The pea fiber market is driven by growing consumer preference for organic products and its extensive use in baked goods. Increasing awareness about health benefits and sustainability supports the organic segment’s growth, while baked products dominate due to pea fiber’s functional benefits in improving texture and nutritional content. These trends are set to shape the market through 2035.

Pea fiber, extracted from the outer hull of peas, is gaining widespread adoption as a versatile ingredient across food and beverage products, dietary supplements, and animal feed. Its popularity stems from its high fiber content, low calorie count, and sustainable production process.

The growing preference for clean-label and functional foods has driven the use of pea fiber as a natural ingredient that enhances texture, improves moisture retention, and extends shelf life without compromising nutritional quality. Pea fiber is increasingly incorporated in bakery items, snacks, meat alternatives, and dairy-free products, as consumers shift toward healthier lifestyles and seek ingredients that promote digestive health and weight management.

Furthermore, sustainability concerns and the growing interest in plant-based diets have significantly contributed to the market’s positive outlook. Pea fiber production utilizes outer hulls, which are byproducts of pea processing, thus supporting waste reduction and efficient resource use. This aligns well with global sustainability efforts and the concept of a circular economy.

Key industry players have taken notable steps to capitalize on this growth trend. Roquette Frères SA launched a new range of pea fiber ingredients in 2024, specifically designed for gluten-free bakery products, addressing the rising demand for allergen-free foods. The company also entered into a partnership with a leading research institution to explore novel applications of pea fiber in textiles and personal care products.

AGT Foods & Ingredients collaborated with Equinom in 2022 to develop minimally processed functional ingredients derived from new yellow pea varieties, aiming to enhance the nutritional profile and sustainability of plant-based products. COSUCRA has committed to investing USD 210 million over seven years to reduce its carbon footprint by 50% by 2030 across its pea protein, fiber, starch, and chicory root fiber businesses. The company is simultaneously expanding production capacity to meet the surging global demand for clean-label and natural food ingredients.

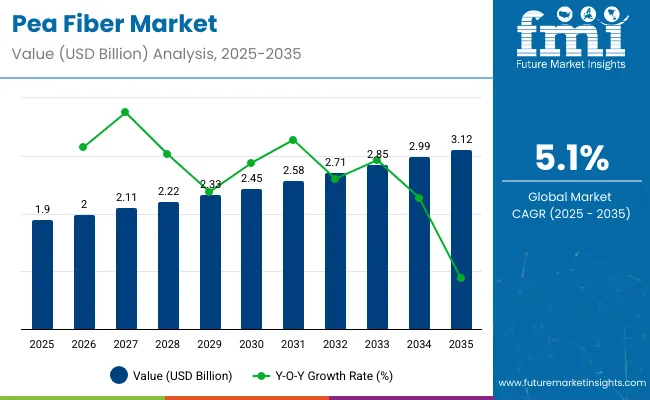

| Metric | Value (USD billion) |

|---|---|

| Market Value (2025E) | USD 1.90 billion |

| Market Value (2035F) | USD 3.12 billion |

| CAGR (2025 to 2035) | 5.1% |

Developed regions like North America and Europe lead in per capita intake due to strong demand for high-fiber, health-focused products and a well-established market for functional and alternative foods. Meanwhile, Asia-Pacific is experiencing steady growth in consumption as urban consumers in China, Japan, and Australia shift toward healthier eating habits. In the Middle East and Africa, although overall intake remains low, demand is increasing gradually as consumers become more health-conscious and product availability improves. These regional trends reflect the growing role of pea fiber in modern nutrition.

Trade activity is concentrated between major producers with abundant pea cultivation and processing infrastructure, and importing countries with high consumption needs but limited local supply. Pea fiber is now widely used in applications such as bakery, plant-based meat, dairy alternatives, and health supplements, making it a key commodity in the global functional ingredients trade.

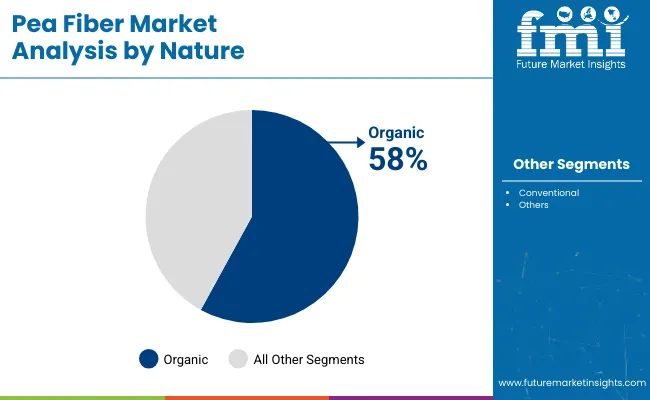

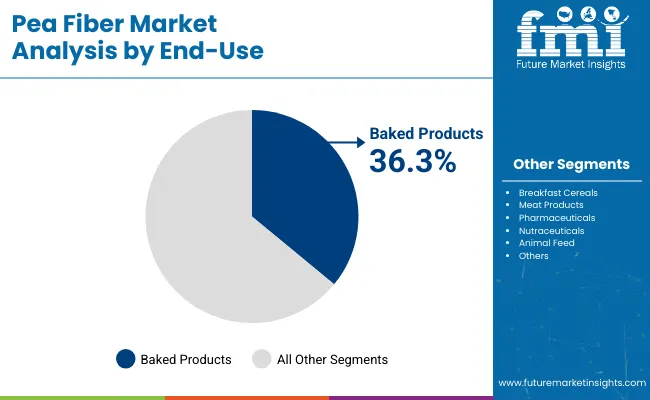

The pea fiber market is driven by growing consumer preference for organic products and its extensive use in baked goods. Increasing awareness about health benefits and sustainability supports the organic segment’s growth, while baked products dominate due to pea fiber’s functional benefits in improving texture and nutritional content. These trends are set to shape the market through 2035.

The organic segment of the pea fiber market, holding a significant 58% market share in 2025, has been driven by increasing consumer preference for natural and sustainably sourced ingredients. Manufacturers and suppliers such as Cargill, Ingredion Incorporated, and Roquette Frères have been expanding their organic pea fiber offerings in response to this trend. Regulatory frameworks and certifications supporting organic farming have bolstered confidence among both producers and end-users.

Advanced processing technologies are being employed to maintain the integrity and quality of organic pea fibers while enhancing their functional properties. This segment has been particularly favored by food and beverage companies that focus on clean-label and plant-based products.

The rise of vegan and health-conscious consumers has further contributed to the demand for organic pea fiber as a source of dietary fiber. With sustainability and health awareness rising globally, the organic segment is forecasted to sustain robust growth, cementing its position as a key market leader within the pea fiber industry.

The baked products segment, projected to capture a dominant 36.3% share of the pea fiber market by 2025, has been a major growth driver due to the functional benefits provided by pea fiber in bakery applications. This includes improvements in moisture retention, texture, and fiber content, which have been highly valued by leading food manufacturers such as Archer Daniels Midland (ADM), Tate & Lyle, and AGT Foods.

Pea fiber has been increasingly incorporated in breads, cookies, and snacks to meet rising consumer demand for high-fiber, gluten-free, and plant-based baked goods. Its compatibility with baking processes and contribution to improved shelf life and product quality have made pea fiber a preferred ingredient. Growing health consciousness and the demand for clean-label bakery products are expected to sustain the segment’s dominance and fuel steady growth throughout the forecast period.

Consumers are increasingly concerned with the source and method of production of the food they consume, and thus, the demand for clean-label food solutions is rapidly increasing. Manufacturers are therefore working hard to produce products that contain high levels of fibre and nutrients, but are free from artificial additives, preservatives, and other chemicals. Such products cater to customers who have adopted the use of natural products in their daily lives.

Consumers can be trusted by providing clean-label solutions that position the company's products more favorably than similar products. Furthermore, clean-label products are launched with a focus on sustainability and environmental responsibility, which is highly popular among twenty-first-century consumers. This move away from complicated, hard-to-pronounce, and generic additives is opening up opportunities for brands to position themselves as suppliers of meaningful, proper, safe, good, and healthy foods.

This trend not only addresses the current consumer needs but also stimulates advancements in the food industry, where manufacturers are seeking ways to improve their products by formulating new products with transparency in adherence to health and wellness concerns.

With an increasing incidence of obesity across the world, more clients are searching for ways to enlist elements that would allow them to consume better calories and also maintain a proper weight. This has led to a shift in the concept of incorporating natural, plant-based products into daily meals. Such ingredients are considered natural and therefore healthier than synthetic or processed food additives, offering advantages such as improved digestion, easy and healthy weight loss, and better metabolism.

People aiming for weight loss or body fat regulation are paying close attention to their diet and products that provide them with high levels of dietary fiber to help them stay within their appetite. Therefore, food manufacturers have started developing new products for the market, targeting the elderly with a special emphasis on using plant-based, high-fiber products.

The concern for weight management is not only driving the consumer towards the purchase of the health food product, but also ensuring that manufacturers innovate more products, so as to cater to the needs of the health-conscious population, creating more opportunities within the industry.

In the food industry, the texture and moisture of the produced products significantly affect consumption. Plant-based fibers, due to their functions such as improving texture or providing water-holding capacity, have become an important component in various food applications. In the bakery, snacks, and meat-based products, the mentioned fibers can be utilized to improve the quality of products through improved texture and improved moisture content, shelf life and mouth feel.

As a result, manufacturers have adopted the use of these functional ingredients in their products to meet consumer preferences for high-quality, tasty foods. In the case of texture improvement and water retention, there are possibilities of cutting on synthetic additives while enhancing on the quality and appeal of the final products that consumers find desirable.

Like other food products, the shift towards plant-based diets for humans is being reflected in pet food as well. In light of this, there is a growing demand for plant-based products for pets, especially from pet owners who practice plant-based diets as well. This shift is paving the way for the development of new products that meet the high standards of food for pets, as demanded by manufacturers.

The use of plant-based fibers makes it possible for the manufacturer to deliver the nutritional needs of the pet without compromising on the wishes of the pet owner to have natural and eco-friendly products. The plant-based pet food industry is expected to continue growing as consumers become increasingly aware of the environmental and ethical implications of using animal products for their pets.

Advanced processing equipment boosts the efficiency and production.

The use of sophisticated processing equipment is considered a major factor that is enhancing the productivity of production processes. These technologies enable manufacturers to work on plant-based ingredients more efficiently, thereby cutting costs and increasing production. By the use of these technologies, it becomes easy for producers to produce higher volumes of productions without compromising on the quality of the final production.

In addition, improved technology also allows the creation of different types of fiber, and thus a variety of products can be manufactured and developed in line with the needs of certain industries. The application of these technologies will enable firms to improve the productivity and profitability of processing natural food ingredients that meet the increasing global demand.

Efficient quality control, production of different grades of pea fibre and key health benefits elevate the global industry

Quality control is another important aspect of production, and manufacturers' integration of strict measures is enhancing this. This concern for quality extends not only to consumer protection but also to the improvement of the market image. That is why manufacturers are introducing different grades of plant-based ingredients, aimed at various applications, including food and beverages, pet food, and other industries such as pharmaceuticals.

The health benefits of digestion, weight loss, and heart health that come with such products take plant-based food sources to another level. When the importance of implementing quality control strategies is maintained within the context of an organization, companies can indeed set themselves on the right path to distinguish themselves within the current global economic environment, with assurance of long-term growth in their establishments.

Global sales increased at a CAGR of 4.7% from 2020 to 2024. For the assessment period from 2025 to 2035, the projections indicate that the value will expand at a compound annual growth rate (CAGR) of 5.1%.

In recent years, the slow and steady sales of various fiber types can be attributed to the growing fitness and nutrition industry. With consumers' growing awareness of health and wellness, and the expanding nutrition industry, the demand for such components, including pea fiber, has skyrocketed. The limited protein sources for vegetarians have also propelled sales.

With the evolution of methods and the rise of advanced processing techniques, companies can now produce high quantities of high-quality fiber in a shorter period, catering to diverse consumer demands. In addition, collaborating with wholesalers and retailers helps the brands to position their products in the business landscape better and make them available on the shelves of convenience stores. This ensures availability not only for retail purposes but also for food service and industrial applications.

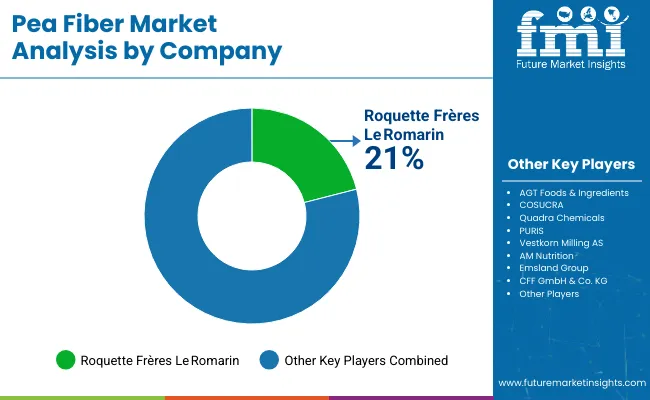

Tier 1 companies comprise leaders with revenue exceeding USD 30 million, capturing a significant share of 50% to 60% of the global market. High production capacity and a wide product portfolio characterize these leaders. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of services, including reconditioning, recycling, and manufacturing, utilizing the latest technology and meeting regulatory standards to deliver the highest quality. Prominent companies within Tier 1 include Roquette Freres SA, AGT Foods & Ingredients, COSUCRA, Quadra Chemicals, PURIS and others.

Tier 2 companies comprise mid-sized players with revenues of USD 10 to 30 million, having a presence in specific regions and a significant influence on local consumption. These are characterized by a strong presence overseas and strong product knowledge. These players have good technology and ensure regulatory compliance, but may not have advanced technology and a wide global reach. Prominent companies in tier 2 include Vestkorn Milling AS, AM Nutrition, Emsland Group, CFF GmbH & Co. KG, and others.

Tier 3 comprises the majority of small-scale companies operating at the local level and serving niche markets, with revenue below USD 10 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, in this context, is recognized as an unorganized business, denoting a sector characterized by a lack of extensive structure and formalization compared to organized competitors.

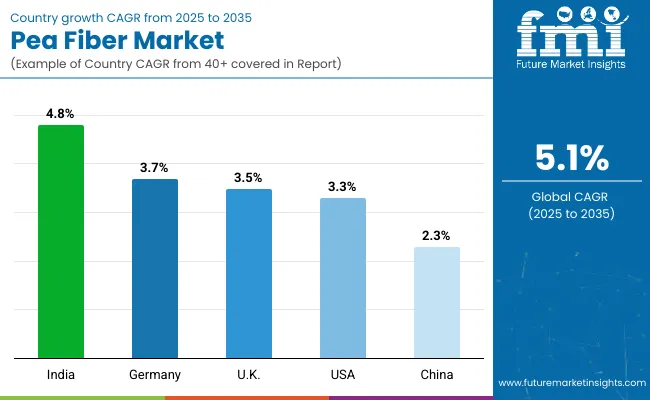

The following table shows the estimated growth rates of the top three countries. USA, Germany and India are set to exhibit high consumption, and CAGRs of 3.3%, 3.7% and 4.8% respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.3% |

| Germany | 3.7% |

| India | 4.8% |

This concept focuses on products with little or no added chemical ingredients for different foods in Germany, clean label products are dominated due to consumer demands for simple and easy to understand ingredients list. One such ingredient emerging in the market is pea fiber, which is touted as a more ‘natural’ solution for health and wellbeing, free from the heavy ingredients typically included in other products.

The German consumer’s last thing they would want is food adulterated with additives and preservatives; thus, the inclusion of pea fiber was seen as an endorsement of their ambitions to produce natural food. This trend drives the market for pea fiber in Germany, and given its dynamic nature, it continues to impact both the development and marketing of this product.

Rising Demand for Vegan and Vegetarian Products. There is a significant demand for vegan and vegetarian products in India, which is also affecting the pea fiber market. Increasingly, consumers are becoming conscious of their intake of plant-based products, and the supplement industry is following this trend with a growing demand for plant-derived substances, such as pea fiber.

Pea fibre is being incorporated into most traditional and new-generation vegetarian products to make nutritional improvements and continue to suit health-conscious consumers. This trend aligns with the general increase in the consumption of plant-based foods in India; consequently, the market for pea fiber is expected to grow.

The global business landscape for fiber used in the industry is becoming an industrial solution for the changing demands of the food industry. Over the past few years, certain sources of fiber, including pea fiber, have been used in various food manufacturing processes that have gained popularity across end-user industries due to the advanced research and innovation of key players such as Roquette Freres SA and AGT Foods & Ingredients.

As the food industry increasingly relies on various key ingredients for new product development, fiber will play a crucial role in enhancing the nutritional value of these products. Key players are developing various solutions for their products to improve their quality. Companies are coming up with products that can easily be approved by regulatory bodies.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.90 billion |

| Projected Market Size (2035) | USD 3.12 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Nature Segments Analyzed (Segment 1) | Conventional, Organic |

| Product Type Segments Analyzed (Segment 2) | Pea Hull Fiber, Pea Cell Wall Fiber |

| End-Use Segments Analyzed (Segment 3) | Breakfast Cereals, Baked Products, Meat Products, Pharmaceuticals, Nutraceuticals, Animal Feed, Others, Snack Foods, Pasta, Crackers |

| Distribution Channel Segments (Segment 4) | Online, Offline |

| Regions Covered | North America; Latin America; Europe; Middle East and Africa; East Asia; South Asia; Oceania |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia & New Zealand (ANZ), GCC Countries, South Africa |

| Key Players influencing the Pea Fiber Market | Roquette Freres SA, AGT Foods & Ingredients, COSUCRA, Quadra Chemicals, PURIS, Vestkorn Milling AS, AM Nutrition, Emsland Group, CFF GmbH & Co. KG |

| Additional Attributes | Dollar sales by nature and product type, Trends in organic fiber demand, Growing use in functional foods and nutraceuticals, Expansion of online distribution channels, Regional dietary preferences impacting product adoption. |

By nature, industry has been categorised into Conventional and Organic.

Two Product types Pea Hull Fiber and Pea Cell wall fiber considered after the exhaustive research.

End Use Applications like Breakfast cereals, Baked products, Meat products, Pharmaceuticals, Nutraceuticals, Animal feed, Others, Snack foods, Pasta and crackers are included in the report.

Distribution channels like Online and Offline are included in the report.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Throughout the forecast period, the business landscape is expected to grow at a CAGR of 5.1%.

By 2035, the sales value is expected to be worth USD 3.12 billion.

Rising vegan trend and awareness about human nutrition are expected to boost sales.

Europe is expected to dominate the global consumption.

Some of the key players in manufacturing include Kemin Industries, Inc., AFB International, Ohly, Lyka, BRF Ingredients, Symrise, DSM, ADM, Profypet, Trilogy Flavors, Susheela Group, Kerry Group plc and others

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Pea Fiber in EU Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Pea Grits Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA