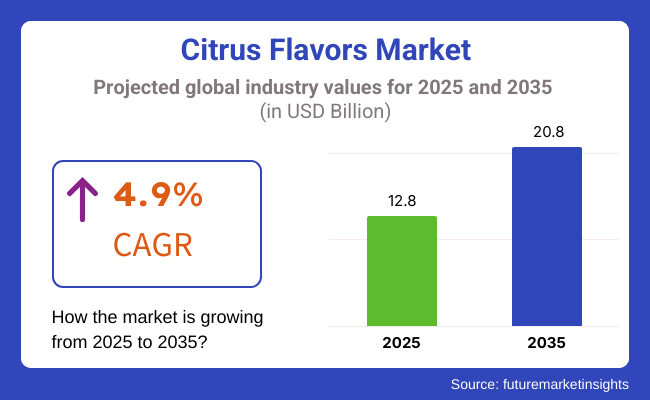

The global citrus flavors market is projected to grow from USD 12.8 billion in 2025 to USD 20.8 billion by 2035, with a compound annual growth rate (CAGR) of 4.9% during the forecast period from 2025 to 2035.

Many of the largest companies in the industry leverage advances in flavor extraction, sustainable sourcing, and massive production volumes to maintain their competitive moats and ride the tide of shifting consumer palates. The strong profiles of products - developed from fruits including lemon, orange, lime and grapefruit - have traditionally been prized for being bright and clean.

These products have numerous applications in beverages, confectionery, dairy, and savory products. With the global trend of increased health awareness, there is a growing movement toward natural flavoring agents, leading companies to reformulate their products using original citrus extracts. Moreover, the international focus on sustainability is inspiring more organizations to adopt sustainable production processes featuring ethically sourced materials and a low carbon footprint.

Consumers are seeking ingredients that provide functional benefits, leading to increased demand for citrus varieties in functional beverages, plant-based foods, and organic chips.

Major companies, including Firmenich, Symrise and Givaudan, bet that more complex extracts can yield an even more true-to-fruit flavor in citrus. Additionally, industry participants are accelerating the establishment of citrus processing capacity in the leading citrus-producing countries of Brazil, Mexico, and Spain to ensure a consistent supply of high-quality raw materials.

The citrus flavor industry, however, also has some limitations, despite a positive growth outlook. The irregular availability of raw materials, resulting from climate change, citrus crop diseases, and seasonal production volatility, is a significant challenge in production. Such conditions can agitate supply chains, raise production costs, and ultimately destabilize markets.

Additionally, the trend toward organic and natural products involves increased investment in manufacturing, which could make it difficult for smaller producers to compete with industry leaders.

Orange flavors are gaining traction due to their widespread use in various food and beverage applications, including juices, carbonated drinks, confectionery, dairy, and bakery products. Orange is a fruit with inherent sweetness, a fragrant aroma, and a refreshing flavor, making it a popular choice to enhance the flavor and nutritional value of an item.

The increasing inclination toward functional drinks and immunity-supporting food and beverage products has contributed significantly to the sales of orange flavors, as customers associate high vitamin C content with oranges, as well as their health benefits. Major beverage manufacturers, such as The Coca-Cola Company (Minute Maid), PepsiCo (Tropicana), and Nestlé, are adding orange flavors to energy drinks, flavored water, and fruit juice blends to appeal to health-conscious consumers.

The addition of citrus flavor, especially lime, lemon, and orange, is a standout part of both alcoholic and non-alcoholic beverages, providing the refreshing, tangy flavor that consumers seek in a product. The health-conscious consumer base continues to drive demand for citrus-infused energy drinks, flavored water, and sports beverages, as the flavors and sweeteners are often associated with hydration and immunity-boosting properties.

Additionally, products are commonly used in ready-to-drink (RTD) beverages, such as iced teas, sodas, and cocktails, further solidifying their prevalence in the industry. The growing trend for craft beverages and flavored spirits, such as ornate fruit-flavored beers, gins, and liqueurs, has also opened up new areas for citrus.

The industry has expanded considerably due to the strong demand from consumers for natural, clean-label, and food and beverage ingredients. Food and beverage vendors initially focused on product novelty, better taste, and formulations without any health-damaging substances, ultimately leading to the widespread use of these products in drinks, candy, ice cream, and bread.

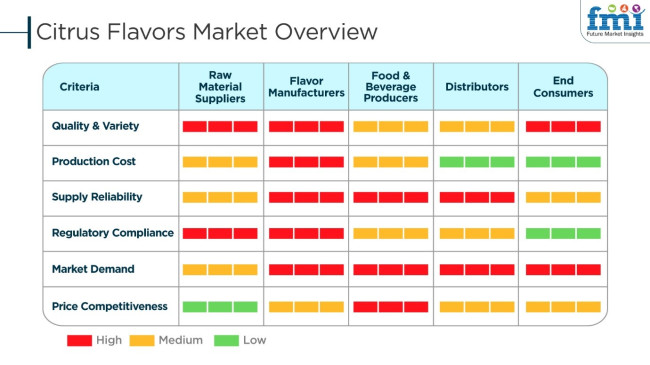

The distributors are the main actors in the ensemble, responsible for providing the supply chain with steady and high-quality citrus flavor solutions to manufacturers and retailers. The people who purchase end products, concerned about health issues and following the trend towards functional and fortified foods, are the ones who ask for original, refreshing, and natural products in their diet.

The increase in the demand for organic, sugar-free, and unique citrus breeds such as yuzu, blood orange, and calamansi is collateral, making product differentiation the key for industry players.

The following table presents a semi-annual analysis of the global industry, highlighting shifts in CAGR across six-month intervals from the base year (2024) to the projected period (2025-2035). This assessment highlights the evolving industry dynamics, revenue realization trends, and key patterns that are shaping industry growth.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.2% |

| H2 (2024 to 2034) | 4.8% |

| H1 (2025 to 2035) | 4.5% |

| H2 (2025 to 2035) | 5.0% |

The first half of the year (H1) spans from January to June, while the second half (H2) extends from July to December. In the first half (H1) of the forecast period from 2025 to 2035, the industry is expected to expand at a compound annual growth rate (CAGR) of 4.2%. This is followed by a higher growth rate of 4.8% in the second half (H2) of the same decade.

Moving further, from H1 2025 to H2 2035, the CAGR is projected to rise to 4.5% in the first half and remain strong at 5.0% in the second half. The industry experienced a 30 basis point (BPS) increase in the first half, whereas the second half saw a 20 BPS increase.

Expansion of Regional Citrus Flavor Profiles

Manufacturers in the global industry are increasingly focusing on region-specific taste preferences to drive product acceptance. The demand for localized products is rising, with companies innovating blends that cater to regional palates. In Asia, yuzu and calamansi-based flavors are gaining popularity in beverages and confectionery, while Latin America is experiencing a surge in lime- and tangerine-infused products.

North America and Europe are experiencing a growing demand for Mediterranean citrus varieties, including bergamot and blood oranges. By incorporating locally sourced citrus ingredients, manufacturers are creating unique offerings that appeal to diverse consumer bases.

Additionally, the growing influence of traditional citrus-based recipes in global cuisines is encouraging brands to explore new formulations. This regional adaptation strategy is also boosting sustainability efforts, as companies invest in local sourcing to minimize supply chain costs and reduce environmental impact. These innovations are positioning products as a versatile component across multiple food and beverage categories.

Digital Expansion and Direct-to-Consumer Growth

E-commerce and direct-to-consumer sales channels are revolutionizing the industry, with brands leveraging digital platforms to reach a broader audience. The shift toward online retail is enabling companies to offer personalized citrus flavor experiences through subscription models and limited-edition flavor drops.

Direct-to-consumer strategies are also fostering deeper consumer engagement, as brands utilize social media and targeted campaigns to promote new citrus-based products. The rising popularity of functional beverages, including citrus-infused energy drinks and wellness shots, is further accelerating online sales. Subscription-based models, particularly in the flavor and beverage sector, are gaining traction as they allow consumers to explore rotating products without committing to bulk purchases.

Additionally, digital marketplaces are driving brand transparency, with companies highlighting ingredient sourcing and health benefits to cater to the growing demand for clean-label products. This strategic digital expansion is reshaping the industry by making products more accessible and customizable.

Sustainable and Functional Packaging Innovations

Packaging strategies in the citrus flavors market are evolving, driven by both sustainability goals and consumer convenience. The shift toward eco-friendly materials, such as biodegradable sachets and recyclable bottles, is becoming a priority for flavor manufacturers and beverage brands.

Companies are also exploring functional packaging solutions, including portion-controlled citrus flavor pods and resealable sachets, to enhance usability and extend shelf life. The increasing demand for on-the-go citrus-infused products has led to innovations in single-serve packaging, particularly in the beverage sector. Additionally, smart packaging technologies, such as QR codes providing ingredient traceability and interactive experiences, are enhancing consumer engagement.

The rise of concentrated citrus extracts in compact, waste-reducing formats is another notable trend, appealing to sustainability-conscious consumers. These packaging advancements not only improve product convenience but also align with the growing demand for environmentally responsible solutions, positioning products as a modern and innovative segment within the global industry.

Consumers are increasingly opting for healthier foods and drinks. This has raised the demand for products, particularly in functional beverages, plant-based food, and confectionary products. As consumers seek fresh, natural tastes, citrus-flavored items are becoming a feature of more and more categories. Increased demand for sustainable and transparent sourcing has driven the industry forward as well.

Naturally extracted citrus-based ingredients are gaining traction over synthetic flavoring agents among consumers. This trend is inspiring manufacturers to introduce organic, non-GMO, and sustainably sourced citrus products. Apart from that, the growing use of products in global food, wellness, and specialty beverages is likely to support industry growth.

Online marketing and direct-to-consumer sales channels are also significantly contributing to increasing the availability of citrus-flavored products, making the industry's future growth even stronger. Therefore, these products will continue to be an integral part in the changing scenario of the food and beverage industry.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in beverage, confectionery, and bakery applications of products | Rising demand in plant-based food, functional drinks, and dietary supplements as consumers prefer shifting their demands |

| Growth in demand for conventional citrus extracts, such as lemon and orange | Growing demand for high-quality citrus types for premium and gourmet usage |

| North American and European countries are leading the way in consumption based on natural ingredient demand | Increasing Asian-Pacific and Latin American demand is fueled by growing health-conscious consumers and regional flavor preferences |

| Consumers prefer natural citrus flavor over artificial flavors. | Growth in organic, non-GMO, and clean-label citrus extracts was fueled by mounting regulations and sustainability demands. |

| Supply chain issues from climate-related citrus crop variability | Increased supply chain efforts with diversified sourcing and flavor extraction technology advancements |

| Regulatory focus on the safety and purity of citrus-derived flavoring materials | More focus on transparency, country of origin labeling, and sustainable sourcing of products |

| R&D focuses mainly in enhancing the stability and shelf life of citrus-based flavors | Higher R&D investment in novel citrus-derived bioactive ingredients for functional and wellness-promoting uses |

The citrus flavors market is susceptible to various types of risks, such as raw material costs, regulatory challenges, price fluctuations, competitive pressures, and changing consumer preferences.

The unavailability of raw materials is the most significant risk factor, as products are made from various fruits, including oranges, lemons, limes, grapefruits, and tangerines. For example, unpredictable weather conditions, fruit diseases (such as citrus greening disease), and supply chain issues can impact fruit production, potentially leading to higher production costs and a shortage of supply.

Regulatory compliance varies across different regions, impacting food safety, ingredient labeling, and the classification of flavors. Alternatively, the Commission, FDA (USA), EFSA (Europe), and FSSAI (India) outline the necessary regulations for flavor formulations, specifically regarding the use of natural extracts, artificial flavors, and additives. Non-compliance can cause product recalls or industry restrictions.

Another problem is the fluctuation of prices in the marketplace. One of the reasons for the instability of citrus fruit prices is the harvest, which is also affected by global warming and trade politics. Costs of natural citrus oils and extracts have risen, which may lead to the production of synthetic alternatives or blends that, in turn, may affect the authenticity of the product and the perception about it by the consumers, as they must think that they are getting something completely different.

The industry remains dynamic, and consumer preferences continue to be pivotal. The high demand for natural, organic, and clean-label flavors has been observed in the industry; however, competition from exotic fruit flavors as well as plant-based alternatives is also crucial. Companies that fail to innovate risk losing industry share to competitors that offer more unique and functional flavor combinations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

| India | 5.98% |

| China | 5.2% |

| Brazil | 4.8% |

| Spain | 4.5% |

The U.S. citrus flavors market is expected to grow at a CAGR of 4.9% from 2025 to 2035, according to FMI. The increasing demand for natural and clean-label products has driven demand for products in the food and beverage sector. Functional foods and drinks, such as plant-based options, often incorporate citrus flavors to enhance both nutritional value and taste. America's established food and beverage industry has consistently expanded into new markets by innovating with citrus flavorings, including protein products and dairy-free beverages.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growing Demand for Natural and Clean-Label Food and Drinks | The consumer's tastes for natural citrus flavor. |

| Development of Functional Drinks | Citrus flavorings enhance health drinks, sports drinks, and immunity boosters. |

| Impact on the Hispanic Population | Latin American cultural flavors influence the development of citrus-based products. |

| Growth of the Plant-Based Food Industry | Products offer a rich taste in plant-based protein foods and milk substitutes. |

The Brazilian industry is expected to expand at a CAGR of 4.8% from 2025 to 2035, as per FMI. Being one of the world's leading producers of citrus fruits, the nation boasts a well-established citrus processing industry. The domestic use of citrus flavor has increased, particularly in food products such as fruit juices, soft drinks, and spirits. Growing consumer demand for natural and organic food products has also led to an increase in citrus-flavored applications.

Growth Factors in Brazil

| Key Drivers | Details |

|---|---|

| Mass Production of Citrus | Sufficient raw material supply is maintained for export and domestic markets. |

| High Demand for Citrus Beverages | Juices, soft drinks, and alcoholic drinks are consumed products. |

| Increasing Application of Organic and Natural Ingredients | Customers prefer clean-label products. |

| Expansion in the Global Industry | Brazilian citrus flavor exports have established global dominance in the industry. |

The Spanish citrus flavor industry is forecasted to grow at a CAGR of 4.5% between 2025 and 2035, cites FMI. Spain has a rich history of citrus cultivation, and citrus flavors are widely utilized in its cuisine. The Mediterranean diet has become popular worldwide and has disseminated its products to many food items, from seafood to sauces and drinks.

Functional drinks, flavored mineral water, and herbal teas now contain citrus flavor due to their invigorating and fragrant nature. Tourism in Spain has also increased the demand for citrus flavor products among hospitality firms. Secondly, the presence of major flavor makers contributes to the industry's growth by offering more citrus-flavored products to consumers.

Growth Factors in Spain

| Key Drivers | Details |

|---|---|

| Rich Gastronomic and Cultural Heritage | Products are part of authentic Spanish cuisine. |

| Growing Adoption of Mediterranean Diets | Health-conscious consumers opt for food and drinks with healthier products. |

| Growing Functional Beverage Industry | Products add flavor and popularity to flavor waters and medicinal beverages. |

| Impact on the Food Industry Through Tourism | Citrus-flavored items are incorporated into the restaurant and hospitality sectors. |

India's citrus flavors market is expected to grow at a CAGR of 5.98% from 2025 to 2035, as per FMI. The growth in the consumption of citrus-flavored food is due to shifting consumer behavior, urbanization, and increasing disposable income.

Citrus flavorings, previously used in Indian cuisine, are now widely employed in processed foods, confectionery, and soft drinks. Ready-to-eat meal demand has increased, with food companies adding citrus flavorings to make the food more palatable and acceptable to consumers.

Health-conscious consumers also prefer citrus-flavored products, as they consider the vitamin C content and antioxidant activity. The increased adoption of organized retailing and e-business platforms enhances product availability and reach in both urban and rural markets.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Urbanization and Disposable Incomes Rising | Citrus flavors are chosen by consumers for food and beverages to be processed. |

| Increased Consumption of Ready-to-Eat and Convenience Food | Ready meals, packaged snacks, and milk foods with flavors are rendered interesting by citrus flavors. |

| Increased Penetration for Functional and Health Drives | Increasing demand for the perceived health benefits of citrus-flavored beverages. |

| Evolution of Organized Retailing and E-Retailing | Retail stores and online websites provide additional avenues for citrus products. |

China's industry for citrus flavor is forecasted to achieve a compound annual growth rate (CAGR) of 5.2% from 2025 to 2035, according to FMI. The major growth drivers for the industry are the increasing middle-class population, the rising health consciousness, and the trend of natural flavor.

Oranges and mandarins belong to the culture-preferred citrus fruits and are used extensively in Chinese cooking. Citrus flavor is also used in contemporary food and beverages, with flavors added to drinks, confectionery, and milk products.

Campaigns promoting healthier foods encourage producers to use natural citrus extracts. The increased use of technology in citrus flavor extraction has enabled the production of high-quality products that cater to evolving consumer tastes.

The increased development of e-commerce platforms has also improved access to markets, and thus, citrus-flavored products are distributed more widely.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Growing Middle-Class Base | Improved disposable incomes drive demand for higher-end citrus-flavored products. |

| Cultural and Traditional Citrus Trend | Mandarins and oranges remain integral to the food industry and continue to be explored for new uses. |

| Government Incentives for Healthier Food | Tax incentives promote the utilization of natural ingredients in food production. |

| Online Sales Channels Growth | Cyber channels improve the accessibility and convenience of citrus-flavored products. |

Major players in the industry include Givaudan, Symrise, International Flavors & Fragrances (IFF), and Sensient Technologies Corporation, which employ advanced extraction techniques, AI-driven flavor formulation, and sustainable sourcing of raw materials. These companies focus on developing high-intensity, authentic citrus flavor profiles as well as expanding their portfolios to include exotic citrus and botanical varieties.

Startups and niche suppliers have redefined the space by underlining cold-pressed, organic, and locally sourced citrus extracts. In addition, sustainability is a key differentiator with brands investing in responsible sourcing, upcycled citrus ingredients, and eco-friendly processing technologies. Companies that successfully integrate innovation with clean-label trends and sustainability initiatives will enhance their competitive positioning in this evolving industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Givaudan SA | 20-25% |

| International Flavors & Fragrances Inc. (IFF) | 15-20% |

| Symrise AG | 10-15% |

| Sensient Technologies Corporation | 8-12% |

| Takasago International Corporation | 5-10% |

| Other Company (Combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan SA | Industry leader in natural citrus flavor innovations, emphasizing sustainable sourcing and AI-driven formulation. |

| International Flavors & Fragrances (IFF) | Expands portfolio with advanced encapsulation technology and citrus-based functional ingredients. |

| Symrise AG | Focuses on organic and clean-label products, investing in extraction technology and global partnerships. |

| Sensient Technologies Corporation | Develops high-intensity citrus extracts for food, beverage, and pharmaceutical applications. |

| Takasago International Corporation | Strengthens industry presence through natural citrus essence innovations and bio-based flavor enhancements. |

Key Company Insights

Givaudan SA: 20-25%

Leader in the innovation of sustainable citrus flavor and formulation techniques using AI.

International Flavors & Fragrances (IFF): 15-20%

Advanced encapsulation technologies and functional citrus-based ingredients applications.

Symrise AG: 10-15%

One of the strongest players in organic citrus extracts in the world. Sustainable sourcing and global R&D work are amongst their most powerful assets.

Sensient Technologies Corporation: 8-12%

Specialized high-intensity products for food, beverage, and pharmaceutical companies.

Takasago International Corporation: 5-10%

Add to its citrus portfolio bio-based flavor solutions and innovative sensory experiences.

Other Key Players (20-30% Combined)

By product type, the market is segmented into lime, grapefruits, orange, lemon, and others.

By nature, the market is segmented into natural and artificial.

By application, the market is segmented into bakery products, confectionery, beverages, savory, and others.

By sales channel, the market is segmented into supermarkets, departmental stores, and e -retailers.

Regionally, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 12.8 billion in 2025.

The industry is predicted to reach a size of USD 20.8 billion by 2035.

Key companies include Givaudan SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Sensient Technologies Corporation, Takasago International Corporation, Firmenich SA, Kerry Group, Dohler Group, Archer Daniels Midland Company (ADM), and Robertet Group.

India, slated to grow at 5.98% CAGR during the forecast period, is poised for the fastest growth.

Orange is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Nature, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Nature, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Citrus Pectin Market Size, Growth, and Forecast for 2025 to 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Alcohol Market Trends - Flavor Innovations & Demand 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Citrus Aurantium Extract Market – Growth, Applications & Industry Trends

Citrus bioflavonoid Market

Demand for Citrus Oil in EU Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA