The biocatalyst market is estimated to be valued at USD 626.4 million in 2025 and is projected to reach USD 1164.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

Between 2020 and 2024, the market expanded from USD 459.3 million to 588.7 million, representing the early adoption phase. During this period, growth was driven by targeted applications in pharmaceuticals, food processing, and specialty chemicals. Early adopters, including niche manufacturers and research-focused enterprises, tested performance, reliability, and integration within existing processes. Incremental adoption allowed companies to refine sourcing, production, and distribution strategies. This stage laid the groundwork for broader market acceptance, providing the confidence and operational experience necessary for the next phase of growth. From 2025 to 2030, the market enters the scaling phase, increasing from USD 626.4 million to approximately 802.8 million.

Adoption broadens as demand rises across industrial and commercial applications, supported by established supply chains and wider availability. By 2030, with the market surpassing USD 802.8 million, the industry begins transitioning to consolidation. From 2030 to 2035, growth continues steadily to USD 1,164.8 million, as leading manufacturers consolidate market share, standardize production practices, and stabilize operations. This phase reflects a mature market with predictable demand, optimized production, and steady expansion across core segments.

| Metric | Value |

|---|---|

| Biocatalyst Market Estimated Value in (2025 E) | USD 626.4 million |

| Biocatalyst Market Forecast Value in (2035 F) | USD 1164.8 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The biocatalyst market is showing consistent growth, supported by rising demand for sustainable and environmentally friendly production methods across industrial sectors. The growing shift away from chemical synthesis toward biologically-driven processes has enhanced the appeal of biocatalysts, particularly in sectors prioritizing green chemistry.

Regulatory support for cleaner manufacturing methods, coupled with advancements in enzyme engineering and process optimization, has created strong momentum for market expansion. Industries such as pharmaceuticals, food processing, and biofuels are increasingly integrating biocatalysts to reduce process times, lower energy consumption, and improve selectivity.

In addition, the increasing focus on cost efficiency and waste minimization is further strengthening the market’s foundation As global sustainability goals become more embedded in industrial policies and corporate strategies, biocatalysts are expected to serve as a critical enabler of low-impact production technologies, offering long-term growth potential across diverse application areas.

The biocatalyst market is segmented by sources, type, application, and geographic regions. By source, the market is divided into microorganisms, plants, and animals. In terms of type, the market is classified into hydrolases, oxidoreductases, transferases, and others. Based on application, the market is segmented into food and beverage industry, cleaning agents, biofuel production, agriculture and feed, biopharmaceuticals, and others. Regionally, the biocatalyst industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microorganisms segment is expected to hold 64.2% of the total market revenue in 2025, making it the dominant source category. This leading position is being attributed to the high availability, adaptability, and scalability of microorganisms in industrial biocatalytic processes. Microorganisms offer a broad enzymatic repertoire, allowing the conversion of complex substrates into value-added products under mild conditions.

Their ability to be cultivated in large volumes with relatively low-cost substrates supports their use in commercial-scale operations. Moreover, advances in microbial fermentation and genetic modification have enabled enhanced enzyme yields and specific activity, further boosting their industrial relevance.

The use of microorganisms also aligns with eco-friendly production strategies, as they contribute to reduced chemical waste and energy input As industries continue to seek reliable and efficient alternatives to synthetic catalysts, the microorganism-based segment is expected to retain its leadership due to its operational flexibility and proven industrial performance.

The hydrolases segment is projected to account for 45.7% of the market revenue in 2025, positioning it as the leading type of biocatalyst. This prominence is being driven by the widespread applicability of hydrolases in hydrolysis-based reactions that are essential in the manufacture of food ingredients, pharmaceuticals, and personal care products.

Hydrolases are valued for their ability to function under ambient conditions while delivering high specificity, which reduces the need for downstream purification. The segment’s growth has also been supported by technological advancements in enzyme stabilization and immobilization, which have improved process efficiency and shelf life.

In industrial settings, hydrolases are preferred for their consistent performance, ease of integration into existing workflows, and ability to catalyze reactions in both aqueous and non-aqueous media Their continued dominance is expected to be reinforced by increasing demand for biodegradable and non-toxic process alternatives across regulated industries.

The food and beverage industry segment is anticipated to contribute 31.6% to the overall market revenue in 2025, emerging as the most significant application area. This leadership is being influenced by the growing adoption of enzymatic processes in food manufacturing, where biocatalysts are used to enhance texture, flavor, nutritional value, and shelf life. Biocatalysts are particularly favored for their ability to facilitate clean-label production, a trend gaining traction among health-conscious consumers.

The rising demand for specialty ingredients and functional foods has further propelled the use of biocatalysts, especially in dairy, baking, and beverage segments. In addition, the regulatory preference for natural processing aids has supported the use of enzyme-based solutions over synthetic additives.

The ability to customize reactions based on substrate specificity and desired product profiles makes biocatalysts highly suitable for food industry innovation As manufacturers seek to meet evolving consumer expectations while improving production efficiency, the food and beverage industry is expected to remain a primary driver of market growth.

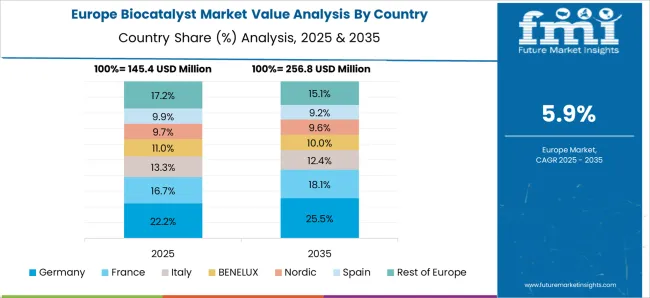

The biocatalyst market is witnessing robust growth, driven by demand for sustainable, enzyme-based solutions across pharmaceuticals, food & beverages, biofuels, and industrial chemicals. Biocatalysts, including enzymes and whole-cell catalysts, enhance reaction efficiency, reduce energy consumption, and support eco-friendly manufacturing. North America and Europe lead due to advanced biotech industries and regulatory support, while Asia-Pacific shows strong growth fueled by expanding industrial and pharmaceutical sectors. Market expansion focuses on novel enzyme development, immobilization techniques, and high-throughput screening for optimized performance. Companies differentiate through enhanced specificity, stability, and compatibility with diverse industrial processes, catering to increasing adoption in green chemistry and bioprocessing applications.

Consistency in biocatalyst performance remains a key challenge. Variability in microbial strains, enzyme purity, and production processes affects activity, stability, and substrate specificity. Lack of standardized protocols for enzyme characterization and activity measurement can lead to batch-to-batch inconsistencies, impacting industrial and pharmaceutical applications. Manufacturers supplying high-value sectors require traceable production processes, validated assay results, and adherence to regulatory standards such as GRAS, ISO, or pharmacopeial guidelines. Until harmonized quality benchmarks and standardized enzyme metrics are widely adopted, maintaining consistent efficacy, regulatory compliance, and customer trust remains challenging.

Technological advancements are enhancing biocatalyst efficiency, stability, and versatility. Innovations include enzyme immobilization, protein engineering, directed evolution, and high-throughput screening to improve catalytic activity and operational stability under extreme conditions. Biocatalysts are increasingly tailored for specific substrates in pharmaceuticals, biofuels, and specialty chemicals. Integration with continuous flow reactors and green chemistry approaches supports scalable, energy-efficient, and sustainable processes. Companies collaborating with research institutions develop novel enzymes and formulations, enabling differentiation and premium solutions. These innovations drive adoption in industrial biotechnology, offering cost-effective, environmentally friendly alternatives to traditional chemical catalysts.

Biocatalysts face regulatory oversight due to safety, environmental, and food/pharmaceutical compliance requirements. Food and feed applications must adhere to GRAS, EFSA, or FAMI-QS guidelines, while pharmaceutical enzymes require GMP compliance and pharmacopeial validation. Industrial applications may be subject to chemical safety and environmental regulations. Non-compliance can restrict market access or result in penalties. Suppliers aligning products with recognized certifications and regulatory standards strengthen market credibility. Until international harmonization of enzyme regulations improves, companies must navigate diverse regional compliance frameworks to ensure safe, legal, and effective adoption.

The biocatalyst market is competitive, with global enzyme producers and regional biotechnology firms vying for market share. Raw material sourcing, strain development, fermentation capacity, and downstream processing impact production scalability and costs. Supply chain disruptions, fluctuations in raw microbial cultures, and production lead times can affect product availability. Companies investing in vertical integration, proprietary strains, or geographically diversified production facilities gain reliability and cost advantages. Competitive differentiation increasingly focuses on enzyme specificity, stability, eco-friendly production, and multi-industry applications. Until production scalability and raw material stability improve, competition and supply chain constraints will remain key factors shaping market growth and adoption.

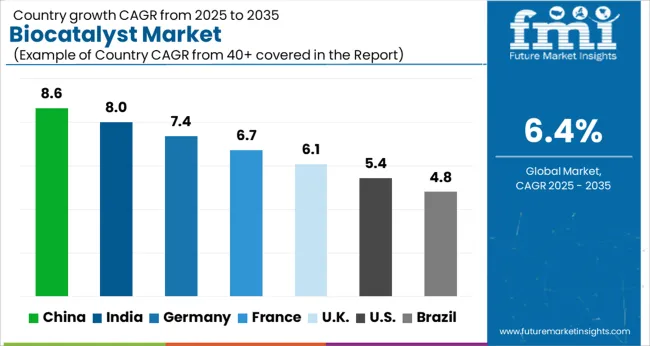

The global Biocatalyst Market is expected to grow at a CAGR of 6.4% through 2035, supported by increasing applications across pharmaceuticals, food processing, and chemical synthesis. Among BRICS nations, China has been recorded with 8.6% growth, driven by large-scale production and industrial adoption in chemical and pharmaceutical sectors, while India has been observed at 8.0%, supported by rising utilization in enzyme-driven processes and manufacturing. In the OECD region, Germany has been measured at 7.4%, where production for pharmaceutical and chemical applications has been steadily maintained. The United Kingdom has been noted at 6.1%, reflecting consistent adoption in industrial and research processes, while the USA has been recorded at 5.4%, with production and deployment in pharmaceuticals, chemicals, and specialty applications being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The biocatalyst market in China is growing at a CAGR of 8.6%, driven by the increasing adoption of sustainable industrial processes and the rising demand for bio-based products. Biocatalysts, including enzymes and microbial catalysts, play a crucial role in improving reaction efficiency, reducing energy consumption, and minimizing environmental impact. The pharmaceutical, food and beverage, and chemical industries are increasingly utilizing biocatalysts for cost-effective and eco-friendly production. Investments in biotechnology research, government incentives for green manufacturing, and the rapid expansion of industrial biotechnology facilities support market growth. Additionally, advancements in enzyme engineering and high-throughput screening techniques are enhancing biocatalyst performance, enabling broader applications. With China’s focus on sustainable industrial development and environmental protection, the biocatalyst market is expected to expand steadily over the forecast period.

The biocatalyst market in India is expanding at a CAGR of 8.0%, supported by the growth of pharmaceutical, food processing, and chemical industries. Biocatalysts enhance reaction selectivity, reduce waste, and improve energy efficiency, making them a preferred choice for green manufacturing processes. India’s biotechnology sector, supported by government initiatives like “Make in India” and “Biotech Startup Policy,” drives adoption of innovative biocatalyst solutions. Increasing R&D activities in enzyme development and microbial catalysis are enabling efficient and cost-effective production methods. Growing awareness of environmentally friendly industrial practices, coupled with rising demand for bio-based products, further accelerates market growth. The Indian biocatalyst market is poised for steady expansion as industries continue to prioritize sustainable, high-efficiency manufacturing solutions.

The biocatalyst market in Germany is growing at a CAGR of 7.4%, driven by industrial applications in pharmaceuticals, chemicals, and food and beverage production. Germany’s strong focus on sustainable manufacturing, energy efficiency, and reducing industrial waste supports biocatalyst adoption. Advanced enzyme technologies and microbial catalysts are increasingly used to optimize reaction efficiency and improve product quality. Regulatory frameworks encouraging green chemistry and environmental sustainability further reinforce market growth. Industrial biotechnology clusters and research centers in Germany promote innovation, enabling the development of high-performance biocatalysts. With increasing emphasis on eco-friendly industrial processes and the rising demand for bio-based products, the biocatalyst market in Germany is expected to grow steadily during the forecast period.

The biocatalyst market in the United Kingdom is expanding at a CAGR of 6.1%, driven by growing industrial applications in pharmaceuticals, food processing, and specialty chemicals. Biocatalysts are increasingly adopted for eco-friendly manufacturing, enhanced reaction efficiency, and cost reduction. The UK’s focus on sustainable industrial processes, research in enzyme technologies, and biotech innovation supports market growth. Government initiatives promoting green manufacturing, combined with rising consumer demand for bio-based products, further accelerate adoption. Biotechnology clusters, universities, and research centers contribute to the development of high-performance biocatalysts. As industries continue to focus on reducing environmental impact and improving production efficiency, the biocatalyst market in the United Kingdom is projected to grow steadily during the forecast period.

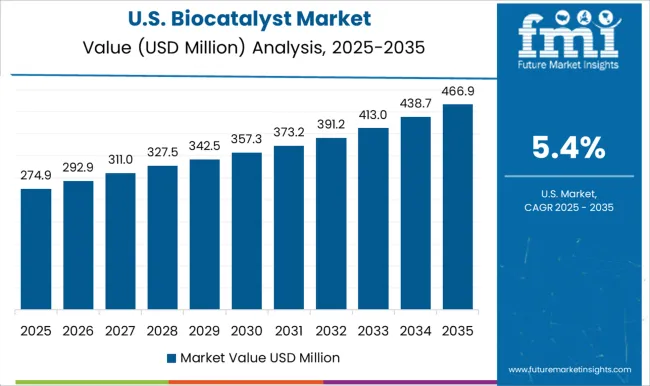

The biocatalyst market in the United States is growing at a CAGR of 5.4%, driven by the pharmaceutical, chemical, and food industries. Biocatalysts, including enzymes and microbial catalysts, improve reaction efficiency, reduce energy consumption, and enable environmentally friendly manufacturing. The USA biotechnology sector, supported by extensive research and development activities, drives innovation in enzyme engineering and microbial catalysis. Increasing demand for bio-based products, coupled with regulatory frameworks favoring sustainable processes, supports market growth. Industrial adoption of biocatalysts is rising due to cost efficiency, high selectivity, and eco-friendly production advantages. With continuous technological advancements and growing emphasis on sustainable industrial practices, the biocatalyst market in the United States is expected to experience steady growth throughout the forecast period.

The biocatalyst market plays a crucial role in modern biotechnology, enabling environmentally friendly, efficient, and sustainable chemical processes across industries such as pharmaceuticals, food and beverages, biofuels, and specialty chemicals. Biocatalysts, including enzymes and microbial catalysts, accelerate biochemical reactions with high specificity and selectivity, reducing energy consumption, waste generation, and the need for harsh chemicals. Novozymes is a global leader in the biocatalyst market, offering a diverse portfolio of industrial enzymes and microbial solutions for applications ranging from bioenergy to food processing. BASF SE leverages its chemical expertise to develop biocatalysts that enhance industrial processes while promoting sustainability and efficiency. DuPont focuses on enzymes and biotechnological solutions for the food, beverage, and pharmaceutical sectors, emphasizing innovation and process optimization.

Codexis, Inc. specializes in protein engineering to develop high-performance enzymes for pharmaceutical synthesis, biofuel production, and fine chemicals. Biocatalysts Limited offers custom enzyme solutions and biotransformation services for industrial applications. AB Enzymes provides a wide array of enzyme products for food, feed, textiles, and bioenergy, supporting global sustainability goals. Additional notable companies include Prozomix Limited, Royal DSM, Lonza, and Amano Enzyme Inc., all of which contribute to the advancement of biocatalysis through research, tailored enzyme solutions, and industrial-scale applications. With growing demand for green chemistry, renewable fuels, and sustainable manufacturing, these leading biocatalyst suppliers and manufacturers are positioned to drive innovation and meet the evolving needs of industrial biotechnology worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 626.4 Million |

| Sources | Microorganisms, Plants, and Animals |

| Type | Hydrolases, Oxidoreductases, Transferases, and Others |

| Application | Food and Beverage Industry, Cleaning Agents, Biofuel Production, Agriculture and Feed, Biopharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novozymes, BASF SE, DuPont, Codexis, Inc., Biocatalysts Limited, AB Enzymes, Prozomix Limited, Royal DSM, Lonza, and Amano Enzyme Inc. |

| Additional Attributes | Dollar sales by type including enzymes, whole cells, and immobilized biocatalysts, application across pharmaceuticals, food and beverages, biofuels, and chemical synthesis, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable and efficient bioprocesses, increasing pharmaceutical production, and advancements in enzyme engineering technologies. |

The global biocatalyst market is estimated to be valued at USD 626.4 million in 2025.

The market size for the biocatalyst market is projected to reach USD 1,164.8 million by 2035.

The biocatalyst market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in biocatalyst market are microorganisms, plants and animals.

In terms of type, hydrolases segment to command 45.7% share in the biocatalyst market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA