The USA Non-Alcoholic Malt Beverages Market is projected to reach USD 10.57 billion in 2025, growing at a CAGR of 6.6% over the next decade to an estimated value of USD 20.08 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated USA Non-Alcoholic Malt Beverages Industry Size (2025E) | USD 10.57 billion |

| Projected USA Non-Alcoholic Malt Beverages Industry Value (2035F) | USD 20.08 billion |

| Value-based CAGR (2025 to 2035) | 6.6% |

The market growth occurs because consumers increasingly choose alcohol-free malt beverages as well as functional drinks and health-conscious alternatives.

The market concentration takes its form from entry barriers that consist of capital-intensive production together with strict regulatory demands and broad distribution networks. Established brands and retail private labels create a market that shows moderate competition.

The USA Non-Alcoholic Malt Beverages market exists as a blend of general Retailer and Specialty sectors because prominent Brands sustain their dominance through consumer brand commitment and advertising and their extensive sales networks. The marketplace has shifted because customers search for new flavors and functionality in their beverages so specialized smaller brands now experience growing success.

The distribution of non-alcoholic malt beverages depends on supermarkets hypermarkets and convenience stores but e-commerce shows strong growth because consumers change their purchasing patterns. The growing number of digital stores alongside direct consumer sales routes creates additional challenges for the market competitors.

Market fragmentation occurs because consumers are interested in premium organic and health-enhancing malt beverages while major players retain their dominant position in the industry.

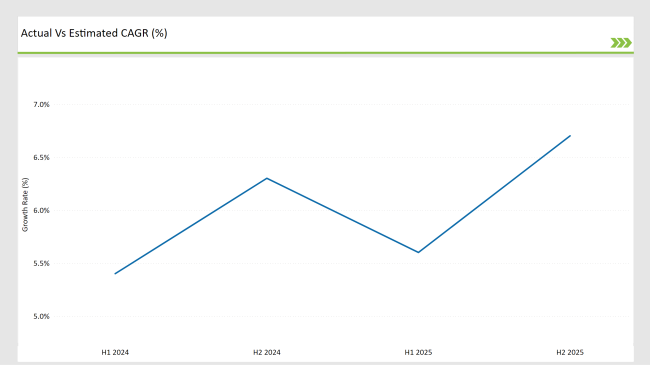

Market development rate in 2024 to 2025 as shown in the following figures in terms of USA Non-Alcoholic Malt Beverages Market is indeed very fluctuating. This half-yearly analysis of changes in the non-alcoholic malt beverage market patterns pictures not only the industry revenues but also trends in the sector. The first half of the year (H1) starts in January and ends in June while the second half of the year (H2) runs from July to December.

Market data reveals consumer preference changes regulatory changes and new product formulation advances in the sector. Businesses need this market breakdown since it enables their strategic alignment with sector trends to maximize opportunities within the transforming non-alcoholic malt beverage industry.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2025 | Molson Coors Partners with Fevertree: Molson Coors acquired an 8.5% stake in Fevertree Drinks for £71 million, securing exclusive USA marketing rights for Fevertree's mixers, including tonic water and ginger beers. |

| January 2025 | Anheuser-Busch InBev to Brew Pabst Beer: Following the end of Pabst's two-decade partnership with Molson Coors in December 2024, Pabst Brewing Company entered a new brewing contract with Anheuser-Busch InBev, set to commence in early 2025. |

| July 2024 | FDA Bans Brominated Vegetable Oil (BVO): The FDA prohibited the use of BVO in food and beverages due to health concerns, effective August 2, 2024. Companies were given one year to reformulate products containing BVO. |

| August 2024 | Tilray Acquires Four Molson Coors Breweries: Tilray Brands purchased four craft breweries—Hop Valley Brewing Co., Terrapin Beer Co., Revolver Brewing, and Atwater Brewery—from Molson Coors, expanding its presence in the USA beverage market. |

| July 2024 | Corona Cero's Olympic Sponsorship: Anheuser-Busch InBev announced plans to promote its zero-alcohol beer, Corona Cero, through its Olympic sponsorships, aiming to position it as a leading non-alcoholic beer globally. |

Functional and health-focused malt beverages continue to rise as a main sector in the market.

The United States market for non-alcoholic malt beverages is evolving toward products that provide functional and health benefits. The desire from consumers to find beverages that offer more than hydration forces companies to create malt beverages with vitamins and minerals adaptogens and probiotics.

The market shows a rising interest in prebiotic beverages linked to gut-health which draws health-conscious drinkers between traditional sweet sodas and malt beverages. These day low-calorie sugar-free and organic malt beverages are branching out into both market stores and e-commerce outlets. Manufacturers use monk fruit stevia and erythritol to produce sweet beverages that adhere to evolving health regulations as the food regulatory bodies aim to lower beverage sugar levels.

Non-Alcoholic Craft Malt Beverages prove to be an emerging vital segment within the market.

The market shifts toward non-alcoholic craft malt beverages attract average consumers who want upscale handcrafted premium choices that match commercial beverages. Millennials and members of the entire Z population are leading the market shift which focuses on distinctive flavors combined with premium ingredients as well as environmentally friendly manufacturing practices.

Modern consumer preferences resulted in novel malt beverage releases which include restricted quantities with botanical-infused and barrel-aged combinations alongside tropical fruit mixes in each brew.

Market accessibility keeps growing because specialty beverage retailers, taprooms, and online subscription models are becoming more widespread. With rising demand for zero-alcohol beverages that deliver rich flavor experiences craft malt beverages enter the market as an upscale beverage category in the non-alcoholic drink segment.

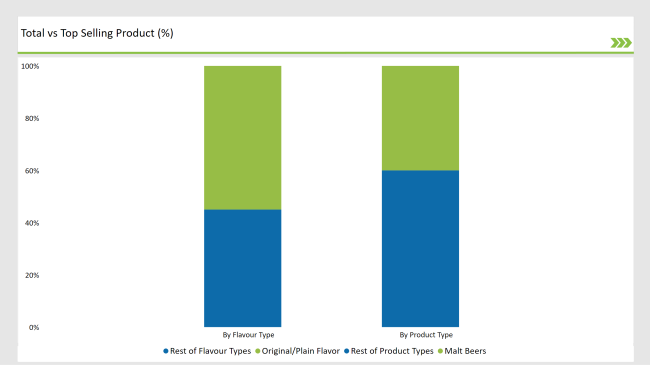

% share of Individual categories by Product Type and Flavor in 2025

Malt Beers Dominate Product Type (40%)

Malt beers control 40% of the USA Non-Alcoholic Malt Beverages Market because consumers increasingly favor alcohol-free products that replicate the beer-drinking experience without alcohol.

Malt beers exploit innovative brewing approaches to duplicate alcoholic beverage preferences and eliminate alcohol from the products. Product innovation targeting health-conscious consumers resulted in hopped malt beverages and craft-style alcohol-free lagers because of the rising need for low-sugar low-calorie malt beverages.

Urban markets experienced an improved malt beer market because premium small-batch and organic beer producers expanded the category. A new social drinking movement that dissociates from alcohol dependency continues to drive sales in bar and restaurant outlets as well as retail chains.

Original/Plain Flavor Leads the Flavor Segment (55%)

The majority of malt beverage sales stem from original/plain varieties which constitute 55% of the market because consumers appreciate the pure malt extract flavor. This category maintains popularity because people find it adaptable to many occasions and it appeals to traditionalists and has broad acceptance among different consumer demographics.

The product functions as an essential component for multiple non-alcoholic craft beers along with functional health drinks and medical formulations. The absence of artificial additives and preservatives along with the absence of overwhelming flavors makes plain malt beverages popular among customers looking for pure beverage experiences.

Plain malt beverages are employed in both culinary and homemade drink production through their function as a baking agent and smoothie and beverage mixture component. This segment experiences growing dominance through prolonged consumer demand for genuine malt profiles together with mounting interest in traditional brewing techniques.

Note: above chart is indicative in nature

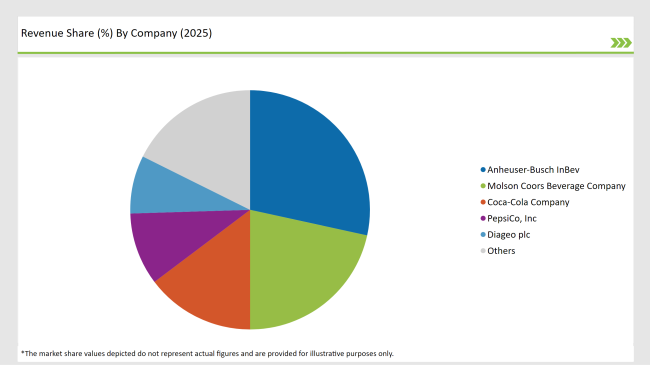

The USA Non-Alcoholic Malt Beverages Market incorporates three concentration segments which include leading global beverage giants as well as regional companies together with niche brand competitors.

The largest multinational corporations within Tier 1 control the market through their strong brand position with extensive advertising budgets and expansive delivery framework. Leading market players maintain their control with a large market presence while they invest in product development along with functional variants and premium goods to maintain their leadership.

The middle segment of malt beverage brands operates under Tier 2 to target specific groups like health-oriented consumers with their craft and organic beverage options. The brands achieve expansion through linkages with neighbourhood businesses as well as independent stores and internet marketplaces.

The bottom tier of beer businesses includes newer brands composed of smaller companies and startup ventures that succeed thanks to diverse flavor profiles alongside exclusive special releases and responsible ingredient-sourcing activities. Through target marketing on digital channels and online retail, they reach younger demographics. The industry has transformed due to e-commerce and functional ingredients and craft brewing so competitors including start-ups and smaller brands can premium market segments.

The market is segmented into malt beers, malt-based soft drinks, malt extracts, and others, catering to diverse consumer preferences and beverage applications.

The market is categorized into original/plain, flavored (e.g., fruit, spices), and herbal, reflecting evolving taste trends and demand for unique beverage profiles.

The segmentation includes cans, bottles, pouches, and others, with packaging innovations influencing consumer convenience, sustainability, and product shelf life.

The market is divided into B2B (HoReCa) and B2C, including hypermarkets/supermarkets, convenience stores, online retail, and others, highlighting diverse retail strategies and sales approaches.

The market is projected to grow at a CAGR of 6.6% from 2025 to 2035.

The market is expected to reach USD 20.08 Billion by 2035.

The Malt-Based Soft Drinks segment is expected to witness the fastest growth, driven by rising demand for health-conscious, fortified, and naturally brewed malt beverages.

Growth is propelled by health-conscious consumers, demand for functional beverages, expanding retail presence, product innovations, and increasing social acceptance of non-alcoholic alternatives.

Anheuser-Busch InBev, Molson Coors Beverage Company, Coca-Cola Company, PepsiCo, and Diageo plc are the dominant players, leveraging strong distribution networks and brand portfolios.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Malt Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

Demand for Caramel Malt in USA Size and Share Forecast Outlook 2025 to 2035

Europe Non-Alcoholic Malt Beverages Market Insights – Demand & Growth 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Malt Sprouts Market Size and Share Forecast Outlook 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA