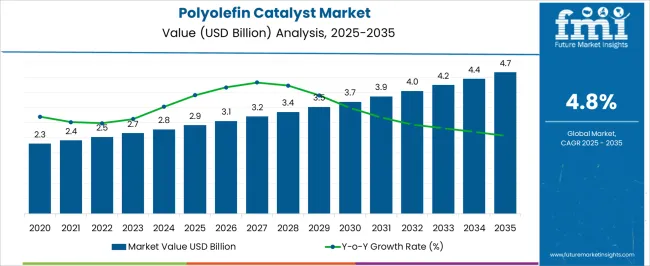

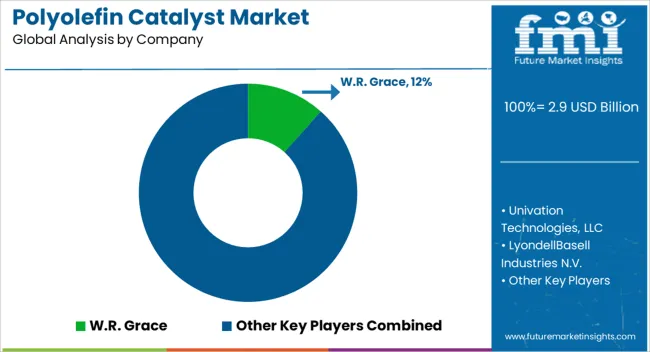

The polyolefin catalyst market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

This growth presents an absolute dollar opportunity of USD 1.8 billion over the decade. Beginning at USD 2.3 billion in the early years, the market demonstrates steady expansion, reaching USD 3.7 billion by 2030. For companies in the chemical and polymer industries, this consistent growth highlights significant revenue potential. By aligning production, distribution, and market strategies with this trend, stakeholders can capture incremental value and strengthen their market presence in a gradually expanding sector. The absolute dollar opportunity from 2025 to 2035 emphasizes steady annual gains, with the market moving from USD 2.9 billion to USD 4.7 billion. Incremental growth rises from USD 3.1 billion in 2026 to USD 4.4 billion in 2034, before reaching USD 4.7 billion in 2035.

This predictable expansion allows businesses to plan capacity increases, partnerships, and sales strategies with low-risk exposure. Capturing market share during this period ensures meaningful revenue gains, enabling stakeholders to maximize returns while positioning themselves strategically within the evolving Polyolefin Catalyst market.

| Metric | Value |

|---|---|

| Polyolefin Catalyst Market Estimated Value in (2025 E) | USD 2.9 billion |

| Polyolefin Catalyst Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

A breakpoint analysis of the polyolefin catalyst market highlights periods where growth is gradual versus phases of stronger expansion. From 2025 to 2028, the market grows from USD 2.9 billion to USD 3.1 billion, with annual increments of around USD 0.1–0.2 billion. This early-stage period represents a stable, low-risk window for companies to establish operations, refine supply chains, and evaluate customer demand. Recognizing this initial breakpoint helps businesses allocate resources efficiently, plan production, and test market strategies, ensuring they are well-positioned to capitalize on higher growth phases in subsequent years.

The next breakpoint occurs between 2030 and 2035, as the market expands from USD 3.7 billion to USD 4.7 billion, reflecting larger annual increments of USD 0.3–0.4 billion. This stage represents accelerated growth and significant absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture meaningful revenue gains while strengthening their competitive stance. Understanding these breakpoints allows stakeholders to time investments effectively, plan expansions, and target high-return opportunities in the evolving polyolefin catalyst market.

The polyolefin catalyst market is experiencing steady expansion, supported by increasing global demand for polyolefins in packaging, automotive, construction, and consumer goods. Industry publications and petrochemical company reports have highlighted advancements in catalyst technology, enabling higher productivity, improved polymer properties, and enhanced process efficiency. Investments in new polymerization facilities, particularly in emerging economies, have broadened production capacity and fueled catalyst consumption.

Regulatory shifts toward lightweight and recyclable plastics have also driven demand for catalysts that produce high-performance, environmentally compliant polyolefins. Technological developments, including next-generation Ziegler-Natta and metallocene catalysts, have allowed manufacturers to tailor polymer grades for specific end-use applications.

Additionally, rising demand for high-quality polypropylene and polyethylene in precision molding, films, and fibers is creating sustained catalyst requirements. Over the forecast period, market growth is expected to be led by polypropylene classification, Ziegler-Natta catalysts, and injection molding applications, reflecting their established industrial usage and strong compatibility with high-volume manufacturing processes.

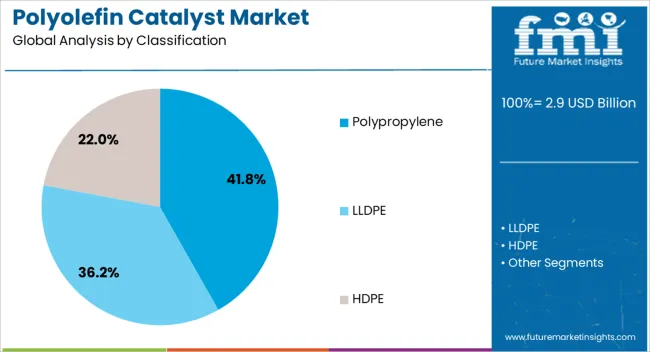

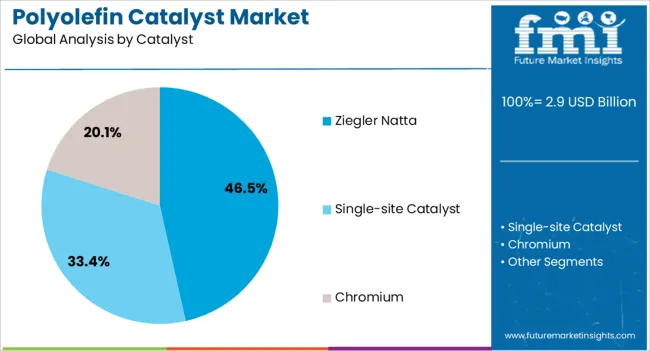

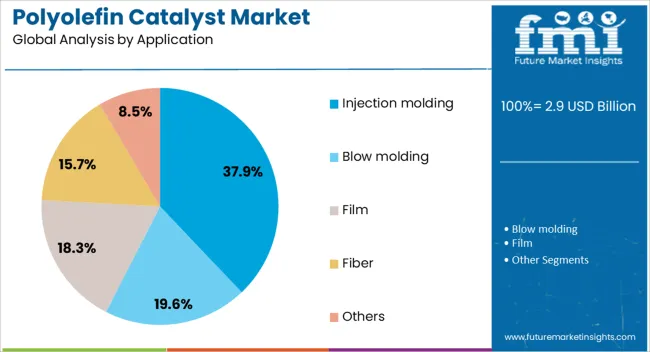

The polyolefin catalyst market is segmented by classification, catalyst, application, and geographic regions. By classification, polyolefin catalyst market is divided into polypropylene, LLDPE, and HDPE. In terms of catalyst, polyolefin catalyst market is classified into Ziegler Natta, single-site catalyst, and chromium. Based on application, polyolefin catalyst market is segmented into injection molding, blow molding, film, fiber, and others. Regionally, the polyolefin catalyst industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polypropylene segment is projected to account for 41.8% of the polyolefin catalyst market revenue in 2025, maintaining its position as the leading classification. Growth in this segment has been driven by polypropylene’s versatility, favorable mechanical properties, and broad range of industrial applications.

Market data and industry reports have indicated that polypropylene production relies heavily on advanced catalysts to achieve desired molecular weights, stereoregularity, and processability. The segment benefits from high demand in packaging films, automotive parts, and household goods, where material strength, chemical resistance, and cost efficiency are critical.

Furthermore, improvements in catalyst design have enabled faster production cycles and reduced energy consumption in polypropylene manufacturing, enhancing its competitive edge. With ongoing innovations in specialty grades and growing consumption in high-growth economies, the polypropylene classification is expected to sustain its leading role in the polyolefin catalyst market.

The Ziegler-Natta catalyst segment is projected to hold 46.5% of the polyolefin catalyst market revenue in 2025, leading the market due to its long-established industrial presence and proven performance. These catalysts have been favored for their cost-effectiveness, scalability, and ability to produce a wide range of polymer grades with consistent quality.

Petrochemical industry publications have noted that Ziegler-Natta catalysts remain the standard choice for bulk polypropylene and polyethylene production, given their adaptability to various polymerization processes and reactor types.

Technological refinements, including improved titanium chloride-based formulations and advanced co-catalyst systems, have further enhanced polymer properties such as tensile strength, clarity, and impact resistance. Additionally, the segment benefits from extensive manufacturing infrastructure and operational expertise, which supports high-volume output at competitive costs. This entrenched market position, coupled with ongoing optimization for efficiency and sustainability, is expected to keep Ziegler-Natta catalysts at the forefront of polyolefin production.

The injection molding segment is projected to contribute 37.9% of the polyolefin catalyst market revenue in 2025, securing its position as the leading application. This dominance has been supported by the widespread use of polypropylene and polyethylene components in industries such as automotive, packaging, appliances, and consumer products. Injection molding processes require catalysts that deliver polymers with high flow properties, dimensional stability, and durability, ensuring precise and consistent part production.

Industry analyses have emphasized that advancements in catalyst technology have enabled faster cycle times, improved surface finish, and reduced defect rates in molded parts. Moreover, the growing demand for lightweight, durable, and recyclable materials in automotive and consumer goods has reinforced the importance of high-performance catalysts for injection molding applications. As end-use industries continue to prioritize material efficiency and product quality, the injection molding segment is expected to sustain its leading role in polyolefin catalyst consumption.

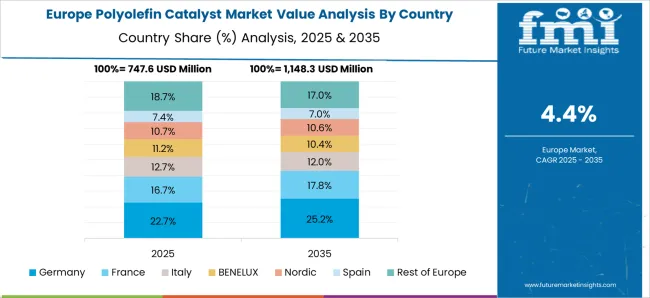

The polyolefin catalyst market is expanding as demand grows for high-performance plastics in packaging, automotive, and construction applications. Ziegler-Natta and metallocene catalysts dominate production due to efficiency and tailored polymer properties. North America and Europe lead in consumption driven by industrial activity and regulatory support, whereas Asia-Pacific shows fastest growth due to manufacturing expansion. Key players differentiate through high-purity catalysts, process optimization, and licensing collaborations. Market focus is shifting toward improved polymer selectivity, reduced energy consumption, and controlled molecular weight distribution to meet evolving material performance requirements.

Catalyst activity and productivity vary significantly among suppliers and catalyst types. Ziegler-Natta catalysts provide cost-effective polymerization for commodity polyolefins, while metallocene catalysts offer precise control over polymer structure. Large producers maintain high-purity formulations ensuring consistent polymer quality, whereas smaller manufacturers face variability in output. In Europe, automotive and packaging sectors demand high-performance catalysts, whereas emerging Asian markets prioritize cost and availability. These differences impact process efficiency, product consistency, and polymer properties. Companies with reliable high-activity catalysts gain trust from industrial users, while less consistent suppliers struggle to meet stringent quality standards.

Control over polymer properties distinguishes leading catalyst producers. Metallocene catalysts allow precise manipulation of molecular weight, density, and comonomer incorporation, enabling high-value applications like specialty films and engineered plastics. Ziegler-Natta catalysts dominate bulk commodity polymer production due to affordability and scalability. North American manufacturers emphasize tailored properties for packaging, whereas Asian manufacturers focus on high-volume, cost-efficient polyolefins. Suppliers that demonstrate reproducible control over polymer characteristics secure long-term contracts and premium pricing. Differences in structural control capabilities drive adoption patterns and establish competitive advantage between established multinational producers and smaller regional suppliers.

Europe and North America maintain mature production networks with integrated supply chains, ensuring consistent catalyst availability year-round. Asia-Pacific experiences rapid growth but relies on imports of high-performance catalysts for advanced applications. Seasonal maintenance, raw material procurement, and regional energy costs create variations in production schedules. Large producers diversify manufacturing locations to mitigate disruption, whereas smaller regional suppliers may face shortages during peak demand periods. These dynamics influence pricing, lead times, and buyer preference. Companies with geographically diversified production maintain reliability and market credibility, while single-location suppliers remain vulnerable to fluctuations in demand or raw material availability.

Catalyst approval and handling regulations differ across regions. Europe imposes strict environmental and safety requirements for catalyst production and storage. North American producers comply with OSHA and EPA standards, affecting formulation and transportation. In Asia-Pacific, regulatory frameworks are evolving, which can delay product introduction or require local certification. Large multinational companies maintain compliance teams and secure approvals faster, while smaller producers may face delays entering regulated markets. Regulatory alignment influences production planning, marketing strategy, and regional market share. Suppliers with proactive compliance gain faster adoption in regulated sectors compared with competitors navigating complex approval processes.

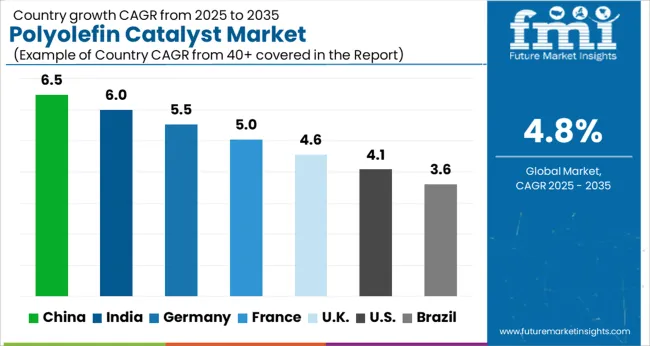

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global polyolefin catalyst market was projected to grow at a 4.8% CAGR through 2035, driven by demand in polyolefin production for packaging, automotive, and construction applications. Among BRICS nations, China recorded 6.5% growth as large-scale catalyst manufacturing facilities were commissioned and compliance with chemical quality standards was enforced, while India at 6.0% growth saw expansion of production units to support rising regional polymer output. In the OECD region, Germany at 5.5% maintained substantial output under strict chemical and industrial regulations, while the United Kingdom at 4.6% relied on moderate-scale operations for specialty polyolefin applications. The USA, expanding at 4.1%, remained a mature market with steady demand in polymer manufacturing, supported by adherence to federal and state-level chemical safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Polyolefin catalyst market in China is growing at a CAGR of 6.5%. Between 2020 and 2024, market expansion was driven by increasing demand for polyethylene and polypropylene in packaging, automotive, and construction industries. Local manufacturers focused on producing high activity and cost effective catalysts to meet growing production needs. Investments in chemical infrastructure and polymer plants supported market development. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of advanced metallocene and single site catalysts that improve polymer properties. Rising demand for lightweight and durable materials in automotive and packaging applications will further drive market expansion. Government initiatives supporting chemical industry modernization and environmental compliance will continue to promote catalyst adoption. China remains a leading market in Asia for polyolefin catalysts due to industrial growth and technological innovation.

Polyolefin catalyst market in India is growing at a CAGR of 6.0%. During 2020 to 2024, adoption was driven by expansion of polymer production and demand in packaging, automotive, and construction sectors. Domestic manufacturers focused on developing high efficiency catalysts to increase productivity and reduce costs. Investment in chemical and polymer manufacturing facilities supported market growth. For the forecast period 2025 to 2035, market growth is expected to continue with increasing adoption of metallocene and single site catalysts. Rising emphasis on lightweight polymers, sustainability, and energy efficient production will encourage wider use of advanced catalysts. Regulatory initiatives to improve chemical safety and environmental compliance will also influence market expansion. India is projected to maintain strong growth as an emerging hub for polyolefin catalyst applications.

Polyolefin catalyst market in Germany is growing at a CAGR of 5.5%. Historical period 2020 to 2024 saw adoption supported by demand for specialty polymers and high quality plastics in automotive, packaging, and construction sectors. Manufacturers focused on high performance catalysts to enhance polymer properties and comply with EU environmental regulations. In the forecast period 2025 to 2035, growth is expected to continue with technological advancements such as metallocene and multifunctional catalysts that improve polymer characteristics and process efficiency. Demand for sustainable and recyclable polymers is rising, influencing catalyst selection. Germany market growth reflects high quality standards, industrial innovation, and environmental regulatory compliance.

Polyolefin catalyst market in the United Kingdom is growing at a CAGR of 4.6%. Between 2020 and 2024, growth was supported by demand from packaging, automotive, and consumer goods industries. Manufacturers focused on reliable and consistent catalyst performance to support polymer production. Investment in chemical production infrastructure and research enabled market expansion. Forecast period 2025 to 2035 is expected to see gradual growth driven by adoption of advanced catalysts that improve polymer uniformity and sustainability. Rising use of recyclable and lightweight polymers will support catalyst demand. Government regulations and environmental compliance initiatives will influence future adoption. The United Kingdom market reflects moderate growth with emphasis on efficiency and sustainable production practices.

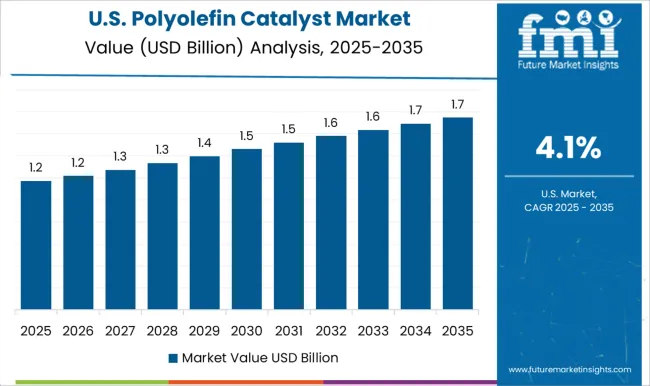

Polyolefin catalyst market in the United States is growing at a CAGR of 4.1%. Historical period 2020 to 2024 saw growth driven by demand for polyethylene and polypropylene in packaging, automotive, and construction industries. Manufacturers focused on process efficiency and catalyst performance to reduce costs and improve polymer quality. In the forecast period 2025 to 2035, market growth is expected to continue moderately with increasing adoption of metallocene and single site catalysts. Rising interest in lightweight, high strength, and recyclable polymers will support future catalyst demand. Regulatory compliance, environmental standards, and innovation in catalyst technology will remain key factors. The United States market demonstrates steady adoption with focus on performance, efficiency, and sustainability.

The polyolefin catalyst market is supplied by W.R. Grace, Univation Technologies, LLC, LyondellBasell Industries N.V., Sud-Chemie India Pvt., Ltd, Johnson Matthey Inc., China Petroleum Corporation (Sinopec Group), TOHO Titanium Company Limited, PQ Corporation, Idemitsu Kosan Co., Ltd., INEOS Group, Mitsui Chemicals, Inc., Clariant AG, Evonik Industries, DuPont, Inc., DORF-KETAL Chemicals India Private Limited, AGC Chemicals Inc., and NOVA Chemicals Corporation, with competition centered on catalyst efficiency, polymer selectivity, and thermal stability. W.R. Grace and Johnson Matthey brochures emphasize Ziegler-Natta and metallocene catalyst performance, specifying activity levels, polymerization temperature ranges, and co-catalyst compatibility.

LyondellBasell and Univation provide datasheets detailing density and molecular weight control in polyethylene and polypropylene production. Sud-Chemie and PQ Corporation focus on specialty catalysts for high-performance polyolefins, with technical sheets including surface area, particle morphology, and activity retention. Observed industry patterns indicate growing demand for catalysts that optimize productivity while reducing energy consumption and waste in polyolefin manufacturing.

Market strategies revolve around differentiation through customized formulations, global supply integration, and technical support. W.R. Grace and Evonik invest in catalysts with enhanced stereoregularity and narrow molecular weight distribution to improve polymer properties. LyondellBasell and Univation support OEMs with tailored solutions for extrusion, injection molding, and film applications. Johnson Matthey, Clariant, and TOHO Titanium prioritize catalyst stability under extreme polymerization conditions.

Observed trends suggest increased emphasis on environmentally safer catalysts, lower residues, and improved handling safety. NOVA Chemicals and Mitsui Chemicals focus on collaborative development with polymer producers to scale advanced catalysts for high-throughput production. Product brochures and datasheets provide detailed specifications including active metal content, particle size distribution, co-catalyst requirements, thermal stability, and handling precautions. DuPont and W.R. Grace include performance curves for polymer yield, molecular weight control, and melt flow index.

Evonik and Clariant detail process compatibility, storage conditions, and shelf life. Sinopec and DORF-KETAL highlight industrial-scale application parameters and quality assurance data. Clear technical documentation allows chemical engineers, polymer producers, and process designers to evaluate catalyst suitability, ensuring adoption based on verified activity, stability, and process compatibility across polyethylene, polypropylene, and specialty polyolefin production.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 billion |

| Classification | Polypropylene, LLDPE, and HDPE |

| Catalyst | Ziegler Natta, Single-site Catalyst, and Chromium |

| Application | Injection molding, Blow molding, Film, Fiber, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | W.R. Grace, Univation Technologies, LLC, LyondellBasell Industries N.V., Sud-Chemie India Pvt., Ltd, Johnson Matthey Inc., China Petroleum Corporation (Sinopec Group), TOHO Titanium Company Limited, PQ corporation, Idemitsu Kosan Co., Ltd., INEOS Group, Mitsui Chemicals, Inc, Clariant AG, Evonik Industries, DuPont, Inc., DORF-KETAL Chemicals India Private Limited, AGC Chemicals Inc., and NOVA Chemicals Corporation |

| Additional Attributes | Dollar sales vary by catalyst type, including Ziegler-Natta, metallocene, and chromium-based catalysts; by application, such as polyethylene, polypropylene, and specialty polyolefins; by end-use industry, spanning packaging, automotive, construction, and consumer goods; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising polyolefin demand, innovations in catalyst efficiency, and expanding end-use industries. |

The global polyolefin catalyst market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the polyolefin catalyst market is projected to reach USD 4.7 billion by 2035.

The polyolefin catalyst market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in polyolefin catalyst market are polypropylene, lldpe and hdpe.

In terms of catalyst, ziegler natta segment to command 46.5% share in the polyolefin catalyst market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Powder Market

Polyolefin Resin Paints Market

Polyolefin Films Market

Catalyst Bins Market Insights – Growth & Forecast 2025 to 2035

Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Chemical Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Refinery Catalyst Market Growth - Trends & Forecast 2025 to 2035

UK Refinery Catalyst Market Insights – Growth, Applications & Outlook 2025-2035

Polyurethane Catalyst Market Size and Share Forecast Outlook 2025 to 2035

USA Refinery Catalyst Market Report - Trends & Innovations 2025 to 2035

BDO Synthesis Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Japan Refinery Catalyst Market Report – Trends, Demand & Industry Forecast 2025-2035

ASEAN Refinery Catalyst Market Analysis

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Emission Control Catalyst for Small Engines Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA