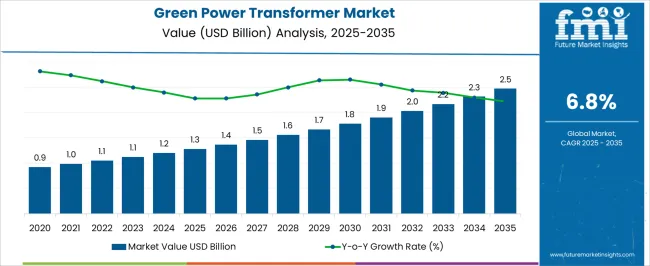

The green power transformer market is projected to expand from USD 1.3 billion in 2025 to USD 2.5 billion in 2035, reflecting a CAGR of 6.8%. This growth represents an absolute dollar opportunity of USD 1.2 billion over the forecast period. Early growth phases see the market rise from USD 1.4 billion in 2026 to USD 1.6 billion in 2029, indicating steady incremental gains.

By 2031, the market will reach USD 1.8 billion, demonstrating mid-term growth momentum. These increases provide manufacturers and distributors opportunities to scale production, optimize supply chains, and capture rising revenue from expanding demand. In the later stage, the market delivers the most significant absolute dollar gains, advancing from USD 2.0 billion in 2032 to USD 2.5 billion in 2035. This period contributes USD 0.5 billion in incremental revenue, with annual gains accelerating toward the end of the forecast. Intermediate benchmarks, such as USD 2.2 billion in 2033 and USD 2.3 billion in 2034, act as bridging periods that sustain momentum. Overall, the cumulative USD 1.2 billion opportunity underscores strong long-term revenue potential, enabling stakeholders to align production, operations, and distribution strategies with growth milestones in the green power transformer market.

| Metric | Value |

|---|---|

| Green Power Transformer Market Estimated Value in (2025 E) | USD 1.3 billion |

| Green Power Transformer Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

In the green power transformer market, the first breakpoint occurs between 2025 and 2027, as the market grows from USD 1.3 billion to USD 1.4 billion. This early phase reflects steady adoption with moderate annual increments of approximately USD 0.05–0.1 billion, establishing a foundation for predictable growth. The next significant breakpoint is observed between 2029 and 2031, when the market rises from USD 1.6 billion to USD 1.8 billion. During this stage, absolute dollar gains accelerate, signaling mid-term growth momentum. Manufacturers and distributors can leverage this period to optimize production, enhance supply chains, and capture incremental revenue efficiently.

Major breakpoint emerges between 2032 and 2035, as the market surges from USD 2.0 billion to USD 2.5 billion, representing the largest absolute dollar increase in the forecast period. Intermediate years, such as USD 2.2 billion in 2033 and USD 2.3 billion in 2034, act as bridging periods that sustain growth momentum before peak values are reached. Recognizing these breakpoints allows stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential.

The Green Power Transformer market is experiencing robust growth driven by increasing global emphasis on sustainable energy and the modernization of electrical grids. The transition towards renewable energy sources such as solar and wind power has heightened the demand for efficient and environmentally friendly transformers that reduce energy losses and support smart grid applications.

Infrastructure investments in emerging economies, along with regulatory support for clean energy adoption, are further accelerating market expansion. The integration of advanced materials and design innovations that improve transformer efficiency and longevity is shaping the future outlook of the market.

Additionally, growing industrial electrification and the rise of commercial renewable installations are creating new avenues for deployment.

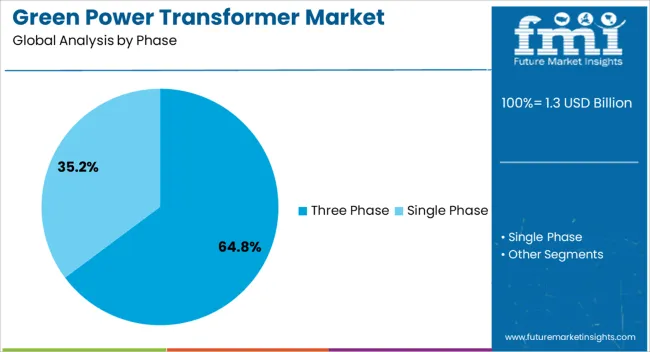

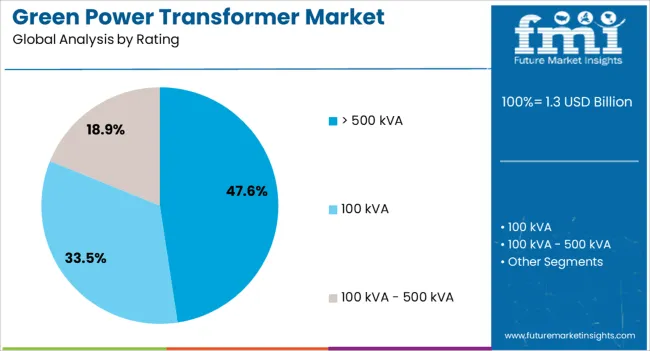

The green power transformer market is segmented by phase, rating, application, and geographic regions. By phase, the green power transformer market is divided into three-phase and single-phase. In terms of rating, green power transformer market is classified into > 500 kVA, 100 kVA, and 100 kVA - 500 kVA.

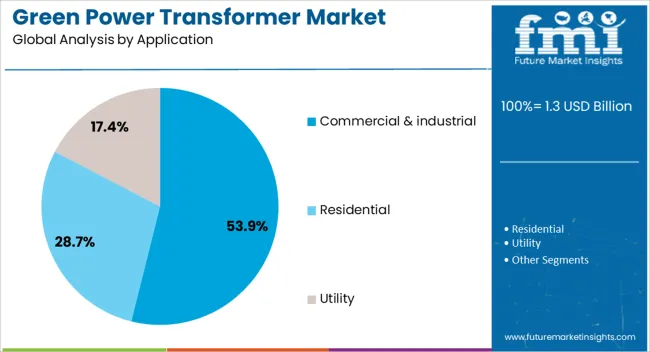

Based on application, green power transformer market is segmented into Commercial & industrial, Residential, and Utility. Regionally, the green power transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment is projected to hold 64.8% of the Green Power Transformer market revenue share in 2025, establishing it as the leading phase type. This prominence is attributed to its widespread use in power transmission and distribution networks, which require reliable and high-capacity transformers to handle large loads efficiently.

The ability of three phase transformers to deliver balanced power with reduced losses makes them ideal for commercial and industrial power systems. Their compatibility with renewable energy systems and smart grid applications has further strengthened their position.

The extensive adoption of three phase transformers in both developed and developing markets is being driven by infrastructure upgrades and expansion projects focused on improving grid stability and efficiency.

Transformers with a rating above 500 kVA are expected to capture 47.6% of the market share in 2025, making this rating category a dominant segment. This is mainly due to the increasing demand for high-capacity transformers capable of managing large power loads in industrial and commercial sectors.

The rising scale of renewable energy plants and the need for efficient power distribution in smart grids necessitate transformers with higher ratings. The robust performance, reliability, and energy efficiency of these transformers align with the growing emphasis on reducing energy losses and operational costs.

Additionally, large-scale infrastructure projects and expanding industrial power requirements continue to bolster the demand for transformers in this rating category.

The commercial and industrial application segment is anticipated to hold 53.9% of the Green Power Transformer market revenue in 2025, marking it as the leading application area. This dominance is driven by the extensive use of green transformers in commercial buildings, manufacturing plants, and industrial complexes where energy efficiency and compliance with environmental standards are critical.

The integration of renewable energy sources and the demand for a reliable power supply in these sectors have accelerated the adoption of green transformers. Moreover, increasing regulatory pressure to reduce carbon footprints and energy consumption in commercial and industrial operations has led to a preference for environmentally friendly transformer solutions.

Continued investment in infrastructure modernization and smart grid initiatives within these sectors is expected to sustain the segment’s growth trajectory.

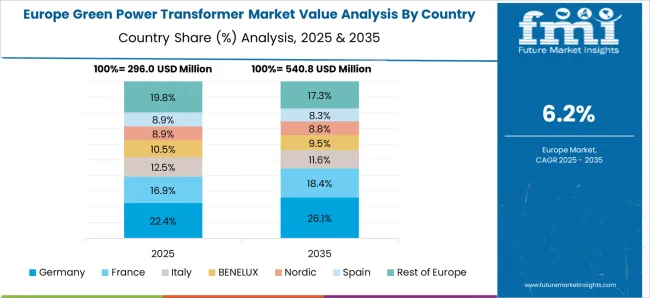

The green power transformer market is expanding due to rising renewable energy integration, grid modernization, and demand for energy-efficient electrical infrastructure. North America and Europe lead with advanced transformers supporting solar, wind, and hybrid energy systems, emphasizing reduced losses and environmental compliance. Asia-Pacific demonstrates rapid growth driven by large-scale renewable projects, industrial expansion, and government incentives.

Manufacturers differentiate through efficiency ratings, insulation technology, low-noise design, and smart monitoring. Regional variations in regulatory frameworks, energy infrastructure, and cost considerations influence adoption, procurement strategies, and competitive positioning globally.

Transformer performance and longevity depend on insulation systems, cooling methods, and material quality. North America and Europe prioritize advanced insulation materials, oil-immersed or dry-type cooling, and thermal monitoring for high-voltage, renewable-integrated applications. Asia-Pacific often uses conventional insulation and cost-efficient cooling systems for medium-voltage networks and industrial setups. Differences in insulation technology and thermal management affect operational stability, maintenance frequency, and lifespan. Leading suppliers provide high-performance transformers with superior insulation and cooling solutions for reliable operation, while regional producers offer robust, affordable units. Insulation and cooling contrasts shape adoption, reliability perception, and long-term performance across renewable energy and conventional distribution networks.

Compliance with safety standards, pressure vessel codes, and industrial gas regulations is vital for cryogenic vaporizer adoption. Europe and North America enforce strict standards covering pressure integrity, leak prevention, and operational safety, demanding advanced monitoring systems and certifications. Asia-Pacific regulations vary, with high-budget projects adhering to similar standards while smaller facilities focus on basic compliance due to cost considerations. Differences in regulatory adherence affect installation approvals, operational risk management, and procurement decisions. Suppliers providing certified, safety-compliant vaporizers gain premium market access, while regional manufacturers focus on affordable, functional solutions. Regulatory contrasts influence adoption timelines, operational reliability, and competitiveness in energy and industrial applications globally.

Integration of sensors, IoT-based monitoring, and automated diagnostics enhances transformer performance and predictive maintenance. North America and Europe prioritize smart transformers compatible with grid management systems, enabling real-time monitoring, fault detection, and remote control for renewable integration and industrial usage. Asia-Pacific adoption is growing, with smart monitoring implemented in large-scale projects while smaller installations rely on traditional monitoring.

Differences in grid integration and monitoring capabilities affect operational efficiency, preventive maintenance, and downtime reduction. Suppliers offering smart, connected transformers gain higher-value contracts, while regional manufacturers focus on functional, conventional units. Monitoring contrasts shape adoption, operational reliability, and strategic positioning in modern energy networks.

Compliance with energy efficiency standards, environmental regulations, and emission requirements is critical for green transformer adoption. Europe and North America enforce strict standards such as IEC, DOE, and EU directives, demanding low-loss, environmentally friendly transformer designs. Asia-Pacific markets follow variable compliance levels; developed regions adopt similar standards, while emerging markets focus on cost-effective installations with basic environmental requirements.

Differences in regulatory frameworks affect procurement decisions, certification processes, and project approvals. Manufacturers providing certified, eco-compliant transformers gain access to high-value renewable and industrial projects, while regional producers deliver cost-optimized solutions. Regulatory contrasts determine adoption rates, market access, and competitiveness in the global green transformer landscape.

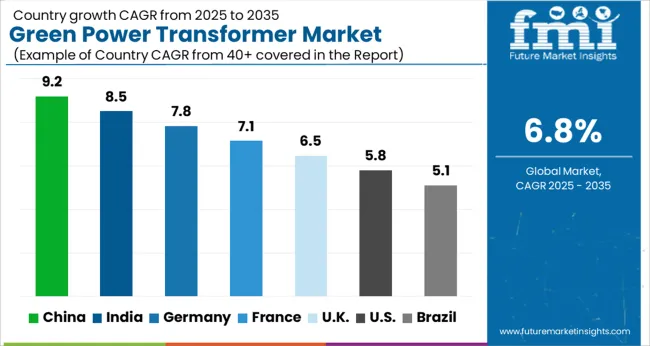

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The global green power transformer market was projected to grow at a 6.8% CAGR through 2035, driven by demand in electrical grids, industrial power distribution, and commercial energy systems. Among BRICS nations, China recorded 9.2% growth as large-scale production and assembly facilities were commissioned and compliance with industrial and electrical standards was enforced, while India at 8.5% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 7.8% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 6.5% relied on moderate-scale operations for power distribution and industrial applications. The USA, expanding at 5.8%, remained a mature market with steady demand across commercial and industrial segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The green power transformer market in China is growing at a CAGR of 9.2% driven by rising investments in renewable energy, smart grids, and energy efficiency projects. Utilities and industrial operators are adopting green transformers to reduce energy losses, improve grid reliability, and minimize environmental impact. Growth is supported by government incentives, increasing renewable energy capacity, and modernization of electrical distribution networks. Suppliers provide transformers with high efficiency, low environmental footprint, and compliance with international standards suitable for commercial, industrial, and utility applications. Distribution through electrical equipment dealers, utility partnerships, and direct sales ensures broad market accessibility. Adoption is further supported by the need for reliable power transmission, operational efficiency, and cost savings. China remains a leading market due to large-scale renewable energy installations and expansion of power infrastructure.

India is witnessing growth at a CAGR of 8.5% in the green power transformer market due to rising adoption in renewable energy projects, industrial facilities, and utility grids. Utilities implement green transformers to reduce transmission losses, improve reliability, and meet environmental regulations. Growth is supported by government programs promoting renewable energy, increasing electricity demand, and modernization of distribution networks. Suppliers offer high efficiency, low loss, and environmentally friendly transformers suitable for industrial, commercial, and utility applications. Distribution through equipment dealers, service providers, and utility partnerships ensures market accessibility across urban and rural regions. Adoption is further driven by operational efficiency, reduced energy costs, and compliance with grid reliability standards. India continues to see strong market growth due to expanding renewable energy capacity and increasing power infrastructure investments.

Germany is growing at a CAGR of 7.8% in the green power transformer market due to rising demand from renewable energy, industrial, and utility sectors. Utilities and companies adopt green transformers to reduce energy losses, improve operational efficiency, and minimize environmental impact. Growth is supported by investments in wind, solar, and smart grid projects, as well as regulatory emphasis on energy efficiency. Suppliers provide transformers with low loss, high reliability, and compliance with international environmental standards suitable for commercial and industrial applications. Distribution channels include electrical equipment distributors, utility partnerships, and direct sales networks, ensuring accessibility. Adoption is further driven by the need for efficient power transmission, energy cost reduction, and environmental compliance. Germany remains a key European market due to advanced energy infrastructure and renewable energy adoption.

The United Kingdom market is expanding at a CAGR of 6.5% due to increasing adoption in utilities, industrial facilities, and renewable energy projects. Companies implement green transformers to improve grid reliability, reduce transmission losses, and meet environmental regulations. Growth is supported by investments in renewable energy, smart grid initiatives, and modernization of electrical networks. Suppliers offer high efficiency, low loss, and environmentally friendly transformers suitable for utility and industrial applications. Distribution through electrical equipment dealers, utility partnerships, and service providers ensures broad market accessibility. Adoption is further driven by operational efficiency, energy cost reduction, and compliance with environmental standards. The United Kingdom continues to see steady growth due to renewable energy expansion and increasing demand for energy efficient power equipment.

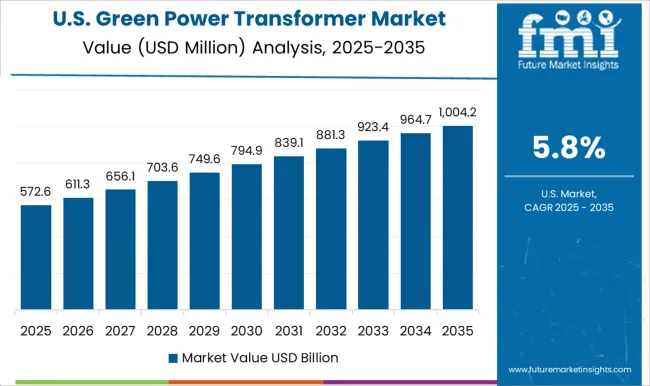

The United States market is growing at a CAGR of 5.8% supported by rising adoption in utilities, industrial facilities, and renewable energy projects. Utilities adopt green transformers to reduce energy losses, improve operational efficiency, and support grid modernization. Growth is supported by expansion of solar, wind, and other renewable energy sources, as well as regulatory emphasis on energy efficiency. Suppliers provide transformers with high efficiency, low environmental impact, and compliance with industrial standards suitable for commercial, industrial, and utility applications. Distribution channels include electrical equipment dealers, service providers, and direct supply networks, ensuring wide market accessibility. Adoption is further driven by energy cost reduction, reliable power transmission, and environmental compliance. The United States remains a key market due to its large industrial base and increasing renewable energy capacity.

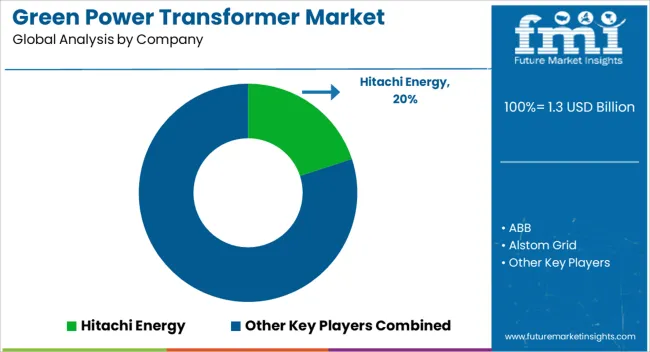

The green power transformer market is dominated by industry leaders, including Hitachi Energy, ABB, Alstom Grid, CG Power and Industrial Solutions, Eaton, GE Grid Solutions, Hyosung Heavy Industries, Ormazabal, Schneider Electric, Siemens Energy, and Westrafo. These companies provide advanced transformer solutions tailored for renewable energy integration, smart grids, and environmentally conscious power distribution systems. Their offerings include high-efficiency transformers designed to minimize energy losses, withstand variable loads from renewable sources, and comply with global standards for eco-friendly operations. Companies like Hitachi Energy, Siemens Energy, and ABB focus on large-scale grid integration solutions, delivering transformers for solar, wind, and hybrid energy projects with high reliability and longevity. GE Grid Solutions, Eaton, and Schneider Electric provide modular and flexible transformer designs that support rapid deployment in utility and industrial settings while enhancing system stability and efficiency.

CG Power, Hyosung Heavy Industries, Ormazabal, and Alstom Grid emphasize compact and lightweight transformer solutions suitable for distributed generation, microgrids, and urban renewable energy applications. The demand for transformers with improved thermal performance, reduced maintenance requirements, and advanced monitoring capabilities increasingly drives the market. Manufacturers are incorporating digital sensors, real-time diagnostic tools, and automation features to enhance reliability and optimize energy flow.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Phase | Three Phase and Single Phase |

| Rating | > 500 kVA, 100 kVA, and 100 kVA - 500 kVA |

| Application | Commercial & industrial, Residential, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Energy, ABB, Alstom Grid, CG Power and Industrial Solutions, Eaton, GE Grid Solutions, Hyosung Heavy Industries, Ormazabal, Schneider Electric, Siemens Energy, and Westrafo |

| Additional Attributes | Dollar sales vary by transformer type, including distribution transformers, power transformers, and smart transformers; by application, such as renewable energy integration, grid modernization, and industrial power distribution; by end-use industry, spanning utilities, renewable energy projects, and industrial facilities; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising renewable energy adoption, energy efficiency regulations, and grid sustainability initiatives. |

The global green power transformer market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the green power transformer market is projected to reach USD 2.5 billion by 2035.

The green power transformer market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in green power transformer market are three phase and single phase.

In terms of rating, > 500 kva segment to command 47.6% share in the green power transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Green Coffee Bean Extract Market Analysis by Form, Application, and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA