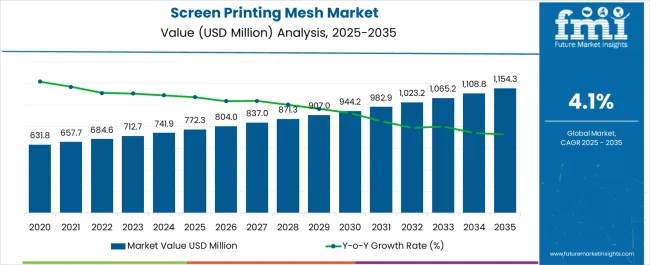

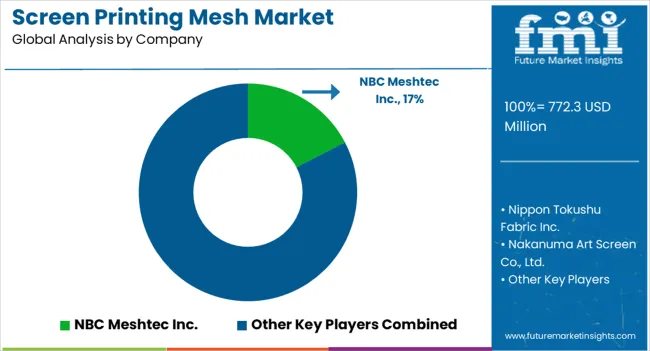

The Screen Printing Mesh Market is estimated to be valued at USD 772.3 million in 2025 and is projected to reach USD 1154.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Screen Printing Mesh Market Estimated Value in (2025 E) | USD 772.3 million |

| Screen Printing Mesh Market Forecast Value in (2035 F) | USD 1154.3 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The screen printing mesh market is advancing steadily as demand from textiles, electronics, packaging, and advertising industries continues to expand. Current growth is supported by the increasing adoption of fine mesh technology, improvements in printing precision, and the widespread need for cost-effective and durable mesh materials. Manufacturers are investing in advanced production processes and high-performance synthetic fibers that enhance tensile strength, chemical resistance, and dimensional stability.

Market expansion is further driven by the shift toward digital integration in printing operations, enabling greater consistency and reduced wastage. The outlook remains positive as sustainability concerns encourage the use of recyclable and long-lasting mesh materials.

Additionally, strong demand from electronics and solar industries, where high accuracy is essential, is providing further impetus to growth The combination of rising industrial applications, technological innovation, and enhanced supply chain capabilities is expected to ensure sustained revenue generation and continued adoption across developed and emerging economies over the forecast horizon.

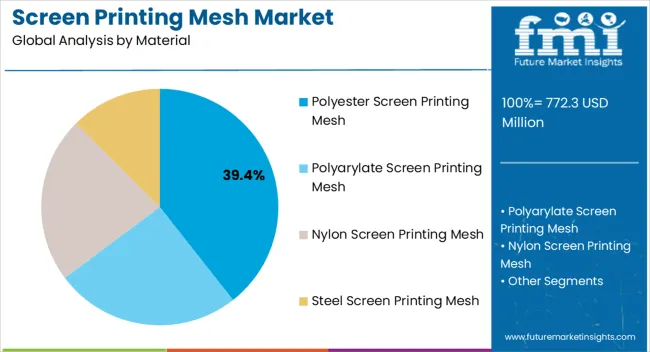

The polyester screen printing mesh segment, holding 39.4% of the material category, has been leading the market owing to its superior mechanical properties, durability, and cost-effectiveness. Polyester offers high elasticity, chemical resistance, and long service life, making it the preferred choice for mass production in textiles, packaging, and industrial printing.

Its wide availability and adaptability to multiple printing techniques have reinforced its dominance. Continuous product innovation, such as low-elongation polyester meshes, has further enhanced precision in high-speed printing operations.

With growing demand for uniform print quality and reduced downtime, polyester meshes are expected to retain their leadership, driven by performance advantages and steady cost structures that align well with industrial-scale requirements.

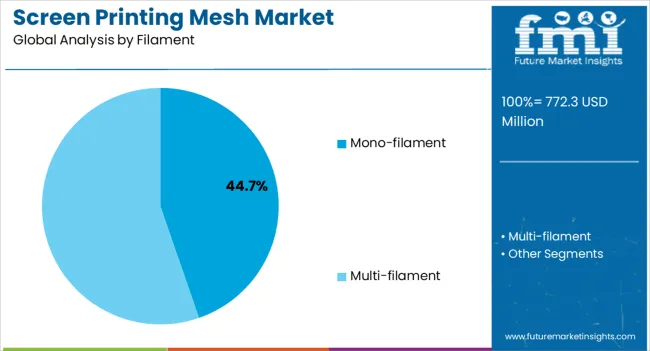

The mono-filament segment, accounting for 44.7% of the filament category, has maintained its leadership due to superior dimensional stability, reduced ink consumption, and improved print accuracy compared to multi-filament variants. Its structure allows for precise control of ink flow, making it suitable for applications requiring high resolution, such as electronics, graphics, and fine textiles.

Increased operational efficiency and ease of cleaning have added to its adoption in large-scale production. The segment’s growth is supported by ongoing development in specialized coatings that improve abrasion resistance and extend service life.

Strong end-user preference for consistent output and reduced maintenance costs is expected to sustain the dominance of mono-filament meshes across high-demand industrial segments.

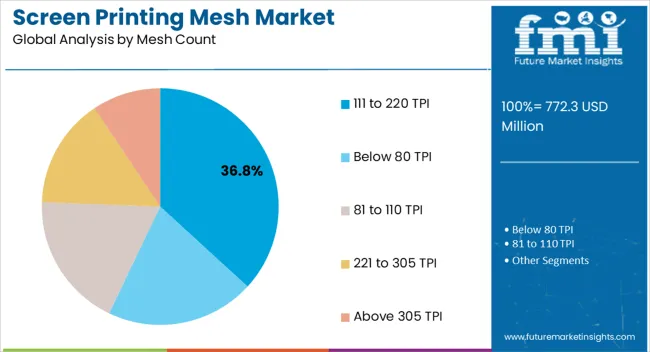

The 111 to 220 TPI segment, representing 36.8% of the mesh count category, has emerged as the leading range due to its versatility in balancing ink deposit and print detail. This range is widely utilized in textiles, promotional products, and industrial applications where medium to high detail is required.

Its adaptability across a broad spectrum of substrates has reinforced market acceptance. Manufacturers have been improving weave uniformity and mesh tension stability within this count range, further supporting precision in repeat printing.

The consistent performance and cost-efficiency of this category have contributed to its widespread use, and increasing demand for high-quality prints in packaging and decorative applications is expected to sustain growth momentum, ensuring the segment’s continued leadership in the market.

Competition: The growing alternative technologies, such as digital printing, are offering high-quality, better designs to decline the demand for screen printing mesh.

Environmental Concerns: The increasing environmental concerns increase the demand for eco-friendly inks. The lack of these inks and sustainable materials for printing may restrain the global market growth.

High Material Costs: Shortage of materials, supply chain disruptions, and reduced profit margins are likely to increase the costs, which may decrease the market size.

Quality Control: Manufacturers are facing issues with color accuracy, and printing quality is restraining the global market revenue.

Shortage of Skilled Labor: The need for more technicians and operators faced challenges regarding using chemicals and inks for printing, which may decline the market growth.

The global screen printing mesh market grew steadily, with a valuation of USD 772.3 million in 2025. The increasing demand for attractive packaging style and sealing packaging outlook is raising the need for screen printing mesh.

Increasing consumer demand for decorative items such as glass, cloth, electronic goods, and electric items is rapidly surging the adoption of screen printing mesh.

| Attributes | Details |

|---|---|

| Screen Printing Mesh Market Size, 2025 | USD 772.3 million |

Consumers are looking for effective and high-quality printing solutions for special event presents, increasing the market revenue. Manufacturers are focused on shifting consumers' preferences, changing lifestyles, and enhancing product quality with printing technologies.

Manufacturers are developing new technologies to strengthen touchscreen production for electronic components to boost the global industry.

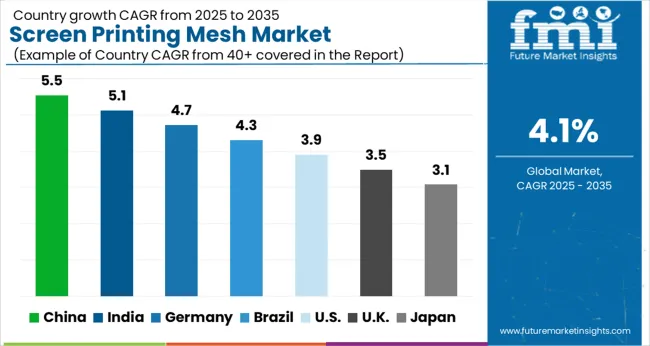

| Countries | Forecast CAGR Between 2025 to 2035 |

|---|---|

| United States | 2.1% |

| Canada | 3.7% |

| Germany | 2.0% |

| United Kingdom | 3.9% |

| Italy | 2.9% |

| France | 3.3% |

| Spain | 2.5% |

| China | 5.7% |

| India | 6.3% |

| Japan | 3.1% |

| South Korea | 4.5% |

| Thailand | 5.2% |

During the forecast period, Canada is estimated to secure a CAGR of 3.7% in the global market. Increasing manufacturing, retail, glass, and ceramic industries are significantly booming the global Canada screen printing mesh market. The rising fashion industry and advertising companies are adopting a wide range of printing products, increasing the demand for screen printing mesh.

Diverse businesses are producing customized products such as apparel, electronic, and electric products, gaining vast popularity in the market. Key players are growing concerned about effective and sustainable practices to reduce carbon footprints by maintaining product quality. They are trying to offer cost-effective screen printing mesh to capture consumers' requirements.

The United Kingdom is anticipated to capture a CAGR of 3.9% in the global market during the forecast period. The rapidly surging fashion and creative industries are bringing opportunities by increasing demand for screen printing services.

These industries heavily rely on screen printing mesh for customized design and print for apparel to gain consumers' desires.

Growing trade activities and changing regulations seek advanced printing operations, enhancing businesses' revenue. The changing consumers' desire for sustainable and high-quality printing solutions is increasing the demand for screen printing mesh.

Rapidly growing e-commerce sectors offering better pricing or affordable customized printing products fuel the United Kingdom screen printing mesh market.

France is likely to secure a CAGR of 3.3% in the global market during the forecast period. Rising, well-established infrastructure, urbanization, and fashion & art industries are surging the demand for screen printing mesh.

France is rich in art, advertising, fashion, and design for promoting their products internationally and is gaining the popularity of screen printing mesh.

Manufacturers are providing efficient products with sustainable materials without lacking quality and are capturing consumers' requirements. France's screen printing mesh market is constantly gaining by managing initial costs, quality control, and craftsmanship with digital printing technologies.

During the forecast period, India is anticipated to secure a CAGR of 6.3% in the global market. The growing economies, urbanization, and vast infrastructure are increasing the demand for screen printing mesh. The rising middle class, changing demographic trends, and custom clothing are increasing the adoption of screen printing mesh.

Manufacturers promote their products with effective logo printing designs, attracting consumers' attention.

Key companies are offering large quantity printing with color accuracy, high quality, and eco-friendly inks, driving the India screen printing mesh market. These companies are offering environmentally friendly products to meet customers' requirements. Key companies are reaching the international market by developing high-material printing products.

The increasing demand for sustainable practices is raising the adoption of screen printing mesh. Based on substrate, paper & paperboard are likely to lead the global screen printing mesh market by capturing a share of 36.1% by 2035.

Consumers are looking for paper-based substrates for eco-friendly solutions to reduce carbon footprints. Key players designing advanced labeling and packaging solutions for various industries are increasingly adopting paper & paperboard. They are branding their products and enhancing sales by offering eye-catching paper & paperboard screen printing, enhancing consumers' desires.

Manufacturers can offer better designs without compromising the quality of products and are increasing the adoption of paper & paperboards. They provide safety regulations with standardized solutions and are gaining vast popularity among customers.

Ongoing technologies, equipment, and mesh are easy to work with, and these substrates are driving the market growth.

Based on end-use, the textile sector is estimated to dominate the global screen printing mesh market by securing a CAGR of 58.1% by 2035. The increasing trendy fashions, cloth designing, and apparel printing are increasing the demand for screen printing mesh in the flourishing textile sector.

They are printing fabrics with unique designs and customized solutions for advertising and promoting their brands, which drive consumer demand.

The rising sports and athletics wear such as t-shirts, jerseys, and uniforms are surging the demand for durable screen printing mesh and are fueling the market size. The textile industry offers its products for promotional merchandise, increasing the adoption of screen printing mesh for effective marketing.

Manufacturers offer innovative printing in the textile sector to improve printing machines, inks, materials, and screen mesh to enhance quality. These technologies bring businesses forward to boost sales and provide high-quality screen printing solutions.

Various events and trade shows are produced to attract a wide range of audiences to promote their brand. The textile sector dominates the global market due to its variety of trends, fashion, and promotional apparel activities to gain maximum Share.

The global screen printing mesh market is highly fragmented by prominent players developing reliable, versatile, and high-quality products significantly. They are focused on end users' requirements and create better products to gain their trust. Key players heavily invest a vast amount in research and development to carry out new and brilliant ideas to expand the market reach.

Recent Developments in the Screen Printing Mesh Market

In 2024, Haver & Boecker announced its newly launched metal mesh for architecture printing in France. This mesh is suitable for outdoor activities with sun protection and ensuring sustainability.

MaiShi Manufacture Group, a China-based manufacturer of wire mesh products, launched an FDA-approved nylon mesh that is acid and alkaline-resistant. It is primarily used to create filtration bags and for pharmaceuticals and food filtration.

The global screen printing mesh market is estimated to be valued at USD 772.3 million in 2025.

The market size for the screen printing mesh market is projected to reach USD 1,154.3 million by 2035.

The screen printing mesh market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in screen printing mesh market are polyester screen printing mesh, polyarylate screen printing mesh, nylon screen printing mesh and steel screen printing mesh.

In terms of filament, mono-filament segment to command 44.7% share in the screen printing mesh market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Screen Cleaner Market Analysis by Type, Application and Region from 2025 to 2035

Screenless Display Market

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Rainscreen Cladding Market Growth - Trends & Forecast 2025 to 2035

Lab Screening Test Kit Market

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Sand Screens Market Analysis - Size, Growth, and Forecast 2025 to 2035

Touchscreen Controller Market Growth - Trends & Outlook 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Touchscreen Gloves Market

Oral Screening Systems Market

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Touch Screen Film Market Size and Share Forecast Outlook 2025 to 2035

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Touch Screen Module Market

Vision Screener Market Size and Share Forecast Outlook 2025 to 2035

Carrier Screening Market Size and Share Forecast Outlook 2025 to 2035

Trommel Screen Market

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA