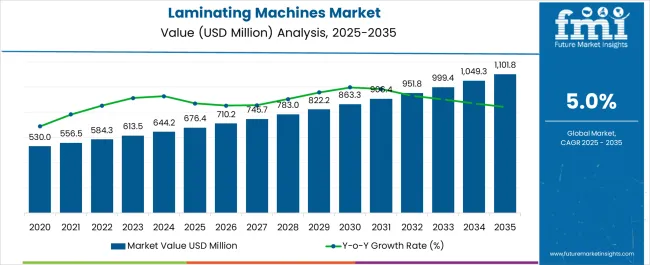

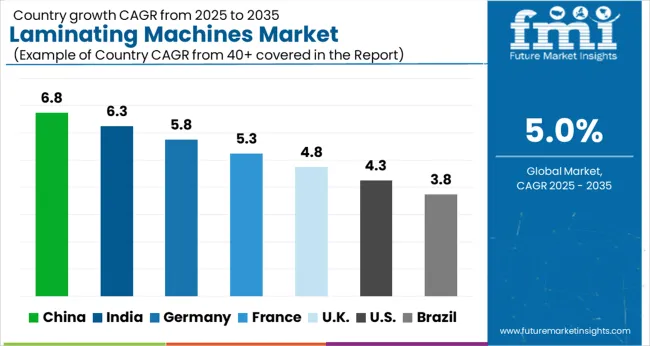

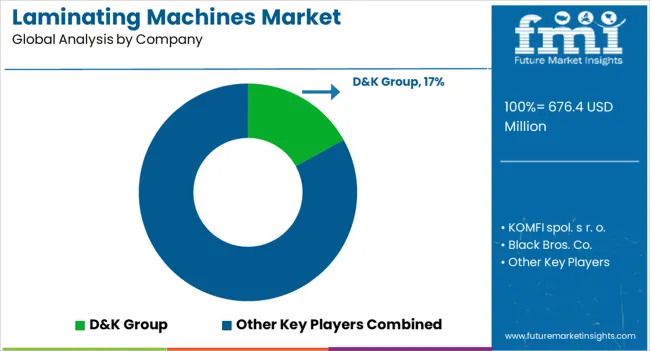

The Laminating Machines Market is estimated to be valued at USD 676.4 million in 2025 and is projected to reach USD 1101.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Laminating Machines Market Estimated Value in (2025 E) | USD 676.4 million |

| Laminating Machines Market Forecast Value in (2035 F) | USD 1101.8 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The laminating machines market is experiencing steady growth, fueled by increased demand for document protection, branding enhancement, and product durability across industries. The rise in packaged food, e-commerce, and print media has created a strong need for high-efficiency lamination equipment, particularly in applications requiring visual appeal and barrier functionality.

Advancements in automation and temperature control technologies have improved machine throughput and compatibility with diverse substrates. Sustainability is also reshaping buyer priorities, with growing preference for lamination systems that support recyclable films and energy-efficient operation.

Integration with smart sensors, real-time diagnostics, and remote monitoring is enabling predictive maintenance and operational optimization. Going forward, the market is expected to benefit from the expanding need for tamper-evident, water-resistant packaging and secure document finishing in sectors such as food & beverage, education, and logistics.

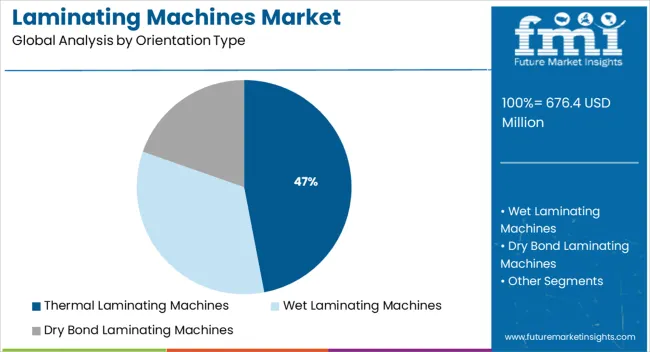

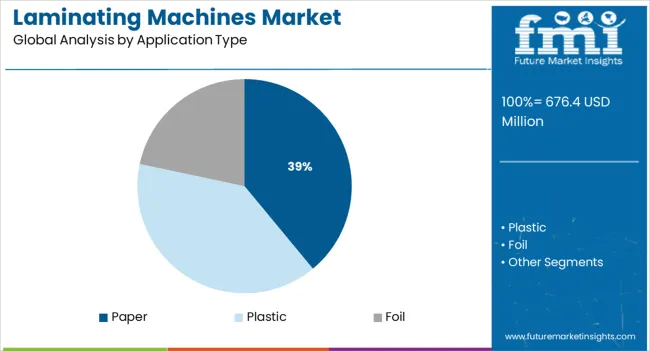

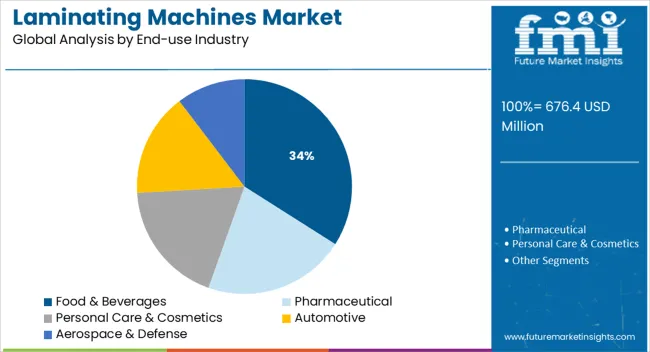

The market is segmented by Orientation Type, Application Type, and End-use Industry and region. By Orientation Type, the market is divided into Thermal Laminating Machines, Wet Laminating Machines, and Dry Bond Laminating Machines. In terms of Application Type, the market is classified into Paper, Plastic, and Foil. Based on End-use Industry, the market is segmented into Food & Beverages, Pharmaceutical, Personal Care & Cosmetics, Automotive, and Aerospace & Defense. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Thermal laminating machines are projected to account for 47.0% of the total market revenue in 2025, making them the leading orientation type segment. This leadership is being driven by the machines’ ability to provide strong adhesion, bubble-free finishes, and consistent output across a wide range of materials.

The technology’s reliability and lower operating costs compared to cold lamination methods have made it a preferred choice in both commercial and industrial settings. As manufacturers seek equipment that delivers fast warm-up times and high-speed lamination with minimal maintenance, thermal systems have continued to dominate procurement trends.

Moreover, the compatibility of thermal machines with environmentally friendly laminating films is aligning well with the industry's evolving sustainability requirements, reinforcing their adoption across multiple sectors.

Paper applications are expected to capture 39.0% of the laminating machines market revenue in 2025, positioning them as the largest application segment. This prominence is being attributed to the widespread use of lamination in printed documents, packaging labels, book covers, and certificates, where protection from moisture, fading, and physical damage is essential.

Increased demand for high-quality print finishes in marketing collateral, education materials, and retail packaging has further supported the use of lamination. The resurgence of printed materials for branding and product storytelling, particularly in premium segments, has encouraged investment in machines designed for high-speed paper lamination.

Additionally, the availability of cost-effective lamination films and the rise in localized printing services have enhanced accessibility for small and medium enterprises, contributing to the sustained growth of this segment.

The food & beverages industry is forecast to contribute 34.0% of the overall revenue in the laminating machines market by 2025, making it the leading end-use industry. This segment’s growth is being propelled by increasing demand for visually appealing, functional packaging that maintains product integrity throughout the supply chain.

Lamination enhances the barrier properties of flexible packaging, providing resistance against moisture, oxygen, and contaminants—factors critical in preserving food safety and shelf life.

The shift toward ready-to-eat, single-serve, and sustainable packaging formats has driven food manufacturers to adopt laminating machines that offer both speed and versatility. Additionally, stringent food safety regulations and the need for traceability have further encouraged the use of lamination in protective labeling and tamper-evident packaging solutions across the F&B sector.

The global laminating machines market witnessed a CAGR of 3.7% during the historic period with a market value of USD 644.2 Million in 2024 from USD 530 Million in 2020.

Laminating machines are used to produce a final flexible packaging with enhanced strength, durability, appearance, etc. Lamination helps in increasing the shelf life of the product by keeping them preserved from the external environment.

Manufacturers are focusing on environment-friendly laminating machines. Paper is being used more as a base of the application segment in the laminating machines market. Thus, laminating machines are easy-to-use equipment that provides high-quality lamination to protect the products.

The recent trend of automation in the packaging industry has brought innovations and advancements. The rising need for laminating machines in the various end-use industries attracted new players. Manufacturers are focusing on bringing changes and innovations to gain competitive advancement.

New products are being launched with enhanced capabilities. Machines with improved machine accuracy and capabilities are being introduced to the market. Manufacturers are implementing automation techniques to reduce labour costs and increase productivity. Thus, various advancements and innovations brought by manufacturers are enhancing the demand for laminating machines.

The laminating machines are used for the packaging of the items such as ready-to-eat meals, processed foods, and packed food. In the food industry, laminated flexible packaging is applied to both cooked and non-cooked foods. Laminating machines help in preventing food and beverages from being contaminated.

The efficient lamination by the machines provides extended shelf life to the food products. One of the reasons for the growth of laminating machines is the fast worldwide growth of food outlets and the shift of consumers to higher-quality packaged foods as they have become more conscious of a healthy lifestyle. Thus, the growing food & beverages industry is boosting the laminating machines market.

Based on the orientation, the wet laminating machines segment holds the largest share of the laminating machines market. The targeted segment is projected to hold around 43.6% of the market share in 2025. Wet laminating machines are the most preferred laminating machines among the end users as they provide effortless lamination.

The wet laminating machines provide high production with low investment. In addition, the operating cost of the wet laminating machines is also low. It is generally used to produce a paper-foil laminate that is extensively used in flexible packaging. Thus, due to added advantages, as compared to other-oriented segments of laminating machines, the demand for wet laminating machines is very high and is projected to grow at a rate of 6.5% CAGR over the forecast period.

Food and beverages are the topmost end-use industry segment in the market for laminating machines. The food and beverages segment is estimated to have a market share of ~36% in laminating machines market for the year 2025. Laminating machines are used in the food & beverages industry to prevent the impact of the external environment, which helps in increasing the shelf life of the products. In addition, with the rising consumption of easy-to-use and carry packaged food & beverage products, the demand for laminating machines has increased. Thus, due to various benefits, laminating machines as an end-use industry are expected to provide an incremental opportunity of around USD 164.7 Million in the forecasted period.

The above image represents the basis point (BPS) analysis for the orientation and end-use industry segment for the laminating machines market. The wet laminating machines segment under orientation is estimated to gain around 630 BPS whereas the dry bond laminating machines segment is estimated to lose around 530 BPS during the forecast period. Based on the end-use industry, the food & beverages segment is projected to gain around 200 BPS during the decade.

Food & beverages are the top end-use industry of the laminating machines market. Packed and processed foods require efficient sealing for preservation. Laminating machines provide the best-automated laminating packaging solution in the food & beverages industry. According to the USA DEPARTMENT OF AGRICULTURE, the significant demand for processed food items in the USA is shown by the export value of the country's processed food products in 2024, which was USD 34.24 Billion.

Thus, as per FMI analysis, the USA rising demand for food products is expected to drive the demand for laminating machines and is expected to grow the market at the rate of 4.5% CAGR in the forecast period.

FMI analysis states that the Indian laminating machines market is estimated to grow at the rate of 6.0% CAGR from 2025 to 2035.

According to the data provided by the Ministry of Heavy Industries, the Indian government had launched six technology innovation platforms for the development of technologies for making Indian manufacturing compatible with the global market. These platforms would help in solving the technological challenges in India. It will help in transforming the manufacturing industries of India.

Lamination is one of the growing packaging segments owing to the rising need for safe & secure packaging. Thus, due to such initiatives, industries such as laminating machines are projected to witness decent growth, as it would bring opportunities for the key players to set up their manufacturing plants in India.

The key players operating in the laminating machines market are trying to focus on increasing their sales and revenues by expanding their capacities to cater to the growing demand. The key players are trying to adopt different strategies to expand their resources and are developing new products to meet upcoming customer requirements. Also, the players are upgrading their production facilities to cater to the demand. Some of the recent key developments in the market by the leading players are as follows -

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Orientation, Application, End-use Industry, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | D&K Group; KOMFI spol. s r. o.; Black Bros. Co.; Graphco; HMT Manufacturing, Inc.; Comexi Group Industries; Karl Menzel Maschinenfabrik GmbH; Monotech Systems Ltd.; ALEMO; Chongqing Sinstar Packaging Machinery Co., Ltd; L.R. Schmitt Nachfolger Sondermaschinenbaugesellschaft m.b.H.; WORLDLY INDUSTRIAL CO., LTD.; GMP; Robert Bürkle GmbH; VEIT GmbH; SAM Europe Srl; Reliant Machinery; HIP-MITSU srl |

| Customization & Pricing | Available upon Request |

The global laminating machines market is estimated to be valued at USD 676.4 million in 2025.

The market size for the laminating machines market is projected to reach USD 1,101.8 million by 2035.

The laminating machines market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in laminating machines market are thermal laminating machines, wet laminating machines and dry bond laminating machines.

In terms of application type, paper segment to command 39.0% share in the laminating machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Laminating Machines Sector

Thermal Film Laminating Machines Market

Laminating Adhesives Market Growth - Trends & Forecast 2025 to 2035

PP Laminating Films Market

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Self-Laminating Tags Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Tube Laminating Films

Self-Laminating Labels Market

Thermal Laminating Machine Market – Trends & Forecast 2025 to 2035

Lathe Machines Market

Sorter Machines Market Demand & Automation Innovations 2024 to 2034

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA