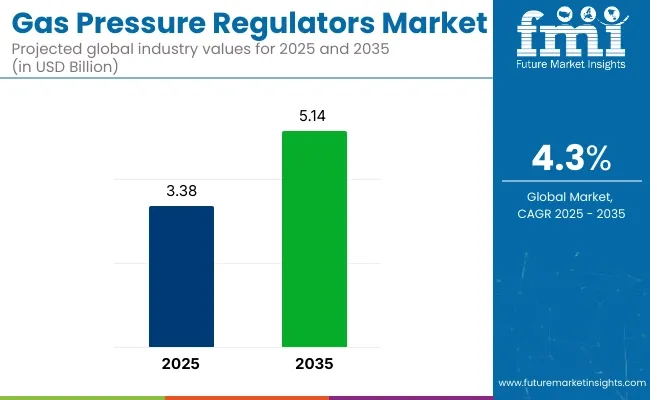

The global gas pressure regulator market is projected to be valued at USD 3.38 billion in 2025, with the market size expected to grow to USD 5.14 billion by 2035, reflecting a CAGR of 4.3%.

This growth is supported by rising urbanization, ongoing investment in gas distribution networks, and increasing regulation of process safety in various industries. The continuous innovation in gas regulators, including features like smart sensing technology, corrosion-resistant components, and greater compatibility for use with a wider range of gases, is enabling the expanded usage of these devices across diverse industries, from oil & gas to HVAC and food processing.

The global gas pressure regulators market is expected to experience consistent growth in the coming decade due to increasing energy requirements across domestic, commercial, and industrial sectors, along with the growing use of natural gas and the development of gas-based infrastructure.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3.38 billion |

| Market Size in 2035 | USD 5.14 billion |

| CAGR (2025 to 2035) | 4.3% |

Gas pressure regulators are essential in safely and efficiently controlling the flow of gases such as industrial gases, propane, and natural gas, ensuring they are regulated to appropriate levels for downstream applications. As the world’s energy system shifts towards cleaner, more efficient energy sources, the application of advanced regulation systems is becoming increasingly important.

Key players in the gas pressure regulators market are also driving innovation with new product offerings and strategic initiatives. Emerson Electric introduced the TESCOM ER5000 series in 2024, which features remote setpoint control and wireless diagnostics.

In 2025, the company deployed hydrogen-ready dome-loaded regulators in demo stations across the EU, contributing to the development of hydrogen infrastructure. The Linde Group expanded its SPECTRA product line in 2024, adding UHP compatibility for semiconductor fabs.

In 2025, Linde partnered with OEMs for the production of dual-stage regulators in green hydrogen projects. Air Liquide launched smart regulators in 2024 with real-time leak detection for medical and industrial use. In 2025, the company retrofitted existing hospital gas networks in Southeast Asia to improve efficiency and safety.

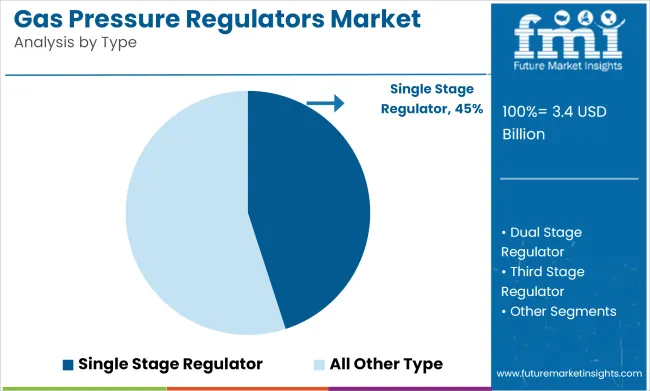

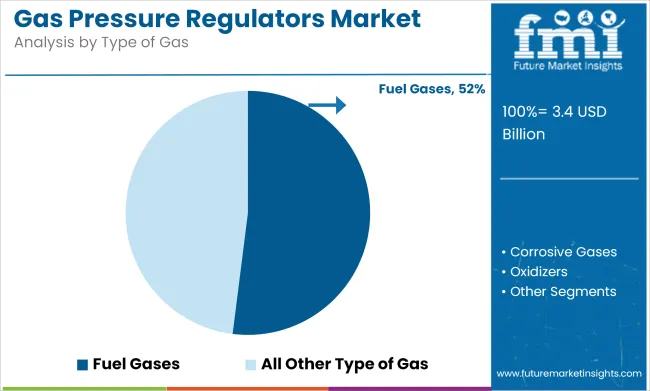

The gas pressure regulators market is projected to experience significant growth, driven by key segments such as single-stage regulators and fuel gases. Single-stage regulators are anticipated to lead the market in terms of product type, while fuel gases will continue to dominate as the primary gas used across sectors. These two segments are expected to play a critical role in shaping the market’s growth.

Single-stage regulators are expected to capture 45% of the market share in 2025. Their simple design, which reduces pressure in a single step, makes them ideal for residential and light commercial applications. Single-stage regulators are commonly used in low-pressure systems where simplicity, affordability, and ease of operation are crucial.

For instance, in suburban areas where propane tanks are used for outdoor heating and cooking, single-stage regulators are preferred due to their ease of installation and low maintenance requirements. They are also frequently chosen for applications like barbecue grills, home heating, and cooking. The demand for these regulators has been increasing, particularly in rural areas where there has been a shift from central gas supply systems to mobile ones.

Companies like Emerson, Honeywell, and Pentair have been leading the production of single-stage gas regulators, offering products that cater to both residential and light commercial needs. As demand for mobile and portable gas supply systems increases, single-stage regulators are expected to remain the preferred choice due to their cost-effectiveness and reliability.

Fuel gases, including compressed natural gas (CNG) and liquid propane, are projected to capture 52% of the market share in 2025. These gases remain the most widely used in various applications such as domestic heating, mobile food carts, and industrial combustion. For instance, food truck vendors often rely on CNG-powered cooking systems, where a stable and constant gas pressure is essential for performance and safety.

Similarly, rural households using propane for furnaces and water heaters require precise pressure regulation to prevent flame instability or fuel loss. The wide-ranging applications of fuel gases in both household and industrial settings continue to drive demand for gas pressure regulators.

Companies like Honeywell, Emerson, and Cavagna Group have been providing specialized regulators designed for fuel gases, ensuring consistent pressure control in diverse applications. The growing use of CNG and propane in residential, commercial, and industrial installations is expected to continue propelling the dominance of fuel gases in the market. Their wide application, coupled with the increasing demand for safe and efficient energy solutions, ensures fuel gases remain a critical segment in the gas pressure regulator market.

Material Degradation, Infrastructure Retrofitting, and International Safety Standards

The threats facing the gas pressure regulator market are retrofitting aged infrastructure in mature cities with lengthy pipe systems. Additionally, corrosion and deterioration due to the dynamic nature of gases also cause maintenance and safety issues. Finally, worldwide consistency of safety standards and certification also pose a difficulty in producing and exporting gas regulators globally.

Intelligent Regulators, Hydrogen Readiness, and Module Systems

Challenging, yet great opportunities are on the horizon. Development of the intelligent regulators with remote diagnosis, real-time monitoring, and prognostics will transform the management of gas pressure. Emergence of hydrogen as a viable alternative fuel brings the promise of highly specialized high-precision regulators. Modular, field-reconfigurable regulator systems are now at last gaining widespread acceptance, particularly among industrial end-users who crave flexibility and use variety.

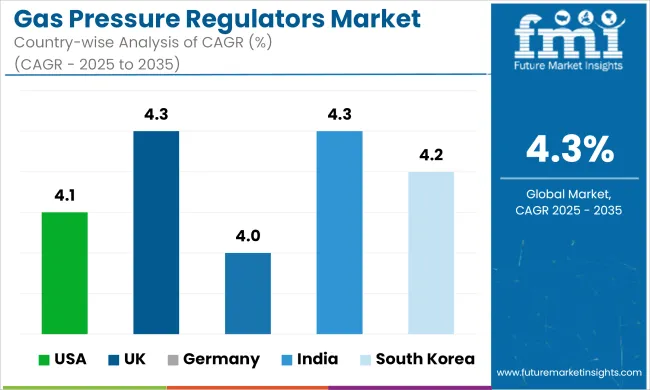

The USA gas pressure regulator market has transitioned from a utility-oriented industry to one that's heavily interwoven with the green revolution. With residential structures moving towards hybrid heating systems and hydrogen blending pilots spreading over municipal utilities, the demand for dual-capable, self-regulating valves is increasing.

Also, the increasing trend of home automation has compelled manufacturers to integrate smart monitoring systems that notify users of pressure drops or micro-leaks through mobile apps-creating a more integrated gas delivery environment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

Within the UK, natural gas boiler phasing out by 2035 and the increased hydrogen blending into grid networks are instigating a significant transformation. Gas pressure regulators are currently being designed for varying gas mixtures and coupling with renewable gas supplies.

Regulator designs to accommodate future retrofitting as "hydrogen-ready" are being invested in by companies. Regulator support by government programs, such as the Green Gas Support Scheme, adds to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

Germany’s regulators market is underpinned by the Energiewende transition. The push toward decentralized energy systems and biogas plants has spurred demand for highly customizable gas regulators compatible with various fuel mixtures.

German manufacturers are developing plug-and-play regulator kits for industrial SMEs that are shifting to local CHP (Combined Heat and Power) systems. Sustainability goals are also pushing for non-toxic coatings and easy-disassembly for recycling.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.0% |

India’s rapid urbanization and continued LPG subsidy programs have fueled massive adoption of gas regulators in both domestic and commercial kitchens. However, the next growth phase is being shaped by industrial clusters upgrading to compressed natural gas (CNG) and bio-CNG systems. Startups are entering the space with low-maintenance, tamper-proof designs ideal for rural gas distribution and smart metering integrations, especially in smart city development zones.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.3% |

South Korea is advancing toward gas digitization under its national clean energy roadmap. Gas pressure regulators are seeing increased demand in residential and commercial settings equipped with smart sensors and AI-based fault diagnostics. Additionally, the growing use of hydrogen as a transport and heating fuel is pushing R&D toward micro-regulators with ultra-sensitive adjustment capabilities suited for hydrogen’s light molecular profile.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Exponential industrialization, hydrogen shift, and tighter safety protocols for gas flow are boosting the need for sophisticated gas pressure regulators. Industry players now specialize in regulators with extreme pressure-handling capabilities, zero leakage tolerance, and the incorporation of real-time diagnostics.

Applications span across semiconductor fabs with ultra-high-purity (UHP) lines to hydrogen refuelling stations where precise delivery in varying demand situations is required. To address them, companies are designing dome-loaded, spring-loaded, and electronic pressure regulators that include embedded sensors for predictive maintenance.

Emerson Electric (24-28%)

Emerson is in the lead with comprehensive regulatory solutions in energy, chemical, and hydrogen segments. Its ER5000 series balances high-performance ruggedness with intelligent controls, which enables utilities and energy centers to minimize manual intervention in high-risk locations.

The Linde Group (18-22%)

Linde uses its domination of gas supply to provide in-house-designed regulators engineered for semiconductor and hydrogen applications. Its dual-stage configurations provide consistent pressure control throughout transient gas requirements in clean tech installations.

Air Liquide (14-18%)

Air Liquide spans industrial and healthcare markets with an emphasis on safety and digitalization. Its intelligent medical regulators with in-built leak detection systems address increasing hospital safety standards, particularly in developing economies.

Cavagna Group (9-12%)

Cavagna combines Italian technology with IoT preparedness, being the leading LPG and specialty gas company. Its 2025 launch of digital brewery regulators is a reflection of increasing niche markets requiring precision as well as smart notifications.

Itron Inc. (6-9%)

Itron's capability is in utility-scale deployment. Its smart grid-ready regulators, which automatically adjust according to real-time demand, enable next-generation energy infrastructure in cities going into distributed gas systems.

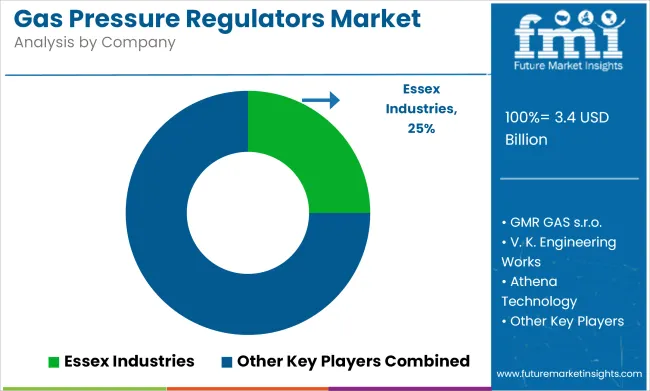

Other Key Players (13-17% Combined)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.38 billion |

| Projected Market Size in 2035 | USD 5.14 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, GCC Countries, South Africa |

| Key Players influencing the Market | Essex Industries, Greggersen Gasetechnik, GMR GAS s.r.o., V. K. Engineering Works, Athena Technology, SAP INDUSTRIES, DEM Machinery Co., Ltd., NISSAN TANAKA CORPORATION, Tewelding Engineers, ESKA |

| Additional Attributes | Dollar sales by region (North America, Europe, etc.), Growth trends in gas pressure regulators demand across industries like oil & gas, healthcare, and food & beverages, Regional adoption and regulatory compliance in gas pressure regulation systems |

The overall market size for gas pressure regulators market was USD 3.38 billion in 2025.

The gas pressure regulators market is expected to reach USD 5.14 billion in 2035.

The expanding demand for natural gas in residential and industrial sectors, along with stricter safety regulations, fuels the gas pressure regulators market during the forecast period.

The top 5 countries which drive the development of gas pressure regulators market are USA, China, India, Germany, and Japan.

On the basis of type, single-stage regulators to command significant share over the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Pressure Oil and Gas Separator Market

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA