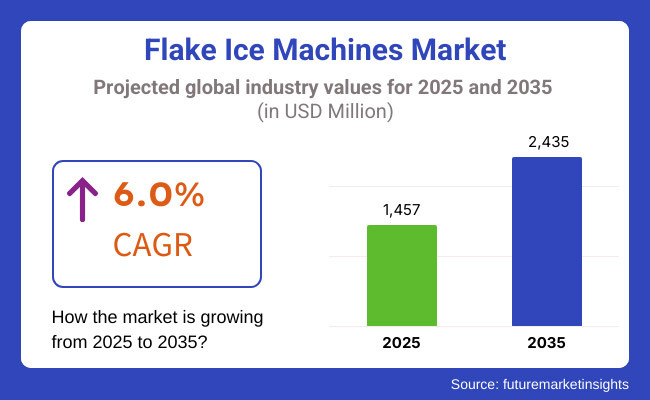

The flake ice machines market is expected to witness steady growth between 2025 and 2035, driven by increasing demand across various industries such as food processing, healthcare, sports, and construction. The market was valued at USD 1,457 million in 2025 and is projected to reach USD 2,435 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The flake ice machines market is set to see many trends as per the top market report. Flake ice machines are widely used for seafood preservation, meat processing, and cooling in the food processing industry. Moreover, the increasing requirement for temperature control systems in end-use industries, especially in the healthcare sector is accelerating the market growth.

Moreover, use of flake ice is intended for concrete cooling in the construction industry while snow-based sports activities require them. The emerging technologies such as improved refrigeration and energy-efficient cooling methods to enhance the efficiency of the product are further contributing to the market growth.

There are some challenges facing the market though amid the positive perspective. The high upfront capital and maintenance costs associated with flake ice machines can be a barrier to adoption, particularly for small businesses.

Additional challenges arise from shifts in raw material pricing and scrutiny over energy usage. Yet, market players are concentrating on producing economical and eco-friendly solutions to overcome these challenges. The growing adoption of smart and automated ice-making technologies is expected to create new growth opportunities for manufacturers in the coming years.

Energy efficiency, sustainability, and cooling solutions for specific industries are gaining traction among ice machine providers, and these trends are expected to contribute to the growth of flake ice machines market.

The market is expected to exhibit steady growth over the forecast period, aided by the growing application area across various sectors and new ice making technologies being developed. Moreover, escalating investments in research and development for the advanced refrigeration techniques and automated ice production will fuel the growth of the ice machines market across the globe.

The flake ice machines market in North America is expected to grow owing to the emerging applications for concrete cooling, seafood processing, and various applications in the healthcare sector that have driven the consumption of flake ice machines in the region. The USA and Canada are the primary markets owing to strict regulations related to food preservation and demand for effective cooling solutions in construction industry.

Market growth is further driven by technological advancements in energy-efficient and eco-friendly ice-making machines. But high upfront investment costs and maintenance needs are barriers to broad adoption. Focus on new cooling technologies and automation to achieve efficiency and cut operational costs by manufacturers.

Europe is a major market for flake ice machines in Germany, France, and the UK, where stringent food safety rules and sustainability initiatives fuel demand. Reliable ice production is crucial for the region's seafood industry, hospitality business, and industrial applications.

An ever-increasing focus on energy efficiency and green refrigerants is driving manufacturers to create flake ice machines that meet stringent European regulations. But high electricity prices and worries over carbon emissions present hurdles. To this end, companies are introducing smart ice machine technologies and alternative refrigerants in line with the region’s sustainability mandates.

Flake ice machine are anticipated to grow at fast segment in Asia-Pacific attributed to rapid industrialization, growing seafood exports, and growing demand in food processing and healthcare. The fast adoption of temperature control solutions in different applications is leading to high adoption rates in countries like China, Japan, India, and South Korea.

The booming hospitality and tourism industries in the region further propel market growth, especially in coastal areas with high seafood consumption. The market expansion is adversely impacted by the inconsistent power supply and cost-prohibitive bottlenecks in developing countries. To tackle these issues, manufacturers are rolling out economical, frugal power models designed around regional requirements, as well as creating localized production plants to improve distribution networks.

Challenges

High Initial Investment and Maintenance Costs

The up-front investment required for flake ice machines limits its accessibility for small-scale businesses. Refrigeration systems, compressors, and evaporators are complex systems that entail high maintenance and operational costs, particularly in stringent sectors like food processing and healthcare. Moreover, electricity tariff fluctuations, along with stringent refrigerant regulations, challenge operational efficiency and lead manufacturers to create energy-efficient, economical offerings.

Opportunities

Rising Demand from the Food Processing and Healthcare Sectors

The rising demands of flake ice for food bust preservation, seafood storage, and proper medical applications are expected to expand the market for flake ice. There are lucrative opportunities for global expansion of cold chain logistics, rapid urbanization, and demand for fresh food storage solutions.

Moreover, advancements in energy-efficient cooling systems, environmentally friendly refrigerants, and intelligent ice-making technologies will promote the adoption of the market in various industries such as concrete cooling, recreational facilities, and biomedical research.

From 2020 to 2024, steady growth in the flake ice machines market was reflected in expanding food supply chains, increasing healthcare investments, and growth in commercial refrigeration. Nonetheless, factors such as high-operational costs, refrigerant phase-out regulations, and supply chain disruptions prevented the widespread adoption. This prompted manufacturers to work on smaller, more energy-efficient models, complete with smart automation features for better usability and efficiency.

2025 to 2035 Forecast market - more adoption of green refrigerants, AI-based optimization of ice production and modular ice machines. Over time, smart refrigeration solutions, solar-powered ice machines, and more use in industrial cooling applications will help to transform the industry yet again.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter regulations on CFC and HCFC refrigerants |

| Technological Advancements | Growth of automated ice-making systems |

| Industry Adoption | Expansion in food and beverage storage |

| Supply Chain and Sourcing | Dependence on refrigerant imports |

| Market Competition | Dominated by large-scale refrigeration companies |

| Market Growth Drivers | Demand for cold chain logistics |

| Sustainability and Energy Efficiency | Initial adoption of energy-saving models |

| Consumer Preferences | Need for high-capacity, low-maintenance machines |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of eco-friendly, low-GWP refrigerants |

| Technological Advancements | AI-powered, energy-efficient flake ice machines |

| Industry Adoption | Increased use in concrete cooling, medical, and biotech |

| Supply Chain and Sourcing | Diversification of refrigerant sources and local production |

| Market Competition | Entry of tech-driven start-ups and modular system providers |

| Market Growth Drivers | Smart refrigeration, automation, and sustainable solutions |

| Sustainability and Energy Efficiency | Solar-powered and AI-optimized ice-making systems |

| Consumer Preferences | Shift towards eco-friendly, smart-connected ice solutions |

This is mainly because the food processing industry, healthcare sector, and concrete cooling business also use flake ice machines, making the United States a fast-growing market. The market is positively influenced by the propelling application of flake ice in seafood preservation and medical usage.

The growth is further driven by technological advancements in ice-making technology coupled with presence of leading manufacturers. Demand is also supported by the hospitality and tourism sector, especially for hotels and restaurants that require efficient cooling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The UK flake ice machines market is at a steady growth due to its pressure in demand for efficient cooling solutions across various applications and industry. The food processing and preservation industry continues to be a significant end-user segment, with companies looking for energy-efficient and eco-friendly technologies for ice-making.

In addition, flake ice is increasingly being adopted by medical facilities and supermarkets, thus augmenting growth of the market. The rising demand for advanced technologies in the ice machine market is also influenced by government initiatives that encourage energy efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

In industries such as healthcare, hospitality, and food processing, flake ice machines are increasingly penetrating into the European Union. High demand for efficient ice-making solutions for Deutschland, France, and Spain are pushing the market. Moreover, government support for energy-efficient appliances and sustainability initiatives is propelling the market growth. The growing seafood processing industry and cold chain logistics industry in the region is also driving the flake ice machine market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The public hospitals and needs in medical and seafood processing, as well as beverage industries are driving the growth of flake ice machines in Japan. A focus on tech and on automation is resulting in high-efficiency ice machines with smart controls in the country.

Moreover, the well-established seafood industry of Japan is also dependent on the use of flake ice for transportation and preservation, which is another factor driving the market growth. Growing usage of convenience stores along with supermarkets is also adding to the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Booming food processing and healthcare industries are creating demand for flake ice machines in South Korea. Flake ice is widely used in cosmetic procedures, industrial applications, and event catering, which is expected to boost the growth rate of the market over the forecast period.

Moreover, the country's push for energy-efficient and sustainable solutions has resulted in innovations in the ice-making technologies. The market is also projected to be driven by stringent government regulations encouraging the adoption of environmentally friendly appliances.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Flake ice machines market is a self-expanding market and is expected to achieve high growth in the forecast period. Flake ice machines are used extensively in activities that maintain preservation, temperature control and operational efficiency in industry.

These machines create soft, malleable pieces of ice in the form of flakes, making them easier to disperse for superior cooling and ideal for the food processing, medical, concrete cooling and mining applications.

Advancements in the flake ice machine technology are being driven by the growing focus on energy efficient, automatic and sustainable flake ice machines. Industries are searching for increased cooling efficiency and low-cost operations, thus the adoption of flake ice machines is expected to grow rapidly in many industries.

Based on the application segment, the food processing and medical facilities segment dominate the market share owing to their high demand for effective cooling and preservation solutions. Flake ice is widely used in food processing for preserving seafood, meat, dairy and other perishable food products.

Flake ice is soft and moldable, enabling even coverage on food surfaces that minimizes the growth of pathogenic bacteria and helps keep foods fresh. Flake ice is widely used in seafood processing plants for the storage of fish and shellfish to extend the shelf life and improve the quality of the product.

Flake Ice machines are also used in bakeries, beverage manufacturers, and poultry processing plants to keep a hygienic environment and preserve the storage temperature. On the other hand, the growing consumption of processed and frozen foods and rising food safety regulations, are expected to bring new growth opportunities for the flake ice machines in the food industry.

These are also a major market segments for flake ice machines in Fluids (Medical Facilities ,hospitals, laboratories, pharmaceutical manufacturing units). Flake ice is used extensively in hospitals for therapeutic applications, surgical cooling, and specimen preservation.

Flake ice is used in laboratories and research facilities for preserving biological specimens, blood, and vaccines at proper temperature. In addition to that, pharmaceutical manufacturers also rely on flake ice to keep certain cooling conditions during production and storage of medicines.

With the burgeoning growth and demand for the right cooling solutions in the medical sector ensuring the flake ice machines market witness a steep growth during the forecast period. Food processing and medical facilities are expected to be the contributors resisting the flake ice machines market as the focus grows on food safety and the healthcare industry progresses.

In terms of cooling methods, the water-cooled flake ice machines are earning popularity as these devices consumes low amount of energy and can work efficiently in harsh environmental conditions.

Devices that create flake ice, are water-cooled, and the likes provide good performance in any industrial and commercial situations even if the atmosphere is too hot. These machines employ a water-based cooling method which increases the ability of producing ice with low energy consumption.

Water-cooled systems are the first choice for industries such as seafood processing, mining, and concrete cooling projects due to their reliability, consistent performance, and comparatively less heat output. Moreover, these machines are more popular in the areas with the high ambient temperature, where the air cooled system may face operating difficulties.

In contrast, air-cooled flake ice machines continue to be the more popular option for places where there is not enough water. These machines use fans to disperse heat and provide a low-cost cooling solution for small- and mid-scale applications. Air-cooled systems are more portable and easier to install but have lower efficacy when dealing with high heat in hotter climates, making them often ill-suited for a high volume industrial operations.

Owing to the sustainable and high-efficiency cooling solutions offered by water-cooled flake ice machines, adoption of water-cooled flake ice machines is likely to grow across various end-use industries, particularly in large-scale commercial and food processing industries in all parts of the world.

Flake ice machines market shows the existing status of the industry, market by the end user, and by region. From even cooling to better food preservation and industrial applications, flake ice machines are the best choice to use in different domains. Both companies are working to advance technology, support energy efficiency initiatives, and grow to meet the global increase in both consumer and industrial utilization.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hoshizaki Corporation | 18-22% |

| Scotsman Ice Systems | 15-19% |

| Manitowoc Ice | 12-16% |

| Ice-O-Matic | 10-14% |

| Other Companies (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hoshizaki Corporation | Develops advanced flake ice machines with high energy efficiency and consistent ice quality. |

| Scotsman Ice Systems | Specializes in industrial-grade flake ice machines with smart monitoring and water-saving technology. |

| Manitowoc Ice | Provides high-capacity flake ice solutions for food processing and healthcare applications. |

| Ice-O-Matic | Focuses on compact, high-efficiency ice machines, catering to hospitality and sports industries. |

Key Company Insights

Hoshizaki Corporation (18-22%)

The companies covered in the flake ice machines market report are Hoshizaki Corporation, Ice-O-Matic, Manitowoc Ice, and other key market players. Its commitment to sustainable ice production, improved cooling technologies, and reliability have helped it gain a foothold in the global marketplace. Now an industry giant, Hoshizaki continues to keep the momentum going through constant investment in R&D, and expansion into third world countries.

Scotsman Ice Systems (15-19%)

Tried-and-tested Scotsman Ice Systems is a leader in ice machine innovation, and its flake ice machines are some of the toughest and most efficient in the business. We have also strengthened company competitive position in the market through our commitment to water conservation, self-monitoring ice solutions, and industrial grade solutions.

Manitowoc Ice (12-16%)

Manitowoc Ice is a dedicated leader in high-performance flake ice machines for demanding food service, healthcare and industrial cooling applications. It continues to grow its market share with the emphasis on automation and sustainable designs.

Ice-O-Matic (10-14%)

Specifically serving restaurants, bars, and sports facilities, Ice-O-Matic provides compact, energy-efficient flake ice solutions. The company has carved its niche in the market with a robust distribution network and focus on affordable, high-quality solutions.

Other Main Participants (35-45% Combined)

The flake ice machines market is fairly competitive and occupied by many market leaders as well as emerging market players who are emphasizing on R&D, innovative cooling solutions, and their product portfolio expansion. Key players include:

The overall market size for the flake ice machines market was USD 1,457 million in 2025.

The flake ice machines market is expected to reach USD 2,435 million in 2035.

The demand for flake ice machines is expected to rise due to increasing demand across various industries such as food processing, healthcare, sports, and construction.

The top five countries driving the development of the flake ice machines market are the USA, Germany, China, Japan, and India.

Air-cooled flake ice machines and water-cooled flake ice machines are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Cooling Method, 2023 to 2033

Figure 28: Global Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Cooling Method, 2023 to 2033

Figure 58: North America Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Cooling Method, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Cooling Method, 2023 to 2033

Figure 118: Europe Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Cooling Method, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: MEA Market Attractiveness by Application, 2023 to 2033

Figure 177: MEA Market Attractiveness by Cooling Method, 2023 to 2033

Figure 178: MEA Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 179: MEA Market Attractiveness by End User, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flakes Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Flake Graphite Market

Flaked Shortening Market

Deflaker Market Growth – Trends & Forecast 2024-2034

Pea Flakes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pea Flakes Manufacturers

Yeast Flakes Market

Potato Flakes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Barley Flake Market Size and Share Forecast Outlook 2025 to 2035

Banana Flakes Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Potato Flakes Industry

Competitive Landscape of Edible Flakes Providers

Cereal Flake Market

UK Potato Flakes Market Report – Growth, Demand & Forecast 2025-2035

USA Potato Flakes Market Growth – Innovations, Trends & Forecast 2025-2035

ASEAN Potato Flakes Market Report – Growth, Demand & Forecast 2025-2035

Europe Potato Flakes Market Trends – Demand, Innovations & Forecast 2025-2035

Australia Potato Flakes Market Trends – Growth, Demand & Analysis 2025-2035

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Latin America Potato Flakes Market Report – Demand, Growth & Industry Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA