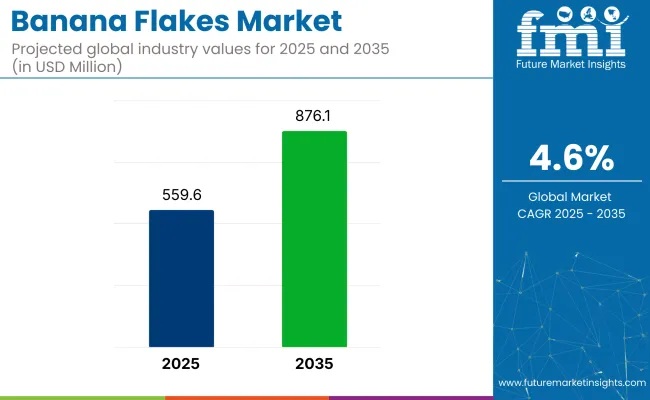

Global banana flakes market reached USD 559.6 million in 2025 and is projected to grow to USD 876.1 million by 2035, advancing at a CAGR of 4.6% during this period.

| Attributes | Values |

|---|---|

| Industry Size (2025E) | USD 559.6 million |

| Industry Value (2035F) | USD 876.1 million |

| Value-based CAGR | 4.6% |

Rising preference for fruit-derived ingredients in everyday food choices is driving this growth. Banana flakes, valued for their fiber, vitamin, and antioxidant content, are commonly used in breakfast cereals, snack bars, and processed food items. Their gluten-free and plant-based nature fits well with evolving dietary habits. Increasing attention to digestive health and heart-friendly nutrition continues to shape consumer interest in banana-based food formulations.

Banana flakes hold a modest but expanding position across their parent markets, with estimated shares ranging from 1.2% to 3.9%. In the processed fruit market, they account for about 2.1%, supported by demand in infant food and health-based applications. Within the dehydrated food market, the share reaches 3.5%, reflecting their integration into shelf-stable blends.

The natural and clean-label ingredients market sees a 1.6% share, as manufacturers seek simple, single-origin ingredients. In the functional food ingredients category, banana flakes contribute around 1.2%, driven by interest in digestive health and fiber enrichment. The highest penetration is in breakfast cereals and snack ingredients, where the share stands at 3.9%, driven by use in granolas, fruit bars, and mixed flake products.

Banana flakes are gaining traction among health-conscious consumers seeking plant-based, clean-label ingredients in everyday foods. With rising demand for convenient and nutrient-rich options, banana flakes are increasingly used in cereals, snacks, and processed foods.

Manufacturers are focusing on enhancing shelf life, improving taste, and refining production methods to deliver better quality and wider availability. The appeal of banana flakes lies in their natural composition, fiber content, and compatibility with gluten-free and vegan diets. As consumer preference shifts toward simple, wholesome ingredients, the use of banana flakes in diverse food applications continues to grow, supported by evolving dietary habits and innovation.

Banana flakes are seeing increased demand due to their versatility in both breakfast and snack foods. The organic segment and direct sales channels are driving substantial market growth, with consumers seeking healthy, convenient options in their food choices.

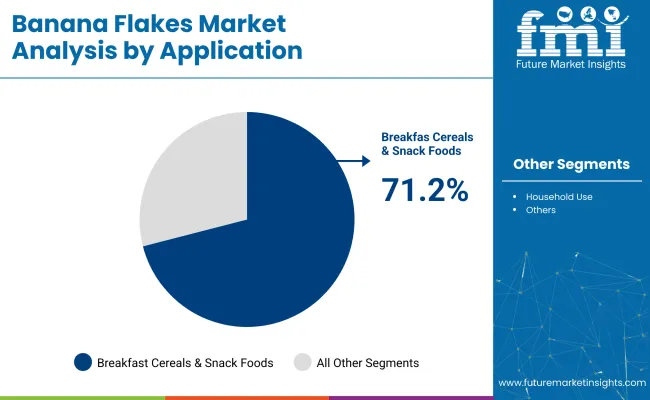

Breakfast cereals and snack foods continue to dominate the banana flakes market, accounting for 71.2% of total demand in 2025. Their inclusion in ready-to-eat cereals, granola bars, and energy snacks reflects growing consumer interest in nutritious, on-the-go options. Companies like Kellogg's, General Mills, and Nestlé are incorporating banana flakes into their product offerings to cater to health-conscious consumers seeking added natural flavors and nutrients.

Organic banana flakes are projected to capture 52% of the source segment by 2025, reflecting the growing demand for natural, pesticide-free foods. Consumers are increasingly seeking organic products for their perceived health benefits, leading to increased availability in major brands such as Dole Organic, Chiquita, and small-scale organic suppliers. Organic banana flakes cater to consumers who prioritizeethical sourcing, and high-quality ingredients in their diets.

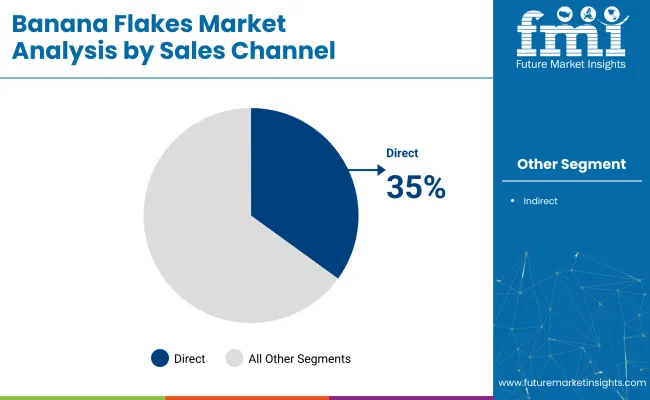

Direct sales channels, including company websites and direct-to-consumer (DTC) platforms, are expected to contribute 35% of the market share in 2025. With the rise of e-commerce, companies are increasingly turning to online platforms to reach customers directly, bypassing traditional retail networks. Brands like Banana Blossom, Tropical Foods, and Wild Foods are capitalizing on the DTC trend by offering personalized packages, subscriptions, and discounts for bulk purchases.

Banana flakes market dynamics are shaped by improved post-harvest integration, rising demand for functional ingredients, and input cost pressures. Advances in drying, packaging, and contract farming are boosting supply chain efficiency, while nutritional validation drives new applications. However, inflation in raw material and freight costs continues to strain processor margins.

Crop Processing Integration and Shelf-Life Extension Drives Supply Chain Efficiency

Banana flake producers have adopted integrated processing models to reduce post-harvest losses and optimize ripening cycles. In India and the Philippines, contract farming with calibrated ripening chambers reduced overripe wastage by 19% between Q4 2024 and Q1 2025. Solar-assisted dryers deployed in Ecuador’s El Oro region trimmed average drying time by 22%, enabling tighter batch scheduling and reducing energy costs by 14%. Major exporters like Peru have shifted to nitrogen-flushed packaging for industrial buyers, extending shelf life from 9 to 15 months and reducing returns from EU buyers by 11%.

Inventory days held at regional processing hubs declined by 27% as producers synchronized flake output with short-term demand forecasts from infant nutrition and breakfast cereal clients. This leaner model is enabling processors to downsize buffer stock and minimize capital lock-up across the value chain.

Margin Volatility Due to Input Inflation and Trade Bottlenecks

Volatility in raw banana procurement and export logistics continues to compress processor margins. Farm-gate prices in Uganda and Costa Rica rose 12% YoY by Q2 2025, driven by climate-related yield dips and rising fertilizer costs. Freight rates for reefer containers from Guayaquil to Rotterdam climbed 9% in the same period, exacerbated by port congestion and equipment delays.

Major exporters faced a 6-8% spike in per-tonne processing costs due to energy price surges and packaging material shortages. To counterbalance, processors in Colombia and Sri Lanka adopted belt-dryer retrofits and labor automation, reducing per-unit drying costs by 17%.

Some European importers renegotiated contracts from CFR to FOB terms to control landed costs, yet the pricing gap between industrial-grade and foodservice-grade flakes widened. The resulting cost pressures have narrowed average processor margins from 18% in 2023 to 13% by mid-2025.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

| Germany | 5.4% |

| China | 4.6% |

| Japan | 4.8% |

| India | 3.3% |

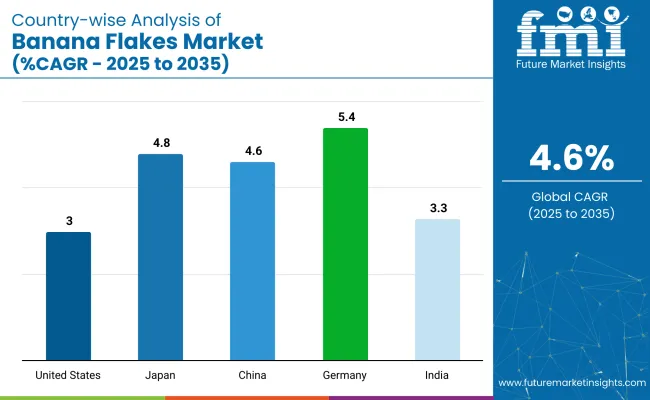

Global industry for banana flakes is projected to grow at a 4.6% CAGR from 2025 to 2035. Among the five profiled markets out of 40+ covered, Germany leads at 5.4%, followed by Japan at 4.8%, China at 4.6%, India at 3.3%, and the United States at 3.0%. These growth rates translate to a +28.6% premium for Germany, +14.3% for Japan, +9.5% for China, and discounts of -21.4% for India and -28.6% for the United States, compared to the global baseline.

Germany’s rise is driven by demand in health-oriented cereal blends and natural snack formulations, while Japan and China are expanding use in infant food and rehydrated food products. India and the U.S. show modest growth due to stable applications and relatively mature consumer segments.

Banana flakes industry in the USA is forecast to grow at a 3.0% CAGR through 2035, shaped by rising incorporation in high-fiber breakfast cereals, plant-based smoothies, and functional snack bars. In 2024, over 72% of total usage came from clean-label and low-sugar product categories.

Freeze-dried and enzyme-stabilized flakes are increasingly used in pediatric nutrition, especially for potassium and iron enrichment. Food manufacturers in Wisconsin, Ohio, and California have added banana flakes to their formulation pipelines for gluten-free, dairy-light, and hypoallergenic applications under regulated ingredient codes.

The banana-based flakes market in Germany is projected to grow at a 5.4% CAGR, led by consumer preference for traceable, bio-labeled fruit ingredients and freeze-dried formats with high micronutrient retention.

Retail expansion across Bavaria, Berlin, and NRW pushed banana flake sales into gluten-free snack kits, long-shelf porridges, and baking mixes. Sun-dried flake variants have gained market entry through discount chains and organic food retailers targeting zero-additive snack customization.

Banana flakes industry in China are expanding at a 4.6% CAGR, led by growing demand in fortified baby foods, on-the-go fruit mixes, and low-residue snack applications. Producers across Guangdong, Hubei, and Anhui processed 86,000+ metric tons in 2024, emphasizing pesticide-free and non-GMO formulations for infant-safe use. Functional ingredient expansion was supported by national dietary guidelines promoting natural fruit bases in school nutrition and maternal wellness programs.

Japan is witnessing the growth in banana flake industry at a 4.8% CAGR, anchored in enzyme-activated formats, prebiotic-enhanced products, and freeze-dried snack blends. Biokuro-style banana flakes are being used across sports recovery, digestive support, and natural sweetener categories, with strong uptake in Tokyo, Osaka, and Fukuoka. Japan’s proprietary freeze-drying systems enhance polyphenol and fiber preservation, which supports demand in low-sugar, wellness-positioned products.

The banana flake market in India is rising at a 3.3% CAGR, supported by applications in traditional wellness foods, baby food blends, and export-grade fruit powder mixes. Tamil Nadu, Maharashtra, and Gujarat produced over 110,000 metric tons in 2024, supplying both domestic retail and Middle East-bound processed food. Government support for fruit dehydration and banana processing hubs under agri-export schemes has widened access to low-cost flake variants suitable for herbal, fasting-friendly, and energy-boosting recipes. Sun-dried banana flakes are leading value-based demand.

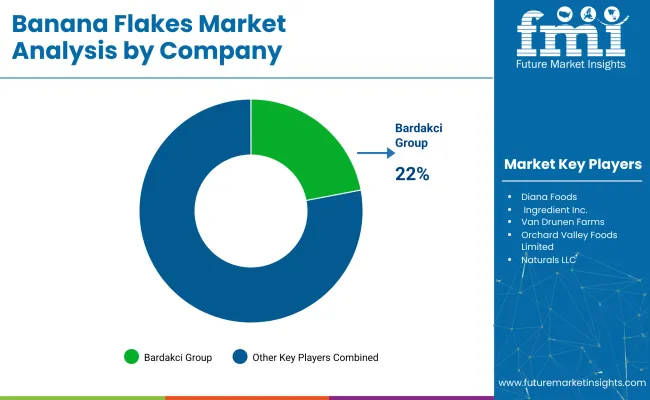

The banana flakes market is dominated by key players like Bardakci Group, Diana Foods, and Van Drunen Farms, which focus on expanding production capacity and enhancing product quality. For instance, Orchard Valley Foods Limited recently launched a new line of organic banana flakes to cater to the growing demand for clean-label ingredients.

Emerging players like Naturals LLC and P&G Food Industries are gaining traction by investing in efficient drying techniques to improve shelf life and reduce waste. The market remains moderately fragmented, with regional players competing on price and quality. Entry barriers include high capital requirements for processing equipment and the need for consistent raw material supply, which favors established suppliers with integrated supply chains

Recent Banana Flakes Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 559.6 million |

| Projected Market Size (2035) | USD 876.1 million |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Source Types Analyzed | Organic, Conventional |

| Applications Analyzed | Household Use, Food and Beverage Industry, Other Applications |

| Sales Channels Analyzed | Direct Sales, Indirect Sales |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Brazil, Germany, India, China, UAE, Poland, Vietnam |

| Key Players | Bardakci Group, Diana Foods, Ingredient Inc., Van Drunen Farms, Orchard Valley Foods Limited, Naturals LLC, Rabeler Fruchtchips GmbH, Johs,Thoms GmbH & Co. KG, P&G Food Industries, Top Line Foods |

| Additional Attributes | Dollar sales, share by organic vs. conventional categories, strong demand in baby food and cereal mixes, growing use in bakery and dairy sectors, expansion of private label offerings in emerging markets, regional sourcing variations, and export competitiveness from Southeast Asia and Latin America |

The segment includes Organic and Conventional product categories.

The market includes Household Use, Food and Beverage Industry and Other Applications.

Segmented into Direct and Indirect Sales Channels.

Industry performance assessed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and the Middle East & Africa.

The global banana flakes market is estimated to be valued at USD 565.4 million in 2025.

It is projected to reach USD 886.4 million by 2035.

The market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types are conventional and organic.

food & beverage industry segment is expected to dominate with a 52.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Milk Market Trends - Demand & Growth 2025 to 2035

Korea Banana Flour Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

Cavendish Banana Market Size and Share Forecast Outlook 2025 to 2035

Demand for Banana Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Banana Flour Market Analysis by Source, Application, Distribution Channel, and Country Through 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Flakes Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Pea Flakes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pea Flakes Manufacturers

Yeast Flakes Market

Potato Flakes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Leaders & Share in the Potato Flakes Industry

Competitive Landscape of Edible Flakes Providers

UK Potato Flakes Market Report – Growth, Demand & Forecast 2025-2035

USA Potato Flakes Market Growth – Innovations, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA