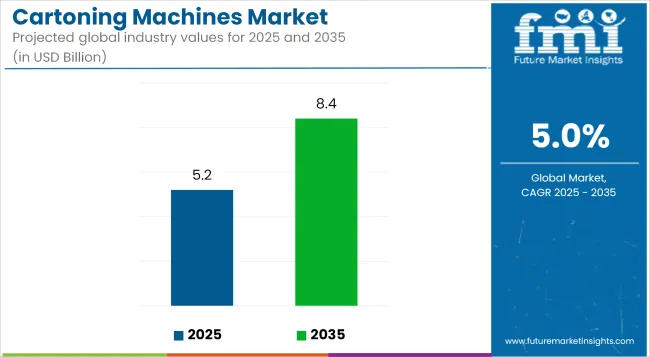

The cartoning machines market is projected to grow from USD 5.2 billion in 2025 to USD 8.4 billion by 2035, registering a CAGR of 5.0% during the forecast period. Sales in 2024 reached USD 4.9 billion, indicating a robust demand trajectory. This growth has been attributed to the increasing demand for automated and efficient packaging solutions across various sectors, including food and beverage, pharmaceuticals, and personal care.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5.2 Billion |

| Projected Market Size in 2035 | USD 8.4 Billion |

| CAGR (2025 to 2035) | 5.0% |

The rise in e-commerce activities and the need for sustainable packaging have further propelled the adoption of cartoning machines. Additionally, advancements in technology have enhanced the functionality and efficiency of these machines, aligning with the evolving needs of manufacturers and consumers alike.

In April 2025, Syntegon, a global leader in packaging technology, is proud to announce the launch of the Pack 103, the latest model of its popular entry-level flow wrapping machine. “We’re excited to introduce the Pack 103 to the market,” said Kimberly Kocer, product manager at Syntegon. “This machine embodies our commitment to providing cost-effective, highly durable flow wrapping solutions.

Whether you’re a Mom & Pop shop or a growing enterprise, the Pack 103 is an ideal companion on your journey to automation.” The Pack 103 is available now and can be tailored to suit a wide range of product types, helping businesses optimize their packaging lines and improve overall productivity.”

The cartoning machines market has been significantly influenced by the increasing demand for sustainable and environmentally friendly packaging solutions. Manufacturers have been transitioning towards recyclable and biodegradable materials to align with environmental sustainability goals and meet regulatory requirements.

Innovations in material science have led to the development of packaging solutions that not only provide superior protection but also minimize environmental impact. Additionally, advancements in manufacturing technologies have enabled the production of lightweight and durable cartoning machines, catering to a wide range of applications across different industries.

The cartoning machines demand is poised for continued growth, driven by the ongoing expansion of various end-use industries and the increasing emphasis on sustainable and recyclable packaging solutions. The market's trajectory suggests a steady rise in demand for innovative, high-quality packaging that caters to both consumer preferences and regulatory requirements.

Companies investing in research and development to create durable, cost-effective, and environmentally friendly cartoning machines are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the cartoning machines market.

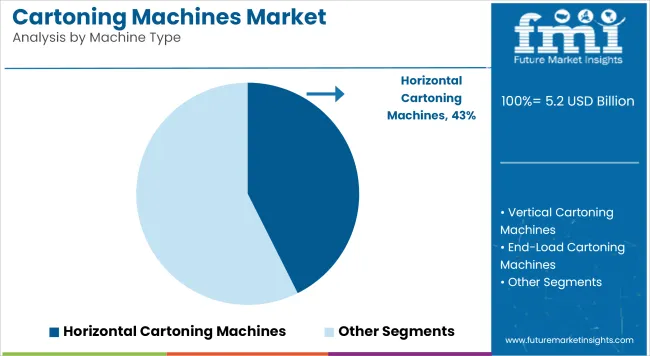

The market is segmented based on machine type, orientation, end-use industry, and region. By machine type, cartoning equipment includes horizontal cartoning machines, vertical cartoning machines, end-load cartoning machines, top-load cartoning machines, and wrap-around cartoning machines-each selected based on product configuration and automation needs.

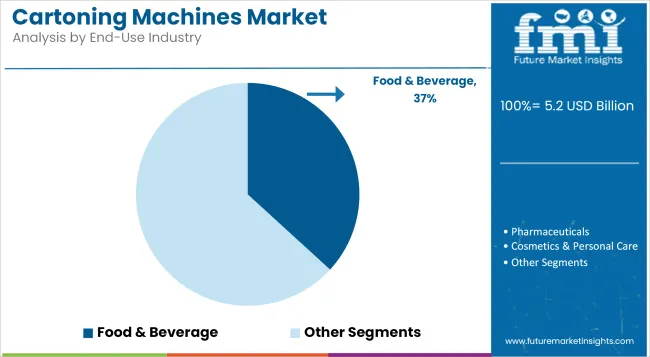

Orientation-wise, the market divides into horizontal form-fill-seal (HFFS) and vertical form-fill-seal (VFFS) systems, chosen for their packaging speed, footprint, and compatibility with solid or liquid products. End-use industries span food & beverage, pharmaceuticals, cosmetics & personal care, household products, consumer electronics, and industrial goods, with automation and hygiene requirements shaping machine adoption. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Horizontal cartoning machines are projected to account for 42.6% of the market in 2025 due to their high-speed automation and compatibility with a wide range of products. These machines have been adopted in packaging lines for items that are rigid or semi-rigid and can be loaded horizontally. Efficiency in forming, loading, and closing cartons has supported their use across food, pharma, and cosmetics sectors.

Consistent performance and throughput have ensured dominance in high-volume production. Operational flexibility and ease of integration with upstream equipment have reinforced their appeal. Multiple loading configurations and end-of-line compatibility help in handling diverse SKUs with minimal changeover. Cost-efficiency and footprint optimization contribute to wider deployment across global packaging facilities. Advanced sensor integration ensures precision and reduces product waste.

Servo-driven horizontal cartoners have improved packaging accuracy while minimizing downtime. With electronic control systems, real-time diagnostics and feedback have enhanced maintenance predictability. Tool-less adjustments and modular construction enable quicker format changes, reducing operational delays.

Carton quality, flap integrity, and sealing precision are maintained even at accelerated speeds. Growing use in packaging dry foods, confectionery, and medical kits has kept demand high. Customizable feed systems and product handling modules are being tailored to industry-specific needs. Market leaders have introduced robotics-enabled horizontal machines for handling fragile or multi-component packs. As demand for packaged goods increases, their share is expected to remain the highest.

The food & beverage sector is estimated to capture 36.8% of the global cartoning machines market in 2025, driven by rising packaged food consumption and retail distribution. Cartoning machines are used to package items like snacks, frozen foods, cereals, ready-to-eat meals, and beverage multipacks. High-speed packaging and consistent carton sealing are required for retail-ready formats. The format supports extended shelf life and damage prevention during transit. Horizontal and wrap-around cartoners are favored in beverage and bakery industries for bundling and stacking cartons.

Ready-meal and dairy packaging applications benefit from precise dosing and containment capabilities. Carton customization has also supported brand differentiation through unique formats and printing options. Food safety regulations have prompted adoption of machines with hygienic design and contamination control features.

Automation in food packaging has been further accelerated by labor cost pressures and retail demand fluctuations. Cartoning machines with vision inspection and rejection systems have enabled compliance with stringent packaging standards. Integration with labeling and coding units ensures traceability and supply chain visibility. Predictive maintenance features are being included to minimize operational disruption.

Brands are investing in sustainable packaging using recyclable cartons processed through advanced machines. Light-weighting of cartons without compromising structure has become a key development area. Packaging equipment is being designed to handle various board grades and reduce glue consumption. As convenience foods and on-the-go consumption trends continue, the food & beverage sector will remain the leading end-use application.

High capital investment and maintenance costs The integration of AI, robotics, and smart monitoring systems increases the initial investment cost for cartoning machines. Additionally, the need for regular maintenance and skilled operators presents challenges for small and mid-sized manufacturers.

AI-powered automation, robotics, and sustainable packaging solutions Advancements in machine learning, robotics, and IoT-enabled cartoning machines are creating opportunities for highly efficient and adaptive packaging solutions.

The demand for recyclable and eco-friendly cartons is driving innovation in cartoning machines that support flexible and biodegradable packaging materials. Additionally, the use of digital twin technology is optimizing predictive maintenance and reducing machine downtime.

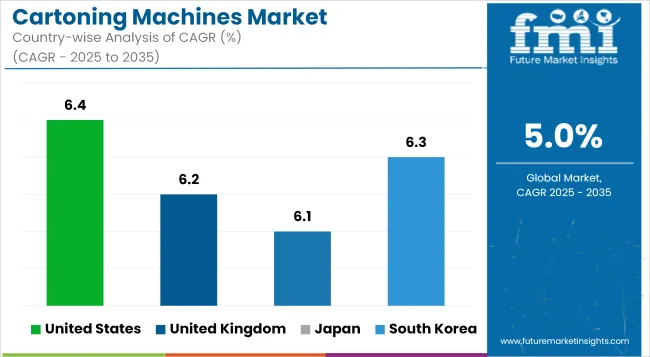

The United States is the leader in the cartoning machines market owing to heightening demands for automation and efficiency regarding packaging formulate, beverages, pharmaceuticals, and personal care items. USA manufacturers are busy investing in high-speed, servo-driven horizontal and vertical cartoning machines that improve throughput while reducing the chances of error incurred in human handling.

These vision systems, AI-based inspection, and IoT-enabled monitoring facilities empower the next level of quality control and maintenance prediction. In addition, machine suppliers are designing energy-efficient and compact machines, which will be relevant enough for space-constrained production establishments, and meet improved sustainability targets.

Many USA firms are also bringing smart changeover systems that allow for rapid format adjustments. Besides, cloud-based analytics tools are already used to provide real-time measurement of performance metrics. Personalized packaging patterns continue to drive machine developers to think about flexible, multi-format solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The UK cartoning machine market is also fast expanding, given that industries have started prioritizing packaging solutions that are flexible, sustainable, and digital-ready. Thus, manufacturers are going for modular cartoning machines that can be quickly changed over to align with adaptable needs across SKUs and come equipped with smart human-machine interface (HMI) configurations.

While another reason to require precision-engineered machines is due to packaging for e-commerce and retail, there is an increasing demand for such machines that can easily handle custom carton formats. UK manufacturers also look into packaging lines that integrate recyclable materials and generate less waste to support sustainability goals and in compliance with circular economy standards.

They also employ predictive maintenance solutions to reduce any downtimes encountered in their processes while optimizing operational efficiencies. Other enhancements underway include smart vision systems for real-time quality checks and validation of packaging. Lastly, there is an increasing demand for robotics-integrated cartoners, which cater to the speed and customization demands of modern packaging lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

Japan's cartoning machines market continues to thrive because of the emphasis it places on high-precision automation and cleanroom-compatible equipment for pharmaceutical and cosmetics packaging. Japanese manufacturers produce ultra-compact machines with added technology, which include product handling, barcode verification, and tampering evidence.

Innovations in robotics and the introduction of servo motors and touchless systems increase efficiency but reduce contamination risk. Within Japan, energy-efficient cartoning machine development occurs with high-speed camera systems used for 360-degree product inspection.

It, too, steps ahead by incorporating AI monitoring either to trace anomalies in real-time and reduce downtime. The fact that customized packaging is on the rise propels many investments in multiple formats machine versatility. Miniaturization is also a trend toward generating innovations in compact, space-saving machine designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

Market for cartoning machines in South Korea is growing at a fast pace because industries are scaling up production to meet increased domestic and export demand. The channeling of smart automation systems with AI diagnostics, performance surveillance, and remote troubleshooting is gaining traction.

Demand for multi-format and high-speed cartoning machines is rising across pharmaceuticals, food, and electronics. Companies are now focusing on sustainable cartoning technologies such as machines that reduce secondary packaging waste or are supportive of biodegradable materials.

Besides, companies seek to integrate modular configurations into their machines for better scalability. Value is added through advanced HMI interfaces for operational control and efficiency. The e-commerce trend created a heightened demand for cartoning systems allowing swift and accurate handling of variable package sizes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The cartoning machines market is expanding with growing demand for compact, high-speed, and flexible systems. Leading manufacturers are offering machines with real-time monitoring, smart automation, and sustainability-enhancing features. Key trends include augmented reality for remote troubleshooting, paperboard-compatible designs, and carton customization for branding.

Companies are also adopting predictive maintenance technologies to minimize downtime and extend equipment life. Increased demand for carton-based packaging as a plastic alternative is influencing machine design. Modular cartoners are gaining traction among small and medium enterprises due to scalability. User-friendly interfaces are making it easier for operators to manage diverse packaging runs. Furthermore, innovations in servo-driven automation are enhancing speed and precision across packaging lines.

The market size for the Cartoning Machines Market was USD 5.2 Billion in 2025.

The market is projected to reach USD 8.4 Billion in 2035.

Growth will be driven by the need for end-of-line packaging automation, SKU variety, smart features, and eco-friendly carton solutions.

The top 5 contributing countries are the USA, Germany, China, Japan, and Italy.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horizontal Cartoning Machines Market Size and Share Forecast Outlook 2025 to 2035

Top Loading Cartoning Machine Market from 2024 to 2034

Lathe Machines Market

Sorter Machines Market Demand & Automation Innovations 2024 to 2034

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Granulator Machines Market Size and Share Forecast Outlook 2025 to 2035

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA