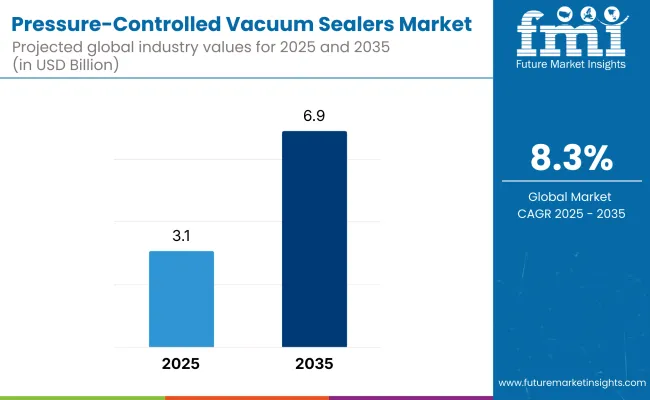

The pressure-controlled vacuum sealers market is projected to grow from USD 3.1 billion in 2025 to USD 6.9 billion by 2035, registering a total gain of USD 3.8 billion over the forecast period. This reflects a 122.6% overall expansion, with the market achieving a compound annual growth rate (CAGR) of 8.3%. Over the ten-year span, the market is expected to grow by a 2.2 multiple.

| Metric | Value |

|---|---|

| Estimated Value in (2025 E) | USD 3.1 billion |

| Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

In the first half of the decade (2025 to 2030), the market expands from USD 3.1 billion to USD 4.6 billion, contributing USD 1.5 billion, or 39.5% of the total decadal growth. This phase is driven by increased demand from premium food packaging, aerospace components, and medical devices, where pressure precision is critical for preserving product integrity. Bench-top and chamber sealers with programmable pressure control gain popularity due to their flexibility and reduced operator dependency.

In the second half (2030 to 2035), the market grows from USD 4.6 billion to USD 6.9 billion, contributing USD 2.3 billion, or 60.5% of the decade’s growth. Growth accelerates due to broader adoption in automated vacuum lines, pharmaceutical serialization, and high-value electronics, where real-time vacuum monitoring and dynamic pressure regulation are mandatory. Software-integrated sealers, IoT-enabled diagnostics, and compatibility with recyclable barrier materials drive significant value creation in this phase.

From 2020 to 2024, the pressure-controlled vacuum sealers market grew from USD 2.1 billion to USD 2.8 billion, driven by hardware-centric adoption in the food processing, pharmaceutical, and medical device packaging sectors, where precise air extraction and seal consistency are critical.

During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of the revenue, with leaders such as Avid ARMOR, VAC Master, Nesco, and AmeriVacS Manufacturing, Inc. focusing on chamber-based and external vacuum systems with programmable pressure cycles.

Competitive differentiation relied on vacuum pressure precision, multi-bag compatibility, and hygienic design, while digital control modules were commonly bundled as auxiliary features rather than standalone revenue streams. Service-based models including calibration, seal testing, and maintenance subscriptions accounted for less than 10% of the market value, as end-users favored capital expenditure models.

Demand for pressure-controlled vacuum sealers will expand to USD 6.9 billion in 2035, and the revenue mix will shift as sensor-based monitoring, cloud integration, and aftermarket services grow to over 40% share. Traditional sealing equipment manufacturers face growing competition from automation-forward players offering smart diagnostics, adaptive pressure algorithms, and IoT-enabled dashboards.

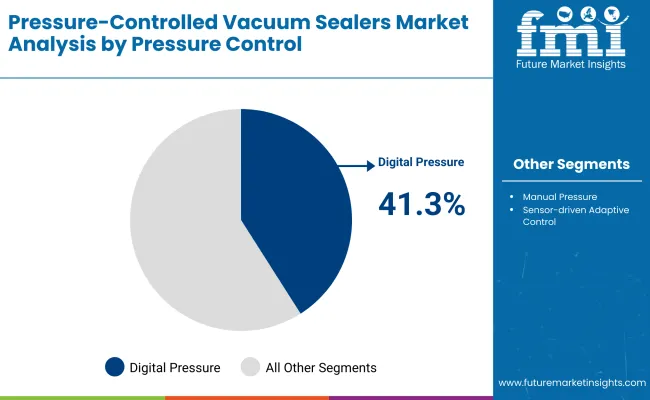

The market is segmented by chamber type, pressure control, sealing type, application, end-use industry, and region. Chamber type includes external vacuum, single chamber, double chamber, and inline conveyor systems, supporting varying throughput needs from low-volume operations to high-speed production lines. Pressure control segmentation features manual pressure setting, digital pressure programming, and sensor-driven adaptive control, enabling precise vacuum regulation for sensitive products and automated workflows.

Based on sealing type, the market includes single seal, double seal, and gas flush option configurations, ensuring extended shelf-life, leak prevention, and modified atmosphere packaging (MAP) compatibility. Application areas comprise perishables, medical instruments, and electronics packaging, where vacuum sealing enhances product protection, hygiene, and preservation.

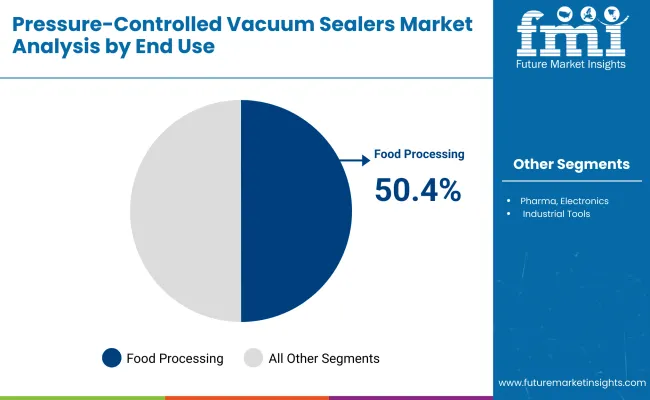

End-use industries include food processing, pharma, electronics, and industrial tools, each with unique sealing standards and contamination control requirements. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The single chamber segment is expected to account for the highest share of 43.8% in 2025 in the pressure-controlled vacuum sealers market. This dominance stems from the wide adoption of single chamber systems in small to mid-scale operations requiring precise vacuum pressure control with a compact footprint. These machines offer significant benefits including lower operational costs, simplified maintenance, and adjustable vacuum cycles that make them ideal for sealing delicate or perishable items under controlled pressure environments.

The popularity of single chamber vacuum sealers is particularly strong among small food processors, specialty meat packers, and contract manufacturers, where space efficiency and cost-to-performance ratio are crucial. Moreover, the integration of digital pressure sensors and programmable sealing profiles enhances the appeal of these systems in regulated industries like pharmaceuticals and high-end food production. As demand rises for precision vacuum packaging of both solid and liquid products, the single chamber format is expected to remain a top choice for its adaptability.

The food processing segment is projected to lead the end-use industry category with a 50.4% share in 2025, driven by the increasing need to extend product shelf life, minimize oxidation, and maintain hygienic standards. Vacuum sealing, particularly with pressure-controlled systems, is essential in meat, seafood, dairy, and processed food segments where packaging integrity directly impacts safety and freshness.

Adoption is further propelled by global regulatory mandates and consumer demand for preservative-free, vacuum-sealed products with clean-label attributes. Pressure-controlled sealers ensure consistent evacuation and sealing regardless of product volume or moisture levels, reducing the risk of contamination or spoilage.

These machines also support MAP (Modified Atmosphere Packaging) protocols, which are becoming standard in the chilled and frozen food sectors. With automation and digital control becoming essential in HACCP-compliant food plants, food processors are increasingly investing in pressure-controlled sealing systems to optimize throughput and maintain high quality assurance standards.

The digital pressure programming segment is expected to account for the highest share of 41.3% in 2025 in the pressure-controlled vacuum sealers market. This segment's rise is driven by manufacturers’ growing preference for programmable vacuum cycles that offer granular control over internal pressure settings. Such digital systems ensure uniformity across sealing runs, reduce human error, and are essential in sectors requiring high consistency, such as pharmaceuticals and precision food processing.

The growing shift toward automation and smart packaging systems has accelerated the adoption of digital interfaces that allow operators to store multiple pressure profiles and integrate quality assurance protocols.

The double seal segment is projected to lead the sealing type category with a 46.2% share in 2025. This growth is primarily attributed to the increasing demand for dual-bar or parallel seals that offer higher sealing strength, minimize leak risks, and improve protection against oxygen and moisture ingress. Particularly in vacuum applications, a double seal ensures redundancy and reduces rework or product loss due to seal failure.

Adopted widely in sectors such as industrial food packaging, pharmaceuticals, and vacuum-sealed electronics, the double seal format reinforces product shelf life and hygiene.

The perishables application segment is anticipated to hold a 42.1% share in 2025, making it the dominant end-use in the pressure-controlled vacuum sealers market. The consistent demand for extended shelf life, microbial safety, and oxygen reduction across food categories like meats, dairy, and seafood has driven adoption of vacuum sealing solutions tailored to perishable products.

Vacuum sealers with precise pressure control are instrumental in maintaining the integrity of perishable goods during distribution and cold chain logistics.

Rising demand for extended shelf life, airtight preservation, and precision-controlled packaging across food, pharmaceutical, and electronics sectors is driving the growth of the pressure-controlled vacuum sealers market. These sealers enable accurate pressure regulation during vacuum cycles, ensuring optimal removal of air without damaging delicate products. Growing focus on food waste reduction, freshness retention, and contamination prevention has accelerated their adoption in both industrial and commercial applications.

Programmable and sensor-based vacuum sealers have gained popularity due to their ability to monitor chamber pressure and adjust sealing parameters in real time. This ensures consistent seal quality, especially for moisture-rich or fragile items such as marinated proteins, medical devices, or microelectronic components. Integration with MAP (Modified Atmosphere Packaging) systems and hygienic design standards has further expanded their suitability in cleanroom and food-grade environments.

Industries such as meat processing, ready-to-eat meals, nutraceuticals, and semiconductor packaging are driving demand for machines that provide controlled vacuum profiles, reduce oxidation, and enable compliance with regulatory packaging norms. These sealers support quality assurance, traceability, and material cost savings through repeatable and uniform sealing processes.

Equipment calibration sensitivity and high setup costs slow down wider deployment, even as demand rises in pharmaceuticals, food packaging, electronics, and aerospace for precision-sealing systems that ensure vacuum accuracy, extended shelf life, and product sterility.

Precision Sealing Demand in Regulated and High-value Packaging Applications

Pressure-controlled vacuum sealers are becoming critical in industries that require highly controlled packaging environments, such as pharmaceuticals, biotechnology, medical devices, and high-end food processing. These systems allow operators to precisely regulate pressure levels and vacuum duration during the sealing process, ensuring consistent pack quality, integrity, and sterility. In pharmaceutical blister packs or sterile barrier systems, exact vacuum profiles reduce the risk of microbial ingress and seal failure.

Calibration Complexity and Cost of System Ownership

Despite their performance benefits, pressure-controlled vacuum sealers face adoption barriers due to their technical sophistication and initial investment cost. Achieving and maintaining optimal vacuum profiles requires precision sensors, programmable logic controllers (PLCs), and high-end vacuum pumps driving up capital expenditure.

These systems also need routine calibration and validation, especially in pharmaceutical or aerospace settings where audit readiness is essential. operators must be trained to manage multiple sealing parameters, including vacuum levels, dwell time, and pressure differentials, increasing the learning curve.

Smart Sealing Interfaces and Multi-Recipe Programmable Systems Gaining Adoption

A key trend driving growth in this market is the integration of digital intelligence and recipe-based automation. Manufacturers are equipping vacuum sealers with touchscreen HMIs, pre-set packaging profiles, and IoT connectivity to enable remote diagnostics, real-time process monitoring, and batch traceability. These features improve user control, reduce human error, and support compliance with GMP and HACCP standards. Advanced systems now offer dual-chamber or impulse sealing options for multi-format adaptability.

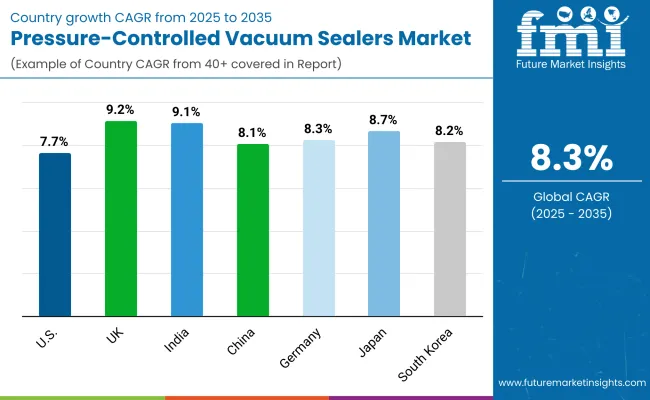

| Country | CAGR |

|---|---|

| USA | 7.7% |

| United Kingdom | 9.2% |

| India | 9.1% |

| China | 8.1% |

| Germany | 8.3% |

| Japan | 8.7% |

| South Korea | 8.2% |

The global pressure-controlled vacuum sealers market is experiencing sustained growth due to rising demand for precision sealing, extended shelf life, and contamination-free storage across pharmaceuticals, diagnostics, perishable foods, and industrial packaging. These systems regulate vacuum pressure precisely to accommodate sensitive contents such as medical devices, electronics, and soft foods.

The UK and India lead in terms of growth due to pharma and diagnostics export packaging. Germany and Japan continue to adopt automated vacuum sealing within GMP-compliant cleanrooms. Meanwhile, China and South Korea are integrating pressure-sensitive vacuum units into high-speed industrial production. The USA market is focused on incorporating programmable pressure profiles and digital compliance features in pharma and electronics sealing.

The USA market for pressure-controlled vacuum sealers is expected to grow at a CAGR of 7.7%, driven by stringent packaging compliance in medical and electronics sectors. These vacuum sealers offer programmable pressure settings and are essential in protecting sensitive devices from stress or oxygen ingress. American OEMs are embedding pressure monitoring sensors and integrating digital interfaces to log sealing events for CFR Part 11 compliance.

The UK market is projected to grow at a CAGR of 9.2%, the highest among developed economies, supported by demand for regulatory-compliant vacuum packaging in biopharma and pathology test kits. British diagnostic exporters are transitioning to pressure-controlled systems to ensure sterile barrier integrity during air transit and long-haul storage. Smart vacuum systems with pressure relief valves and safety seals are also gaining traction.

India’s pressure-controlled vacuum sealers market is forecast to grow at a CAGR of 9.1%, driven by increasing GMP compliance in pharma manufacturing, food exports, and medical kit assembly. These systems are being rapidly adopted by Indian exporters to extend shelf life and prevent contamination in sensitive product flows. Local manufacturers are developing cost-effective digital vacuum sealers for SMEs.

The Chinese market is growing at a CAGR of 8.1%, fueled by fast-evolving industrial packaging standards, electronics manufacturing, and rapid foodservice digitization. Pressure-controlled vacuum sealers are used in applications where thermal stress, oxygen ingress, or seal distortion must be avoided. Chinese integrators are embedding these systems into semi-automated packaging lines across tier-1 and tier-2 cities.

Growth & Expansion of Pressure-Controlled Vacuum Sealers Germany

Germany’s market is projected to expand at a CAGR of 8.3%, owing to high-standard applications in biotechnology, diagnostics, and industrial precision parts packaging. German firms favor high-spec machines with dynamic pressure monitoring, data integrity logging, and contamination risk mitigation. Cleanroom-rated sealers are deployed widely in medical packaging under EU-MDR guidelines.

Japan’s pressure-controlled vacuum sealers market is projected to grow at a CAGR of 8.7%, driven by demand from ultra-clean electronics, biotech labs, and temperature-sensitive foods. Japanese manufacturers emphasize vacuum control accuracy and seal validation data logging. Consumer health and wellness products in soft packaging also benefit from controlled pressure sealing to preserve content integrity.

South Korea is witnessing 8.2% CAGR in pressure-controlled vacuum sealers adoption between 2025 and 2035. Exporters of medical consumables, batteries, and smart food kits are investing in advanced sealing systems. Korea’s smart factory initiatives and automated QMS adoption are creating demand for vacuum sealers with pressure feedback, traceable logs, and robotic compatibility.

The pressure-controlled vacuum sealers market is moderately fragmented, featuring consumer-grade appliance brands, industrial sealer manufacturers, and regional vacuum technology specialists serving food, pharma, electronics, and logistics industries.

Global leaders such as PAC Machinery, Bernhardt SAS, and Boss Vakuum hold significant market share, driven by precision-controlled vacuum cycles, robust chamber construction, and compliance with hygienic and industrial packaging standards. Their strategies increasingly emphasize programmable pressure sensors, gas-flush compatibility, and HACCP/ISO-certified sealing solutions tailored for bulk packaging and high-value perishables.

Established mid-sized players including Avid ARMOR, AmeriVacS Manufacturing, Inc., and PlexPack cater to medium-scale production environments with semi-automatic and automatic pressure-sensitive vacuum sealing units. These firms are expanding adoption through customizable seal bar widths, sensor-based sealing accuracy, and integration with MAP (Modified Atmosphere Packaging) and moisture-sensitive packaging systems.

Key Development of Pressure-Controlled Vacuum Sealers

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| By Chamber Type | External Vacuum, Single Chamber, Double Chamber, and Inline Conveyor |

| By Pressure Control | Manual Pressure Setting, Digital Pressure Programming, and Sensor-driven Adaptive Control |

| By Sealing Type | Single Seal, Double Seal, and Gas Flush Option |

| By Application | Perishables, Medical Instruments, and Electronics Packaging |

| By End-Use Industry | Food Processing, Pharma, Electronics, and Industrial Tools |

| Key Companies Profiled | Avid ARMOR, VAC Master, AmeriVacS Manufacturing, Inc., PAC Machinery, Bernhardt SAS, Boss Vakuum , and PlexPack Corporation |

| Additional Attributes | Growing demand for adjustable pressure sealing in sensitive packaging, adoption of sensor-driven control for precision sealing in pharma and electronics, increasing use of gas flush to extend shelf life of perishables, integration of digital pressure programming for consistent seal quality, rising deployment in medical instrument sterilization packaging, demand from industrial tools packaging to prevent corrosion, strong uptake in double chamber systems for higher throughput, compact designs gaining popularity for small-scale processors, technological advancements in inline conveyor sealers for automation, and expanding adoption in North America and Western Europe driven by food safety and product integrity standards |

The global pressure-controlled vacuum sealers market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the pressure-controlled vacuum sealers market is projected to reach USD 6.9 billion by 2035.

The pressure-controlled vacuum sealers market is expected to grow at a CAGR of 8.3% between 2025 and 2035.

The key product types in the pressure-controlled vacuum sealers market include single chamber sealers, double chamber sealers, external vacuum sealers, and belt-type continuous vacuum sealers.

In terms of product type, the single chamber segment is expected to account for the highest share of 43.8% in the pressure-controlled vacuum sealers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA