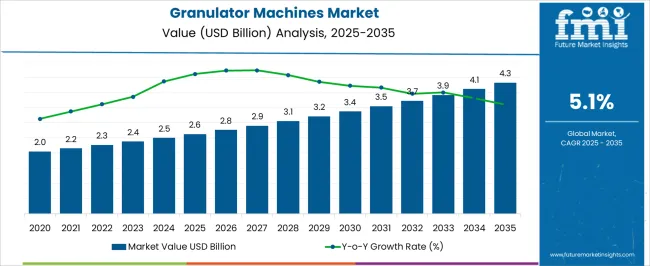

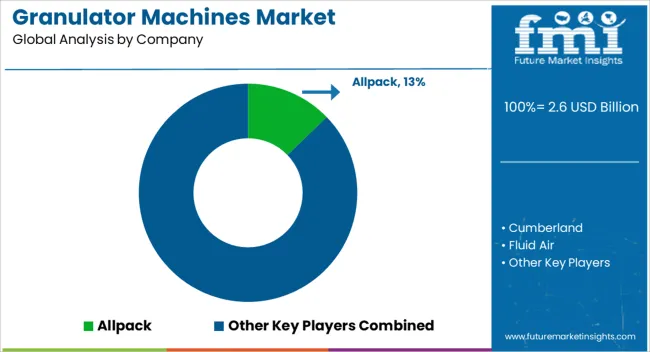

The granulator machines market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

This growth represents an absolute dollar opportunity of USD 1.7 billion over the decade. Annual growth shows a steady trajectory, rising from USD 2.6 billion in 2025 to USD 2.9 billion in 2028, USD 3.4 billion in 2031, and USD 4.1 billion by 2034. The consistent upward trend highlights significant potential for manufacturers and suppliers to expand production, optimize distribution, and meet increasing demand across plastics, pharmaceuticals, and chemical processing industries.

The absolute dollar opportunity underscores the growing value within the granulator machines market over the next ten years. Incremental growth from USD 2.6 billion in 2025 to USD 4.3 billion in 2035 signals a cumulative increase of USD 1.7 billion. Key years such as USD 3.1 billion in 2029 and USD 3.7 billion in 2033 indicate periods of steady adoption. This trend allows stakeholders to strategically enhance production capabilities, strengthen supply chains, and expand product offerings to capture a meaningful portion of the expanding market throughout the 2025–2035 period.

| Metric | Value |

|---|---|

| Granulator Machines Market Estimated Value in (2025 E) | USD 2.6 billion |

| Granulator Machines Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The granulator machines market is a segment of the broader industrial machinery and equipment market, which includes shredders, pulverizers, milling machines, and extrusion equipment. In 2025, granulator machines are estimated to account for approximately 6% of the total industrial machinery market, highlighting their critical role in size reduction, recycling, and material processing across various industries. With the parent market projected to grow from around USD 43.3 billion in 2025 to USD 73.6 billion in 2035, the granulator machines segment’s growth from USD 2.6 billion in 2025 to USD 4.3 billion in 2035 at a CAGR of 5.1% represents roughly 8% of the total incremental growth in the parent market.

Within the parent market, shredders hold about 25% of total value, milling and crushing equipment account for 20%, and extrusion and processing machinery contribute around 15%. Granulator machines, with their CAGR of 5.1%, demonstrate steady growth compared to other segments, reflecting consistent adoption in plastics recycling, pharmaceuticals, and chemical processing. The absolute growth of USD 1.7 billion over the decade represents roughly 8% of total parent market expansion. This trajectory provides manufacturers and suppliers opportunities to scale production, expand distribution channels, and strengthen their presence in the growing industrial machinery landscape.

The granulator machines market is witnessing steady expansion, driven by increasing demand for efficient particle size reduction and material processing across pharmaceutical, chemical, food, and plastic manufacturing sectors. Advancements in processing technology, including improved control systems and precision engineering, are enhancing machine performance, reducing downtime, and improving output consistency.

Rising investments in automation and process optimization are encouraging the adoption of high-capacity and energy-efficient granulators that meet stringent regulatory and quality standards. The growing emphasis on achieving uniform granulation for enhanced product quality is influencing manufacturers to integrate advanced features such as real-time monitoring and automated adjustments.

Expanding applications in recycling, waste management, and additive manufacturing are also contributing to the market’s growth trajectory As industries continue to focus on sustainable and high-efficiency production systems, the demand for machines that offer consistent granule size, reduced operational costs, and enhanced process control is expected to rise, positioning the granulator machines market for sustained growth in both developed and emerging economies over the next decade.

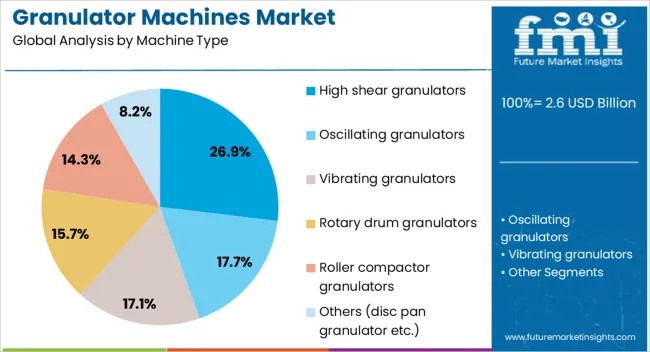

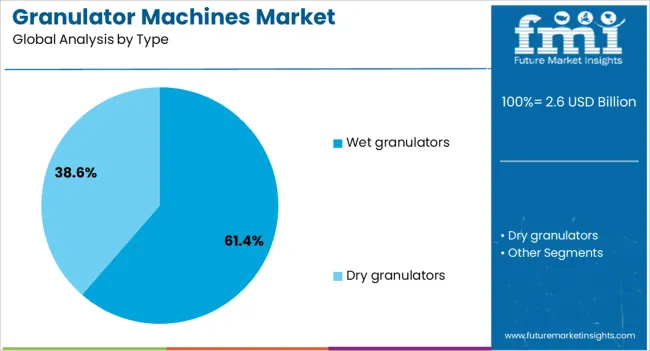

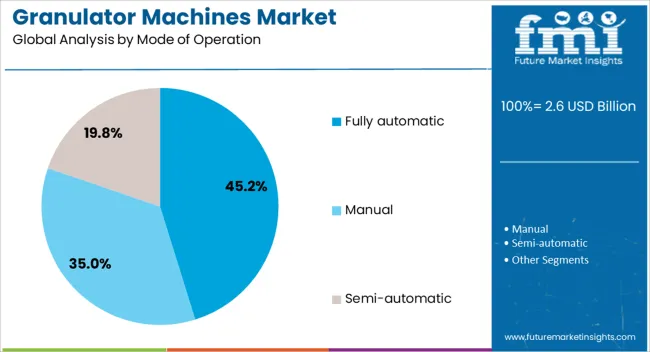

The granulator machines market is segmented by machine type, type, mode of operation, capacity, end use industry, distribution channel, and geographic regions. By machine type, granulator machines market is divided into high shear granulators, oscillating granulators, vibrating granulators, rotary drum granulators, roller compactor granulators, and others (disc pan granulator etc.). In terms of type, granulator machines market is classified into wet granulators and dry granulators. Based on mode of operation, granulator machines market is segmented into fully automatic, manual, and semi-automatic. By capacity, granulator machines market is segmented into above 1500 Kg/hr, Below 500 Kg/hr, 500 to 1000 Kg/hr, and 1000 to 1500 Kg/hr. By end use industry, granulator machines market is segmented into pharmaceutical, chemical, food industry, plastic industry, recycling industry, and others (cosmetics industry etc.). By distribution channel, granulator machines market is segmented into direct sales and indirect sales. Regionally, the granulator machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high shear granulators segment is expected to account for 26.9% of the granulator machines market revenue share in 2025, making it the leading machine type. This dominance is attributed to their ability to produce highly uniform and dense granules, which is critical in industries where product consistency directly impacts quality and performance.

The segment is benefiting from strong adoption in the pharmaceutical sector for tablet and capsule production, where high shear mixing and controlled granulation processes are essential. Their capability to handle a wide range of materials, including cohesive and fine powders, makes them versatile for different industrial applications.

Technological advancements have enabled better process control, shorter batch times, and reduced energy consumption, further increasing their appeal As industries seek greater productivity and higher-quality output, the demand for high shear granulators is being reinforced by their proven efficiency, adaptability, and ability to meet regulatory requirements for precision manufacturing.

The wet granulators segment is projected to hold 61.4% of the granulator machines market revenue share in 2025, establishing it as the dominant granulation type. This leadership is being driven by their ability to process fine powders into uniform granules using liquid binders, which enhances flow properties, reduces dust, and improves compressibility.

Wet granulation is widely preferred in pharmaceutical manufacturing, where it enhances tablet hardness, dissolution rates, and uniformity, ensuring consistent product quality. The segment is also gaining traction in food processing, fertilizer production, and specialty chemical manufacturing, where moisture-assisted granulation improves product stability and performance.

Increasing investment in advanced wet granulation systems with features such as closed-system designs, automatic binder addition, and optimized drying mechanisms is further supporting market growth The proven ability of wet granulators to handle a variety of formulations while ensuring high-quality output is cementing their position as the preferred choice in large-scale, precision-driven manufacturing environments.

The fully automatic mode of operation segment is anticipated to capture 45.2% of the granulator machines market revenue share in 2025, making it the leading operational category. Its dominance is being reinforced by the growing demand for high-efficiency, low-labor, and precision-controlled production systems across industries. Fully automatic granulators offer significant advantages, including reduced human error, consistent product quality, and enhanced throughput through real-time monitoring and automated adjustments.

They are increasingly adopted in pharmaceutical, chemical, and food industries, where compliance with strict quality control standards is mandatory. The integration of advanced control panels, programmable settings, and data logging capabilities allows operators to optimize performance while reducing downtime.

As industries move toward Industry 4.0 practices, fully automated systems are becoming essential for scaling production while maintaining precision and efficiency The combination of productivity gains, cost savings, and superior quality assurance is expected to keep the fully automatic segment at the forefront of market adoption in the coming years.

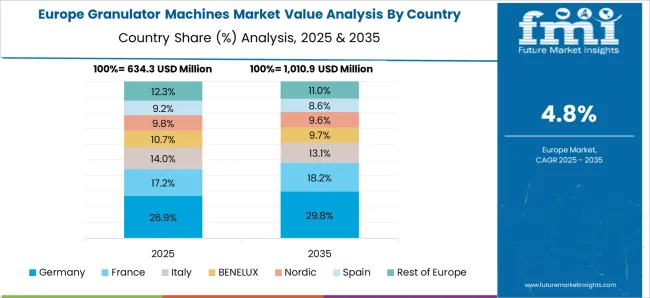

The granulator machines market is expanding due to rising demand in pharmaceuticals, chemicals, plastics, and food processing industries. North America and Europe lead adoption with advanced, automated, and high-capacity granulators ensuring uniform particle size and process efficiency. Asia-Pacific shows rapid growth driven by industrial expansion, raw material availability, and cost-effective manufacturing needs. Manufacturers differentiate through machine throughput, precision, and energy efficiency. Regional differences in production scale, regulatory compliance, and automation requirements strongly influence adoption, operational performance, and global competitiveness.

Industrial expansion across pharmaceuticals, chemicals, plastics, and food processing sectors is a major driver for granulator machine adoption. North America and Europe prioritize high-throughput, automated machines with precise particle size control and minimal downtime to meet stringent quality standards. Asia-Pacific markets adopt cost-effective granulators suitable for large-scale production and diverse raw materials, including agricultural and polymer feedstocks. Differences in industrial scale, automation readiness, and product uniformity requirements influence machine type, capacity, and energy efficiency. Leading suppliers provide advanced granulators with real-time monitoring and adaptive control, while regional manufacturers focus on reliable, low-cost alternatives. Industrial production contrasts shape adoption, productivity, and competitiveness across global granulator machine markets.

Automation and advanced technology significantly influence granulator machine adoption. North America and Europe emphasize machines with programmable logic controllers (PLCs), touchscreen interfaces, and integrated monitoring for consistent granule size and operational efficiency. Asia-Pacific markets prioritize simpler, semi-automated designs that balance cost and performance for diverse industrial applications. Differences in process complexity, production volume, and workforce skills affect automation level, control precision, and maintenance requirements. Leading suppliers invest in high-speed, multi-functional granulators with enhanced safety features and minimal energy consumption, while regional players provide practical, robust machines suitable for small and medium-scale operations. Technology and automation contrasts drive adoption, operational efficiency, and global competitiveness in granulator machinery.

Compliance with industry-specific regulations strongly affects granulator machine demand. North America and Europe require granulators that meet GMP, FDA, and ISO standards for pharmaceutical and food production, emphasizing hygiene, traceability, and reproducibility. Asia-Pacific markets vary; developed regions follow international standards, while emerging regions prioritize local compliance and affordability. Differences in regulatory rigor, certification requirements, and quality expectations influence machine design, materials, and safety features. Leading suppliers provide fully certified, traceable, and validated granulators, while regional manufacturers offer cost-effective, compliant solutions tailored to local industry norms. Regulatory contrasts shape adoption, product quality, and market competitiveness globally.

Granulator machines are adopted across multiple industries due to their versatility in producing powders, pellets, and granules. North America and Europe emphasize high-precision granulators for pharmaceuticals, chemicals, and specialty plastics, while Asia-Pacific markets focus on large-scale processing of fertilizers, feed, and bulk chemicals. Differences in feedstock properties, output specifications, and industry-specific standards influence granulator design, material construction, and operational capabilities. Leading suppliers provide multi-purpose, durable machines with adjustable configurations for varied applications, while regional players focus on specialized, cost-effective units. Application diversity contrasts drive market adoption, innovation, and competitiveness across global granulator machine segments.

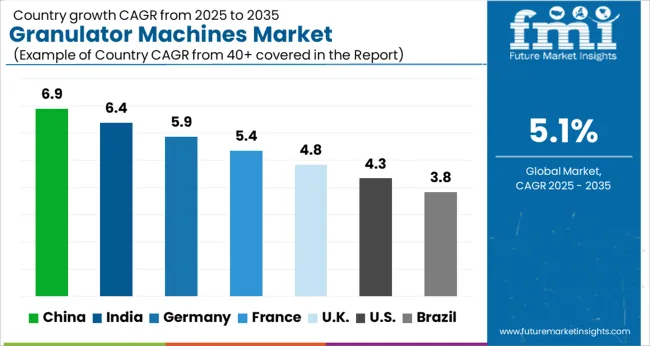

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global granulator machines market is projected to grow at a 5.1% CAGR through 2035, driven by demand in plastics processing, recycling, and industrial manufacturing. Among BRICS nations, China led with 6.9% growth as large-scale manufacturing and deployment were executed across production and recycling facilities, while India at 6.4% expanded production and adoption to meet rising regional processing requirements. In the OECD region, Germany at 5.9% maintained steady utilization under stringent quality and operational standards, while the United Kingdom at 4.8% implemented granulator machines across commercial and industrial applications. The USA, growing at 4.3%, supported consistent deployment in plastics processing and recycling operations while adhering to federal and state-level regulatory frameworks. This report includes insights on 40+ countries; the top countries are shown here for reference.

The granulator machines market in China is projected to grow at a CAGR of 6.9%, driven by rising demand from pharmaceutical, chemical, and food processing industries. Adoption is being encouraged for machines that provide high efficiency, uniform particle size, and reliable operation. Local manufacturers are being urged to supply advanced, cost effective, and durable equipment. Distribution through industrial suppliers, manufacturing units, and service providers is being strengthened. Research in process optimization, energy efficiency, and automation is being conducted. Expansion of industrial production, modernization of processing facilities, and growing focus on quality output are considered key factors driving the granulator machines market in China.

In India, the granulator machines market is expected to grow at a CAGR of 6.4%, supported by increasing industrial production, growing pharmaceutical sector, and expansion in food processing operations. Adoption is being promoted for machines that ensure consistent particle size, efficiency, and operational reliability. Domestic manufacturers are being encouraged to provide cost effective, robust, and technologically advanced equipment. Distribution through industrial suppliers, process plants, and service providers is being strengthened. Government programs and private sector investments in manufacturing modernization are recognized as major factors propelling the granulator machines market in India.

Germany is witnessing steady growth in the granulator machines market at a CAGR of 5.9%, driven by adoption in chemical processing, pharmaceutical production, and food manufacturing. Adoption is being encouraged for machines that offer high efficiency, durability, and precise granulation. Manufacturers are being urged to supply advanced, eco friendly, and high performance equipment. Distribution through industrial suppliers, manufacturing units, and service providers is being optimized. Research in automation, energy efficiency, and process improvement is being conducted. Expansion of precision manufacturing, industrial upgrades, and quality control measures are considered essential drivers of the granulator machines market in Germany.

The granulator machines market in the United Kingdom is projected to grow at a CAGR of 4.8%, driven by demand from pharmaceutical manufacturing, chemical processing, and small scale food industries. Adoption is being promoted for machines that ensure operational reliability, efficiency, and consistent output. Manufacturers are being encouraged to supply cost effective, durable, and advanced solutions. Distribution through industrial suppliers, process plants, and equipment dealers is being optimized. Pilot programs and industrial demonstrations are being conducted to highlight machine efficiency and reliability. Expansion of pharmaceutical production, chemical processing, and small scale industries are recognized as key factors driving the granulator machines market in the United Kingdom.

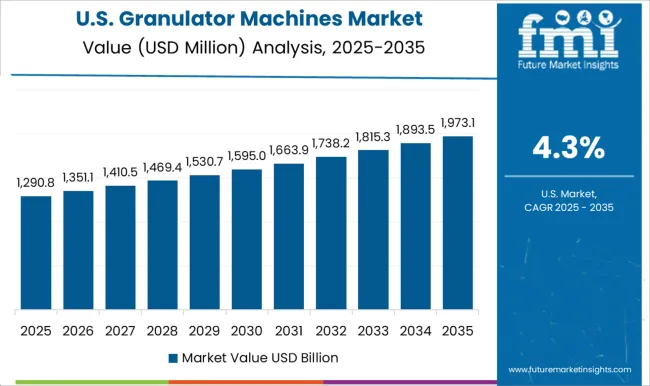

The granulator machines market in the United States is expected to grow at a CAGR of 4.3%, influenced by adoption in pharmaceutical production, chemical manufacturing, and food processing operations. Adoption is being encouraged for machines that provide high precision, reliability, and energy efficiency. Manufacturers are being urged to supply technologically advanced, durable, and cost effective equipment. Distribution through industrial suppliers, process facilities, and service providers is being maintained. Research in automation, particle size control, and energy saving processes is being pursued. Expansion of industrial production, adoption of automated processes, and emphasis on consistent output are considered major drivers of the granulator machines market in the United States.

The granulator machines market is dominated by a range of prominent suppliers providing high-performance equipment for plastic, pharmaceutical, and chemical processing industries. Companies such as Allpack, Cumberland, and Fluid Air are recognized for their reliable granulation systems, offering precise particle size reduction and efficient material handling. Freund-Vector and GEA provide innovative granulators with advanced features, ensuring consistency, productivity, and energy efficiency in processing operations. Getecha and Glatt are also key contributors, delivering specialized solutions for wet and dry granulation processes in diverse industrial applications.

Other significant market players include GlobePharma, Levstal, and Rapid Granulator, offering equipment designed for continuous production, high throughput, and ease of maintenance. ServoLiFT, THM Recycling Solutions, and Vaner Machinery contribute with environmentally sustainable and automated granulation solutions that meet modern industrial standards. These suppliers focus on enhancing operational efficiency, reducing material waste, and improving overall production output. Additionally, companies like Wittmann and Xertecs strengthen the market by providing highly customizable granulation systems suitable for small-scale to large-scale industrial requirements.

Their solutions integrate advanced control systems, modular designs, and safety features, enabling manufacturers to achieve precision and consistency across various materials. Collectively, these suppliers play a crucial role in advancing the granulator machines market by offering durable, efficient, and innovative equipment, supporting the growing demand across multiple sectors including plastics, pharmaceuticals, and food processing industries. Their continuous innovation and technological advancements ensure that the market remains competitive and responsive to evolving industrial needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 billion |

| Machine Type | High shear granulators, Oscillating granulators, Vibrating granulators, Rotary drum granulators, Roller compactor granulators, and Others (disc pan granulator etc.) |

| Type | Wet granulators and Dry granulators |

| Mode of Operation | Fully automatic, Manual, and Semi-automatic |

| Capacity | Above 1500 Kg/hr, Below 500 Kg/hr, 500 to 1000 Kg/hr, and 1000 to 1500 Kg/hr |

| End Use Industry | Pharmaceutical, Chemical, Food industry, Plastic industry, Recycling industry, and Others (cosmetics industry etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allpack, Cumberland, Fluid Air, Freund-Vector, GEA, Getecha, Glatt, GlobePharma, Levstal, Rapid Granulator, ServoLiFT, THM recycling solutions, Vaner Machinery, Wittmann, and Xertecs |

| Additional Attributes | Dollar sales vary by machine type, including single-shaft, twin-shaft, and cutting mill granulators; by application, such as plastic recycling, pharmaceutical, food processing, and chemical industries; by end-use, spanning manufacturing units, recycling companies, and processing plants; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising recycling initiatives, demand for size reduction, and efficient material processing. |

The global granulator machines market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the granulator machines market is projected to reach USD 4.3 billion by 2035.

The granulator machines market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in granulator machines market are high shear granulators, oscillating granulators, vibrating granulators, rotary drum granulators, roller compactor granulators and others (disc pan granulator etc.).

In terms of type, wet granulators segment to command 61.4% share in the granulator machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Sulfur Palletized Plant And Granulator Market

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA