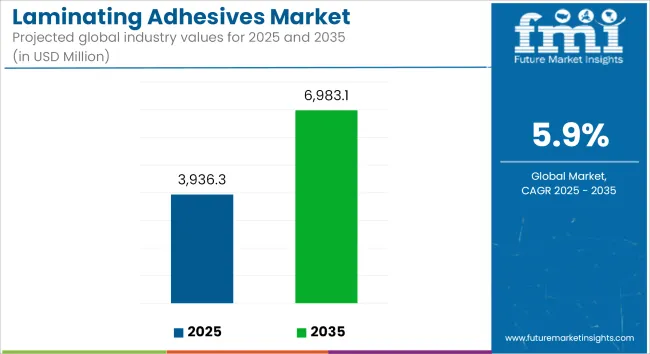

The global laminating adhesives market is anticipated to grow from USD 3,936.3 million in 2025 to USD 6,983.1 million by 2035, achieving a CAGR of 5.9% during the forecast period. Market growth is being supported by increasing demand for flexible packaging, rising investments in high-performance adhesive technologies, and growing preference for lightweight and durable materials across end-use industries.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3,936.3 Million |

| Projected Market Size in 2035 | USD 6,983.1 Million |

| CAGR (2025 to 2035) | 5.9% |

Laminating adhesives are being used to bond multiple layers of substrates such as films, foils, and papers to create composites with enhanced tensile strength, chemical resistance, barrier properties, and durability. These adhesives are being adopted extensively in food and beverage packaging, industrial laminates, pharmaceutical applications, and consumer goods to ensure material integrity and functional performance during storage and transportation.

The shift toward solvent-free and water-based adhesive formulations is accelerating, driven by regulatory pressure to reduce volatile organic compound (VOC) emissions and promote eco-compliant manufacturing. UV-curable systems and fast-curing chemistries are being developed to improve production speed, reduce energy usage, and meet safety standards in sensitive application areas.

Growth in bio-based and renewable adhesive feedstocks is further contributing to the development of sustainable lamination technologies. Manufacturers are integrating natural polymers, low-emission curing agents, and recyclable packaging formats to align with circular economy initiatives and carbon reduction commitments.

The rise in high-performance packaging for moisture-sensitive, temperature-sensitive, and gas-sensitive contents is increasing demand for laminating adhesives with enhanced barrier properties and chemical resistance. These advancements are supporting the adoption of adhesives in multilayer packaging formats across pharmaceuticals, processed foods, pet food, and personal care products.

In automotive and construction industries, laminating adhesives are being employed in interior trim, insulation panels, and safety glazing to deliver noise reduction, thermal resistance, and structural bonding. The continued push for weight reduction, improved aesthetics, and sustainable components is expanding the scope of application.

The laminating adhesives market is expected to maintain steady momentum through 2035, supported by technological innovation, sustainability-driven product development, and increased consumption of functional and recyclable packaging solutions across industrial and consumer sectors.

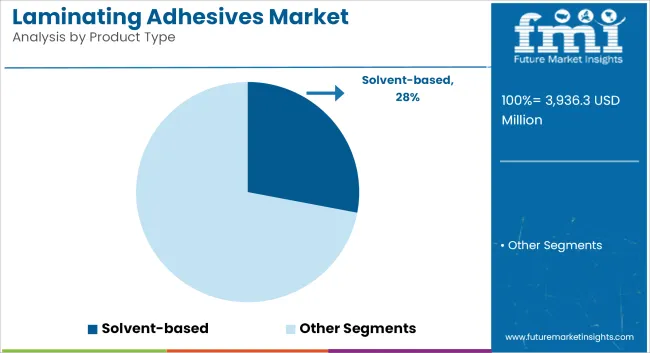

Solvent-based laminating adhesives are projected to hold approximately 28% of the global market share by 2025 and are expected to grow at a CAGR of 4.3% through 2035. Despite regulatory pressure to reduce volatile organic compounds (VOCs), these adhesives remain critical in demanding applications requiring superior bond strength, chemical resistance, and fast curing-particularly in electronics, industrial laminates, and high-barrier food packaging.

Solvent-based systems are favored in regions with advanced regulatory compliance infrastructure, such as Japan and Western Europe. Manufacturers are innovating low-VOC and hybrid solvent formulations to extend product life and address sustainability concerns while preserving

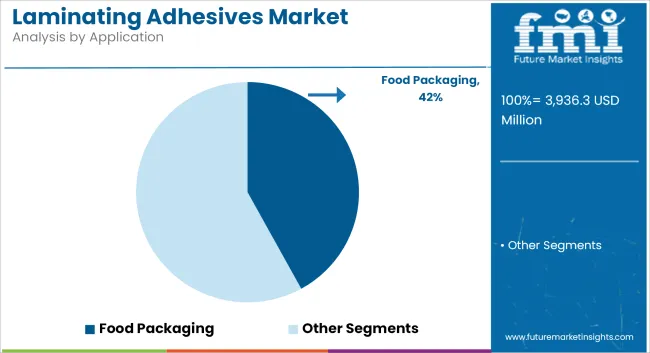

Food packaging is expected to account for over 42% of the global laminating adhesives market share by 2025, With CAGR 4.4% driven by rising demand for flexible, lightweight, and durable packaging formats. Laminating adhesives are critical in multi-layer film structures that ensure barrier protection, printability, and shelf-life extension.

Growth in packaged and processed food consumption especially in Asia-Pacific and Latin America is fueling demand. Stringent safety and compliance standards are also accelerating the adoption of FDA- and EU-compliant adhesive solutions. Manufacturers are investing in solvent-free and water-based systems tailored for food applications to meet sustainability targets and reduce potential chemical migration risks.

Stringent Environmental Regulations and Compliance

Challenges for laminating adhesives market include sustainability trends that call for restrictions on VOCs and hazardous materials from adhesives. There are various legislative acts by government agencies like the EPA and REACH that regulate the use of solvent-based adhesives and drive manufacturers towards using low-VOC and solvent-free adhesive manufacturing adhesives machine.

Adhering to these evolving regulations heightens production costs and demands ongoing innovation of eco-friendly formulations. To ensure regulatory requirements are met without hindering performance and cost-effectiveness, manufacturers will need to use R&D investments to create sustainable adhesives.

Fluctuating Raw Material Costs and Supply Chain Disruptions

The input prices of key raw materials such as polyurethane, acrylics, and solvents constitute the largest input costs impacting the industry. Global supply chains already strained from the impact of the COVID pandemic face volatility from geopolitical tensions and energy rises (e.g., oil, coal, and natural gas), negatively affecting production stability and profit margins.

Manufacturers here need diversification solutions in their supply chain, the ability to find alternative raw materials, to increase operational efficiency to deal with the challenges of rising technology and production costs.

Increasing Demand for Flexible Packaging in the Food and Beverage Industry

Laminating adhesives market is driven by increasing demand for light weight, durable, and aesthetically appealing packaging across food and beverages market. Flexibles offer better barrier protection, longer shelf-life and more affordable transportation are often the packaging of choice for manufacturers. The expanding global packaging and changing consumer preferences towards convenience and sustainability will also benefit companies involved in the development of high-performance, food-safe, and sustainable adhesive solutions.

Advancements in High-Performance and Sustainable Adhesives

Innovations in water-based, solvent-free, and bio-based laminating adhesives are creating new growth opportunities for the market. Advancements in UV curable adhesives, hybrid polymer technologies, and ultra-high performance bonds improve adhesion quality for a reduced environmental footprint. Moreover, the introduction of smart adhesives with enhanced chemical and heat resistance is propelling their adoption across the automotive, electronics, and medical applications. In the changing industry landscape, firms working towards high-performance, green laminating adhesives will stand to offer significant competitive advantage.

The laminating adhesives market is poised to excel in the upcoming years owing to a range of factors like the rising demand for laminated products across industries. Yet market expansion was hindered by raw material price volatility, regulatory pressures and supply chain disruptions, according to the report. As a result, companies responded by investing in sustainable adhesive solutions, addressing demand by increasing production capacities, and enhancing supply chain resilience.

Between 2025 to 2035: The market will be seeing significant innovations including bio-based adhesives, nanotechnology-enhanced bonding solutions, and AI-driven formulation optimization. Smart adhesives capable of providing real-time performance monitoring, with fast curing technologies and recyclable formulations, will disrupt industry standards.

Moreover, the use of blockchain to trace materials and AI-based sustainability analytics will bring compliance and efficiency. The next phase in the evolution of the market will be driven by companies that place product sustainability & eco-innovation, digital transformation, and circular economy initiatives first.

The Americas are the leading region for laminating adhesives market, where the United States emerges as the dominating region, owing to the rising demand for flexible packaging, growing use of sustainable adhesives and robust investments in food and pharmaceutical packaging applications. The market growth is also driven by the increasing demand for high-performance adhesives in automotive, construction, and consumer goods. The growth of the market is also aided by increased investments in solvent-free and water-based laminating adhesives and high-strength, heat-resistant product formulations.

Moreover, the combination of bio-based adhesives, UV-curable solutions and smart packaging compatibility are diversifying product visibility and presence. Additionally, companies are shifting their attention towards the development of low-VOC and high-bond-strength laminating adhesives in response to changing regulations and consumer preferences. Also, the rising usage of laminating adhesives for flexible packaging, medical applications, and various industrial laminates is unlocking new market opportunities on the market.

| Country | CAGR (2025 to 2035) |

|---|---|

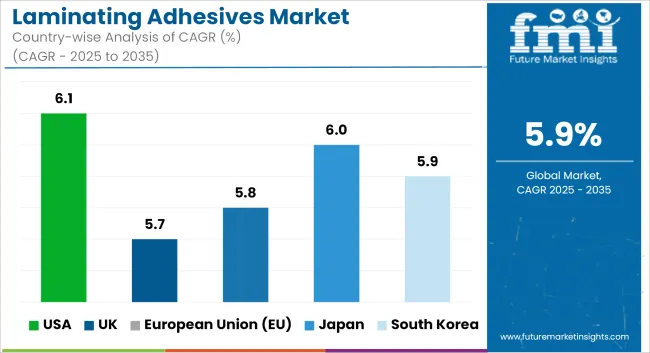

| USA | 6.1% |

Laminating adhesives are also emerging as a substantial product segment in the United Kingdom due to responsible demand for sustainable packaging, escalating regulatory pressure over solvent-based adhesives, and rising innovation for high-performance flexible laminates in the market. The growth of the market is also being aided by the emphasis on recyclability and compliance with food safety. The growth of the market is augmented due to government policies encouraging sustainable adhesives along with technological advancements in fast curing and low migration adhesives. Further, development in biobased and compostable laminating adhesives is also gaining prominence.

To improve performance across multiple industries, companies have also been focusing on developing solvent-free, moisture-resistance, and food-safe adhesive solutions. Moreover, growing need for lightweight and high tensile strength laminates in flexible food packaging, healthcare, and automotive sectors is further propelling the market growth in the country. Furthermore, the transitioning toward circular economy packaging solutions is propelling the demand for next-generation laminating adhesives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The European laminating adhesives market is highly concentrated in the Germany, France, and Italy as these countries have strong manufacturing infrastructure, growing investments in sustainable packaging technologies, and increasing regulatory support for low-emission adhesives. Growth in the market is spurred by the European Union's focus on reducing volatile organic compounds (VOCs) and investment in bio-based adhesive formulations and recyclable multilayer packaging. In addition, the high-strength, solvent-free adhesive is used in automotive interiors, electronics, and industrial laminates to enhance durability and efficiency.

Moreover, the proliferation of demand for flexible laminates from pharmaceuticals, food packaging, and consumer electronics is also stimulating market growth. Increased adoption in the region is also aided by the extending requirements of strict EU regulations on food contact adhesives and the rising R&D initiatives within advanced polymer chemistry. Moreover, with rising paradigm investment in circular economy initiatives, innovation in environmentally-friendly adhesive solutions is growing aggressively.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.8% |

Japan laminating adhesives market by is witnessing growth with the advancements made in the country as the suppliers of high-performance materials, adoption of state-of-the-art packaging technologies are being adopted in the market place along with growing demand for environmentally friendly adhesive solutions. Market Growth is fueled by increasing demand for durable and lightweight laminates in the electronics, automotive, and consumer goods packaging industries.

Innovations are driven there due to the country’s focus on solvent-free adhesive technologies, along with advancements in high-precision bonding and low-migration adhesives. Additionally, the government's strict regulations regarding chemical emissions, along with the growing investment in nanotechnology-enhanced adhesives, offer incentives to companies involved in the development of high-quality laminating adhesive products.

Increasing characteristics of high-barrier, food-safe, and tamper-evident laminates in the packaging arena of Japan are contributing to market growth. Moreover, Japan-specific adhesive laminating technologies available with automation and AI-based adhesive application process.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The market is proliferating in South Korea, owing to the rising demand for flexible packaging in industries such as food, pharmaceuticals, and consumer electronics, and robust government support for sustainable adhesive technologies. The growth of the market is also driven by stringent environmental regulations on solvent-based adhesives and the rise in investments in high-performance and bio-based adhesive solutions. Moreover, engineering polymers and nanotechnology are improving competitiveness by targeting increased adhesive durability, heat resistance, and adhesion efficiency.

The increasing demand for lightweight, flexible, and moisture resistant laminates in electric vehicles (EVs), medical packaging, and industrial application are also expected to drive market penetration. Fast-curing adhesive solutions that are solvent-free and recycling-friendly are helping companies improve their production efficiency to meet sustainability targets. Growing demand for intelligent labeling solutions and smart packaging in South Korea, paired with innovation in laminating adhesives, is consistently propelling the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The global laminating adhesives market is highly competitive, with manufacturers prioritizing innovation, sustainability, and regional expansion. Players are investing in solvent-free, bio-based, and high-efficiency adhesive technologies to comply with regulatory changes and consumer demand for safer, recyclable materials.

Strategic collaborations with film producers, packaging converters, and OEMs are enabling quicker commercialization of next-gen adhesive solutions. Asia Pacific remains the manufacturing hub, while Europe and North America lead in technological development and product reformulation. Market leaders are also enhancing digital printing compatibility and improving automation processes to gain competitive advantage in the evolving packaging ecosystem.

The overall market size for laminating adhesives market was USD 3,936.3 million in 2025.

The laminating adhesives market expected to reach USD 6,983.1 million in 2035.

The demand for the laminating adhesives market will be driven by increasing use in flexible packaging, rising demand from the food and beverage industry, growing adoption in automotive and construction applications, advancements in eco-friendly and high-performance adhesives, and expanding e-commerce packaging requirements.

The top 5 countries which drives the development of laminating adhesives market are USA, UK, Europe Union, Japan and South Korea.

Solvent-based and water-based laminating adhesives drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Laminating Machines Sector

PP Laminating Films Market

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Self-Laminating Tags Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Tube Laminating Films

Self-Laminating Labels Market

Thermal Laminating Machine Market – Trends & Forecast 2025 to 2035

Thermal Film Laminating Machines Market

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Skin Adhesives Market

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA