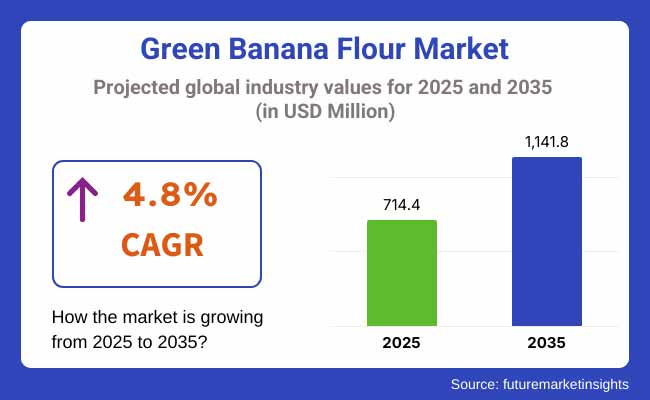

The green banana flour market is expected to witness steady growth between 2025 and 2035, driven by rising consumer demand for gluten-free and grain-free alternatives, increasing health consciousness, and growing adoption of resistant starch in functional foods. The market is projected to be valued at USD 714.4 million in 2025 and is anticipated to reach USD 1,141.8 million by 2035, reflecting a CAGR of 4.8% over the forecast period.

In baking, dietary supplements, baby food, and functional beverages, green banana flour is widely used as a high-fiber, low-sugar, and prebiotic-rich ingredient.

As a result, there is an increasing demand for clean-label, plant-based, and nutrient-dense flour alternatives are driving the market expansion. Yet, costly production, supply chain issues and low consumer knowledge in some areas present barriers to wider market acceptance.

Improvements in spray-dried banana flour processing, AI-powered supply chain optimization and organic-certified production are improving product quality, shelf life and sustainability. The boom of banana flour keto, paleo, and diabetic-friendly fresh and ultra-processed food innovations are also broadening opportunities in functional nutrition verticals.

Green banana flour market in North America is expected to maintain its position as a prominent market, owing to factors such as increasing demand for gluten-free options, growing health-conscious consumer base, and robust distribution of organic and functional foods.

There is immense growth in banana flour-based baking, protein powders, and gut-health formulations in the United States and Canada, as well as a growing interest in banana-derived functional ingredients in the sports nutrition and weight management sectors.

Europe is expected to register a steady growth in terms of adoption of green banana flour, with increasing dietary consciousness, high demand for high-fiber foods, and regulatory support for clean-label starch alternatives driving the market growth.

Germany, the UK, France, and Italy are at the forefront of banana flour-based pasta, breakfast cereals, and functional beverage formulations. The EU is also placing an increasing emphasis on sustainable agriculture and food waste reduction, which further increasingly encourages the upcycling of green bananas into high-value nutritional ingredients.

Asia-Pacific is expected to be the fastest-growing region during the forecast period due to increased production of bananas for agricultural purposes in China, India, Japan, and Australia, growth of the functional food industry, and increasing adoption of plant-based diets.

China continues to be the key player in the banana flour exports while India’s traditional usage of raw banana flour in Ayurvedic nutrition is promoting increase in domestic consumption. Japan and South Korea are interested in banana flour-based fermented health foods and beauty supplements, broadening its usage in holistic wellness purposes.

Challenges: High Processing Costs and Limited Consumer Awareness

Investigating the dietary advantages of green banana flour, other than those that other food products can also provide, in addition to high production and processing costs, scarcity of organic-certified raw materials, and low consumer awareness in underdeveloped countries about its significant nutritional advantages over its competitors are the greater concerns for marketing agents who play an important role in boosting this product, which has been considered as a functional food owing to the sustainability of its organic production and remarkably high dietary contents. Gluten-free flours made from almond or coconut are often used as substitutes, which gives manufacturers competition in the market position.

Opportunities: Functional Nutrition and Sustainable Sourcing

New growth opportunities are arising from the growing uptake of resistant starch, particularly for gut health, weight management and blood sugar control. Technological advancements in AI-powered agricultural analytics, sustainable banana farming practices, and biofortified banana flour production would propel the market growth in the forecast years.

Furthermore, the emerging upcycled food trends and zero-waste manufacturing are also granting rapid demand of banana flour-based functional ingredients in sports nutrition, baby food and plant-based protein products.

The market is projected to grow at a moderate pace due to factors such as an increase in demand for gluten-free products and an increase in health-conscious consumers along with increasing gene therapy applications in the functional food sector during the period between the years 2020 to 2024.

The movement towards resistant starch, organic and sustainable green banana flour grew, with particular opportunities in bakery, dietary supplements, baby food, and plant-based diets.

Low-temperature drying procedures, prebiotic-rich compositions, and AI-based supply chain management allowed the product to not only reach the market but to maintain high quality. Still, obstacles including high processing costs, low consumer awareness in various regions, and competition with other gluten-free flours (i.e. almond and coconut flour) restricted widespread adoption.

By 2025 to 2035, the market will adapt to include personalized nutrition recommendations powered by AI, bioengineered starch banana variants with high resistance to processing, and blockchain-driven farm-to-table transparency.

Also, the use of precision agriculture for optimized banana agriculture, AI-generated predictive demand analytics and enzymatically enhanced banana flour for better digestibility will improve efficiency and market coverage.

Innovations such as smart packaging for longer shelf life, artificial intelligence(Powered food formulation customization, and regenerative farming for banana cultivation also play an important role in accelerating the transformation of the industry.

Innovations such as zero-waste banana processing, artificial intelligence nutritional profiling, and carbon-neutral banana flour will reshape market trends to deliver greater sustainability, health benefits, and accessibility.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EU organic certification, and gluten-free food labeling standards. |

| Product Innovation | Use of air-dried and spray-dried banana flour, organic variants, and basic functional food applications. |

| Industry Adoption | Growth in gluten-free baking, baby food, plant-based diets, and functional food formulations. |

| Smart & AI-Enabled Solutions | Early adoption of smart supply chain monitoring, automated sorting in banana processing, and AI-powered demand forecasting. |

| Market Competition | Dominated by specialty flour manufacturers, organic food brands, and gluten-free product suppliers. |

| Market Growth Drivers | Demand fueled by increasing gluten intolerance, growing interest in gut health, and rise in plant-based diets. |

| Sustainability and Environmental Impact | Early adoption of organic banana farming, reduced pesticide usage, and biodegradable flour packaging. |

| Integration of AI & Digitalization | Limited AI use in basic supply chain tracking, retail analytics, and production monitoring. |

| Advancements in Manufacturing | Use of traditional milling, basic drying methods, and conventional packaging. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven food safety compliance, blockchain-backed ingredient traceability, and carbon-neutral processing mandates. |

| Product Innovation | Adoption of bioengineered high-resistance starch banana flour, AI-optimized food formulations, and enzymatically modified prebiotic-enhanced flours. |

| Industry Adoption | Expansion into AI-driven personalized nutrition, smart food packaging with shelf-life monitoring, and next-gen sustainable superfoods. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-assisted crop yield optimization, blockchain-backed sustainable farming certification, and AI-driven consumer dietary recommendations. |

| Market Competition | Increased competition from AI-integrated food-tech startups, precision agriculture-driven banana suppliers, and sustainable plant-based ingredient companies. |

| Market Growth Drivers | Growth driven by AI-powered personalized nutrition, biofortified banana varieties, and fully sustainable food production chains. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste banana processing, AI-optimized regenerative agriculture, and blockchain-tracked carbon-neutral supply chains. |

| Integration of AI & Digitalization | AI-powered real-time nutritional profiling, automated smart food labeling, and blockchain-backed farm-to-consumer traceability. |

| Advancements in Manufacturing | Evolution of self-stabilizing banana flour, AI-driven enzymatic flour enhancement, and fully biodegradable nanotech-based food packaging. |

North America is a leading market for green banana flour as the demand for gluten-free food options, the awareness of gut health benefits, and the applications of banana flour in baking and functional food segments increase.

Market growth is being driven by the rise of plant-based and paleo-friendly diets. Novel food processing techniques such as enzymatic treatment and spray drying are also being used to improve the texture and shelf stability of green banana flour. E-commerce also on the rise for sales of specialty health foods and direct-to-consumer sales significantly shaping the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

The United Kingdom green banana flour industry is expected to witness impressive growth due to the demand for clean-label and allergen-free ingredients, growing implementation of resistant starch in gut health products and increased consumer interest in functional food applications. The growing demand for premium banana flour product is propelled by the expansion of organic and non-GMO food categories.

Furthermore, the growing focus on environmentally friendly packaging and sustainable sourcing practices is also shaping consumer purchasing behavior. The trend of using alternative flours in plant-based and gluten-free baking also contributes to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

A rising propensity of consumers in these regions towards high-fiber and prebiotics-rich food, increasing regulatory support for clean-label ingredients and the growing adoption of banana flour in functional food formulations are the key factors for the growth of the green banana flour market in the European Union.

EU is making quicker shift to organic and fair-trade banana flour. Moreover, developments in food science and product innovation for example, blends with other alternative flours are driving industry growth. in infant nutrition and protein-enriched food is also expected to boost market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

Japan's green banana flour market is growing due to increasing interest in digestive health solutions, rising demand for plant-based functional foods, and a growing adoption of banana flour in alternative baking applications. The country’s top role in precision food processing has also catalyzed its developing of high-quality, nutrient-dense banana flour.

In addition to this, incorporation of banana flour in traditional snacks and desserts of Japanese origin is allegedly impacting product innovation. Trends towards more dietary fiber-enhanced food products and gut-friendly prebiotics also play a part in developments in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The country is establishing itself as an important market for green banana flour, with growing demand for low-GI and gluten-free products, increasing use of resistant starch in weight management and metabolic health, and high demand for natural food additives in the food and beverage industry driving market growth.

Demand for premium banana flour is increasing due to the country’s trend towards clean-label nutrition and high-fiber diets. Moreover, improvements in processing technology and AI-based food formulation are facilitating product development. Additionally, increasing adoption of banana flour in trending food products such as protein bars, energy snacks, and health-oriented beverages is driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Organic Green Banana Flour Gains Popularity as Demand for Chemical-Free, Sustainable Food Options Increases

The organic green banana flour is the fastest growing which is mainly used by health-conscious individuals who prefer eco-friendly flour that is devoid of pesticides and processed as little as possible. Unlike all-purpose flours, organic banana flour is produced free of synthetic fertilizers, chemical additives, and artificial preservatives, making it ideal for clean-label and organic certified food brands.

Market adoption has been driven by the growing demand for higher fiber content, resistant starch, and gut-friendly nutrients found in certified organic banana flour. This trend, combined with the growth of organic farming programs with sustainable farming practices, carbon-neutral processing, and ethical sourcing have driven market demand, focusing on environmental sustainability and product quality.

Adoption has also been catalyzed by the integration of advanced AI-powered quality assessment technologies with real-time pesticide residue detection, blockchain-supported traceability, and digital supply chain monitoring to ensure consumer trust and regulatory compliance.

With its health benefits, sustainability, and premium positioning, the Organic Green Banana Flour segment is expected to drive demand, even as the segment faces limits around raw material production and higher production costs, as well as strict organic certification requirements.

Some of the social dynamics, however, are emerging innovations in precision agriculture, AI-powered organic yield optimization and sustainable packaging solutions that improve efficiency scalability, and accessibility, will allow continued global expansion of organic green banana flour in the market.

Conventional Green Banana Flour Maintains Strong Market Presence Due to Cost-Effectiveness and Wide Industrial Applications

The conventional green banana flour segment accounts for significant market share globally, especially in industrial food processing, animal feed, and bulk food products. This, however, is not the case for banana flour because compared to organic flour, conventional banana flour has the advantage of higher yield efficiencies, cost-effective farming techniques, and broader distribution in global markets.

The growing use of commercial-grade banana flour abilities, along with improving shelf stability and shelf life in processed foods, as well as fortifying several nutrient formulations, has supported its adoption. Bulk supply networks, coupled with globalized trade partnerships, developed storage solutions, and optimized logistics, have further consolidated market demand with consistent product availability at competitive price points.

Adoption has been significantly supported with the automations available in banana flour processing industries, where multiple automated banana flour milling technologies work in harmony high-speed processing systems, moisture control optimization, and AI-based quality inspection which ensures higher efficiency with a high degree of product consistency.

While Conventional Green Banana Flour segment is cost-effective and can be produced in mass quantity with extensive acceptance among consumers it does face challenges such as chemical residue, regulatory scrutiny, and a surge in consumer preference over organic alternatives.

Nevertheless, recent innovations in clean-label processing methods, hybrid organic-conventional agriculture models, and AI-driven quality assurance systems are providing transparency, affordability, and sustainability which add to the facts extending the global market of conventional green banana flour.

Spray-Dried Banana Flour Leads Market Adoption as Food Processing Industries Prioritize Efficient Production

The spray-dried green banana flour segment is highly adopted in the market owing to its high-speed production rate, higher solubility, and longer time shelf stability. Spray drying allows for faster moisture removal, uniform particle distribution, and consistent texture compared to traditional drying methods, which makes it more favorable for the production of instant food mixes, baby food formulations, and nutritional supplements.

Adoption is driven by the rising demand for on-the-go banana-based food ingredients, with rapid rehydration property, light packaging & concentrated nutrient retention. High-capacity spray drying facilities with energy-efficient drying chambers, automated powder collection systems, and AI-based moisture level monitoring have improved market demand, providing higher efficiency and product uniformity.

Moreover, smartening food drying technologies with features such as real-time temperature control, predictive maintenance algorithms, and AI-controlled powder texture evaluation have further accelerated adoption due to product quality & negligible processing waste.

While cost-effective production, high-speed drying, and increased solubility make them an advantageous option, the spray dried green banana flour segment is hindered by nutrient degradation, restricted compatibility with organic processing, and the generation of capital-intensive infrastructure.

Emerging innovations such as low-temperature spray drying techniques, AI-driven moisture retention optimization methods, and sustainable energy recovery systems are enhancing efficiency, preserving nutrients, and promoting environmental sustainability, paving the way for sustained market growth of spray-dried banana flour in the global market.

Freeze-Dried Banana Flour Gains Popularity as Premium Nutritional Solutions Expand in Health Food Markets

The freeze-dried green banana Flour segment is seeing significant demand, especially for high-end health food, organic baby nutrition & functional dietary supplements. Cool ores like fruits, grains, veggies, and other items are dried in a unique way that preserves more nutrients, natural flavors, and increases bioavailability than traditional drying methods, making them desirable to specialty health food brands and premium organic powders.

The market is witnessing high adoption due to the growing demand for formulations with high retention of nutrients, preserved levels of resistant starch, probiotic compatibility, and health advantages for gut health. More than half of the premium health brands are using freeze-dried banana flour in top end nutritional products, studies show.

Market drivers are robust due to the application of vacuum-sealed dehydration, rapid sublimation techniques, and advancements in AI-assisted nutrients retention monitoring through freeze-drying technology.

The adoption has been further enhanced due to the implementation of precision freeze-drying control systems, which include automated moisture extraction and real-time quality assessment as well as blockchain-enabled supply chain traceability which provides additional transparency and allows for greater quality assurance.

Though freeze-dried green banana flour has the upper edge regarding nutritional integrity, premium positioning, and shelf life, the segment's growth is hindered by high production costs, low scalability, and niche targeting.

And yet, continued innovation, in fields such as energy-reduced freeze-drying and AI-based raw material selection and sustainable biodegradable packaging solutions, is making it cheaper, more accessible and more environmentally conscientious, scavenging for a spot in the global market for talking freeze-dried banana flour.

The green banana flour market is driven by increasing consumer demand for gluten-free and resistant starch-rich products, advancements in food processing technologies, and growing applications in the health and wellness industry.

The growing consumption of bakery, baby food, sports nutrition, and functional food products has led to steady growth of the market. Examples of trends driving the entire industry are organic and non-GMO banana flour, clean-label ingredient formulations, and sustainably sourced bananas.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Natural Evolution | 12-16% |

| International Agriculture Group (IAG) | 10-14% |

| NuNaturals Inc. | 8-12% |

| Kanegrade Ltd. | 6-10% |

| Woodland Foods | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Natural Evolution | Develops high-resistance starch banana flour for gut health and functional food applications. |

| International Agriculture Group (IAG) | Specializes in green banana flour for gluten-free and plant-based nutrition. |

| NuNaturals Inc. | Offers organic banana flour formulated for baking, smoothies, and health supplements. |

| Kanegrade Ltd. | Focuses on clean-label banana flour ingredients catering to food and beverage industries. |

| Woodland Foods | Provides non-GMO banana flour with high fiber content for health-conscious consumers. |

Key Company Insights

Natural Evolution (12-16%)

Natural Evolution leads in high-resistance starch banana flour, supporting gut health and functional nutrition markets.

International Agriculture Group (IAG) (10-14%)

IAG specializes in gluten-free and plant-based banana flour solutions for baking and nutrition-based products.

NuNaturals Inc. (8-12%)

NuNaturals focuses on organic banana flour, widely used in health supplements, smoothies, and alternative baking.

Kanegrade Ltd. (6-10%)

Kanegrade pioneers clean-label banana flour, serving food manufacturers with natural ingredient solutions.

Woodland Foods (4-8%)

Woodland Foods provides high-fiber, non-GMO banana flour designed for functional food and dietary applications.

Other Key Players (45-55% Combined)

Several health food and ingredient suppliers contribute to the expanding Green Banana Flour Market. These include:

The overall market size for the green banana flour market was USD 714.4 million in 2025.

The green banana flour market is expected to reach USD 1,141.8 million in 2035.

The demand for green banana flour will be driven by increasing consumer preference for gluten-free and healthy food alternatives, rising adoption in bakery and snack products, growing awareness of its prebiotic and digestive health benefits, and expanding use in plant-based and functional food industries.

The top 5 countries driving the development of the green banana flour market are the USA, Brazil, India, Australia, and the Philippines.

The Organic Green Banana Flour segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Process, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Process, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Process, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Process, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Process, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Process, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Process, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Process, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Process, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Process, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Process, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Process, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Process, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Process, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Process, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Process, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Process, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Process, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Process, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Process, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Process, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Process, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Process, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Process, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA