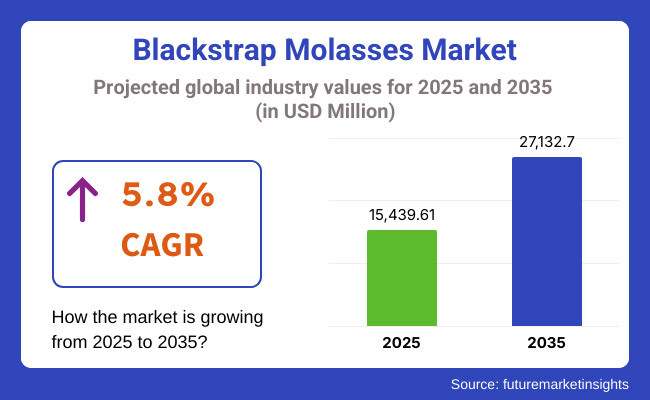

World blackstrap molasses market was USD 13,793.2 million in 2023 and will be USD 15,439.61 million in 2025. Total sales will increase with a CAGR of 5.8% for the forecast period (2025 to 2035) and will be USD 27,132.7 million in 2035.

Some of the forces behind the growth in the market for blackstrap molasses include the rising application within the food and beverage sector for its use both as a flavor and sweetener. Blackstrap molasses is found to be very much in demand as a health supplement based on the substantial content of iron, calcium, magnesium, and potassium. Blackstrap molasses is favored by emerging health consumers and alternative white sugar consumers due to the nutritional benefit of the product.

And another force behind market demand growth is heightened demand for natural and organic foods. As the average consumer increasingly spurns more processed food and food additives, blackstrap molasses is an entirely natural food whose strong, full naturally occurring flavor appeals to the growing markets of natural and organic food consumers.

Blackstrap molasses is also acquiring large-scale applications in animal feed, i.e., farm animals, where it is acquiring the primary role of supplying growth-nutrients to enhance health. Compatibility for application for purposes in the biofuel sector is also another developing trend, where it can also acquire applications as an extremely fine feedstock in ethanol production.

Additional market size expansion is further driven by augmented demand for plant food and sustainable food. Blackstrap molasses as a sweetener, sugar supplement again is an affordable product in food and beverage ingredients and sweeteners.

The demand for blackstrap molasses will grow even more because of natural sweetener, vegetable food, and health food consumers demanding more and more. With an epoch-making breakthrough in sustainable food production as well as levelled demand for blackstrap molasses as a commodity in the majority of industries, the industry will continue to grow well in the future years.

Below is the table indicating difference in CAGR of base year (2024) and current year (2025) of global blackstrap molasses market. Difference is observed in performance, and stakeholders can link the trend in realization of revenue to the trend in growth of the year. H1 refers to January to June and H2 refers to July to December of the year.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.5% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 5.6% |

| H2 (2025 to 2035) | 5.8% |

Market growth for Blackstrap molasses will reach 5.6% in H1 2025. It is a result of strong food and beverage, health supplement, and animal feed uses. There will be replicating patterns as H1 2024 from H1 2025 onwards, where the demand for organic and natural formulations of mass market sweeteners continues to remain firm.

Industry during the second half of the year 2025 (H2 2025) will also see even faster industry growth of 5.8%. Industry growth is aided by greater demand for blackstrap molasses as it continues to grow as a carrier of applications in the biofuels sector and is becoming increasingly popular as an ingredient with greater nutritional value.

vs H1 2024, blackstrap molasses will see a 10 BPS increase in H1 2025. It is sustainable food and popular plant food ingredient. The company will be supported by a 20 BPS versus year-ago in H2 2025. Overall blackstrap molasses segment will see trend growth in 2025 as healthy-consumer devotees drive demand to remain unchanged.

Tier 1 Global Agribusiness Industry Leaders - Their market profiles are linked with high revenue, wide coverage across the globe, and penetrative strategies in their markets. Their research and development outlay is significant, their brand profiles are strong, and they have wide channels of distribution.

ADM is a diversified agribusiness multinational entity whose product portfolios have blackstrap molasses as one of the products. Their big processing and supply chain operations render them a giant in the molasses industry. Cargill is an international industrial, financial, agricultural, and food products group. The manufacturing and processing operation of its include the production of blackstrap molasses for industrial application.

Tier 2 Current Molasses Manufacturers - These institutions have adequate market presence and influence, dealing with production and distribution of the product. They specialize in product quality, sustainability, and market targeting of the mass and niche markets.

B&G Foods owns the brand Grandma's Molasses, which is a popular consumer brand. Its quality focus and brand name have made it a household name in the blackstrap molasses industry. Mexican Domino Comercio is a foreign and domestic market molasses company. Its capacity for handling sugarcane has made it the market leader.

Tier 3 Regional and Niche Suppliers - They are specialized companies in a niche marketplace or specific marketplace, and focus their capability to supply regional industry or specialty application. They focus on individualized applications and flexibility for accomplishment of single customers. Specialization in the manufacture of molasses products for use in the food industry.

Its quality control and in-house knowledge have placed it as one of the more trustworthy players in its line of business. Mahajan Molasses Company is an Indian company that supplies molasses to animal feed and fermentation industries. Its network of distribution and in-house knowledge address local markets' requirements.

Increasing Demand for Natural Sweeteners

Shift: Natural sweeteners are being increasingly used by consumers as a healthy alternative to white sugar. Natural sweetener market will be expanding at 6.4% to 2030 due to blackstrap molasses because the latter has high mineral content with low glycemic index.

Health-oriented consumers of today want foods that allow them to achieve well-being goals on value from functionality. Blackstrap molasses, with its nutrient density in iron, calcium, and potassium, is increasingly being sought as a number-one sugar alternative. The trend is particularly pronounced in North America and Europe, where clean-label and organic are motivating consumers.

Strategic Response: Grandma's Molasses launched an organic blackstrap molasses product, and USA sales increased by 12%. Meridian Foods in the United Kingdom launched the natural sweetener line including blackstrap molasses and reported 8% sales gains.

The companies are highlighting the health advantages of blackstrap molasses and organic in order to obtain health-conscious buyers. Companies are utilizing social media promotion and support from influencers in order to drive the health advantage of blackstrap molasses and hence make it desirable among younger buyers.

Growing Demand for Plant and Vegan Foods

Shift: Blackstrap molasses is also used as a vegan food since it contains iron and calcium content. Plant foods are expected to grow at a CAGR of 9.6% starting 2030, and blackstrap molasses is among the leading products that are being added to plant foods.

The trend is most prevalent in Europe, North America, and Oceania, where people are turning to plant foods as a source of necessary nutrients. Blackstrap molasses is a dense plant iron supplement and thus one of mine to utilize adding to energy bars, smoothies, and baked goods.

Strategic Response: Brer Rabbit Molasses introduced vegan-certified blackstrap molasses, and sales in North America increased by 14%. Wholesome Sweeteners partnered with vegan recipe bloggers to promote blackstrap molasses in vegan recipes, and growth in sales was seen in Europe by 10%. Companies are promoting health bloggers and introducing recipe booklets to encourage the use of blackstrap molasses in daily life, generating product awareness and demand.

Functional Drink Consumption Up

Shift: Blackstrap molasses is also finding extensive use in functional beverages such as detox beverages and herbal teas since they are extremely rich in iron and potassium. Functional beverage sales will increase to 7.8% CAGR through 2030, and blackstrap molasses products do have future potential.

Functional beverages have perceived health benefits and convenience that are further augmented by fortification. Blackstrap molasses is a food item to which the trend is well with a T, providing nutrition in addition to flavor.

Strategic Response: Golden Barrel retailed blackstrap molasses-based detox syrups and USA sales rose by 15%. Steen's Pure Cane Syrup retailed bottled molasses-flavored drinks in ready-to-drink forms and posted 10% growth in North America.

All such brands are introducing special promotion activities coupled with product innovation to sell blackstrap molasses as the foundation for wellness-based drinks. Product adoption is also executed in conjunction with well-being influencers along with also retailers who have a health-directed direction.

Demand for Clean-label and Organic Products

Shift: Clean-label food demands fewer ingredients and no additives from consumers. The clean-label market globally will increase at 7.2% CAGR by 2030 and blackstrap molasses is a minimally processed natural sweetener. Clean-label food is more demanded in North America and Europe, where customers most need transparency and sustainability as the drivers for strongest consumption. Blackstrap molasses is a by-product of sugar refining and naturally falls under these categories.

Strategic Response: Wholesome Sweeteners brought out a series of organic, non-GMO blackstrap molasses and saw that growth 11% in North American sales. Meridian Foods added sophistication to the organic product line, growing 9% in sales in Europe.

Both companies are focusing on product transparency as well as organic certification as a temptation factor appealing to healthy-mindful consumers positively. Brands are going the extra mile to feature sustainable packaging and eco-friendly shopping habits as they try to engage consumer values and become more desirable.

More Use in Animal Feed

Shift: Blackstrap molasses is increasingly being used in animal feed because it is nutritionally valuable and has a strong taste. Animal feed additive consumption worldwide will grow at 6.3% CAGR in 2030, and blackstrap molasses must be one of the major drivers as a natural additive.

Blackstrap molasses is being used more and more by animal feed manufacturers to promote the quality, palatability, and health of animals. It is Europe, Latin America, and North America, particularly, that are seeing more demands for natural and sustainable animal feed ingredients.

Strategic Response: Westway Feed Products introduced value-added blackstrap molasses for cattle, which increased 13% higher North American sales. United Molasses Group introduced molasses formulated animal feed additives and recorded 10% increases in European sales.

They are collaborating with agri-players for realization of blackstrap molasses benefits popularity in animal feeds. They are introducing value-added products for cattle, piglets, chicken broilers, calves, etc. Further increasing penetration and adoption levels.

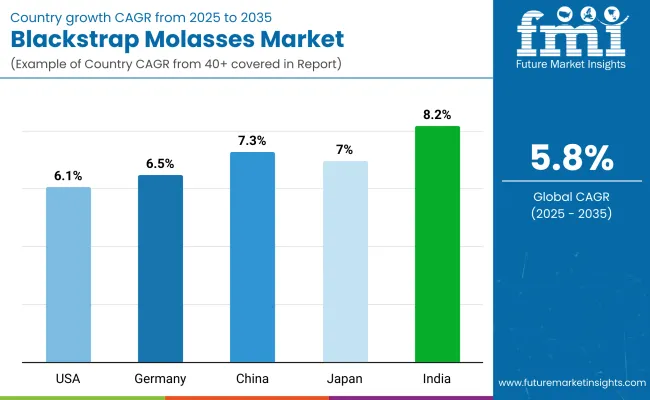

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.1% |

| Germany | 6.5% |

| China | 7.3% |

| Japan | 7.0% |

| India | 8.2% |

Expansion of USA blackstrap molasses market can be attributed to increasing consumer inclination toward natural, nutrient-high, and functional food ingredients for sweeteners. Blackstrap molasses is used in organic baking, dietary supplements, and plant-based IRON sources.

Another factor boosting the blackstrap molasses market is increasing demand for non-GMO and clean-label sweeteners, increases awareness for blackstrap molasses as used against refined sugar.

Demand of Organic and Natural Sweeteners to Drive Growth in Germany Blackstrap Molasses Market Germany blackstrap molasses market will continue to thrive on high preference of customers towards healthier alternatives of sweeteners. Demand for blackstrap molasses in baking, breakfast cereals and nutritional drinks is being spurred by European food regulations favouring natural and unrefined ingredients.

With an rising demand for iron-rich, vegan compatible food sources, German producers are pouring resources into fortified blackstrip molasses with enhanced minerals.

The blackstrap molasses market in China is undergoing rapid expansion due to increasing consumption of functional food ingredients, applications in traditional medicine and plant-based iron supplements. Demand for high-mineral-content molasses is being driven by the rise of health-conscious consumer segments and traditional Chinese medicine (TCM) practices.

Some Chinese manufacturers are emphasizing their work of integrating top-grade blackstrap molasses in herbal crémeaux, as well as organic food, with government-backed initiatives favoring natural sweeteners and dietary health.

Japan’s blackstrap molasses market is fueled by the country’s keen emphasis on gut-friendly fermented foods, non-GMO ingredients, and functional dietary elements. Japanese consumers favor mildly sweet, mineral-rich molasses for use in traditional foods, energy drinks and fortified drinks.

Furthermore, according to data up to October 2023, Japan is likely to leverage its advancement in enzymatic processing and fermentation of sugars from sugarcanes to buoy demand for high-purity blackstrap molasses with a balanced flavor profile.

Demand for natural, iron-rich foods, Ayurvedic treatments and affordable plant-based supplements are driving growth in India’s blackstrap molasses market. Blackstrap molasses are a much used ingredient in herbal medicine, dairy prevention products, and nutraceutical foods.

Indian producers are competing to provide cost-effective, mineral-fortified molasses formulations for mass-market applications, as government initiatives promote organic farming and sustainable sugarcane processing.

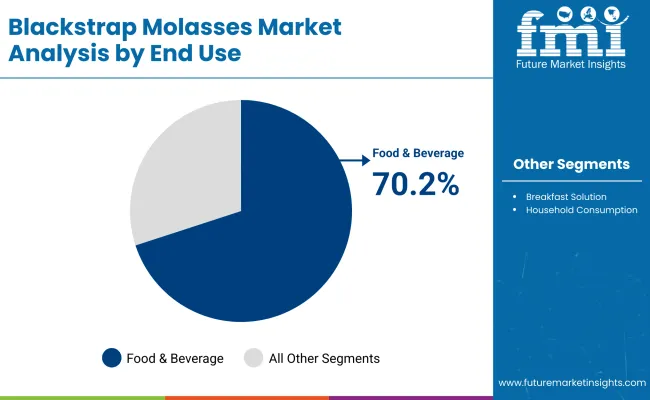

| Segment | Value Share (2025) |

|---|---|

| Food & Beverage (By Application) | 70.2% |

Food & beverage industry holds the largest market share owing to the increased demand for natural sweeteners, functional food ingredients, and plant-based mineral sources. Blackstrap offers the most nutrients, and can even help with digestion as it has a low glycemic index which is also very appealing to those who are looking for ways to use alternatives to refined sugar in their diet.

It is high in iron, calcium and magnesium, which help support healthy bones and energy levels. With the demand for sugar alternatives, organic baking ingredients and fortified beverages now on the rise, manufacturers are creating clean-label blackstrap molasses formulations to prevent potential hazards and increase sustainability.

This versatile product has applications in baking, sauces, beverages and dietary supplements. As consumer demand grows for organic, non-GMO, and unrefined sweeteners, blackstrap molasses is emerging as a go-to ingredient for functional and natural applications in foods.

| Segment | Value Share (2025) |

|---|---|

| Animal Feed & Industrial (By Application) | 29.8% |

The global blackstrap molasses market is mainly driven by the rising consumer preference for natural animal nutrition and sustainable industrial applications for blackstrap molasses in livestock feed, fermentation industries, and biofuel production. It is used as a feed supplement for cattle, poultry, and other livestock because of its high mineral content, which is palatable and energy boosting.

The demand is also bolstered by the proliferation of organic and clean-label livestock feed solutions that lead to a substantial conversion to nutrient-dense, chemical-free live stock feed. Furthermore, xanthan gum produced by fermentation industries uses blackstrap molasses as an essential ingredient for the purpose of yeast production, enzyme synthesis, and ethanol production.

As agriculture and industrial manufacturers seek more economical, more environmental, and multi-functional ingredients, bulk blackstrap molasses for animal nutrition and bioprocessing is expected to be increasingly in demand. And its function in improving the quality of animal feed and supporting renewable energy solutions continues to promote the growth of the market.

The blackstrap molasses market is moderately competitive due to various international and local players, and thus, focuses on sourcing sustainability, organic certification, and functional food application. Industry investment in high-efficiency sugarcane extraction, bioactive nutrient preservation, and molasses-based formulations.

The market is propelled by key manufacturers like Malt Products Corporation, Meridian Foods, B&G Foods, Zook Molasses, and ED&F Man who specialize in organic sugar processing, functional ingredient development, and global supply chain capabilities. Several companies are further expanding their Asia-Pacific and North American operations area to meet growing demand for high-end molasses products.

Important Plans Facilitate Collaborations With Organic Food Brands, Investment in Fortified Formulations, and Expansion Inter-Sugar Free and Functional Beverage Applications. Manufacturers are also prioritizing initiatives around sustainable sugarcane farming and ethical sourcing.

For instance

The product is categorized as Organic or Conventional.

It is utilized in Food and Beverage Processing, including Bakery and Confectionery Products, Breakfast Solutions, Desserts and Puddings, and Other Food and Beverage Processing. It is also used in Functional Foods and Dietary Supplements, Foodservice/HoReCa (Hotels, Restaurants, and Cafés), Household consumption, and other applications.

It is available through Direct Sales/B2B and Indirect Sales/B2C, including Hypermarkets/Supermarkets, Convenience Stores, Mass Grocery Retailers, Specialty Stores, and Online Retailing.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global blackstrap molasses industry is projected to reach USD 15,439.61 million in 2025.

The market registered a CAGR of 6.2% between 2020 and 2024.

Key players include ASR Group, B&G Foods Inc., Allied Old English, Inc. Crosby Molasses Co Ltd.

North America is expected to dominate due to strong demand for organic, functional food ingredients and sustainable sugar processing solutions.

The industry is forecasted to grow at a CAGR of 5.8% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Nature, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Nature, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Nature, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 166: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molasses Market Analysis by Industrial, Commercial, Household and Other Through 2035

Dry Molasses Products Market

Cane Molasses Market Analysis by Type, Application, Form, End Use and Region Through 2035

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA