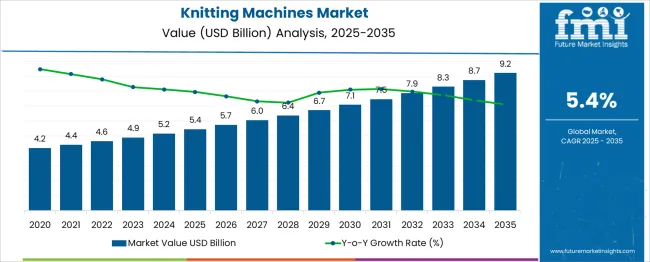

The Knitting Machines Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 9.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Knitting Machines Market Estimated Value in (2025 E) | USD 5.4 billion |

| Knitting Machines Market Forecast Value in (2035 F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The knitting machines market is expanding steadily as the textile industry adapts to increased demand for diverse fabric types and faster production methods. Industry insights have highlighted the rising preference for efficient and versatile knitting equipment that can handle various fabric structures with high precision.

Investments in textile manufacturing infrastructure and technological advancements have enhanced machine capabilities, enabling producers to meet changing consumer demands. The trend towards automated manufacturing processes has led to the adoption of fully automatic knitting machines, which improve productivity and reduce labor costs.

Growth in apparel and home textiles sectors has also spurred demand for machines capable of producing single knit fabrics, known for their flexibility and comfort. Overall, the market is poised for growth as manufacturers focus on improving efficiency and product quality while addressing sustainability concerns. Segment growth is anticipated to be driven by weft knitting machines as the primary type, single knit as the dominant knit type, and fully automatic operation modes.

The knitting machines market is segmented by type, knit type, mode of operation, end use industry, and distribution channel and geographic regions. By type of the knitting machines market is divided into Weft knitting machines and Warp knitting machines. In terms of knit type of the knitting machines market is classified into Single knit and Double knit. Based on mode of operation of the knitting machines market is segmented into Fully automatic, Manual, and Semi-automatic. By end use industry of the knitting machines market is segmented into Apparel textiles, Automotive textiles, Sports textiles, Home textiles, and Others (footwear industry etc.). By distribution channel of the knitting machines market is segmented into Direct sales and Indirect sales. Regionally, the knitting machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

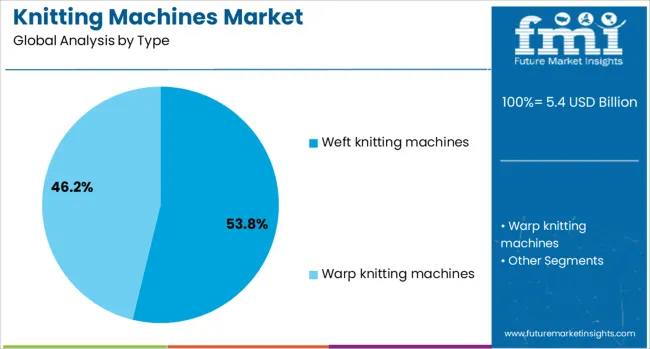

The weft knitting machines segment is expected to account for 53.8% of the knitting machines market revenue in 2025, establishing its dominance in the type category. This segment’s growth can be attributed to the machines’ capability to produce a wide range of fabrics including jersey and rib, which are highly popular in apparel manufacturing.

Weft knitting machines offer design flexibility and are widely used in producing stretchable and comfortable textiles. Manufacturers favor these machines for their adaptability and ability to work with various yarns.

The segment benefits from technological improvements that enhance machine speed and fabric quality. As demand for versatile knitwear increases, the weft knitting machines segment is poised to retain its leadership.

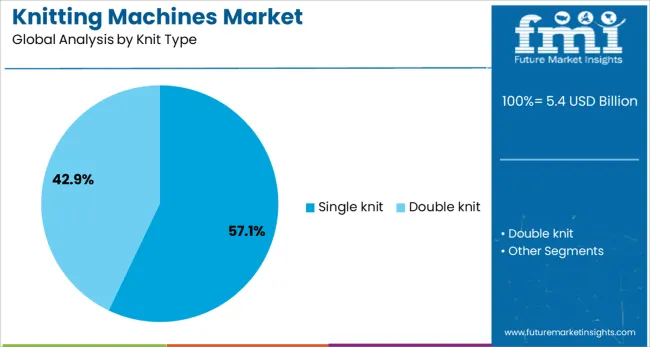

The single knit segment is projected to hold 57.1% of the knitting machines market revenue in 2025, maintaining its position as the leading knit type. Single knit fabrics are valued for their lightweight, elasticity, and breathability, making them ideal for a wide array of clothing applications.

Production efficiency and the ability to produce seamless designs have made single knit the preferred fabric type for manufacturers aiming to meet fast fashion demands.

The segment’s growth is supported by innovations in machine technology that allow high-speed production without compromising fabric integrity. As consumer preferences for comfortable and functional textiles grow, single knit fabrics will continue to dominate.

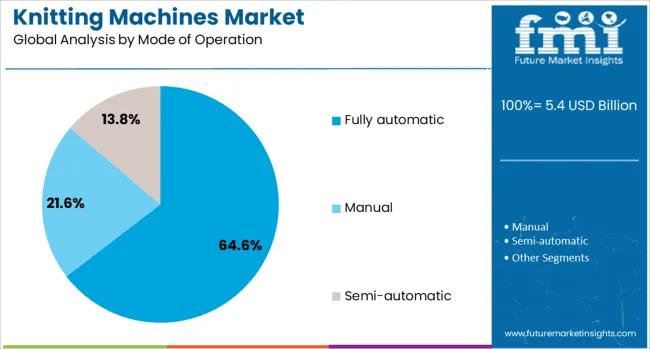

The fully automatic segment is projected to contribute 64.6% of the knitting machines market revenue in 2025, securing its place as the leading mode of operation. The shift towards automation has been motivated by the need to increase production efficiency, reduce labor costs, and improve product consistency.

Fully automatic knitting machines reduce human intervention and errors while enabling complex fabric designs. These machines are preferred in large-scale textile manufacturing units focused on high output and quality assurance.

The integration of digital controls and monitoring systems has further enhanced their appeal. With manufacturers increasingly adopting Industry 4.0 practices, the fully automatic mode is expected to sustain its growth momentum.

Knitting machines are seeing increased demand for flexible and customisable garment manufacturing. In 2024, approximately 32% of new textile mill installations featured digital flat‑bed or seamless specialty machines. Growth is strongest in China and Turkey, where fashion brands seek shorter lead times, higher fabric quality, and reduced labour intensity.

Manufacturers using digital flat‑bed and circular knitting machines improved their pattern changeover speed, reducing setup time by 18%. In China, fashion mills adopting seamless knitting lowered fabric wastage by 12% through automated pattern slicing controls. Turkey’s home textile sector increased its use of multi-gauge machines for varied fabric textures across the year, boosting line output flexibility by 15%. European specialty knitting brands integrated IoT-enabled tension control systems to maintain yarn consistency, cutting defect rates by 9 %. Shared CAD-to-Knitting workflows now support smaller batch deliveries, allowing mills across Asia to refresh collections faster while holding 14 % less inventory.

Advanced knitting equipment requires a high upfront investment, often 14–20% above older models, which restricts adoption in smaller mills. In regions such as Southeast Asia, a lack of certified technicians for machine calibration and maintenance leads to operational delays of 2–3 days per fault event. Yarn sourcing variation in Indian and Turkish markets has caused inconsistent tension, triggering machine alerts in 11% of shift cycles. Warranty claims on pattern and gauge misalignment have increased by 2.2× compared to conventional machines. Brands moving to automation face equipment downtimes while training operators on digital pattern interfaces, extending commissioning time by an average of one week.

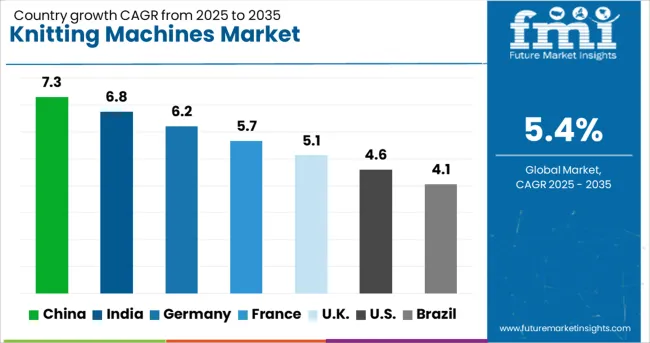

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

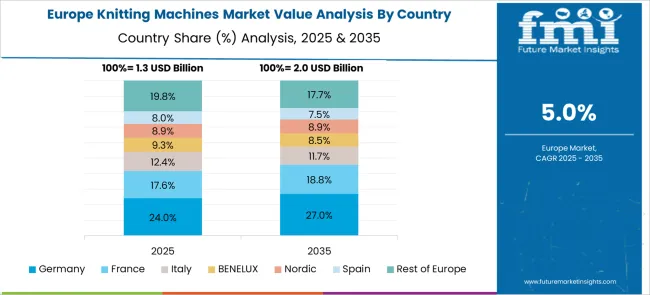

The global knitting machines market is projected to grow at a 5.4% CAGR through 2035. China leads with a growth rate of 7.3%, which is +35% above the global average. India follows at 6.8%, and Germany at 6.2%, outperforming by +26% and +15%, respectively. The UK posts a 5.1% CAGR, slightly below the global benchmark, while the US trails at 4.6%, reflecting a -15% deviation. China’s lead stems from high-volume textile manufacturing clusters and investments in circular knitting technologies. India’s expansion reflects rising demand for mid-range textile machinery among domestic producers. Germany’s growth is supported by automation upgrades in legacy mills. In contrast, the US and UK face slower growth due to lower manufacturing reliance. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The knitting machines market in China is forecasted to grow at a CAGR of 7.3% from 2025 to 2035. The textile industry’s reliance on circular and flat knitting machines for producing innerwear, sportswear, and technical fabrics supports equipment demand. Key provinces including Jiangsu and Zhejiang continue to attract investment in semi-automatic and computer-controlled systems. Chinese manufacturers like Cixing and Groz-Beckert are expanding machine lines compatible with fine-gauge yarns and specialty synthetics. Apparel exports and private label production sustain year-round machinery utilization across regional hubs.

Sales of knitting machines in India are projected to expand at a CAGR of 6.8% through 2035. Growth is attributed to increased apparel manufacturing for domestic consumption and export. Tiruppur and Ludhiana remain key regions where textile mills are installing computerized flat knitting machines for rapid design changes. Demand is concentrated in cotton and blended knitwear production. Manufacturers, including Mayer & Cie and Santoni, supply India-based garment exporters with high-speed circular knitting systems. Import of precision spandex-capable machines is also on the rise.

Demand of knitting machines in Germany is set to grow at a CAGR of 6.2% between 2025 and 2035. Known for high-performance textiles, Germany focuses on medical, automotive, and sportswear applications. Investments are directed toward programmable flat knitting machines for custom-fit components and engineered fabrics. KARL MAYER and Stoll maintain strong local presence, offering advanced machine models integrated with IoT sensors. Sustainability requirements are also influencing machine upgrades for waste reduction and material efficiency in knitting cycles.

The knitting machines market in the UK is expected to grow at a CAGR of 5.1% through 2035. Demand comes from small-scale knitwear producers and specialty fabric developers. Urban textile labs and craft production firms use flat knitting equipment for limited-edition and custom orders. Retailers offering made-to-order woolwear are driving new machine purchases. Imports from Germany, Italy, and Japan remain vital. London and Manchester serve as hubs for fashion-tech startups investing in programmable, low-waste knitting solutions.

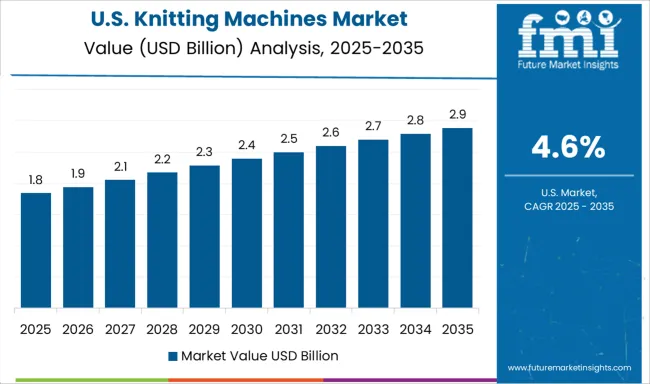

The United States knitting machines market is projected to grow at a CAGR of 4.6% from 2025 to 2035. Applications include activewear, PPE, and automotive textiles. Investment is concentrated in compact flat knitting systems for short-run and high-mix production. Major states like North Carolina and California support demand from contract knitwear makers and functional textile suppliers. Brands such as Nike and Under Armour are involved in nearshoring knitting operations. USA imports machines primarily from Germany, South Korea, and Taiwan.

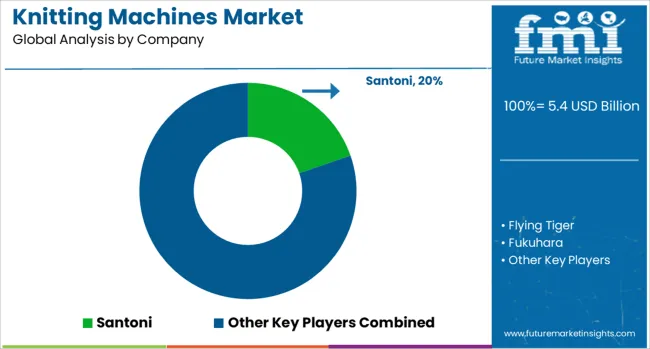

The global knitting machines market is dominated by Santoni, with key competitors including Shima Seiki, Mayer & CIE, and Stoll offering advanced circular and flat knitting technologies for apparel and technical textiles. Asian manufacturers like Fukuhara, Pai Lung, and Jingwei Textile Machinery provide cost-effective solutions for mass production, while European specialists such as Lamb and Orizio focus on high-precision machinery for luxury knitwear. The market is experiencing technological transformation through digitalization, with manufacturers integrating IoT-enabled monitoring and AI-driven pattern programming. Sustainability demands are driving innovations in energy-efficient motors and reduced yarn waste systems. Regional dynamics show China's Hanma group expanding in emerging markets, while Yamato Sewing Machine leads in seamless knitting technology for sportswear applications. The industry faces challenges from fast fashion's demand volatility but benefits from growing interest in 3D knitting for customized apparel production.

In June 2024, Monarch Knitting Machinery (UK) unveiled its latest AI-connected circular knitting machines at ITM 2024 in Istanbul. These new models are equipped with advanced sensors and real-time inspection capabilities to ensure superior production quality and defect detection.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Type | Weft knitting machines and Warp knitting machines |

| Knit Type | Single knit and Double knit |

| Mode of Operation | Fully automatic, Manual, and Semi-automatic |

| End Use Industry | Apparel textiles, Automotive textiles, Sports textiles, Home textiles, and Others (footwear industry etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Santoni, Flying Tiger, Fukuhara, Hanma group, Jingwei Textile Machinery, Lamb, Lisky, Mayer & CIE, Orizio, Pai Lung, Shima Seiki, Stoll, Tompkins, Yamato Sewing Machine, and Zentex |

| Additional Attributes | Dollar sales by machine type (circular, flatbed, warp) and application (apparel, home textiles, technical textiles), demand dynamics across sportswear manufacturing, automated garment shaping, and fashion prototyping, regional trends led by Asia‑Pacific with Europe focusing on high-speed electronic models, innovation in digital jacquard control and seamless knitting integration, and operational impact of production flexibility, yarn tension precision, and defect rate reduction. |

The global knitting machines market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the knitting machines market is projected to reach USD 9.2 billion by 2035.

The knitting machines market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in knitting machines market are weft knitting machines, _circular, _straight bar, _others (loop wheel etc.), warp knitting machines, _raschel warp, _tricot warp and _others (crochet etc.).

In terms of knit type, single knit segment to command 57.1% share in the knitting machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Granulator Machines Market Size and Share Forecast Outlook 2025 to 2035

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA