The High Pressure Washer Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| High Pressure Washer Market Estimated Value in (2025 E) | USD 4.7 billion |

| High Pressure Washer Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The high pressure washer market is witnessing strong momentum as industries and households increasingly adopt efficient cleaning solutions to meet rising hygiene, maintenance, and aesthetic standards. Demand is being propelled by growing construction activity, urbanization, and awareness of water-efficient cleaning methods.

Manufacturers are innovating with energy efficient motors, ergonomic designs, and advanced safety features, enabling broader acceptance across residential, commercial, and industrial sectors. Future growth is expected to be supported by expansion of organized retail channels, rising disposable incomes, and integration of smart technologies to improve usability and monitoring.

Sustainability considerations and stricter regulations on water usage are further shaping product development and adoption, paving the way for durable, efficient, and environmentally responsible solutions.

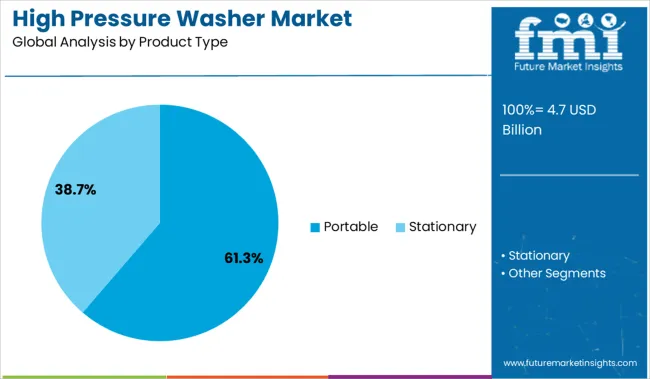

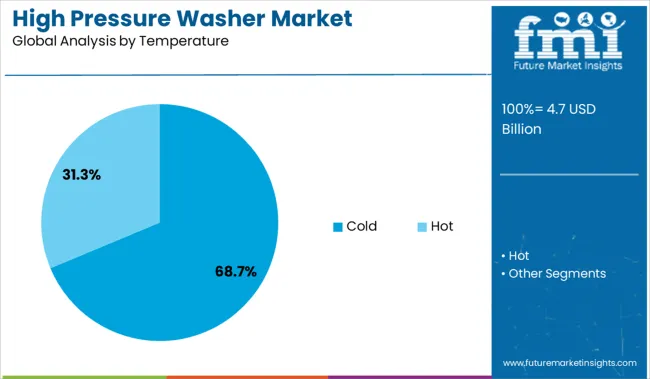

The market is segmented by Product Type, Temperature, PSI, Driving Force, and Application and region. By Product Type, the market is divided into Portable and Stationary. In terms of Temperature, the market is classified into Cold and Hot.

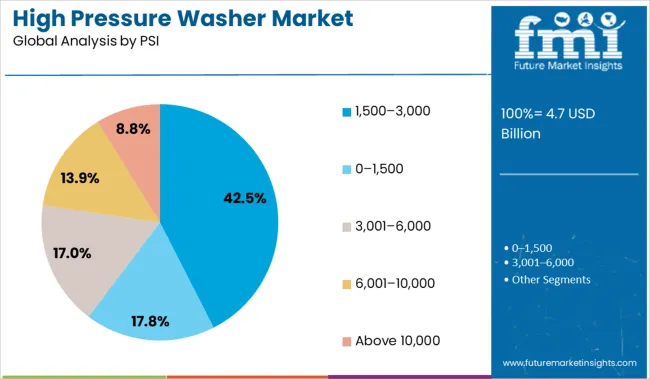

Based on PSI, the market is segmented into 1,500-3,000, 0-1,500, 3,001-6,000, 6,001-10,000, and Above 10,000. By Driving Force, the market is divided into Electric, Gas, and Others (fuel, battery etc.). By Application, the market is segmented into Homeowner, Construction, Municipal, Mining, Agriculture, CVCC, Oil & Gas, Food & Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, the portable segment is anticipated to account for 61.3% of the total market revenue in 2025, establishing itself as the dominant category. This leadership has been attributed to the segment’s ease of mobility, compact design, and suitability for both indoor and outdoor cleaning tasks.

Manufacturers have focused on optimizing weight-to-power ratios and improving storage efficiency, which has significantly increased appeal among residential and light commercial users. The convenience of transportation and setup without specialized infrastructure has expanded its applicability across diverse environments.

Further, the affordability of portable models combined with innovations in cordless technology and user-friendly controls has reinforced its preference over heavier alternatives.

Segmenting by temperature, the cold segment is projected to hold 68.7% of the total market revenue in 2025, maintaining its position as the leading category. This dominance has been supported by the lower cost of operation, reduced energy requirements, and effectiveness of cold water units for general cleaning tasks.

The segment has benefited from advancements in nozzle and pump technologies, which have enhanced cleaning performance without the need for heated water. Ease of maintenance and longer equipment life have further strengthened its adoption across residential and commercial settings.

Increased awareness of safety benefits associated with cold water models has also contributed to sustained preference, particularly in environments where heat-sensitive surfaces are cleaned.

When analyzed by PSI range, the 1500-3000 segment is expected to capture 42.5% of the total market revenue in 2025, emerging as the most prominent category. This leadership has been reinforced by the segment’s balance between cleaning power and user safety, making it suitable for a wide range of residential and commercial applications.

Manufacturers have developed durable and efficient pumps within this PSI range to cater to common cleaning requirements such as vehicle washing, patio cleaning, and light industrial maintenance. The segment’s appeal has also been enhanced by its compatibility with a variety of accessories and surfaces, offering flexibility without excessive water or energy consumption.

This optimal power range has proven to deliver effective results while minimizing operational risks, securing its strong position in the market.

High pressure washers are witnessing increased demand across residential, commercial, and industrial sectors due to their ability to deliver deep cleaning, surface stripping, and maintenance efficiency. The market is being shaped by trends in portable units, electric motor-driven systems, and foam-based cleaning extensions.

Growth is supported by car detailing services, industrial equipment maintenance, and building restoration activities. Compact form factors, lower water consumption, and compatibility with multi-surface cleaning tools are further expanding market appeal in both developed and emerging regions.

High pressure washers have gained traction in car wash stations, detailing centers, and facility management services due to their ability to remove grease, dirt, and residues effectively. Automotive care operators favor pressure washers for their precision cleaning, reduced water usage, and compatibility with foam cannons and rotary brushes.

Facilities such as parking garages, warehouses, and commercial kitchens rely on high PSI washers to maintain hygiene and surface longevity. Brands like Kärcher and Bosch are innovating with electric models tailored for residential users and gas-powered variants for industrial-grade applications. Modular attachments and noise reduction technologies have improved user experience. The growing outsourcing of cleaning services and the rise in vehicle ownership have directly contributed to consistent demand for pressure-based surface cleaning equipment.

The demand for cold water and electric-powered pressure washers presents a major growth avenue, especially in residential and light commercial markets. Cold water variants are more energy-efficient and suitable for routine surface cleaning, making them ideal for patios, sidewalks, and personal vehicles. Electric washers, favored for their low maintenance and quiet operation, are being promoted in urban households with limited storage and utility access.

Manufacturers are targeting homeowners through e-commerce channels with lightweight, plug-and-play models that include detergent injectors and multi-nozzle sets. The rise in do-it-yourself outdoor cleaning habits, combined with smart storage solutions and wall-mounted units, is reshaping how consumers approach surface maintenance. These compact machines are positioned as eco-efficient and user-friendly alternatives to traditional cleaning tools.

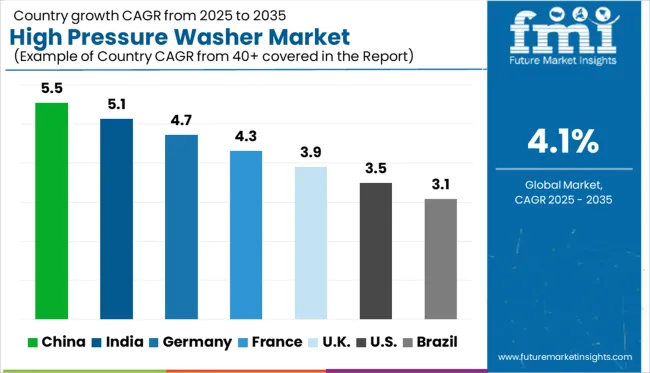

| Countries | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

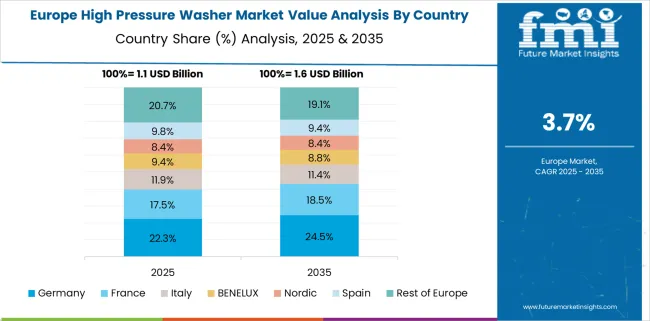

The high pressure washer market is forecast to grow at a CAGR of 4.1% from 2025 to 2035, driven by increased demand for surface cleaning efficiency, water-saving systems, and automation in industrial cleaning applications. China, part of BRICS, leads with 5.5%, supported by public procurement programs and rapid urban cleaning infrastructure upgrades.

India, also within BRICS, follows at 5.1%, enabled by demand from vehicle care centers and commercial complexes. Germany, a core OECD economy, registers 4.7%, driven by CE-certified commercial washers with modular attachments. France records 4.3%, supported by demand in agricultural cleaning and food-grade sanitation. The United Kingdom grows at 3.9%, influenced by lightweight washers for home detailing and school utility maintenance. The report includes analysis of over 40 countries, with five profiled below for reference.

Sales for high pressure washers in China are growing at a CAGR of 5.5% between 2025 and 2035. Institutional purchases for urban infrastructure cleaning, industrial equipment maintenance, and transport hubs are driving bulk demand. Local manufacturers are optimizing electric washers with features such as integrated nozzles, water-saving mechanisms, and quieter motor units.

Compact and wall-mountable variants are gaining attention from residential buyers in metro cities. Regional procurement is being guided by eco-compliance mandates and operational flexibility. Eastern provinces remain the strongest contributors to equipment sales.

The market for high pressure washers in India is anticipated to grow at a CAGR of 5.1% through 2035. Demand is being led by automotive detailing outlets, gated communities, and commercial cleaning franchises in mid-tier cities. Regional assemblers are introducing fuel-powered washers with enhanced durability for outdoor and semi-industrial settings.

The shift toward longer hose attachments and pressure regulators is becoming common across institutional segments. Online channels and retail chains are expanding coverage through combo sales with cleaning agents. Preference continues to grow for units with minimal maintenance needs and energy-saving motors.

Sales for high pressure washers in Germany are expanding at a CAGR of 4.7% from 2025 to 2035. Preference is being shown for electric-powered units equipped with variable pressure control, spray angle adaptation, and water-efficiency systems.

Regulatory compliance and CE-label adherence are central to procurement, especially in commercial and industrial applications. Rental fleets, logistics facilities, and construction firms are seeking washers that offer long-term operability and modular part replacements. Buyers are also targeting models that minimize splashback and noise in densely populated work zones.

Demand for high pressure washers in France is expected to grow at a CAGR of 4.3% from 2025 to 2035. Demand is being guided by use in food-grade environments, farm machinery maintenance, and community cleaning tasks. Local distributors are offering compact units with detergent modules, hose reel kits, and mobility-focused enhancements.

Washers with chemical compatibility and quick nozzle switching are seeing higher uptake. Utility contractors are purchasing temperature-tolerant units with minimal vibration levels for use in confined zones. Washer selections are influenced by hygiene compliance, ease of repair, and silent operation.

Adoption of high pressure washers in the United Kingdom is projected to expand at a CAGR of 3.9% through 2035. Household cleaning requirements and light commercial tasks remain the major demand contributors. Buyers are opting for wall-mountable washers with secure nozzles and automatic detergent dispensing systems.

School districts and municipal boards are increasing their purchases of electric washers with extended runtime and safety locks. Product bundling with surface cleaners and foam cannons is growing on e-commerce platforms. Brands offering rapid customer support and DIY maintenance kits are gaining buyer preference across home use cases.

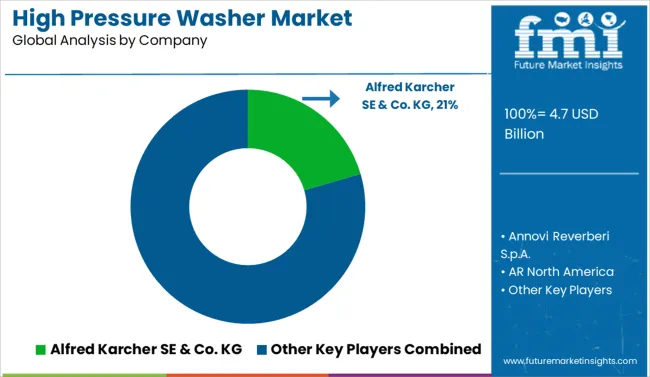

The high pressure washer industry is led by Alfred Karcher SE & Co. KG, holding a 20.5% market share through its broad product range catering to both domestic and industrial users. The company’s dominance stems from its global distribution, ergonomic product designs, and innovation in electric and battery-powered washers.

DeWalt and Stanley Black & Decker compete through rugged gas-powered models for heavy-duty cleaning, while Bosch and Husqvarna appeal to European DIY and residential users. FNA Group, Generac, and Briggs & Stratton serve North American demand for portable, high-output units.

Annovi Reverberi and Comet Spa specialize in professional-grade washers with robust pump systems. Competitive strategies now focus on motor efficiency, noise reduction, and integration with water-saving and cordless technologies for diversified applications.

In February 2025, Annovi Reverberi introduced its “AR Green Oil” eco-friendly pump oil, marking a major move toward reducing environmental impact in high-pressure washer systems and demonstrating the company’s commitment to sustainable innovations.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product Type | Portable and Stationary |

| Temperature | Cold and Hot |

| PSI | 1,500-3,000, 0-1,500, 3,001-6,000, 6,001-10,000, and Above 10,000 |

| Driving Force | Electric, Gas, and Others (fuel, battery etc.) |

| Application | Homeowner, Construction, Municipal, Mining, Agriculture, CVCC, Oil & Gas, Food & Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alfred Karcher SE & Co. KG, Annovi Reverberi S.p.A., AR North America, Bosch, Briggs & Stratton Corporation, Clearforce, Comet Spa, DeWalt (Stanley Black & Decker), FNA Group, Generac Power Systems, Husqvarna Group, Karcher, Nilfisk Group, Stanley Black & Decker, Inc., and Techtronic Industries Co. Ltd. (TTI Group) |

| Additional Attributes | Dollar sales are led by electric high-pressure washers, which are gaining share across both residential and industrial segments. Demand is rising for compact, water-efficient models with adjustable pressure settings. Contract manufacturers support private-label output. Adoption remains strong in North America and Europe, where preferences are shifting toward corrosion-resistant structures and multifunctional, environmentally conscious cleaning systems. |

The global high pressure washer market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the high pressure washer market is projected to reach USD 7.0 billion by 2035.

The high pressure washer market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in high pressure washer market are portable and stationary.

In terms of temperature, cold segment to command 68.7% share in the high pressure washer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA