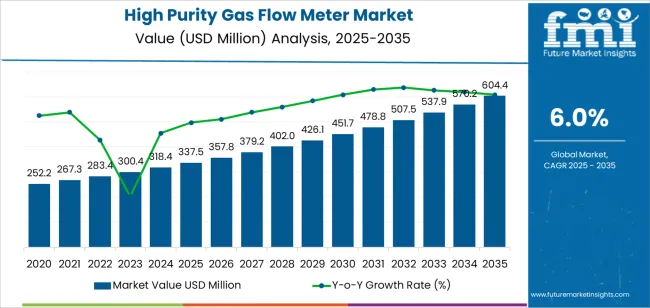

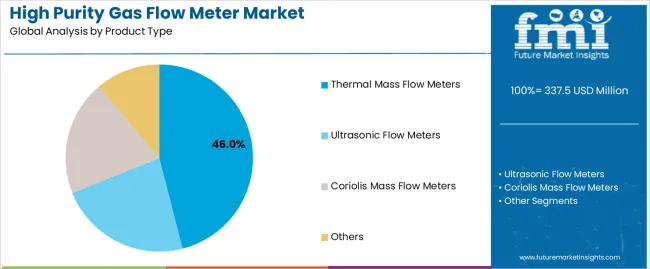

The high purity gas flow meter market increases from USD 337.5 million in 2025 to USD 604.4 million by 2035 at a CAGR of 6.0%, with segment performance defining overall expansion. Thermal mass flow meters lead with a 46% share, driven by their ability to measure ultra-clean gases at low flow rates with minimal pressure drop, no moving parts, and negligible particle generation. Their dominance aligns with semiconductor process requirements, where deposition gases, etchants, dopants, and purge gases demand high precision and contamination-free delivery. Ultrasonic meters at 29% support non-contact measurement in specialty gas lines, while Coriolis meters at 18% serve multi-parameter monitoring needs in high-value chemical and pharmaceutical applications.

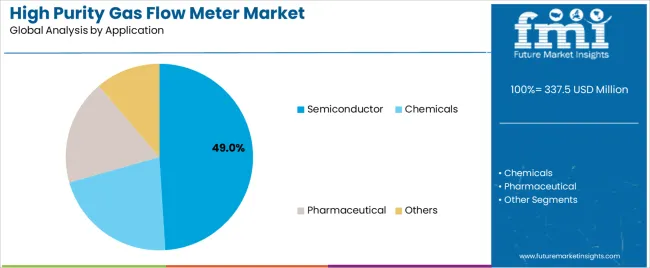

The semiconductor segment accounts for 49% of market demand, supported by advanced node manufacturing that relies on precise gas metering for lithography, etching, CVD, ALD, doping, and chamber cleaning. Cleanroom environments require stable, drift-resistant gas control to maintain wafer yield as device geometries shrink. The chemicals segment at 24% depends on high purity meters for specialty gas blending, vapour-delivery skids, and corrosion-sensitive processes, while pharmaceuticals at 17% adopt high-purity meters for sterile gas handling, fermentation atmospheres, and biologics processing lines. Segment-level behaviour reflects rising semiconductor capacity in Asia Pacific, strict GMP compliance in pharmaceuticals, and increased adoption of high-accuracy gas instrumentation across laboratory and specialty-gas ecosystems. As contamination-control expectations intensify and flow-measurement standards tighten, segment-driven purchasing ensures sustained market expansion through 2035.

Asia Pacific leads global market expansion, supported by strong semiconductor and electronics manufacturing growth in China, South Korea, Taiwan, and Japan. Europe and North America maintain steady demand through established pharmaceutical, specialty gas, and precision manufacturing sectors. Key market participants include Horiba, Brooks Instrument, Beijing Sevenstar, Fujikin, MKS Instrument, Azbil, and MK Precision, focusing on precision engineering, contamination control, and integration with automated process control systems.

The 10-year growth comparison shows a balanced expansion driven by semiconductor fabrication, biopharmaceutical processing, and specialty gas applications. Between 2025 and 2030, growth will be anchored by intensive semiconductor investment, where precise gas-flow control is required for lithography, etching, and deposition steps. This period will record stronger annual gains as fabrication plants upgrade metrology systems to support advanced process nodes and contamination-control requirements.

From 2030 to 2035, growth will remain steady but shift toward diversification across regulated industries. Bioprocessing, analytical laboratories, and high-purity industrial gas systems will account for a greater share of incremental demand. Replacement cycles for metering technologies will also strengthen during this period as accuracy, traceability, and digital-integration standards evolve. While early growth reflects capital-driven expansion in semiconductor ecosystems, later growth is shaped by sustained compliance needs and equipment modernization across high-purity environments. The decade-long pattern indicates a stable and precision-oriented market supported by long-term investments in clean-gas handling and advanced instrumentation.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 337.5 million |

| Market Forecast Value (2035) | USD 604.4 million |

| Forecast CAGR (2025-2035) | 6.0% |

The high purity gas flow meter market is expanding as industries handling ultra-clean gases impose strict measurement, contamination and traceability standards. High-purity meters are critical for applications in semiconductor fabrication, pharmaceutical manufacturing, specialty gas distribution and advanced research where even trace impurities or flow errors compromise product yield or safety. Growth in semiconductor production, especially node shrinkage and 3D architectures, elevates the need for high-precision flow management in clean utilities and gas delivery.

Pharmaceutical active-ingredient synthesis and biotechnology processes demand inert or ultra-high-purity gas flows with no contamination risk. Developments in sensor technology, low-dead-volume flow paths, metal-sealed construction and digital communication capabilities support advanced functionality and integration with process control systems. Constraints include higher cost relative to conventional meters, the need for specialised installation and calibration to preserve purity levels, and lead-times due to rigorous qualification and certification requirements.

The high purity gas flow meter market is segmented by product type and application. By product type, the market includes ultrasonic flow meters, thermal mass flow meters, Coriolis mass flow meters, and others. Based on application, it is categorized into semiconductor, chemicals, pharmaceutical, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

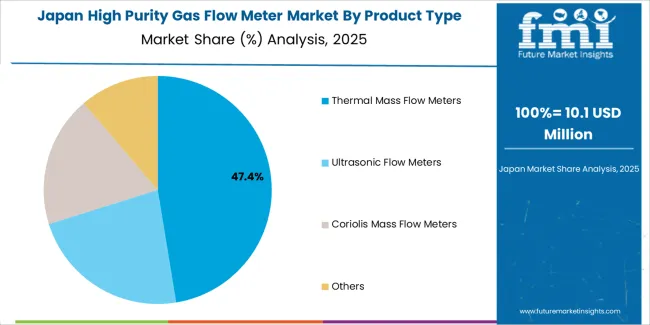

The thermal mass flow meters segment holds the leading position in the high purity gas flow meter market, representing an estimated 46.0% of total market share in 2025. Thermal mass flow meters are widely used for ultra-clean gas measurement due to their sensitivity at low flow rates, minimal pressure drop, and compatibility with high-purity distribution systems used in semiconductor and life-science environments. Their non-intrusive sensing elements limit contamination risk, supporting use in controlled manufacturing atmospheres.

The ultrasonic flow meters segment follows with an estimated 29.0%, driven by demand for non-contact gas measurement with high accuracy and long-term stability. The Coriolis mass flow meters category accounts for about 18.0%, valued for multi-parameter measurement and high precision in specialty gas lines. The others segment, representing approximately 7.0%, includes differential pressure and laminar flow element meters used in niche precision applications.

Key factors supporting the thermal mass flow meters segment include:

The semiconductor segment accounts for approximately 49.0% of the high purity gas flow meter market in 2025. Semiconductor fabrication relies on precise flow control for process gases used in etching, deposition, doping, and cleaning stages. High purity gas flow meters are essential for maintaining yield stability, ensuring contamination-free operation, and meeting process repeatability standards in advanced node manufacturing.

The chemicals segment follows with an estimated 24.0%, supporting high-purity chemical vapor distribution and specialty gas handling. The pharmaceutical segment accounts for about 17.0%, driven by sterile manufacturing, biologics production, and controlled environmental processes. The others category, representing roughly 10.0%, includes research labs, precision optical manufacturing, and controlled atmospheric processing.

Primary dynamics driving demand from the semiconductor segment include:

The high purity gas flow meter market is expanding as industries rely on precise and contamination-resistant measurement tools for high purity gases such as nitrogen, argon, helium, hydrogen, and speciality calibration gases. Semiconductor fabrication plants require accurate flow control for etching, deposition, doping, and inert gas purging, making high purity meters essential for process integrity. Biopharmaceutical and cell-culture facilities depend on ultra-clean gas delivery for fermentation, sterilisation, and controlled atmospheres. Growth in laboratories, research institutes, and advanced materials manufacturing strengthens demand for meters constructed from corrosion-resistant alloys and high-purity polymers. Improvements in sensor stability, digital calibration, and low-flow sensitivity also support adoption across highly regulated environments where precision and reproducibility are critical.

High purity gas flow meters often require specialised manufacturing processes, precision machining, and extensive contamination control, which raise unit cost. Installation typically demands cleanroom handling, specialised fittings, and skilled technicians to avoid particulate introduction into gas lines. Some aggressive or reactive gases require specific material grades that increase procurement and maintenance costs. Smaller facilities or cost-constrained laboratories may choose lower-specification meters, which slows adoption in certain regions. Calibration and periodic validation add additional operational expense, particularly in sectors with strict quality-assurance protocols.

Manufacturers are integrating real-time diagnostics, remote calibration alerts, and data logging to improve traceability and support predictive maintenance. Semiconductor investment in South Korea, Japan, Taiwan, China, and the United States is strengthening demand for high purity gas control components across new and expanding fabrication lines. Rising adoption of ultra-low-flow metering technologies supports advanced applications in research instrumentation, microreactors, and precision gas dosing systems. These developments are broadening the market’s technical scope and positioning high purity gas flow meters as essential components in next-generation high-tech manufacturing environments.

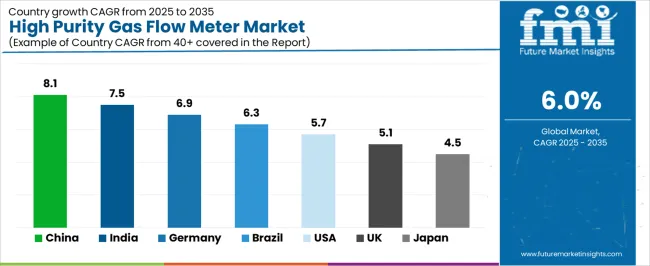

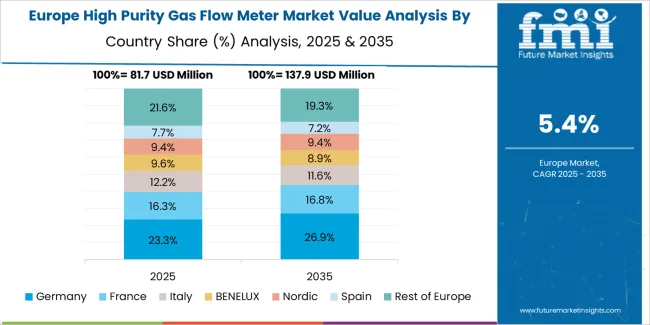

The global high purity gas flow meter market is expanding through 2035, supported by increased investment in semiconductor fabrication, advanced pharmaceutical manufacturing, laboratory automation, and clean-process industries requiring contamination-free gas-flow measurement. China leads with a 8.1% CAGR, followed by India at 7.5%, reflecting strong growth in electronics production and controlled-environment facilities. Germany grows at 6.9%, supported by strict process-control standards. Brazil records 6.3%, driven by modernizing industrial and healthcare infrastructure. The United States grows at 5.7%, while the United Kingdom (5.1%) and Japan (4.5%) maintain stable demand through established precision-manufacturing sectors.

| Country | CAGR (%) |

|---|---|

| China | 8.1 |

| India | 7.5 |

| Germany | 6.9 |

| Brazil | 6.3 |

| USA | 5.7 |

| UK | 5.1 |

| Japan | 4.5 |

China’s market grows at 8.1% CAGR, supported by rapid expansion in semiconductor fabrication, increased investment in pharmaceutical manufacturing, and rising deployment of advanced laboratory-process systems. High purity gas flow meters are used in ultra-clean gas lines, analytical-instrument networks, and contamination-sensitive production environments requiring accurate flow stabilization. Domestic and international suppliers offer stainless-steel, fluoropolymer-lined, and high-precision thermal and mass-flow technologies suited for cleanroom conditions. Growth in electronics assembly, biotech, and gas-distribution skids strengthens long-term procurement. GMP-aligned facilities increase demand for validated and traceable gas-measurement devices.

Key Market Factors:

India’s market grows at 7.5% CAGR, driven by advancing pharmaceutical manufacturing, expansion of biologics facilities, and increased use of high-purity instrumentation in specialty-gas distribution. Facilities in pharma, diagnostics, and chemical-research clusters adopt thermal and mass-flow meters for controlled-environment applications. Semiconductor packaging, specialty-materials processing, and laboratory-automation projects further support adoption. Domestic distributors expand availability of corrosion-resistant and precision-calibrated devices suited for sterile-gas and high-purity utility lines. Regulatory alignment with global manufacturing standards strengthens equipment demand across industry segments.

Market Development Factors:

Germany’s market grows at 6.9% CAGR, supported by strict quality-control expectations, advanced research infrastructure, and strong adoption across pharmaceutical, semiconductor, and analytical-instrumentation sectors. High purity gas flow meters are used in controlled-gas distribution systems requiring stable flow, corrosion-resistant construction, and validated measurement accuracy. German suppliers develop high-grade stainless-steel and precision mass-flow sensors aligned with EU process-compliance guidelines. Increased demand for cleanroom instrumentation in biotechnology and microelectronics reinforces long-term procurement.

Key Market Characteristics:

Brazil’s market grows at 6.3% CAGR, driven by modernization of pharmaceutical plants, increased investment in diagnostic laboratories, and growing use of high-purity gas systems across industrial automation projects. High purity gas flow meters support controlled-gas delivery for sterile production, analytical testing, and specialty-gas applications. Imported stainless-steel and polymer-lined meters dominate supply, while local distributors expand calibration and validation services aligned with regulatory expectations. Growth in industrial modernization and laboratory infrastructure strengthens demand for precision gas-measurement instruments.

Market Development Factors:

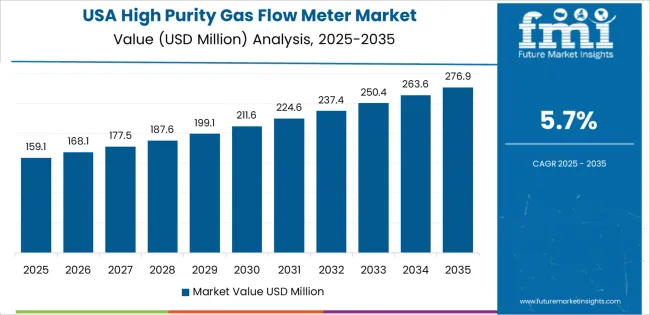

The United States grows at 5.7% CAGR, supported by advanced semiconductor fabrication, strong biotechnology and pharmaceutical production, and widespread laboratory-instrumentation activity. High purity gas flow meters are used in ultra-clean gas networks, controlled-environment reactors, and analytical-instrument setups requiring precise flow regulation. Manufacturers supply mass-flow, thermal-flow, and pressure-compensated designs with high accuracy and low dead-volume characteristics. Increased adoption in microelectronics, biologics, and high-purity gas skids supports consistent equipment replacement cycles across regulated environments.

Key Market Factors:

The United Kingdom’s market grows at 5.1% CAGR, supported by established pharmaceutical manufacturing, expanding biotech research activity, and modernization of laboratory gas-distribution systems. High purity gas flow meters are deployed in GMP-aligned facilities, sterile-manufacturing units, and analytical laboratories requiring contamination-free flow control. Suppliers offer stainless-steel and high-accuracy mass-flow meters compliant with regional regulation. Growth in precision-diagnostics, research centers, and advanced therapy-manufacturing facilities increases long-term adoption.

Market Development Factors:

Japan’s market grows at 4.5% CAGR, supported by strong electronics production, established pharmaceutical capabilities, and consistent use of high-purity instrumentation in cleanroom environments. High purity gas flow meters are deployed in semiconductor-process gases, analytical instruments, and sterile-manufacturing lines requiring accurate and contamination-resistant flow control. Domestic manufacturers focus on compact, corrosion-resistant, and thermally stable flow-measurement devices suited for high-precision operations. Long-standing industrial and research sectors ensure stable procurement cycles.

Key Market Characteristics:

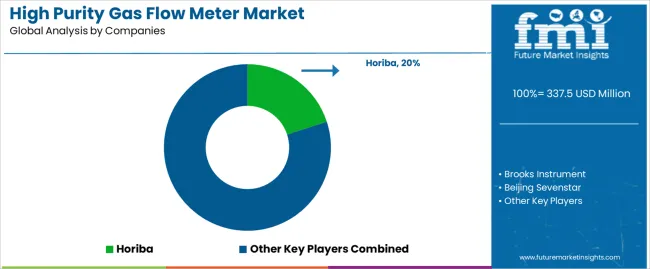

The high purity gas flow meter market is moderately consolidated, with about eighteen manufacturers supplying precision instruments for semiconductor processing, specialty gases, and contamination-sensitive industrial systems. Horiba leads the market with an estimated 20.0% global share, supported by its established mass flow controller technology, stable accuracy under ultra-high-purity conditions, and deep integration with semiconductor fabrication equipment. Its position is reinforced by controlled manufacturing environments and reliable calibration infrastructure.

Brooks Instrument, MKS Instruments, Fujikin, and Bronkhorst follow as major competitors, offering thermal, pressure-based, and Coriolis gas flow meters designed for cleanroom-grade applications. Their competitive strengths include repeatable measurement performance, inert material construction, and compliance with industry standards for advanced gas delivery systems. Azbil, Alicat Scientific, Tokyo Keiso, and Malema (Dover) maintain strong mid-tier roles through instruments optimized for process gases, chemical vapor deposition, and high-precision dosing.

Regional suppliers including Beijing Sevenstar, MK Precision, Kofloc, LINTEC, SONIC Corporation, Sierra Instruments, SONOTEC, Katronic, and Intek (Bionetics) expand market access through cost-efficient production, localized service, and compact models suited to laboratory and pilot-scale installations.

Competition centers on measurement accuracy, contamination control, material purity, calibration stability, and responsiveness to rapid flow changes. Market growth is driven by expansion in semiconductor manufacturing, rising specialty gas consumption, and increased adoption of high-precision, cleanroom-compliant gas flow measurement systems in electronics, pharmaceuticals, and high-purity industrial processes.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Ultrasonic Flow Meters, Thermal Mass Flow Meters, Coriolis Mass Flow Meters, Others |

| Application | Semiconductor, Chemicals, Pharmaceutical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Horiba, Brooks Instrument, Beijing Sevenstar, Fujikin, MKS Instrument, Azbil, MK Precision Co., Ltd., Kofloc, Bronkhorst, LINTEC, Alicat Scientific, FLEXIM, SONIC Corporation, TOKYO KEISO, Malema (Dover), Sierra Instruments, SONOTEC, Katronic, Intek (Bionetics) |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of high-purity gas flow metering technology manufacturers; advancements in ultrasonic, thermal mass, and Coriolis measurement precision; integration with semiconductor fabrication, chemical processing, and pharmaceutical production systems. |

The global high purity gas flow meter market is estimated to be valued at USD 337.5 million in 2025.

The market size for the high purity gas flow meter market is projected to reach USD 604.4 million by 2035.

The high purity gas flow meter market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in high purity gas flow meter market are thermal mass flow meters, ultrasonic flow meters, coriolis mass flow meters and others.

In terms of application, semiconductor segment to command 49.0% share in the high purity gas flow meter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA