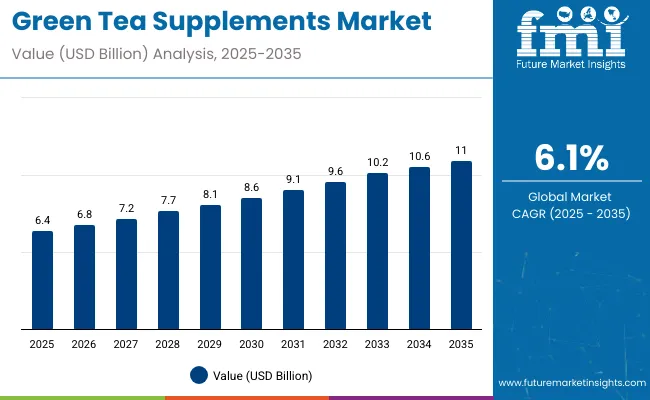

The global green tea supplements market is projected to increase from USD 6.4 billion in 2025 to approximately USD 11 billion by 2035, registering a CAGR of 6.1% over the forecast period. Growth momentum in 2024 was supported by expanding consumer awareness around antioxidant intake, weight management, and natural health remedies. In 2025, higher demand was observed for multi-functional supplements containing green tea extract, particularly in North America, Japan, and urban regions across Europe.

Green tea supplements are being adopted in various formats including capsules, powders, and ready-to-drink solutions. These products are widely consumed for their polyphenolic compounds, primarily EGCG, which are linked to improved metabolism, cardiovascular health, and cognitive clarity. Supplement companies have responded by developing formulations with enhanced bioavailability, sugar-free variants, and plant-based delivery systems. In 2025, sachets and bottled extracts became increasingly prominent in online wellness kits and immunity bundles.

The rise of preventive healthcare and increased interest in clean-label formulations has further accelerated product innovation. In markets such as the USA and China, personalized nutrition platforms began recommending green tea supplements tailored to specific health conditions such as gut health or skin support. Regulatory frameworks remained favorable in 2025, with approvals and ingredient validations being extended for green tea-derived actives.

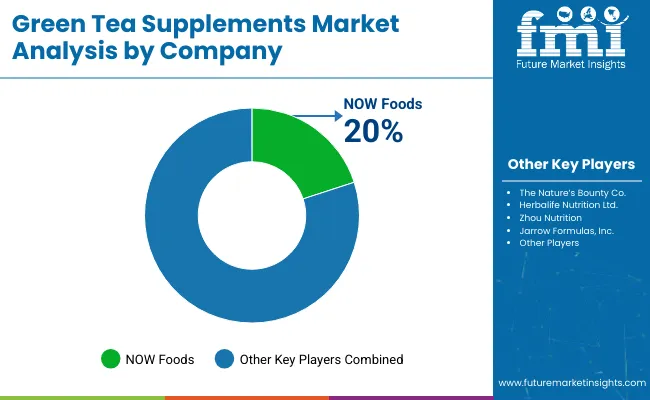

Major manufacturers such as Herbalife, Amway, Nature’s Bounty, and NOW Foods continued to expand distribution through both retail and digital-first models. As of 2025, clean-label certification and traceability are being viewed as essential attributes by educated consumers seeking transparency and ethical sourcing.

The industry's current trajectory suggests continued alignment with plant-based health trends and functional wellness. As consumers gravitate toward natural and effective supplementation, green tea extract products are expected to sustain strong momentum through 2035.

Green tea extract shows its clearest and most reproducible benefit in lowering LDL and total cholesterol, with multiple large RCTs and meta-analyses confirming modest reductions of around 2–5%. HDL and triglycerides are largely unaffected or show inconsistent shifts, meaning GTE is a useful but limited adjunct rather than a primary lipid-lowering tool. Compared to pharmaceutical options like statins or ezetimibe, the effect size is small, but for individuals seeking a dietary aid with some evidence behind it, this is the one outcome worth taking seriously.

Claims around weight loss and metabolic health are much weaker. High-quality trials find little to no meaningful effect on body weight or long-term maintenance. For blood pressure and glycemic control, there are signals of modest short-term improvements, but these have not held up consistently in longer studies, and HbA1c reductions remain uncertain. Cognitive effects are intriguing in small studies but far from clinically established.

One area that cannot be ignored is safety. Doses of EGCG at or above 800 mg per day, common in supplement form, have been linked to elevated liver enzymes and potential hepatotoxicity. Brewed tea at normal consumption levels appears safe, but concentrated extracts carry real risk. In short, GTE’s role is narrow: it can shave a few points off LDL, but pushing the dose higher in pursuit of bigger effects risks harm without added benefit.

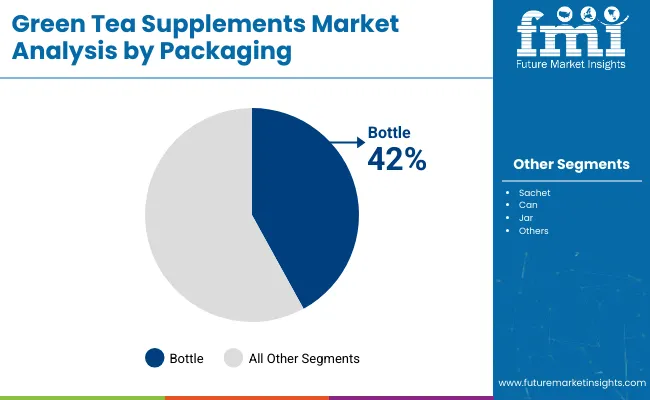

In 2025, the bottle segment leads with a 42% market share, largely due to its dominance in retail distribution and ease of storage. Bottles are preferred for liquid and capsule formats sold in pharmacies and health stores. Sachets follow with 25%, driven by their portability and single-use convenience, especially for powdered forms.

Sachets are popular in e-commerce kits, trial packs, and on-the-go health regimens. Cans hold an 18% share, gaining modest traction through functional beverage formats, though they face sustainability scrutiny and higher packaging costs. Jars account for 15%, favored by premium brands for bulk powdered supplements and reusable formats.

In 2024 and early 2025, brands focused on sustainable packaging innovations to align with global eco-conscious trends. Compostable sachets, recyclable jars, and glass bottles saw notable R&D activity. As consumer convenience, shelf presence, and eco-friendliness continue to influence purchase decisions, packaging strategy remains a critical differentiator in the competitive landscape for green tea supplements globally.

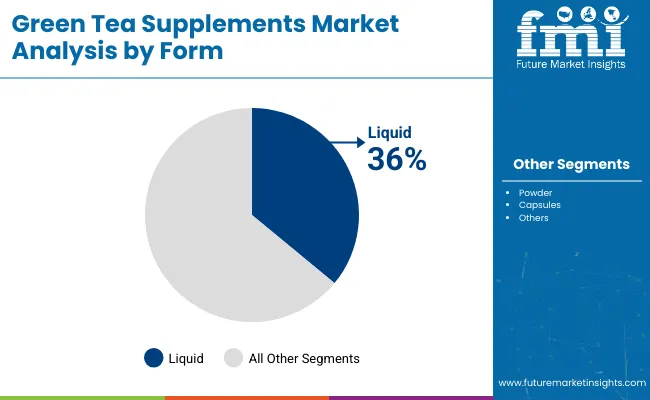

By form, liquid green tea supplements hold a 36% share in 2025, favored for their high absorption rate and suitability for functional beverages. Powders follow at 34%, driven by flexibility in dosing, lower costs, and strong popularity in fitness and wellness regimes. Capsules account for 30%, offering convenience and precise intake for consumers seeking measured supplementation.

In 2024, powder formats saw a spike in popularity due to rising DIY drink culture and mix-and-match nutrition routines. Meanwhile, liquid formats expanded in urban markets, with brands offering green tea elixirs fortified with botanicals like ashwagandha and ginseng.

Capsule formats remained a go-to for traditional supplement users and older demographics, where reliability and shelf life matter most. Across all forms, manufacturers prioritized enhanced bioavailability, clean-label certification, and flavored variants to attract broader demographics. With innovation focusing on both efficacy and experience, form remains a key battleground for differentiation in the global green tea supplements market.

North America will likely lead the green tea supplements market. This is due to strong affection for natural health goods, more people wanting metabolism aids, and the rise of online sales in the health sector. The US and Canada are ahead because of more money to spend, more knowledge about antioxidants, and more people choosing vegan and organic products.

Green tea drinks that help our bodies, more want for herbal sports aids, and the trend of personal nutrition are boosting market demand. Also, rules allowing health claims of green tea extracts are helping the industry grow.

Europe's market for green tea supplements is quite big. Countries like Germany, the UK, France, and Italy lead. They like organic herbs, plant-based foods, and clean-label products. The EU has strict health rules, and people want non-GMO herbs. This drives the market up. Anti-aging and brain health supplements are also popular.

Green tea extract is becoming more known. Sustainable packaging is growing too. Foods rich in polyphenols are in demand. Also, many people are interested in herbal weight loss solutions. This increases the market demand even more.

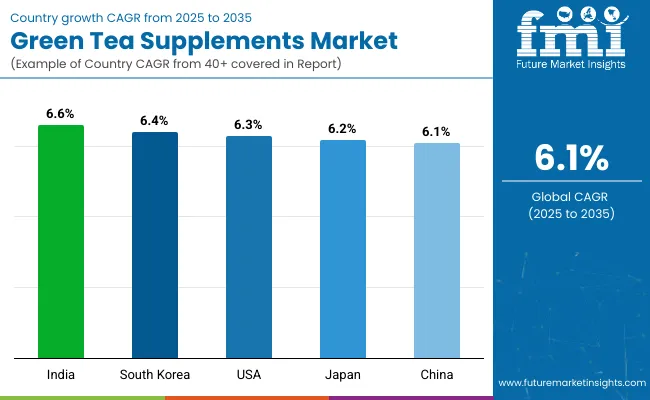

The Asia-Pacific will see the biggest growth in green tea supplements market. This is due to more health-aware buyers, higher use of green tea in old medicines, and a rise in demand for herbal, anti-pain, and cleansing supplements. China, Japan, India, and South Korea are at the top in making green tea, new supplements, and adding them to foods.

China is growing its use of green tea in old medicine recipes, facing more demand for herbal food supplements, and the love for plant-based foods is boosting the market. India's rise in using Ayurvedic herb mixes, more intake of weight loss aids, and government backing for natural health goods are helping its growth. Also, Japan and South Korea are leading in making top-quality green tea and adding green tea to collagen supplements, aiding the region's market rise.

A huge issue in selling green tea supplements are the strict rules. Health claims, label rules, and ingredient standards differ by area. Also, worries about too much green tea extract causing liver harm and mixing badly with drugs may lead to doubts among buyers.

Other herbal options like turmeric, ashwagandha, and matcha also fight with green tea pills for customers.

Even with challenges, the green tea supplements market has big chances to grow. The use of green tea pills in sports, mostly for more energy and burning fat, is helping sales. More people want brain health supplements with green tea stuff like L-theanine for stress and focus, pushing up demand.

Additionally, more customers prefer eco-friendly pill packaging with biodegradable and recyclable materials. This eco trend is catching the eye of earth-friendly buyers.

Also, making custom green tea pills for personal health goals, genetic make-up, and body needs should help the market grow more.

From 2020 to 2024, the green tea supplements market grew a lot. More people cared about health and wellness. They liked natural, plant-based supplements. This made demand go up, especially for weight control, immune help, and heart health. The focus on stopping health issues and functional foods helped the market grow even more.

Between 2025 and 2035, big changes will happen. New technology like nanotech and AI will change the market. These will help make custom green tea supplements for each person. Better nutrition and health data will make these personalized supplements more wanted. Sustainable practices will keep the market green and trusted.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with basic supplement safety and quality regulations. |

| Technological Advancements | Development of enhanced extraction techniques for improved potency. |

| Industry Applications | Predominantly used in weight loss, heart health, and antioxidant support. |

| Adoption of Smart Equipment | Limited automation in processing and packaging. |

| Sustainability & Cost Efficiency | Initial shift toward eco-friendly packaging and ethical sourcing. |

| Data Analytics & Predictive Modeling | Basic market trend tracking and historical sales analysis. |

| Production & Supply Chain Dynamics | Reliance on regional suppliers and conventional farming. |

| Market Growth Drivers | Growth fueled by rising consumer interest in natural health and functional foods. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter global regulations on product efficacy, labeling transparency, and environmental sustainability. |

| Technological Advancements | Integration of nanotechnology, AI-driven supplement personalization, and bioenhanced green tea formulations. |

| Industry Applications | Expansion into cognitive health, gut microbiome support, and AI-driven precision nutrition. |

| Adoption of Smart Equipment | Widespread use of AI-assisted production, real-time quality control, and blockchain-enabled supply chain tracking. |

| Sustainability & Cost Efficiency | Mainstream adoption of regenerative agriculture, carbon-neutral production, and zero-waste supplement packaging. |

| Data Analytics & Predictive Modeling | AI-driven predictive analytics for personalized supplement formulations and demand forecasting. |

| Production & Supply Chain Dynamics | Shift to decentralize sourcing, vertical farming for green tea cultivation, and automated supply chain optimization. |

| Market Growth Drivers | Expansion driven by AI-powered wellness trends, regulatory focus on plant-based medicine, and sustainability-driven consumer choices. |

The green tea supplements market in the USA is growing steadily. This growth comes from more people knowing about the health benefits. There's also a higher demand for weight loss pills and a love for natural antioxidants. The USA FDA and DSHEA make sure green tea supplements are safe and labelled right. Organic and non-GMO green tea extracts are getting popular.

More people use green tea supplements for sports nutrition. Online sales channels are expanding too. The market is also shaped by rising demand for green tea drinks and dietary capsules.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

In the UK, the green tea supplements market is growing fast. More people care about their health and want plant-based or organic supplements. Green tea helps with detox and speeds up metabolism. Rules about product quality and safety come from the MHRA and the FSA. There’s more demand for green tea beauty supplements.

Many like herbal and functional teas now. More folks want caffeine-free green tea too. The market is also booming thanks to green tea products in many forms like powders, capsules, and gummies. This makes the product range wide and varied.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

The green tea supplement market in the EU is seeing steady growth. This is due to strict rules, more interest in natural wellness, and demand for green tea in functional foods. The EFSA and EMA make sure food supplements stay safe and true to their claims. Germany, France, and Italy are leading the way. They use green tea for heart health, seek sustainable and organic sources, and research its anti-aging benefits. More green tea is also used in fortified drinks and blends. This push leads to new products and ideas.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.1% |

In Japan, the market for green tea supplements is growing. This growth ties to the long love for green tea there. More people use matcha supplements now. The government helps boost the use of health foods. The Japanese Ministry of Health, Labour, and Welfare (MHLW) and the Japan Health Food & Nutrition Food Association (JHFA) check the quality of green tea supplements and claims about health benefits.

Japanese firms make strong green tea supplements. They are also making more health drinks with matcha. New ideas include green tea probiotics and gut-health formulas. Interest in traditional and fermented green tea extracts is also rising, pushing the market ahead even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The green tea supplements market in South Korea is growing fast. More people are seeking natural health products, and K-beauty trends highlight green tea for better skin. The rise of health drinks also helps. The Ministry of Food and Drug Safety (MFDS) and the Korea Health Supplements Association (KHSA) oversee supplement quality and labels. Green tea extract is popular in weight loss products.

Polyphenols from green tea are used in anti-aging skincare. Herbal medicine with green tea is also on the rise. Plus, more online sales of high-end and organic green tea supplements are increasing demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

The green tea supplements market is growing fast. More and more people want natural health stuff, weight loss help, and supplements with antioxidants. People are getting smarter about green tea and its good points. They like plant-based items and new tech that helps the body use the supplements better. Firms are making organic green tea extracts, pills, and powder blends.

These blends often have vitamins and other good stuff to help with energy, brain health, and the immune system. Big companies, herbal makers, and organic brands all play a part. They work on improving high-EGCG extracts, liquid supplements, and finding green tea in eco-friendly ways.

| Company Name | Key Offerings/Activities |

|---|---|

| NOW Foods | Develops high-EGCG green tea extract capsules for metabolism and antioxidant support. |

| The Nature’s Bounty Co. | Specializes in standardized green tea supplements with polyphenol-rich formulations. |

| Herbalife Nutrition Ltd. | Manufactures green tea-based metabolism boosters and energy-enhancing supplements. |

| Zhou Nutrition (Nutraceutical International) | Provides organic green tea extract with adaptogens for stress and cognitive health. |

| Jarrow Formulas, Inc. | Focuses on green tea polyphenol supplements with bioavailable catechins. |

Several herbal supplement manufacturers, organic wellness brands, and functional beverage companies contribute to advancements in green tea supplement purity, bioavailability, and sustainable sourcing. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.4 billion |

| Projected Market Size (2035) | USD 11 billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Bottle, Can, Jar, Sachet |

| Applications Analyzed (Segment 2) | Pharmaceuticals, Food & Beverages, RTD Teas, Functional Foods, Dietary Supplements, Energy Drinks, Cosmetics |

| Sample Types Analyzed (Segment 3) | Not Applicable |

| Distribution Channels Analyzed (Segment 4) | Retail, Supermarket, Hypermarket, Others (Direct Selling, Mass Retailers), Online |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | NOW Foods, The Nature’s Bounty Co., Herbalife Nutrition Ltd., Zhou Nutrition (Nutraceutical International), Jarrow Formulas Inc., DSM, BASF, Danone, Changsha Sunfull Bio-tech, Blue California, Nutrigold, Tate & Lyle, Hard Rhino, Bulk Supplements |

| Additional Attributes | Growth in nutraceutical demand, Surge in functional food formulations, Expansion of online supplement retail, Use in cosmetics and energy drinks |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the Green Tea Supplements Market was USD 6.4 Billion in 2025.

The Green Tea Supplements Market is expected to reach USD 11 Billion in 2035.

Increasing consumer focus on health and wellness, rising demand for natural antioxidants, and growing adoption of weight management supplements will drive market growth.

The USA, China, Japan, Germany, and India are key contributors.

Capsule-based green tea supplements are expected to dominate due to their convenience, longer shelf life, and precise dosage.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Green Coffee Bean Extract Market Analysis by Form, Application, and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA