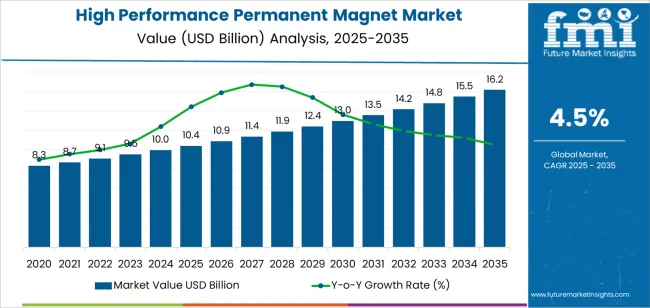

The high performance permanent magnet market is likely to grow from USD 10.4 billion in 2025 to USD 16.2 billion by 2035 at a CAGR of 4.5%, with regional dynamics shaping most of the growth. Asia Pacific dominates global expansion, led by China at 6.1% CAGR and India at 5.6%, driven by the rapid scaling of electric vehicle production, strong industrial-motor manufacturing, and integrated rare-earth mining and processing capabilities. China’s extensive NdFeB supply chain supports traction motors, robotics, wind turbines, and precision electronics. India’s surge in electric two-wheelers, industrial automation, and electronics assembly reinforces steady magnet demand across domestic OEMs.

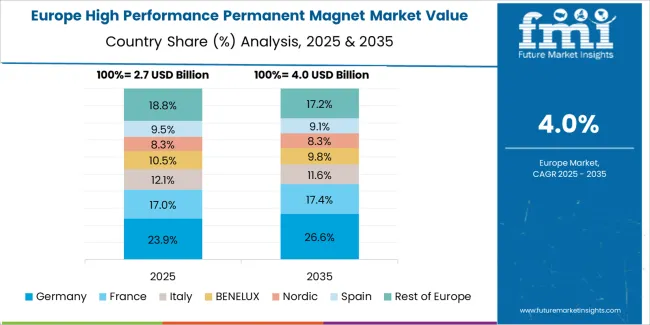

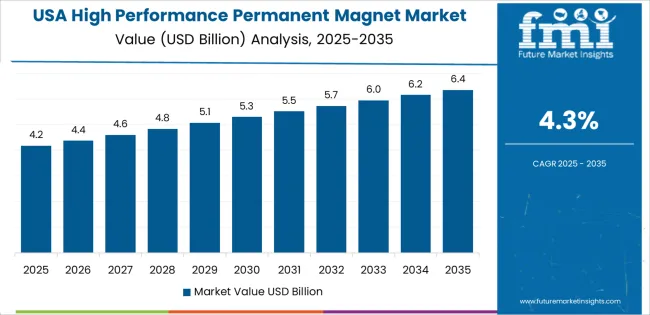

Europe records strong engineering-led adoption, with Germany growing at a 5.2% CAGR as high-performance magnets are embedded in EV drive units, industrial robots, medical systems, and wind-energy generators. Strict quality and performance standards fuel demand for high-coercivity sintered NdFeB and SmCo magnets capable of reliable operation under elevated temperatures. The UK, at 3.8%, shows stable usage across instrumentation, compact motors, and precision devices. North America maintains consistent activity, with the United States growing at a 4.3% CAGR, supported by EV manufacturing, aerospace programs, advanced automation, and efforts to develop domestic rare-earth processing capabilities. High-performance magnets remain central to defense equipment, high-efficiency motors, and robotics platforms. Brazil and broader Latin America advance at a 4.7% CAGR as industrial modernization, renewable energy installations, and increased adoption of motor-driven equipment accelerate demand. Japan, at 3.4% remains a mature, technology-focused market, using high-stability magnet grades across automotive, robotics, and electronics sectors. Collectively, region-specific electrification, automation expansion, and material-technology improvements sustain long-term global market growth through 2035.

Asia Pacific leads global market expansion, driven by strong electric vehicle production, extensive motor manufacturing, and integrated rare earth processing capacity in China. Europe and North America maintain steady demand through developments in renewable energy, precision automation, and advanced drive systems. Key companies include Hitachi Metals Group, Shin-Etsu, TDK, VAC, and Beijing Zhong Ke San Huan Hi-Tech, focusing on material optimization, high-coercivity magnet grades, and stable supply chain management.

The early growth curve, spanning 2025 to 2029, will show steady acceleration driven by rising demand for high-efficiency motors in electric vehicles, industrial automation, and renewable-energy systems. During this period, neodymium-iron-boron (NdFeB) magnets will account for most of the expansion as manufacturers scale production to support electrification and lightweight component design. Supply-chain diversification and improvements in magnet processing will reinforce early adoption.

Between 2030 and 2035, the late growth curve will move into a more stable trajectory as major users reach mature deployment levels. Growth will slow slightly as EV penetration stabilizes in developed markets and wind-turbine procurement cycles normalize. Demand will shift toward replacement, performance optimization, and next-generation magnet designs with reduced reliance on heavy rare earth elements. Industrial and robotics applications will continue to provide incremental gains. The comparison reflects a transition from technology-intensive acceleration to steady, application-driven maturity supported by long product lifecycles and consistent use of high-performance magnets across advanced manufacturing and energy systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 10.4 billion |

| Market Forecast Value (2035) | USD 16.2 billion |

| Forecast CAGR (2025-2035) | 4.5% |

The high performance permanent magnet market is growing as industries increasingly require compact, efficient and powerful magnetic components for electric motors, renewable energy systems and advanced automation. Rare-earth magnets, such as neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo), deliver superior magnetic strength, thermal stability and energy density compared to conventional ferrite or alnico materials. This allows manufacturers to reduce motor size, increase torque and improve system efficiency across electric vehicles, wind turbines and industrial robots.

Further growth is driven by global electrification trends, demand for lightweight designs in mobility applications and expanded use of automation in manufacturing processes. Simultaneously, delays or disruptions in supply of rare-earth elements and strategic material sourcing heighten the value of advanced magnet technology and encourage investment in production capacity closer to end markets. The market faces constraints such as high raw-material cost, dependency on rare-earth supply chains and technical complexity in manufacturing. Regional regulatory scrutiny and trade controls may also influence adoption and manufacturing investment.

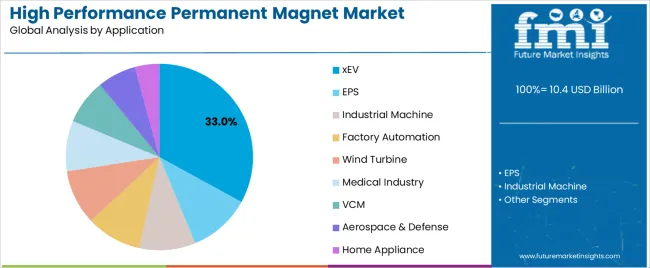

The high performance permanent magnet market is segmented by product type and application. By product type, the market includes sintered magnets and hot-pressed magnets. Applications span xEV, EPS, industrial machinery, factory automation, wind turbines, medical industry, VCM, aerospace and defense, and home appliances. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

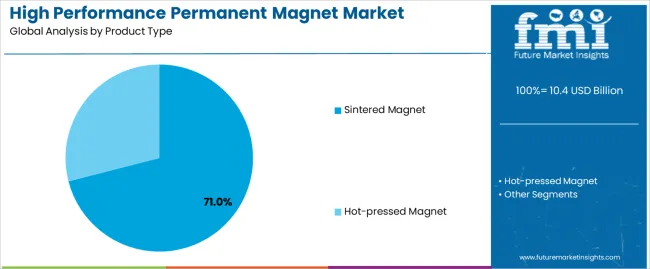

The sintered magnet segment represents the leading category in the high performance permanent magnet market, accounting for an estimated 71.0% of total market share in 2025. Sintered magnets, especially NdFeB grades, deliver high magnetic energy density, strong coercivity, and thermal stability, making them essential for traction motors, servo drives, wind generators, and high-precision industrial systems.

Their dominance is reinforced by extensive deployment across electric mobility, advanced automation, and renewable energy technologies requiring consistent high-performance magnetic output. The hot-pressed magnet segment, estimated at 29.0%, serves applications requiring improved mechanical strength, isotropic properties, and thin-wall shaping flexibility used in compact motors, sensors, and specialized aerospace systems.

Key factors supporting the sintered magnet segment include:

The xEV (electric vehicle) segment accounts for approximately 33.0% of the high performance permanent magnet market in 2025. Electric traction motors, on-board compressors, steering motors, and powertrain auxiliaries require strong NdFeB and high-coercivity magnet grades to support energy efficiency and compact motor architectures.

The EPS (electric power steering) segment follows with an estimated 14.0%, supported by rising adoption of steer-by-wire and electric assist systems. Industrial machinery represents about 13.0%, driven by servo motors and precision drive systems. Factory automation holds roughly 11.0%, tied to robotics, conveyors, and automated tooling. Wind turbines account for an estimated 9.0%, using high-strength magnets in direct-drive generators. The medical industry represents 7.0%, with magnets used in imaging and surgical devices. VCM (voice coil motors) contributes about 6.0%, followed by aerospace and defense at 4.0% and home appliances at 3.0%.

Primary dynamics driving demand from the xEV segment include:

Growing demand for advanced electric motors, expansion of renewable energy systems, and increased use of compact high-efficiency components are driving market growth.

The High Performance Permanent Magnet Market is expanding as industries adopt motors and generators that require strong magnetic fields, stable performance, and compact designs. Electric vehicles, industrial automation, robotics, and consumer electronics rely on permanent magnets to improve torque density, reduce energy consumption, and enhance operational reliability. Wind turbine generators are another major driver, as modern turbine designs depend on rare earth magnets with high coercivity and temperature stability. The shift toward electrification across transport and manufacturing strengthens long-term demand. Manufacturers are improving magnet performance through grain-boundary engineering, advanced sintering, and refined alloy compositions designed to maintain magnetic strength under high thermal and mechanical loads.

Price volatility in rare earth elements, geopolitical supply concentration, and technical challenges in high-temperature environments are restraining adoption.

High performance magnets often rely on neodymium, dysprosium, terbium, and other rare earth elements with volatile pricing and geographically concentrated mining operations. Supply risk and trade restrictions increase procurement uncertainty for manufacturers. Some magnets lose coercivity under high operating temperatures, requiring costly additives or engineered microstructures to maintain performance in electric motors and aerospace applications. Recycling rates for rare earth magnets remain low, which raises environmental and cost concerns. High material and processing costs also limit adoption in price-sensitive sectors that depend on lower-cost ferrite or bonded magnet alternatives.

Growth in magnet recycling, development of heavy rare earth free compositions, and wider use in emerging electric mobility markets are shaping industry trends.

Manufacturers are investing in recycling processes that recover rare earth elements from end-of-life motors and electronics, improving supply resilience and reducing environmental impact. Research into magnet chemistries that reduce or eliminate heavy rare earth elements is gaining momentum to limit supply chain exposure and lower production costs. Rapid expansion in electric scooters, drones, small electric machinery, and compact robotics is widening the application base for high performance permanent magnets. Improvements in additive manufacturing and advanced coating technologies are also enhancing durability, thermal stability, and corrosion resistance, supporting continued global market growth.

The global high performance permanent magnet market is expanding through 2035, supported by increased use of rare-earth magnet materials, growing adoption of electric motors, and rising demand from automotive, electronics, and industrial-equipment sectors. China leads with a 6.1% CAGR, followed by India at 5.6%, reflecting strong manufacturing growth and expanding demand for high-efficiency magnet systems. Germany grows at 5.2%, supported by regulated engineering standards and advanced motor applications. Brazil records 4.7%, driven by industrial modernization. The United States grows at 4.3%, while the United Kingdom (3.8%) and Japan (3.4%) maintain stable demand across electronics, robotics, and precision-motor applications.

| Country | CAGR (%) |

|---|---|

| China | 6.1 |

| India | 5.6 |

| Germany | 5.2 |

| Brazil | 4.7 |

| USA | 4.3 |

| UK | 3.8 |

| Japan | 3.4 |

China’s market grows at 6.1% CAGR, supported by its dominant rare-earth mining capacity, extensive magnet manufacturing infrastructure, and increasing use of high-strength neodymium and samarium–cobalt magnets in electric motors and industrial automation. Automotive electrification strengthens demand for high-coercivity magnets used in traction motors, battery systems, and auxiliary components. Electronics, renewable-energy systems, and robotics add to consistent consumption of high performance magnet materials. Domestic producers refine alloy quality, grain-boundary technology, and corrosion-resistant coatings to meet advanced industrial requirements. Broader investments in high-efficiency motor production reinforce long-term demand.

Key Market Factors:

India’s market grows at 5.6% CAGR, driven by expansion in automotive manufacturing, growth in electronics assembly, and increased deployment of high-efficiency motors across industrial sectors. Demand rises for neodymium and samarium–cobalt magnets used in actuators, sensors, electric mobility systems, and precision motors. Domestic producers and assemblers expand product lines using imported rare-earth materials and locally fabricated magnet components. Growth in renewable-energy installations, electric two-wheelers, and automation equipment strengthens market activity. Increased participation of small and mid-sized manufacturers enhances availability of high-performance magnet assemblies.

Market Development Factors:

Germany’s market grows at 5.2% CAGR, supported by precision engineering, strong automotive and industrial motor production, and strict quality standards for magnetic materials. High performance permanent magnets are used in electric drive systems, robotics, automation units, and medical devices requiring stability and thermal resistance. Manufacturers integrate advanced neodymium and samarium–cobalt magnets into motors designed for high efficiency and regulated performance. German engineering firms emphasize reliability, dimensional stability, and consistent magnetic flux for industrial applications. Adoption increases through renewable-energy systems, particularly wind-power generators.

Key Market Characteristics:

Brazil’s market grows at 4.7% CAGR, driven by industrial modernization, increased automation across manufacturing sectors, and rising consumption of electric motors in equipment and appliances. High performance permanent magnets are adopted in motor-driven systems, transportation equipment, and industrial tools requiring compact and efficient magnetic components. Import-driven supply chains distribute neodymium and ferrite magnets used in consumer electronics and machinery. Renewable-energy installations, including localized wind-power projects, support additional demand. Expansion of industrial machinery refurbishment contributes to recurring magnet replacement needs.

Market Development Factors:

The United States grows at 4.3% CAGR, supported by broad adoption of high-strength magnets in electric vehicles, aerospace systems, industrial automation, and consumer electronics. Precision motors, actuators, and control systems rely on high-coercivity neodymium and samarium–cobalt magnets for durability and thermal resistance. Manufacturers invest in domestic magnet-processing capabilities to reduce reliance on imported rare-earth materials. Increased development of high-efficiency motors, robotics platforms, and advanced manufacturing systems strengthens market activity. Growth in renewable-energy equipment and defense applications supports consistent procurement.

Key Market Factors:

The United Kingdom’s market grows at 3.8% CAGR, supported by steady adoption of high-performance magnets in electronics, medical devices, and compact industrial motors. Companies use neodymium and samarium–cobalt magnets in robotics, instrumentation, and energy-efficient drive systems. R&D activity in advanced manufacturing encourages development of magnet assemblies for lightweight and precision-controlled applications. Increased use of electric mobility solutions, including e-bikes and compact transport devices, reinforces demand. Supply chains rely on imported rare-earth materials integrated into domestic assembly operations.

Market Development Factors:

Japan’s market grows at 3.4% CAGR, supported by advanced motor manufacturing, strong electronics production, and consistent use of high-performance magnets in precision-engineering applications. Automotive, robotics, and industrial machinery manufacturers rely on neodymium and samarium–cobalt magnets for compact, high-efficiency motor designs. Domestic producers refine magnet coatings, grain structures, and thermal-stability characteristics to support high-performance applications. High demand for precision actuators, sensors, and servo motors strengthens adoption. Established manufacturing sectors ensure steady replacement cycles for magnetic components.

Key Market Characteristics:

The high performance permanent magnet market is moderately consolidated, with roughly eighteen manufacturers supplying rare-earth magnets for automotive, electronics, and industrial applications. Hitachi Metals Group leads the market with an estimated 20.0% global share, supported by established NdFeB technology, controlled production processes, and long-standing relationships with global OEMs. Its position is reinforced by documented material consistency and reliable high-temperature performance.

Shin-Etsu, TDK, and VAC follow as major competitors, offering sintered and bonded magnet grades suited to electric motors, sensors, and precision devices. Their competitive strengths include stable magnetic properties, optimized coercivity, and adherence to international standards for high-performance applications. Beijing Zhong Ke San Huan Hi-Tech, Yunsheng Company, YSM, and JL MAG maintain strong positions in China through large-scale NdFeB production, regional supply capability, and cost-efficient manufacturing aligned with high-growth electric mobility sectors.

Mid-tier producers such as ZHmag, Jingci Material Science, AT&M, NBJJ, and Innuovo Magnetics contribute to domestic and export supply with application-specific magnet grades for consumer electronics and industrial automation. SGM, Zhejiang Zhongyuan Magnetic, Earth-Panda, Daido Electronics, and Tianhe Magnetics expand market diversity, offering specialized compositions and coated magnets for demanding thermal and corrosion environments.

Competition in this market centers on magnetic strength, temperature stability, corrosion resistance, and supply reliability. Growth is driven by rising demand in electric vehicles, renewable energy systems, and miniaturized electronics requiring high-performance rare-earth magnets with consistent long-term operating properties.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Sintered Magnet, Hot-pressed Magnet |

| Application | xEV, EPS, Industrial Machine, Factory Automation, Wind Turbine, Medical Industry, VCM, Aerospace & Defense, Home Appliance |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Hitachi Metals Group, Shin-Etsu, TDK, VAC, Beijing Zhong Ke San Huan Hi-Tech, Yunsheng Company, YSM, JL MAG, ZHmag, Jingci Material Science, AT&M, NBJJ, Innuovo Magnetics, SGM, Zhejiang Zhongyuan Magnetic, Earth-Panda, Daido Electronics, Tianhe Magnetics |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of high-performance permanent magnet manufacturers; advancements in rare-earth magnet processing, sintering, and hot-press technologies; integration with electric vehicles, automation equipment, renewable energy systems, and advanced aerospace components. |

The global high performance permanent magnet market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the high performance permanent magnet market is projected to reach USD 16.2 billion by 2035.

The high performance permanent magnet market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in high performance permanent magnet market are sintered magnet and hot-pressed magnet.

In terms of application, xev segment to command 33.0% share in the high performance permanent magnet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA