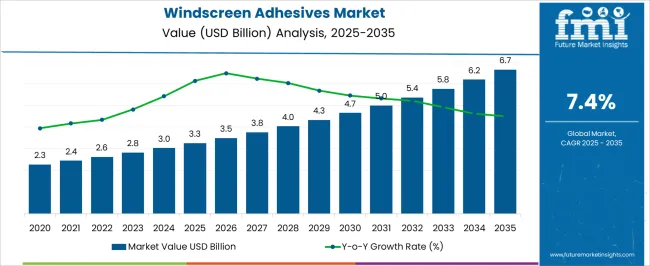

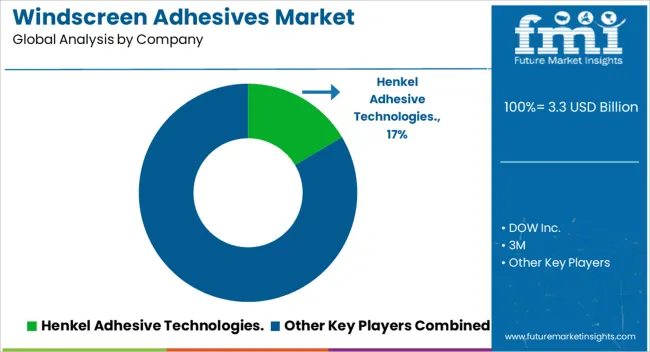

The Windscreen Adhesives Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 6.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Windscreen Adhesives Market Estimated Value in (2025 E) | USD 3.3 billion |

| Windscreen Adhesives Market Forecast Value in (2035 F) | USD 6.7 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The Windscreen Adhesives market is experiencing strong growth, driven by the increasing demand for lightweight, high-performance adhesives in the automotive and commercial vehicle sectors. Rising vehicle production, coupled with stringent safety and structural integrity standards, has intensified the need for reliable and durable windscreen bonding solutions. Adhesives that offer high strength, flexibility, and resistance to environmental stresses such as temperature fluctuations and UV exposure are being increasingly adopted.

Technological advancements in adhesive chemistries, including polyurethane-based formulations, and innovative curing methods are enhancing performance while reducing installation times. Growing emphasis on vehicle safety regulations, crashworthiness, and aesthetic integration is further supporting market expansion.

The adoption of advanced manufacturing processes, including automated dispensing systems, is enabling improved efficiency and consistency in adhesive application As vehicles continue to incorporate complex designs and lighter materials, the Windscreen Adhesives market is expected to maintain steady growth, driven by both replacement and original equipment applications, and supported by continuous innovation in materials and process technologies.

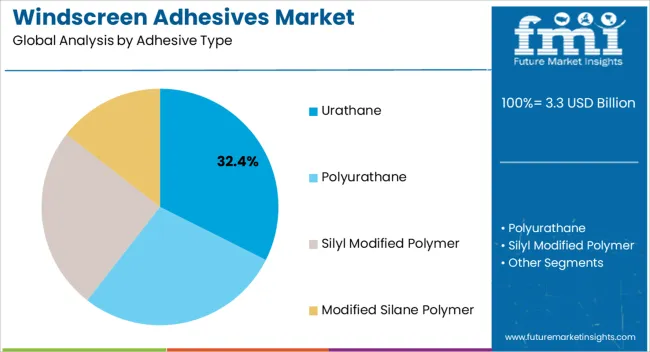

The urathane adhesive type segment is projected to hold 32.4% of the market revenue in 2025, establishing it as the leading adhesive type. This segment’s growth is driven by its superior bonding strength, flexibility, and durability, which are critical for maintaining windscreen integrity under varying mechanical and environmental stresses. Urathane adhesives provide high resistance to vibration, temperature changes, and moisture, making them ideal for both passenger and commercial vehicles.

Their compatibility with different glass types and substrates further strengthens adoption across original equipment manufacturers and aftermarket applications. The ability to achieve consistent performance while meeting stringent safety standards has reinforced market preference.

Continuous improvements in formulation, including fast curing and enhanced UV stability, are increasing reliability and efficiency With growing vehicle production, rising replacement demand, and emphasis on safety and aesthetics, urathane adhesives are expected to maintain leadership, supported by innovations that enhance bond performance and reduce installation time.

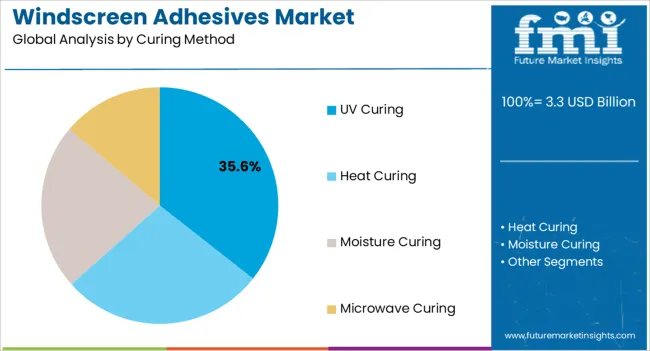

The UV curing method segment is anticipated to account for 35.6% of the market revenue in 2025, making it the leading curing technology. Its growth is driven by the demand for rapid, precise, and energy-efficient curing processes that reduce assembly time while maintaining high adhesive performance. UV curing enables controlled polymerization, ensuring consistent bond strength and minimizing defects in windscreen installation.

Adoption is being supported by advancements in UV light sources, automation in adhesive application, and improved formulations that are compatible with UV activation. This method also supports environmental sustainability by reducing volatile organic compound emissions compared to traditional curing techniques.

The increasing integration of UV curing in high-volume automotive assembly lines further accelerates market growth As vehicle manufacturers continue to seek faster, more reliable, and environmentally friendly adhesive solutions, the UV curing segment is expected to retain its leading position, reinforced by innovations in process automation, energy efficiency, and adhesive formulations that optimize performance.

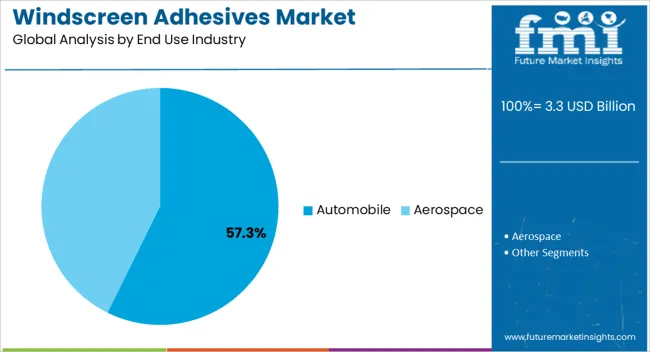

The automobile end-use industry segment is projected to hold 57.3% of the market revenue in 2025, establishing it as the largest end-use category. Growth is being driven by rising vehicle production, increasing adoption of advanced safety standards, and the need for structurally bonded windscreens that enhance crashworthiness and occupant protection.

Adhesives are being leveraged to reduce vehicle weight, improve aerodynamics, and support innovative glass designs, aligning with fuel efficiency and performance requirements. Original equipment manufacturers are increasingly adopting high-performance adhesive solutions for consistent and reliable bonding, while aftermarket demand is supported by repair and replacement services.

Technological advancements in adhesive chemistries and curing methods, including urathane-based formulations and UV curing, are improving efficiency and reducing installation times As automotive production continues to grow globally and emphasis on safety, aesthetics, and sustainability increases, the automobile segment is expected to remain the primary driver of Windscreen Adhesives market growth, supported by continuous innovations in materials and application processes.

From 2020 to 2025, the global Windscreen Adhesives market experienced a CAGR of 7.6%, reaching a market size of USD 3.3 billion in 2025.

From 2020 to 2025, the global Windscreen Adhesives industry witnessed steady growth due to the rising demand for vehicle production. The need to improve the safety and reduce the production cost of vehicles. Additionally, the implementation of Advanced technologies like ADAS and HUD Systems across the globe further propelled market growth during this period.

Looking ahead, the global Windscreen Adhesives industry is expected to rise at a CAGR of 7.8% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 5.5 billion.

The Windscreen Adhesives industry is expected to continue its growth trajectory from 2025 to 2035, driven by increasing concerns over safety concerns.

The growth of the automobile sector and the rising adoption of lightweight vehicles are expected to drive the demand for Windscreen Adhesives during the forecast period.

The market is also likely to witness significant growth in the Asia Pacific region due to the presence of significantly developing economies such as China, Japan and India. However, market growth may be hindered by the emergence of alternative technologies and the environmental effects and installation costs associated with Windscreen Adhesives.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 6.7 billion |

| CAGR % 2025 to End of Forecast (2035) | 6.9% |

The Windscreen Adhesives industry in the United States is expected to reach a market share of USD 6.7 billion by 2035, expanding at a CAGR of 6.9%. The Windscreen Adhesives industry in the United States is expected to witness growth due to the increasing production of vehicles. Additionally, there are a few other factors expected to drive the demand for Windscreen Adhesives in the country are:

| Country | The United Kingdom |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.71 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The Windscreen Adhesives industry in the United Kingdom is expected to reach a market share of USD 0.71 billion, expanding at a CAGR of 7.2% during the forecast period. The United Kingdom market is projected to experience growth owing to the rising demand for Windscreen Adhesivess automobile industries. The increasing demand for lightweight vehicle and the need for durable adhesives solution is also expected to boost market growth.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 1.1 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.3% |

The Windscreen Adhesives industry in China is anticipated to reach a market share of USD 1.1 billion, moving at a CAGR of 7.3 % during the forecast period. The Windscreen Adhesives industry in China is expected to grow prominently due to the increasing production of vehicles and the growth of the automobile industry. Additionally, the increasing focus on sustainable development and environmental protection steps are expected to drive market growth.

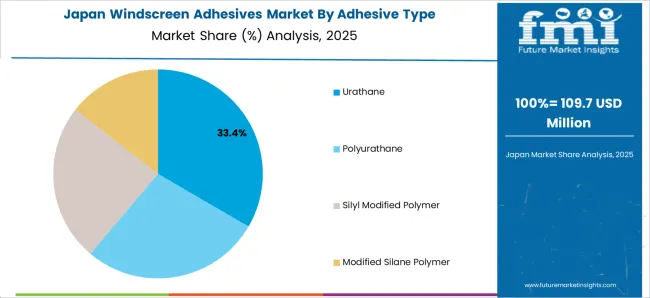

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.93 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.1% |

The Windscreen Adhesives industry in Japan is estimated to reach a market share of USD 0.93 billion by 2035, thriving at a CAGR of 7.1%. The market in Japan is predicted to grow because of the increasing adoption of Windscreen Adhesives in automobile industries. Market expansion is anticipated to be fueled by the growing emphasis on sustainable development and cost effective measures are expected to drive market growth.

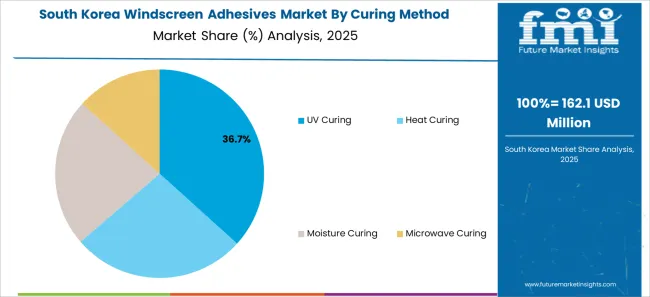

| Country | South Korea |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 6.78 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.0% |

The Windscreen Adhesives industry in South Korea is expected to reach a market share of USD 6.78 billion, expanding at a CAGR of 7.0% during the forecast period. The market in South Korea is forecasted to witness growth due to the increasing demand for Windscreen Adhesivess in automobile industry. Growing vehicle production and sales are driving the continued expansion of the global automotive sector.

The polyurathane segment is expected to dominate the Windscreen Adhesives industry with a CAGR of 7.2% from 2025 to 2035. This segment captures a significant market share in 2025 due to its cost-effectiveness, high efficiency and durability.

Polyurethane is 90 times stronger than a silicone sealant. It is also the OEM-recommended adhesive type. In case of an accident, polyurethane prevents your car windscreen from coming out of the frame or caving in and collapsing on you during a rollover. It also has extraordinary elasticity, better elongation, and is incredibly tough and abrasion-resistant.These are the key factors driving the growth of the polyurathane segment in the Windscreen Adhesives industry.

The automobile industry is expected to dominate the Windscreen Adhesives industry with a CAGR of 7.8% from 2025 to 2035. This segment captures a significant market share in 2025 due to automotive aftermarket, which includes the repair and replacement of vehicle parts.

The glueing of windscreens to the vehicle structure is very well accomplished using windscreen adhesives. They are made to offer a solid, durable bond that can withstand the force of abrupt stops, sharp bends, and other stressors that can happen while driving.

The Windscreen Adhesives industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Product Innovation

Companies invest hugely in research and development to introduce innovative products that offer enhanced efficiency, reliability, and cost-effectiveness. Product innovation enables companies to differentiate themselves from their competitors and cater to the evolving needs of customers.

Strategic Partnerships and Collaborations

Key players in the industry often form strategic partnerships and collaborations with other companies to leverage their strengths and expand their reach in the market. Such collaborations also allow companies to gain access to new technologies and markets.

Expansion into Emerging Markets

The Windscreen Adhesives industry is witnessing significant growth in emerging markets such as China and India. Key players are expanding their presence in these markets by establishing local manufacturing facilities and strengthening their distribution networks.

Mergers and Acquisitions

Key players in the Windscreen Adhesives industry often engage in mergers and acquisitions to consolidate their market position, expand their product portfolio, and gain access to new markets.

Key Players in the Windscreen Adhesives Industry

Key Developments in the Windscreen Adhesives Market:

The global windscreen adhesives market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the windscreen adhesives market is projected to reach USD 6.7 billion by 2035.

The windscreen adhesives market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in windscreen adhesives market are urathane, polyurathane, silyl modified polymer and modified silane polymer.

In terms of curing method, uv curing segment to command 35.6% share in the windscreen adhesives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Skin Adhesives Market

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Silicone Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Footwear Adhesives Market

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Anaerobic Adhesives Market

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Automotive Adhesives & Sealants Market Size and Share Forecast Outlook 2025 to 2035

Laminating Adhesives Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA