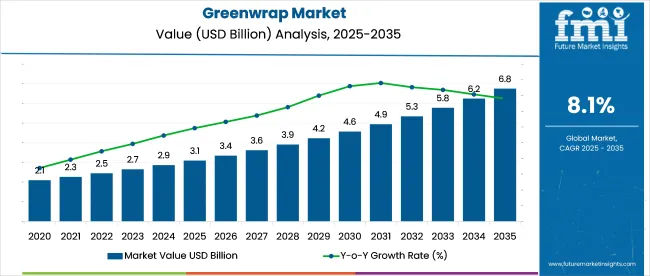

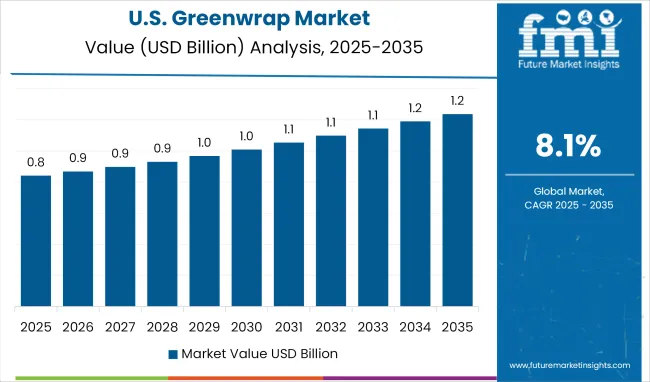

In 2025, the global greenwrap market is likely to be valued at USD 3.1 billion, with projections indicating growth to USD 6.8 billion by 2035 at a CAGR of 8.1%. Between 2020 and 2024, the greenwrap market expanded from USD 2.05 billion to USD 2.88 billion at an average YoY growth of 8.6%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3.1 billion |

| Projected Market Size in 2035 | USD 6.8 billion |

| CAGR (2025 to 2035) | 8.1% |

Early growth was driven by adoption in EV logistics and pharmaceutical cold-chain packaging. In 2021, vaccine transport requirements created a short-term spike, particularly for temperature-controlled variants. Automotive use expanded from 2022 as manufacturers replaced rigid packaging with recyclable insulation wraps. By 2024, stabilization was observed as demand shifted from emergency healthcare logistics to structural packaging needs in e-commerce and electronics.

From 2025 to 2035, steady YoY gains of around 8% are expected through 2034, followed by a 10.9% jump in 2035. Regulatory mandates in the USA, South Korea, and Germany will likely accelerate adoption across sectors. Growth in India is expected to remain gradual due to cost sensitivity, though local wrap production may improve accessibility.

Forecast expansion will rely on integration in food delivery, expansion of cold-chain infrastructure, and compliance with evolving producer responsibility norms across OECD and BRICS economies.

As of 2025, the greenwrap market accounts for an estimated 4-6% share of the global protective packaging market, valued at over USD 55 billion. In the sustainable packaging market is projected at USD 285 billion, greenwrap represents a smaller share of around 1-2%, reflecting the wide range of materials included in that segment.

In the e-commerce packaging market, estimated at USD 78 billion, greenwrap holds a share of approximately 3-4%, driven by growing demand for eco-friendly alternatives. Its presence in the void fill packaging market is more pronounced, at around 7-9%, due to its direct application in that function. In the biodegradable packaging market, which stands at about USD 25 billion, greenwrap comprises roughly 6-8%, reflecting its compostable composition and material profile.

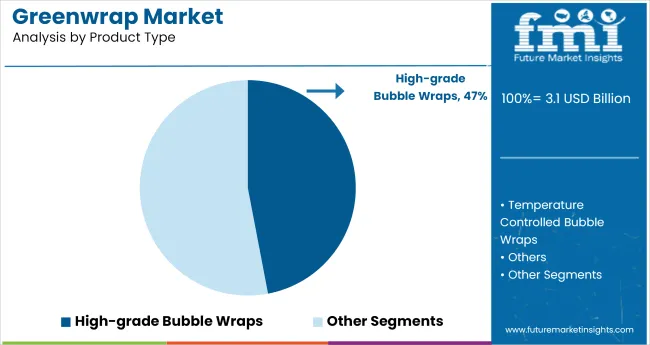

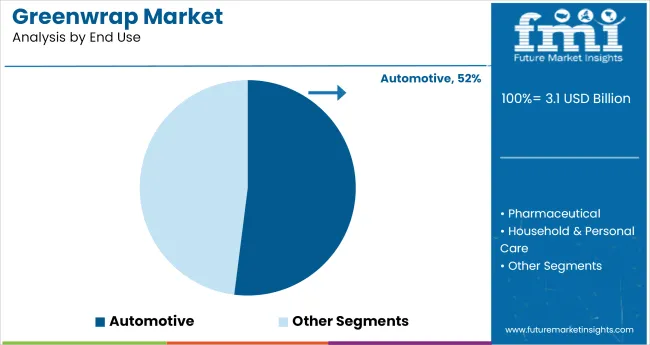

The greenwrap market is growing steadily, supported by increased demand for lightweight, durable, and efficient protective packaging. High-grade bubble wraps lead the product category with 47% market share in 2025, offering enhanced protection for precision items during transit. Among end users, the automotive sector dominates with 52% share, driven by consistent use in component wrapping and cross-border logistics.

High-grade bubble wraps are projected to hold 47% of the global bubble wrap packaging market in 2025, reaching a value of USD 1.57 billion. This growth is driven by rising demand for protective packaging across electronics, precision tools, and luxury goods. Between 2020 and 2024, adoption surged due to the expansion of e-commerce, where fragile items required consistent cushioning to minimize damage and returns.

Automotive is projected to account for 52% of greenwrap end-use demand in 2025, sustained by long-term packaging shifts across EV and component logistics. Between 2020 and 2024, OEMs in Germany, South Korea, and the United States gradually replaced rigid foams with recyclable insulation wraps for batteries, sensors, and lightweight body parts.

The greenwrap market is adjusting to shifts in protective packaging demand across perishables, direct-to-consumer shipments, and light electronics. Converter decisions are being shaped by input volatility, volume-to-weight optimization, and wrapping automation feasibility. Material sourcing adjustments and retailer kitting changes are influencing how vendors address breakage reduction, unit throughput, and inbound logistics.

Format Substitution Reducing Void Fill And Labor Hours

E-commerce fulfillment centers in Canada and Spain replaced kraft paper and bubble wrap with die-cut greenwrap for boxed glassware, trimming void fill use by 38% and reducing pack station time per order by 19%. Artisanal food exporters in Chile switched to roll-fed perforated greenwrap sheets for chilled hampers, eliminating the need for inner liners while maintaining damage thresholds on long-haul deliveries.

Boutique cosmetics brands in Australia adopted interleaf dispensers for jar and bottle SKUs under 200 g, which allowed single-operator kitting with no post-wrap taping. USA-based distributors of handmade ceramics noted a 14% drop in breakage claims after transitioning to multi-ply greenwrap structures for regional shipments.

Input Cost Fluctuation and Throughput Adjustments Affect Margin Structure

Between January and June 2025, virgin kraft paper prices rose by 9.6%, while demand for pre-expanded wrap formats pushed film-lamination costs up in select SKUs. Converters in South Korea and India noted input-linked per-roll price increases of USD 0.07-USD 0.11, particularly in multi-color variants.

Subscription box brands in the UK capped unit wrap costs at Q3 2024 levels, forcing vendors to offset losses by adjusting roll widths and sheet thicknesses. Some Chinese producers shifted toward regional pulp blends to moderate input volatility, though early feedback flagged minor elasticity mismatches on automated dispensers. These changes reshaped supply agreements for giftware, pottery, and small-format electronics segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

| United Kingdom | 8.0% |

| United States | 7.9% |

| Germany | 7.8% |

| India | 7.2% |

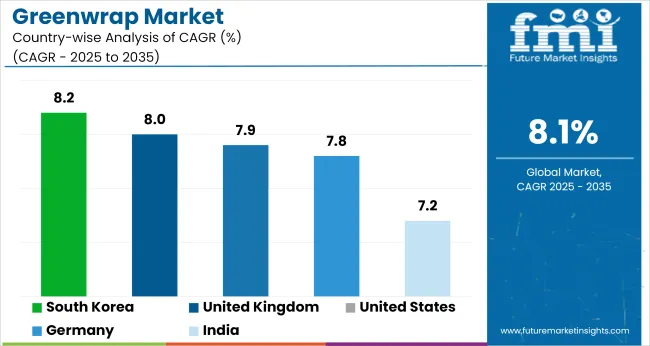

The global industry is projected to grow at a CAGR of 8.1% between 2025 and 2035. South Korea (OECD) leads among the profiled countries at 8.2%, just 0.1% above the global rate. The United Kingdom (OECD) closely follows with 8.0% (- 0.1%), while the United States (OECD) posts 7.9% (- 0.2%) and Germany (OECD) reports 7.8% (- 0.3%).

India (BRICS) stands at 7.2%, falling short by 0.9% relative to the global benchmark. These differences reflect levels of integration of fiber-based alternatives in secondary packaging lines. OECD members show near-parallel growth patterns, likely supported by consistent policy frameworks and supplier ecosystems. India’s gap may stem from limited access to compostable barrier wraps at scale, though overall interest remains positive across both groups.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

In 2025, the greenwrap market in South Korea is projected to reach USD 216.7 million, supported by sustained procurement from EV battery exporters and semiconductor manufacturers. Between 2020 and 2024, market expansion was underpinned by material substitution initiatives targeting non-recyclable fillers.

Firms such as Samsung SDI and LG Chem transitioned to high-grade bubble wraps for cathode and sensor shipments, reinforcing demand stability. Packaging compliance updates in 2021 under Korea’s EPR policy prompted OEMs to formalize greenwrap in outbound logistics workflows.

The UK greenwrap market, projected to reach approximately USD 217 million in 2025, is expected to maintain an 8% CAGR through 2035. Between 2020 and 2024, the market likely expanded from around USD 140 million to USD 200 million, driven primarily by early shifts in retail and e-commerce packaging. The introduction of the Plastic Packaging Tax in 2022 created a compliance-driven inflection point, prompting large retailers to adopt recyclable alternatives to conventional fillers.

In 2025, the USA greenwrap market is estimated to grow at 7.9% CAGR through 2035. Growth between 2020 and 2024 was primarily fueled by pharmaceutical distribution networks and the scaling of e-commerce fulfillment centers. The shift to temperature-sensitive packaging during vaccine rollout created long-term demand for insulated wrap formats.

The industry in India is forecast to grow at a CAGR of 7.2% from 2025 to 2035, with adoption fueled by government incentives for micro and small enterprises and increasing demand from apparel, food, and handicraft exporters. India’s greenwrap market is projected to reach USD 145 million in 2025, rising from approximately USD 102 million in 2020. Growth remained limited until 2022 due to cost barriers, informal logistics networks, and minimal enforcement of packaging norms.

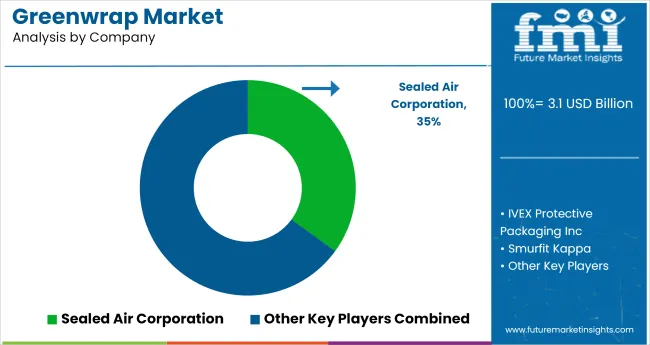

The industry is evolving as key players like Sealed Air Corporation and Smurfit Kappa drive competition through product launches and acquisitions. Sealed Air recently introduced a high-performance protective film for industrial use, while Smurfit Kappa expanded its portfolio by acquiring a European packaging firm. Pregis Corporation opened a new production facility, enhancing its void-fill solutions, and IVEX Protective Packaging invested in R&D to develop stronger lightweight wraps.

Emerging players like Fastpack Packaging are gaining traction with specialized solutions for perishables. Entry barriers include high capital costs for manufacturing and strict material regulations. Established firms benefit from economies of scale, making it tough for new entrants like Eco Packaging International to compete. Recent innovations, such as Pregis’ compostable adhesives, are reshaping industry standards, pushing rivals to accelerate development efforts. Mergers and R&D investments remain key growth strategies

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.1 billion |

| Projected Market Size (2035) | USD 6.8 billion |

| CAGR (2025 to 2035) | 8.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion (value), million units (volume) |

| Product Types Analyzed | High-Grade Bubble Wraps, Temperature Controlled Bubble Wraps, Others |

| End-use Industries Analyzed | Automotive, Pharmaceutical, Household & Personal Care, E-Commerce, Food & Beverage, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Tracked | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sealed Air Corporation, IVEX Protective Packaging Inc, Smurfit Kappa, Pregis Corporation, Barton Jones Packaging Ltd., Fastpack Packaging, Cortec Corporation, Eco Packaging International Company, Dana Poly Inc |

| Additional Attributes | Dollar sales, share by end-use vertical and product innovation, strong demand from e-commerce and personal care segments, regulatory preference for biodegradable formats, growing investments in temperature-controlled protective wrap, regional sourcing opportunities and local production hubs |

The industry is projected to reach USD 6.8 billion by 2035, up from USD 3.1 billion in 2025.

High-grade bubble wraps hold a 47% market share as the top product type in 2025.

Automotive accounts for 52% of greenwrap end-use demand in 2025.

South Korea leads with a CAGR of 8.2% from 2025 to 2035.

Sealed Air Corporation holds the top position with a 35% industry share as of 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA