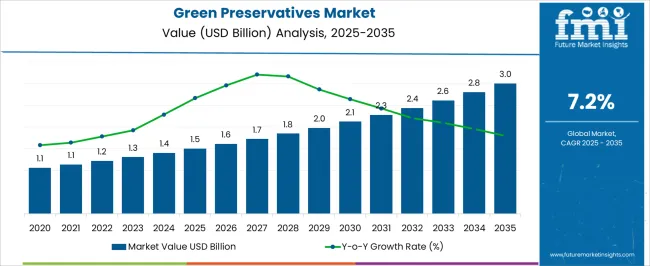

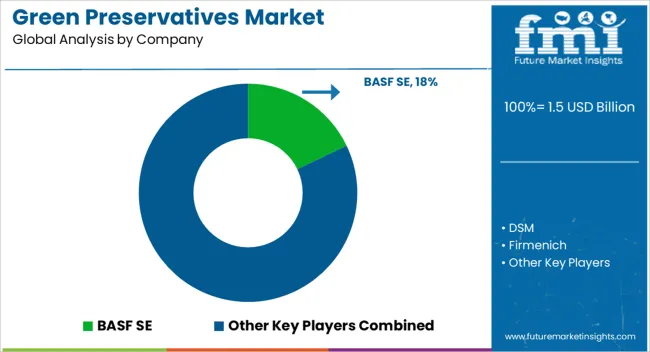

The Green Preservatives Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. The green preservatives market is estimated at USD 1.5 billion in 2025 and is projected to grow to approximately USD 2.1 billion by 2030, reflecting steady expansion over this five-year period. This growth corresponds to a compound annual growth rate (CAGR) of about 7.2%, driven by increasing demand for natural and environmentally friendly preservation solutions across various industries.

Between 2025 and 2027, the market is expected to rise from USD 1.5 billion to around USD 1.7 billion. During this phase, rising consumer preference for clean-label products and stricter regulations on synthetic preservatives are key factors contributing to market growth. Manufacturers are increasingly adopting green preservatives in food, cosmetics, and pharmaceuticals to meet evolving safety standards and consumer expectations. From 2028 to 2030, the market accelerates further, reaching USD 2.1 billion as product innovation and expanded applications drive adoption. Industries such as personal care and packaged foods show significant uptake of green preservatives, improving product shelf life while minimizing chemical additives. Increasing awareness about health and environmental impacts supports sustained demand.

| Metric | Value |

|---|---|

| Green Preservatives Market Estimated Value in (2025 E) | USD 1.5 billion |

| Green Preservatives Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The green preservatives market is undergoing accelerated expansion, driven by rising regulatory scrutiny over synthetic additives, growing consumer preference for clean-label products, and increased R&D investment in bio-based preservation technologies. Manufacturers across food, cosmetics, and pharmaceuticals are increasingly turning to plant-derived and GRAS-certified preservatives to meet both compliance and market demand.

The shift toward transparency in labeling and formulation has positioned green preservatives as critical to brand differentiation and consumer trust. Supply chain advancements in natural extraction methods, along with improvements in ingredient stability and multifunctionality, are making these alternatives commercially viable at scale.

Global food safety standards and sustainability goals are also prompting strategic collaboration between formulators, ingredient suppliers, and packaging companies to ensure efficacy, shelf-life, and minimal ecological impact. As the demand for environmentally responsible and health-conscious products continues to rise, the market for green preservatives is expected to grow substantially across high-volume sectors.

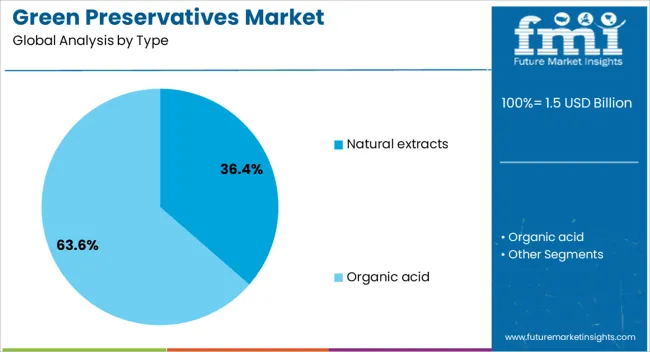

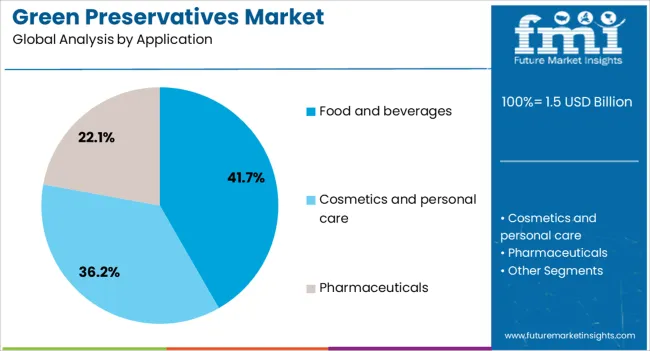

The green preservatives market is segmented by type, application, and geographic regions. The green preservatives market is divided into Natural extracts and Organic acids. In terms of application, the green preservatives market is classified into Food and beverages, Cosmetics and personal care, Pharmaceuticals, and Others (agriculture, packaging, etc.). Regionally, the green preservatives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural extracts are projected to lead the market with a 36.40% revenue share in 2025, making them the most preferred type of green preservatives. This leadership is being driven by their strong antimicrobial and antioxidant properties, derived from botanicals such as rosemary, clove, and tea tree.

Consumers increasingly perceive such ingredients as safer and healthier alternatives to synthetic chemicals, reinforcing their widespread acceptance. Extraction technologies such as supercritical CO₂ and cold pressing have enhanced yield and purity while preserving bioactivity.

Natural extracts offer multi-functionality, serving not just as preservatives but also as flavor enhancers and color stabilizers, which adds value across food, cosmetics, and nutraceutical applications. Their alignment with clean-label demands and organic certification standards further supports growing adoption by premium and mass-market brands alike.

The food and beverages segment is anticipated to account for 41.70% of the total revenue in 2025, establishing it as the largest application area for green preservatives. This segment’s growth is being influenced by stringent food safety regulations, increased consumer awareness of dietary health, and reformulation initiatives by food producers to eliminate artificial additives.

Green preservatives are being increasingly incorporated into processed foods, beverages, and ready-to-eat products due to their efficacy in inhibiting microbial growth without compromising taste or texture. Rising demand for organic and plant-based food products has further propelled the need for natural preservation methods.

Industry players are investing in formulation science to extend shelf life while maintaining nutrient retention and clean-label integrity, all of which strengthen the position of green preservatives in the food and beverage domain.

The green preservatives market is expanding as manufacturers and consumers prioritize natural and safe alternatives to synthetic preservatives. These eco-friendly preservatives, derived from plant extracts, essential oils, and bio-based compounds, are used across food, cosmetics, and pharmaceuticals to extend shelf life while minimizing health and environmental risks. Rising consumer demand for clean-label and organic products fuels growth. However, challenges such as stability, efficacy, and cost compared to synthetic options persist. Innovation in formulation and regulatory acceptance present key opportunities for wider adoption globally.

Consumers increasingly seek products with transparent, natural ingredients, driving the shift from synthetic to green preservatives. Awareness of potential health hazards linked to artificial additives boosts preference for plant-based or microbial-derived alternatives. This trend is prominent in food and beverages, personal care, and cosmetics sectors where clean-label is becoming a standard expectation. Manufacturers respond by reformulating products to include green preservatives that meet safety and efficacy requirements without compromising shelf life. Additionally, consumer demand for sustainable and ethically sourced ingredients supports the green preservative market. This evolving preference reshapes product development strategies, encourages transparent labeling, and promotes trust between brands and customers.

Despite their appeal, green preservatives often face limitations in stability and antimicrobial effectiveness compared to synthetic counterparts. Natural compounds can degrade faster, have narrow antimicrobial spectra, or interact adversely with other ingredients, reducing overall preservation efficiency. This can lead to shorter product shelf life or increased risk of spoilage. Achieving consistent quality and potency is challenging due to variability in raw material sources and extraction methods. Additionally, some green preservatives may alter product sensory attributes such as taste or scent, limiting their use. Research and development efforts focus on overcoming these hurdles through optimized formulations, encapsulation techniques, and synergistic blends. Regulatory approval processes also require comprehensive safety and efficacy data, which can delay market entry for novel green preservatives.

Technological advancements are enabling enhanced performance of green preservatives in various applications. Encapsulation, nanoemulsion, and controlled-release delivery systems improve stability and bioavailability, reducing the amount of preservative needed while maintaining efficacy. Combining multiple natural compounds creates synergistic effects that broaden antimicrobial spectrum and extend shelf life. These innovations also help mitigate sensory impacts, making green preservatives more acceptable in food and cosmetic products. Collaborations between ingredient suppliers, research institutes, and manufacturers accelerate development of next-generation preservatives tailored to specific applications. Such progress opens new avenues for premium clean-label products and supports market expansion in sectors requiring stringent safety standards. Continued investment in innovative preservation technologies is essential to address industry challenges and consumer expectations.

Regulations around preservatives vary globally, influencing the adoption of green alternatives. In many regions, regulatory agencies emphasize safety, toxicology, and labeling compliance, which can be more rigorous for new natural preservatives lacking extensive historical data. Some markets have specific lists of approved natural preservatives or restrict synthetic additives, creating opportunities for green preservatives to gain traction. However, inconsistent standards and lengthy approval timelines can hinder rapid adoption. Companies must navigate complex compliance frameworks while ensuring transparent communication about preservative benefits and limitations to consumers. Increasing harmonization of regulations and growing government support for natural ingredients are expected to facilitate market growth. Effective regulatory strategies and proactive engagement with authorities will be critical for manufacturers to capitalize on emerging opportunities.

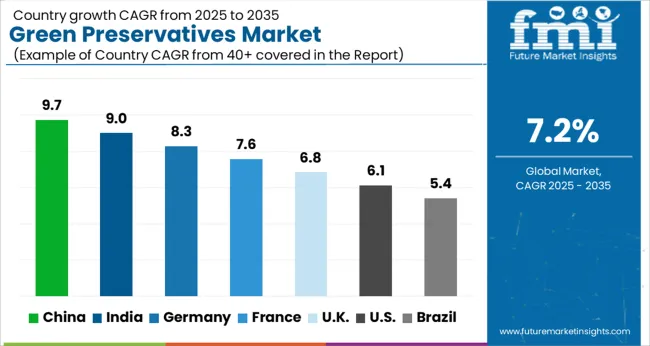

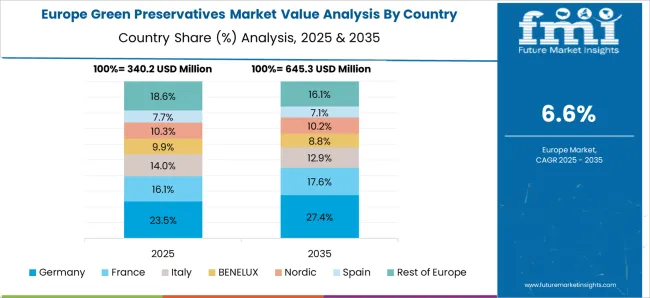

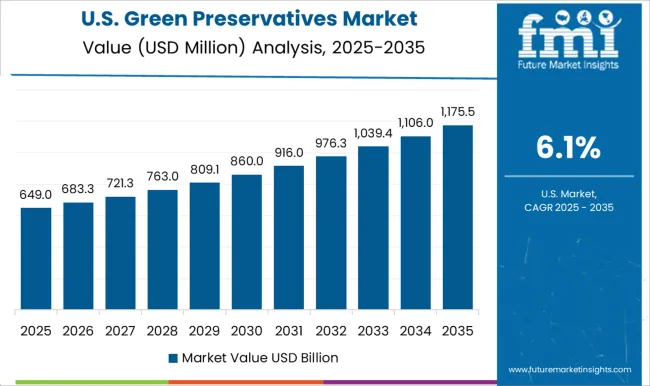

The global green preservatives market is expanding at a healthy CAGR of 7.2%, driven by growing demand for natural and eco-friendly additives. China leads with 9.7% growth, fueled by strong manufacturing capabilities and increased environmental regulations. India follows at 9.0%, supported by rising consumer awareness and sustainable product adoption. Germany records 8.3% growth, reflecting stringent regulatory frameworks and innovation in natural preservative technologies. The United Kingdom grows at 6.8%, driven by increasing demand for clean-label products. The United States, a mature market, shows 6.1% growth, shaped by regulatory compliance and emphasis on sustainability. These countries collectively influence market trends through advancements in formulation, safety standards, and environmental impact reduction. This report includes insights on 40+ countries; the top countries are shown here for reference.

China green preservatives market is expanding at a robust 9.7% CAGR, driven by increasing consumer demand for natural and eco-friendly products. Rising environmental awareness and stricter regulations against synthetic chemicals push manufacturers to adopt plant-based and biodegradable preservatives. The food, cosmetics, and pharmaceutical sectors are major adopters of green preservatives, with innovative R&D accelerating product development. Compared to other markets, China benefits from abundant natural resources and government incentives promoting sustainable practices. E-commerce platforms facilitate wider distribution of green preservative products, reaching urban and semi-urban consumers. Growing export opportunities to environmentally conscious markets further boost growth prospects.

India green preservatives market is growing at a 9% CAGR, fueled by rising health awareness and increasing demand for clean-label products. Consumers show strong preference for natural ingredients, pushing food and personal care manufacturers to replace synthetic preservatives. Regulatory bodies encourage use of safer alternatives through updated guidelines. Unlike China, India’s market still faces challenges with supply chain standardization and product certification. However, local companies are innovating using indigenous herbs and botanical extracts. Awareness campaigns highlight health risks of chemical preservatives, boosting consumer education. Growing domestic consumption and export potential make India a promising market for green preservatives.

Germany green preservatives market expands at an 8.3% CAGR, reflecting its leadership in environmental sustainability and stringent regulatory standards. Consumers demand transparency and clean formulations, leading manufacturers to develop preservative systems based on natural antioxidants, organic acids, and plant extracts. The food, cosmetics, and pharmaceutical industries emphasize safety, efficacy, and certification compliance. Compared to Asian markets, Germany has a more mature green preservatives sector with well-established standards and consumer trust. Companies invest in sustainable sourcing and lifecycle analysis to minimize environmental impact. Partnerships with research institutions accelerate product innovation. Retailers promote green-certified products to meet growing eco-conscious customer segments.

The United Kingdom green preservatives market grows at a 6.8% CAGR, driven by increasing consumer preference for organic and natural products in food and cosmetics. Strict regulations and industry standards encourage formulation changes to remove synthetic preservatives. The market features innovation in bio-based preservative blends and fermentation-derived ingredients. Compared to Germany, the UK market is slightly smaller but rapidly adopting eco-friendly solutions. Retailers and brands emphasize clean labels and product safety to attract health-conscious customers. Education campaigns promote awareness about chemical-free preservation methods. Sustainability initiatives include reducing packaging waste alongside preservative innovation.

United States green preservatives market is growing at a 6.1% CAGR, supported by strong consumer demand for natural and organic product ingredients. The food and personal care industries actively reformulate to meet clean-label trends and regulatory pressures to reduce synthetic additives. The USA market features significant investment in biotechnology and plant-based ingredient sourcing. Compared to European markets, the USA faces challenges with regulatory harmonization across states but benefits from large-scale manufacturing and marketing capabilities. Digital platforms enhance consumer education and product transparency. Growing export demand from eco-conscious global markets presents additional growth opportunities.

The green preservatives market is rapidly expanding as consumers and manufacturers increasingly prioritize natural, sustainable, and eco-friendly ingredients in food, cosmetics, and personal care products. Leading companies in this space include BASF SE, DSM, Firmenich, Givaudan, Kalsec, Kemin Industries, Kerry, Lanxess, Symrise, and Wang Pharmaceuticals and Chemicals. These industry leaders focus on developing bio-based, non-toxic preservatives derived from natural sources such as plant extracts, essential oils, and fermentation processes. BASF SE and DSM, for example, leverage advanced biotechnology and green chemistry to produce preservatives that ensure product safety and longevity without compromising environmental standards.

Firmenich, Givaudan, and Symrise, traditionally known for flavors and fragrances, have diversified into natural preservation systems that align with consumer demand for clean-label and sustainable formulations. Kemin Industries and Kerry also offer specialty bio-preservatives targeting the food and beverage sector, enhancing shelf life while maintaining product integrity and nutritional quality. The market growth is driven by tightening regulatory frameworks against synthetic preservatives due to health and environmental concerns, coupled with rising consumer awareness about the potential risks of chemical additives.

Additionally, manufacturers seek to comply with organic certification standards, further fueling demand for green preservatives. This trend is amplified across various end-use industries including cosmetics, pharmaceuticals, and packaged foods, where clean-label claims and sustainability goals are becoming decisive factors in purchasing decisions. Innovation in extraction technologies, microbial fermentation, and synergistic preservative blends continues to improve the efficacy and cost-competitiveness of green preservatives, positioning the market for robust growth globally, especially in regions such as North America, Europe, and Asia-Pacific.

Companies are exploring new technological advancements to improve the efficiency of green preservatives. For example, nanoencapsulation technologies are being used to enhance the effectiveness of natural preservatives by protecting active ingredients from environmental factors, such as heat and light. This ensures longer-lasting preservation effects while maintaining the natural characteristics of the product. Encapsulation of essential oils in nanostructures is also being used to increase their antimicrobial properties and provide controlled release.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Type | Natural extracts and Organic acid |

| Application | Food and beverages, Cosmetics and personal care, Pharmaceuticals, and Others (agriculture, packaging, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, DSM, Firmenich, Givaudan, Kalsec, Kemin Industries, Kerry, Lanxess, Symrise, and Wang Pharmaceuticals and Chemicals |

| Additional Attributes | Dollar sales vary by type, including natural extracts, organic acids, essential oils, antioxidants, and microbial-derived preservatives; by application, spanning food & beverages, cosmetics & personal care, pharmaceuticals, and cleaning products; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by consumer demand for natural, clean-label products, regulatory support, and sustainability initiatives. |

The global green preservatives market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the green preservatives market is projected to reach USD 3.0 billion by 2035.

The green preservatives market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in green preservatives market are natural extracts, _essential oil, _herbal extract, _plant extract, organic acid, _citric acid, _lactic acid and _ascorbic acid.

In terms of application, food and beverages segment to command 41.7% share in the green preservatives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA