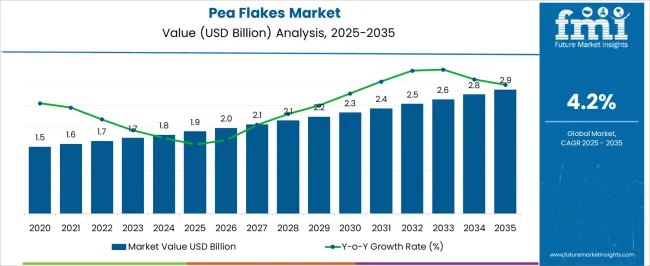

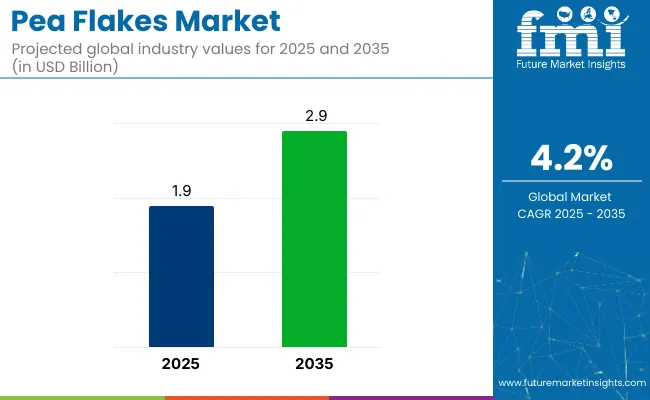

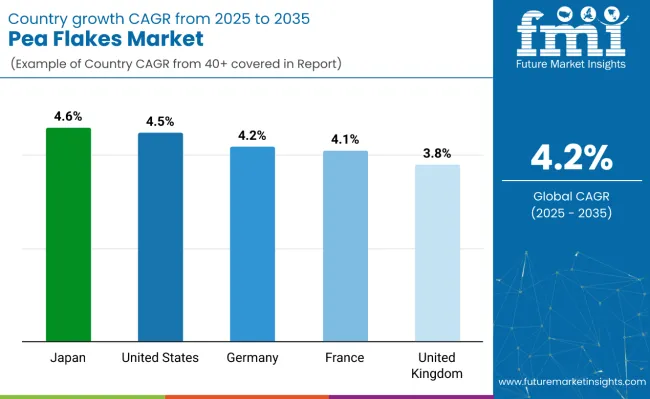

The global pea flakes market is valued at USD 1.9 billion in 2025 and is expected to reach USD 2.9 billion by 2035, reflecting a CAGR of 4.2%. Factors driving this growth include increasing awareness of the health benefits associated with pea flakes, their high nutritional content, and their growing adoption in both food products and pet food.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.9 billion |

| Projected Value (2035F) | USD 2.9 billion |

| CAGR (2025 to 2035) | 4.2% |

The rise in health-conscious consumers opting for plant-based proteins and natural ingredients has significantly impacted the market. Moreover, the pet food industry's increasing demand for high-protein additives is expected to fuel market growth.

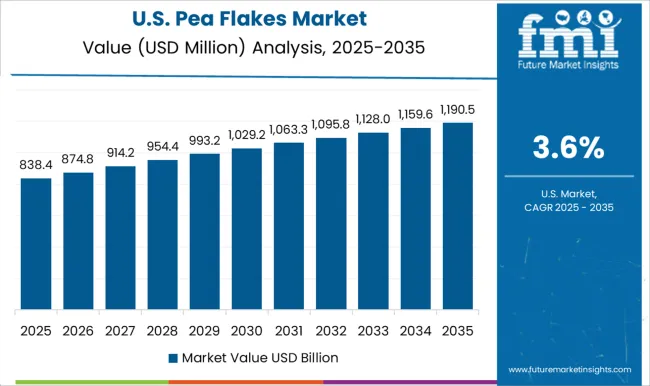

The North American region is expected to hold the largest market share,with the USA expected to continue to be the largest consumer of pea flakes due to the growing demand for healthy food and pet food products, growing 4.5%.

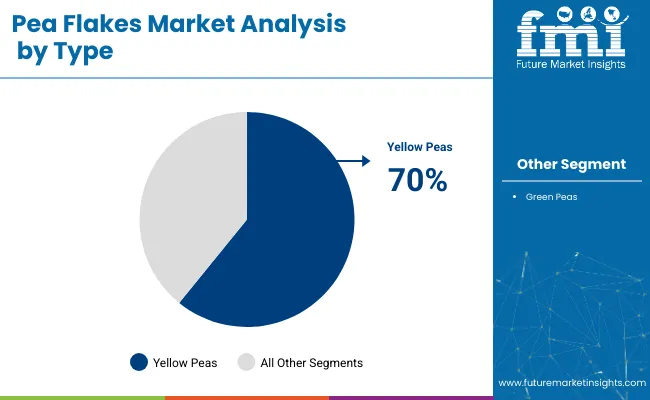

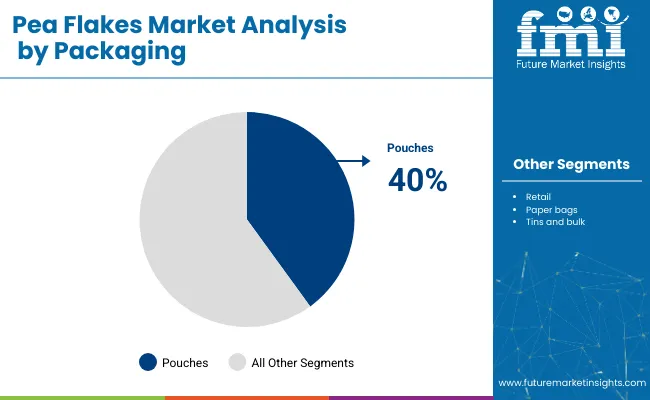

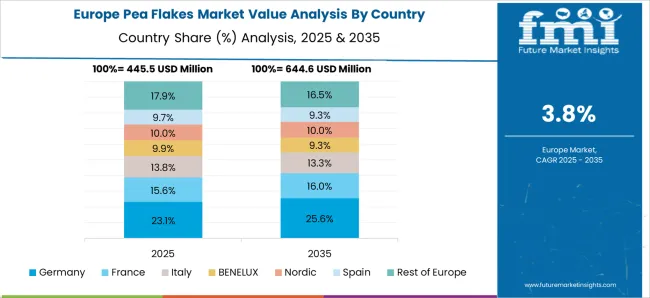

Meanwhile, Japan and Germany are anticipated to register the fastest growth with CAGRs of 4.6% and 4.2% respectively. By type, yellow peas are expected to lead with 70% of the market share. Meanwhile, Pouches by packaging type account for 40% of the market share in 2025.

The market holds a modest yet growing share across its parent markets. It accounts for approximately 6.2% of the plant-based protein market, reflecting its emerging role as a clean-label protein source. Within the pulse ingredients market, it captures around 7.8% share due to its high fiber and nutrient content.

In the broader functional food ingredients market, pea flakes hold about 3.4%, largely used in health-focused snacks and cereals. The market secures roughly 4.6% in the plant-based food market, driven by vegan trends. In the snack ingredients segment, its share is about 5.1%, supporting clean, high-protein snacking options.

The way forward for the pea flakes market includes a growing focus on sustainability and innovation. Manufacturers are increasingly incorporating organic and non-GMO claims into their products to attract health-conscious consumers.

Furthermore, government regulations on healthy food and nutrition are expected to play a significant role in shaping the market. As demand for plant-based proteins rises, manufacturers are expected to enhance their product offerings, focusing on clean-label and transparent production methods to meet the evolving preferences of consumers.

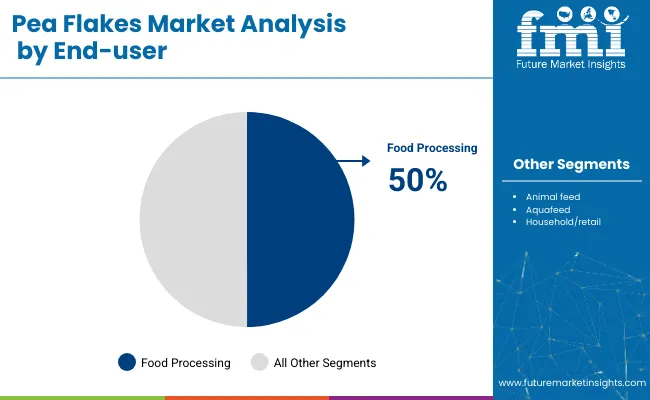

The market can be segmented based on various factors, including nature, type, end-user, packaging, distribution channel, and region. By nature, it is segmented into organic and conventional. By type, it is divided into yellow peas and green peas. By end-user, it is segmented into food processing, animal feed, aqua feed, and household/retail.

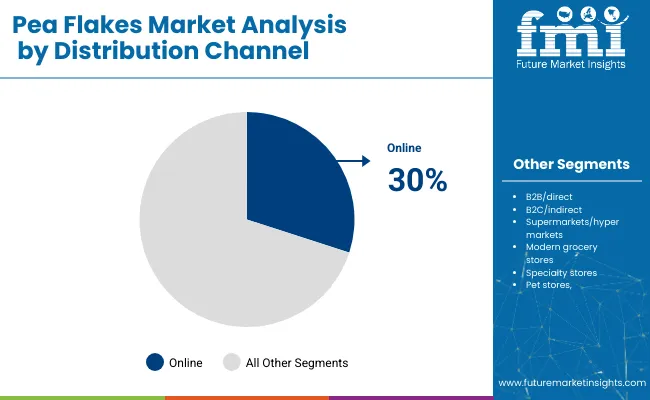

By packaging, it is segmented into retail, pouches, paper bags, tins and bulk. By distribution channel, it includes B2B/direct, B2C/indirect, supermarkets/hypermarkets, modern grocery stores, specialty stores, pet stores, and online retailers. By region, it covers North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, East Asia, and MEA - Middle East & Africa.

The conventional segment continues to hold a dominant position in the pea flake market, accounting for 75% of the total market share in 2025. This dominance is attributed to its cost-effectiveness, large-scale availability, and widespread use in commercial livestock feed, aquaculture, and bulk pet food formulations. Conventional pea flakes remain the preferred choice in price-sensitive markets due to minimal certification requirements and streamlined supply chains.

Yellow peas hold the largest share of 70% within the type segment, due to their higher nutritional value and popularity in protein-rich applications. Yellow peas are increasingly favored in pea flakes due to their higher protein content and superior digestibility. This has made them a staple in fitness and health-focused markets. Yellow pea flakes are also widely used in various food products, such as soups, salads, and snack foods, contributing to their dominant market position.

In the food processing segment, pea flakes are expected to dominate the end-user market with 50% of the market share. Their versatility as an ingredient in soups, salads, baked goods, and snacks contributes to this dominance. Increasing demand for healthy, plant-based ingredients in processed foods, especially those high in fiber and protein, is driving market growth.

Pouches will lead the packaging segment due to their convenience, portability, and cost-effectiveness, accounting for 40% of the market share. Pouches are ideal for retail and household applications, offering a flexible, lightweight option for packaging pea flakes. This packaging type is gaining popularity as it helps in extending shelf life and is eco-friendly, meeting the increasing demand for sustainable packaging solutions.

Online retailers are anticipated to capture the highest share of 30% in the distribution channel segment. E-commerce growth has fueled the rise of online shopping for food products, including pea flakes. The convenience of ordering online, coupled with the increasing availability of pea flakes through direct-to-consumer channels, makes online retail a preferred option.

Recent Trends in Pea Flakes Market

Challenges in the Pea Flakes Market

From 2025 to 2035, Japan is projected to lead the pea flakes market among the listed countries with the highest CAGR of 4.6%, driven by demand for protein-rich and functional foods. The USA follows closely with a CAGR of 4.5%, supported by a strong clean-label and plant-based movement.

Germany and France show steady growth at 4.2% and 4.1% respectively, fueled by sustainability and innovation in food processing. The UK records the lowest CAGR at 3.8%, although rising vegan trends and nutritional awareness are driving market interest. Overall, all five countries show positive momentum, with Asia slightly outpacing Western markets.

The revenue of pea flakes in the USA is projected to expand at a CAGR of 4.5% from 2025 to 2035. As the largest market for pea flakes, the USA is experiencing a surge in demand for plant-based ingredients due to rising health and sustainability concerns. Additionally, the growing preference for organic and non-GMO products is pushing the market forward. With a strong focus on fitness and clean-label foods, the USA remains a key player in the pea flakes market.

The pea flakes market in the UK is expected to grow at a CAGR of 3.8% from 2025 to 2035. The increasing focus on plant-based diets and sustainability has led to a rise in demand for pea flakes. Consumers are gravitating toward high-protein, fiber-rich foods as part of their daily diets. The UK government’s initiatives promoting plant-based eating habits and reducing carbon footprints are further supporting the growth of pea flakes in the market.

The sales of pea flakes in Germany are projected to flourish at a CAGR of 4.2% from 2025 to 2035. Germany is a leader in adopting sustainable and healthy food alternatives, and pea flakes are gaining traction among health-conscious consumers. The country's robust food processing industry contributes to the widespread use of pea flakes in various processed food products.

The revenue from pea flakes in France is anticipated to grow at a CAGR of 4.1% from 2025 to 2035. As a major consumer of plant-based ingredients, France is witnessing increased use of pea flakes in food and beverages, especially in plant-based snacks and vegan products. The growing trend towards natural and functional foods is driving demand for pea flakes.

The pea flakes market in Japan is predicted to rise at a CAGR of 4.6% from 2025 to 2035. Japan has seen significant growth in demand for healthy, protein-rich ingredients like pea flakes, particularly as part of its health-conscious and aging population. The market is being driven by the rise in functional foods and increasing awareness of plant-based proteins as a viable alternative to meat.

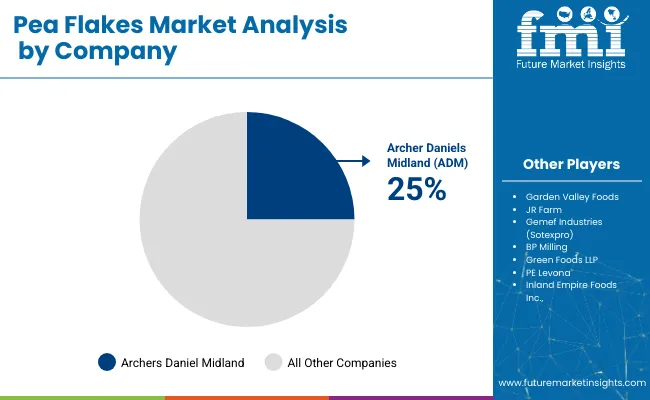

The pea flakes market is moderately fragmented, with numerous key players competing to capture a significant portion of the market. Companies such as Garden Valley Foods, JR Farm, Gemef Industries (Sotexpro), BP Milling, Green Foods LLP, and PE Levona are leading the way, focusing on sustainable production methods and diversifying their product portfolios to cater to the growing demand for plant-based, organic ingredients.

These suppliers are competing through product innovation, strategic partnerships, and expanding their geographical footprint to meet the increasing consumer demand for nutritious, eco-friendly products in both the food and pet food sectors.

Top companies in the pea flakes market are increasingly leveraging pricing strategies, cutting-edge product innovations, and expanding their production capacity to stay competitive. Additionally, partnerships and collaborations with food processing and pet food manufacturers are helping them enhance their market presence.

These companies are also investing in expanding their direct-to-consumer sales channels, particularly through e-commerce platforms, to tap into the growing demand for healthy and functional foods. Furthermore, firms like Danone and Nutiva Inc. are focusing on organic and non-GMO certifications to align with consumer preferences for clean-label products.

Recent Pea Flakes Industry News

Danone, through its plant-based brand Alpro, launched a new product line in 2025 specifically targeted at children, addressing parental concerns about healthy food choices. Alpro’s expansion into child-focused plant-based foods reflects Danone’s ongoing strategy to diversify its product offerings and meet growing demand for nutritious, plant-based options in Europe.

Nutiva Inc. is identified as a leading company in the 2025 global pea flakes market report. The company is known for its commitment to organic, non-GMO, and plant-based ingredients, and its pea-based products are positioned to capitalize on the rising demand for clean-label, allergen-free, and protein-rich foods.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.9 billion |

| Projected Market Size (2035) | USD 2 .9 billion |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Nature | Organic, Conventional |

| By Type | Yellow Peas, Green Peas |

| By End-User | Food Processing, Animal Feed, Aqua Feed, Household/Retail |

| By Packaging | Retail, Pouches, Paper Bags, Tins, Bulk |

| By Distribution Channel | B2B/Direct, B2C/Indirect, Supermarkets/Hypermarkets, Modern Grocery Stores, Specialty Stores, Pet Stores, Online Retailers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, East Asia, MEA (Middle East & Africa) |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ Countries |

| Key Players | Garden Valley Foods, JR Farm, Gemef Industries (Sotexpro), BP Milling, Green Foods LLP, PE Levona, Inland Empire Foods Inc., Inland Empire Foods, Wheeeky Pets, Nutiva Inc., The Simply Good Food Co., Danone SA, Orgain Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by segments, and country-wise analysis |

The global pea flakes market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the pea flakes market is projected to reach USD 2.9 billion by 2035.

The pea flakes market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in pea flakes market are organic and conventional.

In terms of type, yellow peas segment to command 62.7% share in the pea flakes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Pea Flakes Manufacturers

Pea Grits Market Size and Share Forecast Outlook 2025 to 2035

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Fiber Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Flakes Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Milk Market Growth - Industry Projections & Market Trends

Pearlescent Pigment Market Growth - Trends & Forecast 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Peanut Milk Market Analysis - Size, Share & Forecast 2025 to 2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Peanut Flour Market

Spear Phishing Market Size and Share Forecast Outlook 2025 to 2035

Spear Phishing Solutions Market Insights – Trends & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA