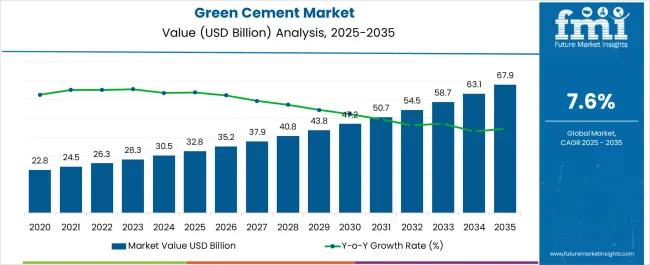

The Green Cement Market is estimated to be valued at USD 32.8 billion in 2025 and is projected to reach USD 67.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Green Cement Market Estimated Value in (2025 E) | USD 32.8 billion |

| Green Cement Market Forecast Value in (2035 F) | USD 67.9 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The Green Cement market is experiencing accelerated adoption, driven by rising concerns over environmental sustainability, carbon emissions, and the urgent need for eco-friendly alternatives in the construction sector. Increasing global regulatory pressure to reduce the carbon footprint of cement manufacturing has made green cement a vital solution for sustainable infrastructure development. Technological advancements enabling the use of industrial byproducts such as fly ash, slag, and silica fume are reducing reliance on conventional clinker while lowering energy consumption during production.

Demand growth is further supported by rapid urbanization, expanding commercial real estate projects, and government initiatives promoting green building certifications. The durability, lower water demand, and enhanced strength properties of green cement are increasing its acceptance among architects and contractors.

Major construction firms are integrating green cement into large-scale infrastructure projects to align with environmental goals and enhance long-term project value As industries and governments continue to pursue carbon neutrality targets, the Green Cement market is expected to remain on a steady growth trajectory, supported by technological innovations, policy frameworks, and rising awareness about sustainable construction materials.

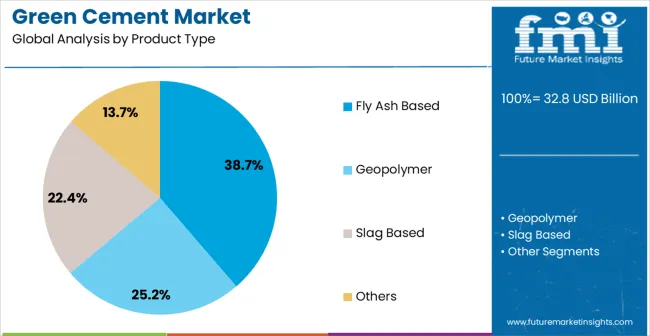

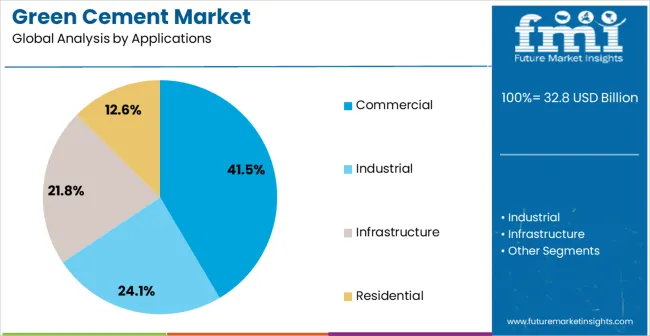

The green cement market is segmented by product type, applications, and geographic regions. By product type, green cement market is divided into Fly Ash Based, Geopolymer, Slag Based, and Others. In terms of applications, green cement market is classified into Commercial, Industrial, Infrastructure, and Residential. Regionally, the green cement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fly ash based product type segment is projected to hold 38.7% of the market revenue share in 2025, positioning it as the leading product category. Its dominance is being driven by the widespread availability of fly ash, which is a byproduct of coal-fired power plants, making it a cost-effective raw material for sustainable cement production. The use of fly ash reduces the need for clinker, which significantly lowers carbon emissions during the manufacturing process.

Additionally, fly ash enhances the strength and durability of cement, while improving resistance to chemical attacks, making it highly suitable for large-scale construction. Its pozzolanic properties enable better performance in blended cement formulations, supporting adoption in both developed and emerging markets.

The ease of blending fly ash with conventional cement, combined with growing regulatory encouragement for industrial waste recycling, further strengthens its role As construction companies increasingly prioritize sustainability and cost efficiency, fly ash based green cement is expected to retain its leadership, driven by strong supply availability and proven environmental benefits.

The commercial application segment is anticipated to account for 41.5% of the market revenue share in 2025, making it the leading application area. Growth is being propelled by the increasing number of commercial buildings, including shopping malls, office complexes, and hotels, where sustainability and energy efficiency are becoming key considerations. Green cement is being used in commercial construction not only for its reduced environmental impact but also for its ability to deliver durable and long-lasting structures.

Companies are adopting green building standards and certifications such as LEED, which are boosting demand for green cement in commercial projects. Additionally, the ability of green cement to improve indoor air quality and lower maintenance costs is making it an attractive choice for property developers and investors.

Governments and municipalities are also mandating the use of sustainable materials in urban infrastructure development, further reinforcing adoption As commercial real estate markets continue to expand globally, the demand for eco-friendly construction solutions will ensure that green cement maintains a dominant role in this application segment.

Green cement is considered as a sustainable construction material owing to significant reduction in carbon footprint associated with manufacturing and use of green cement. Green cement is a class of cements comprising varieties of cement that exhibit functional properties which are at par with conventional cement and do not involve adverse impact on the environment.

Green concrete manufacturing process is characterized by relatively lower carbon dioxide emissions as compared to ordinary cement manufacturing. Moreover, with the use of green cement, significant reduction in water consumption to the level of about 20% can be effected. Green cement and concrete market is in its emerging stage and is currently limited to developed countries.

However, increasing awareness pertaining to use of green cement is expected to boost its adoption in developing countries as well. Key factors driving the growth of global green cement market are availability of large quantity of raw material and also increasing adoption of the green building concept.

The upcoming projects such as the construction of bridges and other infrastructural developments are anticipated to present a lucrative opportunities to the overall green cement market over the forecast period.

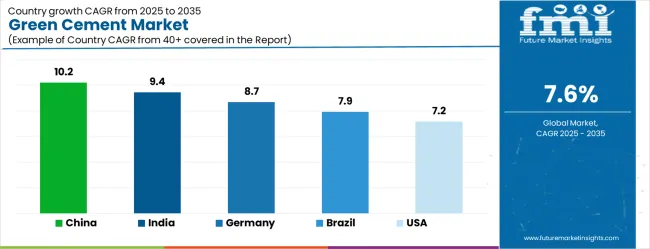

| Country | CAGR |

|---|---|

| China | 10.2% |

| India | 9.4% |

| Germany | 8.7% |

| Brazil | 7.9% |

| USA | 7.2% |

| UK | 6.4% |

| Japan | 5.7% |

The Green Cement Market is expected to register a CAGR of 7.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.2%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.7%, yet still underscores a broadly positive trajectory for the global Green Cement Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.7%. The USA Green Cement Market is estimated to be valued at USD 11.6 billion in 2025 and is anticipated to reach a valuation of USD 11.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.6 billion and USD 859.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.8 Billion |

| Product Type | Fly Ash Based, Geopolymer, Slag Based, and Others |

| Applications | Commercial, Industrial, Infrastructure, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

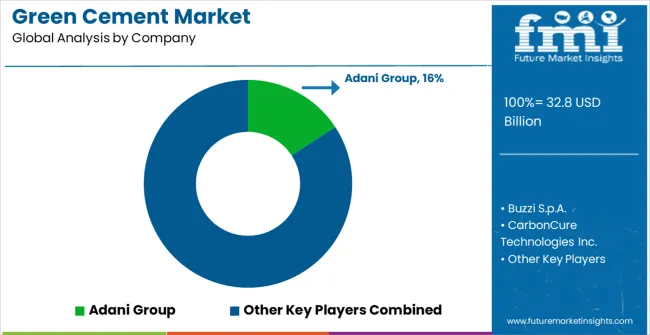

| Key Companies Profiled | Adani Group, Buzzi S.p.A., CarbonCure Technologies Inc., Cemex S.A.B DE C.V., Cenin, China National Building Material Group Corporation, Ecocem, Heidelberg Materials, Hoffmann Green Cement Technologies, and Holcim |

The global green cement market is estimated to be valued at USD 32.8 billion in 2025.

The market size for the green cement market is projected to reach USD 67.9 billion by 2035.

The green cement market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in green cement market are fly ash based, geopolymer, slag based and others.

In terms of applications, commercial segment to command 41.5% share in the green cement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA