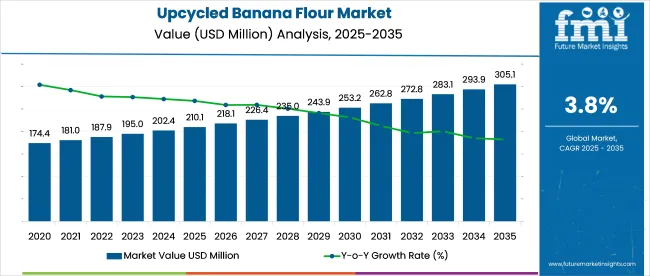

The upcycled banana flour market is being valued at USD 210.1 million in 2025, with projections rising to USD 306.1 million by 2035, at a CAGR of 3.8%. Growth is being driven by demand for gluten-free, resistant starch ingredients in bakery, baby food, and supplements.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 210.1 million |

| Market Size (2035) | USD 306.1 million |

| CAGR (2025 to 2035) | 3.8% |

Powdered green banana flour is being favored for its blendability and prebiotic content, while organic and conventional variants are being positioned for clean label offerings. It is argued that brand differentiation will come from flavored blends and bulk-scale direct sourcing from smallholder growers. However, it is suggested that fragmented processing infrastructure and limited consumer awareness may restrain broader distribution unless educational endorsing and supply chain transparency are prioritized.

In April 2023, Diana’s Bananas CEO Neil Cox highlighted the growing potential of upcycled banana-based products, a category that includes banana flour made from cosmetically imperfect fruit. As food manufacturers and consumers increasingly seek sustainable ingredient solutions, upcycled banana flour has gained attention for its nutritional benefits, long shelf life, and utility in gluten-free baking.

Cox underscored the importance of diverting food waste from landfills by leveraging surplus bananas into value-added products. Addressing this shift, Neil Cox, CEO of Diana’s Bananas, stated, “The bananas are not bad; they simply don’t fit the aesthetic standards of the primary supply chain buyers.”

The industry holds a niche share within its parent markets. In the flour market, it accounts for approximately 1-2%, as it is a specialty product compared to more commonly used flours like wheat and corn. Within the organic food market, its share is around 3-5%, driven by the growing demand for organic, sustainable ingredients.

In the food ingredients market, the share is approximately 2-3%, as it is used in a variety of food products for its functional properties. In the health and wellness food market, the share is about 3-4%, as it is recognized for its nutritional benefits. In the sustainable food market, the share is around 4-6%, reflecting the increasing preference for upcycled and eco-friendly food ingredients.

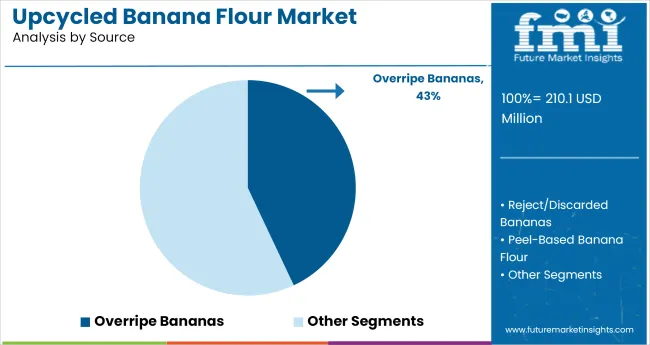

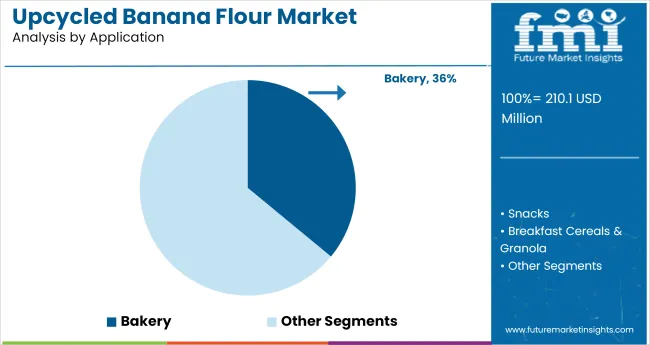

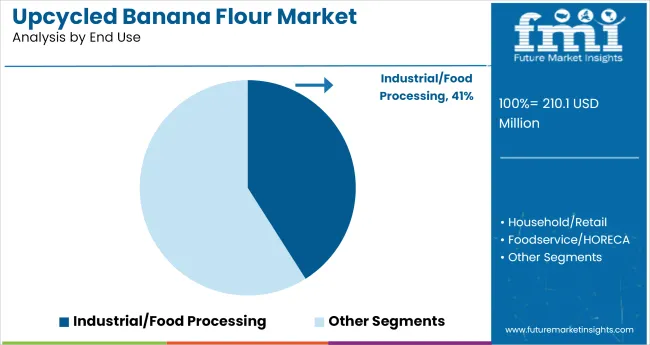

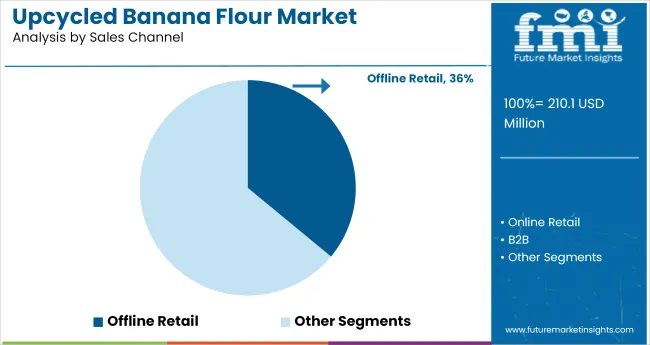

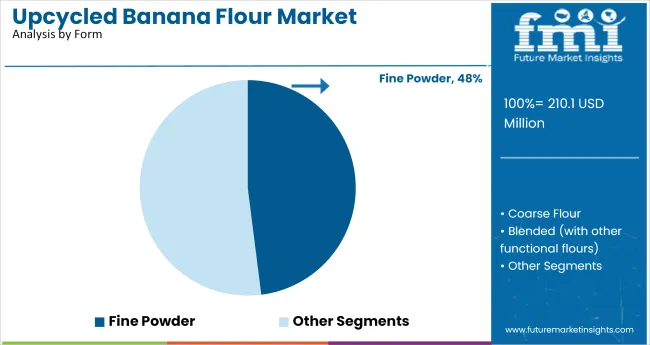

The industry in 2025 is expected to see overripe bananas leading the source segment with 43% industry share, bakery applications at 36%, gluten-free functionality at 32%, and industrial/food processing holding 41% of the end-use segment. Offline retail will account for 36% of the sales channel, and fine powder form will dominate with 48%. Mechanical dehydration and milling technology will lead the industry with a 38% share.

Overripe bananas are expected to capture 43% of the source segment in the industry in 2025. These bananas, which are typically discarded due to their ripeness, are ideal for upcycling into flour, offering a sustainable and eco-friendly alternative.

The growing demand for plant-based, gluten-free, and natural products drives the use of overripe bananas in banana flour production. This segment's dominance reflects increasing efforts to minimize food waste, with overripe bananas providing a valuable resource for the growing industry of sustainable food ingredients.

Bakery applications, including bread, cakes, muffins, and cookies, are projected to hold 36% of the industry share in 2025. Banana flour is gaining popularity in the bakery sector due to its gluten-free nature and natural sweetness, making it a great alternative to traditional wheat flour.

As the demand for gluten-free and allergen-free products rises, upcycled banana flour offers a functional and nutritious alternative for consumers. The versatility of banana flour in baked goods, paired with its health benefits, further boosts its demand in the bakery industry.

Gluten-free functionality is expected to account for 32% of the industry share in 2025. As consumers continue to shift toward gluten-free diets, driven by health-conscious choices and dietary restrictions, banana flour’s gluten-free properties make it a highly sought-after ingredient.

Banana flour is an ideal alternative to wheat flour for people with gluten sensitivity or celiac disease, making it a vital component in many gluten-free food products. The growing gluten-free trend, especially in baked goods and packaged foods, ensures that banana flour’s gluten-free functionality remains a key selling point in the industry.

Industrial and food processing applications are projected to capture 41% of the industry share in 2025. Upcycled banana flour is increasingly used in large-scale food processing for its versatile applications in snacks, ready-to-eat meals, and nutritional products.

The increasing use of sustainable ingredients in the food processing industry, alongside growing consumer demand for natural, functional foods, makes banana flour a key ingredient in processed food formulations. Its ability to improve texture, add nutritional value, and offer cost-effective solutions contributes to its growing presence in the industrial food sector.

Offline retail is expected to hold 36% of the sales channel industry share in 2025. Supermarkets, health food stores, and specialty retail outlets are driving the demand for upcycled banana flour, providing consumers with easy access to gluten-free, plant-based, and sustainable ingredients.

The growing popularity of health-conscious and sustainable food products in retail industries supports the industry dominance of offline channels. As more consumers opt for clean-label products, banana flour’s appeal in mainstream grocery stores continues to expand, offering convenient access to nutritious alternatives.

Fine powder is projected to capture 48% of the industry share in the form segment in 2025. The fine powder form of upcycled banana flour is highly preferred due to its versatility in various food applications, ease of mixing, and suitability for baking and cooking.

Its fine texture makes it ideal for producing smooth batters, dough, and other food products, ensuring consistency in finished goods. The fine powder form also facilitates easier packaging and distribution, making it the leading choice for manufacturers and consumers alike.

Mechanical dehydration and milling are projected to capture 38% of the technology industry share in 2025. This technology is essential for transforming fresh bananas into flour by effectively removing moisture and grinding the dried product into a fine powder.

The mechanical process ensures minimal nutritional loss while maintaining the natural properties of the banana. As the demand for upcycled, clean-label ingredients rises, mechanical dehydration and milling offer a cost-effective and efficient method of producing high-quality banana flour.

The industry is expanding due to the growing demand for gluten-free and high-fiber food products. However, challenges such as limited awareness, logistical inefficiencies, and high production costs hinder broader industry adoption, particularly in less informed regions.

Increasing Demand for Nutritional, Gluten-Free Alternatives

The industry is gaining momentum, driven by the increasing consumer preference for gluten-free, high-fiber alternatives to traditional wheat flour. As more people seek healthier, plant-based diets and better digestive health options, banana flour, made from surplus bananas, is emerging as a key ingredient. With its ability to support gut health, regulate blood sugar, and provide essential nutrients, it is becoming a popular choice for gluten-free baking, snack production, and dietary supplements, expanding its industry footprint.

Challenges in Industry Penetration and Supply Chain

Despite its growth potential, the industry faces significant barriers, particularly in consumer awareness and supply chain management. Many consumers remain unfamiliar with banana flour’s benefits and applications, which limits its adoption, especially in mainstream grocery stores. Additionally, producing upcycled banana flour requires a consistent supply of surplus bananas, which is susceptible to seasonal variability and logistical challenges. These issues contribute to price volatility and inconsistent availability, hindering wider industry penetration.

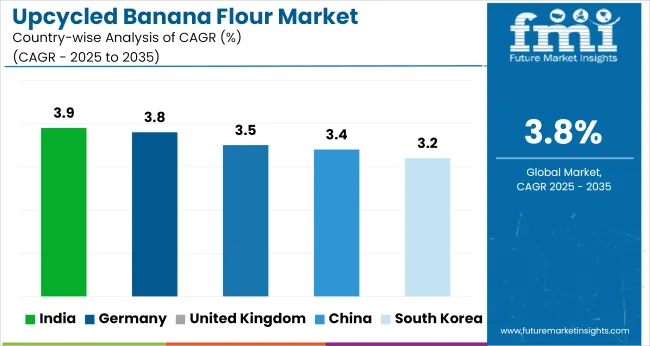

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.5% |

| China | 3.4% |

| India | 3.9% |

| South Korea | 3.2% |

| Germany | 3.8% |

Global industry demand is projected to rise at a 3.8% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 3.9%, followed by Germany at 3.8%, and the United Kingdom at 3.5%, while China records 3.4% and South Korea posts 3.2%.

These rates translate to a growth premium of +3% for India, -1% for Germany, and -9% for the United Kingdom versus the baseline, while China and South Korea show slower growth. Divergence reflects local catalysts: increasing awareness of sustainable food production and nutrition in India, steady demand in Germany driven by eco-conscious food trends, and slower adoption in more mature industries like China and South Korea due to less focus on upcycled ingredients.

The industry in the United Kingdom is projected to expand at a CAGR of 3.5% between 2025 and 2035. Food manufacturers are introducing banana flour in gluten-free bakery ranges, aligning with consumer demand for functional foods. Regulatory alignment under the Food Standards Agency permits clean-label advertising of banana-derived flours as natural dietary fibers.

Sales are rising in vegan and allergen-free product lines in both mainstream supermarkets and independent organic retailers. The country’s circular economy policies have accelerated food waste valorization, strengthening local sourcing of surplus bananas into value-added flours across premium food categories.

China’s industry is forecast to grow at a CAGR of 3.4% from 2025 to 2035. Industrial food processors have begun utilizing banana flour in low-GI noodle production. Provincial governments encourage fruit waste valorization as part of zero-food-loss directives.

Health food brands are using banana flour to lower sugar content in meal replacements and functional beverages. Distribution remains concentrated in specialty nutrition outlets in first-tier cities. Imports of green bananas from Southeast Asia are being diverted into flour manufacturing lines as functional food categories expand.

India’s industry is expected to expand at a CAGR of 3.9% through 2035. Agro-processing clusters in Tamil Nadu and Maharashtra are converting banana rejects into flour for bakery, infant food, and snack sectors. Food Safety and Standards Authority of India (FSSAI) has approved banana flour as a source of dietary fiber in functional food categories.

Ayurvedic nutrition brands are advertising banana flour as gut-friendly and diabetic-safe. Growth is driven by export demand and domestic interest in fiber-rich staples.

The industry in South Korea is projected to grow at a CAGR of 3.2% from 2025 to 2035. Major beverage manufacturers are testing banana flour in dairy-alternative smoothies. Local upcycling tech incubators are supporting banana waste valorization with enzyme-assisted processing lines.

Consumers seeking low-FODMAP and hypoallergenic foods are embracing banana flour in breakfast mixes and children’s snacks. Health claims are supported through collaborations between universities and packaged food manufacturers.

Germany’s industry is expected to grow at a CAGR of 3.8% from 2025 to 2035. Organic and bio-retailers have added banana flour products to gluten-free and clean-label sections. Federal grants are being disbursed to startups that convert food loss into marketable flours.

Importers of organic bananas from West Africa are processing unsold volumes into flour for use in sports nutrition and specialized infant formula. German consumer preferences for traceable, plant-based ingredients support consistent category expansion.

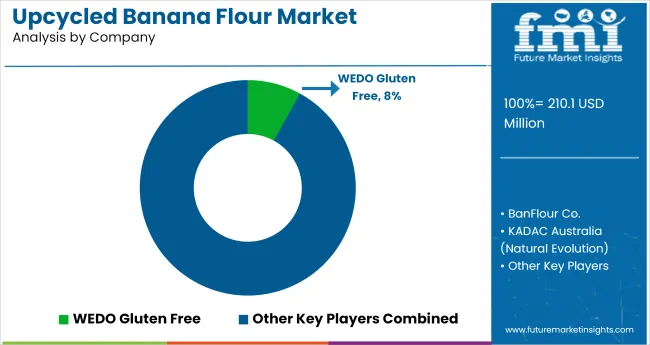

Leading Player - WEDO Gluten Free Industry Share - 8% share

In the industry, value is created through differentiation of product grade, upstream sourcing, and channel outreach. WEDO Gluten Free is positioned strongly in North America via grain-free baking lines and gluten-free certification, sourced from surplus bananas in USA partnerships.

Ban Flour Co. has captured Europe’s mass segment through co-manufacturing in banana-exporting countries and private-label deals with mainstream supermarkets. KADAC Australia (Natural Evolution) is being recognized in premium channels by focusing on organic and single-origin dried banana pulp sold online.

Miski Organics is serving health-conscious consumers in ASEAN using cold-press methods and DTC subscriptions. International Agriculture Group (NuBana™) is offering functional grade flour with higher resistant starch, navigating FDA and EU novel food approvals.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 210.1 million |

| Industry Value (2035) | USD 306.1 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and tons for volume |

| Source Segmentation | Overripe Bananas, Reject/Discarded Bananas, Peel-Based Banana Flour |

| Application Segmentation | Bakery (Bread, Cakes, Muffins, Cookies), Snacks (Chips, Puffs, Bars), Breakfast Cereals & Granola, Baby Food, Dietary Supplements, Beverages (Smoothies, Shakes), Pet Food, Foodservice |

| Functionality/Claim Segmentation | Gluten-Free, High Fiber, Resistant Starch, Prebiotic, Low Glycemic Index |

| End-Use Segmentation | Household/Retail, Industrial/Food Processing, Foodservice/HORECA, Nutraceuticals |

| Sales Channel Segmentation | Offline Retail (Supermarkets, Health Food Stores), Online Retail (Brand Websites, E-commerce Platforms), B2B (Bulk Ingredient Supply) |

| Form Segmentation | Fine Powder, Coarse Flour, Blended (with other functional flours) |

| Technology Segmentation | Mechanical Dehydration & Milling, Solar Drying + Milling, Spray Drying (for peel-based or extract blends), Vacuum Drying, Infrared or Microwave-Assisted Drying, Enzyme-Assisted Preprocessing (for improved nutrient release) |

| Regions Covered | North America, Latin America, Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players | WEDO Gluten Free, BanFlour Co., KADAC Australia (Natural Evolution), Miski Organics, International Agriculture Group (NuBana ™) |

| Additional Attributes | Dollar sales by source type, application, functionality, and form, growing demand for gluten-free and high-fiber alternatives, rising use of banana flour in plant-based diets, regional preferences in ingredient adoption and product innovation. |

Source segmentation includes Overripe Bananas, Reject/Discarded Bananas, and Peel-Based Banana Flour.

Applications span Bakery (Bread, Cakes, Muffins, Cookies), Snacks (Chips, Puffs, Bars), Breakfast Cereals & Granola, Baby Food, Dietary Supplements, Beverages (Smoothies, Shakes), Pet Food, and Foodservice.

Functionality-based segmentation includes Gluten-Free, High Fiber, Resistant Starch, Prebiotic, and Low Glycemic Index.

End-use categories include Household/Retail, Industrial/Food Processing, Foodservice/HORECA, and Nutraceuticals.

Sales channels include Offline Retail (Supermarkets, Health Food Stores), Online Retail (Brand Websites, E-commerce Platforms), and B2B (Bulk Ingredient Supply).

Form segmentation includes Fine Powder, Coarse Flour, and Blended (with other functional flours).

Technology categories include Mechanical Dehydration & Milling, Solar Drying + Milling, Spray Drying (for peel-based or extract blends), Vacuum Drying, Infrared or Microwave-Assisted Drying, and Enzyme-Assisted Preprocessing (for improved nutrient release).

Regional analysis covers North America, Latin America, Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The projected size of the industry in 2025 is USD 210.1 million.

The value of the industry in 2035 is USD 306.1 million, with a CAGR of 3.8%.

Fine powder leads the industry with a 48% industry share.

India is projected to have the highest CAGR in the industry with a growth rate of 3.9% from 2025 to 2035.

The leading company in the industry is WEDO Gluten Free, with an 8% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Upcycled Pet Ingredients Size and Share Forecast Outlook 2025 to 2035

Upcycled Vegetable Snacks Market Size and Share Forecast Outlook 2025 to 2035

Upcycled Cosmetic Ingredients Market Insights & Trends 2025 to 2035

Banana Flakes Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Milk Market Trends - Demand & Growth 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Korea Banana Flour Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Cavendish Banana Market Size and Share Forecast Outlook 2025 to 2035

Demand for Banana Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Banana Flour Market Analysis by Source, Application, Distribution Channel, and Country Through 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA