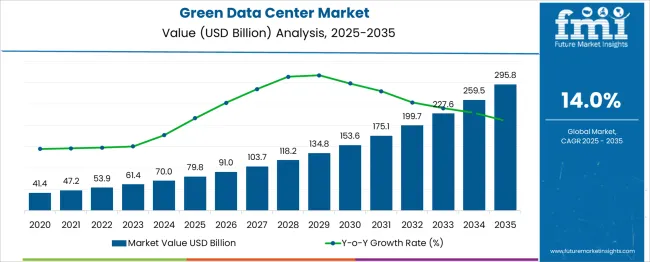

The Green Data Center Market is estimated to be valued at USD 79.8 billion in 2025 and is projected to reach USD 295.8 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period. The green data center market is projected to exhibit strong elasticity with key macroeconomic indicators, especially energy costs, environmental regulations, and capital investment trends. As global energy prices rise and ESG (Environmental, Social, Governance) compliance becomes a corporate priority, data center operators are incentivized to adopt energy-efficient and sustainable infrastructure, driving the green data center surge.

Elasticity with energy pricing is particularly pronounced: higher electricity costs accelerate the adoption of low-power, renewable-integrated data centers. Additionally, regulatory frameworks such as the EU’s Green Deal or the USA's energy efficiency standards exert upward pressure on green IT infrastructure investments. Interest rates and capex availability also shape elasticity; a lower cost of capital boosts the construction and retrofitting of sustainable facilities, enhancing the market’s responsiveness to favorable economic cycles.

Moreover, the elasticity of growth is reinforced by digitalization trends and cloud computing expansion, which scale demand for data processing while mandating energy responsibility. As macroeconomic factors increasingly align with sustainability mandates, the Green Data Center Market is expected to demonstrate high positive elasticity, remaining robust even amid moderate economic headwinds due to its alignment with long-term efficiency and environmental goals.

| Metric | Value |

|---|---|

| Green Data Center Market Estimated Value in (2025 E) | USD 79.8 billion |

| Green Data Center Market Forecast Value in (2035 F) | USD 295.8 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The green data center market is advancing steadily, fueled by regulatory mandates, carbon reduction targets, and rising demand for sustainable IT infrastructure. Enterprises and hyperscalers are investing in energy-efficient solutions to reduce operational costs and environmental impact. The increased adoption of cloud computing, AI workloads, and edge deployments is escalating data center energy consumption, prompting urgent infrastructure transformation.

Government incentives for renewable integration and tax benefits on green investments are driving a shift toward low-emission and modular data centers. Meanwhile, innovations in liquid cooling, real-time energy analytics, and AI-driven thermal management are enabling smarter, greener facilities.

Growing ESG pressure from investors and corporate boards is further reinforcing the transition to green data infrastructure. As technology life cycles shorten and data loads grow exponentially, market momentum is expected to remain strong across regions prioritizing sustainability and digital infrastructure.

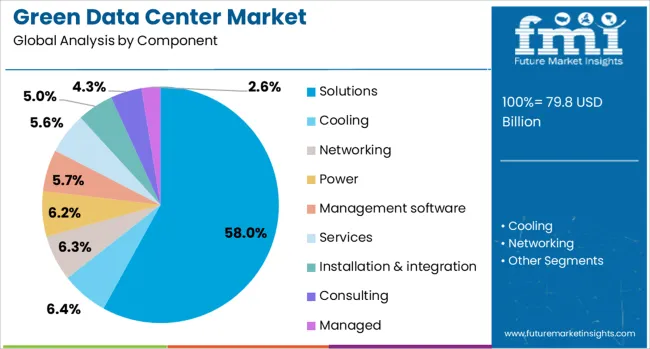

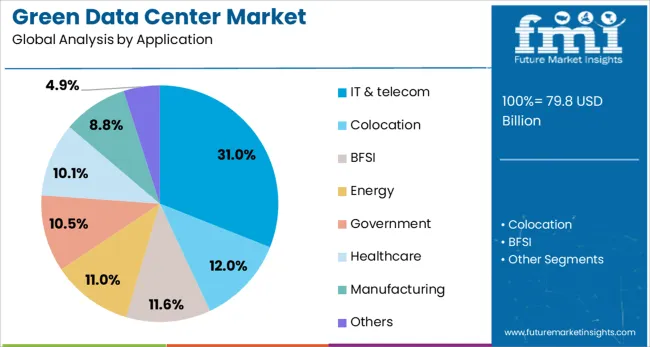

The green data center market is segmented by component, application, and geographic regions. The green data center market is divided into components, such as Solutions, Cooling, Networking, Power, Management software, Services, Installation & integration, and Consulting Managed. In terms of application, the green data center market is classified into IT & telecom, Colocation, BFSI, Energy, Government, Healthcare, Manufacturing, and others.

Regionally, the green data center industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solutions segment is expected to dominate the green data center market with a 58.00% revenue share in 2025. This lead has been driven by increasing integration of energy-efficient power and cooling systems, data center infrastructure management (DCIM) software, and renewable energy technologies.

Organizations are prioritizing modular and scalable solutions to address growing compute needs while maintaining carbon neutrality goals. Solutions that enable real-time monitoring of energy usage and thermal efficiency are being widely adopted, particularly in new and retrofit builds.

The segment’s momentum is further supported by innovation in liquid cooling, uninterruptible power supply (UPS) systems, and intelligent rack designs that improve airflow and resource utilization. The growing emphasis on automation and system-level optimization continues to reinforce the preference for integrated green solutions.

IT & telecom is projected to hold 31.00% of the total green data center market revenue in 2025, establishing it as the leading application segment. This growth is being shaped by rising digital infrastructure demand, 5G expansion, and continuous deployment of data-intensive services across mobile and enterprise networks.

Telecom operators and IT firms are investing heavily in green infrastructure to align with net-zero goals and reduce energy costs amid exponential data consumption. The increasing need for colocation and cloud capacity has driven interest in modular, low-PUE (power usage effectiveness) facilities.

Additionally, strict regulatory frameworks governing emissions, data privacy, and uptime reliability are accelerating the shift toward sustainable designs. The IT & telecom segment remains at the forefront of energy innovation, adopting solar, wind, and AI-optimized energy models to power mission-critical infrastructure efficiently.

The green data center market is evolving rapidly as companies prioritize energy efficiency, carbon footprint reduction, and regulatory compliance. These facilities utilize low-impact materials, renewable energy, and advanced cooling technologies to minimize environmental impact while maintaining performance. Increasing pressure from regulators, customers, and investors is driving demand for sustainable operations. Organizations are adopting green colocation, modular solutions, and energy monitoring systems. Providers are investing in facility upgrades, innovative power sources, and circular waste strategies to align with long-term sustainability commitments and rising operational efficiency expectations.

Tightening global regulations on emissions, energy use, and waste management are pushing enterprises to adopt greener infrastructure. Governments are enforcing data center compliance with environmental standards, including power usage effectiveness (PUE) and renewable energy benchmarks. Simultaneously, corporations are voluntarily aligning with environmental goals under ESG frameworks. This collective responsibility is driving interest in facilities powered by solar, wind, or hydroelectric sources and designed for efficient cooling and recycling. Businesses now evaluate data centers not just on performance but on sustainability metrics. Companies with strong public sustainability commitments are under pressure to partner with environmentally conscious service providers. In this context, green data centers represent both a compliance strategy and a branding opportunity. Operators with low carbon footprints and transparency in reporting gain preference among enterprises seeking long-term, ethical partnerships. This momentum is particularly strong in regions where sustainability policies are integrated into enterprise procurement processes and digital infrastructure planning.

Developing or transitioning to green data centers requires significant upfront investment, which can deter both new entrants and existing operators. Building eco-efficient facilities involves integrating renewable energy systems, sustainable construction materials, advanced HVAC systems, and energy-efficient IT hardware. These features add cost and design complexity compared to traditional setups. For legacy data centers, retrofitting to meet green standards can be disruptive, time-consuming, and cost-prohibitive. The need to balance ongoing operations with sustainability upgrades adds further difficulty. Additionally, renewable energy availability and cost competitiveness vary by region, influencing the feasibility of green initiatives. Without government incentives or financing options, some providers may struggle to justify long-term returns on green investments. This cost burden slows market expansion, especially in developing economies where infrastructure limitations and energy access challenges persist. While long-term operational savings exist, the initial capital barrier continues to restrict faster industry-wide transformation toward green infrastructure.

Innovative technologies are helping data centers reduce power consumption and improve resource efficiency, opening new growth avenues for green infrastructure. Advanced power management systems enable real-time monitoring and optimization of energy usage across servers, cooling units, and power distribution. Liquid cooling systems, free-air cooling, and AI-based climate control are replacing traditional energy-intensive methods. Smart energy analytics allow operators to forecast usage trends and reduce wastage. Modular and prefabricated green data center designs are becoming popular for their scalability and efficiency. Integration of renewable energy storage systems, like battery backups and fuel cells, enhances operational stability and sustainability. These technological solutions not only reduce environmental impact but also lower total cost of ownership over time. Providers investing in such innovations can offer differentiated value to clients seeking high performance with low emissions. As efficiency becomes a priority across industries, green technology is not just an environmental asset but a core competitive lever.

The growth of the green data center market is uneven across regions due to infrastructure readiness, energy policy, and economic support differences. Developed countries in Europe and North America have seen faster adoption due to strong environmental policies, access to renewable energy, and incentives for sustainable construction. In contrast, many developing economies face challenges including inconsistent power supply, limited renewable integration, and fewer green financing options. While demand for digital infrastructure is rising globally, building green data centers in regions with unreliable grids or high fossil fuel dependency remains difficult. The lack of standardized green building codes and limited awareness further constrain local development. However, some emerging markets are catching up through public-private partnerships and foreign investments in green technology. International providers are also entering these regions with hybrid models combining traditional and green approaches. Bridging these regional gaps requires coordinated policy efforts, infrastructure upgrades, and cross-border knowledge sharing to ensure balanced market growth.

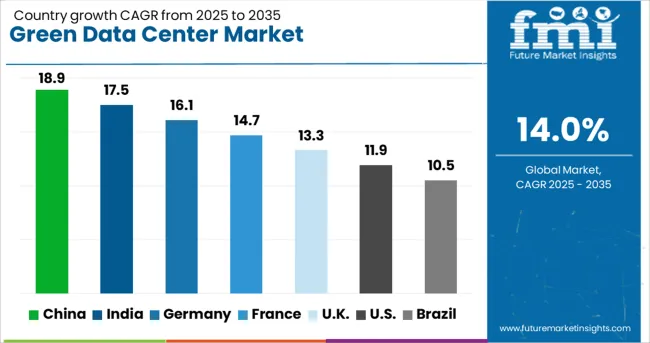

| Country | CAGR |

|---|---|

| China | 18.9% |

| India | 17.5% |

| Germany | 16.1% |

| France | 14.7% |

| UK | 13.3% |

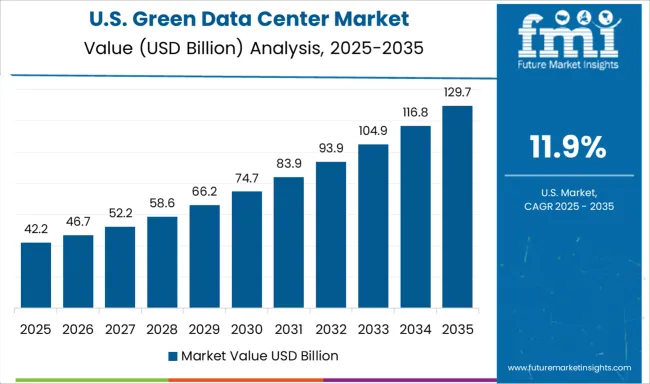

| USA | 11.9% |

| Brazil | 10.5% |

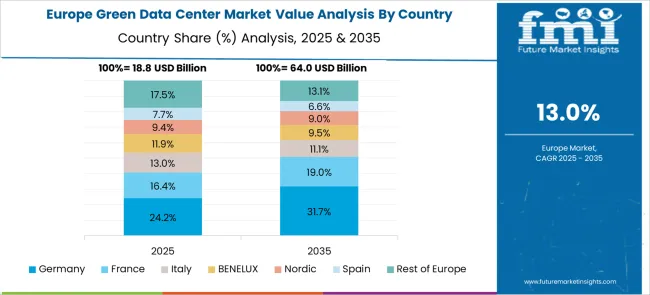

The global green data center market is projected to grow at a CAGR of 14.0%, driven by increasing environmental regulations, rising energy costs, and demand for sustainable IT infrastructure. China leads with an impressive 18.9% growth rate, supported by strong government policies on carbon neutrality and major investments in energy-efficient data parks. India follows at 17.5%, propelled by rapid digital expansion and the push for renewable-powered facilities. Germany posts a solid 16.1% growth, underpinned by strict environmental standards and advanced cooling technologies. The United Kingdom reports steady growth at 13.3%, benefiting from sustainability mandates and green financing initiatives. The United States, with a mature market, sees an 11.9% growth rate, driven by hyperscale operators adopting energy optimization and renewable energy integration. These countries are shaping the market through policy leadership, infrastructure modernization, and green innovation. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the green data center market with an 18.9% CAGR, fueled by national energy efficiency goals and rapid growth in cloud services. Government regulations are mandating reduced carbon emissions, prompting data center operators to shift toward renewable energy, advanced cooling, and low-power hardware. Major tech firms are investing in hyperscale facilities that meet green certification standards. Renewable sources like solar and hydro are increasingly used to power operations, especially in northern and western regions. Energy management platforms and AI-based monitoring systems are being deployed to optimize resource usage. Public-private partnerships are also supporting green data infrastructure in key industrial zones.

India is experiencing a 17.5% CAGR in the green data center market, driven by increased digital activity and strong emphasis on sustainable infrastructure. The government’s push for renewable energy and stricter efficiency norms is encouraging providers to design facilities with minimal environmental impact. Solar-powered data centers are emerging in several regions, and water-free cooling technologies are being tested to reduce ecological strain. Major telecom and IT firms are collaborating with real estate developers to build green-certified facilities in cities like Hyderabad, Chennai, and Pune. Carbon footprint tracking and ESG compliance are becoming critical for enterprise clients.

Germany is registering a 16.1% CAGR in the green data center market, supported by strict environmental standards and widespread use of renewable power. Operators are designing modular, energy-efficient data centers with intelligent cooling and power systems. The integration of wind and solar energy has become common across major data hubs, particularly in Frankfurt and Berlin. Demand for low-carbon hosting solutions from enterprises and public institutions is shaping the market. Reuse of waste heat in nearby communities is being piloted in several facilities. Compliance with EU sustainability goals is also driving innovation in facility architecture and operation.

The United Kingdom is seeing a 13.3% CAGR in the green data center market, driven by government sustainability initiatives and corporate demand for cleaner digital infrastructure. Operators are prioritizing low PUE (Power Usage Effectiveness) through liquid cooling, smart airflow, and renewable integration. Green data centers are emerging outside London to reduce energy congestion and improve regional access. Cloud service providers are offering carbon-neutral hosting options to meet client expectations. Data center certifications such as BREEAM and LEED are influencing investment decisions. The shift toward net-zero operations is shaping procurement, design, and maintenance strategies.

The United States is experiencing an 11.9% CAGR in the green data center market, supported by enterprise ESG goals, tax incentives, and demand for energy-efficient digital infrastructure. Colocation providers and hyperscale firms are investing in wind and solar-powered campuses, particularly in states like Texas, Oregon, and Virginia. Smart building automation, liquid immersion cooling, and AI-based efficiency tools are widely adopted. LEED and ENERGY STAR certifications are standard across new projects. Tech companies are aiming for net-zero operations, driving innovation in design and power sourcing. Edge data centers are also being developed with sustainability-first frameworks.

The hand trucks and dollies market caters to industries ranging from logistics and warehousing to retail and home use, where efficient manual material handling is crucial. Major suppliers such as Magline, Inc., B&P Manufacturing, and BIL Group have established themselves through durable, ergonomic designs and a broad product portfolio. These companies emphasize robust construction and versatility, addressing a wide array of weight capacities and terrain types to meet diverse customer needs.

Brands like Cosco Home & Office Products, Harper Trucks, Inc., and Little Giant Products, Inc. focus on specialized dollies and hand trucks designed for convenience and maneuverability in tighter spaces, appealing to both commercial users and consumers. Their products often feature lightweight frames and foldable designs for easy storage and transport. These suppliers have developed strong distribution networks across hardware stores and online platforms, making their products accessible to a wide audience.

Companies such as Mighty Lift, Milwaukee Hand Trucks, and Wesco Industrial Products provide heavy-duty and industrial-grade solutions tailored for manufacturing and construction sectors. Suppliers from Asia like Qingdao Huatian Hand Truck Co., Ltd. offer competitive pricing with reliable quality, expanding market reach globally. Across the market, innovation focuses on improving load capacity, enhancing safety features, and increasing user comfort to help operators handle heavy materials with greater ease and efficiency.

As mentioned in Google and Intersect Power’s official December 2024 announcements, a groundbreaking partnership was formed with TPG Rise Climate to co-locate data centers with solar and wind farms. The first “power-first” facility is expected by 2026, pioneering a sustainable model for green data infrastructure in the USA.

| Item | Value |

|---|---|

| Quantitative Units | USD 79.8 Billion |

| Component | Solutions, Cooling, Networking, Power, Management software, Services, Installation & integration, Consulting, and Managed |

| Application | IT & telecom, Colocation, BFSI, Energy, Government, Healthcare, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco, Dell Inc., Digital Realty, Eaton Corporation, General Electric, Hitachi, Ltd., Huawei Technologies Co. Ltd., IBM Corporation, Microsoft Corporation, Schneider Electric SE, Siemens AG, and Vertiv Co. |

| Additional Attributes | Dollar sales vary by data center type, with enterprise and colocation leading, and cloud-based centers growing fastest; by cooling technology, including air, liquid, and evaporative systems; and by region, led by North America and Europe. Growth accelerates by renewable energy use, AI-driven efficiency, and carbon neutrality mandates. |

The global green data center market is estimated to be valued at USD 79.8 billion in 2025.

The market size for the green data center market is projected to reach USD 295.8 billion by 2035.

The green data center market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in green data center market are solutions, cooling, networking, power, management software, services, installation & integration, consulting and managed.

In terms of application, it & telecom segment to command 31.0% share in the green data center market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green Data Centers Market

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA