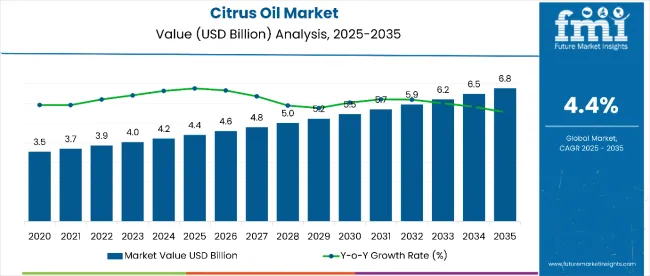

The global citrus oil market is valued at USD 4.4 billion in 2025 and is slated to reach USD 6.8 billion by 2035, recording an absolute increase of USD 2.4 billion over the forecast period. This translates into a total growth of 54.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.4% between 2025 and 2035.

Citrus Oil Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.4 billion |

| Forecast Value in (2035F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The overall market size is expected to grow by nearly 1.55X during the same period, supported by rising consumer preference for natural ingredients and increasing demand across aromatherapy, personal care, and food sectors.

Between 2025 and 2030, the citrus oil market is projected to experience steady growth, driven by rising consumer awareness about natural ingredients benefits, increasing demand for organic and clean-label formulations, and growing penetration of premium essential oil products in emerging markets. Food and beverage brands are expanding their citrus oil product portfolios to address the growing demand for natural flavoring solutions and clean-label ingredients.

The market expansion is supported by technological advancements in extraction and formulation processes. Innovation in extraction methods, including microwave-assisted extraction, ultrasound-assisted extraction, and pulsed electric field technology, are improving oil purity and yield while reducing processing times and energy consumption. These advanced processing techniques enhance product stability and functionality through microencapsulation and nanoemulsion technologies.

Between 2020 and 2025, the citrus oil market experienced robust expansion, driven by increasing consumer focus on natural and organic ingredients and growing awareness of aromatherapy benefits. The market developed as food and beverage brands recognized the need for effective natural flavoring solutions to meet clean-label demands. Regulatory approvals from FDA and EFSA for natural flavoring agents boosted adoption across multiple applications.

The decade ahead is transformative for citrus oils. Consumers, regulators, and innovators are converging on one theme: natural, sustainable, and wellness-driven products. This creates eight powerful growth pathways, together unlocking USD 25-40 billion in incremental revenue by 2030 to 2035.

Pathway A - Clean Label & Organic Premiumisation.

Organic and certified natural citrus oils command price premiums. Food, beverage, and skincare brands leverage clean labels and traceability to win consumer trust. Expected revenue pool: USD 3-5 billion.

Pathway B - Expanded Applications in Food & Functional Nutrition.

Beyond flavouring, citrus oils are gaining traction as natural preservatives and antioxidants in beverages, snacks, and dietary supplements. Functional drinks and health-focused foods lead adoption. Opportunity size: USD 4-6 billion.

Pathway C - Wellness, Aromatherapy & Personal Care Growth.

Citrus oils are increasingly used in aromatherapy, spa, hygiene, and skin & hair care. Their antimicrobial and mood-enhancing properties drive adoption across wellness markets. Potential upside: USD 3-5 billion.

Pathway D - Extraction & Formulation Innovation.

Next-gen extraction methods improve yields and sustainability. Microencapsulation and stabilized blends extend shelf life and broaden usability. Incremental pool: USD 2-4 billion.

Pathway E - Sustainability & ESG Monetization.

Circular use of peel waste, carbon footprint claims, and sustainable sourcing certifications build competitive advantage. This sustainability premium adds USD 2-3 billion.

Pathway F - Geographic Expansion & Localisation.

Demand in Asia-Pacific, Latin America, and MENA is accelerating. Local sourcing and adaptation to regional flavour profiles expand penetration. Opportunity size: USD 4-6 billion.

Pathway G - Platform & Blend Innovation.

Blends of citrus with other botanicals, customised scents, and subscription models open new channels. Though smaller, this pool could add USD 1-2 billion.

Pathway H - Regulatory & Health-Driven Tailwinds.

Tighter regulations on synthetic flavours and consumer preference for natural health solutions drive citrus oil adoption. Additional value: USD 1-2 billion.

Market expansion is being supported by the increasing consumer preference for natural ingredients and the corresponding demand for clean-label products across food, personal care, and aromatherapy applications. Modern consumers are increasingly focused on natural and organic solutions that provide authentic flavoring and therapeutic benefits without synthetic additives. Citrus oils' proven efficacy in providing natural fragrance, flavoring, and therapeutic properties makes them preferred ingredients in premium formulations.

The growing emphasis on sustainability and natural sourcing is driving demand for citrus oils derived from organic cultivation and eco-friendly extraction methods. Consumer preference for multifunctional products that combine natural fragrance with therapeutic benefits is creating opportunities for innovative applications. The rising influence of wellness trends and aromatherapy practices is also contributing to increased product adoption across different demographics and applications.

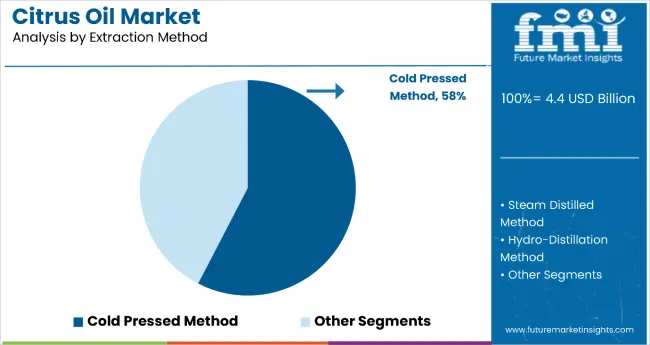

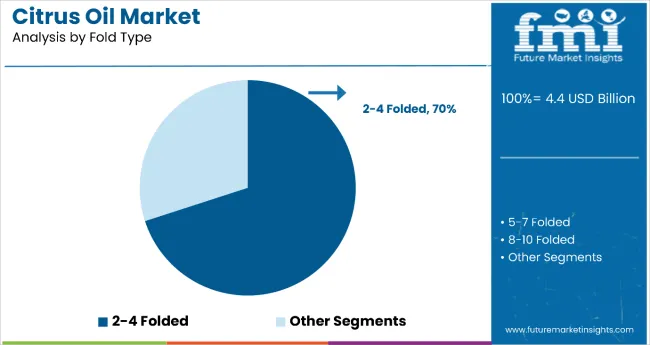

The market is segmented by extraction method, fold type, end use, sales channel, grade type, source, and region. By extraction method, the market is divided into steam distilled method, cold pressed method, and hydro-distillation method. Based on fold type, the market is categorized into 2-4 folded, 5-7 folded, 8-10 folded, and above 10 folded. In terms of end use, the market is segmented into food & beverages, personal care & beauty products, home care products, aromatherapy, and health care products.

By sales channel, the market is classified into supermarket/hypermarket, departmental stores, convenience stores, other sales channels, company website, and e-commerce platforms. By grade type, the market is divided into deterpented oil and terpented oil. By source, the market includes oranges, tangerines & mandarins, grapefruit, and lemon & lime. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The cold pressed method is projected to account for 57.6% of the citrus oil market in 2025, reaffirming its position as the preferred extraction technique. Consumers increasingly understand the benefits of non-thermal processing methods that preserve natural nutrients, vitamins, and aromatic compounds. Cold pressing extracts oils through physical pressure without heat or chemical solvents, maintaining essential bioactive compounds that are highly valued across food, personal care, and aromatherapy applications.

This method forms the foundation of premium product positioning, as it represents the most natural and minimally processed extraction approach. Consumer endorsements and quality validation continue to strengthen trust in cold pressed formulations. With growing focus on clean-label and natural products, cold pressed extraction aligns with both quality and sustainability goals. Its broad appeal across health-conscious consumers ensures sustained dominance, making it the central growth driver of citrus oil demand.

The 2-4 folded segment is projected to represent 70% of citrus oil demand in 2025, underscoring its role as the preferred concentration level for commercial applications. This fold type offers optimal balance between potency and cost-effectiveness, making it highly suitable for food and beverage applications where moderate intensity and commercial viability are essential. The 2-4 folded oils provide sufficient concentration for flavoring applications while maintaining accessibility for high-volume commercial use.

The segment is supported by strong demand from the food and beverage industry, which represents the largest end-use application for citrus oils globally. Additionally, this fold type offers manufacturers the ideal concentration level for natural flavorings, beverages, and food preservation applications without the premium costs associated with higher-fold variants. As ingredient-conscious consumers prioritize natural flavoring solutions, 2-4 folded citrus oils continue to dominate demand, reinforcing their commercial positioning within the natural ingredients market.

The citrus oil market is advancing rapidly due to increasing consumer awareness about natural ingredients and growing demand for clean-label products across multiple applications. However, the market faces challenges including raw material price volatility, seasonal supply variations, and competition from synthetic alternatives. Innovation in extraction technologies and sustainable sourcing practices continue to influence product development and market expansion patterns.

Expansion of E-commerce and Direct-to-Consumer Channels

The growing adoption of e-commerce platforms is enabling brands to reach consumers directly and provide detailed product information about citrus oil benefits and applications. Online channels offer convenience, comprehensive product descriptions, and customer reviews that influence purchasing decisions. Digital marketing strategies and influencer partnerships are driving brand awareness and product adoption, particularly among health-conscious consumers who prefer online shopping experiences for specialty natural products.

Integration of Advanced Extraction Technologies and Processing Methods

Modern citrus oil manufacturers are incorporating advanced extraction systems such as microwave-assisted extraction, ultrasound-assisted extraction, and pulsed electric field technology to enhance processing efficiency and product quality. These technologies improve oil yield and purity while reducing extraction times and energy consumption. Advanced processing techniques also enable the development of specialized products with enhanced stability and extended shelf life for various commercial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.0% |

| India | 4.7% |

| Japan | 4.9% |

| South Korea | 4.8% |

| United States | 4.2% |

| Germany | 4.1% |

| France | 4.4% |

The citrus oil market is experiencing steady growth globally, with China leading at a 5.0% CAGR through 2035, driven by rising middle-class incomes, increasing interest in natural wellness products, and government support for traditional medicine applications. India follows closely at 4.7%, supported by growing demand for natural and Ayurvedic ingredients, rising wellness consciousness, and expanding aromatherapy adoption. Brazil shows growth at 4.5%, emphasizing its position as a major citrus producer and exporter with advantages in raw material supply and processing capabilities.

The report covers an in-depth analysis of 40+ countries; ten top-performing countries are highlighted below.

Revenue from citrus oil in China is projected to exhibit strong growth with a CAGR of 5.0% through 2035, driven by rapid adoption of natural wellness products among younger consumers and increasing integration of citrus oils in traditional medicine applications. The country's expanding middle class and growing health consciousness are creating significant demand for premium natural ingredients across food, personal care, and therapeutic applications. Major international and domestic brands are establishing comprehensive distribution networks to serve the growing population of wellness-conscious consumers.

Revenue from citrus oil in India is expanding at a CAGR of 4.7%, supported by increasing disposable income, growing wellness awareness, and rising integration of natural ingredients in Ayurvedic and traditional medicine practices. The country's young demographic profile and increasing exposure to global wellness trends are driving demand for authentic citrus oil solutions across aromatherapy, natural food flavoring, and traditional medicine applications.

Revenue from citrus oil in Brazil is projected to grow at a CAGR of 4.5%, supported by the country's position as a leading citrus producer and its advantages in raw material supply and processing capabilities. Brazilian producers benefit from favorable climate conditions, extensive cultivation areas, and established extraction infrastructure, positioning the country as a key supplier for global markets while serving growing domestic demand.

United States Focuses on Premium Applications and Clean-Label Trends

Demand for citrus oil in the USA is projected to grow at a CAGR of 4.2%, supported by consumer preference for natural ingredients and clean-label products across food, personal care, and aromatherapy applications. American consumers are increasingly focused on ingredient transparency, product authenticity, and sustainable sourcing practices, driving demand for premium citrus oils with verified origins and quality certifications.

Revenue from citrus oil in Mexico is projected to grow at a CAGR of 4.3% through 2035, driven by the country's strategic position as a major citrus producer with proximity advantages to the large USA market. Mexico benefits from favorable climate conditions, extensive cultivation areas, and established processing infrastructure, particularly for lime and orange oil production serving both domestic and export markets.

Revenue from citrus oil in Germany is projected to grow at a CAGR of 4.1% through 2035, supported by the country's emphasis on quality standards, sustainable sourcing, and organic product preferences. German consumers prioritize product authenticity, environmental responsibility, and proven quality, making citrus oils with verified origins and certifications a preferred choice across aromatherapy, natural cosmetics, and organic food applications.

France's citrus oil market is projected to grow at a CAGR of 4.4% through 2035. The country plays a pivotal role in high-end citrus oil applications, with its global leadership in perfumery, aromatherapy, and gourmet foods reinforcing sustained demand. Grasse, the historic heart of France's fragrance industry, continues to drive artisanal development, where citrus oils like lemon, orange, and bergamot are key ingredients in luxury scent formulations.

The increasing consumer preference for clean-label and natural wellness products is further accelerating demand across cosmetics, spa therapy, and home care categories. France's strict regulatory environment, including ANSM compliance and EU REACH alignment, ensures product traceability and safety-key selling points for global buyers. Although domestic citrus cultivation is limited, Corsica provides a niche supply of organic citrus oils targeted at premium segments.

The citrus oil market in Europe is projected to grow from USD 1.15 billion in 2025 to USD 1.68 billion by 2035, registering a CAGR of 3.9% over the forecast period. Germany will remain the largest national market, holding 24.0% in 2025 and edging up to 24.2% by 2035, supported by strong demand for organic and sustainably sourced citrus oils in food, personal care and aromatherapy applications and by importers focused on verified-origin supply chains.

France follows with 18.5% in 2025, moderating slightly to 18.0% by 2035, underpinned by the country’s luxury fragrance and cosmetics heritage and premium citrus oil formulations.

The United Kingdom accounts for 17.0% in 2025, rising to 17.5% by 2035 as clean-label and natural wellness trends strengthen retail and DTC channels. Italy holds 12.5% in 2025, remaining near 12.3% by 2035, leveraging domestic citrus cultivation for high-quality oil production and export.

Spain represents 10.0% in 2025, easing to 9.6% by 2035, driven by regional processing capacity but facing tighter competition for higher-fold, premium variants. BENELUX countries account for 6.0% in 2025, dipping to 5.8% by 2035 as specialist organic and sustainability certifications concentrate demand.

The Rest of Europe (Eastern Europe, Nordic and other smaller markets) collectively strengthens from 12.0% in 2025 to 12.6% by 2035, reflecting rising awareness of natural product benefits and expanding access to premium citrus oils across diverse retail and professional channels.

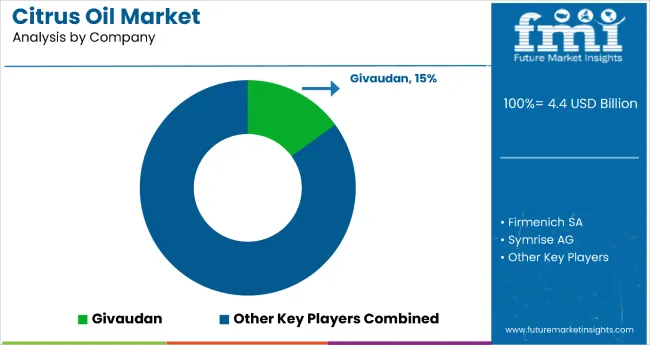

The citrus oil market is characterized by competition among established essential oil suppliers, specialty fragrance companies, and emerging natural ingredient players. Companies are investing in advanced extraction technologies, sustainable sourcing practices, quality certifications, and global distribution networks to deliver effective, authentic, and accessible citrus oil solutions. Brand positioning, supply chain efficiency, and application innovation are central to strengthening product portfolios and market presence.

Givaudan leads the market with 12-15% global value share, offering comprehensive citrus oil portfolios with focus on food-grade and fragrance-grade applications across multiple industries. Firmenich SA provides premium citrus oil solutions with emphasis on fragrance expertise and clean-label formulations for high-value applications. Symrise AG delivers science-backed formulations with focus on sustainable sourcing and eco-certifications for European and Asian markets.

Ultra-International B.V. focuses on specialty citrus oil products serving B2B markets across South Asia and Middle East regions. Phoenix Aromas and Essential Oils LLC emphasizes competitive pricing and flavor applications for North American food and beverage clients. Citrus Oleo supplies industrial and technical-grade citrus oils, particularly D-limonene, for cleaning and solvent applications.

Lionel Hitchen Essential Oils Ltd and Bontoux S.A.S provide artisanal extraction services and perfumery-grade oils for niche European fragrance segments. Citrus and Allied Essences Ltd serves traditional USA-based flavor houses with specialized lime and orange oil products. Mountain Rose Herbs Inc focuses on certified organic citrus oils sold through direct-to-consumer wellness channels.

The success of citrus oils amid the clean-label movement, ESG mandates, and natural product innovation will not only enhance consumer wellness offerings but also strengthen export competitiveness of producing regions. It will consolidate emerging markets’ positions as hubs for organic and sustainable citrus farming, while aligning advanced economies with climate-positive agriculture and natural ingredient sourcing. This calls for a concerted effort by all stakeholders - governments, industry bodies, suppliers, OEMs, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.4 Billion |

| Extraction Method | Steam distilled method, Cold pressed method, Hydro-distillation method |

| Fold Type | 2-4 folded, 5-7 folded, 8-10 folded, Above 10 folded |

| End Use | Food & beverages, Personal care & beauty products, Home care products, Aromatherapy, Health care products |

| Sales Channel | Supermarket/hypermarket, Departmental stores, Convenience stores, Other sales channels, Company website, E-commerce platforms |

| Grade Type | Deterpented oil, Terpented oil |

| Source | Oranges, Tangerines & mandarins, Grapefruit, Lemon & lime |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland and 40+ countries |

| Key Companies Profiled | Ultra-International B.V., Phoenix Aromas and Essential Oils LLC, Firmenich SA, Givaudan, Symrise AG, Citrus Oleo, Lionel Hitchen Essential Oils Ltd, Bontoux S.A.S, Citrus and Allied Essences Ltd, and Mountain Rose Herbs Inc |

| Additional Attributes | Dollar sales by extraction method and fold type concentration level, regional demand trends, competitive landscape, buyer preferences for natural versus synthetic alternatives, integration with clean-label positioning, innovations in extraction technologies, controlled processing, and sustainable sourcing practices |

The industry is projected to grow from USD 4.4 billion in 2025 to USD 6.8 billion by 2035, registering a CAGR of 4.4% during the forecast period.

The 2–4 folded segment holds the largest industry share at approximately 70%, driven by strong demand from the food and beverage industry.

Europe is expected to register the fastest growth with a projected CAGR of 4.5% from 2025 to 2035 due to rising demand for clean-label and sustainable ingredients.

Cold pressed citrus oils are anticipated to grow at the highest CAGR of 5.1%, fueled by increasing consumer preference for natural and minimally processed products.

Leading companies include Firmenich SA, Givaudan, Ultra-International B.V., Symrise AG, and Phoenix Aromas and Essential Oils, LLC.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Citrus Oil in EU Size and Share Forecast Outlook 2025 to 2035

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Citrus Pectin Market Size, Growth, and Forecast for 2025 to 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Citrus Alcohol Market Trends - Flavor Innovations & Demand 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Citrus Aurantium Extract Market – Growth, Applications & Industry Trends

Citrus bioflavonoid Market

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA