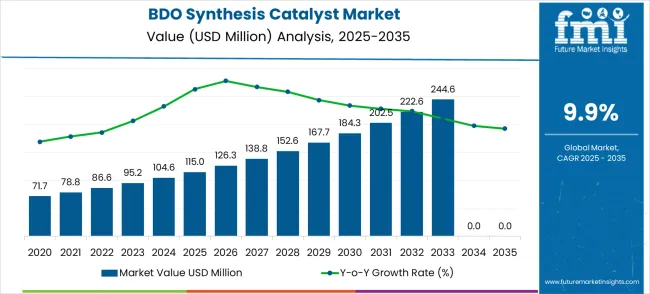

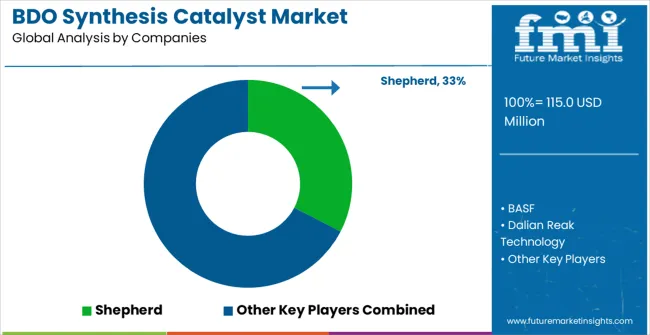

The BDO synthesis catalyst market is valued at USD 115.0 million in 2025 and is forecasted to reach USD 295.5 million by 2035, registering a robust CAGR of 9.9%. The decade-long forecast reflects a healthy and sustained expansion driven by increasing global demand for 1,4-butanediol in applications such as solvents, polymers, and plastics. The YoY growth trajectory begins strongly, with a rise to USD 126.3 million in 2026, representing a growth rate of 9.9%, and continues with steady annual increments, indicating stable market dynamics. This performance underlines that the market is positioned for consistent growth rather than erratic fluctuations, reflecting strong underlying demand and technological adoption.

Analyzing best and worst years reveals that the highest absolute gains occur in later years of the forecast. For instance, growth between 2034 and 2035 amounts to USD 26.6 million, the largest single-year increment, reflecting cumulative compounding benefits and expanded adoption of BDO synthesis catalysts. The lowest absolute growth is observed in the early phase, between 2025 and 2026, at USD 11.3 million, which is consistent with the market’s early development stage. This trend shows gradual acceleration over time rather than abrupt spikes, pointing to a stable long-term growth structure rather than volatile surges. Between 2025 and 2030, the BDO synthesis catalyst market is projected to expand from USD 115.0 million to USD 184.7 million, resulting in a value increase of USD 69.7 million, which represents 38.6% of the total forecast growth for the decade.

This phase of growth will be shaped by rising demand for sustainable chemical production processes, increasing adoption of advanced catalyst technologies, and growing penetration of BDO synthesis catalysts in emerging chemical manufacturing markets. Chemical companies are expanding their catalyst portfolios to address the growing demand for efficient and environmentally friendly BDO production solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 115.0 million |

| Forecast Value in (2035F) | USD 295.5 million |

| Forecast CAGR (2025 to 2035) | 9.9% |

Segment comparison indicates that growth is driven largely by applications in polyurethane production and biodegradable plastics. The polyurethane segment benefits from rising demand in flexible foams, coatings, and adhesives, while biodegradable plastics adoption grows in response to regulatory pressures and environmental awareness. Although specific sub-segment figures are not disclosed, the even growth rates imply balanced expansion across applications rather than dominance by a single category. This balanced growth ensures that no single sub-segment dominates market performance, contributing to overall resilience.

From a regional perspective, Asia-Pacific is likely to register the highest growth rates due to large-scale industrial production and policy incentives for green manufacturing. Europe and North America are expected to follow with steady growth driven by stringent environmental regulations and advanced manufacturing technologies. Year-on-year trends across regions mirror the global CAGR of 9.9%, with no substantial volatility, indicating uniform adoption patterns.

By 2035, the market will have more than doubled in value, reflecting both the expansion of existing applications and the emergence of innovative uses across industries. From 2030 to 2035, the market is forecast to grow from USD 184.7 million to USD 295.5 million, adding another USD 110.8 million, which constitutes 61.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized chemical production facilities, the integration of green chemistry principles with catalyst development, and the advancement of next-generation catalyst formulations. The growing adoption of circular economy approaches and chemical industry sustainability initiatives will drive demand for highly efficient BDO synthesis catalysts with enhanced selectivity and environmental performance profiles.

Between 2020 and 2025, the BDO synthesis catalyst market experienced steady growth, driven by the increasing recognition of the importance of catalyst efficiency in chemical manufacturing and the growing acceptance of advanced synthesis approaches. The market developed as chemical producers recognized the need for optimized catalyst solutions to achieve better yields and process economics in BDO production. Industrial research and process optimization have begun to emphasize the importance of catalyst technologies in achieving sustainable and cost-effective chemical synthesis operations.

Market expansion is being supported by the increasing demand for 1,4-butanediol in various industrial applications and the corresponding need for more efficient synthesis processes. Modern chemical manufacturers are increasingly focused on catalyst technologies that can improve reaction selectivity, enhance product yields, and reduce energy consumption in BDO production. The proven effectiveness of specific catalyst formulations in optimizing reaction conditions and minimizing by-product formation makes them essential components of competitive chemical manufacturing operations.

The growing emphasis on sustainable chemistry and green manufacturing processes is driving demand for advanced catalyst systems that address environmental regulations and process efficiency requirements. Chemical industry preference for catalyst technologies that combine high activity with extended operational lifetime is creating opportunities for innovative catalyst development. The rising influence of process optimization and cost reduction strategies is also contributing to increased adoption of proven BDO synthesis catalysts across different production scales and manufacturing environments.

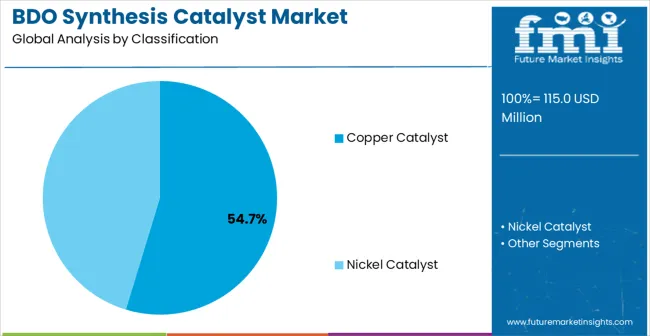

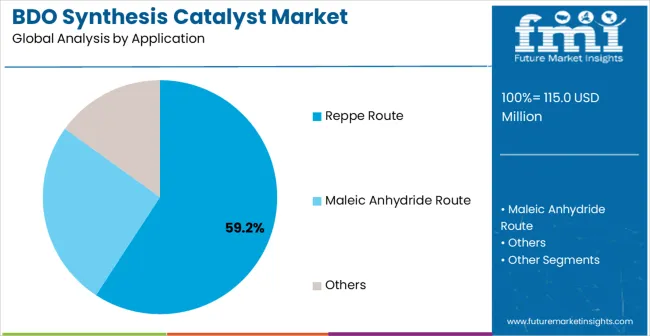

The market is segmented by classification, application, and region. By classification, the market is divided into copper catalyst, nickel catalyst, and others. Based on application, the market is categorized into Reppe route and maleic anhydride route. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The copper catalyst segment is projected to account for 54.7% of the BDO synthesis catalyst market in 2025, reaffirming its position as the category's dominant classification. Chemical process engineers increasingly recognize the superior catalytic properties of copper-based formulations for BDO synthesis applications, particularly their ability to provide high selectivity and stable performance under industrial operating conditions. This catalyst type addresses both activity requirements and operational stability needs, providing comprehensive process optimization coverage.

This classification forms the foundation of most industrial BDO production processes, as it represents the most widely validated and commercially proven catalyst approach in modern chemical manufacturing. Technical certifications and extensive performance testing continue to strengthen confidence in copper catalyst formulations. With increasing recognition of the importance of process efficiency requiring reliable catalyst systems, copper catalysts align with both current production requirements and future process optimization goals. Their broad applicability across multiple synthesis conditions ensures sustained market dominance, making them the central growth driver of BDO synthesis catalyst demand.

Reppe route applications are projected to represent 59.2% of BDO synthesis catalyst demand in 2025, underscoring their role as the primary synthesis pathway driving catalyst adoption. Chemical manufacturing professionals recognize that Reppe route processes require specialized catalyst systems that can effectively facilitate the complex multi-step synthesis reactions involved in BDO production. BDO synthesis catalysts offer optimal performance characteristics for acetylene-based synthesis and formaldehyde conversion processes.

The segment is supported by the established industrial preference for Reppe route technology requiring proven catalyst systems and the growing recognition that this pathway provides superior process economics for large-scale BDO production. Additionally, chemical manufacturers are increasingly adopting integrated process designs that leverage Reppe route advantages for optimal production efficiency. As BDO production capacity continues to expand toward higher throughput and improved cost-effectiveness, catalyst systems optimized for Reppe route applications will continue to play a crucial role in competitive manufacturing strategies, reinforcing their essential position within the chemical synthesis market.

The BDO synthesis catalyst market is advancing steadily due to increasing demand for efficient chemical synthesis processes and growing adoption of advanced catalyst technologies. However T, the market faces challenges including high catalyst development costs, complex synthesis reaction requirements, and concerns about catalyst deactivation and regeneration. Innovation in catalyst formulation and process optimization technologies continue to influence product development and market expansion patterns.

The growing adoption of sustainable green chemical manufacturing practices is enabling more sophisticated catalyst system requirements and process optimization. Green chemistry principles require comprehensive catalyst performance, including high selectivity, minimal waste generation, and extended operational lifetime, that advanced BDO synthesis catalysts can provide effectively. Sustainability initiatives create demand for catalyst technologies that can reduce environmental impact while maintaining industrial productivity.

Modern chemical manufacturing companies are incorporating process intensification technologies such as microreactor systems, continuous flow processing, and advanced heat management to enhance BDO synthesis catalyst performance. These technologies improve reaction efficiency, enable better process control, and provide enhanced catalyst utilization and longevity. Advanced process monitoring also enables optimized catalyst management and early identification of potential deactivation or performance degradation issues.

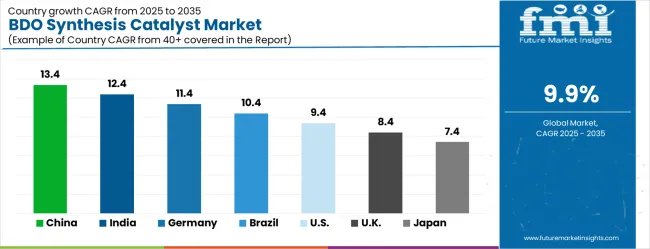

| Country | CAGR (2025-2035) |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| Brazil | 10.4% |

| USA | 9.4% |

| UK | 8.4% |

| Japan | 7.4% |

The BDO synthesis catalyst market is experiencing varied growth globally, with China leading at a 13.4% CAGR through 2035, driven by expanding chemical manufacturing capacity, increasing BDO production requirements, and growing investment in advanced catalyst technologies. India follows at 12.4%, supported by chemical industry expansion, increasing petrochemical sector development, and expanding catalyst manufacturing capabilities. Germany shows growth at 11.4%, emphasizing advanced chemical process technologies and sustainable green manufacturing practices. Brazil records 10.4% growth, focusing on improved chemical production infrastructure and catalyst technology adoption. The USA shows 9.4% growth, representing a mature market with established catalyst technologies and ongoing process optimization initiatives.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is projected to grow at a CAGR of 13.4% from 2025 to 2035, driven by rising industrial chemical production and the growing demand for bio-based chemicals. BDO synthesis catalysts are widely adopted in the manufacturing of tetrahydrofuran, polybutylene terephthalate, and other intermediates for polymers. Domestic manufacturers are investing in high-efficiency catalyst development, process optimization, and cost-effective manufacturing methods. Growth is supported by China’s expanding polymer production industry, rising automotive demand, and increased consumption of consumer goods requiring high-performance materials. Strategic partnerships between catalyst producers and chemical manufacturers are enabling advanced production capabilities. Export demand for BDO derivatives and catalysts is also accelerating growth. Increasing R&D investment ensures continued innovation and stronger competitive positioning of China in the global catalyst market.

India is expected to expand at a CAGR of 12.4% between 2025 and 2035, driven by growth in polymer production, automotive manufacturing, and chemical processing industries. BDO synthesis catalysts are used extensively in producing solvents, polyurethanes, and performance plastics. Domestic manufacturers are investing in catalyst innovation, high-efficiency process integration, and cost optimization to strengthen competitiveness. Rising demand from packaging, automotive, and electronics industries is driving market growth. Government initiatives to boost chemical manufacturing and reduce import dependence also support expansion. Collaborations with international catalyst producers are enabling technology transfer, ensuring higher catalyst efficiency. Adoption of next-generation catalysts is transforming BDO production, leading to lower energy consumption and improved product quality.

Germany is projected to grow at a CAGR of 11.4% through 2035, driven by its strong chemical manufacturing base and high demand for engineering plastics and high-performance polymers. BDO synthesis catalysts are critical in producing polybutylene terephthalate and other intermediates for automotive, electronics, and industrial applications. German manufacturers focus on high-purity catalysts, efficient process control, and environmentally friendly production methods. Strong demand from the automotive sector and precision engineering industries supports adoption. Strategic collaborations between catalyst producers and chemical manufacturers enhance innovation and optimize production processes. EU regulations further encourage investment in advanced catalyst technologies, reinforcing Germany’s leadership in high-performance chemical manufacturing.

Brazil is expected to grow at a CAGR of 10.4% from 2025 to 2035, supported by demand from the polymer, automotive, and chemical manufacturing industries. BDO synthesis catalysts are widely used for producing high-quality polymers, solvents, and engineering plastics. Local manufacturers focus on cost-effective catalyst solutions while importing advanced catalysts for high-value applications. Growth is driven by expanding automotive manufacturing, increasing polymer demand for packaging, and government initiatives supporting chemical production. Collaborations with global catalyst suppliers enhance access to innovative products and advanced manufacturing techniques. Rising exports of polymer-based products and growth in automotive components further strengthen catalyst consumption, supporting long-term growth in Brazil’s BDO synthesis catalyst market.

The United States is projected to grow at a CAGR of 9.4% during 2025–2035, driven by demand from polymer manufacturing, automotive, and chemical processing industries. BDO synthesis catalysts are critical for producing engineering plastics, high-performance materials, and solvents. Leading manufacturers focus on high-efficiency catalysts, green manufacturing processes, and automation integration. Growth is supported by expansion in packaging materials, automotive components, and electronics manufacturing. Collaborations with global catalyst suppliers enhance innovation and cost efficiency. Increased regulatory pressure to adopt eco-friendly catalysts further strengthens market adoption. Demand is reinforced by a growing focus on performance polymers in aerospace, automotive, and electronics applications, supporting growth for catalysts in BDO synthesis processes.

The United Kingdom is expected to grow at a CAGR of 8.4% between 2025 and 2035, driven by demand from chemical manufacturing, packaging, and engineering plastics industries. BDO synthesis catalysts are used extensively for producing high-quality polymers, solvents, and elastomers. UK manufacturers focus on catalyst efficiency, process innovation, and cost reduction to strengthen competitiveness. Growth is supported by expansion in packaging and automotive sectors, along with stricter regulatory requirements for production quality and environmental compliance. Collaborations with international catalyst suppliers provide access to advanced materials and production techniques. Increasing exports of polymer-based products and adoption of high-performance catalysts strengthen the UK market outlook.

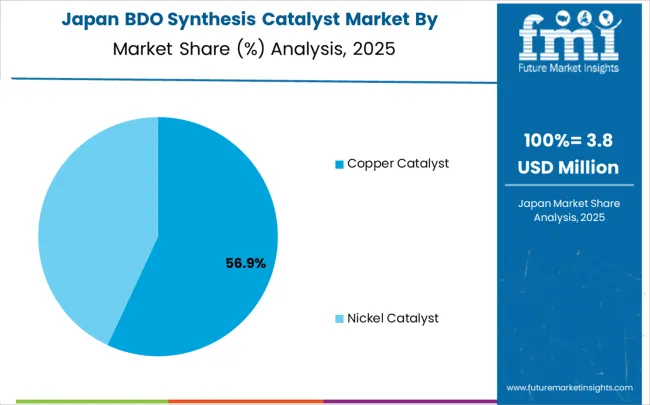

Japan is projected to grow at a CAGR of 7.4% from 2025 to 2035, influenced by demand from automotive manufacturing, electronics, and high-performance polymer production. BDO synthesis catalysts are critical in producing tetrahydrofuran, polybutylene terephthalate, and other intermediates for high-value applications. Japanese manufacturers focus on high-purity catalyst production, energy-efficient processes, and advanced coating technologies. Growth is reinforced by strong automotive component manufacturing, rising demand for electronics-grade polymers, and strict quality standards. Collaborations with global catalyst technology firms enable innovation and knowledge sharing. Demand is also driven by exports of high-performance polymers, supporting catalyst adoption across multiple industries in Japan.

Revenue from BDO synthesis catalysts in China is projected to exhibit robust growth with a CAGR of 13.4% through 2035, driven by massive chemical industry expansion and increasing domestic demand for BDO in various industrial applications. The country's growing petrochemical infrastructure and increasing investment in advanced catalyst technologies are creating significant opportunities for BDO synthesis catalyst adoption. Major international and domestic catalyst manufacturers are establishing comprehensive supply networks to serve the growing demand for efficient chemical synthesis solutions across industrial and specialty chemical production facilities.

Government initiatives supporting chemical industry modernization and sustainable manufacturing practices are driving demand for advanced catalyst technologies throughout major industrial regions and chemical production centers.

Chemical manufacturing expansion programs and process optimization initiatives are supporting increased utilization of BDO synthesis catalysts among large-scale producers and specialty chemical manufacturers nationwide.

Revenue from BDO synthesis catalysts in India is expanding at a CAGR of 12.4%, supported by increasing petrochemical sector development, growing chemical manufacturing capacity, and expanding industrial catalyst market presence. The country's large chemical industry and increasing adoption of advanced synthesis technologies are driving demand for effective BDO synthesis catalyst solutions. International catalyst companies and domestic chemical manufacturers are establishing distribution channels to serve the growing demand for reliable catalyst technologies.

Rising adoption of modern chemical manufacturing processes and catalyst optimization strategies are creating opportunities for BDO synthesis catalysts across industrial and specialty chemical production facilities.

Growing chemical infrastructure development and technology transfer initiatives are supporting increased access to advanced catalyst systems among manufacturers requiring efficient BDO production capabilities.

Demand for BDO synthesis catalysts in the USA is projected to grow at a CAGR of 9.4%, supported by well-established chemical manufacturing infrastructure and comprehensive process optimization requirements. American chemical producers consistently utilize advanced catalyst systems for efficient BDO production and process economics optimization. The market is characterized by mature catalyst technologies, comprehensive technical support systems, and established relationships between chemical manufacturers and catalyst suppliers.

Process optimization standards and chemical industry best practices are supporting continued utilization of proven catalyst technologies throughout industrial manufacturing facilities.

Chemical industry research and development initiatives are facilitating access to advanced catalyst systems while ensuring optimal performance and cost management.

Revenue from BDO synthesis catalysts in Brazil is projected to grow at a CAGR of 10.4% through 2035, driven by chemical industry expansion, increasing petrochemical production capacity, and growing recognition of catalyst technology importance. Brazilian chemical manufacturers are increasingly adopting advanced catalyst system approaches for competitive BDO production, supported by expanding industrial infrastructure and improved technical expertise availability.

Chemical industry development programs and manufacturing modernization initiatives are supporting increased availability of catalyst technologies across diverse production environments.

Growing collaboration between international catalyst companies and local chemical manufacturers is enhancing catalyst options and technical expertise in BDO synthesis catalyst management.

Revenue from BDO synthesis catalysts in Germany is projected to grow at a CAGR of 11.4% through 2035, supported by established chemical industry excellence, advanced process technology requirements, and comprehensive sustainable manufacturing frameworks. German chemical companies consistently utilize cutting-edge catalyst systems as part of integrated process optimization approaches, emphasizing efficiency enhancement and environmental performance.

Chemical industry innovation initiatives and sustainable manufacturing programs are maintaining strong growth across industrial and specialty chemical production facilities.

Engineering excellence standards and advanced catalyst research are supporting continued innovation and appropriate utilization of BDO synthesis catalyst technologies.

Revenue from BDO synthesis catalysts in the UK is projected to grow at a CAGR of 8.4% through 2035, supported by comprehensive chemical manufacturing requirements and established process optimization standards that facilitate appropriate use of catalyst systems for efficient BDO production processes. British chemical manufacturers consistently utilize proven protocols for catalyst system implementation, emphasizing performance optimization and cost-effectiveness within integrated manufacturing operations.

Chemical industry standards and process optimization practices are supporting systematic adoption of proven catalyst technologies across industrial and specialty chemical manufacturing facilities.

Technical development programs and catalyst research initiatives are maintaining high standards for BDO synthesis catalyst utilization and process performance optimization.

Revenue from BDO synthesis catalysts in Japan is projected to grow at a CAGR of 7.4% through 2035, supported by the country's advanced chemical technology infrastructure, comprehensive manufacturing standards, and systematic approach to process optimization. Japanese chemical companies emphasize precision-engineered catalyst system utilization within structured manufacturing frameworks that prioritize performance reliability and operational efficiency.

Advanced chemical manufacturing requirements and technology integration standards are supporting stable utilization of catalyst systems across diverse industrial and specialty chemical applications.

Research institutions and chemical companies are maintaining leadership in catalyst system optimization research and process development for optimal manufacturing performance.

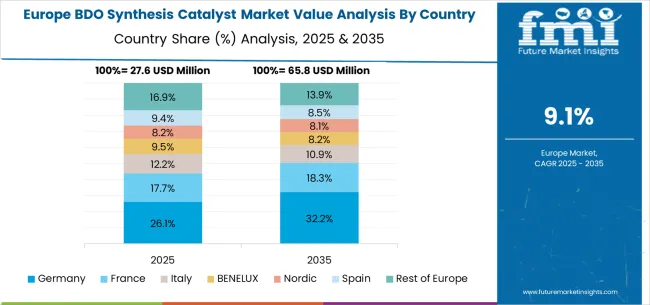

The BDO synthesis catalyst market in Europe is projected to expand steadily through 2035, supported by increasing adoption of sustainable green chemical manufacturing practices, rising demand for efficient catalyst technologies, and ongoing innovation in chemical process optimization. Germany will continue to lead the regional market, accounting for 26.8% in 2025 and rising to 27.5% by 2035, supported by strong chemical industry infrastructure, advanced catalyst research capabilities, and robust sustainable green manufacturing initiatives. The United Kingdom follows with 19.3% in 2025, increasing to 19.8% by 2035, driven by comprehensive chemical manufacturing standards, process optimization requirements, and expanding catalyst technology adoption.

France holds 16.7% in 2025, edging up to 17.2% by 2035 as chemical manufacturers expand catalyst utilization and demand grows for advanced synthesis technologies. Italy contributes 13.2% in 2025, remaining broadly stable at 13.6% by 2035, supported by growing specialty chemical production and increasing catalyst technology adoption. Spain represents 9.8% in 2025, inching upward to 10.1% by 2035, underpinned by strengthening chemical manufacturing infrastructure and sustainable green production initiatives.

BENELUX markets together account for 7.4% in 2025, moving to 7.7% by 2035, supported by advanced chemical technology requirements and process innovation initiatives. The Nordic countries represent 5.2% in 2025, marginally increasing to 5.4% by 2035, with demand fueled by comprehensive sustainability standards and early adoption of advanced catalyst technologies. The Rest of Western Europe moderates from 1.6% in 2025 to 0.7% by 2035, as larger core markets capture a greater share of catalyst technology investment, chemical manufacturing projects, and BDO synthesis catalyst adoption.

The BDO synthesis catalyst market is characterized by competition among established chemical catalyst manufacturers, specialized synthesis technology companies, and comprehensive chemical process solution providers. Companies are investing in catalyst research and development, process optimization, strategic partnerships, and technical support services to deliver efficient, reliable, and cost-effective BDO synthesis catalyst solutions. Product innovation, performance validation, and market access strategies are central to strengthening product portfolios and market presence.

Shepherd leads the market with comprehensive catalyst solutions focusing on high-performance synthesis technologies and process optimization. BASF provides extensive chemical catalyst portfolios with emphasis on sustainability and technical excellence. Dalian Reak Technology focuses on specialized catalyst systems and custom synthesis solutions for diverse BDO production requirements. Sunchem delivers innovative catalyst formulations with strong performance characteristics and technical support.

Hunan Yussen Energy Technology operates with focus on advanced catalyst technologies and energy-efficient synthesis processes for comprehensive chemical manufacturing applications. These companies provide comprehensive catalyst portfolios including research and development support, technical consulting services, and process optimization assistance to enhance market accessibility and customer satisfaction across diverse chemical manufacturing environments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 115.0 mMillion |

| Classification | Copper Catalyst, Nickel Catalyst, Others |

| Application | Reppe Route, Maleic Anhydride Route |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Shepherd, BASF, Dalian Reak Technology, Sunchem, Hunan Yussen Energy Technology |

| Additional Attributes | Dollar sales by catalyst type and synthesis route, regional demand trends, competitive landscape, chemical manufacturer preferences for specific formulations, integration with production processes, innovations in catalyst design, process optimization strategies, and performance enhancement |

The global BDO synthesis catalyst market is estimated to be valued at USD 115.0 million in 2025.

The market size for the BDO synthesis catalyst market is projected to reach USD 295.5 million by 2035.

The BDO synthesis catalyst market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in BDO synthesis catalyst market are copper catalyst and nickel catalyst.

In terms of application, reppe route segment to command 59.2% share in the BDO synthesis catalyst market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Butynediol Synthesis Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Catalyst Bins Market Insights – Growth & Forecast 2025 to 2035

Abdominal Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Abdominal Aortic Aneurysm Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Abdominal Closure Systems Market Analysis – Trends & Forecast 2024-2034

Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

Radiosynthesis Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gene Synthesis Market Growth – Trends & Forecast 2025 to 2035

cDNA Synthesis Market

Transabdominal Retrieval Kits Market

Intra-Abdominal Infection Treatment Market Size and Share Forecast Outlook 2025 to 2035

Intra-Abdominal Pressure Measurement Devices Market Analysis - Size, Trends & Forecast 2025 to 2035

Peptide Synthesis Market Analysis – Trends, Share & Growth 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Chemical Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Refinery Catalyst Market Growth - Trends & Forecast 2025 to 2035

Polyolefin Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Spinal Osteosynthesis Units Market Trends – Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA