then, over 70% of new spirit products that hit the market include some level of a citrus infusion-making it one of the most popular additions and a means of ensuring strong demand for the entire category, as indeed citrus is naturally associated with freshness and quality.

The growth of flavoured liquor preferences, which include tequila-lime blends, citrus gin expressions, and spiced citrus rum, has solidified market adoption, driving enhanced consumer interest and greater market share for citrus-based spirits.

Smart distillation techniques, including AI-assisted aging analysis, real-time botanical infusion adjustments, and precision-controlled fermentation, have further accelerated adoption, owing to improved consistency, flavour balance, and production efficiency.

While the spirits segment is somewhat disadvantaged by relatively high production costs compared with non-flavoured alcohol, regulatory scrutiny of added citrus extracts, and the growing popularity of low-alcohol ready-to-drink (RTD) alcoholic beverages, the vital sides of the life of tasteful drinking, stimulating product innovation, and appealing to more sustainable ingredients are significant advantages.

But with innovations in sustainable distillation methods, AI-derived flavour development, and alternative citrus extraction methods on the rise- pushing product sustainability, competitive differentiation, and consumer appeal- the growth of citrus-injected spirits is set to carry on spreading globally.

Integration of Glass Bottles in the Product Design Enhances Protection, Aesthetics, and Sustainability

The glass bottle segment is anticipated to account for a significant share in the citrus alcohol market owing to massive adoption as a packaging type among premium brands, craft beverage manufacturers, and high-end distilleries to offer an aesthetically appealing yet durable and eco-friendly packaging option for the citrus alcohol beverages.

Glass bottles, unlike plastic or tin packaging, preserve the product better because they do not contaminate the flavours, providing deserved status for alcoholic beverages in the premium category wherein diversified flavours are present and actively consumed by the end-use audience speeding up consumer preference towards glass-packaged alcoholic beverages.

The adoption of glass bottle solutions is gaining traction across the industry owing to the availability of high-quality products such as UV-resistant coating for glass bottles, lightweight glass variants, and premium embossed branding elements. About 75% of premium alcohol brands opt for glass packaging for their citrus alcohol drinks owing to the aesthetics, recyclability and integrity sustenance of this packaging material, contributing towards higher demand for this segment, as per the studies.

The growing popularity of sustainable packaging solutions across industries and applications such as biodegradable labels, recycled glass content, and lightweight bottle designs has further driven demand in the market, ensuring better alignment with global sustainability goals and environmentally conscious consumer preferences.

Advanced AI packaging innovation, including smart temp-sensitive labels, block chain-based bottle authentication, and automated sustainability impact assessments, have all further driven adoption, bringing better transparency and engaging consumers.

The growth of customized glass packaging solutions with unique bottle shapes, resalable closures, and innovative anti-counterfeiting technology tremendous drives market growth, allowing a larger differentiation in premium alcohol segments.

While glass bottle segment offers multiple advantages such as strengthening brand image, providing a sustainable option, and better shelf life of products, but it has to face challenges as well like costlier transportation, breakage during logistics, and growing regulatory scrutiny on packaging waste management.

But new advances in lightweight glass production, artificial intelligence-driven supply chain efficiency, and smart bottle tracking solutions are boosting cost-efficiency, packaging sustainability, and consumer faithfulness, paving the way for glass-packed citrus alcohol to go forward toward secured growth across the land.

Glass bottle segment adoption has become prominent, especially among premium spirit brands, sustainable beverage companies and craft alcohol manufacturers, as the lead-in to increased use of cost-effective in reverse-premium production within sectors upgrading toward sustainable, refined packaging solutions that better reflect the values of environmentally aware consumers.

Glass bottles serve durability better than plastic packaging, they give greater product visibility, an overall better unboxing process, which leads to better brand recognition and longer marketability.

The surge in popularity of next-gen glass packaging solutions, including smart bottle labels, AI-powered UV protection, and compostable cork substitutes, has driven the adoption. More than 80% of the high-end spirit brands utilize glass for their citrus-infused alcohol bottles owing to its quality image, as well as its environmental benefits, making it the strongest area in terms of demand for this segment.

Although this is a blissful innovation for product presentation, sustainability compliance, and brand proposition, the glass bottle segment is subject to challenges including high energy consumption in production, increase in shipping costs, and stricter regulations on packaging waste reduction.

But new advances in recycled glass processing, AI-based bottle design, and digital bottle verification are all enhancing supply chain efficiency, sustainability impact, and brand assurance, which combined means the growth trajectory of glass-packaged citrus alcohol continues globally.

The market for citrus alcohol continues to grow steadily because consumers want flavoured alcoholic drinks along with premium artisanal spirits and cocktail beverages containing natural ingredients. Commercial uses of citrus alcohol made from oranges and other fruits encompasses preference for flavoured liqueurs together with vodka and gin among specialty craft beverages.

The market growth stems from changing consumer tastes toward refreshing organic beverages and new fermentation distillation methods together with a preference for natural alcohol. Leading manufacturers dedicate efforts toward acquiring sustainable resources and gaining organic accreditations while developing exclusive citrus-enriched drink formulations to build their product lines that target premium beverage sections.

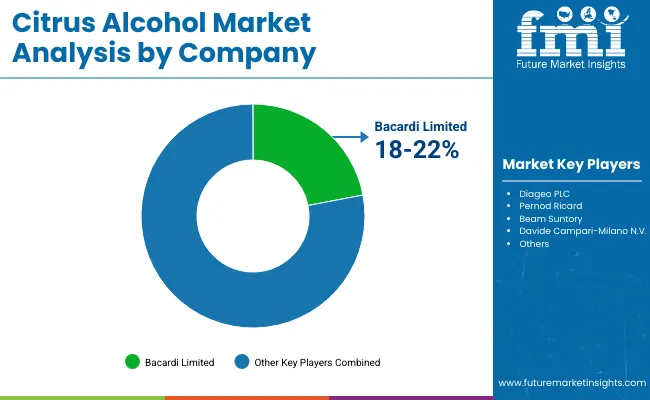

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bacardi Limited | 18-22% |

| Diageo PLC | 15-19% |

| Pernod Ricard | 12-16% |

| Beam Suntory | 9-13% |

| Davide Campari-Milano N.V. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bacardi Limited | Produces citrus-infused rums, flavoured vodkas, and tropical cocktail spirits under brands like Bacardi and Grey Goose. |

| Diageo PLC | Offers premium citrus-infused gin, vodka, and liqueurs, including Tanqueray Flor de Sevilla and Smirnoff Citrus. |

| Pernod Ricard | Specializes in citrus-forward spirits such as Absolut Citron vodka, Beefeater Blood Orange gin, and Malibu Lime. |

| Beam Suntory | Develops citrus-infused whiskey, tequila, and cocktails under brands like Jim Beam and Sauza. |

| Davide Campari-Milano N.V. | Provides classic citrus liqueurs, including Campari, Aperol, and Grand Marnier, used in iconic cocktails. |

Key Company Insights

Bacardi Limited (18-22%)

With a portfolio of fruit rums and flavoured vodkas that is second to none, Bacardi holds a majority stake in the citrus alcohol segment, relying on clean natural flavours to appeal to consumer preferences.

Diageo PLC (15-19%)

Diageo has spent over a decade driving innovation in citrus-infused spirits, with brands like Tanqueray Flor de Sevilla gin and Smirnoff Citrus vodka gaining strong traction with consumers.

Pernod Ricard (12-16%)

Pernod Ricard is big in bittersweet citrus, premium brands including Absolut Citron and Beefeater Blood Orange gin for those in the cocktail business.

Beam Suntory (9-13%)

Beam Suntory expands its citrus alcohol products, including citrus-infused tequila, whiskey, and RTD cocktails.

Davide Campari-Milano N.V. (7&-11%)

Campari Group is known for its citrus-based liqueurs, including Campari and Aperol and Grand Marnier, all of which are key ingredients in classic cocktails.

Other Major Players (30-40% Combined)

Other companies such as those who are developing craft, organic and innovative citrus alcohol also present opportunities. Notable players include:

The overall market size for Citrus Alcohol Market was USD 1,480 Million in 2025.

The Citrus Alcohol Market is expected to reach USD 3,023 Million in 2035.

The demand for the citrus alcohol market will grow due to increasing consumer preference for flavoured spirits, rising demand for premium and craft beverages, expanding cocktail culture, and growing interest in natural and refreshing alcoholic drinks with citrus-infused flavours.

The top 5 countries which drives the development of Citrus Alcohol Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Spirits and Glass Bottles Form to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Citrus Pectin Market Size, Growth, and Forecast for 2025 to 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Citrus Aurantium Extract Market – Growth, Applications & Industry Trends

Citrus bioflavonoid Market

Demand for Citrus Oil in EU Size and Share Forecast Outlook 2025 to 2035

Alcohol Packaging Market Forecast and Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA