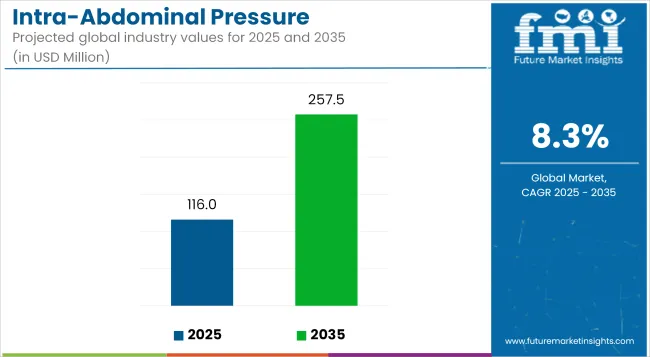

The intra-abdominal pressure measurement devices market is expected to reach USD 116.0 Million by 2025 and is expected to steadily grow at a CAGR of 8.3% to reach USD 257.5 Million by 2035. In 2024, the intra-abdominal pressure measurement devices market generated roughly USD 107.1 Million in revenues.

IAP Measuring Devices are medical equipment used to measure pressure within the abdominal cavity to diagnose and treat intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS). Factors that emphasize the higher need for these devices are the increasing incidence of ACS and IAH resulting from trauma, sepsis, and critical illnesses requiring continuous monitoring for West Hospital Bed patients. Technological advances have led to the introduction of new, less invasive, and automated monitoring devices that are more precise and user-friendly.

The increase in ICU admissions has also positively impacted the growth of the market, as many critically ill patients require pressure monitoring. In addition, regulatory recommendations regarding standardized IAP measurement protocol shall promote wider acceptance in various health care settings.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 116.0 Million |

| Industry Value (2035F) | USD 257.5 Million |

| CAGR (2025 to 2035) | 8.3% |

The COVID-19 pandemic placed an enormous burden on intensive care units (ICUs), with a massive inflow of critically ill patients requiring mechanical ventilation and fluid resuscitation. The technological advancement in minimally invasive procedures and automated pressure monitoring improved safety and accuracy, making the IAP measurement easier.

More research and clinical guidelines on the early detection of IAH further stimulated its adoption. In addition, increasing trauma and emergency care services induced by road accidents and complications from surgeries created a demand for constant pressure monitoring. Regulatory support and hospitals' investment in critical care facilities significantly aided in the market expansion.

The rising incidence of intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS) among these patients has been common, as well as among other critically ill cases. Obesity is also an increasing risk factor for IAH and metabolic diseases in the United States and Canada, further increasing market growth.

Moreover, advanced ICU infrastructure combined with solid regulatory guidelines and reimbursement policies has allowed hospitals to incorporate the IAP measurement into critical care pathways. The development of innovative technologies such as automated and minimally invasive monitoring systems has further increased access and productivity, which eventually leads to their widespread use across the region.

Established and consistent framework for the management of IAH and ACS, mainly in Germany, France, and the UK, enshrined in their critical care guidelines, has significantly contributed to the growth of the market. Increased pressure put on trauma/emergency services due to increased road traffic accidents and surgeries has also heightened the need for continuous monitoring of IAP.

Additionally, adoption has been improved by governmental funding programs for research and development of automated and minimally invasive measurement equipment for IAP. Stringent patient safety and infection control standards also compel hospitals to improve their investment in higher-quality monitoring tools to enhance clinical outcomes in critical care settings.

The need for intra-abdominal pressure (IAP) monitoring devices is growing in the Asia-Pacific region due to the concomitant developments in healthcare infrastructure, rising ICU admissions, and advancing knowledge for critical care monitoring among the ever-increasing populace.

The newer technologies in China, India, and Japan are making considerable contributions toward the acceptance of IAP monitoring in hospitals and trauma centers with higher rates of road traffic accidents (RTAs), sepsis, and abdominal surgery necessitating early detection of intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS).

Government healthcare reforms, improving medical tourism, and affordability enhancements of monitoring devices have also found adoption rises. The mass-market reach and sales in the region are further buoyed by bringing advanced technologies, including automated and minimally invasive IAP measurement systems.

Challenges

Limited Awareness and Standardization in Clinical Practice Hinders the Adoption of Intra-Abdominal Pressure Measurement Devices

The proper application and acceptance of monitoring techniques for intra-abdominal pressure (IAP) measurement devices face some challenges due to a lack of awareness and standard protocols in major healthcare delivery systems. While aware of its existence, most practitioners in IAH-accompanied ACRs are not trained in developing country settings to demonstrate the continuous need for IAP observation and be validated on such.

Furthermore, discrepancies between different hospitals in terms of measurement methodologies and criteria of interpretation can create variations in diagnosis and treatment. While the benefits of IAP monitoring in critical care are known, its variable application is hindered by such discrepancy. This barrier might be removed with global clinical guidelines, better training, and a better push by medical societies to assimilate IAP measurement right into standard ICU and trauma care protocols.

Opportunities

Technological Advancements in Non-Invasive Monitoring Pose New Opportunities in the Market

The prime opportunity for Intra-Abdominal Pressure (IAP) Measurement Devices lies in the search for non-invasive and real-time monitoring systems. Now, most techniques rely on catheter-based methods, invasive and with potential for infection. Innovation in non-invasive ultrasound-based and sensor-implemented technologies would vastly improve the universality, safety, and ease of integration of IAP measurement into conventional patient monitoring.

Such technology could take IAP monitoring beyond the ICC into emergency departments, trauma services, and possibly, outpatient settings. Moreover, the integration of AI analytics and wireless connectivity could enable automatic alerts and predictive analytics in such devices to allow for better real-time detection and consequently enhanced patient outcomes. Should these innovations take off, they will turn into a global best practice for intra-abdominal pressure monitoring in critical care.

Growing Adoption in Trauma and Emergency Care Surges the Growth of the Market

An important industry trend is the broad application of Intraabdominal Pressure (IAP) Measurement Devices in emergency and trauma care facilities. With an ever-increasing number of cases being admitted into emergency departments and trauma centers for abdominal complications following trauma and surgery, IAP monitoring is fast becoming a diagnostic arm among others in the assessment of a patient.

This now opens up an avenue for early recognition of intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS), instituted not as a mere academic exercise but having a direct bearing on saving the lives of critically injured patients.

Increasing Investments in Critical Care Infrastructure Anticipate the Growth of the Market

Growth in the additional admission of patients to ICUs and worldwide improvements in critical care facilities have brought increased investments for surveillance technologies such as equipment for IAP measurement. Most ICUs in hospitals are gradually being equipped with pressure monitoring units that are fully automated in order to deliver enhanced treatment for patients.

Most of the Middle Eastern and Asia-Pacific governments and private healthcare organizations are spending significant budgets on high-tech machines meant for ICUs, hoping for an improved outcome from critical care. Increased costs coupled with the growing awareness of ACS have forced the hospitals to include IAP monitoring in the sepsis-care, post-surgical recovery, and trauma protocols.

Shift Toward Non-Invasive IAP Monitoring Technologies is an Ongoing Trend in the Market

The primary advancement is toward the development of new non-invasive intra-abdominal pressure monitoring solutions. The catheter-based approaches are effective but have associated concerns about infection hazards and procedural issues. New technologies based on ultrasound and bioelectrical impedance procedures are in the experimental phase to enable continuous and non-invasive monitoring. Real-time information, reduced risk of infection, and comfort for patients characterize these new monitoring systems.

With more and more research in this area, the day may come when non-invasive technologies will replace conventional techniques and open up IAP monitoring to outpatient clinics and home healthcare settings, thus improving accessibility and adoption of these products.

Growing Adoption of Wearable and Portable IAP Monitoring Devices

Formulation of wearable and portable monitoring devices has become one of the major upcoming trends within intra-abdominal pressure (IAP) measurement devices. Areas that primarily fit into intensive care unit-type scenarios require traditional IAP measurement practices in catheter-based systems.

However, with the development of miniaturized sensor technology alongside wireless communication, the possibility of developing portable continuous monitoring devices has been realized. Such wearability transforms the system into real-time monitoring of intra-abdominal pressure during times spent outside of critical care environments, thus making it suitable for postoperative recovery, trauma tracking, and long-term management of high-risk patients.

The market size of intra-abdominal pressure measurement devices is booming between 2020 and 2024 due to the increasing incidence of intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS) in ICU, trauma, and surgical patients. Moreover, the pandemic made critical care monitoring a necessity, thereby accelerating adoption.

Advancements in non-invasive monitoring and artificial intelligence integration, as well as the increasing wearability of IAP devices, will help sustain the market after this point from 2025 to 2035. The movement towards remote patient monitoring devices, the growth of healthcare infrastructure in developing economies, and rising investments in critical care solutions will also enhance patient outcomes and clinical decision-making.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | More FDA, EMA, and CFDA clearances for IAP measurement instruments, especially for ICU and trauma care use. Increased focus on standardizing the measurement protocols to ensure uniform clinical application. |

| Technological Advancements | Use of catheter-based IAP measurement in most ICUs. Development of wireless and automated pressure monitoring systems. Initial investigation of non-invasive ultrasound-based IAP measurement. |

| Consumer Demand | Increasing awareness of IAH and ACS in intensive care. Increased use of IAP monitoring in emergency and trauma conditions, owing to rising road traffic accidents and abdominal surgeries |

| Market Growth Drivers | Increasing growth is driven by increasing ICU admissions, postoperative complications, and trauma cases. Increasing use of IAP monitoring for sepsis treatment and abdominal surgeries |

| Sustainability | Transition towards energy-efficient IAP monitors and biocompatible catheter materials to minimize infection risk . |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stringent regulations on monitoring IAP in intensive care environments. Greater emphasis on non-invasive technology and predictive diagnostics based on AI, combined with greater patient data protection legislation |

| Technological Advancements | Faster uptake of sensor-based and non-invasive IAP monitoring. AI and machine learning-based predictive analytics integration in real-time. Portable, wearable devices for remote monitoring and post-surgery care |

| Consumer Demand | Growing need for non-invasive, real-time monitoring products. Greater adoption in emerging markets is expected owing to growing critical care infrastructure and investments in healthcare by governments. |

| Market Growth Drivers | Advances in technology are fueling market growth. Increasing penetration in home and ambulatory healthcare. Increase in medical tourism and digitization of healthcare. |

| Sustainability | Emphasis on environmentally friendly, reusable medical sensors. Designing battery-free, wireless monitoring solutions to promote sustainability in critical care. |

The United States market has to its advantage a notably strong ICU admissions base and trauma, which then translates into a growing awareness of Abdominal Compartment Syndrome (ACS). Being supported by government healthcare programs and an insurance coverage system, the growth of the United States market is facilitated. Meanwhile, many leading medical devices enter this line in parallel with further inventions in non-invasive technology for IAP monitoring purposes.

Market Growth Factors

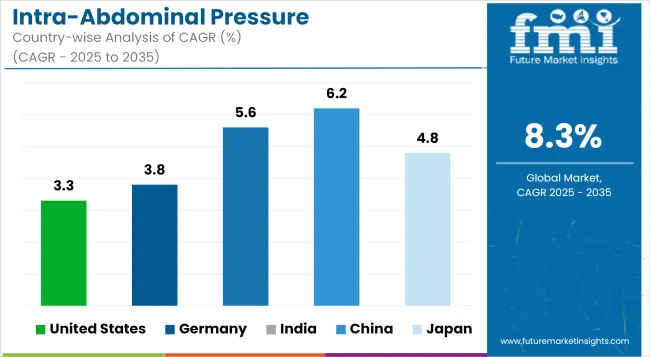

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

Market Outlook

IAP devices are on the rise in Germany's robust healthcare infrastructure and regulatory compliance. Although the selling point of these devices is adherence to regulations, in Germany, the growing population of old people has fueled the growth of the abdominal surgery market. Germany has also been impelled to invest heavily in government expenditure in AI-based monitors alongside critical care advancements, which have also been a focus.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

In India, the IAP field is comprised of hospitals associated with growing critical care facilities, and road traffic accidents result in trauma, generating a demand for IAP Devices. And with the initiatives being taken by the government concerning healthcare and the indigenous medical device manufacturing with the aim of facilitating market expansion, low-cost, portable monitoring systems are witnessing an increasing access as well as adoption in rural and semi-urban markets.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

China is enjoying expanding exports of IAP devices because there has been a rise in support from the growing hospital infrastructure, investment in critical care, and awareness of intra-abdominal hypertension (IAH). The rising investment profile on ICU devices is complemented widely by incentives for other adoptions. AI-based IAP monitors are being spotted in hospitals with excellent earnings.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Japan's elderly population and its growing disease incidence in their abdomens mean there is an immense buildup for such a technology as is IAP devices in the elderly and postoperative care. Along with this, Japan's advanced technology in precision medicine, AI-driven healthcare technologies also paved the way for the development in non-invasive, real-time monitoring systems for critical care with higher patient outcomes.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The disposables segment leads the market due to its high usage frequency and infection control benefits.

Disposables account for most of the market since they are frequently used and help infection control. Hospitals and ICUs prioritize disposable IAP catheters, transducers, and tubing sets to reduce the risk of cross-contamination and provide a sterile environment. Demand remains steady due to the increasing cases of abdominal compartment syndrome (ACS), trauma, and patients being admitted to critical care.

Regulations support single-use medical devices to limit hospital-acquired infections (HAIs). Since disposables require frequent replacement, they also provide a repeat business opportunity to manufacturers; hence, they form the largest segment of the IAP measurement devices market.

The increasing adoption of advanced IAP monitoring systems in hospitals aids it to hold a substantial share.

The equipment segment holds the highest market share due to increased usage of advanced IAP monitoring systems in hospitals. Digital pressure monitors, bedside monitors, and automated IAP measurement devices are key components in the real-time monitoring of intra-abdominal hypertension and its early detection.

Investment in critical care infrastructure, along with the expansion of ICUs and AI-enabled monitoring systems, drives demand for premium equipment. While disposables take the cake for high-volume utilization, equipment is a one-time high-cost investment that makes hospitals efficient and safer in patient care, thus possessing its fair share in the market with an infinitesimal option of sales.

Hospitals dominate the market due to their high patient volume and advanced ICU facilities.

Hospitals are able to monopolize the Intra-Abdominal Pressure Measurement Devices market through their heavy and continuous patient traffic, advanced ICU equipment, and persistent demand for critical care monitoring. They cater to the majority of abdominal compartment syndrome (ACS), sepsis, organ failure, or postoperative complications, all of which require continuous intra-abdominal pressure (IAP) recording.

Hospitals typically purchase advanced digital monitoring equipment and single-use IAP measuring equipment so that they may guarantee patient safety and avoid infection. Besides, their larger buying power and compliance with stricter regulatory guidelines confirm large-scale usage of IAP measurement devices, making them the biggest end-user segment in the market.

Trauma centers hold a substantial share due to their critical role in handling emergency cases.

Trauma centers occupy these large figures of the market because they maintain a large part of the total pool of medical care for nearly all patients with a need for emergency management of trauma, including accident victims from road traffic crashes, victims from blunt abdominal trauma, or patients with internal hemorrhage. Trauma centers need estimation of IAP as soon as it becomes clinically indicated to avert the complications of intra-abdominal hypertension, organ failure, and compartment syndrome.

Owing to the large patient handling, constant monitoring for trauma patients in post-operation and emergency environments results in a greater demand for disposable catheters and bedside monitors. Moreover, global figures of vehicle crashes and severe trauma increase calls for measuring IAP in trauma care.

Technological advancements, regulatory requirements, and collaborative alliances are among the reasons that drive growing market competition pertaining to intra-abdominal pressure measurement devices. The FDA and EMA have been directing towards a more precise IAP monitoring solution that is least invasive.

Simultaneously, emerging players in these emerging markets are amassing competition and entering with their pricing policies, localized product portfolios, and increasingly disposable solutions, thereby trying to make their products specifically of intra-abdominal pressure measurement devices accessible and affordable. The consequent rise in competition that these sellers bring in will clinch the market condition even further.

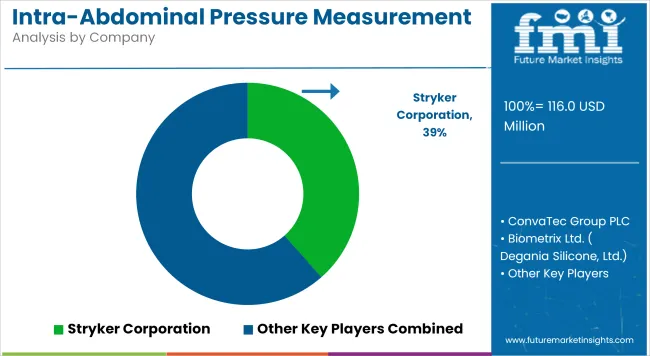

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stryker Corporation | 33.6% to 38.5% |

| ConvaTec Group PLC | 20.4% to 22.6% |

| Biometrix Ltd. ( Degania Silicone, Ltd.) | 15.1% to 17.2% |

| Centurion Medical Products | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stryker Corporation | Creates AI-powered digital IAP monitoring solutions that are integrated with ICU platforms. Increasing hospital alliances to drive adoption in trauma and emergency care |

| ConvaTec Group PLC | Expert in disposable catheter-based IAP systems for infection prevention. Investing in biocompatible technologies and international expansion in critical care. |

| Biometrix Ltd. ( Degania Silicone, Ltd.) | Offers silicone-based IAP monitoring catheters for ICU and trauma treatment. Dedicated to sensor-based and wireless technologies. |

| Centurion Medical Products | Provides cost-effective disposable IAP kits with an emphasis on infection control. Building distribution in growth markets and creating non-invasive solutions. |

Key Company Insights

Stryker Corporation

Stryker Corporation is a leading player in the arena of digital intra-abdominal pressure monitoring, providing a combination of artificial intelligence-enabled automation with ICU platforms. The potential benefit of increasing its competitive edge, which focuses on real-time analytics and trauma care, includes driving more hospital partnerships for increased adoption.

ConvaTec Group PLC

ConvaTec Group PLC concentrates on disposable intra-abdominal pressure monitoring, infection control, and biocompatible materials, which include strategies for global expansion, as well as regulatory approvals for a placement of a leading supplier in critical care.

Biometrix Ltd. (Degania Silicone, Ltd.)

Targeting high-accuracy silicone-based monitoring of IAP, the company offers solutions based on sensors for the ICU and trauma arena under wireless technologies, winning a greater market presence in this way through its focus on customized medical solutions.

Disposables and Equipment

Intra-abdominal Hypertension and Intra-compartment Pressure

Hospitals, Clinics, Trauma Centers and Ambulatory Surgical Centers (ASCs)

The overall market size for intra-abdominal pressure measurement devices market was USD 116.0 Million in 2025.

The intra-abdominal pressure measurement devices market is expected to reach USD 257.5 Million in 2035.

Growing cases of Abdominal Compartment Syndrome (ACS) and ICU Admissions anticipates the growth of the intra-abdominal pressure measurement devices market.

The top key players that drives the development of intra-abdominal pressure measurement devices market are Stryker Corporation, ConvaTec Group PLC, Biometrix Ltd. (Degania Silicone, Ltd.), Centurion Medical Products and Nutrimedics S.A.

Disposables segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Cushions Market Trends - Growth, Size & Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Pressure Cookers Market

Pressure Calibrator Market

Pressure Redistribution Pads Market

Pressure Relief Valve (PRV) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA