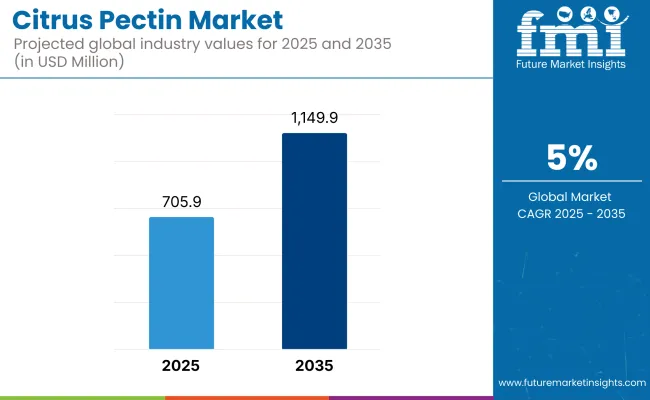

The global citrus pectin market is projected to expand from USD 705.9 million in 2025 to USD 1,149.9 million by 2035, growing consistently at a CAGR of 5% throughout the assessment period.

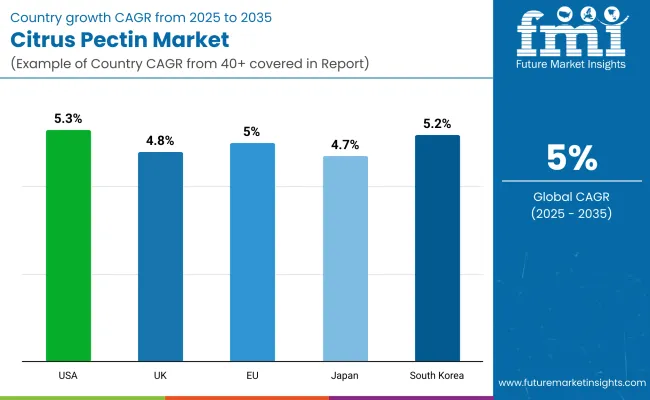

In 2025, the United States emerges as the most lucrative market, reflecting robust consumer preferences for natural food additives and fortified dietary supplements. Meanwhile, Asia-Pacific countries, notably China and Japan, are anticipated to exhibit the fastest growth rates between 2025 and 2035 due to rising health awareness, increasing disposable incomes, and shifting dietary patterns towards plant-based and functional ingredients.

The ongoing growth of the citrus pectin market is substantially driven by heightened consumer awareness regarding the health benefits associated with dietary fibers and the natural origins of citrus pectin. As consumers increasingly gravitate towards clean-label products, manufacturers are responding by integrating citrus pectin in diverse applications ranging from jams and confectionery to pharmaceutical and nutraceutical formulations.

Regulatory emphasis on food safety, particularly in developed markets, has further propelled adoption rates, as citrus pectin offers a natural alternative to synthetic stabilizers and emulsifiers. However, fluctuations in citrus fruit supply, price volatility, and sustainability concerns related to agricultural practices pose potential restraints on market growth.

Current trends indicate significant innovation in extraction techniques aimed at enhancing yield and purity levels, alongside strategic partnerships within the value chain to streamline sourcing and ensure traceability of raw materials.

Looking forward, the decade spanning 2025 to 2035 is likely to witness an acceleration in citrus pectin's adoption across the pharmaceutical and nutraceutical sectors. Industry forecasts anticipate novel product development focused on specialized health claims, including cardiovascular wellness, digestive health, and weight management.

Technological advancements, especially in enzymatic extraction and membrane filtration techniques, are expected to drive improvements in product quality and cost-effectiveness. Manufacturers will increasingly prioritize sustainability through eco-friendly production processes, reduced chemical usage, and responsible sourcing strategies. Consequently, the market will likely witness enhanced consumer confidence, further reinforcing demand growth and opening opportunities in previously untapped emerging markets.

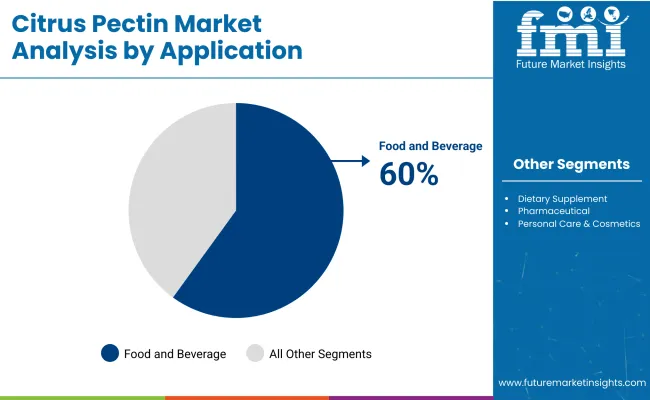

Food & beverage applications hold a dominant 60% share of the global citrus pectin market in 2025, underpinned by consistent end-use demand and growing clean-label preferences. The segment is forecast to maintain a stable trajectory through 2035, as global food processors increasingly favor natural emulsifiers, thickeners, and stabilizers over synthetic counterparts.

The versatility of citrus pectin in both acidic and low-sugar environments-especially in jams, fruit-based beverages, and dairy-alternative formats-continues to sustain its value proposition. Regulatory alignment in North America and Europe on labeling and additive safety has further reinforced industry reliance on citrus-derived hydrocolloids.

While technical challenges such as solubility and process tolerance remain, innovation in enzyme-assisted extraction and formulation science is addressing these limitations, paving the way for broader adoption across newer beverage categories and reduced-sugar reformulations.

Food manufacturers are also leveraging citrus pectin’s fiber content to support nutrition-forward positioning, particularly in gut health and satiety claims. As Asia-Pacific food processing capacities mature, demand is expected to rise rapidly in emerging economies where Western-style convenience and wellness cues are gaining traction.

Consequently, the food & beverage segment will remain strategically central-not just as the largest consumer of citrus pectin, but also as the primary driver of product standardization, functional diversification, and cost optimization initiatives.

The pharmaceutical and nutraceutical segment is projected to grow at a CAGR of 6.3% between 2025 and 2035, making it the fastest-growing application area in the global citrus pectin market. This momentum is driven by rising interest in its bioactive potential and fiber-linked health benefits.

Although currently smaller in volume compared to food applications, this segment is undergoing transformation from incidental usage to deliberate formulation design, especially in gastrointestinal, cardiovascular, and metabolic health products.

Clinical research validating citrus pectin’s role in modulating gut microbiota, improving lipid profiles, and supporting detoxification pathways has catalyzed formulation interest in functional supplements, prebiotic blends, and medical nutrition. Additionally, regulatory openness to naturally sourced excipients and carriers has expanded pectin’s role in controlled-release and chewable dosage forms.

As pharmaceutical firms seek differentiation in an increasingly competitive OTC and preventive health market, citrus pectin is being positioned as a clean-label excipient with functional benefits. Supply chain collaborations with citrus processors and extraction technology firms are enabling quality consistency and bioavailability enhancements, critical to gaining trust among formulators.

With demand expected to rise from health-conscious middle-class consumers in China, India, and Southeast Asia, this segment is anticipated to become a strategic value lever for manufacturers-offering margin expansion, portfolio diversification, and potential entry into regulated therapeutic nutrition markets.

Challenge

Supply Chain Constraints and Price Volatility

Citrus pectin market is already facing issues with supply chain disruptions and disruptions in production of citrus fruits. Because citrus pectin is derived from citrus peels, it is scarcer than apple pectin (which is driven by higher seasonal juice processing industries) and is plagued by market fluctuations, climate changes, and crop diseases like citrus greening.

Geopolitical trade restrictions and transportation costs also exacerbate price volatility. Manufacturers’ ability to two, maintain stable production is at risk, as the reliance on a limited number of citrus-producing regions increases supply risk. Long-term, to ensure market stability, companies should look into diversifying sourcing strategies, investing in extraction processes, and promising alternative sources of fruit-derived pectin.

Opportunity

Expanding Applications in Health and Functional Foods

Increasing consumer demand for natural, plant-based, and clean-label ingredients is turning citrus pectin into a popular ingredient for functional foods,beverages, and dietary supplements.Citrus pectin has a beneficial prebiotic feature and is being incorporated into gut health formulations, low-sugar jams, dairy alternatives, and plant-based meat products.

Furthermore, pharmaceutical applications are being explored, such as the use of modified citrus pectin for detoxification and immune health. This opens up room for manufacturers to improve their pectin formulations to increase solubility, bioavailability, and multifunctional properties suited for food and healthcare applications. Consumers are looking at natural options, investing in organic and non-GMO citrus pectin will complement market growth.

Since there is a growing demand from the food and beverage, pharmaceutical, and personal care industries, the USA citrus pectin market is stable. The frequent use of citrus pectin for the purpose of gel, thickener, and stabilizer for jams, dairy, and drinks is inducing the market growth.

The increasing acceptance of natural and clean-label ingredients in ready-to-eat foods is driving demand for citrus pectin across diverse formulations. In addition, demand is being boosted due to soaring usage of citrus pectin in the pharmaceutical industry for the preparation of drug delivery systems and cholesterol-lowering supplements.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK citrus pectin market is slowly increasing as there is a growing demand for natural-based plant and functional food ingredients. Market Trend: The growing trend for low sugar and sugar free food formulations is driving the demand for the usage of citrus pectin as a fat replacer and sugar substitute in bakery and confectionery applications.

Besides, in the cosmetic segment, the personal care industry is adopting more amounts of citrus pectin due to its skin-conditioning and emulsifying properties which are used in toiletries and beauty products including moisturizers, anti-aging creams, and hair care. Additionally, the increasing consumer demand for sustainable and natural additives is also driving the demand for the market.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

Germany, France and Italy are leading the demand in the European lemon pectin market. However the market for lemon pectin in Europe is growing at a stable rate. With applications in jams, dairy items and fruit-based drinks, the food and refreshment industry is still the biggest shopper segment.

The rising emphasis on dietary fibers and functional ingredients is further encouraging the use of citrus pectin in health supplements and digestive health products. Also, with increasing consumption of vegan and plant-based food products is also positively influencing market growth, as it is used as a natural substitute for gelatine in diverse food applications.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japan’s citrus pectin market expands because it finds growing applications in functional foods together with pharmaceuticals and nutraceuticals products.The market demand for digestive supplements with prebiotic content and fiber-enriched beverages is increasing due to rising consumer preference for gut health products.

Industrial applications of citrus pectin within the pharmaceutical sector result in drug encapsulation and both cosmetic and pharmaceutical development of skincare products and anti-aging formulations. The movement toward natural biodegradable ingredients promotes manufacturers to investigate new applications of citrus pectin.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The market for citrus pectin in South Korea continues its expansion because manufacturers seek dietary fibers and clean-label food additives simultaneously. The growth of functional beverages along with health supplements stimulates demand for citrus pectin as it appears in multiple weight management products as well as energy drinks and detox juices.

The market for cosmetics utilizes citrus pectin as they incorporate it into moisturizers while using it for both skincare and hair brand serums to block pollutants. Sustainable food processing together with eco-friendly packaging stimulates research into citrus pectin as key component of natural emulsifiers and biodegradable coatings.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

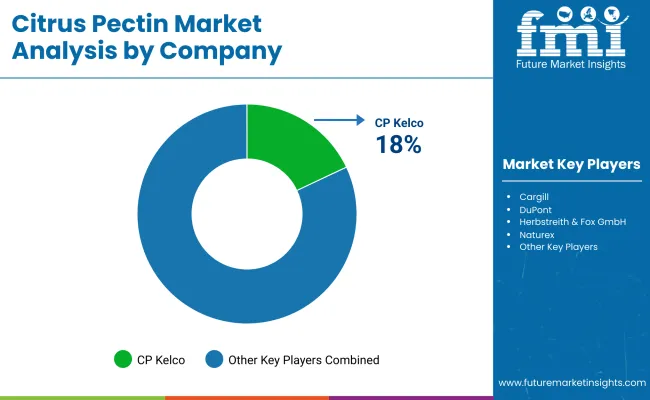

CP Kelco (J.M. Huber Corporation) (18-22%)

CP Kelco is a leading supplier of citrus pectin, offering high-performance gelling and stabilizing solutions for food and pharmaceutical applications.

Cargill, Incorporated (15-19%)

Cargill specializes in citrus pectin formulations for enhanced texture and dietary benefits, catering to food and nutraceutical industries.

DuPont (IFF) (12-16%)

DuPont (now part of IFF) focuses on citrus pectin as a natural stabilizer, with clean-label and high-functional properties for dairy, beverages, and confectionery.

Herbstreith & Fox GmbH (9-13%)

Herbstreith & Fox provides customized pectin solutions for food manufacturing, particularly for jams, fruit fillings, and plant-based alternatives.

Naturex (Givaudan) (7-11%)

Naturex offers organic and natural citrus pectin extracts, targeting the growing demand for functional food ingredients and clean-label formulations.

Other Key Players (30-40% Combined)

The market incorporates various manufacturer participation through creation of sustainable organic solutions and specialized pectin products. Notable players include:

The overall market size for Citrus Pectin Market was USD 705.9 Million in 2025.

The Citrus Pectin Market is expected to reach USD 1,149.9 Million in 2035.

The demand for the citrus pectin market will grow due to increasing applications in food and beverage as a natural gelling agent, rising demand for clean-label and plant-based ingredients, expanding use in pharmaceuticals and cosmetics, and growing consumer preference for functional and dietary fiber-rich products.

The top 5 countries which drives the development of Citrus Pectin Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Oranges and Dairy Products & Frozen Desserts Form to command significant share over the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Citrus Alcohol Market Trends - Flavor Innovations & Demand 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Citrus Aurantium Extract Market – Growth, Applications & Industry Trends

Citrus bioflavonoid Market

Demand for Citrus Molasses in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Citrus Molasses in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Citrus Oil in EU Size and Share Forecast Outlook 2025 to 2035

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA