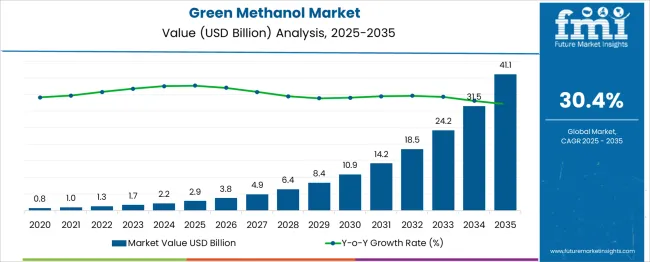

The green methanol Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 41.1 billion by 2035, registering a compound annual growth rate (CAGR) of 30.4% over the forecast period. During the initial phase from 2020 to 2025, the market grows from USD 0.8 billion to USD 2.9 billion, contributing an incremental gain of USD 2.1 billion, which accounts for about 5% of the total expansion. This early growth phase is driven by rising environmental regulations targeting carbon emissions, growing awareness of green energy alternatives, and increasing investments in renewable fuel production infrastructure. Technological advancements in methanol production from biomass, waste, and carbon capture sources bolster market adoption.

From 2026 to 2030, the market accelerates significantly, expanding from USD 3.8 billion to USD 10.9 billion. This surge is supported by enhanced government incentives, expanding use cases across marine fuel, transportation, and industrial sectors, and heightened corporate commitments toward carbon neutrality. The deployment of methanol-fueled engines and blending technologies gains traction, enabling broader market penetration. In the latter half, spanning 2031 to 2035, the market experiences exponential growth from USD 14.2 billion to USD 41.1 billion. This phase is fueled by large-scale commercial adoption, global decarbonization efforts, and integration with hydrogen and renewable energy systems. Manufacturers focusing on process optimization, cost reduction, and scaling production capacity are expected to capture substantial value in this transformative and rapidly expanding market.

| Metric | Value |

|---|---|

| Green Methanol Market Estimated Value in (2025 E) | USD 2.9 billion |

| Green Methanol Market Forecast Value in (2035 F) | USD 41.1 billion |

| Forecast CAGR (2025 to 2035) | 30.4% |

The green methanol market holds a significant share within the renewable fuels landscape, contributing approximately 22–25% of the overall methanol sector as industries transition toward low-carbon alternatives. Within the broader renewable energy value chain, green methanol represents around 5–6%, highlighting its growing relevance in decarbonizing chemical and energy-intensive industries. Adoption is being driven by demand from marine transportation, where compliance with stricter emission mandates has accelerated interest in methanol-based propulsion systems. Industrial applications in formaldehyde production and fuel blending are also witnessing increased acceptance as organizations seek to reduce lifecycle emissions.

The market presence of green methanol is further reinforced by its role in supporting net-zero strategies across chemicals, shipping, and power generation. Feedstock flexibility using biomass, captured CO₂, and renewable hydrogen enhances its appeal for integrated energy systems. Competitive advantage lies in its ability to use existing methanol infrastructure, reducing conversion costs for storage and distribution. Growing investments in electrolysis technologies and biomass gasification are expected to elevate production efficiency, positioning green methanol as a key alternative to fossil-based feedstocks. Regional adoption will be influenced by policy frameworks that prioritize clean fuels, carbon pricing mechanisms, and incentives for renewable energy deployment. Long-term prospects suggest its integration into global supply chains as a scalable solution for energy transition and circular carbon utilization, ensuring green methanol becomes a central pillar in the future of low-emission chemical and fuel markets.

Growth is being driven by the rising demand for cleaner alternatives in industrial applications and transportation fuels, in line with net-zero targets and emission reduction mandates. Production processes that utilize captured carbon dioxide and renewable hydrogen have emerged as favorable solutions, aligning with decarbonization goals and national energy transition strategies.

Regulatory backing, green fuel subsidies, and the expansion of carbon pricing mechanisms are further accelerating the commercial viability of green methanol. Innovations in electrolysis, carbon capture, and scalable fuel synthesis have supported the market's technological maturation.

As countries implement stricter emissions standards and industries shift toward low-carbon operations, the demand for green methanol is expected to rise steadily. Infrastructure development, maritime decarbonization efforts, and increasing investment from both public and private sectors are laying the foundation for long-term market expansion across various global regions..

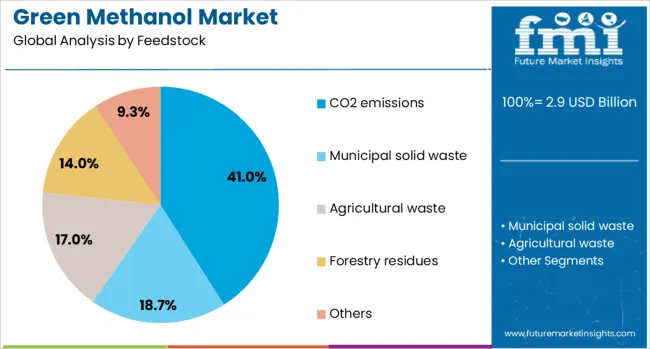

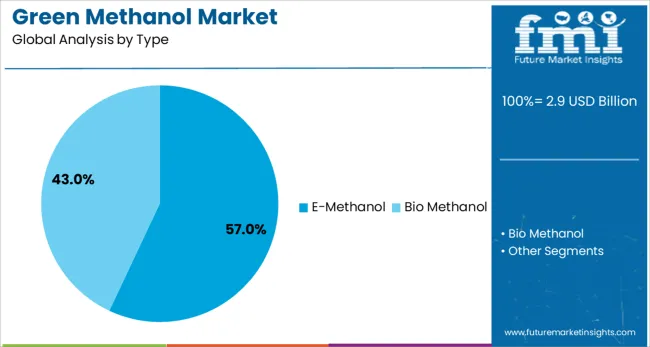

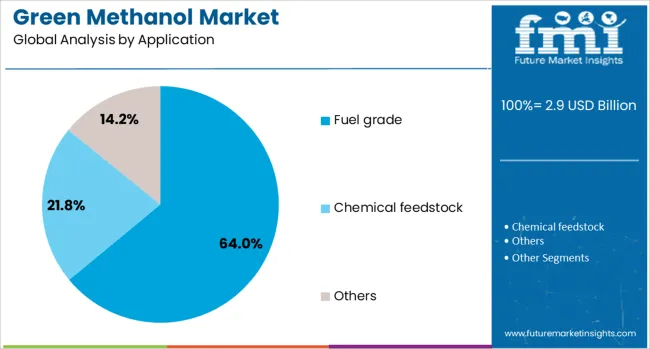

The green methanol market is segmented by feedstock, type, application, and geographic regions. The feedstock of the green methanol market is divided into CO2 emissions, Municipal solid waste, Agricultural waste, Forestry residues, and Others. In terms of type, the green methanol market is classified into E-Methanol and Bio-Methanol. The green methanol market is segmented into Fuel grade, Chemical feedstock, and Others. Regionally, the green methanol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CO2 emissions segment is projected to account for 41% of the green methanol market revenue share in 2025, making it the leading feedstock type. This dominance is being attributed to growing industrial initiatives to capture and utilize carbon dioxide emissions from point sources such as cement, steel, and chemical manufacturing facilities. Regulatory pressures and net-zero mandates have motivated industries to adopt carbon utilization strategies rather than incur compliance penalties.

The conversion of CO2 into value-added chemicals like methanol has allowed for both emissions reduction and resource circularity. Investment in carbon capture and utilization infrastructure has been accelerating, supported by public funding and policy incentives.

The reliability and abundance of CO2 from industrial operations have further reinforced its position as the preferred feedstock. As the demand for clean fuel alternatives increases, the technological viability and environmental benefits of converting CO2 into methanol are expected to secure continued growth in this segment..

The E Methanol segment is anticipated to hold 57% of the green methanol market revenue share in 2025, establishing it as the leading type. This leadership has been driven by the increasing application of renewable electricity to produce hydrogen via electrolysis, which is then combined with captured carbon dioxide to synthesize e methanol. The scalability, environmental compliance, and energy security offered by this process have made it highly attractive to governments and clean energy stakeholders.

The shift toward decarbonized fuels for shipping, aviation, and chemical industries has further elevated demand for e methanol due to its traceable green credentials and compatibility with existing infrastructure. Supportive policy frameworks and zero carbon targets have catalyzed commercial investments and long-term offtake agreements.

Additionally, improvements in electrolyzer efficiency and declining renewable energy costs have significantly enhanced the economic feasibility of e methanol production. These advantages have positioned the segment as the cornerstone of the green methanol market’s future growth trajectory..

The fuel grade segment is expected to represent 64% of the green methanol market revenue share in 2025, making it the dominant application. This segment’s expansion is being driven by its alignment with international goals to decarbonize transportation and maritime operations. Regulatory developments such as the International Maritime Organization’s carbon intensity targets have incentivized the adoption of low-emission fuels, including green methanol.

Fuel-grade green methanol has gained preference due to its high energy density, compatibility with modified combustion engines, and ease of storage and transport. The integration of green methanol into shipping fuel supply chains is accelerating, supported by strategic partnerships between fuel producers, port authorities, and shipbuilders.

Additionally, its application in road transportation and power generation is being explored as a transitional energy source. As global logistics and mobility sectors undergo a clean fuel transformation, the versatility, regulatory compliance, and lifecycle emission benefits of fuel-grade methanol are expected to maintain its market leadership..

Green methanol is becoming integral to clean energy transitions across marine, transportation, and chemical industries. Its growth is strongly supported by policy mandates, scalable feedstock options, and compatibility with existing infrastructure.

Green methanol has emerged as a preferred alternative fuel for marine and heavy transportation sectors. Stricter emission mandates under IMO regulations have accelerated its adoption for shipping applications, as it offers compliance without major engine modifications. Its high energy density and compatibility with existing bunkering infrastructure make it an attractive solution for operators seeking lower lifecycle emissions. Aviation and road transport segments are also exploring green methanol blends to meet carbon reduction targets. Its ability to integrate into current logistics chains reduces conversion costs and operational disruptions, which further strengthens its market position. This trend highlights the growing reliance on green methanol as a viable pathway for decarbonizing hard-to-abate transportation segments globally.

Green methanol is gaining traction as a sustainable feedstock across various chemical value chains. It serves as an essential raw material for formaldehyde, acetic acid, and olefins production, ensuring continuity in chemical manufacturing while reducing greenhouse gas intensity. The transition from fossil-based methanol to green variants is encouraged by corporate carbon-neutral commitments and stricter compliance norms. Many chemical companies are investing in retrofitting facilities to accommodate renewable methanol in their processes. Industrial integration is also supported by the compatibility of green methanol with established infrastructure, which lowers capital expenditure compared to alternative renewable pathways. This application growth reinforces its strategic role in bridging renewable energy objectives with traditional chemical production demands.

The scalability of green methanol production depends heavily on diversified feedstock sources. Current production relies on biomass residues, captured CO₂, and renewable hydrogen, making it a versatile energy carrier within circular carbon strategies. Gasification of agricultural waste and advanced electrolysis technologies are improving efficiency in converting renewable energy inputs to methanol. However, challenges persist in sourcing consistent volumes of green hydrogen and maintaining competitive pricing against conventional methanol. Policy incentives and regional feedstock abundance are influencing investment flows toward integrated projects. Such developments highlight the critical importance of resource optimization and localized production models to minimize costs and ensure commercial viability at a global scale.

Government regulations and financial incentives play a decisive role in accelerating green methanol adoption. Carbon pricing mechanisms, renewable fuel standards, and green fuel mandates have positioned methanol as a strategic alternative in decarbonization frameworks. Public-private partnerships are creating investment pipelines for production facilities and supply chain integration. Regional strategies, particularly in Europe and Asia-Pacific, include funding programs that support renewable methanol blending in fuels and industrial processes. These policy-driven mechanisms enhance investor confidence and stimulate demand across shipping, energy, and chemicals sectors. Future competitiveness will depend on how effectively policies incentivize cost reductions while ensuring a steady scale-up in renewable methanol production capacity globally.

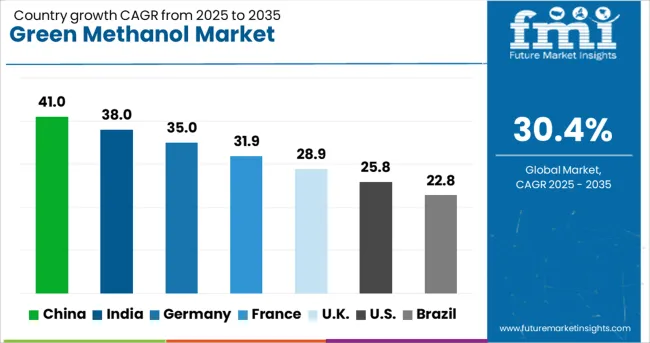

| Country | CAGR |

|---|---|

| China | 41.0% |

| India | 38.0% |

| Germany | 35.0% |

| France | 31.9% |

| UK | 28.9% |

| USA | 25.8% |

| Brazil | 22.8% |

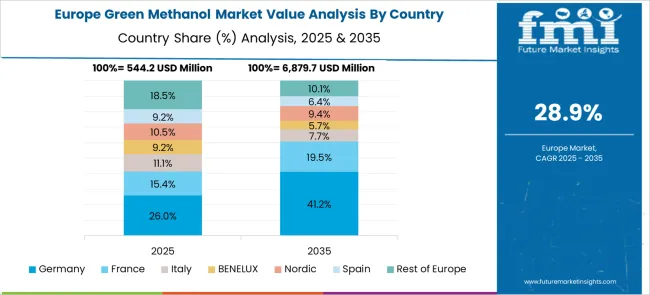

The green methanol market is projected to expand at a remarkable CAGR of 30.4% from 2025 to 2035, fueled by increasing demand for low-emission fuels and integration of renewable energy in industrial and marine applications. China dominates with a strong 41.0% CAGR, driven by aggressive investment in renewable methanol projects, large-scale integration in shipping, and government-led carbon reduction mandates. India follows at 38.0%, supported by policy-driven incentives for biofuel adoption, rising renewable energy capacity, and growing chemical industry integration. France shows 31.9% CAGR, aided by stringent emission regulations and active deployment of renewable fuel programs in transportation sectors. The United Kingdom posts 28.9%, driven by marine decarbonization initiatives and funding for green fuel infrastructure. The United States grows at 25.8%, influenced by clean fuel standards, tax credits, and expansion of methanol-to-power projects. The analysis covers more than 40 nations, but these five economies serve as primary benchmarks for evaluating growth potential and strategic investments across the global green methanol market.

China is projected to register a CAGR of 41.0% during 2025–2035, up from nearly 19.8% during 2020–2024, driven by aggressive renewable energy integration and large-scale investments in methanol-to-fuel projects. This significant rise in CAGR reflects strategic policy support through carbon-neutral targets and green fuel mandates across transportation and industrial sectors. Marine shipping decarbonization has played a critical role, with major shipping corporations adopting methanol-powered fleets to comply with emission standards. Domestic producers are expanding electrolysis-based hydrogen and biomass gasification projects to strengthen supply security. Partnerships between state-owned enterprises and global fuel technology firms are enhancing scale and infrastructure readiness, positioning China as a central hub for global green methanol capacity development.

India is forecasted to post a CAGR of 38.0% during 2025–2035, improving from approximately 17.5% during 2020–2024, supported by initiatives promoting biofuel blending and renewable energy adoption. The increase in CAGR is attributed to strong policy measures under National Green Hydrogen Mission and Make-in-India programs, which have prioritized methanol as a transitional energy carrier. Heavy industries and power sectors are integrating green methanol for process heating and electricity generation to meet emission reduction commitments. Growing domestic demand for methanol-based fuel blends and export opportunities for low-carbon shipping fuels have encouraged investments in biomass gasification projects and CO₂-to-methanol technologies. Market expansion is also supported by public-private collaborations for scaling pilot projects into commercial capacity.

France is anticipated to achieve a CAGR of 31.9% during 2025–2035, compared to about 14.2% during 2020–2024, driven by stringent emission compliance requirements and increased investment in renewable fuel infrastructure. The growth in CAGR reflects accelerated adoption in marine and road transportation under EU decarbonization frameworks. Methanol-based synthetic fuels have gained importance for industrial heating and chemical feedstock purposes as businesses seek low-carbon alternatives. Domestic production capacity is being strengthened through partnerships leveraging renewable electricity and carbon capture technologies. Research grants and tax incentives under the national energy transition plan are further supporting the adoption of renewable methanol for chemical processes, positioning France as a leader in advanced green fuel technologies across Europe.

The United Kingdom is set to record a CAGR of 28.9% during 2025–2035, improving from around 11.3% during 2020–2024, supported by rapid policy execution and investments in alternative fuel systems. The sharp rise in CAGR is linked to strong focus on marine decarbonization under Clean Maritime Plan and the introduction of funding schemes for green fuel production plants. Demand is also growing in industrial heating applications as companies seek low-emission feedstocks for energy efficiency compliance. Partnerships with Scandinavian and European methanol technology providers are accelerating project implementation. Regional green shipping corridors being established in collaboration with port authorities are expected to make the UK a strategic hub for low-emission maritime solutions.

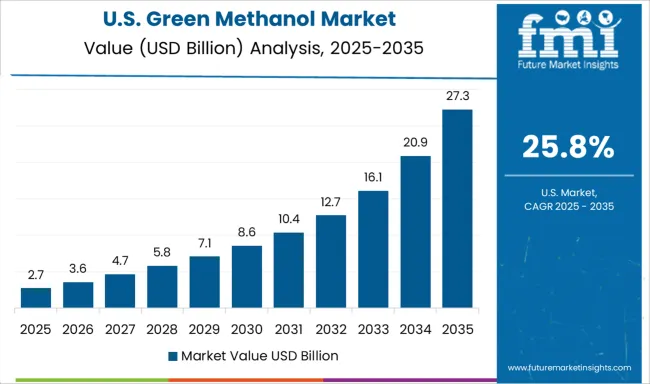

The United States is expected to post a CAGR of 25.8% during 2025–2035, up from nearly 10.4% during 2020–2024, supported by increasing demand for renewable fuels under federal and state-level clean energy regulations. The jump in CAGR is attributed to renewable fuel credits, tax benefits, and expanded investment in methanol-to-power applications for grid reliability. Integration of green methanol in chemical industries and transportation fleets is advancing due to compliance-driven frameworks under the Renewable Fuel Standard and Inflation Reduction Act incentives. Energy companies are collaborating with technology providers to expand CO₂-to-methanol conversion facilities in key states, enabling significant progress toward domestic decarbonization targets while creating competitive export opportunities for the US market.

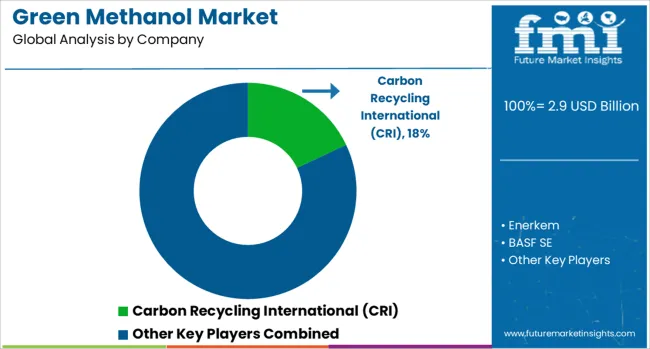

The green methanol market is witnessing strong competition, characterized by established global producers and technology-driven innovators such as Carbon Recycling International (CRI), Enerkem, BASF SE, OCI N.V., and Methanex Corporation. These companies compete by leveraging feedstock flexibility, production scalability, and strategic partnerships to meet growing demand from marine fuel, chemical manufacturing, and energy sectors. Carbon Recycling International is recognized for pioneering carbon capture and utilization technologies, converting CO₂ into renewable methanol through advanced electrochemical processes, positioning itself as a leader in low-emission solutions.

Enerkem focuses on waste-to-methanol pathways, offering circular economy benefits by using non-recyclable municipal waste as feedstock, which has gained traction in regions with strict landfill regulations. BASF SE integrates green methanol into its chemical value chain, supporting its sustainability targets and providing low-carbon solutions for derivative manufacturing. OCI N.V. invests heavily in renewable methanol plants and explores long-term supply agreements to strengthen its presence in marine and industrial markets. Methanex Corporation, the world’s largest conventional methanol producer, is transitioning toward renewable variants through strategic partnerships and renewable hydrogen sourcing. Competitive strategies include building large-scale plants near renewable energy hubs, securing long-term green hydrogen supply, and engaging in joint ventures with shipping companies. Future market positioning will depend on cost optimization, technology efficiency, and adherence to regulatory mandates that incentivize clean fuel adoption across global markets.

On September 9, 2024, Methanex announced plans to acquire OCI Global’s methanol business for USD 2.05 billion.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Feedstock | CO2 emissions, Municipal solid waste, Agricultural waste, Forestry residues, and Others |

| Type | E-Methanol and Bio Methanol |

| Application | Fuel grade, Chemical feedstock, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carbon Recycling International (CRI), Enerkem, BASF SE, OCI N.V., and Methanex Corporation |

The global green methanol market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the green methanol market is projected to reach USD 41.1 billion by 2035.

The green methanol market is expected to grow at a 30.4% CAGR between 2025 and 2035.

The key product types in green methanol market are co2 emissions, municipal solid waste, agricultural waste, forestry residues and others.

In terms of type, e-methanol segment to command 57.0% share in the green methanol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA