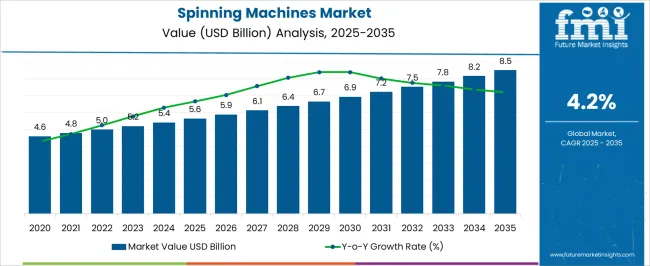

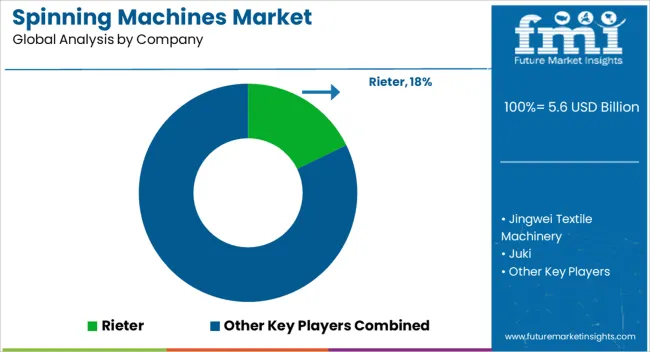

The spinning machines market is set to grow from USD 5.6 billion in 2025 to USD 8.5 billion by 2035, with a CAGR of 4.2%. An acceleration and deceleration pattern analysis reveals steady but fluctuating growth. Between 2025 and 2030, the market increases from USD 5.6 billion to USD 7.2 billion, adding USD 1.6 billion with a CAGR of 5.3%. This initial phase sees strong growth as demand rises for more efficient and technologically advanced spinning machines in industries such as textiles, automotive, and other industrial applications. Innovations such as automation, energy efficiency, and improved production capabilities fuel this acceleration. From 2030 to 2035, the market continues its growth, moving from USD 7.2 billion to USD 8.5 billion, contributing USD 1.3 billion in incremental growth, with a slightly lower CAGR of 3.4%. This phase shows a deceleration in growth, likely due to the maturation of the market and the widespread adoption of existing technologies. The slower growth is a reflection of the market stabilizing, as most major manufacturers have integrated advanced spinning machinery into their production lines. The overall acceleration and deceleration pattern demonstrates an initial phase of strong growth, followed by a more gradual increase as the market matures and adoption stabilizes.

| Metric | Value |

|---|---|

| Spinning Machines Market Estimated Value in (2025 E) | USD 5.6 billion |

| Spinning Machines Market Forecast Value in (2035 F) | USD 8.5 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The spinning machines market is experiencing sustained momentum, supported by rapid modernization in textile manufacturing, increasing labor cost optimization, and automation across fiber-to-yarn production lines. With rising demand for high-quality yarn and productivity optimization, manufacturers are transitioning to integrated spinning lines capable of reducing waste and energy consumption.

Government-backed textile cluster development, especially in Asia-Pacific regions, is accelerating equipment replacement cycles and technology upgrades. Additionally, export-driven growth in synthetic and blended yarns is driving demand for spinning systems that offer higher efficiency, quality consistency, and compatibility with new fiber blends.

The focus on reducing downtime, enhancing spindle speed, and automating manual tasks is expected to underpin long-term growth, particularly in cost-sensitive and volume-driven markets.

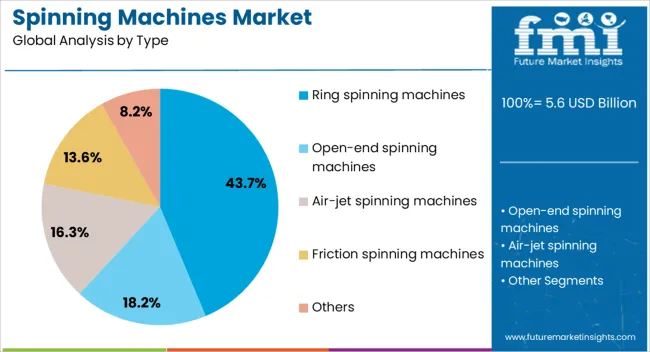

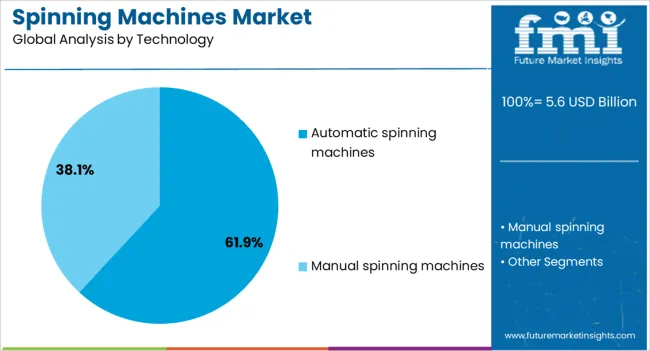

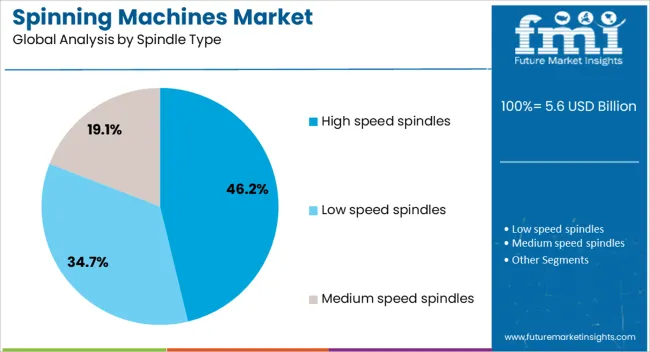

The spinning machines market is segmented by type, technology, spindle type, distribution channel, and region. By type, the market is divided into ring spinning machines, open-end spinning machines, air-jet spinning machines, friction spinning machines, and others. In terms of technology, it is classified into automatic spinning machines and manual spinning machines. Based on spindle type, the market is segmented into high-speed spindles, medium-speed spindles, and low-speed spindles. By distribution channel, the market is categorized into offline and online. Regionally, the spinning machines industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ring spinning machines are expected to hold 43.70% of the total market revenue in 2025, making them the leading machine type. This dominance is attributed to the high-quality yarn output, versatility across natural and synthetic fibers, and widespread adoption in textile mills globally.

Ring spinning technology is favored for its ability to produce fine, strong, and uniform yarns, which is essential for apparel and technical textile applications. The adaptability of these machines to both coarse and fine yarn production has reinforced their continued use despite the emergence of newer alternatives.

Investments in modern ring spinning systems with automated doffing and real-time monitoring have enhanced operational productivity, further supporting segment growth in both emerging and developed markets.

Automatic spinning machines are projected to contribute 61.90% of the market revenue in 2025, making this the leading technology segment. Growth in this segment is driven by the industry’s focus on reducing human intervention, minimizing operational errors, and ensuring consistent yarn quality.

These machines offer higher throughput, better energy efficiency, and improved maintenance protocols through digital integration. Integration of intelligent controls and remote diagnostics has helped textile producers respond quickly to production anomalies while optimizing machine uptime.

Additionally, as textile manufacturers face labor shortages and stricter quality benchmarks, automatic spinning machines have become the preferred investment for facilities targeting high-volume and export-grade production.

High speed spindles are forecast to command 46.20% of the total spindle type revenue share in 2025, establishing them as the dominant spindle segment. Their rise is closely linked to the demand for high-throughput operations, reduced cycle times, and improved yarn strength across spinning processes.

These spindles support enhanced rotational speeds while minimizing vibration and heat generation, resulting in higher productivity without compromising on yarn uniformity. Adoption is also being encouraged by innovations in spindle bearing systems, drive optimization, and compatibility with lightweight, energy-efficient materials.

As spinning mills focus on increasing output per unit footprint and lowering operational costs, high speed spindles are expected to remain central to performance upgrades in both new installations and retrofit projects.

The spinning machines market is expanding due to increasing demand from the textile industry for high-efficiency machinery that can produce high-quality yarns. These machines are vital for the production of fabrics, textiles, and other materials used in various applications, including clothing, home textiles, and industrial fabrics. Technological advancements, including automation and digitalization, are enhancing the productivity and performance of spinning machines. Despite challenges such as high operational costs and maintenance, the market presents opportunities in emerging economies, where the textile industry is experiencing significant growth.

The growth of the spinning machines market is largely driven by the increasing need for high-quality, efficient textile production. The textile industry’s demand for advanced machinery to produce finer, stronger, and more durable yarns is leading to greater adoption of spinning machines. Automation and digital technology integration in these machines help increase operational efficiency, reduce downtime, and lower labor costs. Additionally, the increasing consumption of textiles in emerging markets, combined with the rise in demand for premium fabrics in developed countries, is further driving the need for advanced spinning machines. These trends push manufacturers to invest in innovation, improving machine performance and meeting consumer demand for superior textiles.

A significant challenge in the spinning machines market is the high capital investment required for the purchase and installation of advanced spinning equipment. These machines involve complex technology and require substantial financial resources, making them less accessible for small and medium-sized textile manufacturers. Regular maintenance is essential for ensuring optimal machine performance, but maintenance costs can be high, particularly for advanced systems with specialized components. Manufacturers must also address issues such as energy consumption and machine downtime, which can affect overall profitability. Balancing the upfront costs and ongoing maintenance expenses is critical for companies operating in the highly competitive textile sector.

The spinning machines market offers substantial growth opportunities through technological advancements. The integration of automation, artificial intelligence (AI), and real-time monitoring systems is enhancing the performance and efficiency of spinning machines. These innovations help optimize production processes, reduce waste, and improve yarn quality, driving the adoption of advanced machines. The expansion of the textile industry in emerging markets, particularly in Asia and Africa, presents an opportunity for increased demand for spinning machinery. As textile production increases in these regions, the need for efficient, high-quality machines will rise, offering new avenues for growth. Companies that can provide cost-effective, advanced spinning solutions are well-positioned to benefit from this trend.

A key trend in the spinning machines sector is the increasing adoption of automation and digital integration. Modern spinning machines are being equipped with digital controls and automated systems that allow for real-time monitoring, remote diagnostics, and production optimization. Automation enhances productivity by reducing manual labor, improving consistency, and ensuring higher quality output. Additionally, digital tools such as IoT-based sensors enable manufacturers to monitor machine performance, detect issues early, and streamline maintenance processes. The focus on energy efficiency and sustainability is also driving the development of spinning machines with lower energy consumption and minimal waste. These trends are reshaping the market by making spinning machines more efficient, intelligent, and aligned with industry 4.0 principles.

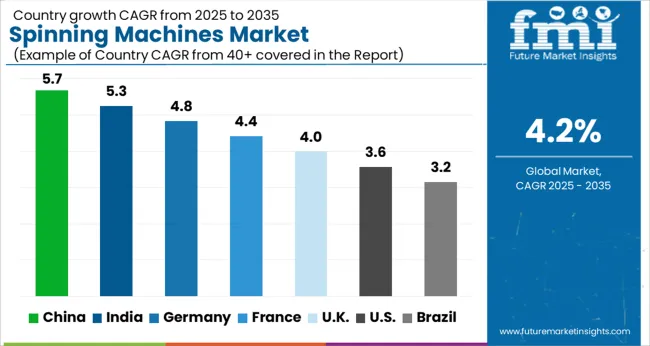

The spinning machines market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads at 5.7%, followed by India at 5.3%, and Germany at 4.8%. The United Kingdom records 4.0%, while the United States stands at 3.6%. The market’s growth is supported by expanding textile industries in emerging economies like China and India, where demand for automated and high-performance spinning machines is increasing. In developed economies such as Germany, the UK, and the USA, growth is driven by the need for advanced machinery to increase efficiency and reduce manufacturing costs in the textile sector. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 5.7% through 2035, owing to its dominant position in global textile production. The country’s manufacturing capacity in the textile industry continues to expand, contributing to an increased demand for spinning machines. As China moves toward high-tech, automated textile production, spinning machines with advanced capabilities are gaining popularity. The shift towards synthetic fiber production, along with investments in modernizing the textile industry, further fuels market growth. The strong export market for Chinese textiles also drives the need for efficient, high-performance spinning machinery.

India is expected to grow at a CAGR of 5.3% through 2035, driven by the country's expanding textile industry and rising demand for high-quality fabrics. India is one of the world’s largest textile producers, and with the increasing demand for advanced textile machinery, the market for spinning machines continues to grow. The demand for synthetic fibers, along with India’s focus on modernizing its textile manufacturing sector, contributes significantly to market growth. Furthermore, the government’s "Make in India" initiative encourages domestic production of textile machinery, which is expected to boost the adoption of spinning machines in the coming years.

Germany is projected to grow at a CAGR of 4.8% through 2035, supported by the country’s robust textile and manufacturing sectors. Known for its engineering prowess, Germany’s textile machinery market is driven by the adoption of state-of-the-art spinning machines. The demand for high-quality, precision-engineered machinery in both natural and synthetic fiber production is expected to grow. Additionally, Germany’s focus on automation and efficiency in industrial manufacturing, including the textile industry, promotes the adoption of spinning machines that enhance productivity and reduce operational costs.

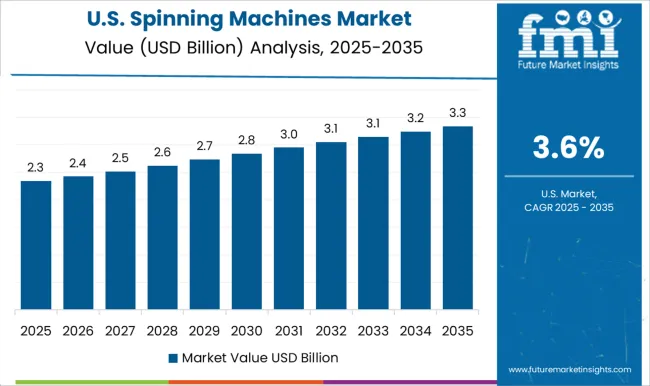

The United States is projected to grow at a CAGR of 3.6% through 2035, driven by the demand for advanced textile machinery. As the USA textile industry continues to modernize, the adoption of spinning machines with higher efficiencies and automated features is increasing. The rise in demand for high-quality fabrics in the fashion and industrial sectors pushes the growth of spinning machinery. Furthermore, technological advancements in machine designs, focusing on sustainability and reducing energy consumption, contribute to market expansion. The USA textile industry’s increasing focus on innovation and high-end textiles supports this trend.

The United Kingdom is projected to grow at a CAGR of 4.0% through 2035, with steady demand coming from the textile and fashion industries. The UK has a well-established textile sector, which is increasingly adopting advanced spinning machines to enhance productivity and reduce costs. The growth of the synthetic fiber market and the UK’s focus on developing eco-friendly textiles further contribute to the demand for high-performance spinning machines. The country’s investment in automation and innovation in textile machinery supports the continued growth of the spinning machines market.

The spinning machines market is led by global players offering advanced machinery for yarn production in the textile industry. Rieter is a market leader, providing cutting-edge spinning technology that emphasizes energy efficiency, precision, and automation. Jingwei Textile Machinery and Lakshmi Machine Works are key competitors, specializing in high-performance spinning machines that cater to both natural and synthetic fiber processing. Juki and Marzoli Machines Textile are known for their focus on innovation in ring spinning, open-end spinning, and air-jet spinning systems, providing tailored solutions for yarn manufacturers. Muratec and Picanol are significant players in the weaving and spinning equipment segments, offering machines with enhanced flexibility and speed.

Saurer and Savio Macchine Tessili focus on providing spinning equipment with robust automation and integration capabilities for modern textile mills. Schlafhorst and Shima Seiki bring expertise in spinning and knitting technologies, offering high-tech machinery for premium yarns and fabrics. TMT Machinery and Toyota Industries provide advanced solutions for industrial-scale yarn production with a focus on energy efficiency and high-speed operations. Trützschler and Zinser specialize in offering high-quality spinning machines with integrated systems for fiber preparation, spinning, and yarn packaging. Competitive differentiation in this market is driven by machine efficiency, technological innovation, automation capabilities, and sustainability in production. Barriers to entry include high capital investment, complex technology requirements, and established customer loyalty. Strategic priorities include expanding automation, enhancing energy-saving features, and exploring digital solutions for improved process control and optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Ring spinning machines, Open-end spinning machines, Air-jet spinning machines, Friction spinning machines, and Others |

| Technology | Automatic spinning machines and Manual spinning machines |

| Spindle Type | High speed spindles, Low speed spindles, and Medium speed spindles |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rieter, Jingwei Textile Machinery, Juki, Lakshmi Machine Works, Marzoli Machines Textile, Muratec, Picanol, Saurer, Savio Macchine Tessili, Schlafhorst, Shima Seiki, TMT Machinery, Toyota Industries, Trützschler, and Zinser |

| Additional Attributes | Dollar sales by machine type (ring spinning, air-jet spinning, open-end spinning) and end-use segments (textile, apparel, technical fabrics). Demand dynamics are driven by the need for high-speed, energy-efficient spinning machines. Regional trends show growth in Asia-Pacific due to manufacturing hubs, with innovation focusing on automation, process optimization, and energy-saving features. Environmental considerations include reducing energy consumption and improving material recyclability. |

The global spinning machines market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the spinning machines market is projected to reach USD 8.5 billion by 2035.

The spinning machines market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in spinning machines market are ring spinning machines, open-end spinning machines, air-jet spinning machines, friction spinning machines and others.

In terms of technology, automatic spinning machines segment to command 61.9% share in the spinning machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Granulator Machines Market Size and Share Forecast Outlook 2025 to 2035

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA