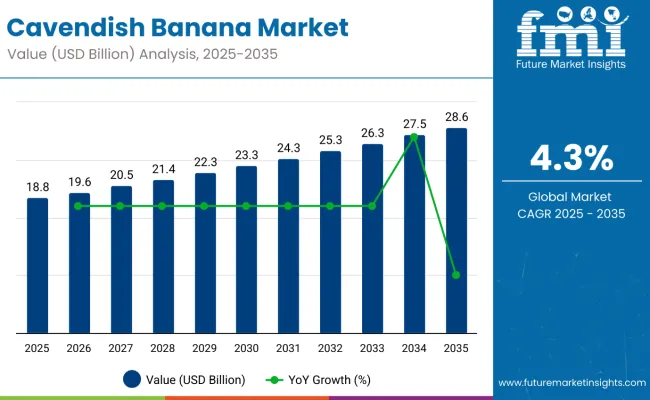

The Cavendish banana market is estimated to be valued at USD 18.8 billion in 2025 and is projected to reach USD 28.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 18.8 billion |

| Forecast Value in 2035 (F) | USD 28.6 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The market is expected to add an absolute dollar opportunity of USD 9.8 billion during this period. This reflects a 1.52 times growth at a compound annual growth rate of 4.3%.The market evolution is expected to be shaped by increasing consumer awareness of health and wellness, as well as the rising popularity of organic banana varieties. The market benefits from Cavendish bananas being widely used as convenient, nutritious snacks and as key ingredients in diverse food and beverage products.

By 2030, the market is likely to reach USD 23.7 billion, adding about USD 4.9 billion in incremental value during the first half of the decade. The remaining USD 4.9 billion is expected during the second half, indicating a balanced growth pattern. Product innovation focused on disease-resistant cultivars and organic farming techniques is gaining traction due to growing consumer demand for sustainable, high-quality, and nutrient-rich bananas. Additionally, advances in supply chain technology and packaging are enhancing freshness and shelf life, supporting expanded market penetration globally.

Companies such as Dole Food Company continue to innovate and invest in disease-resistant banana cultivars and sustainable farming techniques. Moving forward, regulatory compliance, quality control, and technological advancements will shape competitive dynamics, ensuring that the Cavendish banana remains a leading tropical fruit commodity globally.

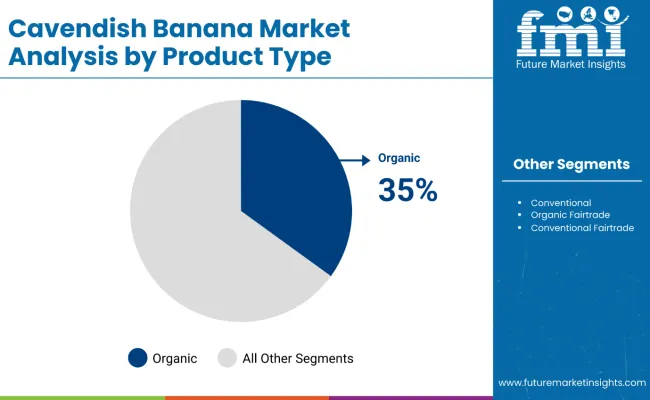

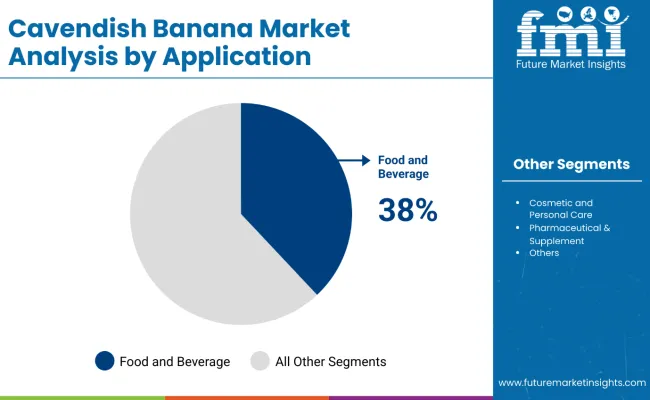

The market holds a strong position across its parent industries, reflecting its rising adoption in food, beverages, and export-oriented agriculture. Within the organic fruit market, Cavendish bananas account for around 35%, driven by rising consumer demand for pesticide-free and sustainably sourced produce. In the food and beverage processing segment, the market contributes nearly 38%, supported by its versatile use in smoothies, baked goods, dairy alternatives, and ready-to-eat products. In the retail fresh fruit market, it holds close to 30%, where its convenience and nutritional benefits strengthen consumer preference. Within the broader tropical fruit market, Cavendish bananas represent about 25%, underscoring their role as a staple fruit across global regions.

Growth is being driven by innovations such as disease-resistant banana cultivars, which improve yield and supply stability. Producers are expanding organic and fair trade offerings, supported by sustainable farming practices. Collaborations with foodservice providers, retailers, and the growth of online grocery platforms are widening market reach and reshaping distribution channels, challenging traditional fruit consumption patterns and increasing year-round availability

Cavendish bananas’ unique combination of affordability, consistent availability, and strong nutritional value is driving their adoption across global markets. Their rich potassium, fiber, and vitamin content makes them indispensable as a staple fruit, while convenience and year-round supply support demand in both fresh consumption and processed food categories.

Rising demand for organic and sustainably sourced produce is further propelling market growth, supported by increasing health consciousness, urbanization, and consumer preference for clean-label and pesticide-free fruits. Their versatility in smoothies, baked goods, dairy alternatives, and ready-to-eat products enhances their value in the food and beverage processing industry.

Expanding retail networks, supermarket penetration, and e-commerce platforms are strengthening market accessibility, while growing export trade ensures wider global reach. As consumers prioritize nutrition, affordability, and convenience, Cavendish bananas continue to dominate the tropical fruit segment. With producers focusing on quality, sustainability, and global supply chain efficiency, the market is set to witness steady expansion in the coming years.

The market is segmented by product type, application, sales channel, and region. By product type, the market is categorized into organic Cavendish banana, conventional Cavendish banana, organic fair trade Cavendish banana, and conventional fair trade Cavendish banana. Based on application, the market is segmented into food and beverage processing, cosmetic and personal care, pharmaceutical and supplements, animal feed, foodservice (HoReCa), household (retail), and others. In terms of sales channel, the market is bifurcated into direct sales, retail sales (modern trade, convenience store, departmental store, online retailers, traditional grocery store, and other sales channels). Regionally, the market spans across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The organic Cavendish banana segment is poised to maintain strong growth, with an estimated market share of around 35%, making it the leading product type in the growing market. The organic Cavendish banana segment represents a rapidly growing portion of the market, driven by increasing consumer awareness of health, sustainability, and environmental concerns. Organic bananas are cultivated without synthetic pesticides, herbicides, or genetically modified organisms, appealing to health-conscious buyers who prioritize natural and chemical-free foods. This segment’s growth is fueled by a global shift toward organic produce, supported by favorable government policies and certifications that assure quality and authenticity.

Consumers value organic Cavendish bananas for their perceived nutritional benefits and contribution to sustainable farming practices, including reduced soil degradation and biodiversity preservation. Retailers and foodservice providers are expanding their organic offerings, enhancing availability in supermarkets, online platforms, and specialty stores. Additionally, organic bananas are integrated into premium food and beverage products targeting niche markets.

The food and beverage processing segment is the largest and most significant application within the market, accounting for 38% of the market share. This segment’s growth is driven by the versatile use of Cavendish bananas as a key ingredient in a wide range of food and beverage products. Bananas are commonly incorporated into smoothies, fruit juices, baked goods such as banana bread and muffins, dairy alternatives like banana-flavored yogurts, and energy bars.

Their natural sweetness, nutritional benefits, and consumer preference for convenient, healthy products boost demand in this segment. The segment also benefits from innovations like ready-to-drink beverages and baby foods containing banana puree. Additionally, the rise of the health and wellness trend globally encourages manufacturers to create nutrient-rich products that include Cavendish bananas. Food and beverage processing remains pivotal in expanding the market’s reach across retail, foodservice, and online channels, reinforcing its position as the leading application segment in the market.

From 2025 to 2035, rising consumer demand for healthy, organic, and sustainably sourced fruits is driving significant growth in the market. Increasing preference for organic Cavendish bananas and their incorporation into fortified and convenience foods has positioned producers investing in disease-resistant cultivars and sustainable farming practices as key players in meeting evolving consumer needs and expanding product offerings.

Growing Consumer Health Awareness Drives Market Growth

The steady rise in consumer focus on wellness, natural foods, and nutritional value is a primary catalyst for growth in the market. Increased demand for organic and fresh bananas as a convenient, nutrient-rich snack is fueling the expansion. By 2025, producers are expected to improve quality through sustainable cultivation and supply chain innovations to meet consumer expectations for freshness and safety.

Innovation in Product Development Expands Market Opportunities

Recent innovations in cultivation, organic certification, and supply chain management have expanded the market’s reach beyond traditional fresh produce. These advancements enable improved disease resistance, extended shelf life, and consistent quality, creating new opportunities in retail, foodservice, and processed food sectors. Producers adopting sustainable practices and certifications cater to environmentally conscious consumers, reinforcing long-term market growth.

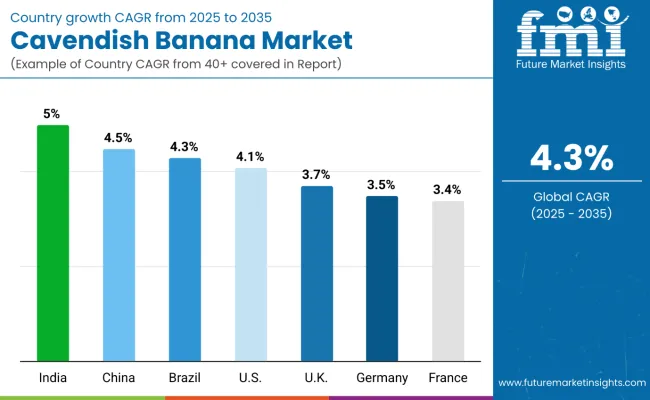

| Countries | CAGR (%) |

|---|---|

| India | 5.0 |

| China | 4.5 |

| Brazil | 4.3 |

| USA | 4.1 |

| UK | 3.7 |

| Germany | 3.5 |

| France | 3.4 |

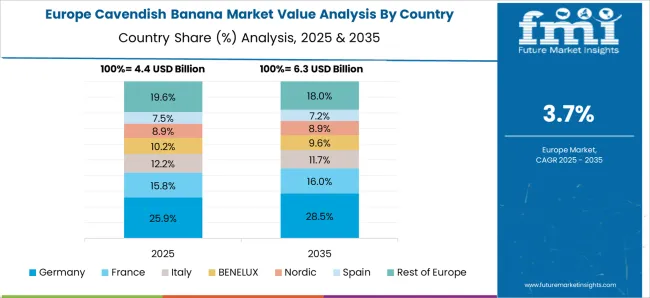

The market shows diverse growth rates among key countries. India leads with a remarkable 5% CAGR, driven by large-scale production and government support for sustainable farming. China follows with 4.5%, fueled by rising urbanization and organic cultivation. Brazil’s market grows at 4.3%, supported by strong local production and expanding retail channels. The USA sees 4.1% growth, propelled by imports and health-conscious consumers. The UK and Germany have moderate growth at 3.7% and 3.5%, focusing on organic and fair trade bananas. France grows steadily at 3.4%, driven by environmental awareness and organic product demand. India holds leadership due to its dominant role in cultivation and exports.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

The Cavendish banana market in India is expected to expand at a CAGR of 5% from 2025 to 2035, due to its status as the world’s largest banana producer. The country is investing heavily in sustainable and organic cultivation practices, supported by strong government initiatives aimed at boosting exports and modernizing agriculture. Expansion of cold chain infrastructure and supply networks improves banana freshness and market reach both domestically and internationally.

Increasing urbanization and health awareness among consumers are driving demand for organic and fair trade bananas. Online and modern retail channels are growing rapidly, making Cavendish bananas more accessible. Challenges such as disease control are addressed through research and innovation, enhancing yield and quality. This combination of factors positions India as a leading market in cultivation, export, and consumption.

Revenue from Cavendish banana in China is expected to grow at a CAGR of 4.5% from 2025 to 2035, driven by increasing urbanization and rising disposable incomes. Domestic consumption is supplemented by growing imports to satisfy healthy eating trends. Organic banana cultivation is gaining traction as consumer demand shifts toward natural, pesticide-free produce. Investments in cold storage, supply chain logistics, and quality control are supporting year-round availability and better product consistency.

Retail expansion through supermarkets, convenience stores, and online platforms is making bananas more accessible. The government is encouraging sustainable agriculture practices, aligning with environmental policies. Market players focus on enhancing processing and packaging innovations to cater to evolving consumer preferences. Overall, China’s market reflects balanced growth with increased production, imports, and consumption.

Revenue from Cavendish banana in Brazil is expected to grow at a 4.3% CAGR from 2025 to 2035, driven by strong local production and expanding domestic demand. Research initiatives focused on disease resistance and yield improvement are enhancing production efficiency. The expanding urban middle class and rising health awareness promote higher banana consumption in both retail and foodservice sectors.

Modern retail channels such as supermarkets and online stores are growing, improving accessibility for consumers. Foodservice adoption of banana-based products is also increasing, supported by convenience and nutrition trends. Sustainability practices and quality control measures are gaining importance to meet market demands. Brazil plays a crucial role as a producer and consumer in the global banana landscape.

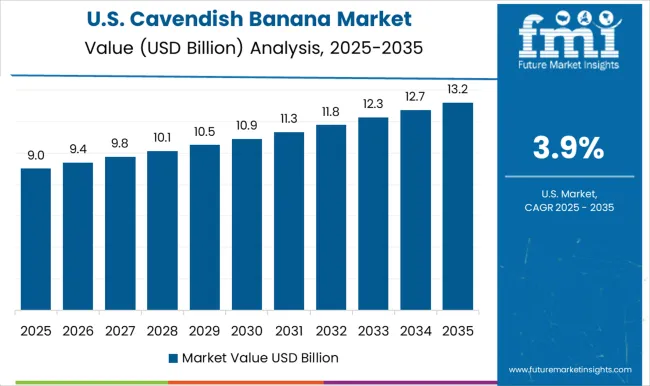

Demand for Cavendish banana in the USA is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by a health-conscious consumer base seeking organic and fresh produce. Imports primarily from Latin America ensure consistent supply throughout the year. Foodservice providers and retailers are adopting innovative banana-based products, including smoothies, snacks, and ready-to-eat foods.

The growth of online grocery platforms has further boosted availability and convenience. Consumers increasingly favor nutrient-rich and convenient foods, aligning with wellness trends. Import infrastructure and cold chain logistics continue to improve, supporting market expansion. Industry players are also investing in sustainable sourcing and certifications to meet ethical demands.

Sales of Cavendish banana in the UK are expected to grow at a CAGR of 3.7% from 2025 to 2035, driven by strong consumer interest in organic and ethically sourced fruit. British consumers prioritize health, convenience, and sustainable sourcing when purchasing bananas. Retailers are actively promoting organic products through certification labels and targeted marketing campaigns. The rise of online supermarkets and quick-delivery services is enhancing product accessibility.

Foodservice businesses are increasingly featuring bananas in nutritious and ready-to-eat options for the growing on-the-go consumer base. Efforts to reduce environmental impact through improved supply chain practices support market growth. The UK market reflects a blend of evolving consumer preferences and retail innovation.

Sales of Cavendish banana in Germany are expected to grow at a CAGR of 3.5% from 2025 to 2035, driven by increasing consumer preference for sustainably sourced fruits and rising health consciousness promoting higher fruit intake. Sensitivity to sustainability and ethical sourcing fuels demand among environmentally conscious consumers. The country benefits from well-established retail chains and rapidly growing e-commerce platforms facilitating broad distribution.

Stringent regulatory standards ensure product quality, safety, and traceability, reinforcing consumer trust. Foodservice sectors increasingly feature organic bananas in their offerings, aligning with health trends. Retailers actively promote organic products through certifications and marketing. Efforts toward reducing carbon footprints in supply chains are shaping competitive strategies. Growth in Germany is steady, supported by consumer preferences for quality and responsibility.

The Cavendish banana market in France is expected to grow at a CAGR of 3.4% from 2025 to 2035, supported by increasing consumer demand for organic and fair trade bananas. French consumers show strong preference for sustainably sourced and high-quality fresh produce, reflecting awareness of the environment and lifestyle health trends. Retailers are expanding organic product ranges in supermarkets and specialty stores, while online grocery shopping is gaining traction.

Foodservice providers incorporate bananas into health-focused menus and snacks. Strict regulatory frameworks ensure product safety, quality, and traceability. The market benefits from collaborations between growers, distributors, and retailers focused on sustainability certifications and carbon footprint reduction. These efforts create a steady growth environment aligned with consumer expectations.

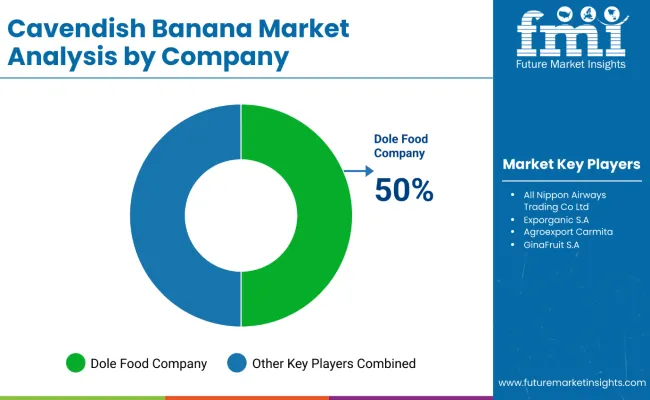

The market is moderately consolidated, with key players differentiating themselves through cultivation expertise, product innovation, and strong regional presence. Dole Food Company holds a significant market share of 50%, reflecting its strong global footprint and extensive distribution network. Leading companies such as Dole Food Company and Chiquita Brands International dominate through large-scale production capabilities and diverse product offerings, including organic, fair trade, and conventional bananas catering to both retail and foodservice sectors. Their strengths lie in sustainable farming practices, disease-resistant cultivar development, quality control, and extensive global distribution networks.

Mid-sized and regional players focus on local sourcing, organic certification, and product customization to serve niche markets, particularly in Asia-Pacific and Latin America. Barriers to entry are moderate due to the need for advanced agricultural techniques, compliance with quality and safety standards, and sustainable sourcing. Competitiveness hinges on innovation in cultivation, environmental sustainability initiatives, and the ability to adapt to shifting consumer preferences and regulatory landscapes across diverse regions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 18.8 Billion |

| Product Type | Organic Cavendish Banana, Conventional Cavendish Banana, Organic Fairtrade Cavendish Banana, and Conventional Fairtrade Cavendish Banana |

| Application | Food and Beverage Processing, Cosmetic and Personal Care, Pharmaceutical & Supplements, Animal Feed, Foodservice (HoReCa), Household (Retail), and Others (Industrial uses, by-products) |

| Sales Channel | Direct Sales, Retail Sales (Modern Trade, Convenience Stores, Departmental Stores, Online Retailers, Traditional Grocery Stores, and Other Sales Channels. |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | All Nippon Airways Trading Co Ltd., Exporganic S.A., DISCOVERY ORGANICS, Salix Fruits, Agroexport Carmita, Union de Bananeros de Uraba, GinaFruit S.A., Chiquita Brands International Sàrl, Dole Food Company, Fresh Del Monte Produce Incorporated, Pisum Food Services Private Limited, Reybanpac, and Rey Banano del Pacífico C.A. |

| Additional Attributes | Dollar sales by product type, application, and sales channel, regional demand trends, competitive landscape, consumer preferences for organic versus conventional alternatives, integration with responsible sourcing practices, innovations in processing technology, and quality standardization for diverse industrial applications |

The global cavendish banana market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the cavendish banana market is projected to reach USD 28.1 billion by 2035.

The cavendish banana market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in cavendish banana market are organic and conventional.

In terms of application, food and beverage processing segment to command 48.7% share in the cavendish banana market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Flakes Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Milk Market Trends - Demand & Growth 2025 to 2035

Korea Banana Flour Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

Demand for Banana Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Banana Flour Market Analysis by Source, Application, Distribution Channel, and Country Through 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA