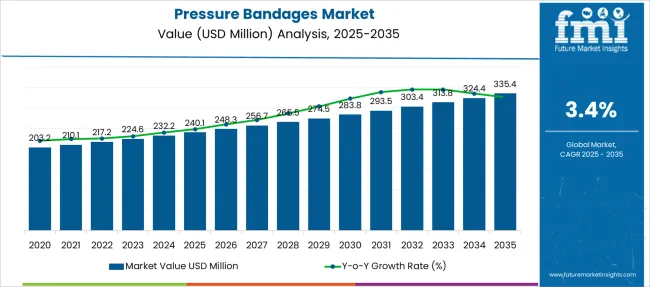

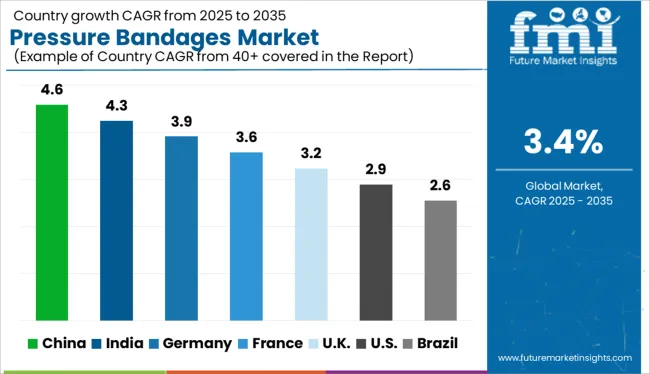

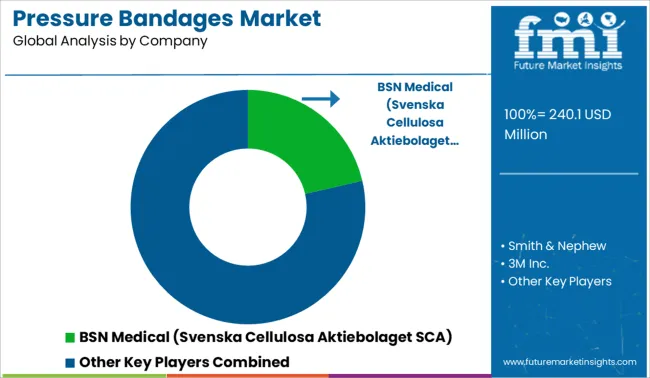

The Pressure Bandages Market is estimated to be valued at USD 240.1 million in 2025 and is projected to reach USD 335.4 million by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Pressure Bandages Market Estimated Value in (2025 E) | USD 240.1 million |

| Pressure Bandages Market Forecast Value in (2035 F) | USD 335.4 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The pressure bandages market is experiencing steady growth due to the rising prevalence of chronic wounds and vascular conditions requiring effective compression therapy. Increasing awareness about the benefits of compression bandages in managing leg ulcers and other venous disorders has driven market demand.

Improvements in bandage design and materials have enhanced patient comfort and treatment outcomes, encouraging wider adoption. Healthcare providers have been emphasizing non-invasive treatments that promote healing and reduce hospital stays.

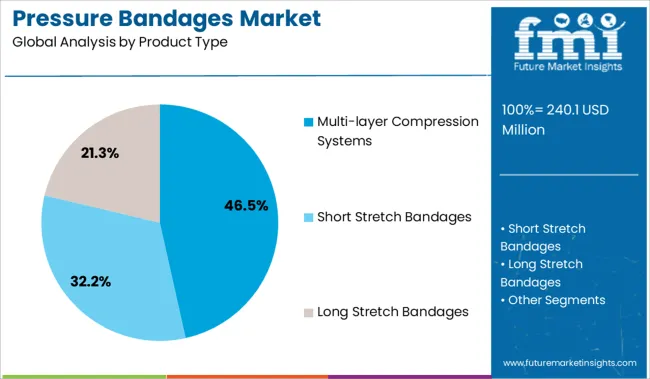

Additionally, the growing elderly population and the incidence of lifestyle-related health issues contribute to the need for advanced pressure bandage solutions. The market is expected to expand further with ongoing innovations in fabric technology and increasing access to healthcare in emerging regions. Segment growth is anticipated to be led by multi-layer compression systems, cotton-based raw materials, and applications focusing on leg ulcers.

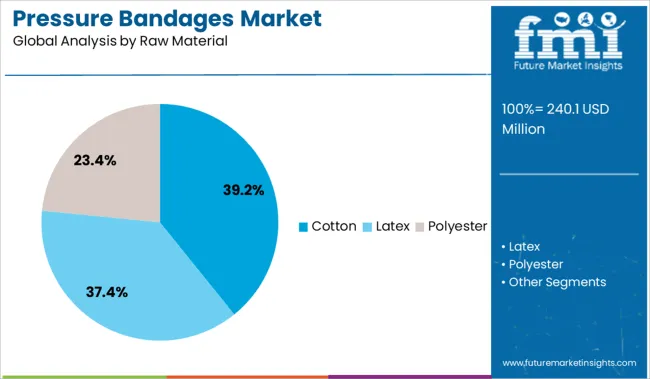

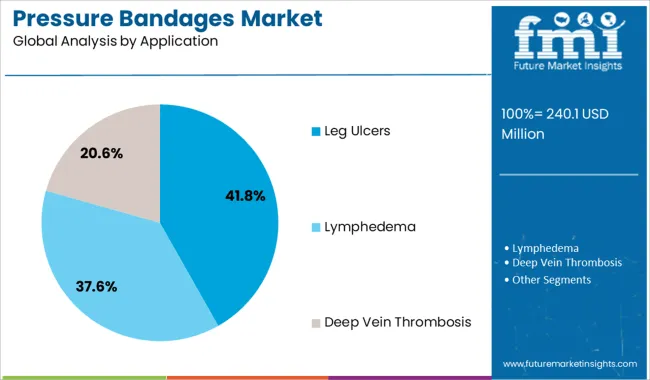

The market is segmented by Product Type, Raw Material, Application, and Distribution Channel and region. By Product Type, the market is divided into Multi-layer Compression Systems, Short Stretch Bandages, and Long Stretch Bandages. In terms of Raw Material, the market is classified into Cotton, Latex, and Polyester. Based on Application, the market is segmented into Leg Ulcers, Lymphedema, and Deep Vein Thrombosis. By Distribution Channel, the market is divided into Pharmacies, Retail Stores, Online Stores, Hypermarkets and Supermarkets, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi-layer compression systems segment is projected to hold 46.5% of the pressure bandages market revenue in 2025. Growth is driven by the effectiveness of multi-layer systems in providing consistent pressure and support for chronic wound management. These systems have been preferred for their ability to improve venous return and reduce edema.

Clinical adoption has increased due to evidence supporting better healing rates and patient compliance compared to single-layer bandages. The segment benefits from advancements that enhance elasticity and durability, making them suitable for long-term use.

As clinicians focus on improving patient outcomes and comfort, multi-layer compression systems are expected to maintain their leading position.

Cotton is projected to account for 39.2% of the pressure bandages market revenue in 2025. The material has been favored for its softness, breathability, and hypoallergenic properties. Cotton bandages offer good moisture absorption, reducing the risk of skin irritation and infection.

Manufacturers have continued to utilize cotton due to its cost-effectiveness and compatibility with advanced compression technologies. Patient preference for natural and comfortable materials supports the segment’s growth.

Furthermore, cotton’s versatility in being blended with other fibers enhances the performance of pressure bandages. The cotton segment is expected to remain prominent as demand for patient-friendly wound care solutions grows.

The leg ulcers application segment is anticipated to represent 41.8% of the pressure bandages market revenue in 2025. The segment’s growth is tied to the high incidence of venous leg ulcers and the critical role of compression therapy in their management. Pressure bandages help improve circulation and accelerate wound healing, making them essential in treating leg ulcers.

Increasing prevalence of chronic diseases such as diabetes and obesity has contributed to rising leg ulcer cases. Healthcare protocols emphasize early intervention using compression bandages to prevent complications and reduce healthcare costs.

The segment is further supported by growing awareness among patients and healthcare providers about the importance of sustained compression therapy. As a result, leg ulcers will remain a primary focus for pressure bandage applications.

| Particulars | Details |

|---|---|

| H1, 2024 | 3.27% |

| H1, 2025 Projected | 3.40% |

| H1, 2025 Outlook | 3.00% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 40 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 27 ↓ |

The comparative and review analysis of market dynamics within pressure bandages market revealed that H1-2025 outlook period in comparison to H1-2025 projected period will show a negative growth in terms of Basis Point Share by 40 BPS. In H1-2025, the market growth rate of pressure bandages is expected to fall by 27 basis point share (BPS) when compared to H1-2024, as per FMI analysis.

The market for pressure bandages is subject to changes as per disease epidemiology, product adoption rate, and product patents, as a part of the macro and industry dynamics. The observed decline in the BPS values is associated with poor patient compliance on the product, as well as the drawbacks associated with inelastic pressure bandages.

Key developments in the market include the design and development of patient specific compression bandages for instances associated with diabetic foot ulcer management, and wound management. The introduction of gradient pressure systems within newly introduced compression socks products will further promote the growth of the overall pressure bandages market during the forecast period.

The utilization of pressure bandages promotes a reduced length of hospital stay along with cost savings on regular bulk inventory of conventional bandages. Thus, adding to the factors for market growth in future.

Demand in the market is forecast to grow at a 3.4% CAGR, in comparison with the 2.7% CAGR registered between 2014 to 2024, finds FMI.

These medical devices are primarily used to compress the dead space at the site of cut, injury, or incision and to prevent the formation of hematoma or seroma. They have a wide range of applications in different cases such as leg ulcers, the management of chronic and acute wounds, orthopedic surgeries, and musculoskeletal injuries.

There are different types of pressure bandages available in the market such as elastic bandages, low elastic bandages, multi-layer bandages to suit applications in different medical indications. To improve the convenience and effectiveness of these bandages, manufacturers are investing in research and development to enhance the quality of raw materials used.

As per FMI, surging incidence of lymphedema, deep vein thrombosis, and diabetic foot ulcers across the globe will drive sales in the market. According to a study published in the National Center for Biotechnology Information, the USA National Library of Medicine, the annual incidence of diabetic foot ulcers worldwide is between 9.1 million to 26.1 million.

As the prevalence continues to rise, demand for pressure bandages will increase in tandem, which is expected to fuel sales in the market over the assessment period.

Since pressure bandages are used as the first line of care in minor injuries, they are widely available in pharmacies, supermarkets, and online retail channels. These bandages are easy to access and are effective for treating minor wounds and injuries at home, which in turn is propelling sales in the market.

These bandages are an important first-aid technique used in medical settings for serious injuries as well. They provide compression to the injured blood vessels by stimulating blood clot formation, thereby preventing rapid blood loss and hemorrhage.

They are also effective in stabilizing wounds such as venomous snake bites as they prevent venom progression into the bloodstream. Owing to the convenience and accessibility at any point of care, they are also being adopted for sports injuries and other severe accidents.

Growing incidence of diabetic foot ulcers and venous leg ulcers is presenting a posing as a burden on the healthcare system. However, these ulcers can be treated by using compression bandages. These bandages are recommended for 2-3 days by physiotherapists for acute injuries to reduce pain and swelling.

In addition to this, growing investments in the healthcare sector to improve the quality of these bandages and to promote their usage will boost the market in the forthcoming years. Growing applications of pressure bandages for foot ulcers in emerging economies will continue fueling sales in the market over the forecast period.

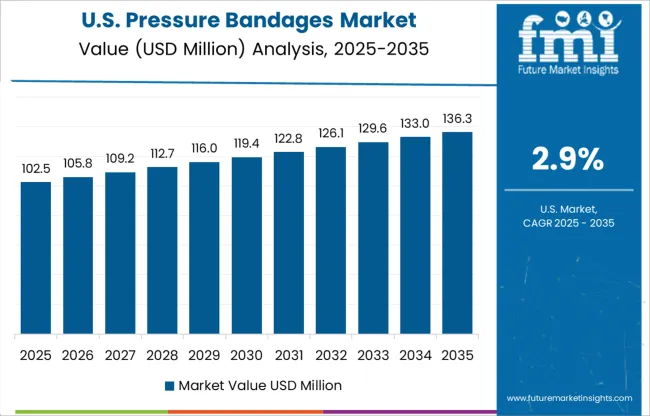

Healthcare Providers in the USA are Prescribing Pressure Immobilisation Bandages for Trauma Injuries

As per the report, the USA is expected to dominate the North America pressure bandages market over the assessment period owing to the presence of a robust healthcare sector and patient healthcare reimbursement plans. Sales in the North America market are slated to account for 40.6% of the total market share in 2025.

According to the Centers for Disease Control and Prevention (CDC), approximately 37.3 million people in the USA currently have diabetes, which is equal to 11.3% of the USA population.

High prevalence of diabetic foot ulcers in the country is spurring demand for effective wound management solutions. Pressure bandages act as a temporary solution to curb excessive blood loss in diabetic foot ulcers till the time of treatment, surgery, or amputation, which, in turn, is driving sales in the USA market.

High Incidence of Leg Ulcers to Fuel Sales of Pressure Bandages for Foot

China is expected to account for a lion’s share of the East Asia pressure bandages market over the forecast period. As per FMI, demand in Asia Pacific Excluding Japan is projected to account for 11% of the total market share in 2025.

Increasing prevalence of leg ulcers due to diabetes and other chronic illnesses such as arthritis is spurring demand for advanced wound management products, which, in turn, is boosting sales of pressure bandages.

In addition to this, increasing investments by the government for availing patient healthcare reimbursement plans in China will continue augmenting the growth of the market in the forthcoming years.

Increasing Applications of Pressure Wound Bandages to Fuel Growth in the UK

Sales in the UK are projected to increase at a considerable pace amid surging demand for effective and easily accessible wound management devices for home and medical settings. As per the report, the Europe pressure bandages market is projected to account for 31.8% of the total market share in 2025.

The presence of leading market players in the UK is also expected to bode well for the market. Players are investing in research and development to improve the quality of raw materials used for making these bandages, including latex and polyester.

Furthermore, growing trend of medical tourism in the country for the treatment of deep vein thrombosis and lymphedema is expected to bolster sales in the market over the assessment period.

Athletes and Sports Professionals Prefer Long Stretch Bandages for Trauma Relief

Based on the product type, demand for long stretch bandages is expected to remain high over the assessment period. Growth can be attributed to the easy availability and accessibility of these bandages in home care and medical settings.

These bandages are being adopted by athletes and sports professionals for quick pain relief from traumatic injuries such as sprains and ligament tears. Further, increasing product developments with enhanced quality of the material will continue fueling sales in this segment over the forecast period.

High Demand for Cotton Pressure Relief Bandages will Bolster Sales

In terms of raw material, demand in the cotton segment is slated to account for a dominant share in the global pressure bandages market. These bandages are soft on the skin and provide adequate pressure to control excessive bleeding and pain.

Besides this, increasing availability and sales of these bandages in supermarkets, hypermarkets, online channels, and pharmacies will bolster growth in this segment over the forecast period.

Demand for Pressure Wound Bandages for Leg Ulcers will Remain High

Sales in the leg ulcers segment are expected to gain traction over the forecast period. Increasing incidence of chronic ulcers, along with the high prevalence of diabetic foot ulcers across the globe is spurring demand for high-pressure wound bandages, thereby pushing sales in this segment.

In addition to this, increasing government-led investments in diabetes awareness programs, along with patient reimbursement plans for ulcer treatment will continue boosting growth in this segment in the forthcoming years.

Sales of Pressure Bandages for Legs Will Increase in Pharmacies

Based on the sales channel, sales in the pharmacies segment are slated to gain momentum through 2035. Easy availability of a wide range of bandage types in pharmacies is a chief factor driving sales in this segment.

Further, hospital pharmacies and general pharmacies retail high-quality bandages suited for various applications, from minor trauma injuries to major burns, cuts, and ulcers, which enables consumers to buy the bandages and use them in homecare settings. This is expected to continue fueling sales over the assessment period.

Leading players operating in the global pressure bandages market are investing in research and development to improve the quality of these bandages. Through this, players are also expecting to expand their product portfolios. Further, players are investing in mergers, acquisitions, and collaborations to expand their distribution networks across various countries and regions.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | Units for Volume and USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania, and MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, others. |

| Key Market Segments Covered | Product Type, Raw Material, Application, Distribution Channel, and Region |

| Key Companies Profiled | BSN Medical (Svenska Cellulosa Aktiebolaget SCA); Smith & Nephew; 3M Inc.; Medtronic, Plc; Cardinal Health; ConvaTec Inc. |

| Pricing | Available upon Request |

The global pressure bandages market is estimated to be valued at USD 240.1 million in 2025.

The market size for the pressure bandages market is projected to reach USD 335.4 million by 2035.

The pressure bandages market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in pressure bandages market are multi-layer compression systems, short stretch bandages and long stretch bandages.

In terms of raw material, cotton segment to command 39.2% share in the pressure bandages market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Pressure Cushions Market Trends - Growth, Size & Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Pressure Cookers Market

Pressure Calibrator Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA