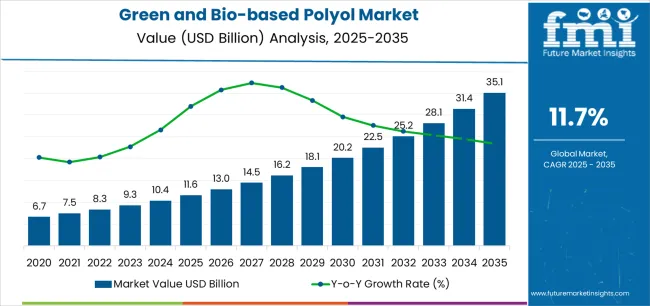

The global green and bio-based polyol market is projected to be valued at USD 11.6 billion by 2025. It is slated to reach USD 35.1 billion by 2035, recording an absolute increase of USD 23.5 billion over the forecast period. This translates into a total growth of 202.6%, with the market forecast to expand at a CAGR of 11.7% between 2025 and 2035. The total market size is expected to grow by nearly 3.03X during the same period, supported by increasing demand for sustainable polyurethane raw materials in building insulation, growing adoption of renewable content polyols meeting automotive original equipment manufacturer sustainability targets, and rising emphasis on bio-based chemical alternatives across diverse construction, automotive, and coatings applications.

Between 2025 and 2030, the green and bio-based polyol market is projected to expand from USD 11.6 billion to USD 20.2 billion, resulting in a value increase of USD 8.6 billion, which represents 36.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing building energy efficiency mandates driving spray foam and rigid insulation adoption, rising automotive electrification supporting bio-based interior materials, and growing demand for low-VOC coatings and adhesives that ensure regulatory compliance and environmental performance. Polyurethane manufacturers and chemical producers are expanding their green polyol capabilities to address the growing demand for renewable feedstock-derived materials and circular economy solutions.

From 2030 to 2035, the market is forecast to grow from USD 20.2 billion to USD 35.1 billion, adding another USD 14.9 billion, which constitutes 63.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced bio-refinery platforms producing next-generation polyols from waste feedstocks, the development of chemically recycled polyol technologies enabling circular polyurethane value chains, and the growth of specialized applications for electric vehicle interiors, net-zero building insulation systems, and bio-based packaging foams. The growing adoption of corporate carbon neutrality commitments and extended producer responsibility regulations will drive demand for green and bio-based polyols with enhanced renewable content, reduced carbon footprint, and comprehensive life cycle assessment documentation.

One of the most defining market dynamics is the evolution of the polyurethane industry. Polyurethane foams used in furniture, automotive interiors, insulation systems, bedding, and construction materials are increasingly incorporating bio-based polyols due to their favorable performance profile and attractive molecular structures. Flexible foams used in mattresses and seating benefit from the mechanical flexibility of certain plant-derived polyols, while rigid foams used in building insulation and refrigeration equipment are being reformulated to meet stricter thermal performance expectations. As construction and infrastructure markets expand, especially in Asia-Pacific and parts of North America, manufacturers are increasing the use of bio-based polyols to achieve targeted foam density, resilience, and processing behavior.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 11.6 billion |

| Forecast Value in (2035F) | USD 35.1 billion |

| Forecast CAGR (2025 to 2035) | 11.7% |

Market expansion is being supported by the increasing global emphasis on building energy efficiency and the corresponding need for high-performance insulation materials that can reduce heating and cooling costs, support net-zero building targets, and meet stringent thermal performance requirements while utilizing renewable raw materials and reducing embodied carbon across residential, commercial, and industrial construction applications. Modern building owners and insulation manufacturers are increasingly focused on implementing sustainable polyurethane foam systems that can deliver superior R-values, ensure long-term durability, and provide documented environmental benefits through bio-based content and reduced fossil fuel dependency. Green and bio-based polyols' proven ability to enable comparable insulation performance while supporting green building certification programs makes them essential materials for contemporary sustainable construction.

The growing emphasis on automotive sustainability and corporate environmental commitments is driving demand for bio-based polyols in automotive seating, interior trim, and acoustic insulation that can reduce vehicle carbon footprint, meet original equipment manufacturer renewable content targets, and support brand sustainability positioning while maintaining comfort, durability, and safety performance standards. Automotive suppliers' preference for materials that combine environmental credentials with regulatory compliance and consumer appeal is creating opportunities for innovative bio-based polyol implementations across electric vehicle interiors, premium automotive segments, and sustainability-focused mobility solutions supporting the automotive industry's transition toward circular economy principles and carbon neutrality objectives.

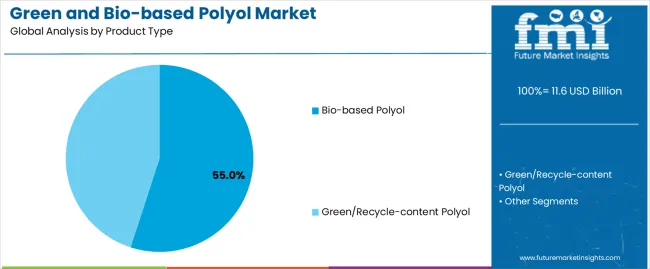

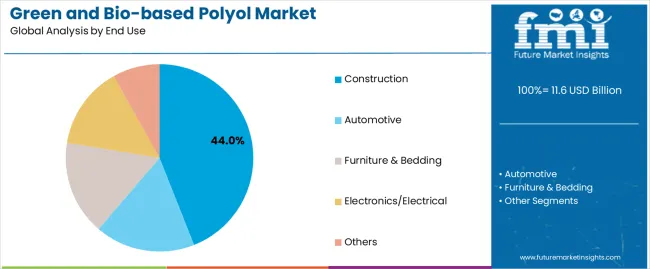

The market is segmented by product type, application, end use, and region. By product type, the market is divided into bio-based polyol and green/recycle-content polyol. Based on application, the market is categorized into foam insulation, coatings & paints, adhesives & sealants, automotive interiors & seating, packaging, and others. By end use, the market covers construction, automotive, furniture & bedding, electronics/electrical, and others. Regionally, the market is divided into Europe, Asia Pacific, North America, Latin America, and the Middle East & Africa.

The bio-based polyol segment is projected to maintain its leading position in the green and bio-based polyol market in 2025 with a commanding 55.0% market share, reaffirming its role as the preferred sustainable polyol category derived from renewable feedstocks including soybean oil, castor oil, tall oil, and sugar-based raw materials providing authentic renewable content with documented carbon reduction benefits. Polyurethane manufacturers and formulators increasingly utilize bio-based polyols for their superior sustainability credentials, compatibility with existing polyurethane processing equipment, and ability to achieve high renewable carbon content measured through ASTM D6866 testing and certified through third-party sustainability programs. Bio-based polyol technology's proven effectiveness in delivering functional polyurethane performance directly addresses industry requirements for sustainable raw materials supporting corporate carbon reduction targets and green building certification.

This product segment forms the foundation of sustainable polyurethane strategies, representing the technology with the greatest environmental impact potential through displacement of petroleum-derived polyols and utilization of agricultural and forestry feedstocks supporting rural economies and renewable resource development. Chemical industry investments in bio-based polyol production continue to strengthen adoption among polyurethane system houses and end-use manufacturers. With sustainability mandates requiring documented renewable content and verified carbon footprint reduction, bio-based polyols align with both environmental objectives and performance requirements, making them the central component of comprehensive sustainable polyurethane formulation strategies across construction insulation, automotive interiors, and specialty applications.

The construction end-use segment commands the largest market share at 44.0% in 2025, reflecting its established position as the most demanding and volume-consuming sector for green and bio-based polyols across building insulation, roofing systems, sealants, and coatings serving new construction, renovation, and retrofit applications. This segment benefits from bio-based polyols' unique combination of properties including thermal insulation performance, adhesion to diverse substrates, weather resistance, and documented sustainability credentials supporting green building certification and building energy code compliance. The extensive use of polyurethane foam insulation in walls, roofs, and foundations combined with growing adoption of bio-based content supports construction segment dominance.

Automotive follows with 28.0% share, utilizing bio-based polyols for flexible foam seating, rigid interior trim, and acoustic insulation serving passenger vehicles, commercial transportation, and electric vehicles. Furniture & bedding account for 14.0%, encompassing mattresses, upholstered furniture, and bedding components using bio-based flexible foam. Electronics/electrical hold 8.0% share, serving potting compounds, encapsulation, and specialty applications. Others represent 6.0%, including footwear, textiles, and industrial applications. The construction segment's leadership is reinforced by continuous building energy efficiency regulation tightening, expanding building renovation activity targeting thermal performance improvement, and increasing corporate real estate sustainability commitments driving specification of materials with verified renewable content and reduced environmental impact across commercial, institutional, and residential building markets.

The green and bio-based polyol market is advancing rapidly due to increasing regulatory pressure for building energy efficiency and sustainable materials and growing adoption of renewable feedstock-derived chemicals that provide comparable performance with reduced carbon footprint across diverse construction, automotive, and coatings applications. The market faces challenges, including price premiums compared to conventional petroleum-derived polyols affecting cost-sensitive applications, feedstock availability constraints and agricultural commodity price volatility impacting production economics, and technical performance limitations in certain demanding applications requiring further formulation optimization and molecular design innovation. Innovation in waste-derived feedstocks and chemically recycled polyol technologies continues to influence product development and market expansion patterns.

The growing adoption of LEED, BREEAM, WELL Building Standard, and comparable green building certification systems is enabling building owners and developers to achieve environmental recognition, access green financing, and meet corporate sustainability targets while driving specification of bio-based polyols contributing renewable content points, reduced embodied carbon, and comprehensive environmental product declarations. Energy code evolution including International Energy Conservation Code updates, European Energy Performance of Buildings Directive requirements, and national building energy standards are mandating higher thermal performance driving polyurethane insulation adoption and creating opportunities for bio-based polyol differentiation. Building professionals are increasingly recognizing the dual benefits of bio-based polyols for achieving both energy performance and sustainability objectives through high-performance insulation systems supporting net-zero building targets.

Modern automotive manufacturers are incorporating bio-based polyols in seating foam, dashboard components, door panels, and headliners to achieve corporate carbon reduction commitments, meet original equipment manufacturer renewable content targets, and support brand sustainability positioning through documented bio-content verification and supply chain transparency. Electric vehicle proliferation creates additional opportunities for interior material innovation as automakers seek to optimize the complete vehicle environmental profile including manufacturing phase impacts beyond operational efficiency. Advanced bio-based polyol applications also allow automotive suppliers to serve comprehensive sustainability objectives and differentiate products beyond traditional performance metrics, creating competitive advantages in premium vehicle segments and sustainability-focused consumer markets while supporting automotive industry decarbonization pathways.

The emergence of chemical recycling technologies for polyurethane foam waste, mattress recycling programs, and end-of-life vehicle polyurethane recovery is creating opportunities for producing recycled-content polyols from post-consumer and post-industrial waste streams while reducing landfill disposal, supporting circular economy implementation, and addressing extended producer responsibility regulations. These innovations enable chemical producers to develop sustainable feedstock sources complementing bio-based routes, optimize material value retention, and create closed-loop polyurethane systems supporting sustainability beyond renewable content through waste valorization. Leading companies are investing in depolymerization processes, glycolysis technologies, and advanced separation systems that enable polyol recovery from mixed polyurethane waste, supporting both environmental objectives and raw material security in polyurethane value chains addressing growing pressure for circular material flows across construction, automotive, and furniture industries.

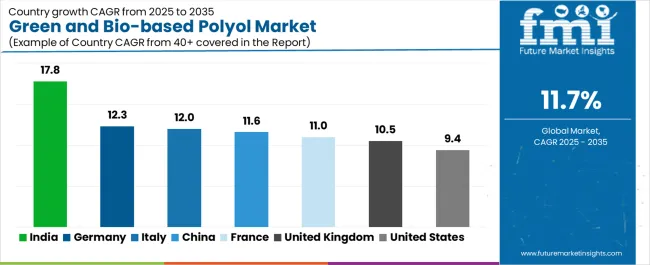

| Country | CAGR (2025-2035) |

|---|---|

| India | 17.8% |

| Germany | 12.3% |

| China | 11.6% |

| Italy | 12.0% |

| France | 11.0% |

| United Kingdom | 10.5% |

| United States | 9.4% |

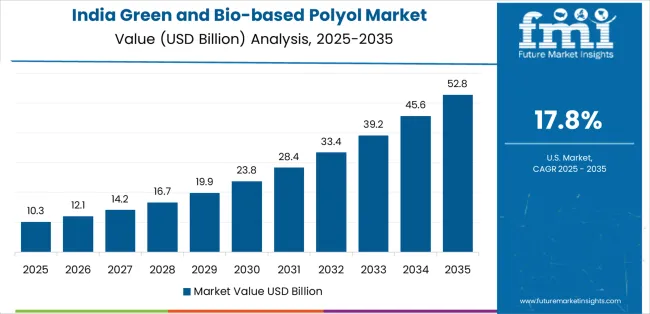

The green and bio-based polyol market is experiencing robust growth globally, with India leading at a 17.8% CAGR through 2035, driven by building energy efficiency code implementation, automotive interior material innovation, and growing domestic chemicals manufacturing capacity supporting bio-based polyol production. Germany follows at 12.3%, supported by automotive original equipment manufacturer sustainability targets, building insulation retrofit programs, and comprehensive renewable energy transition policies. China shows growth at 11.6%, emphasizing electric vehicle interior components, local soybean and castor feedstock development, and building energy efficiency standards driving insulation adoption. Italy records 12.0%, focusing on furniture and footwear manufacturing clusters shifting to bio-content polyols and sustainable material sourcing. France demonstrates 11.0% growth, supported by renovation wave initiatives, coatings and CASE demand for VOC reduction, and green building development. The United Kingdom exhibits 10.5% growth, emphasizing innovation in coatings, adhesives, sealants, and elastomers with public sector procurement standards favoring sustainable materials. The United States shows 9.4% growth, supported by LEED and energy code requirements, automotive interior sustainability, and packaging industry environmental commitments.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The green and bio-based polyols market in India is projected to exhibit exceptional growth with a CAGR of 17.8% through 2035, driven by building energy efficiency code implementation including Energy Conservation Building Code updates mandating thermal performance standards, automotive interior material innovation supporting domestic vehicle manufacturing sustainability, and growing chemicals manufacturing capacity enabling domestic bio-based polyol production from locally-available feedstocks. The country's rapid urbanization, expanding middle class, and infrastructure development are creating substantial demand for sustainable polyurethane materials across construction and automotive applications. Major international chemical companies and domestic polyol producers are establishing comprehensive bio-based polyol manufacturing capabilities to serve Indian markets.

The green and bio-based polyols market in Germany is expanding at a CAGR of 12.3%, supported by the country's automotive original equipment manufacturer sustainability targets driving bio-based content in seating, door panels, and acoustic insulation, building insulation retrofit programs supporting energy efficiency improvement in existing building stock, and comprehensive sustainability frameworks including renewable energy transition and circular economy implementation. The country's leadership in automotive engineering and advanced building materials are driving demand for premium bio-based polyol grades. German chemical companies and polyurethane system houses are establishing extensive development and commercialization capabilities.

The green and bio-based polyols market in the United States is expanding at a CAGR of 9.4%, supported by the country's LEED green building certification system and International Energy Conservation Code driving insulation performance requirements, automotive interior sustainability initiatives addressing original equipment manufacturer carbon reduction targets, and packaging industry environmental commitments supporting bio-based foam adoption in protective packaging and cushioning applications. The nation's mature construction market and automotive industry are driving demand for bio-based polyol solutions. Leading chemical manufacturers and specialty polyol producers are investing in comprehensive supply chains.

The green and bio-based polyols market in China is growing at a CAGR of 11.6%, driven by the country's electric vehicle interior component production serving the world's largest EV market, local soybean and castor feedstock development supporting domestic bio-based polyol manufacturing, and building energy efficiency standards driving insulation adoption in residential and commercial construction. The country's manufacturing scale and government sustainability policies are supporting bio-based polyol market development. Chinese chemical companies and international producers are establishing extensive production capabilities.

The green and bio-based polyols market France is expanding at a CAGR of 11.0%, supported by the country's renovation wave initiative targeting building energy performance improvement, coatings and CASE demand for VOC reduction meeting environmental regulations, and green building development emphasizing sustainable materials and renewable content. France's commitment to climate action and building decarbonization are driving demand for sustainable polyurethane materials. French chemical companies and construction material manufacturers are establishing comprehensive bio-based polyol utilization strategies.

The green and bio-based polyols market in Italy is expanding at a CAGR of 12.0%, supported by the country's furniture and footwear manufacturing clusters shifting to bio-content polyols addressing sustainability requirements, industrial districts in Northern Italy adopting sustainable material sourcing, and design-led manufacturing emphasizing environmental credentials and premium positioning. Italy's established furniture industry and quality focus are driving specialized bio-based polyol demand. Italian furniture manufacturers and chemical suppliers are establishing sustainable polyurethane formulation capabilities.

The green and bio-based polyols market the United Kingdom is growing at a CAGR of 10.5%, driven by the country's innovation in coatings, adhesives, sealants, and elastomers applications emphasizing sustainable raw materials, public sector procurement standards favoring bio-based content and environmental performance, and specialty chemical development supporting advanced polyurethane technologies. The UK's focus on sustainable chemistry and green public procurement are supporting bio-based polyol adoption. British chemical companies and specialty formulators are establishing comprehensive bio-based polyol application development programs.

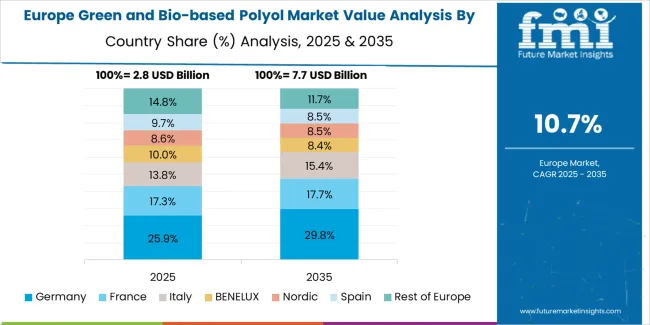

The green and bio-based polyol market in Europe is projected to grow from USD 3.5 billion in 2025 to USD 9.8 billion by 2035, registering a CAGR of 10.8% over the forecast period. Germany is expected to maintain its leadership position with a 26.0% market share in 2025, moderating slightly to 25.7% by 2035, supported by its automotive original equipment manufacturer sustainability targets, building insulation retrofit programs, and strong polyurethane manufacturing clusters serving European markets.

The United Kingdom follows with 14.0% in 2025, projected to reach 14.2% by 2035, driven by adhesives, sealants, and coatings innovation with public sector procurement standards favoring sustainable materials. France holds 13.0% in 2025, rising to 13.3% by 2035, supported by building renovation wave initiatives and CASE demand for VOC reduction. Italy commands 12.0% in 2025, projected to reach 12.2% by 2035, driven by furniture and footwear manufacturing clusters and Northern industrial districts. Spain accounts for 8.0% in 2025, expected to reach 8.1% by 2035, supported by construction activity and appliance insulation applications. Netherlands maintains 7.0% in 2025, growing to 7.1% by 2035, driven by coatings value chains and logistics infrastructure. Nordics hold 8.0% in 2025, reaching 8.2% by 2035, supported by high energy efficiency standards and bio-feedstock initiatives. Rest of Europe represents 12.0% in 2025, moderating to 11.2% by 2035, attributed to growing Central and Eastern European manufacturing with demand concentrated in DACH region, UK, and Northern Italy, where strict EU sustainability and energy efficiency frameworks are steering adoption toward high-performance, bio-content polyols in insulation, CASE applications, and automotive interiors.

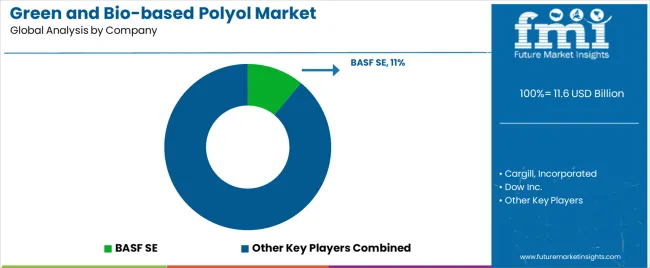

The green and bio-based polyol market features 10–15 players with moderate concentration, where the top three companies collectively hold around 42–48% of global market share. Growth is driven by rising demand for sustainable polyurethane foams, regulatory pressure to reduce petrochemical dependency, and expanding adoption across construction, automotive, furniture, packaging, and CASE (coatings, adhesives, sealants, elastomers) applications. The leading company, BASF SE, commands 11% of the market share, supported by its strong R&D capabilities, scalable bio-based feedstock integration, and partnerships with global polyurethane system houses. Competition centers on renewable content, lifecycle sustainability, performance parity with petro-polyols, and supply reliability rather than price alone.

Market leaders such as BASF SE, Cargill Incorporated, and Dow Inc. maintain dominant positions by offering high-performance bio-polyols derived from vegetable oils, waste streams, and renewable intermediates. Their strengths include advanced enzymatic processes, consistent product quality, and strong alignment with circular material strategies.

Challenger companies including Evonik Industries AG, Mitsui Chemicals, and Stepan Company focus on specialty bio-polyols for flexible foams, rigid insulation, coatings, and high-performance elastomers, emphasizing improved carbon footprints and tailored chemistry.

Additional competition comes from Emery Oleochemicals, BioBased Technologies, Jayant Agro-Organics, and Croda International, which strengthen their market presence through cost-effective oleochemical routes, regionally sourced feedstocks, and customized polyol solutions for rapidly growing Asia-Pacific and North American downstream markets.

Green and bio-based polyols represent a specialized sustainable chemicals segment within polyurethane raw materials, projected to grow from USD 11.6 billion in 2025 to USD 35.1 billion by 2035 at an 11.7% CAGR. These renewable-content polyether and polyester polyols-primarily bio-based grades from vegetable oils and sugars-are produced through bio-refining, chemical modification, and fermentation processes to serve as essential hydroxyl-functional compounds enabling polyurethane foam production in building insulation, flexible foam in automotive seating and furniture, and polyurethane coatings, adhesives, and sealants across construction, automotive, and specialty applications. Market expansion is driven by increasing building energy efficiency mandates, growing automotive sustainability targets, expanding green building certification programs, and rising corporate carbon neutrality commitments across construction, transportation, furniture, and coatings industries.

How Building Code Authorities Could Strengthen Energy Standards and Sustainability Requirements?

How Industry Associations Could Advance Sustainability Standards and Market Development?

How Green and Bio-based Polyol Manufacturers Could Drive Innovation and Market Leadership?

How Polyurethane Manufacturers and Formulators Could Optimize Sustainable Product Development?

How Architects and Specifiers Could Accelerate Sustainable Building Materials Adoption?

How Investors and Financial Enablers Could Support Market Growth and Technology Development?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 11.6 billion |

| Product Type | Bio-based Polyol, Green/Recycle-content Polyol |

| Application | Foam Insulation, Coatings & Paints, Adhesives & Sealants, Automotive Interiors & Seating, Packaging, Others |

| End Use | Construction, Automotive, Furniture & Bedding, Electronics/Electrical, Others |

| Regions Covered | Europe, Asia Pacific, North America, Latin America, Middle East & Africa |

| Countries Covered | India, Germany, China, Italy, France, United Kingdom, United States, and 40+ countries |

| Key Companies Profiled | BASF SE, Cargill Incorporated, Dow Inc., Evonik Industries AG, Mitsui Chemicals, Stepan Company, Emery Oleochemicals, BioBased Technologies, Jayant Agro-Organics, and Croda International |

| Additional Attributes | Dollar sales by product type, application, and end-use categories, regional demand trends, competitive landscape, technological advancements in bio-refining systems, feedstock development, sustainability certification innovation, and circular economy implementation |

The global green and bio-based polyol market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the green and bio-based polyol market is projected to reach USD 35.1 billion by 2035.

The green and bio-based polyol market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in green and bio-based polyol market are bio-based polyol and green/recycle-content polyol.

In terms of end use, construction segment to command 44.0% share in the green and bio-based polyol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GCC Green and Bio-based Polyol Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Germany Green and Bio-based Polyol Market Report – Trends, Demand & Industry Forecast 2025–2035

United States Green and Bio-based Polyol Market Report – Trends, Demand & Industry Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA