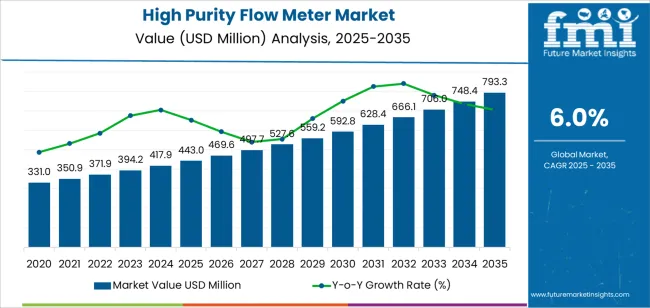

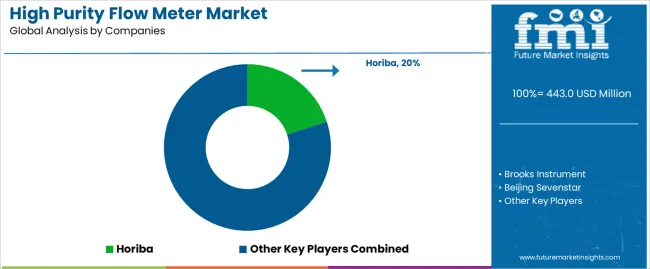

The high purity flow meter market is forecast to grow from USD 443.0 million in 2025 to USD 793.3 million by 2035, at a CAGR of 6.0%, with regional demand patterns shaping overall expansion. Asia Pacific remains the largest contributor to growth, supported by rapid semiconductor-fabrication investments across China, South Korea, Taiwan, and Japan. High-purity gas and fluid metering systems are installed across chip-manufacturing lines handling deposition gases, etching chemicals, CMP slurries, and ultrapure water, emphasizing particle-free construction, digital calibration, and corrosion-resistant pathways. Pharmaceutical and biotechnology facilities in India and Southeast Asia strengthen adoption as single-use bioprocessing expands and regulatory frameworks emphasise traceable, contamination-free fluid handling.

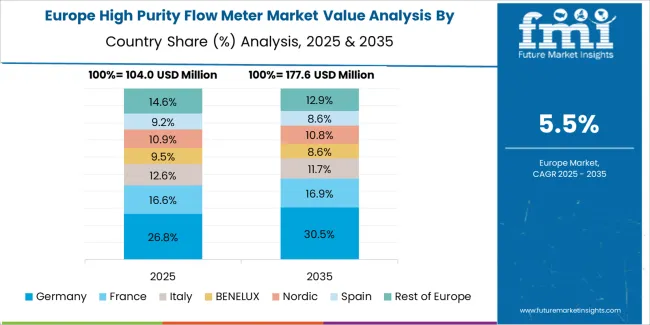

North America maintains a stable demand, driven by mature semiconductor fabs, biologics facilities, and high-spec clean-process environments. Upgrades in ultrapure-water plants, advanced therapy manufacturing, and analytical-lab workflows support consistent procurement of high-accuracy mass, Coriolis, and ultrasonic meters. Replacement cycles intensify as GMP alignment, audit expectations, and calibration traceability become stricter across industrial and research installations. Europe advances through regulated clean-process industries, particularly in Germany, the Netherlands, Ireland, and Switzerland. Biopharmaceutical producers use electropolished stainless-steel and fluoropolymer meters for sterile media, buffer handling, and filling operations, while the semiconductor and specialty-chemical sectors rely on high-purity gas metering for controlled-environment processing.

Asia Pacific leads global market growth, driven by expanding semiconductor capacity and pharmaceutical manufacturing in China, South Korea, Taiwan, and Japan. Europe and North America maintain strong demand through established cleanroom industries and continuous technological upgrades. Key manufacturers include Horiba, Brooks Instrument, Beijing Sevenstar, Fujikin, MKS Instrument, Azbil, and MK Precision, focusing on measurement precision, contamination control, and integration with advanced process control systems.

The growth contribution index shows that semiconductor manufacturing will account for the largest share of incremental expansion during the early period from 2025 to 2029. Demand will be driven by precise flow-control requirements in chip fabrication, where contamination-free fluid handling is essential for deposition, etching, and cleaning processes. Biopharmaceutical production will also contribute significantly as facilities expand single-use systems and high-purity process lines.

Between 2030 and 2035, contributions will broaden across pharmaceuticals, specialty chemicals, and high-accuracy laboratory applications. Replacement cycles will gain weight as manufacturers update metering technologies to maintain compliance with purity, calibration, and traceability standards. Regional contributions will remain led by Asia Pacific due to concentrated semiconductor investment, while North America and Europe will add steady gains through regulated bioprocessing and analytical workflows. The overall contribution index reflects a market shaped by precision requirements, contamination-control standards, and steady integration of high-purity metering technologies across advanced industrial and laboratory environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 443.0 million |

| Market Forecast Value (2035) | USD 793.3 million |

| Forecast CAGR (2025-2035) | 6.0% |

The high performance permanent magnet market is growing because industries are requiring magnetic materials that provide greater power density, thermal stability and energy efficiency in compact and demanding applications. Rare-earth magnets such as neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo) provide significantly higher magnetic strength compared to ferrite or alnico, enabling smaller motor and generator designs in electric vehicles, wind turbines and industrial automation. Surveys indicate that continuing electrification of transport, renewable energy adoption and sophisticated motion control systems drive magnet demand.

Supply-chain focus on rare-earth sourcing and magnet fabrication capacity is motivating investment in localised manufacturing. At the same time, the push for lightweight and efficient designs in aerospace and mobility applications enhances the requirement for advanced permanent magnets. Constraints include high cost of raw rare-earth materials, geopolitical risks associated with rare-earth mining and processing, and technical challenges in maintaining magnet performance under high temperatures.

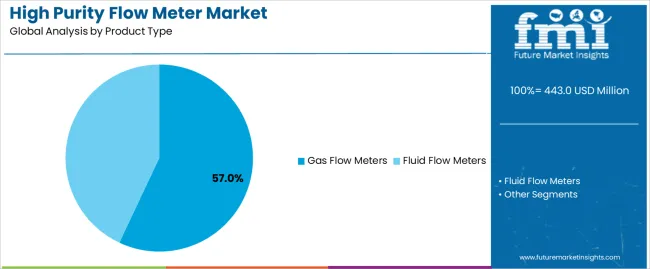

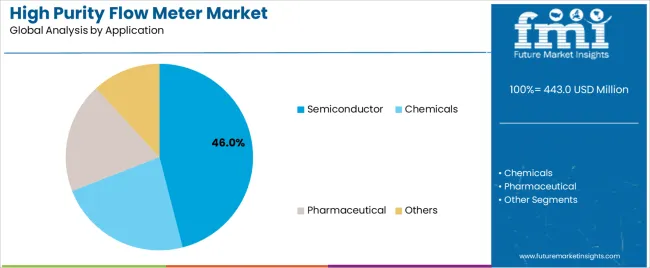

The high purity flow meter market is segmented by product type and application. By product type, the market includes gas flow meters and fluid flow meters. Based on application, it is categorized into semiconductor, chemicals, pharmaceutical, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

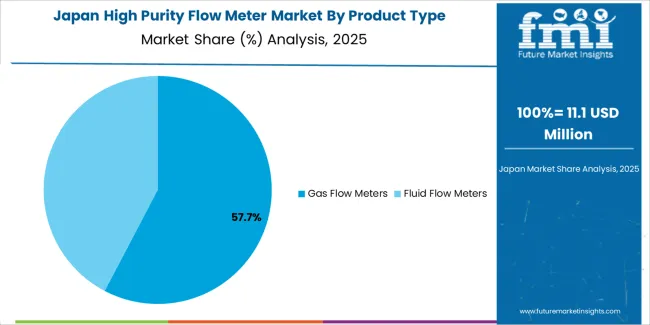

The gas flow meters segment holds the leading position in the high purity flow meter market, representing an estimated 57.0% of total market share in 2025. Gas flow meters are essential in environments requiring ultra-clean gas handling, including semiconductor fabrication, pharmaceutical sterile processing, and chemical vapor delivery. These meters maintain high accuracy at low flow rates and are constructed with contamination-resistant materials suited for high-purity gas distribution.

The fluid flow meters segment, estimated at 43.0%, serves applications involving ultrapure water systems, high-purity solvents, and chemical delivery lines used in microelectronics, life sciences, and specialty chemical processing.

Key factors supporting the gas flow meters segment include:

The semiconductor segment accounts for approximately 46.0% of the high purity flow meter market in 2025. Semiconductor manufacturing requires strict contamination control for processes such as chemical vapor deposition, etching, ultrapure water distribution, and process gas delivery. High purity flow meters ensure stable, traceable, and repeatable flow measurement in these critical steps.

The chemicals segment follows with an estimated 23.0%, supported by demand in high-purity chemical delivery and specialized production lines. The pharmaceutical segment accounts for roughly 19.0%, reflecting use in sterile processing, biologics manufacturing, and ultrapure water systems. The others category, representing about 12.0%, includes research laboratories, optical coating production, and precision manufacturing.

Primary dynamics driving demand from the semiconductor segment include:

The high purity flow meter market is expanding as industries require accurate and contamination-resistant flow measurement for ultrapure water, high-grade chemicals, and clean gases. Semiconductor fabrication depends on high purity flow meters to manage etching chemicals, photoresists, CMP slurries, and process gases under strict purity and precision standards. Biopharmaceutical and cell-culture production facilities use these instruments to regulate media, buffers, and critical process fluids where even minor impurities affect product quality. Growth in advanced materials, specialty chemicals, and clean energy systems strengthens adoption of flow meters constructed from high-purity polymers, stainless steels, and corrosion-resistant alloys. Improvements in sensor design, digital calibration, and high-resolution measurement support wider use in mission-critical production environments.

High purity flow meters are more expensive than conventional meters due to advanced materials, precision machining, and stringent contamination-control standards. Installation often requires specialised fittings, cleanroom handling protocols, and certified technicians to maintain purity integrity, increasing deployment complexity. Some high-performance chemicals used in semiconductor and pharmaceutical operations can degrade certain flow meter materials, requiring frequent upgrades or specific material grades that add to cost. Smaller facilities with constrained budgets may rely on lower specification meters, slowing adoption in cost-sensitive markets.

Biopharmaceutical manufacturers are adopting single-use flow meters compatible with disposable process lines to reduce cleaning and contamination risks. Regional semiconductor investment in South Korea, Taiwan, Japan, and the United States is driving strong demand for high purity fluid-handling components. Digital technologies, including IoT-enabled diagnostics, real-time flow analytics, and automated calibration modules, are becoming standard in advanced manufacturing environments. These developments support increased reliability and precision, reinforcing the long-term growth trajectory of high purity flow meter solutions across multiple high-tech industries.

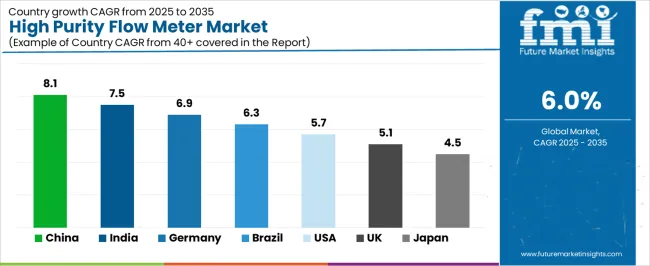

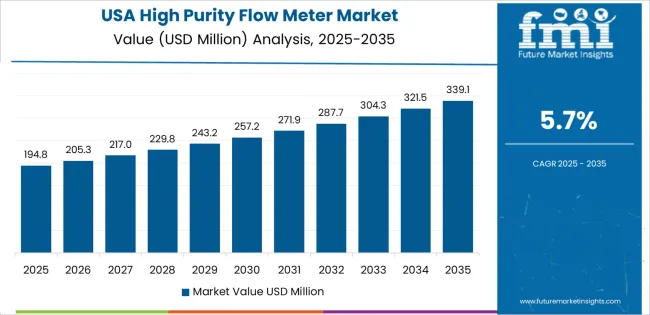

The global high purity flow meter market is expanding through 2035, supported by rising demand for contamination-free measurement systems in pharmaceuticals, biotechnology, semiconductor manufacturing, and precision chemical processing. China leads with a 8.1% CAGR, followed by India at 7.5%, reflecting strong investment in life-science manufacturing and controlled-environment production facilities. Germany grows at 6.9%, supported by strict regulatory standards and advanced instrumentation requirements. Brazil records 6.3%, driven by modernization of pharmaceutical and industrial plants. The United States grows at 5.7%, while the United Kingdom (5.1%) and Japan (4.5%) maintain stable demand through established clean-process industries and consistent equipment replacement cycles.

| Country | CAGR (%) |

|---|---|

| China | 8.1 |

| India | 7.5 |

| Germany | 6.9 |

| Brazil | 6.3 |

| USA | 5.7 |

| UK | 5.1 |

| Japan | 4.5 |

China’s market grows at 8.1% CAGR, supported by expanding pharmaceutical production, rapid semiconductor-fabrication development, and increased investment in biotechnology facilities requiring contamination-controlled fluid-measurement equipment. High purity flow meters are used in ultrapure water systems, chemical-delivery lines, and process environments where precision and material compatibility are essential. Domestic manufacturers and global suppliers offer fluoropolymer, stainless-steel, and ceramics-based flow meters designed for high-cleanliness pipelines. Growth in biologics manufacturing and electronics assembly strengthens demand for high-accuracy instruments. The expansion of GMP-aligned facilities increases procurement of certified flow-measurement devices.

Key Market Factors:

India’s market grows at 7.5% CAGR, driven by expansion in life-sciences manufacturing, growth in biologics and vaccine production, and rising demand for precision instrumentation in clean-process environments. High purity flow meters are used in water-for-injection systems, sterile processing lines, and controlled-flow pharmaceutical equipment. Domestic pharmaceutical clusters adopt advanced flow-measurement systems to meet regulatory requirements. Semiconductor assembly, specialty chemicals, and laboratory-process automation contribute to growing consumption. Suppliers offer polymer-lined and stainless-steel meters suited for sanitary and corrosive environments.

Market Development Factors:

Germany’s market grows at 6.9% CAGR, supported by stringent process-control standards and widespread adoption of high-precision instrumentation across pharmaceutical, biotechnology, and semiconductor industries. High purity flow meters are used in sterile fluid-handling systems, ultrapure-water distribution, and chemical-delivery pipelines requiring accuracy and documented cleanliness. German suppliers develop sensors constructed from electropolished stainless steel and high-grade polymers designed for strict hygienic standards. Demand increases in advanced manufacturing facilities where reliability, compliance, and traceable performance documentation are essential.

Key Market Characteristics:

Brazil’s market grows at 6.3% CAGR, driven by modernization of pharmaceutical plants, increased investment in clean-process systems, and rising adoption of precision flow-measurement equipment. High purity flow meters support sterile production, purified-water systems, and controlled-chemical distribution in pharmaceutical and food-processing environments. Imported polymer-lined and stainless-steel meters dominate supply, while local distributors expand service networks for calibration and validation support. Growth in industrial automation and regulatory alignment with international standards increases the use of contamination-control instrumentation.

Market Development Factors:

The United States grows at 5.7% CAGR, supported by mature semiconductor fabrication, advanced pharmaceutical manufacturing, and strong biotechnology research activity. High purity flow meters are used in ultrapure-water plants, clean-chemical delivery systems, and sterile production environments. Manufacturers introduce meters with high-accuracy sensors, low dead-volume designs, and materials engineered for cleanroom compliance. Increased demand for process repeatability in biologics, microelectronics, and laboratory automation strengthens adoption. Replacement cycles remain steady across regulated industries maintaining validated equipment.

Key Market Factors:

The United Kingdom’s market grows at 5.1% CAGR, supported by established pharmaceutical and biotechnology industries and consistent modernization of clean-process systems. High purity flow meters are used in sterile production lines, research laboratories, purified-water pipelines, and controlled-chemical dispensing. Suppliers offer sanitary-certified stainless-steel and fluoropolymer meters aligned with regional regulatory expectations. Growth in advanced therapy manufacturing, analytical laboratories, and process-control upgrades supports steady equipment demand.

Market Development Factors:

Japan’s market grows at 4.5% CAGR, supported by precision manufacturing, strong pharmaceutical activity, and widespread demand for contamination-free flow-measurement technologies. High purity flow meters are integrated into semiconductor-water systems, clean-chemical lines, and sterile production equipment requiring accurate, low-contamination fluid control. Domestic manufacturers emphasize compact, corrosion-resistant designs and high-accuracy sensors suited for controlled-environment processes. Growth in electronics, medical-device production, and fine-chemical industries supports continued adoption.

Key Market Characteristics:

The high purity flow meter market is moderately consolidated, with about eighteen manufacturers supplying precision instruments for semiconductor, pharmaceutical, and high-spec industrial processes. Horiba leads the market with an estimated 20.0% global share, supported by its strong position in semiconductor mass flow technology, stable measurement accuracy, and long-term integration with wafer fabrication equipment. Its leadership is reinforced by cleanroom-compliant designs and consistent performance in ultra-high-purity gas and liquid systems.

Brooks Instrument, MKS Instruments, Fujikin, and Bronkhorst follow as major competitors, offering high-precision thermal, Coriolis, and pressure-based flow meters designed for contamination-sensitive applications. Their competitive strengths include repeatable flow control, robust calibration protocols, and adherence to industry standards for high-purity materials handling. Azbil, Alicat Scientific, Tokyo Keiso, and Malema (Dover) maintain strong mid-tier positions, serving semiconductor and biotech facilities with instruments optimized for chemical delivery, slurry monitoring, and ultrapure water systems.

Regional suppliers such as Beijing Sevenstar, MK Precision, Kofloc, LINTEC, SONIC Corporation, Sierra Instruments, SONOTEC, Katronic, and Intek (Bionetics) expand market access through cost-efficient designs, ultrasonic measurement options, and localized service networks.

Competition centers on measurement stability, contamination control, calibration accuracy, material compatibility, and responsiveness to process variations. Market growth is driven by rising semiconductor fabrication capacity, stricter purity standards in advanced manufacturing, and increased adoption of non-contact and high-precision flow measurement technologies for critical process environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Gas Flow Meters, Fluid Flow Meters |

| Application | Semiconductor, Chemicals, Pharmaceutical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Horiba, Brooks Instrument, Beijing Sevenstar, Fujikin, MKS Instrument, Azbil, MK Precision Co., Ltd., Kofloc, Bronkhorst, LINTEC, Alicat Scientific, FLEXIM, SONIC Corporation, TOKYO KEISO, Malema (Dover), Sierra Instruments, SONOTEC, Katronic, Intek (Bionetics) |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of high-purity flow measurement technology providers; advancements in ultra-clean gas and fluid flow measurement for semiconductor and pharmaceutical applications; integration with precision manufacturing, chemical processing, and advanced instrumentation systems. |

The global high purity flow meter market is estimated to be valued at USD 443.0 million in 2025.

The market size for the high purity flow meter market is projected to reach USD 793.3 million by 2035.

The high purity flow meter market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in high purity flow meter market are gas flow meters and fluid flow meters.

In terms of application, semiconductor segment to command 46.0% share in the high purity flow meter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA