The global citrus molasses market is projected to reach USD 1,700.0 million by 2035, recording an absolute increase of USD 827.7 million over the forecast period. The market is valued at USD 872.3 million in 2025 and is set to rise at a CAGR of 6.9% during the assessment period. The market size is expected to grow by nearly 1.9 times during the same period, supported by increasing demand for ecological animal feed ingredients worldwide, driving demand for citrus byproduct valorization systems and increasing investments in circular economy initiatives and waste-to-value processing technologies globally. Seasonal raw material availability and competition from alternative feed ingredients may pose challenges to market expansion.

Between 2025 and 2030, the citrus molasses market is projected to expand from USD 872.3 million to USD 1,217.7 million, resulting in a value increase of USD 345.4 million, which represents 41.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for ecological livestock feed and circular economy practices in citrus processing, product innovation in enzymatic hydrolysis technologies and concentration systems, as well as expanding integration with biorefinery concepts and renewable energy applications. Companies are establishing competitive positions through investment in advanced extraction technologies, quality standardization protocols, and strategic market expansion across animal nutrition, pulp production, and biofuel feedstock applications.

From 2030 to 2035, the market is forecast to grow from USD 1,217.7 million to USD 1,700.0 million, adding another USD 482.3 million, which constitutes 58.3% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized citrus molasses systems, including organic certified grades and functional feed additive formulations tailored for specific livestock requirements, strategic collaborations between citrus processors and feed manufacturers, and an enhanced focus on traceability standards and carbon neutrality. The growing emphasis on waste valorization and ecological agriculture will drive demand for advanced, high-quality citrus molasses solutions across diverse animal nutrition and industrial biotechnology applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 872.3 million |

| Market Forecast Value (2035) | USD 1,700.0 million |

| Forecast CAGR (2025-2035) | 6.9% |

The citrus molasses market grows by enabling citrus processors and livestock producers to achieve superior resource utilization and environmental responsibility while creating value from processing byproducts. Citrus juice manufacturers face mounting pressure to maximize byproduct valorization and reduce waste disposal costs, with citrus molasses production typically converting 40-50% of citrus peel waste into valuable feed ingredients, making byproduct processing essential for circular economy economics. The ecological agriculture movement's need for natural feed ingredients creates demand for citrus molasses solutions that can provide digestible energy, enhance palatability, and ensure consistent nutritional value across diverse livestock feeding programs.

Government initiatives promoting agricultural waste reduction and renewable energy development drive adoption in animal feed, pulp production, and biofuel applications, where byproduct utilization has a direct impact on processing economics and environmental compliance. The global shift toward circular bioeconomy models and zero-waste manufacturing accelerates citrus molasses demand as processors seek alternatives to landfill disposal that generates costs without revenue streams. Seasonal production patterns tied to citrus harvest cycles and transportation economics for liquid byproducts may limit adoption rates among distant livestock operations and regions with limited citrus processing infrastructure.

The market is segmented by nature, sales channel, application, and region. By nature, the market is divided into Conventional and Organic. Based on sales channel, the market is categorized into B2B and B2C. By application, the market includes Animal Feed, Pulp Production, and Biofuel. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

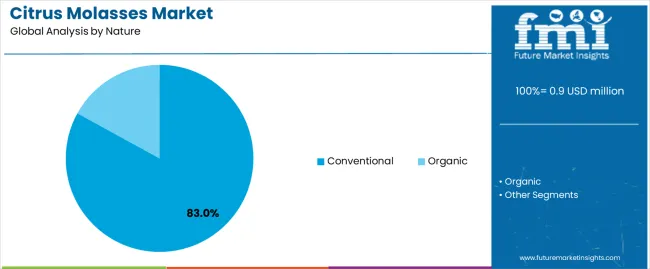

The Conventional segment represents the dominant force in the citrus molasses market, capturing approximately 83.0% of total market share in 2025. This established category encompasses formulations derived from conventionally grown citrus processing with standard extraction methods, delivering reliable nutritional profiles with proven feed application performance. The Conventional segment's market leadership stems from its widespread availability across major citrus processing regions, cost-competitive pricing structures, and compatibility with mainstream livestock feeding operations that prioritize economic efficiency.

The Organic segment maintains a substantial 17.0% market share, serving premium livestock producers and specialty applications requiring certified organic feed ingredients through traceable organic citrus processing operations for dairy, poultry, and organic meat production systems where organic certification premiums justify higher ingredient costs and strict documentation requirements.

Key advantages driving the Conventional segment include:

B2B sales channels dominate the citrus molasses market with approximately 74.0% market share in 2025, reflecting the industrial nature of citrus molasses transactions where bulk volumes flow directly from processors to feed manufacturers, livestock operations, and industrial users. The B2B segment's market leadership is reinforced by long-term supply agreements between citrus processors and commercial feed mills, direct relationships with large-scale dairy operations, and contract arrangements with pulp mills requiring consistent byproduct streams for fiber production.

The B2C segment represents 26.0% market share through retail channels including agricultural supply stores, organic feed retailers, and direct-to-farm sales serving small-scale livestock producers, organic farms, and specialty animal operations requiring smaller quantities with convenient packaging and delivery options.

Key market dynamics supporting sales channel preferences include:

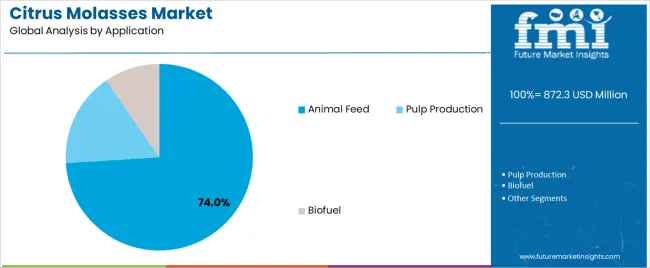

Animal Feed applications dominate the citrus molasses market with approximately 74.0% market share in 2025, reflecting the primary utilization of citrus molasses as energy source and palatability enhancer in ruminant diets throughout livestock production systems. The Animal Feed segment's market leadership is reinforced by widespread adoption in dairy cattle rations, beef cattle finishing diets, and sheep feeding programs, which provide digestible carbohydrates and flavor enhancement improving feed intake and animal performance.

The Pulp Production segment represents significant market share through applications in paper manufacturing where citrus fiber serves as raw material for specialty papers and cellulose products. The Biofuel segment accounts for growing market presence, featuring ethanol fermentation feedstock and biogas production substrate applications leveraging citrus sugar content for renewable energy generation.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to circular economy principles and livestock nutrition requirements. First, sustainable livestock production creates increasing requirements for alternative feed ingredients, with global compound feed production growing 2-3% annually requiring diverse energy sources beyond traditional grains, and citrus molasses providing cost-competitive digestible energy at 70-80% the cost of corn-based alternatives in regions proximate to citrus processing facilities. Second, citrus processing industry waste reduction accelerates byproduct valorization, with major processors converting peel waste into revenue-generating products rather than incurring disposal costs of USD 20-40 per ton, improving processing economics while meeting environmental compliance requirements. Third, organic livestock production expansion drives certified organic citrus molasses demand, with organic feed ingredient premiums of 40-60% creating economic incentives for organic citrus processors to develop certified byproduct streams serving premium dairy and meat production markets.

Market restraints include seasonal production patterns affecting year-round availability, as citrus molasses production concentrates in 4-6 month harvest windows creating inventory management challenges and requiring storage infrastructure to supply markets during off-season periods when fresh production ceases. Transportation economics for liquid products pose adoption barriers in distant markets where freight costs can represent 30-50% of delivered price, limiting economic viability for livestock operations beyond 300-500 km radius from processing facilities unless rail or bulk maritime shipping enables cost-effective long-distance movement. Quality variability concerns create formulation challenges, as citrus molasses composition varies by citrus variety, processing method, and concentration levels requiring feed manufacturers to conduct regular analytical testing and adjust formulations to maintain consistent nutritional delivery across production batches.

Key trends indicate accelerated adoption in dairy cattle nutrition, with nutritionists incorporating citrus molasses at 3-5% of diet dry matter providing energy supplementation while improving ration palatability in high-producing cow groups. Technology advancement trends toward enzymatic treatment processes enhance sugar availability and digestibility, producing modified citrus molasses with improved fermentation characteristics for bioethanol production and enhanced nutritional value for monogastric species including poultry and swine. The market thesis could face disruption if sugar industry byproducts including molasses and beet pulp achieve significantly lower pricing through oversupply conditions, or if precision fermentation technologies produce competitive carbohydrate ingredients with superior consistency and functionality eliminating natural product variability challenges inherent in agricultural byproduct streams.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| USA | 6.6% |

| UK | 5.9% |

| Japan | 5.2% |

The citrus molasses market is gaining momentum worldwide, with China taking the lead thanks to expanding livestock production and citrus processing capacity development programs. Close behind, India benefits from dairy sector modernization and agricultural waste valorization initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where circular economy leadership and organic livestock production strengthen its role in European eco-friendly feed ingredient supply chains.

The USA demonstrates robust growth through Florida citrus processing optimization and dairy nutrition innovation, signaling continued investment in byproduct valorization infrastructure. The UK stands out for its organic farming sector and environmentally-conscious agriculture commitments, while Japan continues to record steady progress driven by feed safety emphasis and quality-focused livestock production. Together, China and India anchor the global expansion story, while established markets build stability and innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

China demonstrates the strongest growth potential in the Citrus Molasses Market with a CAGR of 9.3% through 2035. The country's leadership position stems from comprehensive livestock sector expansion, intensive citrus processing capacity development, and aggressive circular economy targets driving adoption of agricultural waste valorization systems.

Growth is concentrated in major livestock production regions, including Inner Mongolia, Shandong, Henan, and Sichuan, where dairy operations, beef cattle feedlots, and commercial feed manufacturers are implementing citrus molasses programs for cost-effective energy supplementation and palatability enhancement. Distribution channels through feed ingredient distributors, direct processor relationships, and agricultural trading companies expand deployment across commercial livestock operations and integrated feed manufacturing facilities. The country's rural revitalization strategy provides policy support for agricultural waste utilization, including incentives for byproduct processing infrastructure and circular agriculture development.

Key market factors:

In major dairy belts, livestock production zones, and citrus processing regions, the adoption of citrus molasses feed systems is accelerating across commercial dairies, feed manufacturing operations, and cattle fattening enterprises, driven by white revolution continuation and agricultural modernization initiatives. The market demonstrates strong growth momentum with a CAGR of 8.6% through 2035, linked to comprehensive dairy sector development and increasing focus on eco-friendly feed ingredient sourcing.

Indian livestock producers are implementing citrus molasses feeding programs and nutritional management systems to improve feed efficiency while meeting milk production targets across cooperative dairy networks and commercial cattle operations. The country's dairy cooperative structure creates demand for cost-effective energy ingredients, while growing citrus processing capacity drives byproduct availability for livestock applications.

Advanced livestock sector in Germany demonstrates sophisticated implementation of citrus molasses feeding systems, with documented case studies showing integration in organic dairy operations achieving 8-12% feed cost reduction through byproduct ingredient utilization while maintaining milk production performance. The country's agricultural infrastructure in major dairy regions, including Bavaria, Lower Saxony, Schleswig-Holstein, and North Rhine-Westphalia, showcases integration of eco-friendly feed ingredients with existing precision nutrition systems, leveraging expertise in animal science and feed formulation.

German livestock producers emphasize organic certification and circular economy principles, creating demand for certified organic citrus molasses that support environmental commitments and comply with stringent animal welfare regulations while optimizing production economics. The market maintains strong growth through focus on eco-conscious agriculture and premium dairy production, with a CAGR of 7.9% through 2035.

Key development areas:

The USA market leads in citrus molasses feed application innovation based on integration with precision dairy nutrition and TMR (Total Mixed Ration) feeding systems supporting optimal rumen function and milk production. The country shows solid potential with a CAGR of 6.6% through 2035, driven by Florida citrus processing capacity and increasing emphasis on eco-friendly feed ingredients across major dairy regions, including California Central Valley, Wisconsin dairy belt, and New York production areas.

American dairy producers are adopting citrus molasses for energy supplementation in lactating cow diets and as a palatability enhancer in transition cow rations, particularly in organic dairies requiring certified ingredients and in conventional operations seeking cost-effective alternatives to grain-based energy sources. Distribution channels through feed ingredient brokers, direct processor sales, and dairy nutrition consultants expand coverage across diverse livestock feeding applications.

Leading market segments:

The UK's citrus molasses market demonstrates mature implementation focused on organic livestock production and eco-friendly farming systems, with documented integration in organic dairy cooperatives achieving premium milk pricing while utilizing certified organic feed ingredients meeting Soil Association standards. The country maintains steady growth momentum with a CAGR of 5.9% through 2035, driven by a strong organic agriculture sector and consumer preferences for environmentally-conscious animal products supporting premium ingredient demand.

Major dairy regions, including Southwest England, Wales, and Scotland, showcase advanced citrus molasses applications where feeding programs integrate with grass-based production systems and organic certification protocols aligned with ecological stewardship objectives and animal welfare commitments.

Key market characteristics:

Citrus molasses market in Japan demonstrates sophisticated implementation focused on premium livestock production and feed safety assurance, with documented integration in high-quality beef production systems achieving marbling enhancement and flavor improvement through citrus molasses supplementation. The country maintains steady growth momentum with a CAGR of 5.2% through 2035, driven by quality-conscious consumer preferences and emphasis on feed ingredient traceability supporting premium meat and dairy positioning. Major livestock regions, including Hokkaido, Kyushu, and Tohoku, showcase advanced deployment of citrus molasses with comprehensive quality documentation that integrates seamlessly with existing feed safety management systems and traceability protocols meeting stringent Japanese food safety standards.

Key market characteristics:

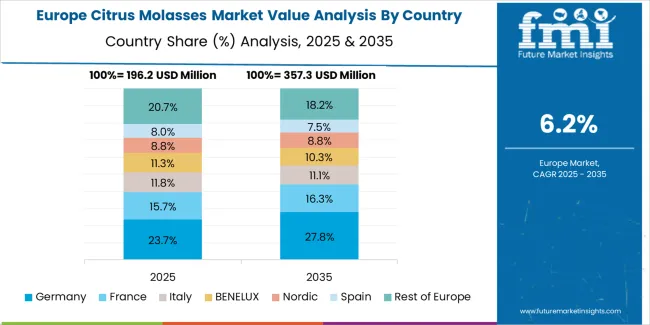

The citrus molasses market in Europe is projected to grow from USD 230.5 million in 2025 to USD 438.2 million by 2035, registering a CAGR of 6.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.3% market share in 2025, declining slightly to 28.0% by 2035, supported by its extensive organic livestock infrastructure and major dairy production centers, including Bavaria, Lower Saxony, and Schleswig-Holstein agricultural regions.

The United Kingdom follows with a 17.8% share in 2025, projected to reach 17.5% by 2035, driven by comprehensive organic farming sector development and eco-friendly agriculture programs implementing certified organic feed ingredient standards. Spain holds a 16.5% share in 2025, expected to rise to 16.8% by 2035 through ongoing citrus processing expansion and livestock production modernization. Italy commands a 13.2% share in both 2025 and 2035, backed by Mediterranean citrus production and dairy sector development.

France accounts for 10.8% in 2025, rising to 11.0% by 2035 on organic dairy expansion and environmentally-conscious agriculture initiatives. The Netherlands maintains 6.4% in 2025, reaching 6.6% by 2035 on livestock intensification and circular agriculture leadership. The Rest of Europe region is anticipated to hold 7.0% in 2025, expanding to 7.3% by 2035, attributed to increasing citrus molasses adoption in Nordic organic dairy operations and emerging Eastern European livestock programs.

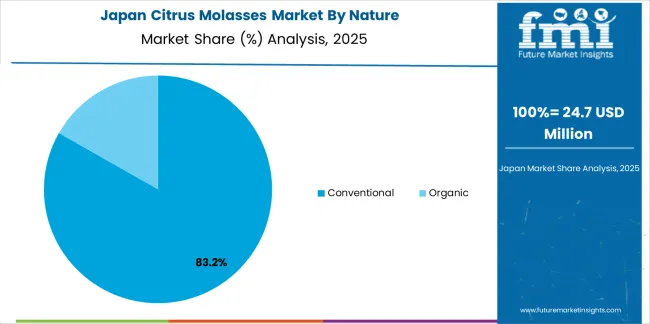

The Japanese citrus molasses market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of traceable feed ingredient systems with existing premium livestock production, comprehensive feed safety protocols, and traditional cattle management practices across quality-oriented animal agriculture. Japan's emphasis on feed safety verification and product traceability drives demand for rigorously documented citrus molasses that support premium meat positioning commitments and feed safety expectations in demanding consumer markets.

The market benefits from strong partnerships between international citrus processors and domestic feed trading companies including major agricultural cooperatives, creating comprehensive service ecosystems that prioritize analytical documentation and origin verification programs. Livestock regions in Hokkaido, Kyushu, Miyazaki, and other major production areas showcase advanced citrus molasses implementations where feed programs achieve comprehensive traceability through batch tracking and quality certification protocols including feed safety management system compliance.

The South Korean citrus molasses market is characterized by growing international feed ingredient supplier presence, with companies maintaining significant positions through comprehensive sourcing capabilities and quality assurance services for livestock operations and feed manufacturing applications. The market demonstrates increasing emphasis on alternative feed ingredients and imported byproduct utilization, as Korean livestock producers increasingly demand cost-effective energy sources that integrate with domestic feed formulation practices and sophisticated nutrition management systems deployed across major livestock production regions.

Regional feed manufacturers are gaining market share through strategic partnerships with international citrus processors, offering specialized services including Korean feed regulation compliance support and customized quality specifications for demanding livestock applications. The competitive landscape shows increasing collaboration between multinational agricultural trading companies and Korean feed industry specialists, creating hybrid service models that combine international sourcing expertise with local livestock production knowledge and feed safety compliance capabilities.

The citrus molasses market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 40-45% of global market share through established citrus processing operations and comprehensive distribution networks. Competition centers on supply reliability, quality consistency, and logistics efficiency rather than price competition alone. Lemon Concentrate S.L. leads with approximately 12% market share through its comprehensive citrus processing and byproduct marketing portfolio.

Market leaders include Lemon Concentrate S.L., Louis Dreyfus Company B.V., and Citrosuco S.A., which maintain competitive advantages through vertically integrated citrus operations from cultivation through processing ensuring byproduct availability, global distribution infrastructure providing market access across multiple regions, and deep expertise in quality standardization and animal nutrition applications across diverse livestock sectors, creating reliability and technical support advantages with feed manufacturer customers. These companies leverage research and development capabilities in processing optimization and ongoing technical relationships to defend market positions while expanding into organic certified grades and functional feed additive formulations.

Challengers encompass Citromax Group and Sucocitrico Cutrale Ltd., which compete through significant processing capacity and strong regional presence in key citrus production markets. Product specialists focus on specific quality grades or application segments, offering differentiated capabilities in organic certification, customized concentration levels, and specialized drying technologies for powder production.

Regional processors and emerging eco-conscious operations create competitive pressure through localized production advantages and rapid delivery capabilities, particularly in high-growth markets including China and India, where proximity to livestock production zones provides advantages in transportation costs and technical service responsiveness. Market dynamics favor companies that combine reliable citrus molasses quality with comprehensive technical support offerings including feeding protocol development, nutritional analysis services, and supply chain management programs that address complete feed formulation requirements across dairy nutrition, beef cattle feeding, and industrial biotechnology applications throughout seasonal production cycles and multi-year supply agreements.

Citrus molasses represents environmentally-friendly byproduct ingredients that enable livestock producers to achieve 70-80% cost advantages compared to grain-based energy sources in proximate markets, delivering superior resource utilization and circular economy benefits with proven digestibility providing 60-65% total digestible nutrients in demanding animal nutrition applications. With the market projected to grow from USD 872.3 million in 2025 to USD 1,700.0 million by 2035 at a 6.9% CAGR, these valorized byproduct systems offer compelling advantages - waste reduction, economic value creation, and environmental responsibility - making them essential for Animal Feed applications (74.0% market share), Pulp Production sectors, and agricultural operations seeking alternatives to landfill disposal that generates costs without revenue opportunities. Scaling market adoption and quality standardization requires coordinated action across agricultural policy, feed safety regulations, processing optimization, livestock nutrition science, and circular economy investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 872.3 million |

| Nature | Conventional, Organic |

| Sales Channel | B2B, B2C |

| Application | Animal Feed, Pulp Production, Biofuel |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Lemon Concentrate S.L., Louis Dreyfus Company B.V., Citrosuco S.A., Citromax Group, Sucocitrico Cutrale Ltd. |

| Additional Attributes | Dollar sales by nature, sales channel, and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with citrus processors and distribution networks, processing facility requirements and specifications, integration with circular economy programs and sustainable agriculture initiatives, innovations in concentration technology and organic certification systems, and development of specialized citrus molasses products with enhanced nutritional profiles and quality standardization capabilities. |

The global citrus molasses market is estimated to be valued at USD 872.3 million in 2025.

The market size for the citrus molasses market is projected to reach USD 1,700.0 million by 2035.

The citrus molasses market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in citrus molasses market are conventional and organic.

In terms of sales channel, b2b segment to command 74.0% share in the citrus molasses market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Citrus Molasses in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Citrus Molasses in USA Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Citrus Pectin Market Size, Growth, and Forecast for 2025 to 2035

Molasses Market Analysis by Industrial, Commercial, Household and Other Through 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Citrus Alcohol Market Trends - Flavor Innovations & Demand 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Citrus Aurantium Extract Market – Growth, Applications & Industry Trends

Citrus bioflavonoid Market

Dry Molasses Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA