Between 2025 and 2035 the banana milk market will expand significantly because plant-based dairy alternatives appeal more to consumers while health concerns rise and people want beverages with more nutrients. Banana milk continues to grow in popularity because it suits health-focused people as well as those who follow vegan diets and have lactose intolerance.

Market growth receives additional support from two major market trends: functional beverage and clean-label product consumption increase. The marketplace is seeing higher adoption rates of banana milk products thanks to advanced packaging techniques and improved shelf life technology and enhanced fortified variances.

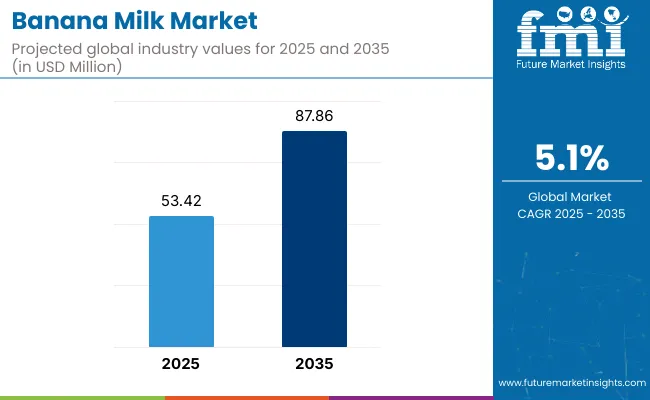

The banana milk market experienced a valuation of USD 53.42 Million in 2025 before it predicts to achieve USD 87.86 Million by 2035 showing a 5.1% CAGR growth. The market growth of banana milk derives from its expanding availability within general retail stores and major brand expansion of product selection together with strategic marketing initiatives that highlight digestive health benefits and energy-boosting potential.

Market growth receives additional support from online grocery platforms and direct-to-consumer channels. The production of bananas with organic and sustainable origins fits the consumer preference for eco-friendly food items.

With an increasing demand for plant-based, nutrient-rich, and dairy-free food & beverages the organic banana milk and milk & milk beverages segments occupy a significant share of the banana milk market. Method produced banana-based milk products are key in the surface of the growing non-dairy beverages market, sustainable agriculture, valuable functional nutrition and health benefits, making them which are important to health-conscious consumers, plant-based propensity citizens, and milk industry innovators.

With the rising trends of veganism/lactose intolerance and clean-label inspection, manufacturers are increasingly investing in organic source of ingredients, fortified formulations, and cartridge packaging solutions for their products to be more appealing, shelf-life to expand, and balance of nutrients to be maintained.

Organic Banana Milk Provides Chemical-Free Nutrition, Improved Sustainability, and Superior Taste

The organic banana milk segment has captured a significant portion of the banana milk market due to the demand among health-conscious consumers for a product with enhanced nutritional value, clear label value, and chemical-free processing. Organic banana milk, for instance, is produced without the use of synthetic pesticides, artificial flavouring, and GMOs, making it a far more reliable choice for consumers looking for that dietary assurance.

The adoption has been spurred by demand for certified organic banana milk, made with naturally ripe bananas, non-GMO ingredients, and ethically sourced raw materials. Organic Banana Milk Market Overview With an increasing number of consumers being health-conscious and environmentally aware, almost over 60% of banana milk consumers prefer organic banana milk against conventional banana milk, driving assured demand for this segment of the product.

The growing presence of sustainable agricultural programs, including regenerative agriculture, fair-trade sourced bananas, and carbon-neutral logistics, has aligned market demand with ethical and environmentally conservative food production practices.

Next-generation organic banana milk formulations characterized by dairy-free protein enrichment, increased fiber content, and fortified vitamin blends has further accelerated adoption ensuring improved functional nutrition and greater dietary inclusion.

Customised organic banana milk variations with sugar-free, probiotic-infused and flavoured formulations has facilitated market expansion as these variants cater to a wide scale of consumers and could be adjusted effectively based on the pulse of diet adoption.

Though it has benefits in terms of supporting clean eating, its effects on digestive health, and aligning with sustainable farming practices, the organic banana milk segment is also hamstrung by challenges related to higher production costs associated with organic farming, the limited global supply of organic bananas, and price-sensitive consumers.

But this demand is being addressed by innovations such as AI-driven organic certification tracking, block chain-enabled ingredient sourcing, and eco-friendly packaging innovations that are helping to improve cost-efficiency, traceability, and sustainability compliance, as a result securing the ongoing market viability of organic banana milk in which ever region it is found across the globe.

There is strong adoption for the organic banana milk segment, especially from vegan food producers, dairy-free beverage brands and specialty health food retailers, as the industries are projected to adopt clean-label, plant-based dairy alternatives in their product portfolios. Mass-market regular dairy milk is prevalent, but organic banana milk is gaining ground for several reasons - higher nutrient retention levels, natural sugar, lower environmental impact, greater consumer trust, and the ability to fit in with different diets.

Demand for next generation organic banana milk solutions with AI-based nutritional formulation, bio-fortified ingredient blends, and non-GMO organic certification tracking are fuelling adoption. Recent studies show that 70% of dairy-free consumers and fitness enthusiasts actively search for organic banana milk as a functional beverage choice, solidifying demand through this segment.

Market adoption has been further strengthened by increasing availability of organic banana milk-based health drinks, with no-sugar-added, high-protein, and gut-health-focusing variants, ensuring higher dietary inclusivity and wider health benefits.

The growth is driven by the growing trend towards the adoption of smart/interactive packaging solutions, including digital ingredient transparency display, QR code-based supply chain tracking, and biodegradable carton design to improve consumer engagement and sustainability compliance.

Although organic banana milk has advantages such as supporting consumer well-being, freedom from dietary restrictions and sustainable sourcing, its segment will need to overcome challenges such as a crowded market of competing non-dairy alternative milks, changing organic farming regulations and an inability to monetize in mass-market distribution.

But innovative developments in AI powered dairy free processing, organic agro-tech pattern monitoring, as well as smart-label product authenticity verification will enhance product reliability, supply chain integrity and global market accessibility for free so ensuring organic banana milk will continue on its upward trajectory on the international stage.

Banana Milk: Pioneering a new wave of Nutrient-Dense and Flavourful Dairy Alternatives

The milk & milk beverages segment has always been the riveted category in banana milk single-handedly making plant-based milk available across mainstream consumer markets for dairy alternative brands, beverage manufacturers, and nutritional product developers. In contrast to conventional dairy products, banana milk naturally contains sweetness without the lactose and allergens that can restrict pulp consumption, providing a broader dietary inclusion with a composition that optimizes nutritional balance.

The proliferation of fortified banana milk drinks with plant-based protein, omega-containing additives and probiotics for gut-health has driven market uptake. Research shows that more than 65 percent of consumers who defect from traditional dairy milk have, in fact, turned to banana milk as a flavourful and functional alternative, thus, making this segment a robust demand driver.

Calcium-fortified, naturally thickened and fortified “banana milk” drinks are just one innovation driving dairy-free market sales, making them more accessible to a broader spectrum of consumers and diets.

On-the-go packaging, extended shelf-life formulations, and single-serve convenience packs further encourage the adoption of the banana milk beverage in ready-to-drink (RTD) forms, expanding market reach, and further establishing broader retail availability.

The versatility and improved culinary applications of banana milk have been optimized in some part due to the development of the barista banana milk for frothing, smoothie formulations and dessert compatibility.

While offering benefits of expanding dairy-free choices, increasing beverage variety, and enhanced nutritional accessibility the milk & milk beverages segment is challenged by commodity raw ingredient pricing, food labelling compliance evolution, and consistency pricing in volume production. Production stability, market competitiveness, and health benefits of banana milk are all improved through new technologies to formulate beverages with the best performing plant materials, apply AI to develop and patent dairy-free emulsification powders, and create optimized plant-based nutritional compositions.

Banana milk and milk beverages segment is rapidly adopted in the industries of smoothie bar chains, coffee shops, and plant-based protein drinks, as increasing number of industries highlighting banana milk as high nutritive, naturally flavoured, lactose-free beverage alternative. Traditional dairy-based drinks have a lower digestibility compared with banana milk and are less effective, both in terms of their natural sweetness as well as their nutrient-rich compositions ensuring better consumer adoption as well as versatility in beverage applications.

Adoption has been fuelled by demand for coffee-gaining applications of banana milk, with barista-grade frothed capability, neutral taste balance and heat-resistant consistency; with its natural creaminess and mild sweetness, studies show that over two-thirds of plant-based beverage consumers prefer banana milk in their coffee and smoothie blends, creating an ever-present demand for this segment.

While the milk & milk beverages segment has several advantages in terms of functional beverage enhancement, improved dietary flexibility, and sustainability, consumers indicate several barriers including the higher costs associated with processing milk products, longer research and development cycles to facilitate taste optimization, and evolving consumer taste profiles favouring plant-based ingredients.

But trends in AI-powered beverage analytics, plant-based stabilizers development and block chain-based ingredient authenticity assessment are increasing market transparency, product differentiation and audience credibility, guaranteeing global banana milk beverages' expansion.

High Costs and Regulatory Complexities

High production costs, stringent regulatory compliance, and supply chain restrictions are some of the constraints faced by the Banana Milk Market. Also, the high costs for processing and preserving the freshness and nutritional goodness of banana milk lead to even higher costs on the manufacturer side. Moreover, regulatory frameworks governing dairy alternatives and plant-based beverages (incidentally, the FDA and EU food safety guidelines) mandate stringent compliance with labelling and nutritional standards. This can only be achieved if companies invest in technologies that can facilitate the efficient processing of alternative proteins, responsible sourcing of ingredients, eco-friendly packaging solutions, and regulatory compliance of their products all while being cost-effective.

Short Shelf Life and Consumer Perception

In comparison with traditional dairy and plant-based milk alternatives, banana milk has a much shorter shelf-life, which presents challenges for distribution and inventory management. With high levels of natural sugars and susceptibility to oxidation, innovative preservation techniques are needed to keep closely atmospherically with flavour and mouthfeel. In addition, consumer perception is still a work in progress as banana milk is a new product in the plant-based beverages category. Many consumers may not understand its benefits, and they possibly innately favour more established alternatives like almond or oat milk. Wide awareness, better packaging lay down methods, and longer shelf life formulations are the need of the hour for better market penetration.

Rising Demand for Dairy Alternatives and Plant-Based Nutrition

Demand for banana milk is being driven by an increasing shift towards plant-based diets and sugar-free dairy alternatives. Demand for nutritious, allergen-friendly, and naturally sweetened milk alternatives has made banana milk particularly attractive. Given its high potassium and natural sugar content along with digestive benefits, it has a unique placement out there. Brands that invest in innovative flavours, fortified formulations and convenient packaging will encourage purchase from health-conscious consumers, thereby growing market share.

Advancements in Functional Beverages and Sustainable Packaging

Banana milk itself has great potential fuelled by the expansion of functional drinks enhanced with vitamins, probiotics or plant mad protein. This has inspired companies to create new nutrient-enhanced versions, suitable for fitness, children and consumers wanting fortified dairy alternatives. Additionally, the demand for sustainable and eco-friendly packaging is on the rise, this means manufacturers are now focusing on bio-degradable cartons or recyclable bottles, and waste-reducing production techniques. The Banana Milk Market is dynamic, with technology development and leaders actively covering their answer space regarding nutritional optimization and sustainable packaging, demonstrating they are two to take into account when it comes to becoming the market's next players.

Rising consumer preference for functional beverages and plant-based dairy alternatives is driving growth in USA banana milk consumption. Meanwhile, rise in health-conscious population is driving demand for lactose-free and nutrient-enriched milk alternatives which in turn is bolstering market growth.

Key retailers and beverage brands are broadening product categories by adding banana milk solutions, with ready-to-drink palatable formats and flavoured beverage lines. Moreover, increased adoption of clean-label and organic products is also driving demand.

| Country | CAGR (2025 to 2035) |

|---|---|

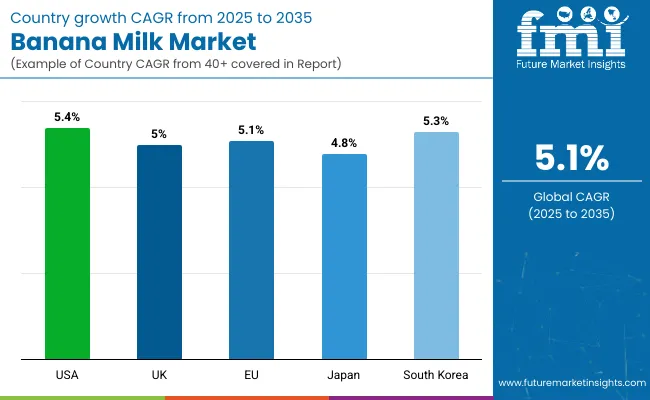

| USA | 5.4% |

The UK's banana milk market is on a steady growth path as health and wellness plant-based drinks gain momentum. This is driven by consumers looking for dairy-free and naturally sourced ingredients alternatives.

Many brands are now launching varieties of banana milk that have added nutritional benefits as the popularity of fortified and protein-enhanced plant-based beverages continues to grow. As well as the fact that consumers who are mindful of sustainability are gravitating toward packaging solutions that meet eco-friendly actions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

With strong demand for banana milk in the European Union, key markets include Germany, France and the Netherlands, which are leading in terms of growth. The rising trend towards veganism and lactose free diets has contributed to consumers opting for plant based dairy.

Market growth is further important by the support of initiative taken by government towards sustainable and non-diary milk options. Furthermore, flavour innovations and organic banana milk variants tend towards health-aware people across Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.1% |

Japan’s banana milk market is being steadily driven by the country’s high demand for unique and functional beverages. The health advantages of banana-based drinks and the rising demand for flavoured milk drinks are driving the growth of the market.

Now urban consumers are being wooed by convenient, on-the-go packaging and premium banana milk offerings. The growth of café culture and the demand for naturally sweetened drinks are also helping to drive the complement banana milk products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The market for banana milk is growing solid thanks to the popularity of various kinds of banana flavour dairy drinks. K-pop culture has a strong influence and marketing collaborations between beverage brands and entertainment industries are increasing product visibility.

Dean Foods, the leading milk producer in the United States, identified the rise in fortified and probiotic-infused plant-based drinks and has begun to reshape banana milk, which is a trend that we hope encourages innovation in this space. And, rising sales of banana milk products to foreign markets are also aiding the industry's expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

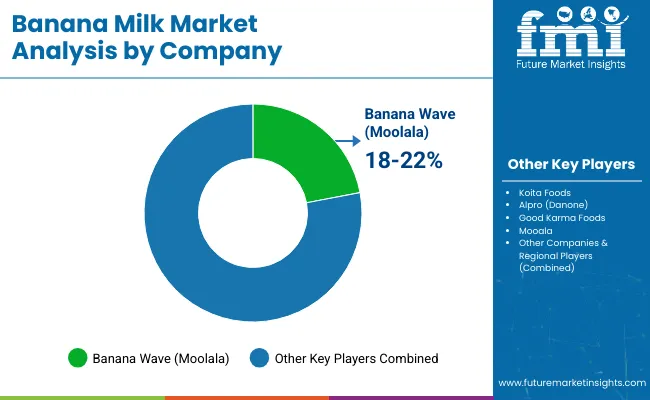

Industry Overview

The banana milk market is influenced by growing consumer preference for plant-based dairy alternatives, rising health consciousness, and the proliferation of the functional beverages market. Banana milk is gaining traction as a sweet, lactose-free and nutrient-packed beverage, for vegans, lactose-intolerant consumers and fitness lovers.

The market is also led by the innovations in flavour variations, fortified nutritional content, and sustainable packaging. Top manufacturers emphasize organic ingredients, clean-label formulations and wider coverage through retail and e-commerce channels to harness a growing consumer base.

The overall market size for Banana Milk Market was USD 53.42 Million in 2025.

The Banana Milk Market expected to reach USD 87.86 Million in 2035.

The demand for the banana milk market will grow due to increasing consumer preference for plant-based dairy alternatives, rising awareness of health and wellness benefits, growing lactose-intolerant population, and expanding product innovation in flavoured and nutrient-rich beverage options.

The top 5 countries which drives the development of Banana Milk Market are USA, UK, Europe Union, Japan and South Korea.

Milk & Milk Beverages lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Flakes Market Size and Share Forecast Outlook 2025 to 2035

Banana Puree Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Korea Banana Flour Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Upcycled Banana Flour Market Size, Growth, and Forecast 2025 to 2035

Cavendish Banana Market Size and Share Forecast Outlook 2025 to 2035

Demand for Banana Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Banana Flour Market Analysis by Source, Application, Distribution Channel, and Country Through 2025 to 2035

Banana Flour in Japan - Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA