The global pea starch market is projected to grow from USD 147.1 million in 2025 to USD 501.6 million by 2035, registering a CAGR of 13.1%. The market expansion is being driven by heightened demand for gluten-free ingredients, the growing influence of celebrity-endorsed diets, and rising health consciousness among consumers globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 147.1 million |

| Industry Value (2035F) | USD 501.6 million |

| CAGR (2025 to 2035) | 13.1% |

Pea starch is gaining traction due to its cost-effectiveness compared to potato or tapioca starch, alongside its superior consistency, texturizing, and stabilizing properties for bakery, confectionery, and processed food applications.

The market holds a 100% share in the pea-based starch market, around 6% share within plant-based functional food ingredients, and 2% in the broader plant-based food ingredients market. Its share is around 0.1% in the global specialty food ingredients market and below 0.01% in the entire global food ingredients market.

This indicates its niche yet high-potential positioning in premium gluten-free, allergen-free, and functional ingredient segments, supported by rising clean label trends, organic product adoption, and bakery sector innovations worldwide.

Government regulations impacting the market focus on food safety standards, allergen labelling, and organic certification. For instance, the FDA’s Gluten-Free Labelling Rule under the Food Allergen Labelling and Consumer Protection Act in the United States ensures pea starch-based products labelled gluten-free meet strict criteria.

In Europe, EFSA’s regulations on novel foods and allergen declarations maintain product safety and transparency. These regulations drive the adoption of pea starch with enhanced purity, traceability, and organic certification, ensuring compliance and supporting its future growth in gluten-free, organic, and weight management segments.

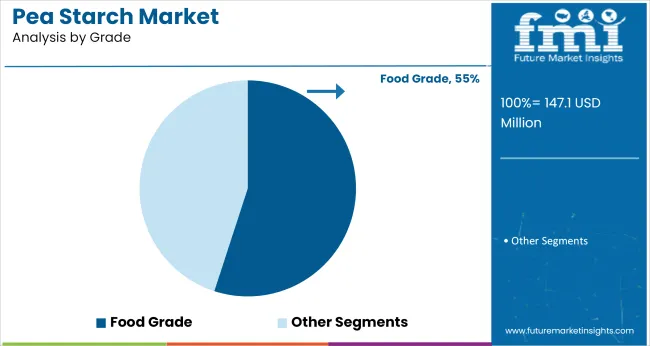

The USA is projected to be the fastest-growing market, expanding at a CAGR of 12.6% from 2025 to 2035. Conventional will lead the nature segment with an 81.5% share, while food grade will dominate the grade segment with a 55% share. The Germany and UK markets are also expected to grow steadily at CAGRs of 10.6% and 8.3% respectively.

The pea starch market is segmented by nature, application, grade, end use, and region. By nature, the market is bifurcated into organic and conventional. In terms of application, the market is classified into thickening & binding, gelling, texturizing, and others (animal feed, cosmetics, pharmaceuticals, and pet food).

Based on grade, the market is divided into feed grade, food grade, and industrial grade. By end use, the market is segmented into soups & sauces, snacks & savory, bakery products, cosmetics, pharmaceuticals, pet food, and others (meat processing, dairy alternatives, confectionery, and beverages).Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Conventional will dominate the nature segment with an 81.5% market share by 2025, driven by its established extraction processes, cost-effectiveness, and extensive usage in bakery and processed foods.

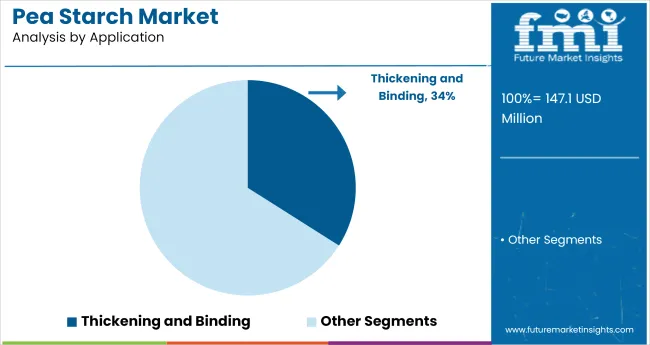

Thickening and binding will account for a 34% market share in 2025, due to the superior texturizing, binding, and stabilizing properties of pea starch in gluten-free soups, sauces, and processed foods.

Food grade is expected to lead the grade segment with a 55% global market share by 2025, supported by its cost-effectiveness, clean-label positioning, and strong demand in bakery and snack applications.

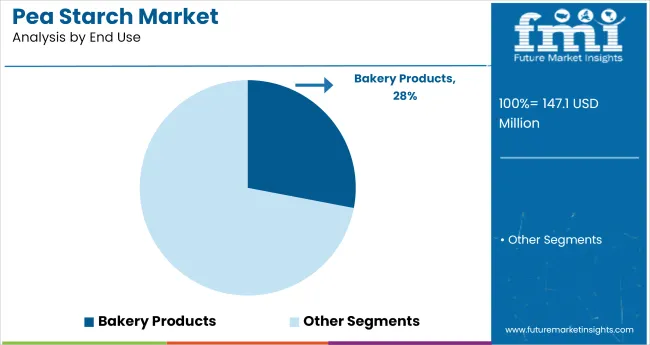

Bakery products are expected to dominate the end use segment, accounting for 28% of the global market share by 2025.

The global pea starch market is experiencing robust growth, driven by the rising demand for gluten-free and allergen-free food ingredients across industries. Pea starch plays a crucial role in enhancing the texture, stability, and binding of various food products.

Recent Trends in the Pea Starch Market

Challenges in the Pea Starch Market

The USA leads with the highest CAGR at 12.6%, driven by rising obesity awareness and growing demand for gluten-free and weight management products. Germany follows at 10.6%, supported by strong sports culture and clean label trends. The UK records an 8.3% CAGR, fueled by increasing bakery production using non-GMO, allergen-free starch. France shows an 8% CAGR, with rising demand for pea starch in gluten-free bakery and confectionery products.

Japan has the lowest growth at 7%, despite strong traditional starch consumption and emerging plant-based product innovations. Western markets lead growth driven by health, fitness, and gluten-free dietary shifts, while Japan grows steadily with a focus on baking, functional foods, and premium product formulations.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan pea starch revenue is growing at a CAGR of 7% from 2024 to 2034. Growth is driven by steady demand in the baking and confectionery sectors, alongside rising use in plant-based and premium food products.

The sales of pea starch in the USA are expanding at 12.6% CAGR during the forecast period, the highest among key countries. Key drivers include rising obesity rates, health-conscious diets, and growing demand for gluten-free, non-GMO food ingredients.

The pea starch market in Germany is projected to grow at a 10.6% CAGR during the forecast period. Sports culture, clean label preferences, and gluten-free dietary trends support market expansion.

The French pea starch market is expected to grow at a CAGR of 8% from 2024 to 2034. Consumer interest in gluten-free and allergen-free ingredients, coupled with demand for plant-based bakery and confectionery products, drives market growth.

The UK pea starch revenue is projected to grow at a CAGR of 8.3% from 2024 to 2034. Bakery production continues to rise, with pea starch gaining market share as a gluten-free and allergen-free alternative.

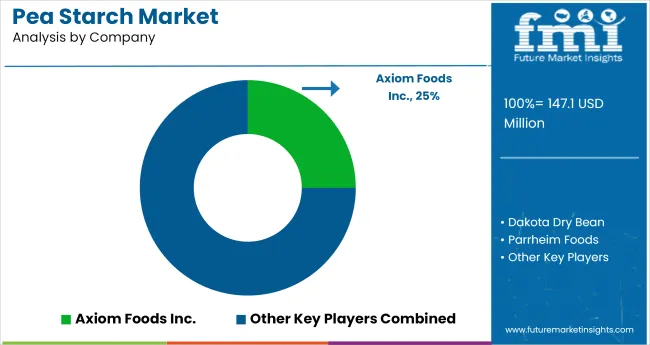

The market is moderately consolidated, with leading players like Axiom Foods Inc., Dakota Dry Bean, Parrheim Foods, Cargill Inc., and Vestkorn dominating the industry. These companies provide high-purity, functional pea starch catering to sectors such as bakery, pharmaceuticals, and functional foods. Axiom Foods Inc. focuses on clean-label, allergen-free pea ingredients, while Dakota Dry Bean specializes in integrated pea processing and starch extraction solutions.

Parrheim Foods delivers food-grade and feed-grade pea starch, emphasizing consistent quality. Cargill Inc. offers globally sourced, GMO-free starches for versatile applications, and Vestkorn is known for its sustainable, eco-friendly production processes. Other key players like Roquette, Sanstar Bio-Polymers, Emsland Group, and American Key Products contribute by providing specialized, high-performance pea starch for a wide range of food, nutraceutical, and industrial uses.

Recent Pea Starch Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 147.1 million |

| Projected Market Size (2035) | USD 501.6 million |

| CAGR (2025 to 2035) | 13.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in metric tons |

| Nature Analyzed | Organic and Conventional |

| Application Analyzed | Thickening and Binding, Gelling, Texturizing, and Others (Animal Feed, Cosmetics, Pharmaceuticals, Pet Food) |

| Grade Analyzed | Feed Grade, Food Grade, and Industrial Grade |

| End Use Analyzed | Soups and Sauces, Snacks and Savory, Bakery Products, Cosmetics, Pharmaceuticals, Pet Food, and Others (Meat Processing, Dairy Alternatives, Confectionery, Beverages) |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Axiom Foods Inc., Dakota Dry Bean, Parrheim Foods, Cargill Inc., Vestkorn , Roquette , Sanstar Bio-Polymers, Emsland Group, and American Key Products |

| Additional Attributes | Dollar sales by source type, purity analysis, regional demand growth, regulatory influence, competitive benchmarking |

Based on its nature, the pea starch market is bifurcated into organic and conventional.

In terms of grade, the pea industry is categorized into feed grade, food grade, and industrial grade.

Key product applications include thickening and binding, gelling, texturizing, and others.

When it comes to end use, the industry is segmented into soups and sauces, snacks and savory, bakery products, food processing industry, cosmetics, pharmaceuticals, and pet food industry.

Analysis has been carried out in key countries of North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The market is valued at USD 147.1 million in 2025.

The market is forecasted to reach USD 501.6 million by 2035, reflecting a CAGR of 13.1%.

Conventional will lead the nature segment, accounting for 81.5% of the global market share in 2025.

Food grade will dominate the grade segment with a 55% share in 2025.

The USA is projected to grow at the fastest rate, with a CAGR of 12.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Pea Grits Market Size and Share Forecast Outlook 2025 to 2035

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Pea Flakes Market Size and Share Forecast Outlook 2025 to 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Fiber Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Pea Milk Market Growth - Industry Projections & Market Trends

Pearlescent Pigment Market Growth - Trends & Forecast 2025 to 2035

Peanut Milk Market Analysis - Size, Share & Forecast 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Market Share Breakdown of Pea Flakes Manufacturers

Peanut Flour Market

Spear Phishing Market Size and Share Forecast Outlook 2025 to 2035

Spear Phishing Solutions Market Insights – Trends & Forecast through 2034

Repeater Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA