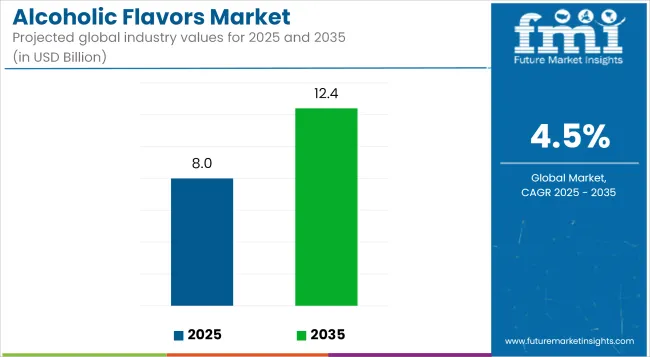

Between 2025 and 2035, the global market for alcoholic flavors is expected to witness accelerated growth, increasing from USD 8.0 billion to USD 12.4 billion at a CAGR of 4.5%. Alcoholic flavor formulations are witnessing a resurgence in demand, particularly in premium beverages and hybrid alcoholic products. The growing sophistication of consumer palates, especially in urban and millennial demographics, is compelling brands to innovate with authentic, natural, and indulgent flavor infusions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8 Billion |

| Industry Value (2035F) | USD 12.4 Billion |

| CAGR (2025 to 2035) | 4.5% |

This evolving landscape is being shaped by several converging trends. Demand for craft cocktail kits, low-alcohol beverages, and flavored spirits is supporting formulation innovation. Consumer gravitation towards experiential drinking has incentivized the use of whiskey, brandy, rum, and botanical flavor profiles, while rising clean-label preference is prompting the adoption of natural and organic alcohol-derived flavor ingredients.

However, regulatory complexities regarding alcohol content declaration and regional restrictions on synthetic carriers are restraining certain formulations. Players are investing in encapsulation technologies and flavor modulation strategies to overcome solubility and stability challenges, ensuring that flavor integrity is maintained across packaging and shelf life.

Over the coming decade, flavor houses and beverage formulators are expected to intensify R&D investments, with flavor masking, ethanol-modified profiles, and multi-sensory blends gaining more ground. By 2025, spirit flavors and wine flavors will have carved out distinct roles across RTDs and cocktail concentrates.

By 2035, product differentiation will rely more heavily on heritage-based and regional taste authenticity, with APAC and Latin America emerging as pivotal innovation hubs. Beverage applications will continue to dominate due to their centrality in product positioning, while bakery and confectionery spaces are anticipated to witness incremental growth, driven by gourmet alcohol flavor incorporation.

Fruit preparation and dairy sectors are projected to jointly account for nearly 14.3% of the global alcoholic flavors market share in 2025, expanding steadily due to indulgence-oriented formulation strategies. Unlike beverage-centric categories, these segments are leveraging alcoholic flavors primarily for sensory layering and consumer intrigue.

Dairy desserts such as rum-flavored ice creams or whiskey-infused yogurts are gaining traction in Europe and North America, especially within gourmet and seasonal lines. Similarly, fruit preparations containing alcohol-derived flavors such as cherry-brandy swirls or orange liqueur fillings are being positioned as premium inclusions in pastries and chilled desserts. Regulatory compliance remains crucial, especially within the EU and Canada, where food labelling must clearly distinguish between flavoring substances and actual alcohol content, per EFSA guidance.

Companies like Döhler and Prova are capitalizing on this trend by launching non-alcoholic flavor systems derived from alcoholic profiles, targeting foodservice and retail brands seeking elevated flavor notes without ethanol presence. As consumer interest in flavor complexity rises, these applications are expected to become important secondary growth areas outside traditional beverage formulations, contributing to category diversification through culinary and dessert innovation.

Functional food and nutraceutical applications are expected to capture a modest but growing 6.1% share of the global alcoholic flavors market by 2025. These formats reflect an emerging niche where taste masking, novelty, and product compliance intersect. Alcohol-inspired flavors are increasingly utilized to improve palatability in protein shakes, botanical elixirs, and even energy supplements, especially in low-alcohol and alcohol-free wellness beverages.

In markets such as the USA and Japan, where functional drink innovation is dynamic, flavor houses are experimenting with zero-ethanol rum, absinthe, and wine variants for nootropic beverages or fermented drink analogs. These formats comply with the USA FDA’s Generally Recognized As Safe (GRAS) provisions for non-alcoholic flavors, thus enabling broader usage across health-aligned formulations.

Players such as Sensient Technologies and Symrise are at the forefront, with R&D focused on ethanol-mimicking flavor actives compatible with functional matrices. This segment’s growth is bolstered by Gen Z and millennial consumers seeking indulgent yet purposeful consumption experiences, paving the way for alcohol flavors as functional sensory enhancers across novel platforms.

The demand for alcoholic flavored drinks, such as infused spirits, craft cocktails and pre-mixes, RTDs (ready to drink) etc., mean that the USA alcoholic flavor market is growing. With strong sales of premium products combining innovative flavors - such as barrel aged versions or botanically infused liquor - growth in consumption also lags behind rising demand for foodstuffs: another reflection of this trend.

With major beverage companies investing heavily in flavor innovation by leveraging AI and consumer preference data to make more flavors, the rise of alcohol-free and low-alcohol drinks is also boosting diversification in market products.

| Country | CAGR (2025 to 2035) |

|---|---|

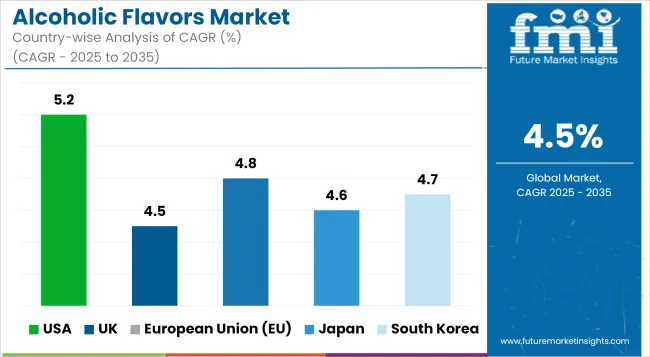

| USA | 5.2% |

US flavored spirits market is expanding with increasing demand for flavored alcoholic drinks, including infused spirits, craft cocktails, and RTD spirits beverages, among consumers. The trend may be a result of product premiumization and innovative pairing of flavors, e.g., barrel aging flavors and botanical-infused spirits, influencing the market.

Big soft drink players are spending on flavor innovation, using AI-based taste profiling and consumer analysis. In addition, the rising shift towards low-alcohol and non-alcoholic flavored drinks is also driving product diversification further in the market

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Germany, Italy, and France are the leaders in alcoholic flavor business in Europe due to large-scale production of wine, beer, and spirits. The specialty fruit-flavored, botanical, and barrel-aged alcoholic flavors market is growing, especially in the premium and craft alcohol sectors.

The European market is also witnessing an increase in demand for natural and organic flavor extracts because consumers require clean-label ingredients. Green production and sourcing of alcoholic flavors are also compelling regulatory frameworks for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The alcohol flavors market of Japan is increasing as flavored spirit consumption, variant sake, and high-end craft cocktails gain traction. Distinctive flavor types like yuzu, matcha, and sakura-flavored liquors are being increasingly implemented in domestic markets as well as for exportation.

Japanese beverage companies are placing bets on fermentation-based flavoring and AI-enabled sensory analysis to drive taste experiences. The demand for no-alcohol and low-alcohol beverages with high-end flavor profiles is also fueling the growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korean alcoholic flavor market is growing due to shifting customer demand for soju-flavored drinks, fruit-flavored beer, and new RTD cocktail drinks. K-culture and K-drinks around the globe are influencing unique alcoholic flavors like ginseng, honey, and tropical fruit-flavored alcohol.

The growing popularity of Western alcoholic drinks with Korean flavor infusions is also influencing market trends. Also, social media influence and digital marketing campaigns are driving the demand for new and seasonal flavors at a faster rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

With consumers increasingly requesting high-quality alcohol-the demand for premium cocktails, flavor-infused spirits and related products continues to grow rapidly. As the market has been changing, beverage producers are trying out new methods like natural extracts, herbal infusions or special blends of striking flavors in its product lines.

Concern for sustainability and clean label has high-profile players all using the latest flavor extraction techniques, to get more flavor and yet still save on energy. At the same time, much that like pre-mixed cocktails rtd (ready to drink), flavoured beers or even light spirits Gregory Hargreaves is a writer living in Berlin. In the future the market will probably develop even more rapidly than it has already been doing.

Alcoholic flavors market becomes generally much more fragmented over time-the CAGR stands at 6.5% globally and over the years has shown remarkable variability in percentage points from one region to another. This depends largely on how various markets' regulatory frameworks are set up or are moving forward, with certain factors such as consumer tastes.

The overall market size for the Alcoholic Flavors Market was USD 8 Billion in 2025.

The market is expected to reach USD 12.4 Billion in 2035.

The demand will be fueled by the rising popularity of flavored alcoholic beverages, increasing consumer preference for craft and premium spirits, growing applications of alcoholic flavors in food and confectionery, and innovations in natural and botanical flavor infusions.

The top five contributors are the USA, European Union, Japan, South Korea and UK.

Whiskey and Rum-based flavors are anticipated to command a significant market share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcoholic Ice Cream Market

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

USA Non-Alcoholic Malt Beverages Market Insights – Trends, Demand & Growth 2025-2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

Europe Non-Alcoholic Malt Beverages Market Insights – Demand & Growth 2025–2035

Pre-mixed/RTD Alcoholic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA