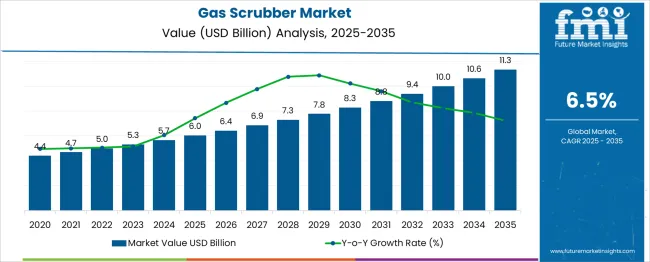

The Gas Scrubber Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The gas scrubber market is projected to grow steadily from USD 4.4 billion in 2021 to USD 7.8 billion by 2030, demonstrating a consistent upward trajectory driven by increasing industrial emissions regulations and the need for effective air pollution control technologies. Between 2021 and 2030, the market value nearly doubles, reflecting an average annual growth rate that indicates gradual but sustained demand across multiple end-use industries including chemical processing, power generation, and manufacturing.

In 2021, the market size stood at USD 4.4 billion, increasing annually with moderate increments such as reaching USD 5.3 billion by 2024 and crossing the USD 6 billion mark by 2026. This progression underscores steady adoption of gas scrubber technologies as stricter environmental policies encourage retrofitting and new installations. By 2030, the market is forecast to achieve USD 7.8 billion, highlighting the growing emphasis on emission reduction solutions in emerging economies alongside developed regions.

The incremental gains over the decade reveal the sector’s resilience amid fluctuating industrial activities, supported by technological advancements improving scrubber efficiency and cost-effectiveness. Furthermore, demand for multi-pollutant control systems and integration with renewable energy setups is expected to contribute to long-term growth.

Companies investing in innovation and tailored solutions stand to capitalize on this expanding USD 3.4 billion market opportunity through 2030, driven by regulatory compliance and environmental stewardship imperatives.

| Metric | Value |

|---|---|

| Gas Scrubber Market Estimated Value in (2025 E) | USD 6.0 billion |

| Gas Scrubber Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The gas scrubber market represents a specialized segment within the broader air pollution control industry, particularly focusing on the removal of particulate matter and gases such as sulfur dioxide (SO2), nitrogen oxides (NOx), and volatile organic compounds (VOCs). Within the global air pollution control market, gas scrubbers hold an estimated share of 12% to 15%.

This share is driven by their critical role in maintaining regulatory compliance across industries like power generation, petrochemicals, and manufacturing, where controlling emissions is vital to both operational efficiency and environmental protection. In the power generation sector, where strict environmental standards for sulfur and nitrogen emissions are enforced, gas scrubbers dominate, capturing nearly 30% to 35% of the market share.

Their application is crucial in coal-fired power plants, which require robust pollution control systems to meet evolving emissions regulations. In the petrochemical and chemical processing industries, gas scrubbers are used to mitigate the release of hazardous gases, thus contributing to approximately 20% of the market share within the industrial emissions control segment.

However, in other industries, such as waste incineration and municipal solid waste facilities, their share is smaller, often falling below 10%, as these sectors typically rely on alternative technologies such as thermal oxidizers or electrostatic precipitators. Despite representing a relatively modest portion of the broader air pollution control market, gas scrubbers play a vital role in enabling compliance with stringent environmental regulations while improving operational.

The gas scrubber market is gaining momentum globally due to escalating environmental compliance standards, particularly around volatile organic compounds, sulfur oxides, and hazardous particulate emissions. Governments and environmental agencies are intensifying enforcement of clean air norms, prompting industries to invest in gas scrubbing technologies that provide high-efficiency contaminant removal. The evolution of scrubber systems into modular, customizable solutions has increased their attractiveness for both new facilities and retrofit applications.

Technological enhancements in droplet separation, fluid dynamics, and corrosion-resistant materials have significantly improved the performance and lifecycle of scrubber units. Additionally, the alignment of industrial sustainability strategies with decarbonization goals is pushing greater adoption of scrubbers in energy-intensive operations.

The market is also benefiting from a shift toward integrated pollution control systems that combine gas cleaning with energy recovery and waste stream optimization. Going forward, the demand for scrubbers is expected to rise steadily across manufacturing, petrochemical, and waste treatment sectors as stakeholders seek to meet emission benchmarks and reduce their environmental footprint.

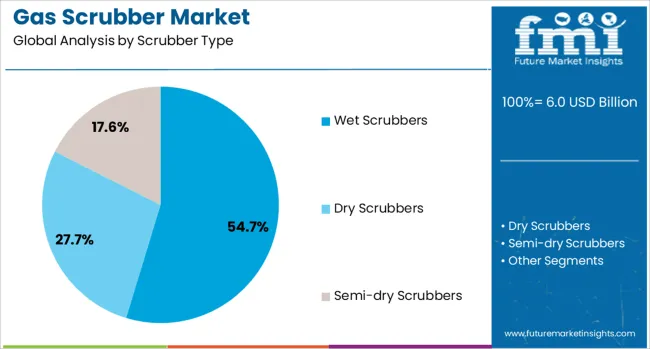

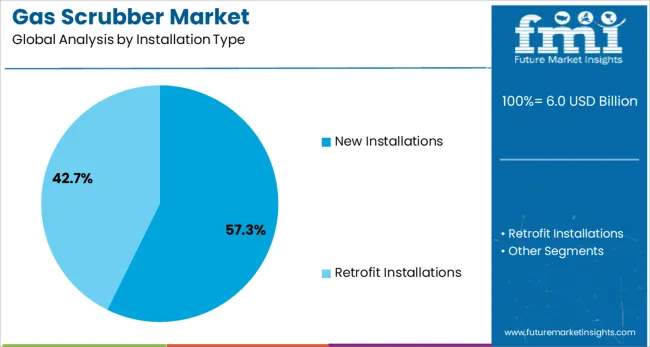

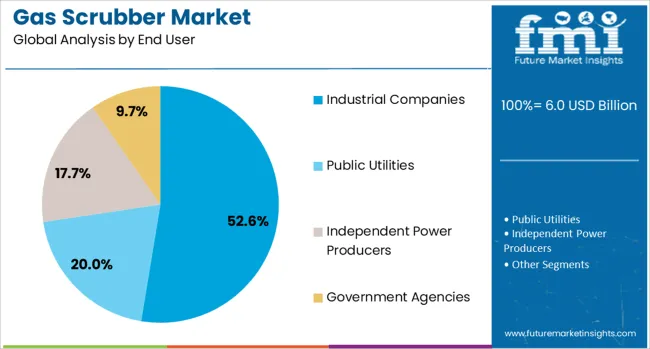

The gas scrubber market is segmented by scrubber type, installation type, end user, application, and geographic regions. The gas scrubber market is divided by scrubber type into Wet Scrubbers, Dry Scrubbers, and Semi-dry Scrubbers. In terms of installation type, the gas scrubber market is classified into New Installations and Retrofit Installations.

The gas scrubber market is segmented based on end user into Industrial Companies, Public Utilities, Independent Power Producers, and Government Agencies. The gas scrubber market is segmented by application into Industrial Emissions Control, Chemical Processing, Power Generation, Oil & Gas, Marine, Waste Management, and Food & Beverages. Regionally, the gas scrubber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Wet scrubbers are expected to account for 54.7% of the total revenue share in the gas scrubber market in 2025, making them the leading scrubber type. This dominance is attributed to their effectiveness in removing a wide range of gaseous pollutants and particulates, especially in high-temperature and corrosive environments. Their operational flexibility allows adaptation to various chemical absorption processes, which has increased deployment across chemical processing, metallurgy, and oil refining facilities.

The ability to handle variable gas flow rates and concentrations without performance degradation has further strengthened their industrial relevance. Technological advancements in droplet separators, mist eliminators, and scrubbing liquids have enhanced efficiency while minimizing maintenance requirements.

The segment's growth is also being driven by stricter regulatory mandates that favor wet scrubbing systems for achieving low emission thresholds. With growing investments in process emission control and continuous monitoring, wet scrubbers are poised to remain the technology of choice in industries prioritizing high-efficiency air purification.

New installations are projected to hold 57.3% of the overall gas scrubber market share in 2025, highlighting their dominance in current adoption trends. This is largely being driven by a surge in greenfield industrial projects, infrastructure development, and the modernization of older plants in compliance with revised environmental norms.

Facility operators are opting for integrated scrubber systems at the design stage to ensure optimal system efficiency and long-term regulatory alignment. Advances also influence the preference for new installations in engineering design, modular layouts, and real-time performance monitoring, which have made modern scrubbers more cost-effective over the lifecycle.

Industries such as power generation, cement, and petrochemicals are prioritizing emission control from project inception, accelerating the deployment of high-capacity systems. Government-backed funding programs and stricter permitting criteria for new facilities are further reinforcing the demand for first-time scrubber installations, which are increasingly viewed as a baseline requirement for operational clearance and sustainability alignment.

Industrial companies are anticipated to contribute 52.6% of the total gas scrubber market revenue in 2025, affirming their role as the dominant end user. This is being driven by intensified air quality compliance frameworks and operational mandates to mitigate emissions from combustion and processing operations.

Sectors such as chemical manufacturing, metal processing, food production, and pulp and paper have shown increased commitment to emission reduction, making scrubbers a critical component of their environmental management systems. The implementation of industry-specific emission thresholds has pushed companies to adopt scrubbers that can be customized for gas flow profiles, particle types, and chemical compositions.

Many firms are also integrating scrubber systems with broader sustainability initiatives, including carbon capture and waste heat recovery, to maximize environmental and economic returns. The ability of gas scrubbers to operate under diverse industrial conditions while maintaining high removal efficiency has positioned them as a key investment for industries navigating rising regulatory and stakeholder pressure for clean and responsible operations.

Gas scrubbers are being widely adopted to meet strict emission regulations and improve safety across industrial sectors, including power, chemical, and metallurgy. Their growing role in energy, mining, and processing industries is driven by compliance needs and advanced system integration.

Stringent air quality standards and industrial safety regulations have influenced the adoption of gas scrubbers in multiple sectors. Power generation and chemical processing plants have prioritized scrubbers to manage hazardous emissions and maintain compliance with environmental frameworks. Industrial players are leveraging wet and dry scrubbers to handle particulates, volatile compounds, and corrosive gases. The demand has been shaped by the need to mitigate acid gases in refining and petrochemical facilities. Integration with smart monitoring solutions for operational efficiency has been adopted by large enterprises, ensuring adherence to emission limits without compromising process output. Scrubber technology selection is being driven by industry-specific challenges, such as corrosive gases in metallurgy or organic compounds in food processing.

The usage of scrubbers in energy, mining, and specialty manufacturing has gained relevance due to their ability to ensure workplace safety and environmental compliance. Energy projects, including biomass and waste-to-energy plants, have incorporated scrubbers to manage flue gases effectively. Chemical sectors have utilized these systems for neutralizing acidic vapors during production, influencing operational continuity. Product configurations like packed bed and venturi scrubbers are increasingly being deployed for high-load processes to optimize gas absorption rates. Competitive pricing pressure and regional policy frameworks have encouraged suppliers to develop scalable solutions tailored to different industrial profiles. The trend of replacing outdated filtration systems with advanced scrubber units has been regarded as a critical operational upgrade for many facilities.

The Gas Scrubber Market growth is primarily influenced by tightening environmental regulations worldwide. Governments are enforcing stricter emission standards for industries such as power generation, chemicals, and manufacturing, compelling companies to adopt advanced gas scrubbing technologies. These regulations target pollutants like sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter, creating a strong demand for efficient scrubbers that ensure compliance. International agreements aimed at reducing air pollution are accelerating the retrofitting of existing plants with modern scrubber systems. This regulatory environment not only drives new installations but also fuels the replacement and upgrade of aging equipment, expanding market penetration.

Technological advancements are playing a crucial role in expanding the gas scrubber market. Innovations such as dry and wet scrubbing systems, bio-scrubbers, and hybrid technologies offer improved removal efficiency and operational cost savings. Integration of smart sensors and automation is enhancing real-time monitoring and maintenance, reducing downtime and increasing reliability. Furthermore, the adoption of gas scrubbers in emerging sectors, including waste-to-energy plants and renewable energy facilities, is broadening the application base. As industries seek sustainable and cost-effective solutions, manufacturers focusing on customized and energy-efficient scrubber designs are positioned to capitalize on the growing demand and diversify their offerings.

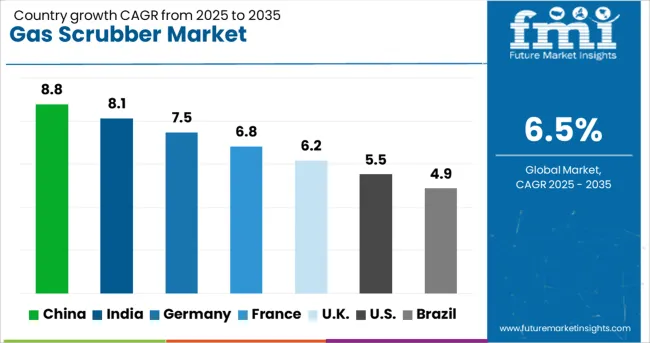

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The gas scrubber industry, projected to grow at a global CAGR of 6.5% from 2025 to 2035, is witnessing varied performance among major countries. China is leading with an 8.8% CAGR, being a BRICS member, supported by heavy investments in emission control technologies for industrial and energy applications. India follows with an 8.1% CAGR, also as part of BRICS, driven by expanding chemical and power generation sectors requiring advanced air quality solutions.

Germany, an OECD member, is reporting a 7.5% CAGR, primarily influenced by stringent environmental regulations and a strong presence of industrial equipment manufacturers. The United Kingdom, another OECD member, is showing a 6.2% CAGR with moderate growth across processing and manufacturing sectors focused on compliance.

The United States, also an OECD member, is maintaining a 5.5% CAGR, where steady demand is being recorded in petrochemical and refining operations. While stable demand is seen in developed economies, rapid adoption in China and India is positioning BRICS as the fastest-growing region for scrubber installations.

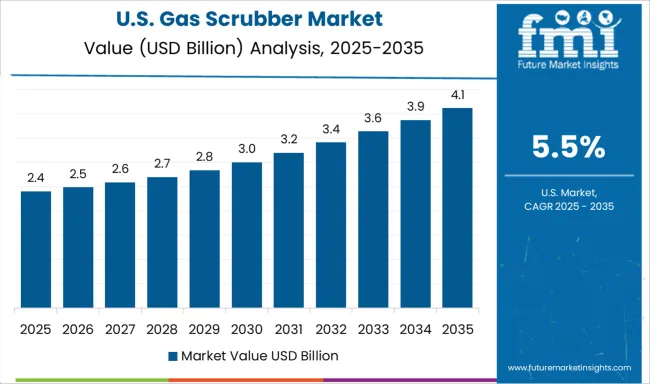

The CAGR for the United States gas scrubber market increased from about 4.2% during 2020-2024 to 5.5% in the period 2025-2035, supported by stricter federal emission norms and modernization in refining operations. Growing integration of digital monitoring in scrubber systems was noted as large petrochemical and manufacturing companies moved toward compliance-driven upgrades.

Demand was reinforced by continuous investments in clean energy projects, where gas cleaning solutions became essential for biomass and waste-to-energy facilities. Supplier networks improved after 2025, reducing installation delays and expanding aftermarket services. Regional regulations for volatile organic compound management contributed to the wider adoption of dry scrubber systems for flexible operating conditions.

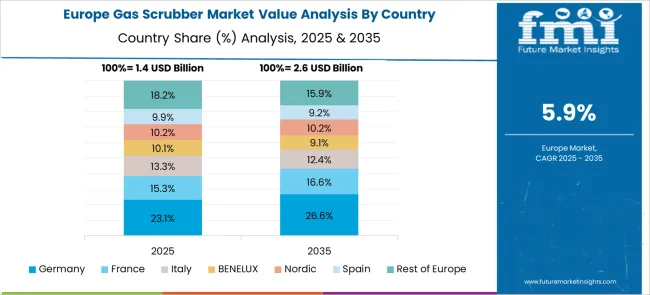

The CAGR in Germany advanced from 6.1% during 2020-2024 to 7.5% across 2025-2035, driven by heightened compliance obligations in industrial emission norms and a rise in environmental audits. Local equipment suppliers strengthened their product portfolios with hybrid scrubber systems suitable for chemical processing and energy generation sectors.

Industrial operators prioritized corrosion-resistant materials and low-maintenance designs for continuous operations, pushing procurement of advanced packed bed scrubbers. Government-led decarbonization policies created incentives for emission control equipment, indirectly accelerating scrubber adoption in metallurgical and food-processing industries. Increased emphasis on workplace safety standards also impacted purchase decisions across mid-sized manufacturers in the country.

The United Kingdom experienced growth from 4.8% CAGR during 2020-2024 to 6.2% for 2025-2035, underpinned by compliance enforcement in the energy and manufacturing sectors. Early-stage investments in flue gas treatment across combined heat and power projects stimulated adoption.

Industrial buyers demonstrated a preference for systems offering modular configurations to optimize installation within compact spaces. Post-Brexit regulatory adjustments resulted in accelerated equipment modernization for emission reduction in core industries. Increased focus on low-capex solutions drove demand for venturi scrubbers capable of handling particulate-heavy gas streams in energy plants and food processing units.

China registered a strong shift from 7.2% CAGR between 2020-2024 to 8.8% in 2025-2035, propelled by aggressive enforcement of emission control norms in heavy industries. Expansion in chemical parks and industrial clusters supported large-scale installation of wet scrubber systems tailored for acid gas removal.

Energy transition programs further expanded scrubber usage in coal-based and waste-to-energy power plants. Localized manufacturing hubs in Zhejiang and Jiangsu enhanced cost competitiveness and reduced dependency on imported components. Smart integration of digital tracking sensors in scrubber designs increased operational transparency, leading to higher adoption among large-scale refiners and metal processing units.

India moved from 6.9% CAGR during 2020-2024 to 8.1% in 2025-2035, driven by strong enforcement of National Clean Air Programme targets and rapid capacity expansion in refining and petrochemicals. Public sector undertakings prioritized high-efficiency scrubbers for SOx and NOx emission management in large-scale energy plants.

Industrial modernization projects accelerated the replacement of conventional filtration units with advanced packed bed systems. Scrubber technology also penetrated food and beverage production, where quality compliance regulations influenced purchasing behavior. Local equipment suppliers strengthened their foothold with cost-effective and low-maintenance designs suited for variable operating loads, reducing barriers for mid-sized manufacturers.

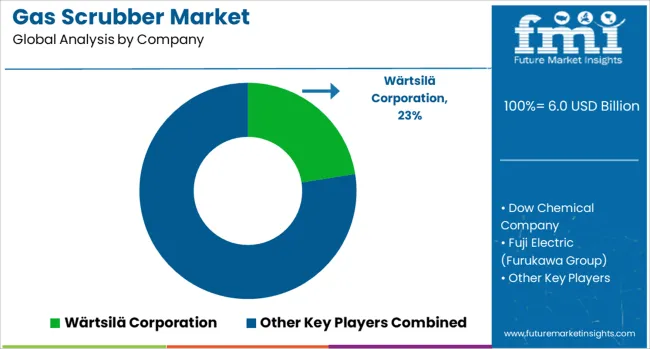

In the gas scrubber market, leading companies are strategically focusing on compliance-driven product innovation and advanced digital integration to address increasingly stringent industrial emission standards. Wärtsilä Corporation, Dow Chemical Company, and Fuji Electric (Furukawa Group) are at the forefront of engineering both wet and dry scrubber systems optimized for demanding applications in high-load energy generation and chemical processing sectors.

These systems are designed to effectively manage pollutants while ensuring operational efficiency under rigorous conditions. Meanwhile, Babcock & Wilcox Enterprises and Johnson Matthey have expanded their product portfolios to include corrosion-resistant materials and multi-pollutant handling technologies, enabling them to tackle complex gas treatment challenges prevalent in diverse industrial environments.

Donaldson Company, Inc. and Mitsubishi Heavy Industries have introduced modular scrubber designs that facilitate easier installation and retrofitting in facilities with limited space, a growing requirement given aging infrastructure. Alstom has concentrated efforts on seamless integration of scrubbers with flue gas desulfurization systems, particularly across power generation plants, enhancing pollutant capture efficiency and regulatory compliance.

Furthermore, Wahlco, Inc. has strengthened its aftermarket support and maintenance services, ensuring operational continuity and prolonged equipment lifespan for existing installations. Collectively, these companies are driving innovation through tailored solutions, robust service models, and adaptive technologies, positioning themselves to meet evolving environmental mandates while capturing growth opportunities across industrial and energy sectors.

In July 2023, Mitsubishi Heavy Industries acquired Concentric to become a leading provider of power solutions in North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Scrubber Type | Wet Scrubbers, Dry Scrubbers, and Semi-dry Scrubbers |

| Installation Type | New Installations and Retrofit Installations |

| End User | Industrial Companies, Public Utilities, Independent Power Producers, and Government Agencies |

| Application | Industrial Emissions Control, Chemical Processing, Power Generation, Oil & Gas, Marine, Waste Management, and Food & Beverages |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wärtsilä Corporation, Dow Chemical Company, Fuji Electric (Furukawa Group), Babcock & Wilcox Enterprises, Johnson Matthey, Donaldson Company, Inc., Mitsubishi Heavy Industries, Alstom, and Wahlco, Inc. |

| Additional Attributes | Dollar sales by scrubber type (wet, dry, hybrid), share by industry application (power, chemicals, metals), competitive positioning of key players, regional demand patterns, pricing benchmarks, regulatory impact on installations, and aftermarket service opportunities. |

The global gas scrubber market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the gas scrubber market is projected to reach USD 11.3 billion by 2035.

The gas scrubber market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in gas scrubber market are wet scrubbers, dry scrubbers and semi-dry scrubbers.

In terms of installation type, new installations segment to command 57.3% share in the gas scrubber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA